- Home

- »

- Advanced Interior Materials

- »

-

Electrical Steel Market Size, Share & Growth Report, 2030GVR Report cover

![Electrical Steel Market Size, Share & Trends Report]()

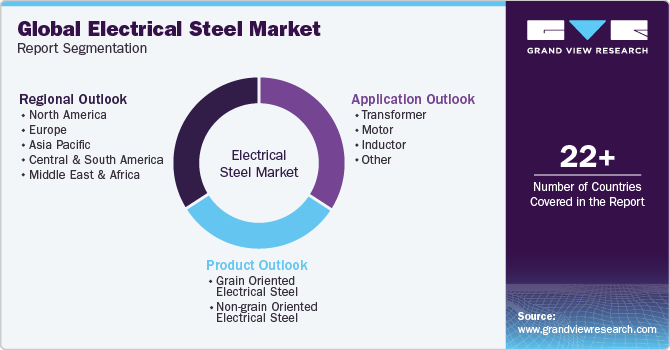

Electrical Steel Market Size, Share & Trends Analysis Report By Product (Grain Oriented Electrical Steel, Non-grain Oriented Electrical Steel), By Application (Transformer, Motor, Inductor), By Region (North America, Europe), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-029-3

- Number of Report Pages: 116

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Electrical Steel Market Size & Trends

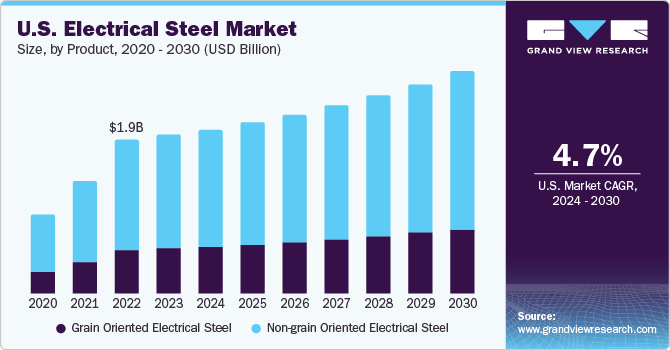

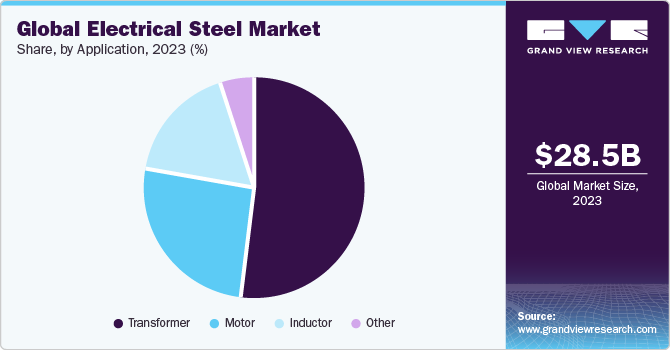

The global electrical steel market size was valued at USD 28.53 billion in 2023 and is expected to grow at a compounded annual growth rate (CAGR) of 4.7% from 2024 to 2030. Increasing electricity generation worldwide is one of the key driving factors for market growth. As the name implies, electrical steel possesses enhanced electrical properties such as high permeability, high electrical resistivity, low hysteresis loss, and low magnetostriction. These properties make it highly desirable for applications related to electricity consumption, distribution, and generation.

Electrical steel finds application in generators, electric motors, relays, solenoids, and other electromagnetic devices, which are further used in power distribution systems and other related applications. The U.S. is the second-largest electricity generator in the world. In 2022, the country generated around 4,243 TWh of electricity, a 6.4% increase compared to 2021. The growth in the electric vehicles (EVs) industry is another driver for the market. Electrical steel contains specific magnetic properties, which makes it of vital use in rotors and stators in motor of an EV. The product helps enhance motor efficiency by minimizing core energy losses and accelerating vehicle’s range.

In 2022, electric car sector reached a notable milestone by achieving a new sales record, despite the contraction in overall car sales. In 2022, EV sales surpassed 10 million units, and this number is anticipated to reach 17 million by the end of 2023. Rising EV production propels use of electric motors, thus boosting electrical steel consumption.

Rising demand for electrical steel has compelled manufacturers to expand their production. For instance, in May 2021, JSW Steel and JFE Steel Corporation signed an MoU to begin a feasibility study for establishing a joint venture company in India for manufacturing and sales of electrical steel sheets in the country.

Application Insights

The transformer segment held the largest revenue share of more than 52.0% of the overall market in 2023. Increasing complexity in electrical grids, penetration of EVs, rise in digital loads, and growth in decentralized generation have augmented the need for transformers. For instance, as per data published by IEA, USD 24,234 billion investment is expected to be pumped between 2014 and 2035 with the aim of net addition of 24.2 million kilometers of power distribution lines.

Rising need for transformers has compelled companies to expand their production capacities. For instance, in February 2021, a new power transformer plant was commissioned in Kerala, India. This new plant was set up with an investment worth ₹12.5 crores (~USD 1.7 million). The annual production capacity of the plant for manufacturing power transformers up to 25 MVA, 132kV class is expected to be 1,500 MVA.

