- Home

- »

- Communication Services

- »

-

Mobile Application Market Size, Share & Growth Report 2030GVR Report cover

![Mobile Application Market Size, Share & Trends Report]()

Mobile Application Market (2024 - 2030) Size, Share & Trends Analysis Report By Store (Google Store, Apple Store, Others), By Application (Gaming, Music & Entertainment, Health & Fitness, Social Networking), And Region, Segment Forecasts

- Report ID: GVR-4-68039-038-0

- Number of Report Pages: 95

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mobile Application Market Summary

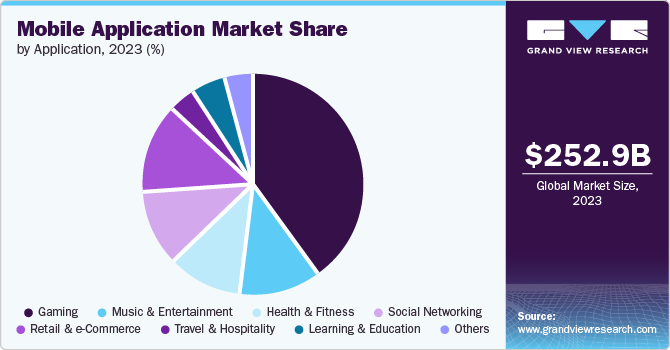

The global mobile application market size was estimated at USD 252.89 billion in 2023 and is projected to reach USD 626.39 billion by 2030, growing at a CAGR of 14.3% from 2024 to 2030. It encompasses applications across various sectors including gaming, health and fitness, music and entertainment, social networking, retail and e-commerce, among others.

Key Market Trends & Insights

- Asia Pacific mobile application market dominated the market and accounted for over 32.0% of the revenue share in 2023.

- The mobile application market of the U.S. is projected to grow at a CAGR of 14.1% from 2024 to 2030.

- By store, the Apple store segment led the market and accounted for more than 62.8% of the global revenue share in 2023.

- By application, the gaming application segment of the market held the largest revenue share of more than 40.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 252.89 Billion

- 2030 Projected Market Size: USD 626.39 Billion

- CAGR (2024-2030): 14.3%

- Asia Pacific: Largest market in 2023

Factors such as the widespread adoption of smartphones, increasing internet usage, and the integration of technologies like artificial intelligence and machine learning in mobile apps indicate a promising future for the demand of mobile applications (apps). Furthermore, these applications are commonly downloaded from platforms such as the Google Play Store and the App Store for iOS.

The primary driver for market expansion is the notable surge in internet usage, particularly in emerging economies like Brazil, China, and India. Over the past decade, the internet has emerged as the predominant mode of communication across various devices, including tablets, smartphones, and laptops. The rise in the number of app consumers in recent years can be attributed to the growth of the e-commerce sector, the availability of various discounts and offers, and a diverse range of products exclusively accessible on online platforms. Additionally, the availability of affordable data plans and packages offered by telecom operators, which reduce internet costs and attract more users online, is another factor driving the increased downloads of applications across all platforms.

The combination of increased internet penetration and advancements in gaming technology has led to greater accessibility to games. Games like Pokémon Go utilize sensors such as motion sensors, gyroscopes, and accelerometers in tablets and smartphones to enable Augmented Reality (AR) and Virtual Reality (VR) capabilities through various apps on smartphone devices. Additionally, there are primarily three revenue models that game and app developers adopt, including in-game purchases, paid game applications, and in-app advertisements.

Amidst the recent coronavirus (COVID-19) pandemic, applications focused on social media, gaming, and entertainment experienced the highest number of downloads compared to other categories. Moreover, there has been a notable increase in demand for e-commerce, healthcare, and educational applications. The shift to remote learning in educational apps has created lucrative growth opportunities for online platforms and tech companies such as Google Classroom, Zoom, and Microsoft Teams.

