- Home

- »

- Next Generation Technologies

- »

-

Industry 4.0 Market Size, Share And Growth Report, 2030GVR Report cover

![Industry 4.0 Market Size, Share & Trends Report]()

Industry 4.0 Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (IIoT, AR & VR, AI & ML), By Component (Hardware, Software), By Industry Vertical (Manufacturing, Oil & Gas), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-125-1

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industry 4.0 Market Summary

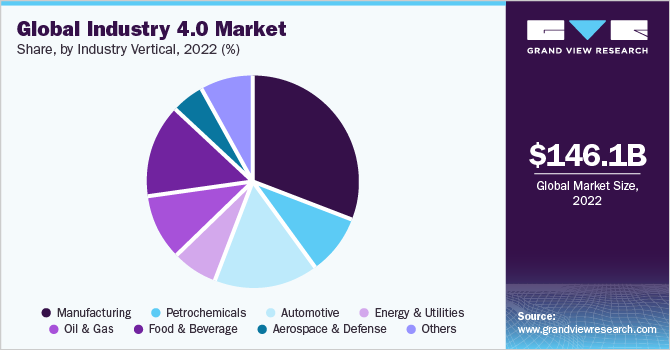

The global Industry 4.0 market size was estimated at USD 146.14 billion in 2022 and is projected to reach USD 627.59 billion by 2030, growing at a CAGR of 19.9% from 2023 to 2030. The factors driving the market growth include increasing adoption of automated equipment & tools on factory floors, warehouses, and manufacturing; rising investment toward addictive manufacturing units; and growing digitalization trends globally.

Key Market Trends & Insights

- Asia Pacific dominated the market in 2022 by holding a revenue share of over 35.0%.

- Middle East and Africa are projected to record a significant CAGR of over 21.0% through 2030.

- Based on components, the hardware segment captured a significant market share of around 50.0% in 2022.

- Based on technology, the Industrial Internet of Things (IIoT) segment captured a significant market share of more than 27.0% in 2022.

- Based on industry Vertical, the manufacturing segment captured a significant market share of around 31.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 146.14 billion

- 2030 Projected Market Size: USD 627.59 billion

- CAGR (2023-2030): 19.9%

- Asia Pacific: Largest market in 2022

Moreover, the emergence of cutting-edge digital technologies like Machine Learning (ML), Artificial Intelligence (AI), Internet of Things (IoT), 5G connectivity, and cloud-based services, among others contribute to the thriving landscape of the market. These converging factors are projected to create lucrative growth opportunities for the market.

Industries are increasingly subject to stringent regulations related to product safety, quality standards, environmental impact, and data privacy. These technologies enable end-users to effectively comply with these regulations by providing real-time monitoring, traceability, and quality control mechanisms. The end-use compliance issues are categorized into process and product compliance. Industry 4.0 practices are ideal for companies aiming to achieve time and quality metrics at reduced costs. Digitization of production aids in numerous tasks, such as engineering changes, risk assessment, process improvement, improving process visibility, and providing data on demand. Therefore, the need for compliance to gain a competitive edge is expected to act as a significant growth driver for the market.

The adoption of IIoT technologies is a significant opportunity in the market. By connecting industrial equipment, sensors, and devices, companies can gather real-time data and enable machine-to-machine communication. This data can be used to optimize production processes, reduce downtime, and improve overall operational efficiency. As the systems become more connected, ensuring the security of industrial networks and data becomes crucial. The increasing complexity of the industrial ecosystem creates opportunities for cybersecurity solutions and services. Companies can develop robust cybersecurity frameworks, implement secure communication protocols, and offer solutions to protect against cyber threats, thereby addressing the growing demand for secure systems.

