- Home

- »

- Healthcare IT

- »

-

Digital Pharmaceutical Supply Chain Management MarketGVR Report cover

![Digital Pharmaceutical Supply Chain Management Market Size, Share & Trends Report]()

Digital Pharmaceutical Supply Chain Management Market Size, Share & Trends Analysis Report By Product (Software, Hardware), By Mode Of Delivery, By Software Modules, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-085-0

- Number of Report Pages: 250

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global digital pharmaceutical supply chain management market size was valued at USD 968.3 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.2% from 2023 to 2030. It is expected to reach USD 1.84 billion by 2030. Government initiatives to improve medical supply, increased investment in next-generation technologies such as digital twin technology and control towers, and the adoption of virtual control towers and dashboards to enhance visibility, analytics, and execution tools are some of the factors driving the demand for digital supply chain management solutions across the healthcare industry, including pharmaceuticals. Furthermore, the demand for digital pharmaceutical supply chain management is fuelled by the necessity to ensure precise and timely delivery of medical supplies, leading to a notable surge in digitization usage.

AI-based solutions have revolutionized the pharmaceutical supply chain by providing actionable insights that lead to better visibility, service quality, and an improved customer experience. Logistics management platforms support pharmaceutical companies in facilitating immediate deliveries seamlessly, resulting in enhanced logistics efficiency through automation and digitalization. This became increasingly important during the peak of COVID-19, as consumers depended heavily on e-commerce and online retailers for essential products.

Applications of the digitalized system such as artificial intelligence-powered technologies in the pharmaceutical supply chain can support companies in overcoming various challenges. For instance, companies can analyze data from numerous sources to find trends and anomalies using artificial intelligence techniques, which enables more precise demand forecasting and better inventory control. One noteworthy example is Merck KGaA's adoption of a data-driven strategy to enhance demand forecasting in their supply chain operations. Merck dramatically increased the forecast accuracy for 90% of its goods by widely implementing this method. Aera's AI algorithms use information from Merck's business resource planning system to provide quick and accurate demand forecasting that takes location and volume into account.

The growing adoption of mobile-based healthcare SCM solutions among manufacturers and providers is expected to boost market growth over the forecast period. Mobile apps have become an essential part of SCM solutions. SCM for logistic companies in developed countries, along with emerging ones, has become easier owing to GPS-enabled mobile applications. These apps use mobile devices and sensors for tracking vehicles, thereby providing better visibility of the entire SCM.

Furthermore, there are several healthcare SCM apps available. For instance, Prodigo Solutions offer various products and applications to optimize the functionality & usability of supply chain management. Prodigo Marketplace is an ordering platform with a seamless user interface, allowing the user to easily search & purchase products at the right price. Prodigo Xchange allows health systems to ensure full security of health data and the lowest cost per transaction, simultaneously offering enhanced visibility of supply chain performance. The other healthcare SCM apps are Premier Connect and Descartes.

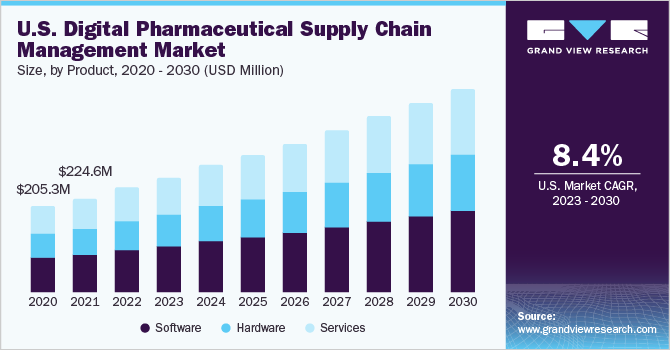

Product Insights

Based on product, the market is segmented into software, hardware, and services. The software segment held the largest market share of 39.7% in 2022, owing to its applications in the digital pharmaceutical supply chain management market. Software is also expected to be the fastest-growing segment over the forecast period. The increasing adoption of software, such as SaaS, which can offer next-generation cloud computing applications including supply chain management & enterprise resource planning, is among the key factors boosting the market.

Based on the software module the software product segment of the market is segmented into planning & analytics, procurement, manufacturing, logistics, and inventory management. The manufacturing software module segment dominated the market with a market share of 41.6% in 2022.

Several market players are attempting to put demand-friendly strategic plans into action. The development of new products and high R&D investments are some of the strategies being implemented by players. For instance, in March 2023, Arkieva, a company specializing in integrated scheduling and planning software for CPG, wholesaler, & manufacturing operations, announced the launch of Arkieva+, a self-service SaaS solution. It was designed to cater to the supply chain management and planning needs of companies & businesses with annual revenue of less than USD 250 million.

