- Home

- »

- Medical Devices

- »

-

DNA Sequencing Market Size & Share, Industry Report 2033GVR Report cover

![DNA Sequencing Market Size, Share & Trends Report]()

DNA Sequencing Market (2025 - 2033) Size, Share & Trends Analysis Report By Product & Service (Instruments, Consumables), By Technology (Sanger Sequencing, Next-Generation Sequencing), By Workflow, By Application, By End Use, And Segment Forecasts

- Report ID: GVR-4-68039-070-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

DNA Sequencing Market Summary

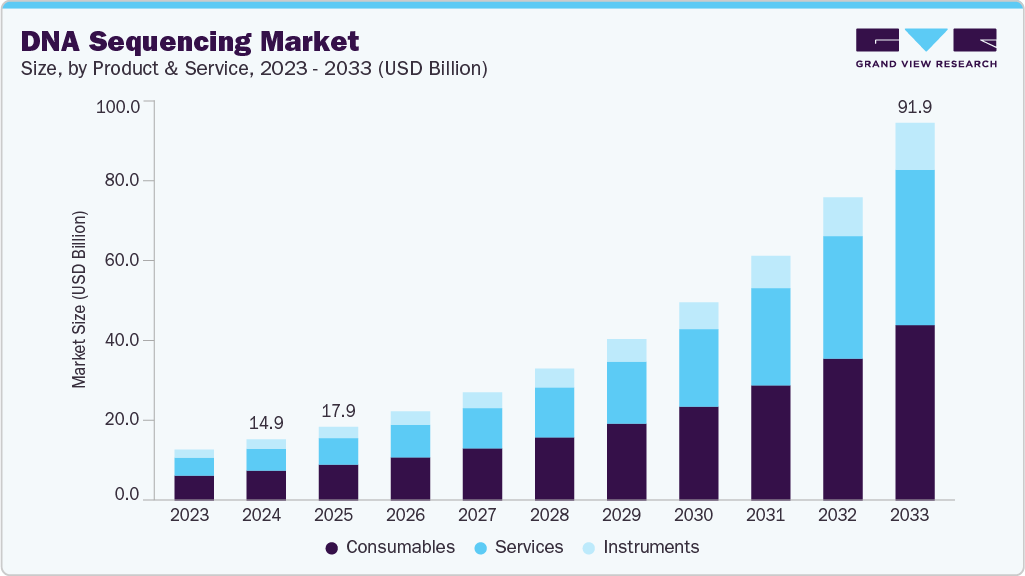

The global DNA sequencing market size was estimated at USD 14.88 billion in 2024 and is projected to reach USD 91.88 billion by 2033, growing at a CAGR of 22.66% from 2025 to 2033. The market’s steady growth is driven by rising adoption of next generation sequencing technologies, increasing clinical applications in oncology and rare disease diagnostics, and expanding investments in genomics research globally.

Key Market Trends & Insights

- The North America DNA sequencing market held the largest share of 50.92% of the global market in 2024.

- The DNA sequencing industry in the U.S. is expected to grow significantly over the forecast period.

- By product & service, the consumables segment held the highest market share of 48.93% in 2024.

- Based on technology, the next generation sequencing segment held the highest market share in 2024.

- By workflow, the sequencing segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14.88 Billion

- 2033 Projected Market Size: USD 91.88 Billion

- CAGR (2025-2033): 22.66%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Increasing Adoption of DNA Vaccines

The market for DNA sequencing is seeing a sharp increase in demand due to the growing use of DNA vaccines. High-precision sequencing is essential to the design, validation, and optimization of plasmid constructs encoding antigenic proteins in DNA vaccine development. To ensure proper gene insertion, confirm plasmid integrity, and identify potential mutations during the manufacturing process, sequencing is crucial.

Clinical Trials of DNA Vaccine

NCT Number

Conditions

Sponsor

Phases

Completed Year

NCT05265065

COVID-19

Murdoch Childrens Research Institute

PHASE3

2024

NCT05188677

COVID-19

Clover Biopharmaceuticals AUS Pty

PHASE3

2023

NCT05567471

COVID-19 Respiratory Infection

Bharat Biotech International Limited

PHASE3

2022

NCT04775069

Chronic Liver Disease

Humanity & Health Medical Group Limited

PHASE4

2023

NCT04914832

COVID-19|Pneumonia, Viral

Shabir Madhi

PHASE4

2022

NCT05715944

COVID-19

Botswana Harvard AIDS Institute Partnership

PHASE3

2022

NCT05426343

COVID-19 Vaccine

Medigen Vaccine Biologics Corp.

