- Home

- »

- Communications Infrastructure

- »

-

Data Center Rack Power Distribution Unit Market Report, 2030GVR Report cover

![Data Center Rack Power Distribution Unit Market Size, Share & Trends Report]()

Data Center Rack Power Distribution Unit Market (2023 - 2030) Size, Share & Trends Analysis Report By Rack Type (Non-intelligent PDU, Intelligent PDU (Metered, Switched)), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-830-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Center Rack Power Distribution Unit Market Summary

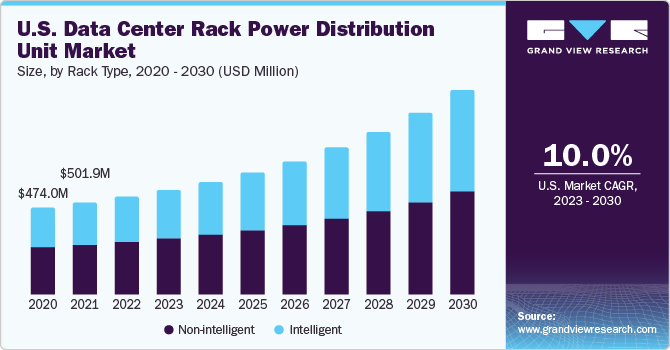

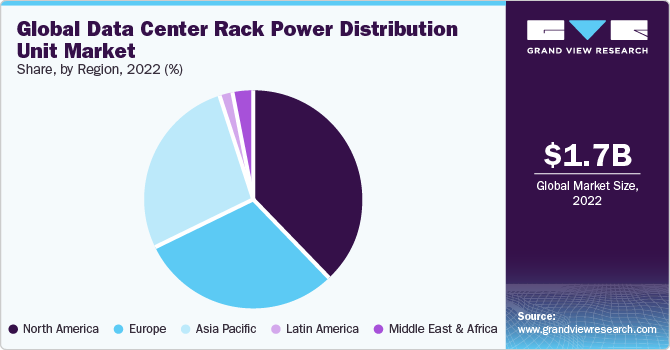

The global data center rack power distribution unit market size was valued at USD 1.65 billion in 2022 and is anticipated to grow at a CAGR of 9.8% from 2023 to 2030. Owing to the COVID-19 pandemic, people were advised to stay at home as a preventive measure.

Key Market Trends & Insights

- North America dominated the market and accounted for the largest revenue share of 37.9% in 2022.

- By rack type, the non-intelligent segment accounted for the largest revenue share of 53.8% in 2022.

- Asia Pacific is expected to grow at the fastest CAGR of 11.6% during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 1.65 Billion

- 2030 Projected Market Size: USD 3.39 Billion

- CAGR (2024-2030):9.8%

- North America: Largest market in 2023

Several companies have been following work-from-home policies not only to protect their employees but also to serve their customers. This has led to an increase in digital traffic and usage of online communication services. Data centers are playing a crucial role in safeguarding and maintaining secure digital infrastructure during this uncertain time. This crisis is expected to shift the focus towards the importance of improved digital infrastructure, coupled with data centers, thereby paving way for the market growth.

Furthermore, the power distribution unit (PDU) regulates the voltage in data centers and provides real-time information related to the power supply. They manage power efficiently in case of equipment failures. These factors are expected to impact market growth positively. Additionally, the market is driven by the growing adoption of cloud-based services. Cloud service providers are engaged in investing in constructing new facilities as well as renovating their existing data centers to manage power efficiently. However, owing to the ongoing coronavirus pandemic, the expansion of several manufacturing facilities is shut down in order to ensure the safety of employees and citizens.

Nevertheless, companies are focused on providing remote access to their employees in order to maintain business continuity. PDU providers are focusing on offering solutions that are equipped with monitoring capabilities. These solutions ensure optimum utilization of available resources and have the capability of controlling power consumption. They assist organizations in reducing their power usage, carbon footprint, and increase the efficiency of data centers.

