- Home

- »

- Next Generation Technologies

- »

-

Digital Twin Market Size And Share, Industry Report, 2033GVR Report cover

![Digital Twin Market Size, Share, & Trend Report]()

Digital Twin Market (2026 - 2033) Size, Share, & Trend Analysis Report By Solution (Component, Process, System), By Deployment, By Enterprise Size, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-494-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Twin Market Summary

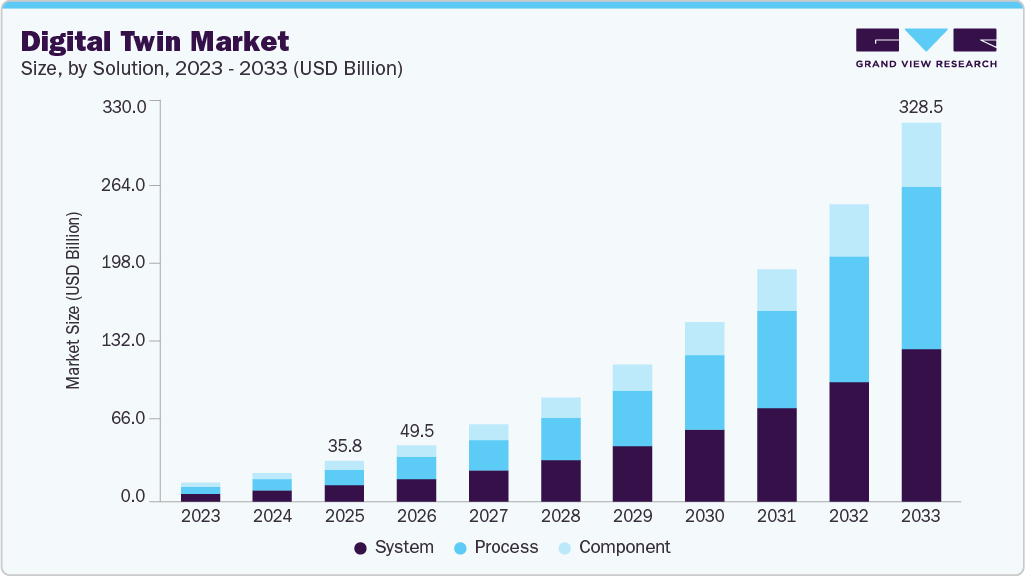

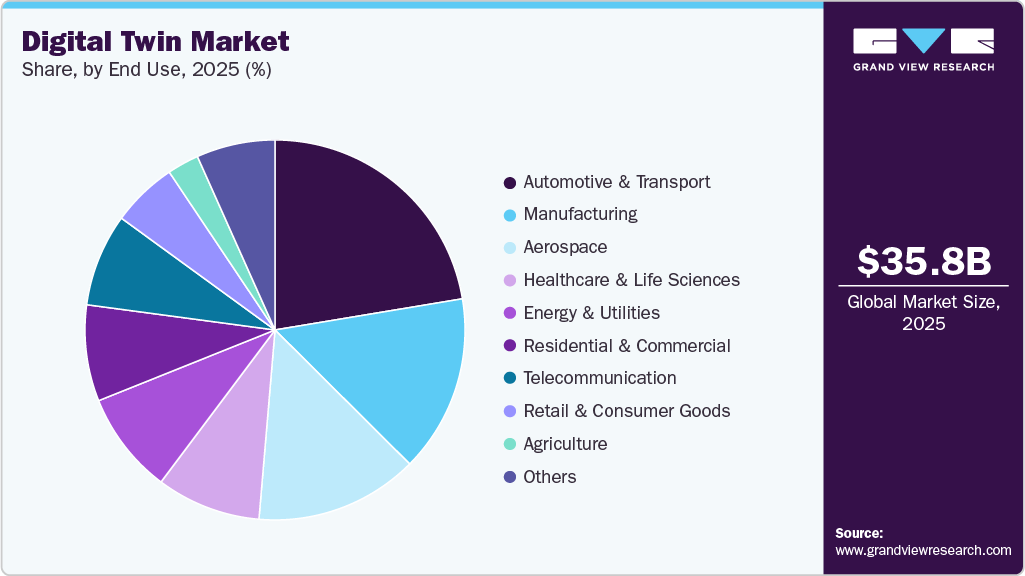

The global digital twin market size was estimated at USD 35.82 billion in 2025 and is projected to reach USD 328.51 billion by 2033, growing at a CAGR of 31.1% from 2026 to 2033 due to the rapid adoption of Industry 4.0 practices, rising demand for predictive maintenance across industries, and the growing need for real-time monitoring of assets to reduce operational costs and downtime. Expanding applications in sectors such as aerospace, automotive, energy, healthcare, and smart cities are fuelling adoption, supported by advancements in IoT, AI, cloud computing, and 5G connectivity that enable seamless data integration between physical and digital systems.

Key Market Trends & Insights

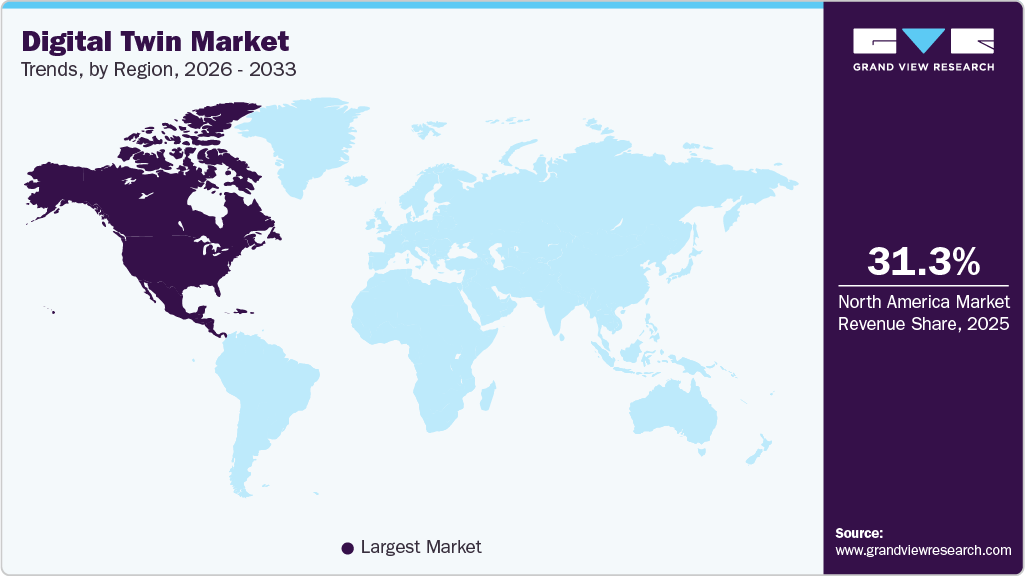

- North America digital twin dominated the global market with the largest revenue share of 31.3% in 2025.

- The digital twin industry in the U.S. is expected to grow significantly over the forecast period.

- By solution, system led the market and held the largest revenue share of 40.9% in 2025.

- By deployment, the on-premise segment held the dominant position in the market and accounted for the largest revenue share in 2025.

- By end use, the telecommunication segment is expected to grow at the fastest CAGR from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 35.82 Billion

- 2033 Projected Market Size: USD 328.51 Billion

- CAGR (2026-2033): 31.1%

- North America: Largest market in 2025

Additionally, increasing investments in sustainability, regulatory compliance, and resource optimization are prompting enterprises and governments worldwide to adopt digital twins as a core tool for enhancing efficiency, driving innovation, and achieving competitive differentiation.The increasing use of Digital Experience Platforms (DXPs) to enhance customer experience and brand loyalty is creating a positive outlook for the digital transformation market. Incumbents of various industries and industry verticals, such as BFSI, retail, IT & telecommunications, and healthcare, are implementing DXPs in their business operations to improve customer engagement and accelerate the product’s time to market. They are partnering with industry players to implement DXPs in their business models.

