- Home

- »

- Biotechnology

- »

-

DNA Diagnostics Market Size, Share & Growth Report, 2030GVR Report cover

![DNA Diagnostics Market Size, Share & Trends Report]()

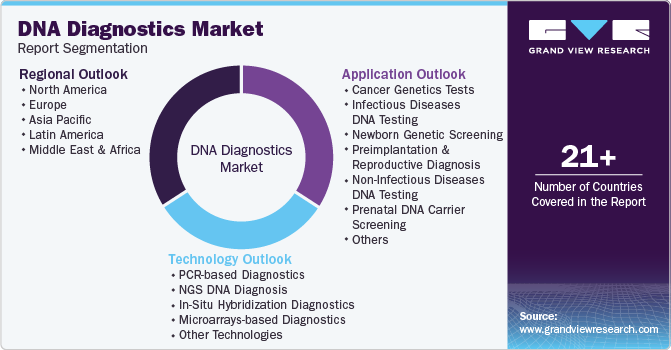

DNA Diagnostics Market Size, Share & Trends Analysis Report By Technology (Microarray-based Diagnostics, PCR-based Diagnostics), By Application (Cancer Genetics Tests, Newborn Genetic Screening), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-676-9

- Number of Pages: 180

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global DNA diagnostics market size was estimated at USD 10.04 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.14% from 2023 to 2030. The growth of the market is attributed to an increase in the incidence of genetic, infectious, and chronic diseases as well as decreasing prices of genetic sequencing technologies aided by the growing adoption of precision medicine diagnostic techniques. The market is primarily driven by DNA profiling, which aims to enhance the understanding of disease predisposition and potential adverse reactions associated with existing or under-clinical development drugs. The increasing significance of early diagnosis and prevention, alongside the growing demand for DNA tests in areas such as pharmacogenomics and cancer genetic testing, contributes significantly to market growth.

The growing demand for DNA diagnostics is expected to be driven by various factors. One such factor is the increasing implementation of personalized medicine applications for the treatment of chronic disorders. This approach emphasizes tailoring medical interventions based on an individual's genetic profile, leading to a growing need for HLA typing and DNA identification for therapy. Furthermore, the demand for DNA diagnostics is expected to be fueled by advancements in technology that enable the commercialization of next-generation diagnostic and testing solutions utilizing genetic analysis. These hi-tech advancements offer more advanced and precise tools for genetic analysis, contributing to improved diagnostic accuracy and expanded testing capabilities. Thus, collectively, these factors are anticipated to increase growth.

With the rising demand for newborn and pre-natal screening aimed at detecting congenital abnormalities, an increased focus on early detection and intervention drives the need for DNA testing in these screening programs. Furthermore, the application of DNA testing as a crucial step in biobanking services, particularly in cord blood banking, contributes to sector growth. Physicians’ higher inclination towards genetic testing to determine patients’ health at different stages of disease development is another factor expected to fuel demand in the coming years.

However, one of the major factors hampering the market’s growth is the high cost associated with the development of these diagnostic tests. The research and development (R&D) efforts related to introducing new techniques and implementing them in practice are expensive and have a high cost associated with them. These costs can be a barrier for some companies and hinder overall industry growth.

Moreover, stringent government regulations surrounding DNA prototyping and the need for a clear reimbursement structure are anticipated to pose obstacles for new market entrants. Compliance with these regulations and navigating the reimbursement landscape can be complex and time-consuming, discouraging potential players from entering the market. Overall, while the market for DNA diagnostics exhibits significant potential, these challenges need to be addressed to ensure sustained growth and a favorable environment for innovation and competition.