Modern data center requires technologically advanced products and systems that meet the market needs and requirements related to capability, reliability, and quality. Numerous organizations are developing products that can manage power consumption effectively and increase energy efficiency, considering the rise in power usage. Furthermore, increasing applications of containerized data centers are expected to drive the market. A portable data center that is installed in a shipping container is known as a containerized data center. It is part of a modular data center in which every module can host IT, cooling, and other power equipment.

Rising temperature in data centers leads to the demand for cooling systems, thereby reducing additional expenses associated with cooling the equipment. However, along with the rising temperature in data center facilities, the exhaust temperature is also increasing. Thus, PDUs with high ambient temperature ratings are vital for avoiding equipment failures due to overheating. These aforementioned factors have led to the demand for power distribution units with a high rating, which is estimated to fuel the data center rack power distribution unit industry growth over the forecast period.

Data centers that have witnessed power shortages have increased over the past few years. This has led to an unavoidable interruption in business processes and has prompted operators to equip their data centers with power units to avoid disruptions and ensure frequent power supply. However, complexity in data center designs is a major factor restricting market growth. The introduction of smart and high-density power distribution units is expected to open new avenues for the market over the forecast period.

Rack Type Insights

The non-intelligent segment accounted for the largest revenue share of 53.8% in 2022. The non-intelligent rack power distribution units, which have only input load monitoring and power distribution functionalities, held the largest share of over 50.0% in 2019. Factors such as increased demand for power and load monitoring capabilities in data centers and cost-effectiveness are anticipated to boost the segment growth over the forecast period. Additionally, these power distribution units fulfill the requirements of various data centers as they accurately distribute current and voltage within the IT infrastructure.

The intelligent segment is expected to grow at the fastest CAGR of 10.7% during the forecast period. The intelligent rack PDU is further bifurcated into Metered PDU and Switched PDU. This is attributed to the shift of various organizations towards hyper-converged infrastructure. Additionally, features such as input metering, network connectivity, and output metering are expected to boost their demand.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 37.9% in 2022. This is attributed to the presence of key players such as APC Corp; Hewlett Packard Enterprise Development LP; and Cyber Power Systems (USA), Inc. U.S. is considered to be a major contributor in terms of revenue owing to the increasing adoption of online shopping, which has led to retailers having data centers in their own premises or lease storage space from third-party service providers. Furthermore, colocation providers in this region are significantly investing in constructing additional data centers to enhance their global footprint, which is subsequently fueling the regional market growth.

Asia Pacific is expected to grow at the fastest CAGR of 11.6% during the forecast period. Growing preference for digitalization is anticipated to encourage the adoption of cloud-based services and in turn, necessitate the utilization of data centers during the forecast period. Companies such as Amazon Web Services, Inc.; Google LLC; and IBM Corporation are expanding their cloud-based services in this region. Furthermore, rising expenditure on IT infrastructure in countries, such as Japan, China, and India, is fueling the demand for power distribution units in the region.

Key Companies & Market Share Insights

The leading players in the market are undertaking strategies such as product developments, mergers and acquisitions, strategic partnerships, and business expansions to maintain their stronghold on the market.

For instance, in October 2022, Vertiv, a provider of critical digital infrastructure and continuity solutions, joined forces with Virtualflex, Fiji's ICT solution partners specializing in enterprise-level and cloud solutions. The collaboration was a response to the rising demand in Fiji for uninterruptible power supply (UPS) technology. This technology was sought after by businesses to ensure seamless operations and maintain IT and data center availability during power outages..

Key Data Center Rack Power Distribution Unit Companies:

- Data Center Rack Power Distribution Unit

- Schneider Electric

- Cyber Power Systems (USA), Inc.

- Eaton

- Enlogic,

- Hewlett Packard Enterprise Development LP

- Leviton Manufacturing Co., Inc.

- Raritan, Inc.

- Server Technology, Inc.

- Tripp Lite

- Vertiv Group Corp

Recent Developments

-

In December 2022, Schneider Electric announced its latest offering, the APC NetShelter Rack PDU Advanced. This innovative solution was designed to provide data centers with increased flexibility to address the ever-growing data requirements faced by businesses. After witnessing successful adoption in North America, the APC NetShelter Rack PDU Advanced was set to expand its availability to various European countries. This expansion showcased Schneider Electric's dedication to delivering enhanced value to cloud service providers and enterprise customers, especially in critical applications.

