- Home

- »

- HVAC & Construction

- »

-

Data Center Market Size & Share, Industry Report, 2033GVR Report cover

![Data Center Market Size, Share, & Trends Report]()

Data Center Market (2026 - 2033) Size, Share, & Trends Analysis Report By Component (Software, Hardware), By Type, By Server Rack Density, By Redundancy, By PUE, By Design, By Tier Level, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-116-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Center Market Summary

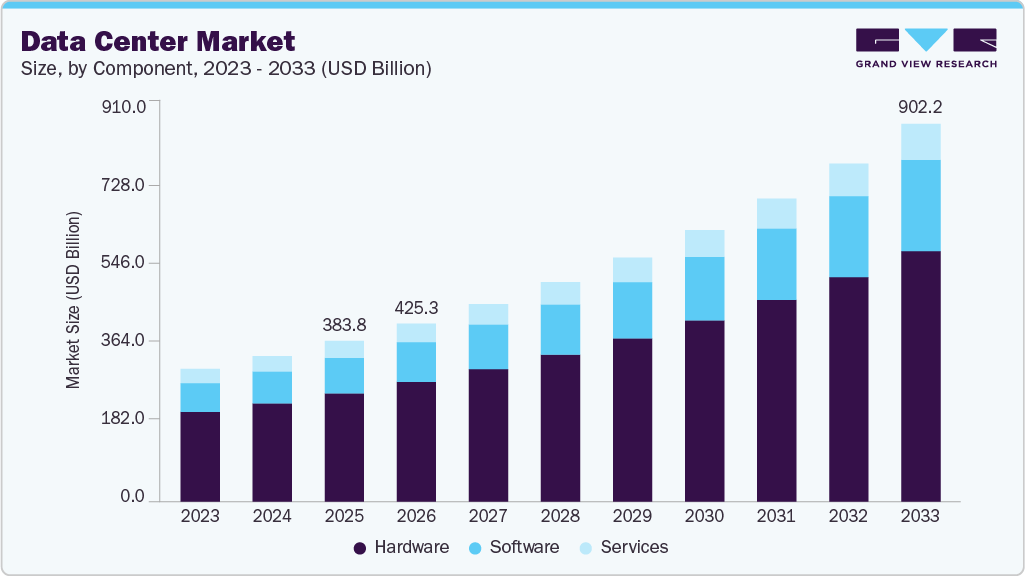

The global data center market size was estimated at USD 383.82 billion in 2025 and is anticipated to reach USD 902.19 billion by 2033, growing at a CAGR of 11.3% from 2026 to 2033, driven primarily by the exponential rise in data generation across industries. The market is undergoing rapid transformation as enterprises, governments, and hyperscale cloud providers aggressively expand digital infrastructure to support the exponential rise in data generation, artificial intelligence (AI) workloads, and cloud-based applications.

Key Market Trends & Insights

- North America held 38.3% revenue share of the data center market.

- In the U.S., the increasing reliance on hyperscale and colocation data centers is accelerating the demand for industrial and commercial LED lighting market.

- By component, hardware segment held the largest revenue share of over 67.0% in 2025.

- By type, on-premise segment held the largest revenue share in 2025.

- By server rack, 10-19kW segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 383.82 Billion

- 2033 Projected Market Size: USD 902.19 Billion

- CAGR (2026-2033): 11.3%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The rapid shift toward cloud computing, as enterprises increasingly adopt public, private, and hybrid cloud models to enhance scalability, reduce capital expenditure, and improve operational efficiency. Organizations are moving critical applications, workloads, and data to cloud platforms to gain flexibility, faster deployment, and better resource optimization. This widespread adoption has compelled major hyperscalers such as Amazon Web Services, Microsoft Azure, Google Cloud, and Alibaba Cloud to aggressively expand their global regions and availability zones to meet rising demand. These expansions support low-latency access, improved redundancy, local data sovereignty compliance, and greater service availability across industries. As more businesses embrace digital transformation, cloud-first strategies continue to accelerate the construction of hyperscale data centers worldwide, reinforcing cloud computing as a central catalyst for market growth.