PHASE3

2023

NCT05572879

COVID-19

EuBiologics Co.,Ltd

PHASE3

2024

NCT04516746

COVID-19|SARS-CoV-2

AstraZeneca

PHASE3

2023

NCT05603052

COVID-19

EuBiologics Co.,Ltd

PHASE3

2024

NCT04864561

SARS-CoV-2 Virus Infection

Valneva Austria GmbH

PHASE3

2023

NCT05011526

Covid19 Vaccine

Medigen Vaccine Biologics Corp.

PHASE3

2022

NCT05198596

COVID-19 Vaccine

Medigen Vaccine Biologics Corp.

PHASE3

2023

NCT06189040

Coronavirus Disease 2019|COVID-19

Universiteit Antwerpen

PHASE4

2022

NCT05343871

COVID-19

Albert B. Sabin Vaccine Institute

PHASE4

2024

Source: Clinical trials, Presentation, Secondary Research, Grandview Resaerch.inc

Next-generation sequencing (NGS) is crucial for verifying the genetic stability and purity of large-scale DNA vaccine production, which also requires strict quality control and adherence to regulatory compliance. Sequencing-based workflows for preclinical validation, immunogenicity assessment, and safety profiling have become increasingly popular among developers due to the global shift toward faster vaccine development, which pandemic preparedness initiatives have accelerated.

Declining cost of genome sequencing

The use of sequencing technologies in clinical and research settings is being greatly accelerated by the falling cost of genome sequencing. Whole-genome, whole-exome, and targeted sequencing workflows can now be utilized more widely, thanks to significant reductions in per-sample costs resulting from advancements in sequencing chemistry, platform efficiency, and automation. Academic labs, biopharmaceutical firms, and translational research centers can increase cohort sizes, scale high-throughput studies, and produce richer genomic datasets as sequencing costs decrease.

The clinical diagnostics landscape is also changing due to lower sequencing costs, which increase the viability of NGS-based testing for standard medical applications. NGS is being increasingly utilized in diagnostic labs and hospitals for reproductive health screening, oncology profiling, infectious disease surveillance, and testing for hereditary diseases. Sequencing's affordability has lowered financial obstacles for patients and providers alike, promoting increased test accessibility and wider reimbursement acceptance.

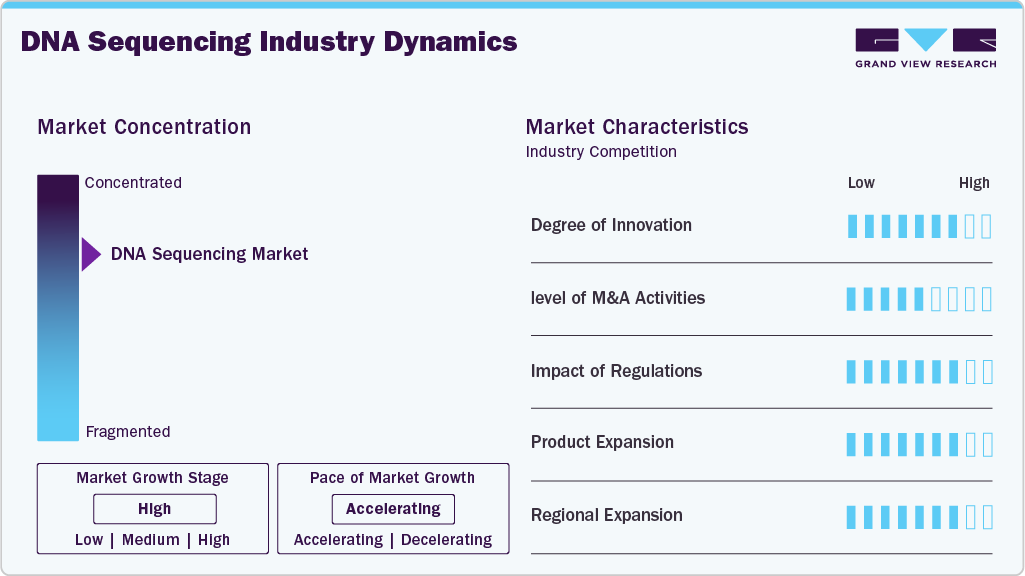

Market Concentration & Characteristics

The DNA sequencing industry is characterized by a high degree of innovation, driven by rapid technological advancements, including the adoption of artificial intelligence and machine learning in genomics. Companies are developing innovative solutions by leveraging artificial intelligence, which is expected to drive significant innovation in the industry. For instance, in June 2022, Ultima Genomics and Nvidia partnered to leverage artificial intelligence (AI) across multiple stages of DNA sequencing and analysis.