The combination of robotics & automation with the IoT results in IoT-enabled robotics, enabling remote monitoring and predictive maintenance, driving efficiency through data-driven insights. Innovations in fleet management and robot swarms are shaping industries, such as logistics and warehousing, by orchestrating coordinated robot actions. Simultaneous localization and mapping (SLAM) technology empowers robots to navigate complex environments autonomously, underpinning applications like autonomous vehicles and drones. Wearable robotics boost human capabilities, particularly in sectors where physical assistance is pivotal, like healthcare and manufacturing. Leveraging digital twins for robot design and optimization expedites development while refining performance.

Enhanced human-robot interaction and user interfaces underscore the seamless integration of robots into various industries. These concepts work together to illustrate the development of industrial robots and automation, revolutionizing manufacturing efficiency, enhancing human skills, and spurring innovation across industries. The market landscape is significantly influenced by AI and ML technology trends. Within this trend, several key developments stand out. Predictive analytics and maintenance leverage AI and ML to foresee and prevent equipment breakdowns, optimizing maintenance schedules. Anomaly detection and quality control utilize these technologies to identify irregularities in manufacturing, ensuring product excellence swiftly. In addition, supply chain and inventory optimization benefit from AI-driven algorithms that enhance efficiency by refining inventory management and logistics.

In August 2023, Telefonaktiebolaget LM Ericsson and RMIT University collaborated to establish the RMIT & Ericsson AI Lab at RMIT's Hanoi campus in Vietnam. This initiative builds upon their existing 5G education partnership, to educate Vietnamese students about 5G and emerging technologies including AI, machine learning, and blockchain. The use of artificial intelligence in Industry 4.0 projects is becoming increasingly prevalent in Vietnam. The deployment of 5G, Ericsson, and RMIT are now able to assist business, academic, and neighborhood partners in developing and implementing AI solutions that will help drive the adoption of Industry 4.0 across a range of sectors. This will benefit industries, such as energy, manufacturing, agriculture, transport, and logistics.

Component Insights

The hardware segment captured a significant market share of around 50.0% in 2022. Hardware components in Industry 4.0 include sensors, actuators, controllers, and various other devices that enable the collection and analysis of data in real-time. These components are critical to the operation of smart factories, which rely on data-driven decision-making and automation to optimize production. Several factors are driving the growth of the hardware component segment. First and foremost is the increasing demand for smart technologies that can improve manufacturing efficiency, reduce downtime, and enhance product quality. As more companies adopt Industry 4.0, the demand for hardware components will continue to grow. The rapid development of IoT technologies drives the growth of the hardware component segment. IoT devices, which collect data from sensors and other sources, require hardware components to function.

As the use of IoT devices continues to expand in the market, the demand for hardware components will also increase. The software segment is expected to witness the highest CAGR of around 20.0% by 2030. Software is instrumental in collecting, analyzing, and interpreting data in real-time, enabling data-driven decision-making and automation to optimize production processes. The increasing demand for AI and ML technologies drives the software component segment growth. These technologies enable predictive maintenance, quality control, and supply chain optimization. Cloud computing is another factor boosting the demand for software in Industry 4.0. Cloud-based platforms also offer manufacturers access to various software tools and services, such as predictive analytics and digital twins, which can help them optimize their production processes.

Technology Insights

The Industrial Internet of Things (IIoT) segment captured a significant market share of more than 27.0% in 2022. The IIoT is a technology that is rapidly gaining popularity in the market. This technology is poised to revolutionize how businesses operate, enabling machines and devices to communicate with each other and humans. The IIoT is a critical component of Industry 4.0 because it allows machines and devices to communicate with each other and humans in real time. As the IIoT technology continues to grow, it is expected to impact the manufacturing Industry significantly.

For example, it will enable manufacturers to collect and analyze data from their machines and devices in real time, identifying inefficiencies and optimizing their processes. In addition to improving efficiency, the IIoT will help manufacturers reduce downtime and maintenance costs. By monitoring their machines and devices in real time, manufacturers can identify potential problems before they occur, allowing them to take preventive action to avoid costly downtime. Predictive maintenance is another area where the IIoT is expected to have a significant impact. The blockchain and secure data exchange segment is expected to witness the highest CAGR of around 21.0% by 2030.