Moreover, the proliferation of edge computing is significantly contributing to the growth of the data center industry. As the volume of data generated by IoT devices and real-time applications increases, there is a growing need for low-latency processing. Edge data centers located closer to the source of data generation reduce latency and improve application performance. This trend is particularly prominent in sectors such as autonomous vehicles, healthcare, and smart cities, where real-time data processing is critical.

Sustainability initiatives are also playing a pivotal role in driving growth in the data center market. Operators are prioritizing energy-efficient designs, renewable energy adoption, and next-generation cooling systems to minimize environmental impact. Governments and regulatory authorities are also pushing for greener data center practices, accelerating investment in sustainable infrastructure. Meanwhile, continuous technological advancements, such as liquid cooling, AI-driven management systems, and modular data center architectures, are significantly improving performance while reducing operational costs. These innovations are motivating enterprises to upgrade and modernize their data environments, further supporting the expansion of the overall market.

Component Insights

The hardware segment accounted for the largest market share of over 67.0% in 2025 in the data center market. The rising demand for high-performance computing (HPC) and AI workloads is a major driver of growth in the data center hardware segment. AI training, machine learning, and complex computational tasks require powerful GPUs and accelerator-based servers that can handle extremely high processing loads. These applications also require high-density racks, ultra-fast NVMe storage, and advanced networking technologies, such as 100G, 400G, and increasingly 800G Ethernet, to support rapid data transfer. As workloads intensify, data centers must adopt more energy-efficient cooling systems to manage the heat generated by dense compute environments. This shift toward performance-driven infrastructure is accelerating investments in next-generation servers, networking gear, and cooling hardware.

The software segment is anticipated to grow at a CAGR of 12.6% during the forecast period. The growing complexity of modern data centers, particularly hyperscale, multi-site, and hybrid environments are likely to help the software segment growth. Operators require DCIM & other platforms to gain real-time visibility into power, cooling, space, and equipment performance across their facilities. These tools support capacity planning, asset tracking, energy optimization, and predictive maintenance, helping reduce downtime and improve operational efficiency. As data centers scale and diversify, DCIM software has become essential for centralized management, automation, and informed decision-making in increasingly dynamic infrastructure environments.

Hardware Insights

The server segment dominated the market and accounted for a revenue share of over 34.0% in 2025. Modern servers are becoming more powerful and energy-efficient due to the continuous advancements in processor technology, memory, and storage solutions. For example, the integration of ARM-based processors into server designs has been gaining traction, offering a more energy-efficient and cost-effective alternative to traditional x86-based servers.

The uninterruptible power supply segment is expected to grow at the fastest CAGR over the forecast period. The growing power requirements of modern data centers, particularly hyperscale and AI-intensive facilities, are driving strong demand for UPS systems. High-density server racks, GPU clusters, and storage arrays consume substantial electricity, making a continuous and reliable power supply critical to prevent downtime and protect sensitive workloads. UPS systems provide backup power, voltage regulation, and surge protection, ensuring operational continuity even during outages or fluctuations. As data centers scale in size and complexity, the need for robust, high-capacity, and energy-efficient UPS solutions becomes increasingly essential to maintain uptime, meet service-level agreements, and safeguard infrastructure.

Software Insights

The virtualization segment dominated the market and accounted for the largest revenue share in 2025. The growth of AI, high-performance computing (HPC), and big data workloads is a major driver for virtualization in data centers. These complex applications require a flexible, scalable infrastructure that can efficiently handle variable processing demands. Virtualization enables dynamic allocation of compute, storage, and networking resources, ensuring high availability and optimal performance without the need to over-provision physical servers. By abstracting hardware and enabling workload mobility, virtualized environments support rapid deployment, resource optimization, and cost efficiency, making them essential for handling large-scale AI training, analytics, and HPC operations in modern data centers.

