- Home

- »

- Advanced Interior Materials

- »

-

Conveying Equipment Market Size And Share Report, 2030GVR Report cover

![Conveying Equipment Market Size, Share & Trends Report]()

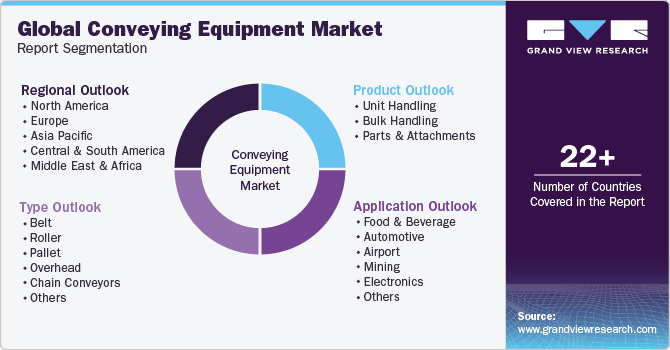

Conveying Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Belt, Roller, Pallet), By Product (Unit Handling, Bulk Handling), By Application (Food & Beverage, Warehouse & Distribution), By Region, And Segment Forecasts

- Report ID: 978-1-68038-194-8

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Conveying Equipment Market Summary

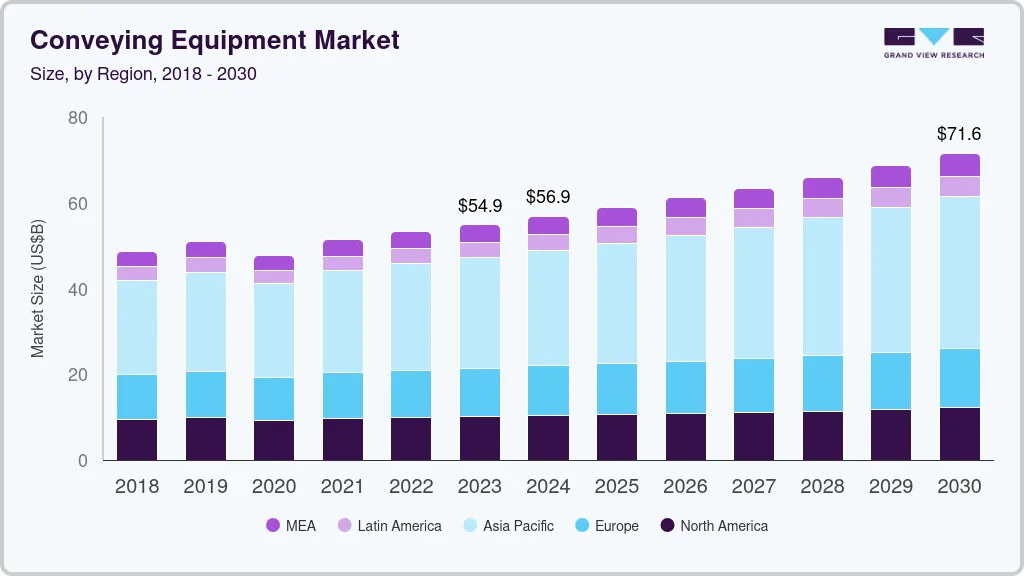

The global conveying equipment market size was estimated at USD 54.88 billion in 2023 and is projected to reach USD 71.57 billion by 2030, growing at a CAGR of 3.9% from 2024 to 2030. Growing dependence on machines with automated systems, leading to a reduction in production time and increasing efficiency, is expected to have a positive impact on the overall conveying equipment industry.

Key Market Trends & Insights

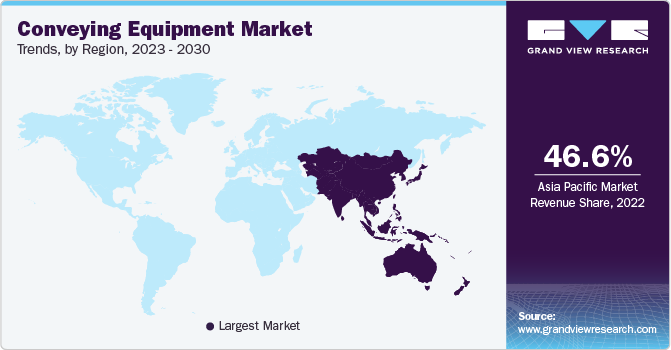

- In terms of region, The conveying equipment market in Asia Pacific accounted for 46.9% of the global revenue share in 2023.