The DNA sequencing industry is also characterized by a moderate level of merger and acquisition (M&A) activity. This is due to several factors, including the desire to gain a competitive advantage in industry and the need to consolidate in a rapidly growing market. Major industry participants are acquiring firms operating across the industry. Some of the companies undertaking mergers and acquisitions include PacBio, QIAGEN, Agilent Technologies, Inc., and Eurofins Scientific.

Regulations influence the DNA sequencing market by setting strict standards for accuracy, quality, and safety, which can increase compliance costs and slow product approvals. However, supportive policies such as reimbursement frameworks and national genomic initiatives help boost adoption. Overall, regulation creates both challenges and opportunities, ensuring reliability while promoting wider clinical use of sequencing technologies.

Product expansion is driving the DNA sequencing industry as businesses introduce cutting-edge platforms, improved chemistries, and specialized kits that enhance speed, accuracy, and the range of applications. These developments support broader adoption and overall market growth by providing researchers and clinicians with more adaptable and scalable options.

Numerous businesses are expanding their geographical presence. This strategy enables them to distribute their products and services across various countries. For instance, in April 2022, Illumina, Inc. announced the launch of a cutting-edge Solution Center in São Paulo, Brazil, aligning with the growing interest in clinical genomics and the company's dedication to enhancing global accessibility to genomics in Latin America.

Product & Service Insights

The consumables segment led the DNA sequencing market for the largest revenue share of 48.93% in 2024. The growing accessibility of reagents and kits designed for various library construction stages, including DNA fragmentation, adapter ligation, and quality control, is a key factor in expanding market share. Many of these tools are characterized by simplified and streamlined workflows, pre-prepared components, and compatibility with low-input and formalin-fixed specimens.

The services segment is anticipated to witness the fastest CAGR over the forecast period. Comprehensive data analysis, library preparation, identification & quantification of protein binding sites on DNA, DNA methylation profiles on a genome-wide scale, shotgun sequencing, primer walking sequencing, bacterial artificial chromosome end sequencing, and expressed sequence tags are among the sequencing services available in the market.

Technology Insights

The next-generation sequencing (NGS) segment led the market, accounting for the largest revenue share of 87.51% in 2024. Continuous technological breakthroughs, along with significant reductions in sequencing time and cost, have made genome sequencing more accurate, accessible, and affordable, driving widespread adoption across research, clinical, and diagnostic applications.

The third-generation sequencing segment is projected to witness the fastest CAGR over the forecast period. By eliminating the need for PCR amplification and incorporating straightforward sample preparation, this technology addresses the limitations of second-generation sequencing while reducing sequencing time and costs. Moreover, this technology can produce long reads longer than many kilobases, which helps to identify repetitive sites in complex genomes and solve assembly problems. Over the forecast period, the advantages of third-generation sequencing are expected to drive growth in this segment.

Workflow Insights

Based on workflow, the sequencing segment held the largest revenue share of 57.09% in 2024. This step enables the sequencing of the genome and profiling of DNA-protein interactions. It is an integral part of the entire DNA sequencing workflow in research and discovery studies, which accounts for its larger share. The ability of sequencers to generate a large amount of data in a relatively short period accelerates understanding of human health and disease treatments. Moreover, major players such as Illumina, Inc. and Thermo Fisher Scientific, Inc. provide novel platforms for sequencing workflows.

The data analysis segment is projected to record the fastest CAGR during the forecast period, driven by the growing demand for sophisticated tools to handle and interpret the vast amounts of data generated. As whole-genome sequencing adoption increases, demand for robust software for sequence assembly, data processing, and storage continues to grow. To meet this demand, industry participants are introducing new computational platforms aggressively. For instance, in October 2023, PacBio introduced a human whole-genome analysis pipeline. These ongoing software advancements are expected to accelerate segment growth further.

Application Insights

The oncology segment led the market, accounting for the largest revenue share of 25.25% in 2024. Technology holds great potential in the field of clinical research, as well as in the development of cancer diagnostics and therapeutics. The value of these technologies in companion diagnostics and precision medicine is widely recognized by clinicians and companies, which is anticipated to propel the segment over the forecast period. NGS is commonly used in oncology, where gene mutations are sequenced and cataloged to develop new cancer diagnoses & treatment methods.

