- Home

- »

- Pharmaceuticals

- »

-

Precision Medicine Market Size, Share, Industry Report 2030GVR Report cover

![Precision Medicine Market Size, Share & Trends Report]()

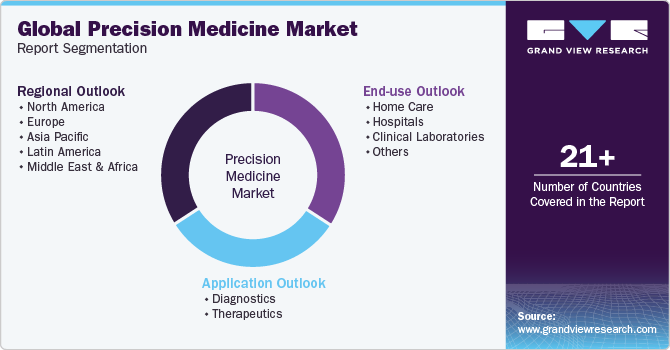

Precision Medicine Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Diagnostics, Therapeutics, Medical Devices), By End-use (Home Care, Hospitals, Clinical Laboratories), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-612-7

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Precision Medicine Market Summary

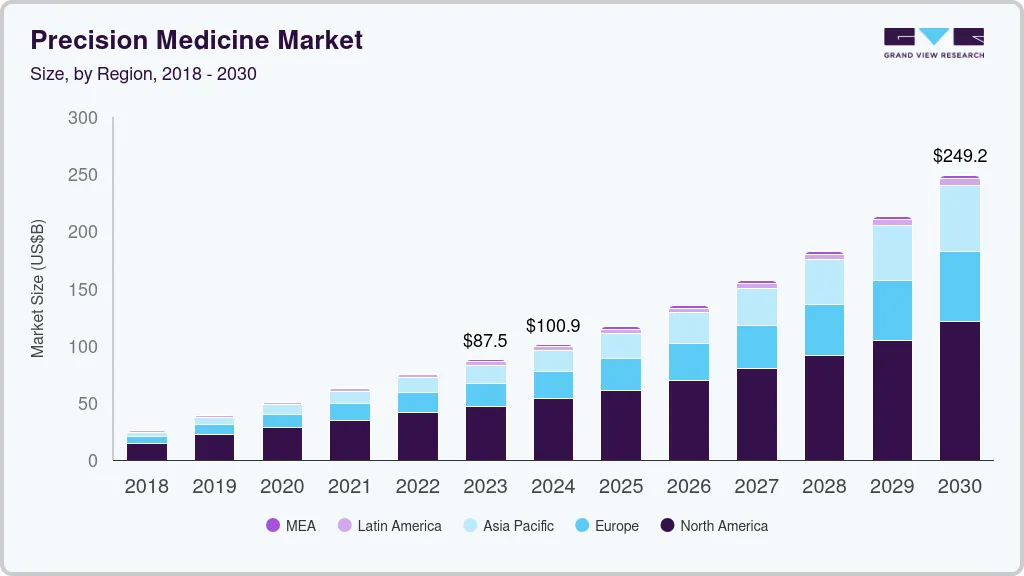

The global precision medicine market size was estimated at USD 87.50 billion in 2023 and is projected to reach USD 249.24 billion by 2030, growing at a CAGR of 16.3% from 2024 to 2030. The market is expected to grow further due to advancements in genomics, increased demand for personalized treatments, and technological innovations in diagnostics.

Key Market Trends & Insights

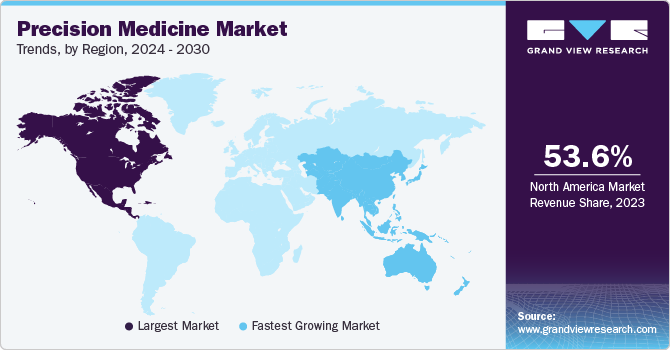

- North America dominated the precision medicine market with a share of 53.62% in 2023.

- The precision medicine market in the U.S. is expected to grow over the forecast period.

- Asia Pacific precision medicine market is anticipated to witness the fastest growth from 2024 to 2030.