- Country-wise, The China conveying equipment market held over 35% of the Asia Pacific market.

- In terms of type, The belt segment dominated the market with the largest share of 24.0% in 2023.

- In terms of application, The warehouse & distribution segment dominated the market with the largest share in 2023.

- In terms of product, The unit-handling segment dominated the market with the largest share in 2023

Market Size & Forecast

- 2023 Market Size: USD 54.88 Billion

- 2030 Projected Market Size: USD 71.57 Billion

- CAGR (2024-2030): 3.9%

- Asia Pacific: Largest market in 2023

Conveying equipment performs the role of goods carrier in numerous industries, including mining and coal, food & beverages, automotive, airports, and ports. Conveyors are essential for the continuous transportation of materials from one place to another in industrial and commercial facilities. Conveying equipment offers high operational efficiency along with improved productivity.The U.S. is one of the prominent markets for conveying equipment owing to its highly developed technology industries, skilled workforce, growing R&D initiatives, and advanced processing capabilities. The growth of the conveying equipment industry in the country is attributed to rising demand from warehouse and distribution, automotive, and food & beverage industries.

The extensive need for automation in the manufacturing sector on account of the rising focus on mass production to decrease capital investments is expected to positively impact the market. Rising infrastructure expenditure, particularly in the emerging economies of Asia Pacific and Central and South America, will also catalyze the market over the forecast period.

At a global level, conveyor systems are the heart of several manufacturing and distribution channels. The growth of the market is highly driven by technological developments in smart conveying equipment. Conveyors are the backbone of Industry 4.0. Key players are developing conveying equipment that incorporates smart devices as well as embedded intelligence. The growing trend of e-commerce, along with modifications in distribution channels from the seller to the client, coupled with the expansion in the food & beverage sector that requires horizontal production and at the same time, delivery of goods, are expected to create new opportunities for the conveying equipment industry in the coming years.

Market Concentration & Characteristics

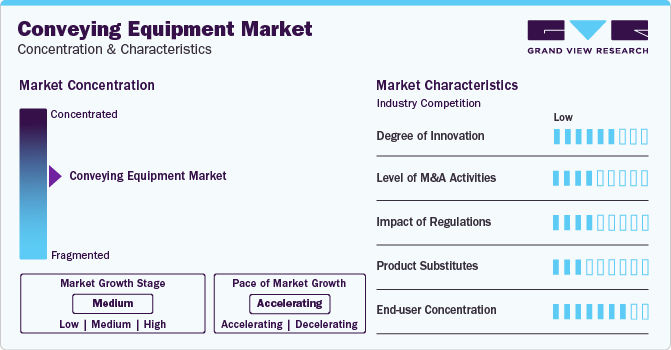

The market is characterized by a high degree of competition owing to the various cost-efficient technologies adopted by the market players for the manufacturing of conveying equipment. Further, emerging economies witnessed rapid growth in the manufacturing sector, leading to increased competition between the market players.

The market is also characterized by a high degree of product innovation, which results in the development of high-quality and technologically advanced conveying equipment. For example, In April 2023, TGW Logistics Group developed a cutting-edge system that would enable food service professionals, grocery producers, and retailers to respond quickly to future challenges. The company presented an efficient solution for completely automated mixed pallet picking called FullPick. Through FullPick, both pallets as well as roll cages are capable of being loaded entirely automatically and in a shop-friendly way. The new product launch can lead to increased market penetration by entering into new segments and expanding its customer base.

The demand for sustainable and energy efficient conveying equipment is increasing, and this trend is likely to increase research and development spending by various market players. Further, the market is also significantly influenced by the growing regulatory compliance across the globe.

The market is moderately consolidated, with a few major players dominating the market and a large number of smaller companies competing in space. In June 2022, BEUMER Group acquired full control of FAM Group of Magdeburg, which is a notable international supplier of loading equipment and conveyor systems. Through this acquisition, FAM Minerals & Mining GmbH has expanded BEUMER Group’s portfolio and brought with it the complete value chain, including after-sales service. Such acquisitions are likely to help the companies to improve their market presence.

Different types of conveying equipment serve a distinct purpose and user group, attracting specialized manufacturers and distributors who cater to specific areas. This creates an advantage for smaller players alongside the giants, boosting innovation and catering to specific regional demands.