The consumer genomics segment is projected to exhibit the fastest CAGR over the forecast period. Growing personal health awareness and the rising use of paternity testing & genealogy are anticipated to drive the consumer genomics segment, particularly as a DNA sequencing application. Several key market players, including PerkinElmer, Inc., Royal Philips, and Quest Diagnostics, are continually expanding their product portfolios by launching new products in the market, which is expected to further drive segment growth.

End Use Insights

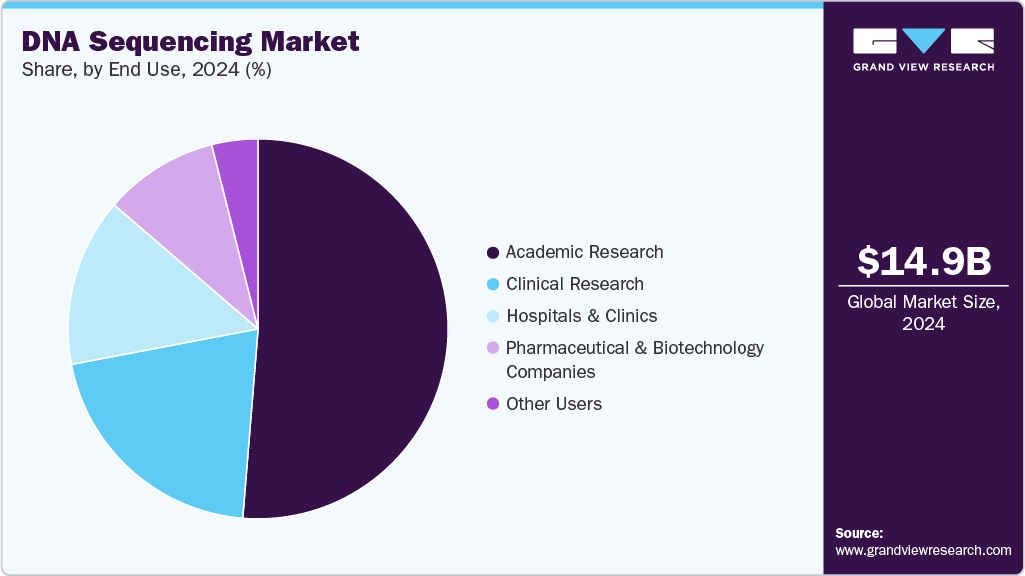

In 2024, the academic research segment accounted for the largest share of the DNA sequencing market at 51.29%, supported by extensive genomics research activity, growing funding for large-scale sequencing projects, and widespread adoption of next-generation sequencing technologies across universities and research institutes.

The clinical research segment is expected to register the fastest CAGR, driven by the growing adoption of NGS technologies for high-throughput, parallel gene analysis. NGS enables the efficient screening of multiple gene markers using minimal nucleic acids, making it an ideal tool for clinical applications. Its use in studying tumor heterogeneity, identifying cancer-related genes, and detecting tumorigenic alterations is further expected to accelerate segment growth over the forecast period.

Regional Insights

North America dominated the market, accounting for a revenue share of 50.92% in 2024, driven by strong genomic research infrastructure, widespread use of cutting-edge sequencing technologies, significant investments in precision medicine, and large-scale sequencing projects. For example, in August 2023, Complete Genomics received the “Oscars of Innovation” award for its ultra-high-throughput DNBSEQ-T20×2 sequencer. It is anticipated that such industry recognition for cutting-edge technologies will promote additional innovation and aid in the expansion of regional markets.

U.S.DNA Sequencing Market Trends

The U.S. dominates North America’s market due to its extensive research in genomics, oncology, and whole-genome-based studies. Other factors that can be attributed to the significant adoption of DNA sequencing technology in this country are sophisticated research & medical infrastructure, funding, skilled personnel, and companies pushing for better research methods to identify newer technologies for diagnosis & therapies.

Europe DNA Sequencing Market Trends

The Europe market is expected to grow at a significant CAGR during the forecast period, due to the increasing R&D investments and continuous research by scientists which has boosted the demand for innovative NGS solutions.

The UK DNA sequencing industry is expected to grow rapidly over the forecast period, due to an increase in the development of companion diagnostics and the subsequent establishment of molecular diagnostic development facilities by key market players. Furthermore, ongoing strategic alliances between players in European and Eastern markets are expected to drive market growth during the forecast period in the region. For instance, in June 2025, DeepMind in the U.K. launched AlphaGenome, an AI model designed to predict gene regulation from DNA sequences, enabling non-commercial researchers to assess mutations, generate hypotheses, and design experiments.

