- Home

- »

- Medical Devices

- »

-

Mammography Market Size & Share, Industry Report, 2030GVR Report cover

![Mammography Market Size, Share & Trends Report]()

Mammography Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Film Screen, Digital, Analog, 3D), By Technology (Breast Tomosynthesis, CAD, Digital), By End Use (Hospitals, Specialty Clinics, Diagnosis Centers), By Region And Segment Forecasts

- Report ID: GVR-1-68038-353-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mammography Market Summary

The global mammography market size was estimated at USD 2,578.2 million in 2024 and is projected to reach USD 4,673.2 million by 2030, growing at a CAGR of 10.5% from 2025 to 2030. The increasing demand for early-stage diagnosis amongst patients and the rising prevalence of breast cancer are some of the key factors anticipated to drive demand for mammography devices over the forecast period.

Key Market Trends & Insights

- The mammography market in North America held the largest share of 35.48% of the global revenue in 2024.

- The U.S. mammography market held the largest share in the North America regional market in 2024.

- By product, the digital systems segment dominated the market with a revenue share of more than 59.82% in 2024.

- By technology, the digital mammography technology segment accounted for the largest revenue share of more than 65.94% in 2024.

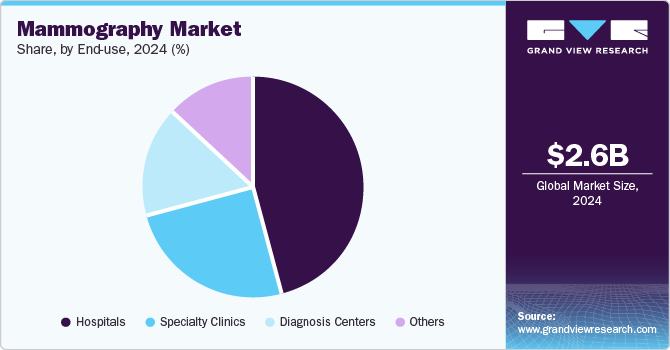

- By end use, the hospitals end Use segment dominated the market in 2024 with a revenue share of around 45.68%.

Market Size & Forecast

- 2024 Market Size: USD 2,578.2 Million

- 2030 Projected Market Size: USD 4,673.2 Million

- CAGR (2025-2030): 10.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

For instance, the study published by Springer Nature Limited in January 2025 projected that the number of patients with breast cancer will increase from 1,254,779 in 2021 to 1,682,326 in 2030 in India. Thus, the rising prevalence of breast cancer is anticipated to propel the mammography industry growth in the coming years.

Moreover, improved access to breast cancer screening systems and expanding government initiatives to support clinical interpretation are key factors anticipated to drive market growth. The demand for mammography screening devices is increasing, primarily due to the rising prevalence of breast cancer among older adults. As the global population grows, many women will reach 60 and above. According to data from the American Cancer Society published in October 2022, 83% of invasive breast cancers were diagnosed in women aged 50 and older in 2022. Breast cancer has a high incidence and fatality rate in this age range, indicating a significant unmet demand for breast cancer diagnostics. The need for mammography is likely to rise as the number of events and fatalities rises. Thus, the increasing geriatric population is expected to propel market growth over the forecast period.

The introduction of new products is expected to boost the adoption rate among end users. Earlier generations of mammography systems provided 2D breast images, limiting the interpretation quality. 2D mammography systems provide Mediolateral-Oblique (MLO) images and Craniocaudal (CC). The flat nature of these images makes it difficult for physicians to interpret images and identify tumors due to the overlapping of tissues and calcifications, which mask cancerous lesions.

With the introduction of a new 3D-based technology called Digital Breast Tomosynthesis (DBT), getting a 3D breast image is possible. This permits radiologists to scan the breast slice by slice and recognize abnormalities, which would be blurred in 2D images. Furthermore, the high demand for mammography screening services can be attributed to the improvement in accuracy & efficiency provided by advanced technologies, such as 3D mammography (tomosynthesis), computer-aided detection (CAD), and digital mammography. For instance, in November 2023, GE HealthCare launched the MyBreastAI suite. This AI-powered product combines three AI applications from iCAD: SecondLook for 2D mammography, ProFound AI for Digital Breast Tomosynthesis (DBT), and PowerLook Density Assessment. This suite aims to enhance early detection, improve patient outcomes, and boost operational productivity in radiology departments. These innovations in mammography technology are fueling the demand for mammography products.