The DCIM segment is expected to grow at a significant CAGR over the forecast period. The increasing demand for real-time monitoring and predictive maintenance is a key growth driver for the DCIM segment. As data centers become increasingly mission-critical, maintaining uptime and preventing failures is essential. DCIM solutions offer continuous monitoring and real-time alerts for vital infrastructure components, including power systems, cooling units, and network devices. This enables operators to detect potential problems early and take proactive measures, minimizing the risk of downtime or system failures while ensuring efficient and reliable operation of the data center infrastructure.

Services Insights

The professional services segment dominated the market and accounted for the largest revenue share in 2025. Rising cloud adoption and hybrid IT environments is driving demand for professional services in data centers. As enterprises move workloads to public, private, or hybrid clouds, they require expert support for migration, system integration, and workload orchestration. Professional service providers ensure smooth transitions, optimize resource allocation, and minimize operational disruption, helping organizations maintain continuity, enhance performance, and fully leverage the benefits of cloud and hybrid IT infrastructures.

The support services segment is expected to grow at a significant CAGR over the forecast period. Support services are vital for assisting organizations in the design, implementation, and maintenance of data centers capable of handling modern operational demands. With the increasing complexity of data centers driven by advanced hardware, networking, software, and storage integration, these services are essential for efficient management and optimization. This rising complexity is fueling the growing demand for professional support services in the data center market.

Type Insights

The on-premise segment dominated the market and accounted for the largest revenue share in 2025, driven by the increasing focus on data security and privacy. Many organizations, especially in regulated industries such as finance, healthcare, and government, prefer to maintain complete control over their data to comply with strict data protection laws and industry standards. By managing their own data centers, these organizations can implement customized security protocols and ensure that their data is stored and processed in-house, which minimizes exposure to external threats.

The hyperscale segment is expected to grow at a significant CAGR over the forecast period, driven the increasing demand for cloud services. The rapid expansion of cloud services is a major driver for hyperscale data centers. Leading cloud providers, such as AWS, Microsoft Azure, Google Cloud, and Alibaba Cloud, are continually building new regions and availability zones worldwide to meet the growing demand for public cloud services, Software-as-a-Service (SaaS), and Infrastructure-as-a-Service (IaaS) solutions. Hyperscale data centers enable these providers to deliver highly scalable, reliable, and cost-efficient services to a global customer base. This expansion ensures low-latency access, redundancy, and enhanced performance, reinforcing the critical role of hyperscale facilities in supporting the digital economy.

Server Rack Density Insights

The 10-19kWsegment dominated the market and accounted for the largest revenue share in 2025. The 10-19 kW data center segment offers modular and scalable infrastructure, making it highly attractive for mid-sized enterprises and regional deployments. These racks can be deployed incrementally, allowing organizations to expand compute and storage capacity as business requirements grow, without over-investing in unnecessary hardware upfront. Modular designs simplify installation, integration, and maintenance, while providing flexibility to adapt to evolving workloads. By enabling efficient resource utilization and minimizing capital expenditures, these medium-density racks help enterprises optimize operational costs, support hybrid or edge computing strategies, and ensure infrastructure can scale in line with business growth.

The 20-29kW segment is expected to grow at the fastest CAGR over the forecast period. Large enterprises and hyperscale data centers favor 20-29 kW racks because they enable high-density workload consolidation while maintaining scalability. This segment serves as an intermediate solution, bridging the gap between smaller modular or edge deployments and full-scale hyperscale facilities. By providing substantial compute capacity in a manageable footprint, these racks allow organizations to handle growing workloads efficiently, optimize space and power utilization, and support expansion without the complexity of building larger hyperscale infrastructure.

Redundancy Insights

The N+1 segment dominated the market and accounted for the largest revenue share in 2025. The increasing demand for high availability is a key driver for the N+1 redundancy segment in data centers. Enterprises and hyperscale operators must maintain uninterrupted operations to meet strict service-level agreements (SLAs) and ensure business continuity. N+1 redundancy provides an additional backup for critical components, such as power, cooling, and networking systems, ensuring that operations continue uninterrupted even if the primary unit fails. This approach minimizes downtime, safeguards mission-critical workloads and enhances overall reliability while balancing cost and system efficiency.