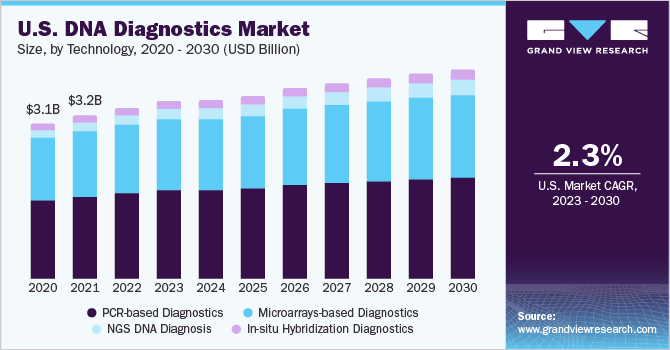

Technology Insights

In terms of technology, the PCR-based diagnostics segment held the largest revenue share of 50.03% in 2022. The dominance of the segment is attributed to the widespread market usage and high availability of products owing to the presence of a significant number of players offering PCR-based diagnostics in the market. Moreover, PCR offers high sensitivity and specificity, allowing for the detection of even small amounts of DNA in a sample. This makes it particularly useful in diagnosing infectious diseases and genetic disorders and identifying genetic variations associated with cancer and other diseases. In May 2023, Sensible Diagnostics, a Los Angeles-based organization, announced that they are targeting the introduction of a 10-minute point-of-care PCR system by early next year. Thus, these factors are anticipated to bolster the growth of PCR-based diagnostic technology, thereby fueling the market growth.

Next-generation sequencing (NGS)-based diagnosis is anticipated to witness the fastest CAGR of 7.98% over the forecast period owing to the development of innovative and breakthrough advancements in the market. NGS platforms have the ability to process multiple samples in parallel, allowing for high-throughput sequencing. This increased efficiency makes NGS suitable for applications such as whole-genome sequencing, exome sequencing, targeted gene panels, and transcriptome analysis. Moreover, NGS-based Diagnostics play a crucial role in advancing precision medicine approaches. By providing detailed genetic information, NGS enables personalized treatment decisions, prognostic assessments, and the identification of targeted therapies based on an individual's genomic profile. Thus, the availability of various platforms for sequencing and analysis of DNA data that result in efficient, highly accurate, and rapid diagnosis is further expected to fuel the growth of the segment.

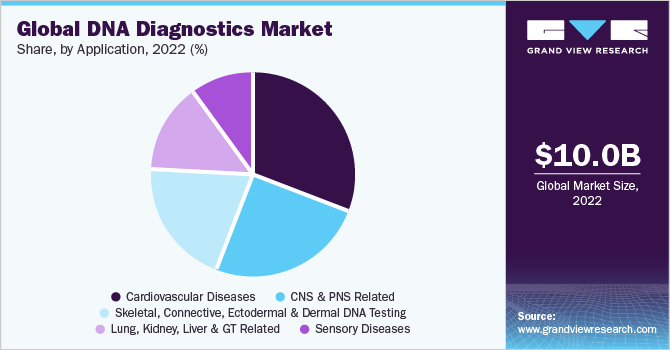

Application Insights

Based on application, cancer genetics tests dominated the market in 2022 with a revenue share of 29.58% in 2022. The dominance of the segment can be attributed to the growing prevalence of cancer globally, increased adoption of personalized medicine, and growing technological advancements in DNA sequencing technology. The development of advanced DNA sequencing technologies, such as NGS, has made cancer genetic testing more accessible, efficient, and cost-effective. These technologies allow for comprehensive analysis of multiple genes simultaneously, increasing the accuracy and efficiency of genetic testing for cancer.

Certain genetic mutations are known to be strongly associated with hereditary cancer syndromes, such as BRCA1 and BRCA2 mutations in breast and ovarian cancer. Cancer genetics tests can identify these mutations, enabling proactive screening and preventive measures for individuals with a higher genetic predisposition to cancer. Thus, these factors are anticipated to boost the cancer genetics tests application, thereby fueling the DNA diagnostic market over the forecast period.

Infectious diseases DNA testing is anticipated to grow at the fastest CAGR of 4.50% over the forecast period. DNA testing methods have proven to be highly important in infectious disease diagnosis and clinical confirmation. This application segment has generated substantial revenue due to the availability of various products designed for diseases such as HBV, HCV, HIV, TB, CT/NG, HPV, and MRSA. In addition, the increasing utilization of DNA diagnostics in chronic oncology cases and related abnormalities is expected to drive significant growth in the oncology diagnostics & histopathology segment in the near future. The adoption of sequencing technology for tumor detection and biomarker analysis is another factor contributing to the overall market growth throughout the forecast period.

Regional Insights

North America dominated the DNA diagnostics market in 2022 with a revenue share of 42.45%. The presence of sophisticated healthcare infrastructure, strong government initiatives, proactive funding for DNA testing research, and the high prevalence of chronic diseases are the major drivers for market growth in this region. Furthermore, North America has seen widespread adoption of genetic testing for various purposes, such as disease risk assessment, pharmacogenomics, prenatal screening, and ancestry testing. The availability of advanced laboratory facilities, favorable reimbursement policies, and a large population base with access to healthcare contribute to the region's dominance in the DNA diagnostic market.