For instance, in May 2025, Endava partnered with AlixPartners to deliver comprehensive, end-to-end, technology-driven solutions to clients worldwide. This collaboration brings together complementary capabilities, combining AlixPartners’ deep expertise in industry-focused operational consulting with Endava’s advanced technical strengths in areas such as AI, cloud adoption, and data analytics. By uniting these skill sets, the partnership is designed to accelerate digital transformation, foster innovation, and tackle complex business challenges. The joint approach enables organizations to move with greater speed, minimize risk, and resolve issues more effectively while maintaining focus on their broader strategic objectives.

Cloud computing and edge computing are transforming the digital twin market by making it easier to deploy scalable and cost-effective solutions. The cloud provides the infrastructure for storing and analyzing vast data sets, while edge computing ensures faster data processing closer to the source. Together, they enable seamless integration of digital twins across large enterprises, supporting remote monitoring and real-time collaboration. This trend is especially valuable in industrial settings, where immediate responses to machine conditions can prevent costly breakdowns and ensure safety compliance. Furthermore, the emergence of 5G technology is acting as a catalyst for digital twin adoption. With its high-speed, low-latency connectivity, 5G facilitates the smooth transmission of data from numerous IoT devices to digital twin platforms.

Solution Insights

The system segment dominated the market and accounted for the revenue share of 40.9% in 2025, driven by the rising enterprise demand for real-time process optimization, operational resilience, and system-wide visibility across manufacturing, logistics, and utility sectors. Digital twins at the process level are increasingly being adopted to simulate entire workflows, improve predictive planning, and support autonomous decision-making, especially in high-variability environments. The growing integration of AI and IoT into digital twin platforms enables the dynamic modeling of production lines, supply chains, and energy management systems, helping to reduce downtime, enhance throughput, and streamline compliance.

The process segment is anticipated to grow at the highest CAGR during the forecast period, driven by the increasing deployment of integrated digital twin environments that simulate the behavior and performance of complex systems across industries. System-level digital twins combine components and processes into unified, large-scale models that support cross-functional optimization, real-time monitoring, and improved decision-making across operations, infrastructure, and enterprise ecosystems.

Deployment Insights

The on-premise segment dominated the market and accounted for the largest revenue share in 2025 due to heightened data security and compliance requirements across industries such as manufacturing, energy, and healthcare. Organizations dealing with sensitive operational or proprietary data prefer on-premise solutions to maintain full control over their digital twin environments, ensuring minimal risk of data breaches and adherence to regulatory standards. Additionally, industries with legacy infrastructure or low-latency operational needs benefit from on-premise deployments, as they allow seamless integration with existing systems and real-time data processing without reliance on cloud connectivity.

The cloud segment is anticipated to grow at the highest CAGR during the forecast period due to its scalability, cost efficiency, and flexibility, enabling organizations to deploy, manage, and update digital twin models without incurring heavy upfront infrastructure investments. Cloud-based digital twins enable real-time collaboration across geographically dispersed teams, seamless integration with IoT and AI analytics, and rapid access to large-scale computational resources, which is particularly valuable for industries such as smart manufacturing, automotive, and energy.

Enterprise Size Insights

The large enterprise segment dominated the market, accounting for the largest revenue share in 2025, driven by the need for operational efficiency, predictive maintenance, and informed strategic decision-making across complex, asset-intensive operations. Large organizations, particularly in manufacturing, energy, automotive, and aerospace, are adopting digital twins to simulate processes, monitor assets in real time, and optimize supply chains, which helps reduce downtime and operational costs. Their substantial IT budgets and focus on digital transformation enable investments in advanced analytics, AI integration, and IoT-enabled digital twin solutions, further accelerating adoption.

The small and medium enterprises (SMEs) segment is expected to grow at a significant CAGR during the forecast period due to the increasing availability of affordable, cloud-based, and scalable digital twin solutions that lower the barrier to entry for smaller organizations. SMEs are adopting digital twins to optimize production processes, reduce operational costs, and enhance product design and quality without the need for extensive IT infrastructure.

Application Insights

The product design & development segment dominated the market, accounting for the largest revenue share in 2025, as organizations increasingly leverage digital twins to accelerate innovation, reduce time-to-market, and enhance product quality. By creating virtual replicas of products, companies can simulate performance, test design variations, and identify potential flaws before physical production, thereby minimizing the cost of prototypes and rework. Industries such as automotive, aerospace, and consumer electronics are driving adoption due to the need for complex, high-precision products and the integration of IoT and AI for predictive insights.