The N+2 segment is expected to grow at the fastest CAGR over the forecast period. The increasing demand for ultra-high availability is a key driver for N+2 redundancy in data centers. Enterprises, hyperscale operators, and critical industries require near-zero downtime to support mission-critical workloads. N+2 redundancy provides two backup components for each critical system, such as power, cooling, or networking, ensuring that even if two units fail simultaneously, operations continue without disruption. This enhances reliability, supports continuous service delivery, and minimizes the risk of costly downtime.

PUE Insights

The 1.2-1.5 segment dominated the market and accounted for the largest revenue share in 2025. The rising focus on energy efficiency and sustainability is a major driver for the 1.2-1.5 PUE segment in data centers. Operators are increasingly designing facilities to minimize energy waste, reduce operational costs, and lower environmental impact. Achieving a PUE between 1.2 and 1.5 indicates highly efficient use of power, where most electricity supports IT equipment rather than cooling or auxiliary systems. Such efficient designs not only enhance sustainability metrics and support ESG goals but also attract environmentally conscious clients while improving overall cost-effectiveness in high-density and hyperscale data center operations.

The less than 1.2 segment is expected to grow at the fastest CAGR from 2026 to 2033. Data centers with a PUE below 1.2 are recognized for their ultra-high energy efficiency, which minimizes wasted energy and significantly lowers operational costs. Operators achieve this by implementing innovative designs and technologies that prioritize power delivery to IT equipment while reducing energy consumption in cooling, power distribution, and auxiliary systems. Such highly efficient operations not only enhance sustainability metrics and ESG compliance but also improve cost-effectiveness, making these facilities attractive to environmentally conscious enterprises.

Design Insights

The traditional segment dominated the market and accounted for the largest revenue share in 2025. Traditional data center designs typically have lower upfront capital expenditures compared to newer, more advanced designs such as modular, containerized, or hyper-scale facilities. For small to medium-sized businesses or organizations that do not have large-scale IT needs, traditional data centers offer a more budget-friendly option for maintaining their operations. These facilities are often designed with a focus on maximizing available space and basic operational requirements, making them appealing to organizations looking for a relatively low-cost and straightforward infrastructure solution.

The modular segment is expected to grow at the fastest CAGR over the forecast period. Rapid deployment and reduced time-to-market are key advantages of modular data centers. Being prefabricated and pre-engineered, these facilities can be installed and commissioned much faster than traditional brick-and-mortar data centers. This enables enterprises and cloud service providers to add capacity quickly in response to growing digital demand, new workloads, or regional expansion needs. Faster deployment also reduces project risks, supports agile scaling strategies, and helps organizations meet business requirements without long construction timelines.

Tier Level Insights

The tier 3 segment dominated the market and accounted for the largest revenue share in 2025. The expansion of cloud and hybrid IT environments is a major growth driver for Tier III data centers. These facilities provide redundancy, concurrent maintainability, and high uptime required to support seamless integration between on-premise infrastructure, colocation services, and public cloud platforms. As enterprises adopt hybrid strategies to balance performance, security, and cost, Tier III data centers offer the reliability needed to ensure continuous operations, efficient workload distribution, and consistent service delivery across interconnected environments.

The tier 4 segment is expected to grow at the fastest growth rate from 2026 to 2033. Applications such as real-time financial trading, national security systems, healthcare platforms, and AI-driven services demand uninterrupted availability and ultra-low latency. Any downtime or performance degradation can result in severe financial, operational, or safety risks. Tier IV facilities provide fully fault-tolerant infrastructure and maximum redundancy, ensuring continuous operations and consistent performance for these high-stakes, always-on workloads.