The Germany DNA sequencing industry is positioned as a key market due to its robust biomedical research ecosystem, extensive funding for genomics programs, high adoption of advanced sequencing technologies, and the presence of leading academic and clinical institutions that drive continuous innovation in DNA sequencing applications.

Asia Pacific DNA Sequencing Market Trends

The Asia Pacific is anticipated to witness the fastest CAGR of 26.07% during the forecast period. The regional market is expected to be driven by the ongoing developments in HLA and prenatal NGS testing, coupled with international collaborations with U.S. & European companies. Moreover, the increasing developments in genomics in countries such as Japan and India are expected to support the regional market. For instance, in July 2025, India’s Gujarat State launched the Tribal Genome Sequencing Project, which aims to sequence 2,000 tribal individuals to identify genetic risks, support precision healthcare, and enhance regional genomic research capacity.

The China DNA sequencing industry is one of the fastest growing and most advanced DNA sequencing markets, supported by strong government funding, rapid adoption of NGS technologies, expanding clinical applications, and significant investments in large-scale population genomics projects.

The Japan DNA sequencing industry is expected to see substantial progress, as healthcare and clinical research service providers in the country have been integrating Next-Generation Sequencing (NGS) technologies over the past few years. Ongoing developments in HLA and prenatal NGS testing, coupled with international collaborations with U.S. & European companies, are expected to drive market growth in Japan during the forecast period.

Middle East & Africa DNA Sequencing Market Trends

The MEA DNA sequencing industry is growing due to rising adoption of NGS for infectious disease monitoring and oncology, increased government investment in precision medicine, and expanding collaborations with global genomic technology providers. For instance, in March 2025, BGI Genomics’ joint venture Genalive secured Saudi Arabia contract from NUPCO for large-scale genetic testing services, expanding precision medicine capabilities across 83 public hospitals, which further supports the regional market expansion.

In Kuwait, several new genome projects are being launched to sequence underrepresented populations and to understand the genetic variation within the human population. For instance, the Kuwait Genome Project aimed to sequence the individual genomes of the country's population.

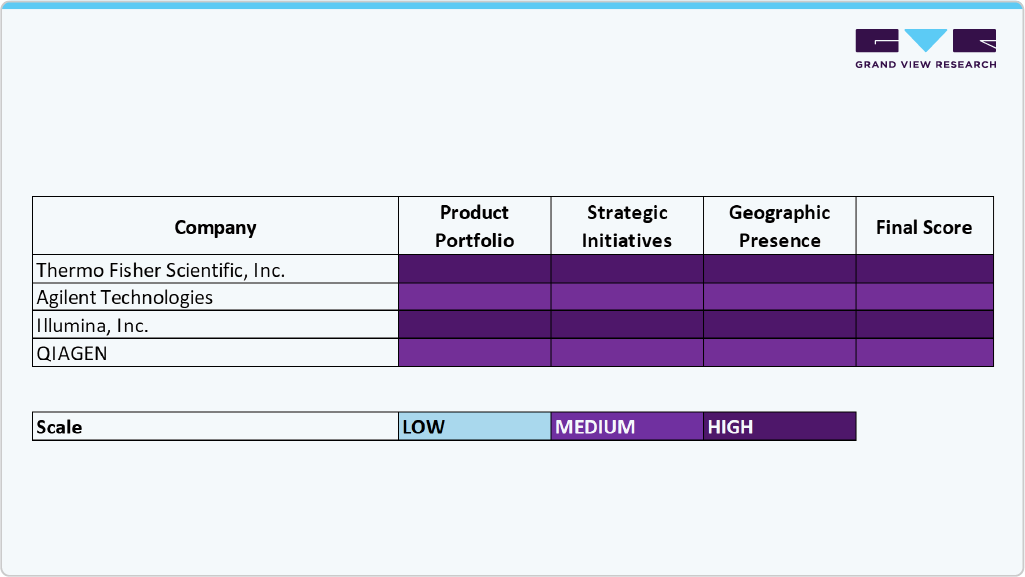

Key DNA Sequencing Company Insights

The DNA sequencing industry is shaped by several established leaders that maintain dominance through advanced sequencing platforms, robust product portfolios, and continuous investment in innovation. Major players, including Thermo Fisher Scientific, Illumina, Agilent Technologies, QIAGEN, and F. Hoffmann-La Roche Ltd., hold a significant market share due to their cutting-edge NGS systems, comprehensive reagent offerings, and globally integrated distribution networks.