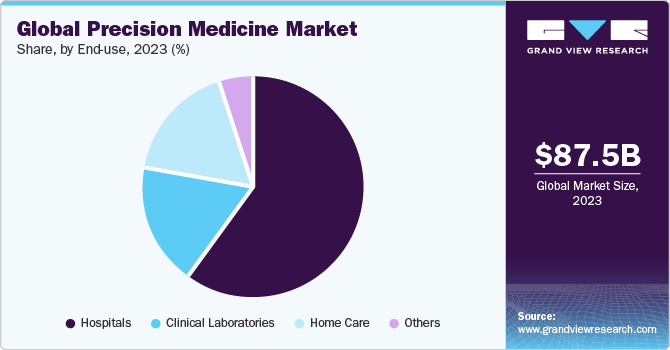

- By end use, the hospitals segment led the market with a revenue share of 60.0% in 2023.

- By application, the therapeutics segment led the market in 2023 and is expected to grow at a CAGR of 15.8% over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 87.50 Billion

- 2030 Projected Market Size: USD 249.24 Billion

- CAGR (2024-2030): 16.3%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The rising prevalence of chronic diseases, favorable government initiatives, and increased investment in research are likely to drive the market, aiming to improve patient outcomes through tailored therapeutic approaches. Next-generation Sequencing (NGS) has transformed genomics and is instantly reshaping clinical diagnosis & personalized medicine. These technological advancements allow for rapid and cost-effective analysis of extensive genomic data, enabling thorough exploration of disease genetics. In clinical settings, NGS is an effective tool for identifying disease-causing variations and facilitating precise & early detection of genetic disorders. In addition, NGS helps diagnose novel disease-related genes & variations, supporting the development of targeted therapies and personalized treatment approaches. These advantages associated with the technology, which include a better understanding of disease mechanisms and identification of specific molecular markers for disease subtypes, significantly enhance precision medicine, enabling tailored medical interventions based on individual characteristics.

Several oncologists expect that NGS combined with companion diagnostics can play a major role in precision diagnostics & therapeutics, significantly increasing the demand for NGS applications. The NGS companion diagnostics space has been continuously evolving and is highly dynamic. Developments in the regulatory framework for the safety & efficacy of NGS-based laboratory tests and increasing clinical investigation data on disease heterogeneity are expected to propel the demand for personalized medicine over the forecast period. For instance, in February 2021, QIAGEN extended its partnership agreement with Inovio Pharmaceuticals, Inc. to develop companion diagnostics for INOVIO’s VGX-3100. VGX-3100 is a phase III DNA immunotherapy candidate for cervical dysplasia.

In addition, due to the successful launch of companion diagnostics, usage & penetration rates of precision diagnostics and drugs greatly depend upon the level of adoption of their respective companion diagnostic tests. Over 150 companion diagnostic on-label combinations and a wide array of precision medicines are expected to be under clinical trials in the coming seven years. Moreover, the adoption of companion diagnostics is expected to increase post-FDA approval of novel tests. The expected increase in accuracy of testing & development of their analysis systems is likely to positively impact the market for companion diagnostics and precision therapeutics & diagnostics over the forecast period.

The utilization of biomarkers for personalized medicine in cancer therapy is also a key factor driving market growth. Biomarkers are crucial in diagnosing cancer and characterizing its specific subtype. This precision allows healthcare professionals to tailor treatment strategies to the unique genetic and molecular profile of each patient’s cancer, improving diagnostic accuracy.

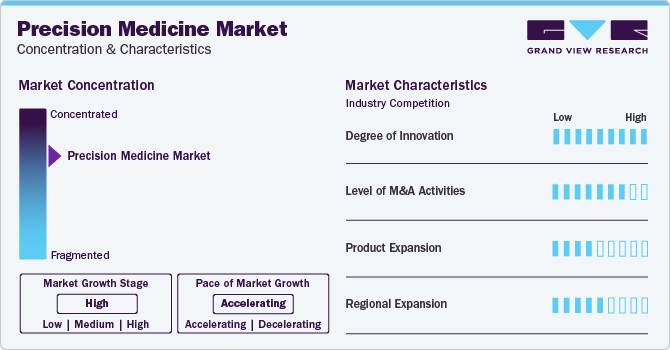

Market Concentration & Characteristics

The precision medicine market exhibits a high degree of innovation, driven by advances in genomics, artificial intelligence, and data analytics. For example, companies like Foundation Medicine offer comprehensive genomic profiling to tailor cancer treatments to individual patients. This approach enables more effective and personalized therapies, improving patient outcomes. In addition, innovative platforms like Tempus use AI to analyze clinical and molecular data, further enhancing the precision and customization of medical treatments based on genetic and molecular profiles