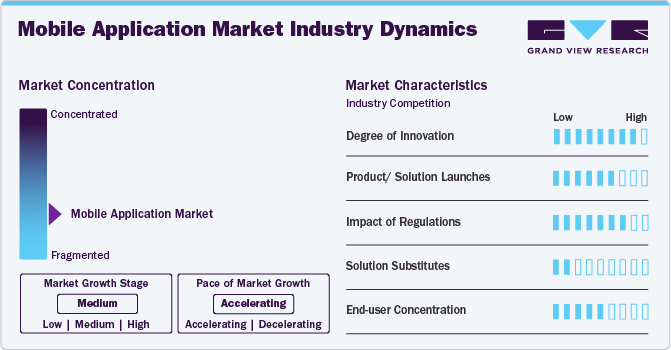

Industry Dynamics

The market growth stage is medium, and the pace of the market growth is accelerating. The apps industry is fragmented, with many app developers. Mobile application developers are utilizing advanced technologies, such as Artificial Intelligence (AI) and the Internet of Things (IoT). AI in applications can be used for supporting backend roles, such as facial recognition. Moreover, a mobile application integrated with IoT can provide users with valuable information. For instance, IoT-based apps can provide manufacturing companies with real-time information about machines.

The market players are investing in mobile application development, which bodes well for market growth. For instance, in June 2023, Ubisoft Entertainment, a France-based company, announced the launch of Rocksmith+, a music learning app. The application was made available on Google’s Android and Apple Inc.’s iOS platforms. The app gives access to over 6,000 songs and enables users to learn guitar from anywhere at any time.

Mobile application security is an important factor, and applications require informing users about data collection practices, including data usage, collection, and storage. Regulations impacting apps require app developers to create a privacy policy and inform app users about how the app collects, stores, and uses their data. Moreover, the app makers need to inform users about their privacy rights and explain what type of personal information, such as username, password, first & last name, and address, among others, is collected from them.

The threat of substitutes for mobile applications is low as there are no direct substitutes. Moreover, the growing adoption of apps for various applications, such as online shopping, food ordering, and digital payments, is boosting the demand for smartphone applications. With the growing internet and smartphone penetration, the need for mobile applications is expected to grow. The ease of use of mobile applications is likely to sustain their demand among users.

People across the globe use mobile applications for various applications, including entertainment, gaming, and social networking, among others. The apps cater to all user types, and different app categories serve users based on demographic factors such as age and gender. For instance, sports apps are more likely to be used by male users, and gaming apps are more likely to be used by the younger generation.

Store Insights

The Apple store segment led the market and accounted for more than 62.8% of the global revenue share in 2023. The segment's notable market dominance stems from iOS apps' relatively higher monetization rate, driven by in-app purchases and premium offerings. Additionally, the increasing global user base of iPhone and iPad users contributes to the segment's growth.

The widespread availability of the App Store across multiple countries enables developers to reach a global audience, expanding their potential reach. Continuous innovation within the App Store introduces new functionalities and updates, empowering developers to craft innovative apps and enhance the user experience. Ultimately, the Apple App Store continues to lead in mobile app distribution, fostering engagement and creating opportunities for developers on a global scale.

The Google Play Store's dominance in the market stems from various factors. Its extensive global reach enables access to a diverse audience across numerous countries and regions. Additionally, the widespread adoption of Android devices, which come pre-installed with the Play Store, reinforces its position.

Developer-friendly policies and integration with other Google services enhance its appeal to both developers and users. Moreover, regular updates and improvements ensure the Play Store remains competitive and relevant amidst evolving app trends. In summary, these elements collectively establish the Google Play Store as the foremost player in the market.

Application Insights

The gaming application segment of the market held the largest revenue share of more than 40.0% in 2023. Moreover, it is projected that the segment will maintain its leading position in the upcoming forecast period, driven by an anticipated surge in the gaming population and subsequently, the proliferation of gaming applications, particularly in economies like China and India. Additionally, the primary operating systems (OS) utilized for developing games are iOS, Android, and Windows. In 2023, Android OS accounted for a substantial portion of game downloads, while iOS generated greater revenue attributed to the prevalence of paid games on the platform.