The business optimization segment is expected to grow at a significant CAGR during the forecast period as organizations increasingly rely on digital twins to enhance operational efficiency, reduce costs, and improve decision-making across complex processes. By providing a virtual representation of entire business operations, digital twins enable real-time monitoring, scenario simulation, and predictive analytics, helping companies identify bottlenecks, optimize resource allocation, and streamline workflows.

End Use Insights

The automotive & transport segment dominated the market, accounting for the largest revenue share in 2025, driven by the industry’s focus on enhancing vehicle design, safety, performance, and operational efficiency. Automotive manufacturers and transportation operators are leveraging digital twins to simulate vehicle dynamics, test new technologies, and optimize production lines, reducing development time and costs. The rise of electric vehicles (EVs), autonomous driving technologies, and connected mobility solutions further fuels adoption, as digital twins enable real-time monitoring, predictive maintenance, and data-driven decision-making.

The telecommunication segment is expected to grow at a significant CAGR over the forecast period as telecom operators adopt digital twins to optimize network planning, deployment, and maintenance while enhancing service quality. By creating virtual models of network infrastructure, including towers, fiber optics, and 5G equipment, companies can simulate network performance, predict outages, and efficiently manage capacity and traffic loads. The rapid expansion of 5G networks, IoT connectivity, and increasing demand for low-latency, high-bandwidth services are key drivers, enabling operators to reduce downtime, improve customer experience, and lower operational costs.

Regional Insights

North America dominated the global market with the largest revenue share of 31.3% in 2025, driven by extensive adoption of Industry 4.0 technologies across manufacturing, aerospace, and automotive sectors. Strong R&D investments, the presence of leading technology providers, and government initiatives promoting smart manufacturing and digital infrastructure are accelerating the deployment of digital twin solutions for predictive maintenance, operational efficiency, and innovation.

U.S. Digital Twin Market Trends

The digital twin market in the U.S. is expected to grow significantly at a CAGR of 27.5% from 2026 to 2033, due to rapid integration of IoT, AI, and cloud computing into industrial processes is a key growth driver. Enterprises are leveraging digital twins to optimize complex supply chains, enhance product lifecycle management, and enable real-time data analytics, supported by a mature IT ecosystem and high technology adoption rates.

Europe Digital Twin Market Trends

The digital twin market in Europe is expected to experience considerable growth from 2026 to 2033, driven by regulatory frameworks that emphasize sustainability and energy efficiency, particularly in the manufacturing and energy sectors. Companies are deploying digital twins to monitor emissions, optimize energy usage, and ensure compliance with EU environmental standards, driving demand for simulation and predictive tools.

The UK digital twin market is expected to grow rapidly in the coming years, owing to smart infrastructure initiatives and the push toward digital cities. Public and private sectors are utilizing digital twins for urban planning, transportation optimization, and infrastructure management, enabling improved decision-making and cost saving.

The Germany digital twin market held a substantial market share in 2025 due to the strong automotive and industrial manufacturing base. Digital twins are being implemented for precision engineering, advanced factory automation, and predictive maintenance, helping German companies maintain global competitiveness and operational excellence.

Asia Pacific Digital Twin Market Trends

Asia Pacific digital twin held a significant share in the global market in 2025, due to rapid industrialization, increasing urbanization, and the adoption of smart manufacturing technologies in countries like South Korea, Singapore, and India. The focus on cost optimization, productivity enhancement, and modernization of legacy industrial processes is boosting demand.

The Japan digital twin market is expected to grow rapidly in the coming years, driven by a focus on robotics, automation, and high-tech manufacturing. Digital twins are extensively used for quality improvement, process optimization, and reducing production downtime, aligning with Japan’s emphasis on precision, efficiency, and advanced engineering solutions.

The China digital twin market held a substantial market share in 2025, due to large-scale investments in smart factories, industrial IoT, and national initiatives for digital transformation such as Made in China 2025. The market benefits from rapid adoption of AI-driven predictive analytics, real-time monitoring, and automation in manufacturing, energy, and transportation sectors.