The market has seen a high level of merger and acquisition activity, with companies seeking to expand their product portfolios and geographic presence. For instance, in October 2022, Eli Lilly and Company acquired Akouos, Inc., a precision genetic medicine company developing an innovative portfolio of adeno-associated viral gene therapies targeting inner ear conditions, including sensorineural hearing loss

Regulations significantly impact the market growth by ensuring the accuracy and reliability of measurements and tests. The FDA has issued numerous guidance documents in response to the growing demand for regulatory clarity. For example, in early 2020, the FDA finalized six guidance documents on gene and cell-based therapy development and released a draft guidance on interpreting the sameness of gene therapies under orphan drug regulations. These efforts aim to clarify regulatory pathways and encourage the development of personalized treatments

Product substitutes can emerge from advancements in alternative therapeutic approaches, such as CRISPR-based gene editing or RNA-based therapies. For instance, while adeno-associated viral (AAV) gene therapies are used for genetic disorders, CRISPR-Cas9 technology offers a potentially more precise method for correcting genetic mutations. Companies like Editas Medicine are developing CRISPR-based treatments that could substitute for existing gene therapies.

End-user concentration in the market is high, primarily within specialized healthcare institutions, research centers, and hospitals. For example, major academic medical centers like the Mayo Clinic and Johns Hopkins utilize precision medicine extensively for cancer treatment and genetic disorders. These institutions invest heavily in personalized medicine technologies and play a crucial role in advancing precision therapies, driving market growth and innovation.

Application Insights

The therapeutics segment led the market in 2023 and is expected to grow at a CAGR of 15.8% over the forecast period. The therapeutics segment is further sub-segmented into pharmaceuticals, medical devices, and others. Personalized pharmaceuticals include biopharmaceuticals & drugs developed through extensive usage of pharmacogenomics and manufactured with personalized therapeutic principles. Owing to the expected development and post-approval commercialization of companion diagnostics, personalized therapeutic drugs will witness significant growth in demand. The fact that a substantial number of personalized biopharmaceuticals are associated with at least one companion diagnostic further reinforces that their expected commercialization during the forecast period will witness linear growth with respect to one another. The companies are also focusing on developing novel solutions in the personalized pharmaceutical marketplace, which are further expected to offer a favorable environment for market growth during the forecast period. For instance, in April 2023, The Barcelona Supercomputing Center and Fujitsu Limited signed a joint agreement to promote and conduct research on personalized medicine with the help of clinical trials data analysis.

The diagnostics segment is anticipated to grow at the fastest CAGR over the forecast period. An increasing number of industrial developments among market players is estimated to offer a favorable environment for segment growth during the forecast period. For instance, in February 2023, Roche announced an extension of its partnership with Janssen Biotech Inc. (Janssen) to develop companion diagnostics for targeted therapies, enhancing its commitment to advancing research and innovation. Moreover, in August 2023, BostonGene, a prominent player in providing AI-driven molecular & immune profiling solutions, and NEC Corporation, along with Japan Industrial Partners, jointly announced the establishment of BostonGene Japan Inc. This Tokyo-based joint venture aimed to advance precision medicine and significantly enhance patient outcomes.

End-use Insights

The hospitals segment led the market with a revenue share of 60.0% in 2023. Hospitals provide the ideal setting for personalized medicine due to their comprehensive infrastructure and access to diverse patient populations. Moreover, hospitals often participate in clinical trials and research, ensuring cutting-edge treatments are available. Their ability to rapidly adapt to new technologies and incorporate patient feedback further enhances the efficacy of precision medicine. By centralizing these resources, hospitals can deliver precise, individualized care, improving outcomes and reducing adverse effects, ultimately advancing the overall standard of healthcare.

The home care segment is projected to witness the fastest growth rate over the forecast period. Home care precision medicine is gaining popularity due to its simplified nature and ability to provide personalized healthcare in the comfort of the patient’s home. Advancements in telemedicine, wearable devices, and remote monitoring technologies enable patients to collect and share real-time health data with healthcare providers. Devices, such as continuous glucose monitors, smartwatches, and at-home genetic testing kits, can enable ongoing health management tailored to individual needs. This approach improves patient engagement & adherence to treatment plans and reduces the need for frequent hospital visits.