Enterprise Size Insights

The large enterprise segment dominated the market and accounted for the largest revenue share in 2025. The growth of hybrid and multi-cloud environments is influencing the data center requirements of large enterprises. Many large organizations adopt hybrid or multi-cloud strategies, where they use a combination of private data centers and public cloud services from providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. Therefore, large enterprises are looking for data center providers that can seamlessly integrate with cloud platforms, support hybrid infrastructure, and offer the flexibility to shift workloads between on-premises data centers and cloud environments.

The small & medium enterprises segment is expected to grow at the fastest CAGR over the forecast period. Local and regional data center options are particularly important for SMEs that need to comply with data sovereignty regulations or require low-latency services. Many SMEs operate within specific geographic regions and need data centers that can meet local regulatory requirements and provide high-speed access to customers. Regional data centers are often more affordable and accessible for SMEs than larger, global data center facilities.

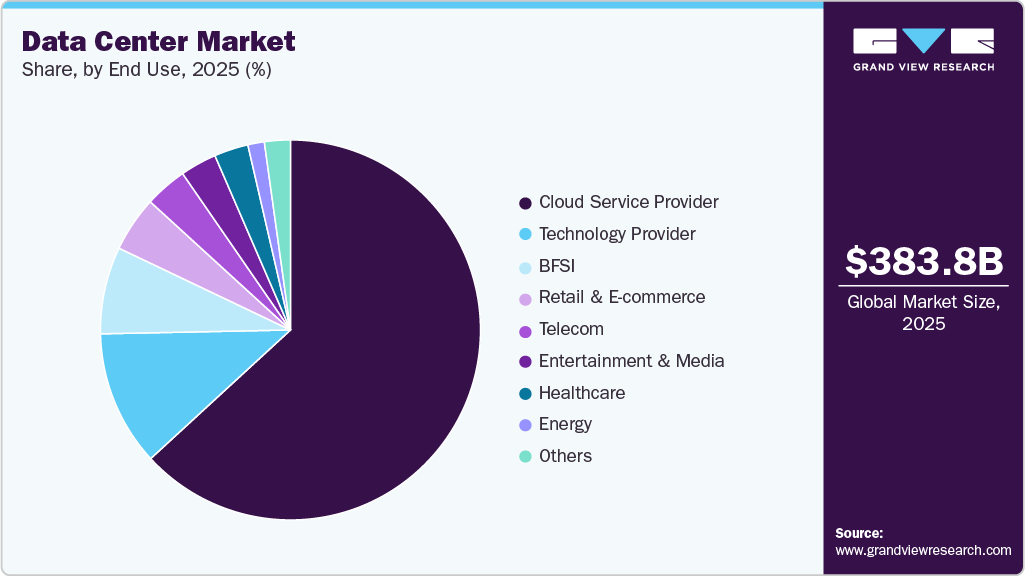

End Use Insights

The cloud service provider segment dominated the market and accounted for the largest revenue share in 2025. The increasing demand for high-performance computing (HPC) and big data processing is significant growth driver for the cloud service provider (CSP) end-use segment. Cloud service providers are increasingly offering specialized services such as AI, machine learning (ML), and big data analytics to assist businesses process and analyze large volumes of data. These services require data centers with advanced infrastructure capable of handling high workloads and providing low-latency processing.

The technology provider segment is expected to grow at the fastest CAGR over the forecast period, driven the increasing demand for cloud-based solutions. As more businesses shift to cloud computing, technology providers need robust data center infrastructure to host applications and services that support digital transformation. Whether it is providing software-as-a-service (SaaS), platform-as-a-service (PaaS), or infrastructure-as-a-service (IaaS) offerings, technology providers rely on data centers to deliver reliable, scalable, and cost-effective cloud services.

Regional Insights

North America data center market held a significant share of over 38.3% in 2025, driven by the increasing adoption of cloud computing, artificial intelligence (AI), and big data analytics. The region hosts leading technology firms, research institutions, and cloud providers developing compute-intensive applications. These advanced workloads require high-density server environments, GPU and accelerator clusters, advanced cooling systems, and highly reliable power infrastructure. As a result, operators are making significant investments in new data centers and upgrades to support performance, scalability, and energy efficiency requirements.