Services accounted for the second-fastest segment in terms of growth, owing to advancements and rising demand for services such as support & maintenance, consulting, and education & training. The development of a range of platforms for monitoring, diagnosis, and wellness & prevention of diseases is another key factor boosting the market. The growing trend of implementing software upgrades to incorporate a more diverse array of healthcare applications is further contributing to segment growth.

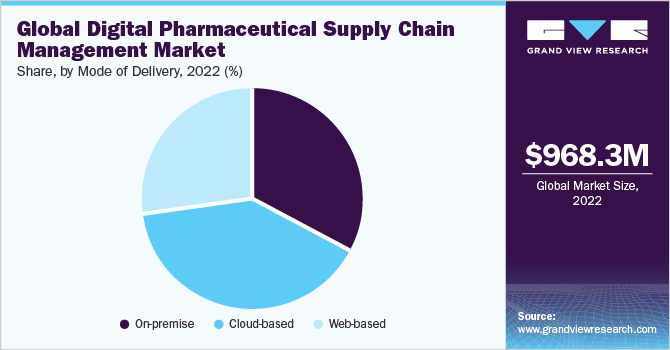

Mode Of Delivery Insights

Based on the mode of delivery, the market is segmented into cloud-based, web-based and on -premises segments. The cloud-based segment dominated the market with a share of 40.3% in 2022. Cloud-based deployment is also expected to be the fastest-growing segment over the forecast period. Its growth can be attributed to rising demand for user-friendly technology, cost-effectiveness, and increasing adoption. Growing penetration of cloud computing among healthcare providers for maintaining inventory and procurement information is expected to further drive the segment.

The on-premise segment is anticipated to show at a CAGR of 7.86% from 2023 to 2030. On-premise deployment is commonly adopted by several medium- & small-scale enterprises through in-house data centers and security infrastructure. Previously, the majority of healthcare centers were dependent on-premise deployment; however, with the advent of cloud-based technology, several organizations are opting for cloud-based deployment.

Moreover, various challenges faced by organizations during the deployment of on-premise solutions are effective implementation & governance, constant policy & process challenges, staff recruitment, and training & retention.

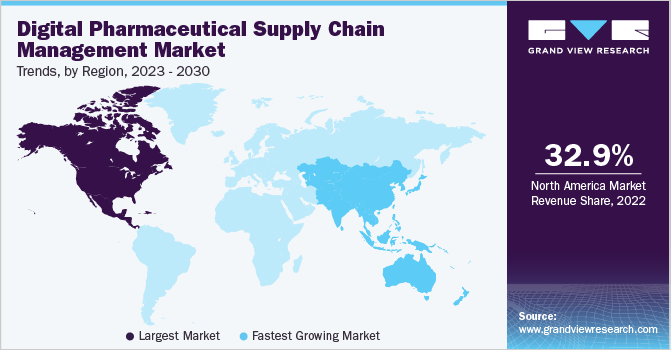

Regional Insights

In 2022, North America dominated the digital pharmaceutical supply chain management market with a share of 32.9% due to its adoption of technological advances that reduce supply chain management costs, the need for improved digital supply chain efficiencies, and the integration of machine learning and artificial intelligence (AI) to better analyze and predict supply chain management outcomes.

Furthermore, the market is supported by several factors such as the rising patient burden in the U.S., the increasing prevalence of chronic diseases, regulatory requirements, and the implementation of various strategies to enhance pharmaceutical supply chain management. The growing adoption of scanning technologies, such as barcodes and RFID, to curb counterfeited drugs has aided in tracking the drugs. Manufacturers in the U.S. have started using edible barcodes in combating the counterfeit drug trade. Furthermore, the adoption of these scanning technologies among healthcare providers and distributors is boosting the market in the region by tracking and tracing the visibility of the product.

The Asia Pacific region is expected to witness the fastest growth at a CAGR of 9.56% over the forecast period owing to mobile-based healthcare supply chain management solutions and increased implementation of technologically advanced solutions in Asian countries such as India, China, and Japan. The growing adoption of GS1 standards in the region to track the visibility of pharmaceutical products is expected to further boost the market in the region. According to the WHO, Asia Pacific holds the biggest share of the trade in counterfeit medicines. The pharmaceutical industry has adopted technologies, such as barcodes and RFID to track products and gain information about products for curbing the counterfeiting of drugs.