The music and entertainment application segment is projected to exhibit a significant CAGR of around 13.5% from 2024 to 2030. the rising preference for streaming services over traditional formats, driven by the convenience and accessibility offered by platforms like Spotify and Netflix. Additionally, the widespread ownership of smartphones, coupled with advancements in mobile technology, has significantly expanded the user base for these apps.

Technological innovations, such as personalized recommendations and high-definition streaming, further enhance the appeal of music and entertainment apps. Furthermore, the globalization of content and diverse monetization opportunities contribute to the segment's growth potential. Overall, these factors collectively position the music and entertainment application segment as a promising sector within the market, poised for substantial expansion in the coming years.

Regional Insights

North America mobile application market is characterized by its significant size and growth fueled by a tech-savvy population and robust economy. Dominated by major players like Apple and Google, the region encompasses diverse app categories ranging from gaming to e-commerce. Innovation and technological advancements thrive in North America, driven by startups and venture capital firms. Regulatory oversight, consumer behavior, and preferences shape the market, emphasizing the importance of compliance and user-centric design. Overall, North America offers a dynamic and competitive landscape ripe with opportunities for those keen on leveraging its diverse mobile app ecosystem.

U.S. Mobile Application Market Trends

The mobile application market of the U.S. is projected to grow at a CAGR of 14.1% from 2024 to 2030. The growth of the market in the country can be attributed to the presence of numerous mobile app development companies and the growing reliance of businesses in the U.S. to engage with customers and increase their reach through mobile apps. Key segments include gaming, social media, e-commerce, fintech, and entertainment, driven by high internet usage and technological advancements like 5G and AI. Popular apps include Facebook, Instagram, Amazon, PayPal, and Netflix. Opportunities arise from innovations in AR/VR and mobile payments, while challenges include regulatory compliance, intense competition, and security and privacy concerns. Success requires continuous innovation, user-focused features, and effective navigation of the regulatory landscape.

Asia Pacific Mobile Application Market Trends

Asia Pacific mobile application market dominated the market and accounted for over 32.0% of the revenue share in 2023. Mobile apps have seen widespread adoption across the Asia Pacific region. Factors such as increasing smartphone penetration and internet access, along with a growing middle class, have led to a surge in app usage in the region. In particular, countries like China, India, and Southeast Asian nations have seen significant growth in mobile app usage, with a focus on areas such as e-commerce, gaming, and social media. Additionally, the COVID-19 pandemic has further accelerated the adoption of apps as people have turned to digital platforms for work, education, and entertainment.

The mobile application market of China is projected to grow at a CAGR of 15.8% from 2024 to 2030. It is driven by the growing popularity of short-form videos that are offered by mobile applications such as TikTok (Douyin in China). Moreover, the growing popularity of e-commerce in the country is driving the growth of the market in the country. Key segments include gaming, e-commerce, social media, fintech, and entertainment, driven by high smartphone penetration and innovations such as 5G and AI. Dominant apps like WeChat, Alipay, and Taobao illustrate the market's diversity and integration of services. Opportunities abound with the advent of 5G and AI, but challenges include regulatory compliance, intense competition, and the necessity for localization. Success requires innovation, adaptation to local preferences, and navigating the complex regulatory landscape.

Japan mobile application market is witnessing significant growth owing to the growing adoption of mobile applications across categories, including gaming, social media, and FinTech. Moreover, initiatives by the Japanese government to promote competition and prevent app store monopolization are expected to drive the market’s growth in the country.

Europe Mobile Application Market Trends

The mobile application market in Europe was valued at USD 52.38 billion in 2023. The growing digitalization, accelerated by the COVID-19 pandemic, is driving the market’s growth in the region. Businesses in the region are integrating mobile apps into their operations to offer enhanced services to their customers. For instance, European railway and airline companies offer mobile applications to facilitate booking and travel processes.