Type Insights

The belt segment dominated the market with the largest share of 24.0% in 2023, owing to a rise in demand for belt conveyors in food and beverage, pharmaceutical, airport, and mining applications. It is the most common conveying equipment that serves a variety of application areas across industries. Belt conveyors can be operated at various speeds depending on the throughput required by using variable speed drive.

The roller segment is anticipated to witness the highest CAGR over the forecast period. The demand for roller conveyors is expected to significantly increase owing to their increasing adoption in material handling applications, including baggage handling, loading docks, and assembly lines, among others. In roller conveyors, rollers are mounted parallel in frames to transfer products either using gravity, manual, or powered systems.

Application Insights

The warehouse & distribution segment dominated the market with the largest share in 2023 and is anticipated to witness high growth over the forecast period. This is due to the meteoric rise of the e-commerce industry. Furthermore, the significant growth of supermarkets, online retail stores, and distribution centers, especially in the Asia Pacific and North America regions, is projected to have a positive impact on market expansion in the coming years.

The food and beverage segment is anticipated to remain the second highest in 2023. Conveying equipment is extensively used in the food and beverage industry. Belt conveyor is the most common conveyor that is used in the packaging and processing of food products. Belt conveyors can be used to horizontally transport, elevate, or descend material for cooling, inspection, storing, or conveying. Other conveyors such as screw, vibratory, aero-mechanical conveyors are also used in food processing industries.

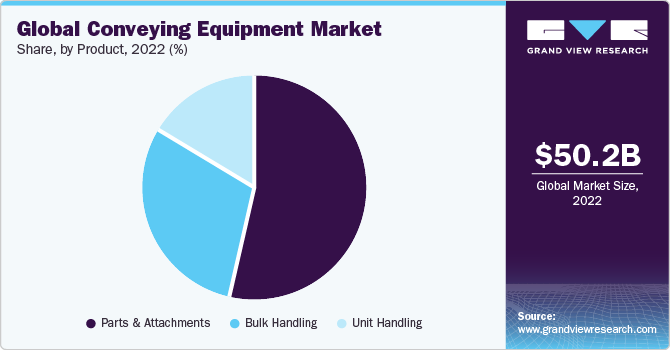

Product Insights

The unit-handling segment dominated the market with the largest share in 2023 and is anticipated to witness high growth over the forecast period. The use of unit handling equipment is primarily for handling small batches of products, which is most widely applicable in industries such as food and beverage processing, warehouse and distribution, and manufacturing of automotive industries, besides other durable goods industries.

Unit handling conveying equipment helps in maintaining sustainability by minimizing energy consumption and optimizing production output. Incorporating these systems reduces the maintenance cost by using more reliable equipment that requires minimal servicing and has a long-term life expectancy. These kinds of equipment are used for both manufacturing and shipping of materials, which makes them a fundamental requirement for any industry.

The parts & attachments segment is anticipated to witness the second-highest growth over the forecast period. The growing intricacy and tailor-made needs of conveyor systems require an expanded assortment of components and attachments to cater to distinct operational needs. As companies aim to enhance their operational efficiency and productivity, particularly within the warehousing and distribution sectors, there is a heightened need for specialized conveyor solutions. This trend is driving the demand for a diverse range of specialized parts and attachments to suit these specific customer requirements.

Regional Insights

North America's conveying equipment market is characterized by a highly developed industrial base, and advanced engineering capabilities. Further, owing to increasing governmental norms and standards is expected to continue over the forecast period. A major opportunity exists for conveying equipment with respect to technology, as the market can innovate better products to facilitate customized needs.

U.S. Conveying Equipment Market Trends

The U.S. conveying equipment market accounted for more than 80.0% of the regional revenue share in 2023. The market is driven by advanced manufacturing capabilities, technological expertise, commitment to quality & innovation across various industrial sectors, and a highly developed warehouse & distribution network. In June 2023, Walmart opened its high-tech fulfillment center. This new fulfillment center, sprawling across 2.2 million square feet, is situated 20 miles northeast of Indianapolis. This state-of-the-art facility stands as Walmart's biggest fulfillment center thus far, designed to significantly enhance the company's order fulfillment capacity and speed. Such new developments in warehousing to improve the distribution is likely to generate demand for conveying equipment to handle vast product portfolios.

