- Home

- »

- Biotechnology

- »

-

Cell Counting Market Size And Share, Industry Report, 2030GVR Report cover

![Cell Counting Market Size, Share & Trends Report]()

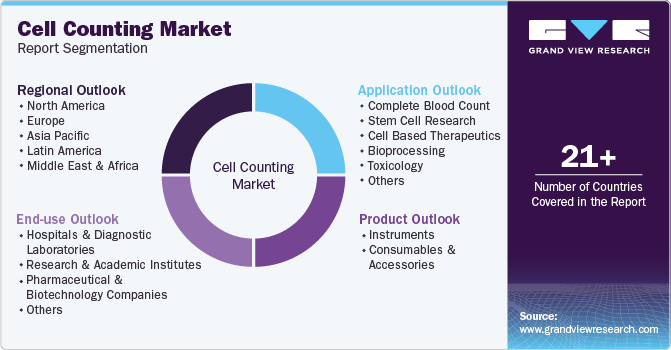

Cell Counting Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Instruments, Consumables & Accessories), By Application (CBC, Stem Cell Research), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-592-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell Counting Market Summary

The global cell counting market size was estimated at USD 9.48 billion in 2024 and is projected to reach USD 15.46 billion by 2030, growing at a CAGR of 8.7% from 2025 to 2030. As healthcare increasingly pivots towards tailored treatments, precision cell counting methodologies are becoming critical for evaluating cell viability and proliferation rates.

Key Market Trends & Insights

- The North America cell counting market dominated the global market with a revenue share of 38.2% in 2024.

- The cell counting market in the U.S. dominated the North America market with a revenue share of 90.8% in 2024.

- Based on products, the consumables & accessories segment dominated the market and accounted for a share of 54.0% in 2024.

- Based on application, the complete blood count (CBC) segment held the largest share of 59.2% in 2024.

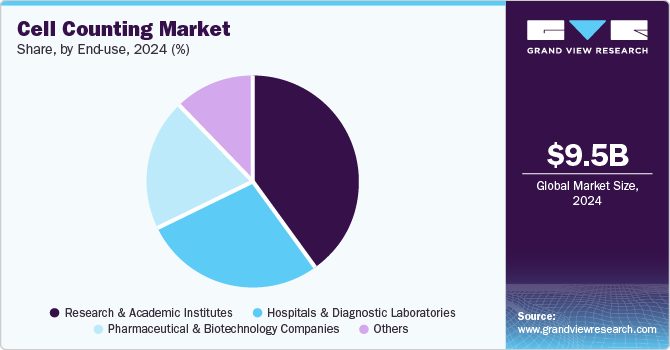

- Based on end-use, the research & academic institutes segment led the market with a revenue share of 39.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.48 Billion

- 2030 Projected Market: USD 15.46 Billion

- CAGR (2025-2030): 8.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

This trend is particularly pronounced in stem cell research and the development of biologics aimed at managing chronic diseases. Enhanced accuracy in cell analysis directly improves therapeutic targeting and disease monitoring, further propelling the market’s growth.

Innovations in automated systems and high-throughput methodologies are transforming traditional approaches to cell counting. For instance, in May 2024, Merck KGaA launched M-Trace Electronic Test Record Software, enhancing microbial quality control by digitizing sterility testing, ensuring data traceability, and reducing deviations while promoting compliance and process safety. Similarly, in January 2024, Thermo Fisher Scientific launched Gibco CTS Cellmation Software, the first validated solution for automating cell therapy manufacturing workflows, enhancing integration, compliance, and efficiency across its instrument portfolio.

The growing investments in research and development (R&D) within the healthcare sector also bolster market prospects. For instance, in March 2024, the FDA approved Bristol Myers Squibb’s Breyanzi as the inaugural CAR T cell therapy for adult CLL or SLL. These advancements reflect a broader trend where company R&D, government initiatives, and private funding increasingly support cell-based therapeutic research. Enhanced financial backing paves the way for innovative projects requiring sophisticated cell counting instruments, driving market demand.

Reports indicate a significant rise in chronic conditions such as hypertension and diabetes among older populations, necessitating greater reliance on accurate cell analysis for effective disease management. As the global healthcare landscape continues to evolve, the integration of innovative cell counting solutions will remain at the forefront of ensuring personalized and effective treatment strategies.

Product Insights

Consumables & accessories dominated the market and accounted for a share of 54.0% in 2024. Consumables and accessories, such as reagents, kits, and sample preparation tools, are crucial for precise cell counting. Their ongoing use in laboratories, especially in personalized medicine and biopharmaceutical research, drives consistent demand due to their role in quality control and standardizing procedures within the cell counting ecosystem.

The instruments segment is expected to grow rapidly over the forecast period. The rising incidence of chronic diseases, including cancer and diabetes, requires monitoring cell counts precisely for effective diagnosis and treatment. Automated cell counters, enhanced with high-throughput capabilities and cloud integration, are vital in research and clinical settings, underpinning the demand for advanced instruments in modern healthcare.

Application Insights

The complete blood count (CBC) segment held the largest share of 59.2% in 2024, driven by its critical role in diagnosing and monitoring health conditions. As blood disorders such as anemia and leukemia rise, the routine use of CBC testing for management, check-ups, and preoperative assessments fuels the demand for reliable cell counting technologies in clinical settings.

Stem cell research is projected to grow at the fastest CAGR of 11.5% over the forecast period, fueled by substantial investments in regenerative medicine. Increased funding from both the government and private sectors will enhance research on stem cell therapies for chronic diseases and injuries. Accurate cell counting is vital for assessing stem cell viability and proliferation, thereby advancing treatment development and clinical trials.