The UK mobile application market accounted for over 26.0% share of the European market in 2023. The growing utilization of mobile apps to access various services, such as healthcare, drives the market’s growth in the country. For instance, UK National Health Service (NHS)’s user base crossed over 22 million in December 2021 within three years of its launch in 2018. The app gives users easier access to various digital healthcare services, such as booking appointments.

The mobile application market in Germany is expected to grow at a CAGR of 14.5% from 2024 to 2030. The growing use of mobile applications for shopping and, travel & tourism primarily drives the German market. Key segments include gaming, e-commerce, social media, fintech, and entertainment, driven by increasing mobile internet usage and technological innovations like 5G, AI, and AR/VR. Popular apps include WhatsApp, Amazon, PayPal, and Netflix. The market offers significant opportunities but faces challenges such as stringent regulatory compliance, intense competition, and the need for robust security and privacy measures. Success requires continuous innovation, user-centric features, and effective navigation of the regulatory landscape.

France mobile application market is witnessing significant growth owing to the growing time spent by French users on mobile apps in recent years. Utility, social, and gaming apps are some of the mobile app categories witnessing significant growth in usage in the country. The market is driven by widespread smartphone adoption, high internet penetration, and a vibrant startup ecosystem, particularly in cities like Paris. Popular app categories include social media, gaming, e-commerce, and health & fitness, reflecting diverse consumer usage.

Technological innovation and government support foster a dynamic environment for app development, while regulations like GDPR ensure data protection and user privacy. Despite challenges such as intense competition and regulatory compliance, the market offers significant opportunities for developers and businesses to capitalize on the increasing reliance on mobile applications across various aspects of daily life.

Middle East & Africa Mobile Application Market Trends

The mobile application market of the Middle East and Africa (MEA) is anticipated to reach USD 26.04 billion by 2030. The rapid growth of the Middle East and Africa (MEA) market can be attributed to the rapidly developing technological infrastructure in the region, which is likely to give the MEA population better access to the internet and smartphones, driving the usage of mobile applications. Key markets include the UAE, Saudi Arabia, South Africa, and Nigeria, with popular app categories ranging from social media to fintech. Technological advancements like 4G and 5G networks are enhancing app development and usage, while burgeoning tech hubs in Dubai, Nairobi, and Lagos foster innovation.

Saudi Arabia mobile application market is witnessing significant growth owing to government initiatives to accelerate digital transformation in the country. According to the National Transformation Program’s 2022 report, over 97% of the country’s total government services are digitized. Moreover, the growth of the FinTech sector in the country is likely to drive the use of mobile apps for banking applications.

Key Mobile Application Company Insights

Some of the key vendors operating in the market include Google, Apple Inc., and Microsoft.

-

Apple Inc. is a U.S.-based company that develops and manufactures personal computers, smartphones, tablets, wearables, and accessories. The company’s App Store enables customers to download digital content and applications. The company offers mobile applications, such as Apple Music and Apple Books. It has a global presence with retail stores worldwide.

-

Google, a subsidiary of Alphabet, is a U.S.-based technology company. The company operates in two reportable segments, namely Google Services and Google Cloud. The company operates the Google Play platform and provides various apps, such as YouTube, Google Maps, Gmail, and Chrome, among others. It has a global presence with over 70 offices across 50 countries.

Practo and cult.fit are some of the emerging mobile application companies.

-

Practo is an India-based company that offers an online doctor consultation platform that helps in scheduling doctor appointments. The company’s platform enables online consulting and automated scheduling with doctors across more than 20 specialties. The company’s appointment mobile application is available on Google Play and App Store.

-

cult.fit is an India-based company that offers a fitness-based platform. The company’s mobile application offers services for fitness, healthy food, and mental wellness, enabling customers to manage their health & fitness on a single platform. The users can access gym sessions, group workouts, and sports with the mobile application.