Asia Pacific Conveying Equipment Market Trends

The conveying equipment market in Asia Pacific accounted for 46.9% of the global revenue share in 2023. The rapid industrialization, growing food processing & automotive industries, and increasing investments in infrastructure and technology drive the demand for conveying equipment. Countries like China, Japan, and India are leading contributors to the growth of the manufacturing sector in the region, with a strong presence in automotive manufacturing, food & beverage, and warehouse & distribution sectors.

The China conveying equipment market held over 35% of the Asia Pacific market. The market for conveying equipment, especially in the segment of warehousing and distribution, is witnessing a notable expansion. This growth is largely due to the rising need for effective material handling mechanisms, fueled by the growing e-commerce sector, technological innovations, and a focus on refining supply chain systems.

The conveying equipment market in India is anticipated to grow at a CAGR of more than 5.0% over the forecast period on account of growth in the manufacturing sector due to the government initiatives like "Make in India". This growth necessitates efficient material handling solutions, including conveying systems, to manage the movement of raw materials and finished products.

Europe Conveying Equipment Market Trends

The conveying equipment market in Europe is characterized by a highly developed industrial base, advanced engineering capabilities, and a strong focus on sustainability and efficiency. Increasing construction and infrastructure spending coupled with increasing industries is expected to drive market growth in this region. The market growth is further augmented by the increasing automation and reducing human efforts in manufacturing plants and distribution centers. The market growth is further augmented by the increasing automation and reducing human involvement in manufacturing plants and distribution centers.

The Germany conveying equipment market accounts for more than 20% of the regional revenue. The demand for conveying equipment in Germany can be attributed to factors such as industrial automation and technology innovation. The automotive sector is primarily driving the demand for conveying equipment due to the requirement for precision manufacturing processes and a high level of quality & process control.

The conveying equipment market in Russia is expected to grow significantly due to expansion of mining and energy sectors. The growth of the mining and energy industries requires the adoption of conveying equipment to facilitate the extraction, transport, and processing of raw materials. This need is driven by the imperative to streamline operations and enhance efficiency in handling resources.

Central & South America Conveying Equipment Market Trends

The conveying equipment market in Central & South America is expected to witness significant growth owing to increasing industrial investments in the automotive, food & beverage, and mining sectors. The e-commerce and mining industry represents a significant segment, leveraging the demand for conveying equipment.

The Brazil conveying equipment market is projected to hold over 30% of the regional market share. The growing manufacturing in the automotive sector and transportation sector are expected to boost the demand for the conveying equipment market in the coming years.

Middle East & Africa Conveying Equipment Market Trends

The conveying equipment market in the Middle East and Africa is driven by investments in e-commerce and industrial diversification initiatives. Countries like the UAE, Saudi Arabia, and South Africa are investing in advanced technologies to enhance the efficiency and reliability of their industrial components, creating opportunities for conveying equipment to provide solutions for reliable and process-controlled manufacturing.

The Saudi Arabia conveying equipment market is projected to grow with a CAGR of 5.0% over the forecast period. The market is driven by the growth of the airport and food & beverage industry in the country.

Key Conveying Equipment Company Insights

Some of the key players operating in the market include Daifuku Co., Ltd., BEUMER GROUP, Fives Group, TGW Logistics Group, and FlexLink.

-

Daifuku Co., Ltd. was established in 1937 and is headquartered in Osaka, Japan. The company manufactures and supplies transport systems, conveying systems, control systems, storage systems, sorting & picking systems, and material handling systems. It also engages in consulting, engineering, design, production, installation, and post-sale services for logistics systems and material handling equipment. In October 2022, Daifuku North America Holding Company announced the opening of its new manufacturing plant in Boyne City, Michigan. The manufacturing facility has brought together the operations of the former Boyne City, Harbor Springs, and Pellston facilities under one roof and is run by Jervis B. Webb Company, a subsidiary of Daifuku North America.

-

BEUMER GROUP is a prominent German industrial and engineering company. It has a long history dating back to its establishment in 1935. Specializing in the creation and production of intralogistics solutions, including conveyance, loading, palletizing, packaging, sorting, and distribution systems, with a global workforce of 5,400 employees. Achieving annual revenues close to USD 1.2 billion

Murata Machinery, Ltd, Kardex, and Phoenix Conveyor Belt Systems are some of the emerging market participants in the market.