The need for increased security and transparency in the digital world drives the growth of blockchain technology and secure data exchange; with more and more data being generated and transmitted online, businesses must have a secure and reliable way to store and exchange this information. The key benefit of blockchain technology is that it provides a decentralized and secure platform for digital transactions. This means that transactions can be verified and recorded without a central authority, such as a bank or government agency. As a result, blockchain technology can help to reduce the risk of fraud and cyber-attacks.

Industry Vertical Insights

The manufacturing segment captured a significant market share of around 31.0% in 2022. The manufacturing Industry is experiencing a significant transformation due to the growth of Industry 4.0. This transformation is driven by a wide range of technologies that enable businesses to operate more efficiently, reduce costs, and improve the customer experience. The key technology driving the growth in the manufacturing Industry is the Internet of Things (IoT). IoT-enabled sensors monitor equipment performance and identify potential issues before they become serious problems. This real-time data and insights can be used to improve operations and increase efficiency, providing significant benefits to businesses.

Another technology driving the growth in the manufacturing Industry is robotics. Advances in robotics technology are enabling businesses to automate a wide range of tasks, from simple assembly line operations to complex logistics and supply chain management. This automation can help businesses reduce costs, increase efficiency, and improve safety by removing human workers from dangerous or repetitive tasks. The automotive segment is expected to witness a CAGR of around 21.0% through 2030.

The automotive Industry is one of the sectors experiencing significant growth in the market. This growth is driven by various technological advancements that enable businesses to operate more efficiently, reduce costs, and improve the customer experience. IoT is the key technology driving the growth in the automotive Industry. IoT-enabled sensors monitor equipment performance and identify potential issues before they become serious problems.

Regional Insights

Asia Pacific dominated the market in 2022 by holding a revenue share of over 35.0%. The region has been experiencing rapid growth in the market in recent years. The region is home to some of the world's largest manufacturing hubs, including China, Japan, and South Korea. These countries have been at the forefront of adopting technologies, with China being the leader in this area. In addition, other countries in the region, such as Australia, Singapore, and Malaysia, have also been investing in technologies. For example, Australia has been promoting the adoption of robotics technology in the mining Industry to increase efficiency and safety. The growth of the regional market is expected to continue in the coming years.

The adoption of Industry 4.0 technologies in the region is driven by several factors. One of the main factors is the need for businesses to remain competitive in an increasingly globalized market. The integration of advanced technologies into manufacturing processes enables businesses to increase efficiency, reduce costs, and improve product quality, thereby increasing their competitiveness. Middle East and Africa are projected to record a significant CAGR of over 21.0% through 2030. The region is experiencing significant growth driven by various factors, such as government support, availability of skilled labor, and strategic location.

The market refers to the integration of advanced technologies, such as robotics, AI, and the IoT, into the manufacturing process to improve efficiency and productivity. In recent years, governments in the region have recognized the importance of Industry 4.0 and have made efforts to promote its adoption. Countries, such as Saudi Arabia, UAE, and South Africa, have invested heavily in infrastructure, education, and research to support the growth of advanced manufacturing technologies. This investment has helped to create a favorable environment for companies to invest in the region. One of the driving factors behind the growth of the market in the region is the availability of skilled labor. The region has a large pool of technical and engineering talent, which is essential for the adoption of advanced technologies. This talent pool is expected to grow further as the region invests in education and training programs to develop the skills required for Industry 4.0.

Key Companies & Market Share Insights

The key players in the market often include technology innovators, solution providers, and research institutions. These players contribute to the development of advanced manufacturing, automation, IoT, AI, and data analytics solutions. Their efforts drive the transformation of industries through digitization and smart technologies, impacting supply chains, production processes, and customer experiences. They also encompass software developers, hardware manufacturers, etc. as these entities collaborate to create integrated solutions that optimize production efficiency, enhance predictive maintenance capabilities, enable real-time monitoring, etc.