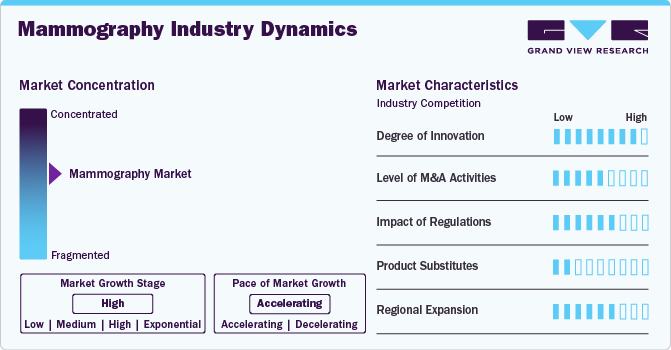

Market Concentration & Characteristics

Market growth stage is high, and the pace of its growth is accelerating. The market is marked by significant innovation, driven by new technologies aimed at enhancing the effectiveness and accuracy of mammography. For example, in June 2023, PinkDrive, a nonprofit organization, introduced a 3D mammography system to facilitate the rapid detection of breast lesions. This system captures multiple X-rays of the breast in an arc and reconstructs them into a 3D image, providing radiographers and oncologists with clear and detailed visuals for assessment. It can identify lesions that may be less visible and harder to detect with traditional 2D mammography. This mobile unit will be deployed for cancer screenings in underserved areas lacking access to health services. Such advancements are expected to propel growth in the industry as innovative technologies gain wider adoption.

The market is also characterized by a high level of merger and acquisition (M&A) activities by the key players. Key players in the market are acquiring small- and medium-sized manufacturers of mammography to expand their product portfolios and increase their share in the industry.

The market is regulated to ensure safety and effectiveness, with certification required for facilities and rigorous approval processes for devices. In the U.S., the U.S. Food and Drug Administration (FDA) oversees these regulations, supported by the Mammography Quality Standards Act (MQSA), which ensures access to high-quality screening services for early breast cancer detection. Compliance is enforced through regular inspections, emphasizing the commitment to quality care and improved health outcomes for women.

There are various substitutes for mammography. Some of the commonly used alternatives include breast ultrasound, magnetic resonance imaging (MRI), automated breast ultrasound (ABUS), breast thermography, and clinical breast examination (CBE). These products may provide similar benefits to mammography.

Manufacturers in the industry are working to expand their presence in various countries and regions to capture market share. For instance, in May 2023, TGH Imaging enhanced patient access to breast cancer screening by introducing Genius 3D Mammography exams from Hologic at 18 locations across Pasco, Hillsborough, Pinellas, and Palm Beach counties. Also known as tomosynthesis, 3D mammography generates a three-dimensional image of the breast, improving the detection of breast cancer.

Product Insights

The digital systems segment dominated the market with a revenue share of more than 59.82% in 2024 and is expected to witness considerable growth over the forecast period. Increased initiatives to combat breast cancer, a growing emphasis on digital mammography, and the availability of digital systems from industry players are expected to expand this segment. For instance, Trivitron Healthcare's radiology division, Kiran Medical Systems, offers advanced Digital Mammography systems for high-precision image-guided procedures. This availability of advanced systems is anticipated to enhance segment growth in the coming years further.

The 3D systems segment is expected to be the fastest-growing segment, with the highest CAGR from 2025 to 2030, due to several advantages such as higher procedure volumes, improved breast cancer detection rates, and favorable reimbursement scenarios. Hospitals and diagnostic clinics are transitioning into 3D systems, as 2D systems often miss cancer signs, increasing screening costs. In addition, leasing contracts for 3D mammography technology are rising, enabling low-income facilities to access advanced imaging. Public mammography screening programs utilizing 3D devices further support this segment's growth.

Technology Insights

The digital mammography technology segment accounted for the largest revenue share of more than 65.94% in 2024 due to the various advantages of this technology. Digital mammography is a sophisticated and specialized form of mammography that examines breast tissue for the presence of cancers using computers and digital sensors rather than X-ray films. The increasing number of digital mammography centers is anticipated to support the segment growth. For instance, in November 2024, the Armed Forces Medical College (AFMC) introduced a digital mammography center for breast cancer screening.

The breast tomosynthesis technology segment is projected to experience the fastest CAGR from 2025 to 2030. Breast tomosynthesis utilizes high-resolution limited-angle tomography and X-rays to produce a three-dimensional image of the breast, aiding in the early detection of breast cancer. This technique is particularly effective for analyzing dense breast tissue, enhancing cancer detection capabilities while reducing false-positive results and the need for biopsies. Its effectiveness in examining dense breasts makes it a valuable tool in breast cancer screening.