Asia Pacific is expected to witness the fastest CAGR of 6.23% from 2023 to 2030 due to rising research & development incentives offered by the government in developing economies such as China and India, which enable R&D and commercialization of technologically innovative products. Moreover, the high accessibility of the target population owing to the prevalence of chronic diseases is also anticipated to supplement growth in the coming years. In addition, the region has witnessed significant advancements in DNA sequencing technologies, such as NGS. These technological developments have made DNA diagnostics more accessible, efficient, and cost-effective, thereby driving market growth.

Key Companies & Market Share Insights

Market participants are involved in R&D for the introduction of rapid testing methods that provide reproducible and accurate results and aid in the diagnosis of genetic abnormalities. For instance, in April 2023, Agilent Technologies Inc. announced the launch of SureSelect Cancer CGP Assay, which is particularly devised for somatic variant profiling for a broad wide range of solid tumor forms. Furthermore, these entities are also engaged in developing and updating their databases for mining and comparing DNA specimens to help law enforcement in solving criminal cases. Some prominent players in the global DNA diagnostics market include:

-

GE Healthcare

-

Abbott

-

Beckman Coulter Inc.

-

Bio-Rad Laboratories, Inc.

-

Thermo Fisher Scientific Inc.

-

Illumina Inc.

-

Cepheid.

-

Hologic, Inc.

-

Siemens HealthcareGmbH

-

F. Hoffmann-La Roche

-

QIAGEN

-

Agilent Technologies Inc.

DNA Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 10.64 billion

Revenue forecast in 2030

USD 14.14 billion

Growth rate

CAGR of 4.14% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE Healthcare; Abbott, Beckman Coulter Inc.; Bio-Rad Laboratories, Inc.; Thermo Fisher Scientific Inc.; Illumina Inc.; Cepheid; Hologic Inc.; Siemens Healthcare GmbH; F. Hoffmann-La Roche; QIAGEN; Agilent Technologies Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global DNA Diagnostics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global DNA diagnostics market report based on technology, application, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Microarrays-based Diagnostics

-

PCR-based Diagnostics

-

In-situ Hybridization Diagnostics

-

NGS DNA Diagnosis

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer Genetics Tests

-

Infectious Diseases DNA Testing

-

HBV Diagnostic

-

HCV Diagnostic

-

HIV Diagnostic

-

TB Diagnostic

-

CT/NG Diagnostic

-

HPV Diagnostic

-

MRSA Diagnostic

-

Others

-

-

Newborn Genetic Screening

-

Preimplantation & Reproductive Diagnosis

-

Non-Infectious Diseases DNA Testing

-

Cardiovascular Diseases

-

CNS & PNS Related

-

Skeletal, Connective, Ectodermal & Dermal DNA Testing

-

Lung, Kidney, Liver & GT Related

-

Sensory Diseases

-

-

Prenatal DNA Carrier Screening

-

Pharmacogenomics/Drug Metabolism

-

Hematology & Immunology/Identity Diagnostics & Forensics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global DNA diagnostics market size was estimated at USD 10.04 billion in 2022 and is expected to reach USD 10.64 billion in 2023.

b. The global DNA diagnostics market is expected to grow at a compound annual growth rate of 4.14% from 2023 to 2030 to reach USD 14.14 billion by 2030.

b. PCR-based diagnostics accounted for the largest share of revenue in 2022 with a market share of 50.03%. The dominance of the segment is attributed to the widespread market usage and high availability of products owing to the presence of a significant number of players offering PCR-based diagnostics in the market.

b. Some key players operating in the DNA diagnostics market include GE Healthcare, Abbott, Beckman Coulter Inc., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., Illumina Inc., Cepheid, Hologic, Inc., Siemens Healthcare GmbH, F. Hoffmann-La Roche, QIAGEN, Agilent Technologies Inc.

b. Key factors that are driving the market growth include an increase in the incidence of genetic, infectious, and chronic diseases, the decreasing prices of genetic sequencing technologies, aided with the growing adoption of precision medicine diagnostic techniques.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."