End Use Insights

Research & academic institutes led the market with a revenue share of 39.8% in 2024. These institutions are crucial in extensive research on chronic diseases, stem cells, and regenerative medicine, necessitating precise cell counting methodologies. The rise in publications and clinical trials in cancer research and immunology, coupled with government funding for innovative projects, further amplifies the demand for reliable cell counting technologies.

Pharmaceutical & biotechnology companies are expected to register the fastest CAGR of 10.0% over the forecast period. These companies depend on accurate cell counting for preclinical testing of new drug candidates and vaccines, which is critical for evaluating therapeutic efficacy and toxicity. The emergence of biologics and advanced therapies, such as CAR T-cell therapies, demands precise counting during production and quality control, enhancing throughput and reducing development costs.

Regional Insights

The North America cell counting market dominated the global market with a revenue share of 38.2% in 2024. The region features a robust healthcare infrastructure, substantial investments in research and development, and a high incidence of chronic diseases. Its focus on precision medicine and personalized treatments fuels demand for accurate cell counting technologies while leading manufacturers and a shift toward automation strengthen the region’s market position.

U.S. Cell Counting Market Trends

The cell counting market in the U.S. dominated the North America market with a revenue share of 90.8% in 2024. The U.S. is characterized by significant healthcare expenditures, a strong biopharmaceutical sector, and a high concentration of research institutions. It leads to technological advancements in cell counting devices, addressing the rising demand for precise diagnostics and effective disease management. With approximately 60% of adults affected by chronic diseases, including 11.5% with diabetes and 21.7% with depression, the growing aging population further accelerates market growth.

Europe Cell Counting Market Trends

Europe cell counting market held a substantial market share in 2024, driven by a growing patient population with chronic diseases and a robust emphasis on research and development. Increased funding in the life sciences and biotechnology sectors facilitates innovations in cell counting technologies, while the rising use of biologics further enhances the demand for precise cell counting methodologies.

The cell counting market in Germany is expected to grow rapidly over the forecast period due to its strong healthcare system, significant investments in life sciences research, and a high prevalence of chronic diseases. The presence of leading biotechnology firms and research institutions focusing on innovative therapies and government initiatives further bolsters the market’s growth.

Asia Pacific Cell Counting Market Trends

Asia Pacific cell counting market is expected to register the fastest CAGR of 11.6% over the forecast period. The increasing prevalence of chronic diseases and infectious conditions underscores the need for precise diagnostic tools, such as cell counters. Moreover, the growth of the biopharmaceutical sector and government initiatives to enhance healthcare access significantly drive market expansion.

In 2024, Japan dominated the Asia Pacific cell counting market owing to its advanced healthcare infrastructure and substantial investments in medical research and biotechnology. With a high prevalence of chronic diseases necessitating accurate cell counting methodologies, Japan’s emphasis on innovative therapies and regenerative medicine further fuels the demand for advanced cell counting technologies.

Key Cell Counting Company Insights

Some key companies operating in the market include Thermo Fisher Scientific Inc., Merck KGaA, Agilent Technologies, Inc., and PerkinElmer. The market is marked by intense competition and significant investment in R&D to enhance cell counting devices, driving strategic partnerships and mergers for broader offerings and reach.

- Agilent Technologies, Inc. specializes in advanced cell counting solutions, offering innovative instruments and reagents such as flow cytometers and automated cell counters that enhance accuracy and efficiency in research, diagnostics, and biopharmaceutical applications, supporting personalized medicine and drug development advancements.

- BD produces varied cell counting instruments and consumables, including automated hematology analyzers and flow cytometry systems that enable accurate cell counting for clinical diagnostics and research, enhancing disease monitoring and patient outcomes through innovation and quality.

Key Cell Counting Companies:

The following are the leading companies in the cell counting market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Agilent Technologies, Inc.

- PerkinElmer

- BD

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

- GE HealthCare

- DeNovix

Recent Developments

-

In October 2024, BD launched its first robotics-compatible reagent kits, enhancing automation in single-cell research, streamlining workflows, and improving efficiency in genetic sequencing across oncology and immunology applications through a collaboration with Hamilton.

-

In August 2024, DeNovix launched the CellDrop FLi Automated Cell Counter, enhancing cell counting capabilities with improved hardware and new applications, leveraging advanced machine-learning algorithms for accurate assessments across various sample types.

-

In June 2024, Bio-Rad launched the ddSEQ Single-Cell 3’ RNA-Seq Kit and Omnition v1.1 analysis software, enhancing single-cell gene expression research with efficient, cost-effective tools and workflows for diverse applications.

Cell Counting Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.20 billion

Revenue forecast in 2030

USD 15.46 billion

Growth rate

CAGR of 8.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Merck KGaA; Agilent Technologies, Inc.; PerkinElmer; BD; Danaher Corporation; Bio-Rad Laboratories, Inc.; GE HealthCare; DeNovix

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell Counting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cell counting market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Spectrophotometers

-

Flow Cytometers

-

Hemocytometer

-

Automated Cell Counters

-

Microscopes

-

Others

-

-

Consumables & Accessories

-

Reagents

-

Microplates

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Complete Blood Count

-

Automated Cell Counters

-

Manual Cell Counters

-

-

Stem Cell Research

-

Cell Based Therapeutics

-

Bioprocessing

-

Toxicology

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Diagnostic Laboratories

-

Research & Academic Institutes

-

Pharmaceutical & Biotechnology Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.