End Use Insights

The hospitals end Use segment dominated the market in 2024 with a revenue share of around 45.68%. The presence of mammography facilities in hospitals can positively influence factors such as hospital stay duration, overall healthcare costs, quality of care, and emergency service availability. Many hospitals are now adopting advanced mammography systems. For example, in June 2023, Amrita Hospital implemented a new contrast-enhanced mammogram system that detects breast cancer before it becomes visible on standard mammograms. This system features auto-stabilization, improving usability, reducing examination time, and enhancing patient comfort. Its contrast-enhanced 3D imaging capabilities provide high-resolution images that can identify even the smallest abnormalities. Such rising adoption of advanced mammography systems in hospital settings is anticipated to drive the segment growth in the coming years.

The diagnostic centers segment is expected to grow at the highest CAGR during the forecast period due to increased breast cancer awareness. This increased awareness has led to a growing demand for mammography procedures utilized in diagnosis, treatment planning, and breast cancer prevention. The availability of advanced mammography services in diagnostic centers across both developed and developing economies, including the U.S., Germany, the UK, Japan, China, and India, is expected to boost the overall growth of this segment further.

Regional Insights

The mammography market in North America held the largest share of 35.48% of the global revenue in 2024. The rising incidence of breast cancer in the region is one of the major factors driving the market growth. According to the American Cancer Society projections, approximately 310,720 new cases of invasive breast cancer among women are estimated to be detected in 2024. Furthermore, 56,500 cases of in situ breast carcinoma in women have been projected, and the number of breast cancer cases is predicted to rise in the coming years.

U.S. Mammography Market Trends

The U.S. mammography market held the largest share in the North America regional market in 2024 due to the high prevalence of breast cancer and the presence of key market players. These factors are expected to drive the demand for mammography devices, supporting market growth.

Europe Mammography Market Trends

The mammography market in Europe is driven by factors such as the rising geriatric population and the presence of well-established healthcare infrastructure. For instance, as per a report by the European Union (EU) population, in February 2025 in Europe, more than 21.3% (448.8 million people) of the total EU population was aged 65 years and over in 2023. This rising older population is anticipated to drive the market.

The UK mammography market is expected to grow significantly over the forecast period. This growth can be attributed to rising healthcare expenditures and the country's geriatric population.

The mammography market in France is anticipated to witness considerable growth in the coming years due to the presence of key players and the increasing prevalence of breast cancer.

The Germany mammography market growth is driven by various factors including the presence of key players. Many local companies are forming strategic partnerships, launching new products, and engaging in mergers and agreements.

Asia Pacific Mammography Market Trends

The mammography market in the Asia Pacific region is expected to experience the fastest growth due to the rising prevalence of breast cancer, substantial investments in research and development for breast cancer therapies, and advancements in breast imaging technologies. According to an article published by the Breast Cancer Network Australia in September 2024, it is estimated that 20,973 women and 221 men will be diagnosed with breast cancer in Australia. Therefore, the increasing incidence of breast cancer and the region's improving healthcare infrastructure are likely to drive overall market growth.

The China mammography market accounted for the largest share of the Asia Pacific mammography market in 2024. The rising elderly population and the growing burden of breast cancer primarily propel growth in the market.

The mammography market in Japan is moderately competitive, with the presence of some major companies offering mammography. Major players in the market are adopting several strategies, such as mergers & acquisitions and partnerships & collaborations, to stay competitive.

Latin America Mammography Market Trends

The Latin America mammography marketgrowth is driven by increased healthcare spending and the expansion of private healthcare facilities, enabling more accessible mammography services, thus fueling market growth. In addition, the higher breast cancer risk among the aging population in Latin America is driving the demand for mammography screening services.

MEA Mammography Market Trends

The mammography market in MEA is expected to witness significant growth due to various factors, such as the increasing prevalence of breast cancer and initiatives led by governments to enhance breast cancer awareness & healthcare infrastructure, driving the demand for mammography screening services and equipment.

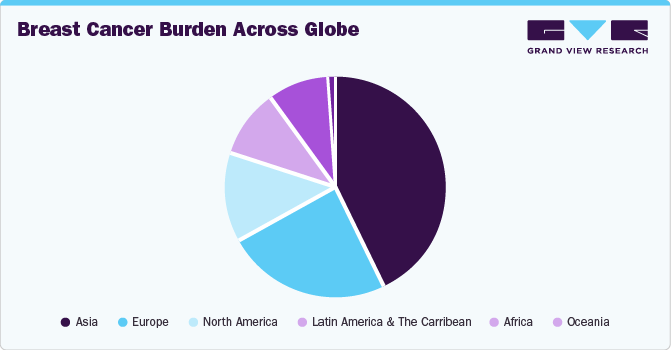

The global burden of breast cancer in 2022 highlights the urgent demand for mammography services, particularly in regions with the highest incidence rates. Asia leads with 42.90%, followed by Europe at 24.30%, underscoring the necessity for effective screening programs. Mammography is essential for early breast cancer detection, improving treatment outcomes and survival rates through timely diagnosis and intervention. As awareness grows, accessible mammography becomes critical for reducing mortality and improving outcomes across diverse populations.