Companies such as PacBio, BGI, Macrogen, PerkinElmer Genomics, and Bio-Rad Laboratories are strengthening their positions by developing high-throughput sequencing platforms, long-read technologies, and specialized analysis tools tailored to clinical diagnostics, oncology, and large-scale genomic research. Meanwhile, firms such as Myriad Genetics, PierianDx, Partek Incorporated, and Eurofins Scientific are expanding their presence through advanced bioinformatics solutions, sequencing-based diagnostic tests, and end-to-end genomic services that address growing demand across research and clinical markets.

As the global adoption of next-generation sequencing accelerates, the market will be increasingly influenced by commitments to data quality, affordability, interoperability, and secure handling of genomic data.

Key DNA Sequencing Companies:

The following are the leading companies in the DNA sequencing market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc

- Agilent Technology

- Illumina, Inc.

- QIAGEN

- F. Hoffmann-La Roche Ltd.

- Macrogen, Inc.

- PerkinElmer Genomics

- PacBio

- BGI

- Bio-Rad Laboratories, Inc.

- Myriad Genetics

- PierianDx

- Partek Incorporated

- Eurofins Scientific

Recent Developments

-

In November 2025, Volta Labs in the U.S. launched an expanded Callisto platform, delivering fully automated, multi-chemistry WGS sample preparation with seven validated apps to improve scalability, efficiency, and cross-platform compatibility.

-

In July 2025, QIAGEN launched its QIAseq xHYB Long Read Panels in the Netherlands, expanding its NGS portfolio with long-read target enrichment solutions optimized for PacBio systems and complex genomic applications.

-

In November 2024, PacBio launched the Vega long-read sequencing platform in the U.S., offering an affordable USD 169,000 benchtop system that delivers HiFi accuracy and expands access to advanced sequencing capabilities.

DNA Sequencing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.93 billion

Revenue forecast in 2033

USD 91.88 billion

Growth rate

CAGR of 22.66% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, technology, workflow, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc; Agilent Technology; Illumina, Inc.; QIAGEN; F. Hoffmann-La Roche Ltd.; Macrogen, Inc.; PerkinElmer Genomics; PacBio; BGI; Bio-Rad Laboratories, Inc.; Myriad Genetics; PierianDx; Partek Incorporated; Eurofins Scientific

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global DNA Sequencing Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the DNA sequencing market on the basis of product & services, technology, workflow, application, end use, and region.

-

Product & Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Consumables

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Sanger Sequencing

-

Next-Generation Sequencing

-

Whole Genome Sequencing (WGS)

-

Whole Exome Sequencing (WES)

-

Targeted Sequencing & Resequencing

-

-

Third Generation DNA Sequencing

-

Single-Molecule Real-Time Sequencing (SMRT)

-

Nanopore Sequencing

-

-

-

Workflow Outlook (Revenue, USD Million, 2021 - 2033)

-

Pre-sequencing

-

Sequencing

-

Data Analysis

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Reproductive Health

-

Clinical Investigation

-

Agrigenomics & Forensics

-

HLA Typing/Immune System Monitoring

-

Metagenomics, Epidemiology & Drug Development

-

Consumer Genomics

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Academic Research

-

Clinical Research

-

Hospitals & Clinics

-

Pharmaceutical & Biotechnology Companies

-

Other Users

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global DNA sequencing market size was estimated at USD 14.88 billion in 2024 and is expected to reach USD 17.93 billion in 2025.

b. The global DNA sequencing market is expected to grow at a compound annual growth rate of 22.66% from 2025 to 2033 to reach USD 91.88 billion by 2033.

b. North America dominated the DNA sequencing market with a share of 50.92% in 2024. Continuous technological developments by key players, high investment in R&D, and availability of technologically advanced healthcare infrastructure have resulted in North America’s leading share in the global market.

b. Some key players operating in the DNA sequencing market include Thermo Fisher Scientific, Inc; Agilent Technology; Illumina, Inc.; QIAGEN; F. Hoffmann-La Roche Ltd.; Macrogen, Inc.; PerkinElmer Genomics; PacBio; BGI; Bio-Rad Laboratories, Inc.; Myriad Genetics; PierianDx; Partek Incorporated; and Eurofins Scientific

b. Key factors driving the DNA sequencing market include technological advancements in sequencing techniques, rising interest in genomics and personalized medicine, and increasing applications of DNA sequencing in clinical diagnostics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.