Regional Insights

The North America precision medicine market accounted for 53.62% share in 2023. PMC report published in 2022 notes that personalized medicines now account for more than one in four drugs approved by the FDA since 2014. The NHGRI also points out that the development and expansion of personalized medicine continue through the Human Genome Project (HGP), conducted from 1993 to 2003. This landmark global research effort created the first sequence of the human genome and several additional well-studied organisms, providing researchers with opportunities to develop gene-targeted treatments. Ongoing research continues to explore the value of personalized medicine. The FDA’s Division of Translational and Precision Medicine (DTPM) comprises translational scientists with expertise in human genomics clinical pharmacology, epidemiology, and molecular biology. This team's efforts further highlight the growing market for Precision Medicine (PM) in North America, driven by the potential to enhance treatment outcomes and the continued development of gene-targeted therapies.

U.S. Precision Medicine Market Trends

The precision medicine market in the U.S. is expected to grow over the forecast period due to several factors, including advancements in genomic and molecular research, increasing number of FDA-approved personalized treatments, and initiatives, such as PMI, which promote the integration of personalized approaches into healthcare. The focus on rare diseases and cancer therapies also highlights the growing impact of PM in developing targeted & effective treatments.

Europe Precision Medicine Market Trends

The Europe precision medicine market was identified as a lucrative region in this industry. In Europe, cancer is the second-leading cause of death and morbidity, with over 3.7 million new cases and 1.9 million deaths each year. This highlights the need for-and the promise of-tailoring cancer care to individual patient characteristics. Fueled by this knowledge, cancer treatment is increasingly shifting toward PM, a healthcare approach that systematically uses patient data to inform personalized treatment decisions.

The precision medicine market in the UK is driven by the presence of sophisticated healthcare infrastructure, collaborations between key market players, and launch of novel products. Government support & initiatives are expected to further propel the growth of the country’s precision medicine market in the coming years.

The France precision medicine market is expected to grow exponentially over the forecast period. This growth can be attributed to the increasing focus on research and development in pharmaceuticals.

The precision medicine market in Germany is expected to grow at a lucrative rate over the forecast period due to the ongoing advancements in personalized medicine in Germany by public and private organizations, such as EuroBioForum, the German Center for Infection Research, and the Personalized Medicine Coalition (PMC).

Asia Pacific Precision Medicine Market Trends

The Asia Pacific precision medicine market is anticipated to witness the fastest growth from 2024 to 2030, driven by increasing investments in healthcare infrastructure, rising prevalence of chronic diseases, and advancements in genomic research. Countries like China, Japan, and India are at the forefront, with significant government initiatives and collaborations with global biotech firms. For example, China's 100,000 Genomes Project aims to enhance personalized medicine capabilities. Additionally, the expanding middle-class population and growing awareness about personalized healthcare are further propelling market growth in the region.

The precision medicine market in China is expected to grow over the forecast period due the rising focus on improving healthcare R&D aided with development of novel technologies.

The Japan precision medicine market is expected to grow over the forecast period due to the presence of well-established healthcare system.

Latin America Precision Medicine Market Trends

The precision medicine market in Latin America was identified as a lucrative region in this industry. Technological advancements in the region are anticipated to fuel market growth.

The Brazil precision medicine market is expected to grow over the forecast period. Genomic technology and research have been gradually adopted in medical research, clinical practices, and genome-wide association studies in genetic epidemiology. In addition, an increasing number of industrial developments, such as expansion policies, mergers & acquisitions, and joint ventures, are expected to propel market growth. For instance, in April 2023, BeiGene announced the opening of its new office in Brazil to expand its presence in Latin America.

MEA Precision Medicine Market Trends

The precision medicine market in MEA was identified as a lucrative region in this industry. The increasing activity in population-scale genomics programs is expected to lead to the publication of research articles in scientific journals, thereby increasing the representation of Middle Eastern genomes in public genetic databases.

The Saudi Arabia precision medicine market is experiencing significant growth, driven by substantial government investment in healthcare and biotechnology. Initiatives like the Saudi Human Genome Program aim to advance genomic research and personalized medicine. Increased funding and a focus on innovative healthcare solutions accelerate the market's development.