Key Mammography Company Insights

Hologic, Inc., Analogic Corporation, CANON MEDICAL SYSTEMS CORPORATION, FUJIFILM Corporation, Siemens Healthcare Private Limited, Toshiba, GE HealthCare, Metaltronica S.p.A, Koninklijke Philips N.V., and Planmed Oy are some of the players in the market. Top players are focusing more on user comfort through technological advancements and innovative products. Thus, advancements in technology and products support the overall market growth.

Key Mammography Companies:

The following are the leading companies in the mammography market. These companies collectively hold the largest market share and dictate industry trends.

- Hologic Inc.

- Analogic Corporation

- CANON MEDICAL SYSTEMS CORPORATION

- FUJIFILM Corporation

- Siemens Healthcare Private Limited

- Toshiba

- GE HealthCare

- Metaltronica S.p.A

- Koninklijke Philips N.V.,

- Planmed Oy

Recent Developments

-

In November 2024, GE HealthCare has introduced the latest Pristina Via mammography system, which has been developed to enhance the breast screening experience for both patients and technologists. The Pristina Via depicts a significant improvement in the Senographe Pristina platform. This platform includes vendor-neutral prior picture comparison and lower radiation doses for all breast thicknesses.

-

In November 2024, Hologic, Inc. unveiled the Envision Mammography Platform at the Radiological Society of North America (RSNA). This platform provides patients a high-speed Hologic 3D mammogram featuring an industry-leading scan time of 2.5 seconds.

-

In June 2024, FUJIFILM's India Healthcare Division launched its first Skill Lab in partnership with NM Medical Mumbai to provide advanced training in full-field digital mammography technologies for radiographers and radiologists.

Mammography Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.84 billion

Revenue forecast in 2030

USD 4.67 billion

Growth rate

CAGR of 10.50% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Hologic, Inc., Analogic Corporation, CANON MEDICAL SYSTEMS CORPORATION, FUJIFILM Corporation, Siemens Healthcare Private Limited, Toshiba, GE HealthCare, Metaltronica S.p.A, Koninklijke Philips N.V., and Planmed

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

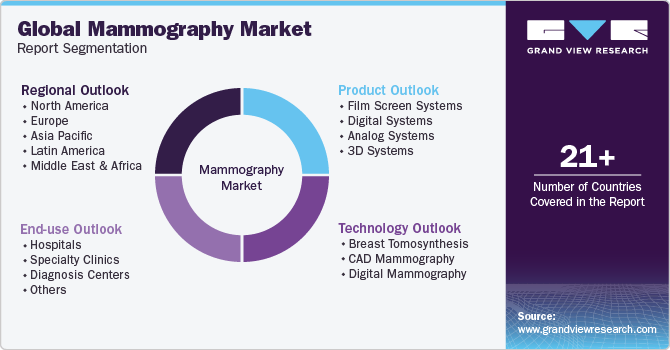

Global Mammography Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mammography market report based on product, technology, end use, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Film Screen Systems

-

Digital Systems

-

Analog Systems

-

3D Systems

-

-

Technology Outlook (Revenue, USD Million; 2018 - 2030)

-

Breast Tomosynthesis

-

CAD Mammography

-

Digital Mammography

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Diagnosis Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global mammography market size was estimated at USD 2.58 billion in 2024 and is expected to reach USD 2.84 billion in 2025.

b. The global mammography market is expected to grow at a compound annual growth rate of 10.50% from 2025 to 2030 to reach USD 4.67 billion by 2030.

b. North America dominated the mammography market with a more than 35.48% share in 2024. This is attributable to the rising growing prevalence of breast cancer and an increase in the women population above 40 years.

b. Some key players operating in the mammography market include Hologic, Inc., Analogic Corporation, CANON MEDICAL SYSTEMS CORPORATION, FUJIFILM Corporation, Siemens Healthcare Private Limited, Toshiba, GE HealthCare, Metaltronica S.p.A, Koninklijke Philips N.V., and Planmed.

b. Key factors that are driving the mammography market growth include the rising prevalence of breast cancer, favorable government initiatives, and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.