In addition, regulatory bodies and standardization organizations play a crucial role in shaping the framework and guidelines for the ecosystem. For instance, In August 2023, Denso Corporation acquired a full stake in Certhon Group, a horticultural facility operator. The aim of this acquisition is to further accelerate their efforts to solve global food challenges by leveraging the strengths of both companies and the results of their past collaboration. Some prominent players in the global Industry 4.0 market include:

-

ABB LTD.

-

Cisco Systems Inc.

-

Cognex Corporation

-

Denso Corporation

-

Emerson Electric

-

Fanuc Corporation

-

General Electric Company

-

Honeywell International Inc.

-

Intel Corporation

-

Johnson Controls International

-

Kuka Group

-

Robert Bosch GmbH

-

Rockwell Automation Inc.

-

Schneider Electric SE

-

Siemens AG

Industry 4.0 Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 175.94 billion

Revenue forecast in 2030

USD 627.59 billion

Growth rate

CAGR of 19.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, Industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Mexico; UAE; Saudi Arabia

Key companies profiled

ABB Ltd.; Cisco Systems Inc.; Cognex Corp.; Denso Corp.; Emerson Electric; Fanuc Corp.; General Electric Company; Honeywell International Inc.; Intel Corp.; Johnson Controls International; Kuka Group; Robert Bosch GmbH; Rockwell Automation Inc.; Schneider Electric SE; Siemens AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industry 4.0 Market Report Segmentation

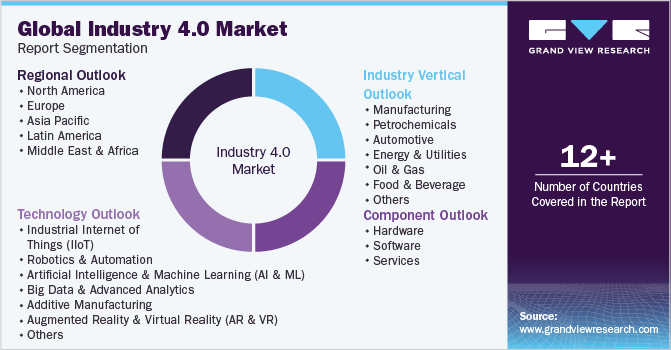

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Industry 4.0 market report based on component, technology, Industry vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Industrial Internet of Things (IIoT)

-

Robotics & Automation

-

Artificial Intelligence & Machine Learning (AI & ML)

-

Big Data & Advanced Analytics

-

Additive Manufacturing

-

Augmented Reality & Virtual Reality (AR & VR)

-

Digital Twin & Simulation

-

Blockchain & Secure Data Exchange

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Manufacturing

-

Petrochemicals

-

Automotive

-

Energy & Utilities

-

Oil & Gas

-

Food & Beverage

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The Industry 4.0 market size was estimated at USD 146.14 billion in 2022 and is expected to reach USD 175.94 billion in 2023.

b. The Industry 4.0 market is expected to grow at a compound annual growth rate of 19.9% from 2023 to 2030 to reach USD 627.59 billion by 2030.

b. Asia Pacific dominated the Industry 4.0 market in 2022 by holding a revenue share of over 35.0%. The region has been experiencing rapid growth in the market in recent years. The region is home to some of the world's largest manufacturing hubs, including China, Japan, and South Korea.

b. The key players in this Industry 4.0 market include ABB Ltd., Cisco Systems Inc., Cognex Corporation, Denso Corporation, Emerson Electric, Fanuc Corporation, General Electric Company, Honeywell International Inc., Intel Corporation, Johnson Controls International, Kuka Group, Robert Bosch GmbH, Rockwell Automation Inc., Schneider Electric SE, and Siemens AG, among others.

b. Key factors boosting the growth of the Industry 4.0 market include increasing adoption of automated equipment and tools on factory floors, warehouses, and manufacturing, rising investment towards addictive manufacturing units, and growing digitalization trends globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.