Key Companies & Market Share Insights

The digital pharmaceutical supply chain market is rapidly evolving, and the role of suppliers is becoming increasingly important. Suppliers in this market are companies that provide a variety of goods and services to support the development, production, & distribution of pharmaceutical products. These include raw materials, packaging materials, equipment, logistics & transportation services, and technology solutions. In recent years, there has been a shift toward more collaborative & integrated relationships between pharmaceutical companies and their suppliers. This has been driven by the need for higher efficiency, cost-effectiveness, & flexibility in the supply chain, as well as the increasing complexity and regulatory requirements of the industry.

For instance, key players operating in the market are adopting various strategic initiatives, such as new product launches, mergers, acquisitions, partnerships, and collaborations, to strengthen their market positions. Some of the strategies are listed below:

Company Name

Year & Month

Initiative Type

Initiative Description

Oracle

October 2022

Product Launch

The company introduced Oracle Cloud SCM, a new industry-focused solution capable of supporting the unique needs of healthcare companies. The Oracle Cloud SCM solution provides improved patient care by automating processes, optimizing planning, and offering enhanced supply chain visibility.

Loopback Analytics

August 2022

Partnership

It entered a partnership with the University of Louisville (UofL Health), an integrated academic health system, to provide advanced data insights and access to its Specialty Pharmacy serving Kentucky.

GreenLight Medical

March 2022

Acquisition

Symplr acquired GreenLight Medical, a provider of healthcare supply chain management solutions. The acquisition will help the company improve its position in the healthcare industry.

RSi

October 2020

Acquisition

IRI acquired Retail Solutions, Inc. (RSi), a supply chain solutions provider for consumer goods retailers and manufacturers. RSi continued operating as a stand-alone subsidiary under IRI. The company's solutions use data from over 150 retailers, and leverage AI to improve on-shelf availability, reduce out-of-stocks, and increase operational productivity for consumer goods manufacturers. The financial terms of the deal were not disclosed.

The market is consolidated, and major market players are adopting various strategies such as acquisitions, partnerships, collaborations, expansions, and new product launches to strengthen their presence in the global market. Some prominent players in the global digital pharmaceutical supply chain management market include:

-

McKesson Corporation

-

Mediceo Corporation

-

Palantir Technologies, Inc.

-

Jump Technologies, Inc.

-

InterSystems Corporation

-

Tecsys

-

Oracle

-

SAP

-

Infor

-

Terso Solutions

-

CenTrak (HALMA plc)

-

Biolog-id

-

TraceLink

Digital Pharmaceutical Supply Chain Management Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.06 billion

Revenue forecast in 2030

USD 1.84 billion

Growth rate

CAGR of 8.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, mode of delivery, software modules, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

McKesson Corporation; Mediceo Corporation;

Palantir Technologies, Inc; Jump Technologies, Inc.;InterSystems Corporation;Tecsys; Oracle; SAP; Infor; Terso Solutions; CenTrak (HALMA plc); Biolog-id; TraceLink

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Digital Pharmaceutical Supply Chain Management Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital pharmaceutical supply chain management market report based on product, mode of delivery, software modules, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Hardware

-

Services

-

-

Mode Of Delivery Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud-based

-

Web-based

-

-

Software Modules Outlook (Revenue, USD Million, 2018 - 2030)

-

Planning & Analytics

-

Procurement

-

Manufacturing

-

Logistics

-

Inventory Management

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global digital pharmaceutical supply chain management market size was estimated at USD 968.30 Million in 2022 and is expected to reach USD 1.06 billion in 2023.

b. The global digital pharmaceutical supply chain management market is expected to grow at a compound annual growth rate of 8.2% from 2023 to 2030 to reach USD 1.84 billion by 2030.

Which segment accounted for the largest digital pharmaceutical supply chain management market share?b. North America dominated the digital pharmaceutical supply chain management market with a share of 32.9% in 2022. This is attributable to its adoption of technological advances that reduce supply chain management costs, the need for improved digital supply chain efficiencies, and the integration of machine learning and artificial intelligence (AI) to better analyze and predict supply chain management outcomes.

b. Some key players operating in the digital pharmaceutical supply chain management market include McKesson Corporation; Mediceo Corporation; Palantir Technologies, Inc; Jump Technologies, Inc.; InterSystems Corporation;Tecsys; Oracle; SAP; Infor; Terso Solutions; CenTrak (HALMA plc); Biolog-id; TraceLink.

b. Key factors that are driving the market growth include expanding usage of the GS1 Standard System and Unique Device Identification (UDI), the emergence of cloud-based solutions, the rising demand for operational cost reduction, and the increased use of mobile-based healthcare supply chain management solutions

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."