Key Digital Twin Company Insights

Key players operating in the digital twin industry are ABB, ANSYS, Inc., AVEVA Group Limited, Bentley Systems, Incorporated, Siemens, IBM Corporation, Microsoft, and Rockwell Automation. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In November 2025, Rockwell Automation and Eplan, an India-based software and service solutions provider, launched a digital twin-driven integration that links Eplan’s schematic design tools with Rockwell’s Emulate3D software. This allows engineers to virtually model, test, and optimize systems like industrial robots, control panels, and automated conveyors before hardware construction, streamlining workflows, reducing engineering time, and improving simulation accuracy.

-

In October 2025, ABB introduced its next-generation excitation system, UNITROL 8000, designed to enhance power generation reliability amid rising energy demand and increased renewable integration. The system combines real-time excitation control, embedded digital twin capabilities, built-in data analytics, and cybersecurity by design. With support for both legacy and modern communication protocols, UNITROL 8000 ensures seamless integration with existing control systems, while its modular design allows customization to site-specific conditions and future upgrades without operational disruption.

-

In June 2025, Siemens and Arm launched the PAVE360 digital twin, giving developers cloud access to virtual models of Arm automotive IP, including the new Zena CSS, ahead of silicon availability. It enables testing of AI-driven, complex vehicle workloads and helps identify system integration issues before hardware and software deployment.

Key Digital Twin Companies:

The following are the leading companies in the digital twin market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Amazon Web Enterprise size, Inc.

- ANSYS, Inc.

- Autodesk Inc.

- AVEVA Group Limited

- Bentley Systems, Incorporated

- Dassault Systèmes

- General Electric Company

- Hexagon AB

- IBM Corporation

- Microsoft

- PTC

- Robert Bosch GmbH

- Rockwell Automation

- SAP

- Siemens

Digital Twin Market Report Scope

Report Attribute

Details

Market size in 2026

USD 49.47 billion

Revenue forecast in 2033

USD 328.51 billion

Growth rate

CAGR of 31.1% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Solution, Deployment, Enterprise Size, Application, End Use, and Region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

ABB; Amazon Web Enterprise size, Inc.; ANSYS, Inc.; Autodesk Inc.; AVEVA Group Limited; Bentley Systems, Incorporated; Dassault Systèmes; General Electric Company; Hexagon AB; IBM Corporation; Microsoft; PTC; Robert Bosch GmbH; Rockwell Automation; SAP; Siemens

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Twin Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the digital twin market report based on solution, deployment, enterprise size, application, end use, and region.

-

Solution Outlook (Revenue, USD Billion, 2021 - 2033)

-

Component

-

Process

-

System

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Product Design & Development

-

Predictive Maintenance

-

Business Optimization

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Manufacturing

-

Agriculture

-

Automotive & Transport

-

Energy & Utilities

-

Healthcare & Life Sciences

-

Residential & Commercial

-

Retail & Consumer Goods

-

Aerospace

-

Telecommunication

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital twin market size was estimated at USD 35.82 billion in 2025 and is expected to reach USD 49.47 billion in 2026.

b. The global digital twin market is expected to grow at a compound annual growth rate of 16.0% from 2026 to 2033 to reach USD 328.51 billion by 2033.

b. North America dominated the global market with the largest revenue share of 31.3% in 2025, driven by extensive adoption of Industry 4.0 technologies across manufacturing, aerospace, and automotive sectors.

b. The automotive and transport sectors dominated the market and accounted for a revenue share of over 22.0% in 2024. The high market share is driven by by the industry’s focus on enhancing vehicle design, safety, performance, and operational efficiency. Automotive manufacturers and transportation operators are leveraging digital twins to simulate vehicle dynamics, test new technologies, and optimize production lines, reducing development time and costs.

b. The key players operating in the digital twin market include ABB, Amazon Web Enterprise size, Inc., ANSYS, Inc., Autodesk Inc., AVEVA Group Limited, Bentley Systems, Incorporated, Dassault Systèmes, General Electric Company, Hexagon AB, IBM Corporation, Microsoft, PTC, Robert Bosch GmbH, Rockwell Automation, SAP, Siemens

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.