U.S. Data Center Industry Trends

The data center market in the U.S. is expected to grow significantly at a CAGR of 10.4% from 2026 to 2033. The U.S. hosts a high concentration of hyperscale cloud providers such as AWS, Microsoft Azure, Google Cloud, Meta, and Oracle, making it a global center for cloud infrastructure. These companies are continuously expanding cloud regions and availability zones to support growing demand for digital services, AI, and enterprise workloads. This ongoing expansion is driving large-scale data center construction, increased capacity additions, and sustained investment in power, cooling, and network infrastructure.

Europe Data Center Industry Trends

The data center market in Europe is anticipated to register considerable growth from 2026 to 2033. Enterprises across the region are increasingly migrating workloads to public and hybrid cloud environments to improve scalability, flexibility, and cost efficiency. This shift is boosting demand for hyperscale and colocation data centers, particularly in established hubs such as Frankfurt, London, Amsterdam, Paris, and Dublin, which offer strong connectivity, cloud on-ramps, and access to major enterprise customers.

Data center market in Germany held a substantial market share in 2025. Industries such as automotive, manufacturing, healthcare, retail, and public services are accelerating digital transformation initiatives. Increased adoption of cloud platforms, data analytics, automation, and digital applications is driving demand for secure, reliable, and resilient data center infrastructure to support critical operations, ensure data protection, and maintain continuous service availability.

Asia Pacific Data Center Industry Trends

Asia Pacific is expected to register the largest CAGR of 13.7% from 2026 to 2033, due to the accelerated adoption of cloud computing, e-commerce expansion, and digital transformation across industries. Countries such as China, Japan, India, and Singapore are leading the market with substantial investments in hyperscale and colocation data centers. The proliferation of 5G technology and IoT devices is driving demand for edge data centers to ensure low latency and seamless connectivity.

The Japan data center market is expected to grow rapidly in the coming years, driven by the increasing adoption of cloud services, AI applications, and digital business solutions. Major global cloud providers, along with domestic players such as NTT Communications and KDDI, are investing in expanding their data center infrastructure. The country’s advanced 5G network and extensive fiber-optic connectivity further enhance its appeal as a data center hub.

Data center market in China held a substantial market share in 2025, driven by the rapid expansion of cloud services, e-commerce, and digital payment systems. Leading Chinese tech giants such as Alibaba, Tencent, and Huawei are heavily investing in hyperscale data centers to support their cloud platforms and AI-driven applications. The Chinese government’s emphasis on data sovereignty and strict regulations mandating local data storage are further driving the construction of regional data centers.

Key Data Center Company Insights

Key players operating in the data center industry are Amazon Web Services (AWS), Inc. Microsoft, Google Cloud, Alibaba Cloud, and Equinix, Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Data Center Companies:

The following are the leading companies in the data center market. These companies collectively hold the largest market share and dictate industry trends.

- Alibaba Cloud

- Amazon Web Services, Inc.

- AT&T Intellectual Property

- Lumen Technologies (CenturyLink)

- China Telecom Americas, Inc.

- CoreSite

- CyrusOne

- Digital Realty

- Equinix, Inc.

- Google Cloud

- IBM Corporation

- Microsoft

- NTT Communications Corporation

- Oracle

- Tencent Cloud

Recent Developments

-

In February 2025, Alibaba Cloud, the digital technology arm of Alibaba Group, opened its second data center in Thailand to meet the growing demand for cloud computing services, particularly for generative AI applications. The new facility enhances local capacity and aligns with the Thai government's efforts to promote digital innovation and sustainable technology. Offering a range of services including elastic computing, storage, databases, security, networking, data analytics, and AI solutions, the data center aims to address industry-specific challenges.

-

In December 2024, Amazon Web Services (AWS) introduced redesigned data center infrastructure to accommodate the growing demands of artificial intelligence (AI) and sustainability. The updates feature advancements in liquid cooling, power distribution, and rack design, enabling a sixfold increase in rack power density over the next two years. AWS stated that these enhancements aim to deliver a 12% boost in compute power per site, improve energy efficiency, and enhance system availability.