-

In June 2022, Schneider Electric introduced the easy modular data center all-in-one solution in Europe. This innovative offering cooling, combines power and IT equipment into a single, pre-configured solution, catering to enterprises and IT organizations adopting edge computing strategies. The launch of this new line of data centers addresses consumer demands for predictability, faster deployment times, and lower total cost of ownership, providing significant value to businesses in the ever-evolving digital landscape.

-

In June 2022, Vertiv, launched a new series of uninterruptible power supply (UPS) solutions, which includes Vertiv Liebert EXM2 and Vertiv Liebert ITA2 - 30 kVA. Among the released power products, the Liebert ITA2 - 30 kVA stands out for its exceptional energy efficiency, offering up to 96.3% efficiency over a wide range of load conditions. This efficiency translates to significant cost savings in operational expenses. Additionally, the Liebert ITA2 30 kVA features integrated Smart Sleep technology in ECO mode, achieving an impressive energy efficiency of up to 99%. Designed for edge and small computer room applications, this rack/tower UPS provides an ideal solution for businesses seeking reliable power protection and economical performance.

-

In May 2022, Panduit Corp. introduced the SmartZone Cloud Software, a sophisticated cloud-based application that seamlessly integrates power and environmental monitoring with rack access, connectivity management, and asset management. With this advanced software, data center operations gain the capability to monitor critical infrastructure resources and make well-informed decisions from any authorized device across the globe. The SmartZone Cloud Software empowers businesses to efficiently oversee their data center operations, even in the face of ever-changing demands on their infrastructure.

-

In January 2022, Equinix, Inc., collaborated with GIC, Singapore's sovereign wealth fund. The partnership aims to develop and manage two xScale data centers in Seoul, South Korea. Through this new joint venture, the global xScale data center portfolio will be expanded, enabling Equinix to further enhance its presence and offerings in the dynamic Korean market.

-

In September 2021, Vantage Data Centers unveiled a significant expansion initiative into the APAC region with two strategic acquisitions. The company made headlines by announcing the purchase of Agile Data Centers and simultaneously taking over the data center portfolio of PCCW Ltd. These acquisitions marked Vantage Data Centers' strategic move to strengthen its presence and offerings in the rapidly growing APAC market.

Data Center Rack Power Distribution Unit Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.77 billion

Revenue forecast in 2030

USD 3.39 billion

Growth rate

CAGR of 9.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Rack type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Schneider Electric; Cyber Power Systems (USA), Inc.; Eaton; Enlogic; Hewlett Packard Enterprise Development LP; Leviton Manufacturing Co., Inc.; Raritan, Inc.; Server Technology, Inc.; Tripp Lite; Vertiv Group Corp.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center Rack Power Distribution Unit Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global data center rack power distribution unit market report based on rack type, and region:

-

Rack Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Non-intelligent

-

Intelligent

-

Metered

-

Switched

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global data center rack power distribution unit market size was estimated at USD 1.65 billion in 2022 and is expected to reach USD 1.77 billion in 2023.

b. The global data center rack power distribution unit market is expected to grow at a compound annual growth rate of 9.8% from 2023 to 2030 to reach USD 3.39 billion by 2030.

b. North America dominated the data center rack power distribution unit market with a share of 38.0% in 2022. The colocation providers in this region are significantly investing in constructing additional data centers to enhance their global footprint, which is subsequently fueling the regional market growth.

b. Some key players operating in the data center rack power distribution unit market include Schneider Electric; Cyber Power Systems (USA), Inc.; Eaton; Enlogic; Hewlett Packard Enterprise Development LP; Leviton Manufacturing Co., Inc.; Raritan, Inc.; Server Technology, Inc.; and Tripp Lite; Vertiv Group Corp.; among others.

b. Key factors that are driving the market growth include an increase in digital traffic and usage of online communication services. Data centers are playing a crucial role in safeguarding and maintaining secure digital infrastructure during this uncertain time. This crisis is expected to shift the focus towards the importance of improved digital infrastructure coupled with data centers, thereby paving the way for market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.