-

Murata Machinery, Ltd was established in 1935 and is headquartered in Kyoto, Japan. The company has a strong market presence in Japan and provides solutions under the brand Muratec. It operates its business through six divisions such as logistics & automation, sheet metal machinery, textile machinery, machine tools and communication equipment. Under the logistics and automation division, the company provides a Logistics Center, Automated Storage & Retrieval Systems (AS/RS), Transportation Systems, Picking Systems, Sorting Systems, and Data Management Systems.

-

Kardex is a leading global partner in the field of intralogistics, offering a wide range of automated storage solutions and material handling systems. The company is structured into two independently managed divisions: Kardex Remstar and Kardex Mlog. Kardex Remstar specializes in developing, manufacturing, and servicing dynamic storage and retrieval systems, while Kardex Mlog is focused on providing integrated material handling systems and automated high-bay warehouses. Kardex employs around 2,100 people across more than 30 countries, demonstrating its global reach and commitment to excellence in intralogistics solutions.

Key Conveying Equipment Companies:

The following are the leading companies in the conveying equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Daifuku Co., Ltd.

- BEUMER GROUP

- Fives Group

- FlexLink

- Jungheinrich AG

- Kardex

- Kion Group AG

- KUKA AG

- Murata Machinery, Ltd

- Phoenix Conveyor Belt Systems

- Siemens

- TGW Logistics Group

- Continental AG

- Emerson Electric Co.

Recent Developments

-

In July 2023, Jungheinrich AG disclosed that by October 2024, it would be building a new logistics warehouse in Freilassing for Hawle Armaturen GmbH. The scope of delivery from Jungheinrich AG includes a full conveyor system featuring order-picking workstations, five stacker cranes with SPS, and silo steel rack constructions with roof and wall cladding.

-

In June 2023, TGW Logistics Group announced that it would be building a high-performance e-commerce system for SKECHERS USA, Inc., a manufacturer of premium-quality shoes, about 50 km north of Shanghai. The automated system is expected to go active in the summer of 2025. The core element of the TGW Logistics Group offers is a 13-kilometer-long network of energy-effective KingDrive conveyors that not only link every part of the system to one another but also ensure that they are connected to the current fulfillment center.

Conveying Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 56.87 billion

Revenue forecast in 2030

USD 71.57 billion

Growth Rate

CAGR of 3.9% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends

Segments covered

Type, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain Russia; Japan; China; India; Australia; South Korea; Thailand; Indonesia; Malaysia; Brazil; Argentina; Saudi Arabia; UAE; South Africa.

Key companies profiled

Daifuku Co., Ltd.; BEUMER GROUP; Fives Group; FlexLink; Jungheinrich AG; Kardex; Kion Group AG; KUKA AG; Murata Machinery, Ltd; Phoenix Conveyor Belt Systems; Siemens; TGW Logistics Group; Continental AG; Emerson Electric Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Conveying Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global conveying equipment market report based on type, product, application, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Belt

-

Roller

-

Pallet

-

Overhead

-

Chain Conveyors

-

Others

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Unit Handling

-

Bulk Handling

-

Parts & Attachments

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food & Beverage

-

Warehouse & Distribution

-

Automotive

-

Airport

-

Mining

-

Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Spain

-

Russia

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global conveying equipment market size was estimated at USD 54.88 billion in 2023 and is expected to be USD 56.87 billion in 2024.

b. The global conveying equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.9% from 2024 to 2030 to reach USD 71.57 billion by 2030

b. The Asia Pacific region dominated the market and accounted for 46.9% share in 2023, due to the growing manufacturing sector, favorable government policies, surge in industrial activities, and investment in infrastructure, and growing e-commerce sector

b. Some of the key players operating in the Conveying Equipment Market include Daifuku Co., Ltd., Beumer Group GmbH & Co., KG, Fenner Group Holdings Ltd., Fives Group, Flexlink, Jungheinrich AG, Kion Group AG, Continental, Siemens, Kardex Group, KUKA AG, Murata Machinery, Ltd, and Phoenix Conveyor Belt System.

b. The key factors that are driving the conveying equipment market include the expansion of automotive, manufacturing, and e-commerce industries. In addition to that, the need for effective material handling, investment in the development of advanced conveying equipment to achieve high process control in manufacturing sector, and growing emphasis on supply chain management are further driving the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.