Key Precision Medicine Company Insights

Some of the leading players operating in the precision medicine market include F. Hoffmann-La Roche Ltd.-(Foundation Medicine), Siemens, Janssen Global Services, LLC, Illumina, Inc., Quest Diagnostics Incorporated, and 23andMe, Inc. These companies lead the market with their advanced genomic technologies and personalized treatment solutions. Roche, for instance, leverages its extensive diagnostics and pharmaceuticals portfolio to provide integrated precision medicine approaches. Illumina dominates the genomic sequencing market, essential for personalized therapies. Novartis focuses on targeted cancer therapies and gene treatments. Thermo Fisher Scientific offers comprehensive tools for genetic analysis. Foundation Medicine specializes in genomic profiling for cancer. Together, these companies hold significant market shares and drive innovation in personalized medicine.

Tempus, GRAIL, and Adaptive Biotechnologies, which are gaining traction with innovative solutions. Tempus utilizes AI and machine learning to analyze clinical and molecular data, enhancing personalized treatment strategies. GRAIL focuses on early cancer detection through advanced blood tests, aiming to revolutionize cancer diagnostics. Adaptive Biotechnologies specializes in immune system profiling, offering insights for personalized immunotherapies.

Key Precision Medicine Companies:

The following are the leading companies in the precision medicine market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche Ltd.-(Foundation Medicine)

- Siemens

- Janssen Global Services, LLC

- Illumina, Inc.

- Quest Diagnostics Incorporated

- 23andMe, Inc.

- NeoDiagnostix

- Myriad Genetics

- Medtronic

- GE Healthcare

- Abbott

- QIAGEN

Recent Developments

- In May 2024, Atara filed a Biologics License Application (BLA) with the U.S. FDA for tabelecleucel (tab-cel). It is proposed as a standalone treatment for Epstein-Barr Virus-Positive Post-Transplant Lymphoproliferative Disease (EBV+ PTLD) in adults and children aged 2 years and above who have undergone at least one prior therapy. In the case of solid organ transplant recipients, prior therapy typically involves chemotherapy if suitable. Notably, there are currently no FDA-approved treatments available for this specific condition

- In May 2024, Dragonfly Therapeutics, Inc., a biotechnology company dedicated to pioneering new immunotherapies, announced a clinical collaboration with Merck (known as MSD outside the U.S. and Canada). This collaboration aims to assess DF9001, Dragonfly's Epidermal Growth Factor Receptor (EGFR) immune engager, alongside Merck's anti-PD-1 therapy, KEYTRUDA (pembrolizumab), in patients with advanced solid tumors expressing EGFR

Precision Medicine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 100.88 billion

Revenue forecast in 2030

USD 249.24 billion

Growth rate

CAGR of 16.3% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

F. Hoffmann-La Roche Ltd.-(Foundation Medicine); Siemens; Janssen Global Services, LLC; Illumina, Inc.; Quest Diagnostics Inc.; 23andMe, Inc.; NeoDiagnostix; Myriad Genetics; Medtronic; GE Healthcare; Abbott, QIAGEN

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Precision Medicine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the precision medicine market report based on application, end-use, and region:

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Diagnostics

-

Genetic Tests

-

Direct to Consumer Tests

-

Esoteric Tests

-

Others

-

-

Therapeutics

-

Pharmaceuticals

-

Oncology

-

Respiratory Diseases

-

Skin Diseases

-

CNS Disorders

-

Immunology

-

Genetic Diseases

-

Others

-

-

Medical Devices

-

Others

-

-

-

End-use Outlook (Revenue, USD Million; 2018 - 2030)

-

Home Care

-

Hospitals

-

Clinical Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global precision medicine market size was estimated at USD 87.50 billion in 2023 and is expected to reach USD 100.88 billion in 2024.

b. The global precision medicine market is expected to grow at a compound annual growth rate of 16.3% from 2024 to 2030 to reach USD 249.24 billion by 2030.

b. North America dominated the precision medicine market with a share of 53.62% in 2023. This is attributable to the presence of a large number of leading pharmaceutical and biotech companies, along with a well-established healthcare infrastructure. Furthermore, support from government entities, coupled with higher R & D investment, is driving these regional markets.

b. Some key players operating in the precision medicine market include Abbott Laboratories; Biogen Inc.; Foundation Medicine Inc.; Illumina, Inc.; Precision Biologics; IBM Watson; Siemens Healthineers; Janssen Pharmaceuticals; and GE Healthcare

b. Key factors that are driving the market growth include drop in the prices of molecular testing and genetic sequencing, lLiquid biopsies emerging as the next big thing for detecting metastatic cancers, increasing demand for precision medicine and diagnostic precision medicines in non-oncology areas, harnessing big data for improving preventive care, and advancements in NGS, companion diagnostics and biomarkers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.