-

In May 2024, Equinix, Inc. launched its first two data centers in Malaysia, with the International Business Exchange (IBX) facilities now operational in Johor and Kuala Lumpur. The facilities are intended to cater to Equinix Inc.'s customers in Malaysia while enhancing regional connectivity.

Data Center Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 425.28 billion

Revenue forecast in 2033

USD 902.19 billion

Growth rate

CAGR of 11.3% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report vertical

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component,type, server rack density,redundancy, PUE,design,tier level,enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Alibaba Cloud; Amazon Web Services Inc.; AT&T Intellectual Property; Lumen Technologies (CenturyLink); China Telecom Americas, Inc.; CoreSite; CyrusOne; Digital Realty; Equinix, Inc.; Google Cloud; IBM Corporation; Microsoft; NTT Communications Corporation; Oracle; Tencent Cloud

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global data center market report based on component, type, server rack density, redundancy, PUE, design, tier level, enterprise size, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Servers

-

Enterprise network equipment

-

PDU

-

UPS

-

-

Software

-

DCIM

-

Virtualization

-

Others

-

-

Services

-

Managed Infrastructure Services

-

Hosting Services

-

Support Services

-

Professional services

-

-

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-premise

-

Hyperscale

-

HPC

-

Colocation

-

Edge

-

-

Server Rack Density Outlook (Revenue, USD Billion, 2021 - 2033)

-

<10kW

-

10-19kW

-

20-29kW

-

30-39kW

-

40-49kW

-

>50kW

-

-

Redundancy Outlook (Revenue, USD Billion, 2021 - 2033)

-

N+1

-

2N

-

N+2

-

N

-

-

PUE Outlook (Revenue, USD Billion, 2021 - 2033)

-

Less than 1.2

-

1.2 - 1.5

-

1.5 - 2.0

-

Greater than 2.0

-

-

Design Outlook (Revenue, USD Billion, 2021 - 2033)

-

Traditional

-

Containerized

-

Modular

-

-

Tier Level Outlook (Revenue, USD Billion, 2021 - 2033)

-

Tier 1

-

Tier 2

-

Tier 3

-

Tier 4

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprise

-

Small & Medium enterprises

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud Service Provider

-

Technology Provider

-

Telecom

-

Healthcare

-

BFSI

-

Retail & E-commerce

-

Entertainment & Media

-

Energy

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center market size was estimated at USD 383.82 billion in 2025 and is expected to reach USD 425.28 billion in 2026.

b. The global data center market is expected to grow at a compound annual growth rate of 11.3% from 2026 to 2033 to reach USD 902.19 billion by 2033

b. The hardware segment accounted for the largest market share of over 67.0% in 2025 in the data center market. The rising demand for high-performance computing (HPC) and AI workloads is a major driver of growth in the data center hardware segment. AI training, machine learning, and complex computational tasks require powerful GPUs and accelerator-based servers that can handle extremely high processing loads. These applications also require high-density racks, ultra-fast NVMe storage, and advanced networking technologies, such as 100G, 400G, and increasingly 800G Ethernet, to support rapid data transfer. As workloads intensify, data centers must adopt more energy-efficient cooling systems to manage the heat generated by dense compute environments. This shift toward performance-driven infrastructure is accelerating investments in next-generation servers, networking gear, and cooling hardware.

b. Some key players operating in the data center market include Alibaba Cloud, Amazon Web Services, Inc., AT&T Intellectual Property, Lumen Technologies (CenturyLink), China Telecom Americas, Inc., CoreSite, CyrusOne, Digital Realty, Equinix, Inc., Google Cloud, IBM Corporation, Microsoft, NTT Communications Corporation, Oracle, Tencent Cloud

b. Key factors driving the growth of the data center market include the rapid adoption of digital transformation initiatives, cloud computing, and emerging technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), which have substantially increased data processing and storage requirements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.