Key Mobile Application Companies:

The following are the leading companies in the mobile application market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- Microsoft

- Amazon.com, Inc.

- Gameloft

- Netflix, Inc.

- Practo

- cult.fit

- Ubisoft Entertainment

- Xiaomi

Recent Developments

-

In September 2023, Google announced new features on YouTube. The new features would enable creators to edit, develop, and share content in new ways. One of the features, called ‘Dream Screen,’ enables creators to add AI-generated video or image backgrounds in YouTube shorts. With these new features, the company aimed to help creators reach more viewers and reduce time-consuming tasks.

-

In December 2022, Apple Inc. announced the launch of Freeform, a new application available for iPad, Mac, and iPhone. Freeform helps users organize content on a flexible canvas and gives them the ability to share and collaborate on one platform. The application offers numerous color options and brush styles to draw diagrams and add comments.

-

In October 2022, cult.fit and boat (Imagine Marketing Limited), an India-based company, partnered to launch the at-home workout program called ‘Fitness Xtended.’ The program comprises strength, yoga, and conditioning exercises, among others, designed by popular fitness coaches. The content was also made available on the cult.fit app.

Mobile Application Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 281.52 billion

Revenue forecast in 2030

USD 626.39 billion

Growth rate

CAGR of 14.3% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Store, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Russia; India; China; Japan; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); U.A.E.; South Africa

Key companies profiled

Apple Inc.; Google; Microsoft; Amazon.com, Inc.; Gameloft; Netflix, Inc.; Practo; cult.fit; Ubisoft Entertainment; Xiaomi

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mobile Application Market Report Segmentation

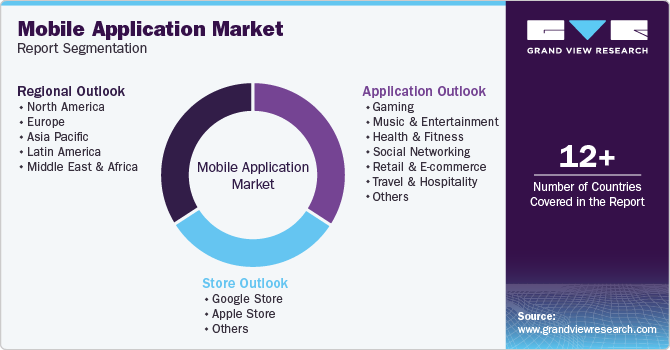

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global mobile application market report based on store, application, and region.

-

Store Outlook (Revenue, USD Billion; 2017 - 2030)

-

Google Store

-

Apple Store

-

Others

-

-

Application Outlook (Revenue, USD Billion; 2017 - 2030)

-

Gaming

-

Music & Entertainment

-

Health & Fitness

-

Social Networking

-

Retail & E-commerce

-

Travel & Hospitality

-

Learning & Education

-

Others

-

-

Regional Outlook (Revenue, USD Billion; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Russia

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

U.A.E.

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mobile application market size was estimated at USD 252.89 billion in 2023 and is expected to reach USD 281.52 billion in 2024.

b. The global mobile application market is expected to grow at a compound annual growth rate of 14.3% from 2024 to 2030 to reach USD 626.39 billion by 2030.

b. North America was one of the dominating regions in the mobile application market, with a share of around 33% in 2023. This is attributable to the presence of numerous players in the region, such as Apple Inc., Google LLC, Hewlett Packard Enterprise, Netflix Inc., and Microsoft Corporation, among others. Also, strong in-app consumer spending, high smartphone penetration, and a relatively greater number of mobile application downloads have collectively ensured a high market share in the region.

b. Some key players operating in the mobile application market include Apple Inc., Google LLC, Microsoft Corporation, Amazon Inc., Gameloft SE.

b. Key factors that are driving the mobile application market growth include smartphone proliferation, increased internet penetration, and growing use of technologies such as machine learning and artificial intelligence in mobile apps.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.