The motor segment is anticipated to register the fastest growth rate across the forecast period. High frequency, high permeability, and excellent magnetic properties of electrical steel make it preferable in electric motors. Increasing emphasis on EV production is propelling the need for electric motors, which is eventually expected to benefit market growth.

Compared to motors used in industrial machinery, electric motors provide four times higher speed. High speed can cause the generation of significant heat, which can impact a vehicle’s performance by increasing core losses and putting extreme mechanical stress on motor components. Electrical steel overcomes this situation owing to its properties, making it reliable and increasing the durability of the motor.

Market Dynamics

Fluctuation in raw material prices hinders market growth. Ferrosilicon, one of the key raw materials for electrical steel, faces demand-supply hindrances on account of parameters such as production cut-down, trade disparity, and low demand, which affect electrical steel market. For instance, in H1 2023, Asia witnessed fluctuations in ferrosilicon prices owing to low production as many plants were under maintenance.

Ferrosilicon prices can be affected by numerous parameters including environmental regulations, energy costs, exchange rates, steel market, global economic conditions, supply-demand, quality, grade, trade, and raw material prices. Any of these parameters can affect the product’s price, and eventually impact market sentiments of electrical steel.

Regional Insights

Based on region, North America held a revenue share of more than 12.0% of the global market in 2023. Growing emphasis on power generation and EV production in the region has propelled the need for electric motors and charging stations, which in turn is driving market for electrical steel. For instance, in 2020, Foxconn announced to build EVs in North America and after a year, the company unveiled three models. In October 2023, the company unveiled another new model N electric cargo van and announced to further deepen partnership with NVIDIA and ZF Group.

With increasing investments in the EV industry, companies are emphasizing electric motors as well. For instance, in April 2021, Exro Technologies Inc. announced its plan to open a 37,000-square-foot manufacturing facility in Calgary, Canada. In September 2023, the company announced its official start. This facility will produce 100,000 units of coil drivers under European automotive standards. Its current purchasers include HB4 Group and Vicinity Motor.

Europe was the second-largest regional market for electrical steel in 2023. The EV market is key growth driver for the consumption of electrical steel in Europe. In 2022, the EU witnessed nearly 2 million EV registrations from 1.74 million in 2021. The growing EV market attracted foreign companies to invest in the region.

In November 2020, Nidec announced to build EV factory in Serbia to expand its foothold in Europe and compete against Chinese players. As of May 2023, the company opened 2 new factories in Serbia. Nidec Electric Motor Serbia will manufacture auto motors and Nidec Elesys Europe will produce inverters and electronic control units. Serbia is gaining prominence in EV market due to its proximity to EV and related component manufacturing sites. The country is home to companies such as Bosch, Magna, ZF, Lear, Continental, Stellantis, and Yanfeng Automotive Interiors.

Product Insights

In terms of revenue, the Non-grain Oriented Electrical Steel (NGOES) segment dominated the market and accounted for the largest share of more than 71.0% in 2023. NGOES find applications in entire energy value chain, from generators to electric motors and appliances. It is available in numerous grades depending upon properties, composition, and applications. Grain-oriented Electrical Steel (GOES) mainly finds application in transformers and charging infrastructure of EVs. It has high magnetic induction and stacking factor enabling less usage of material in winding of the core. Its magnetic properties reduce core losses and provide economical and efficient solutions for transformers.

GOES is used in various types of transformers and is available in different grades. Grades differ based on their thickness. The product segment is anticipated to register a higher growth rate compared to NGOES over the forecast period. Increasing production of transformers is propelling the segment growth. Its smaller market share can be attributed to its high cost compared to NGOES.

Key Companies & Market Share Insights

The market for electrical steel is highly competitive in nature owing to presence of several major players. The key players have a competitive edge such as advanced technology, significant research activities, and a strong foothold in regional markets. To compete in the market, key manufacturers are adopting numerous strategies, such as upgrading plants to cater high-quality products to customers. In May 2023, Nippon Steel Corporation announced further expansion for its high grades non-oriented electrical steel sheets.

Key Electrical Steel Companies:

- ArcelorMittal

- Cleveland-Cliffs Corporation

- JFE Steel Corporation

- Nippon Steel Corporation

- POSCO

- Tata Steel

- thyssenkrupp AG

Electrical Steel Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 29.71 billion

Revenue forecast in 2030

USD 39.56 billion

Growth rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company market positioning, competitive landscape, growth factors, trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Russia; Turkey; France; Italy; China; India; Japan; South Korea; Brazil; Iran

Key companies profiled

ArcelorMittal; Cleveland-Cliffs Corporation; Nippon Steel Corporation, Tata Steel, POSCO, thyssenkrupp AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electrical Steel Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electrical steel market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Grain oriented electrical steel

-

Non-grain oriented electrical steel

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Transformer

-

Motor

-

Inductor

-

Other

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

Turkey

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Iran

-

-

Frequently Asked Questions About This Report

b. Increasing electricity generation and growth in EV production are key growth drivers of the electrical steel market.

b. The global electrical steel market size was estimated at USD 28.53 billion in 2023 and is expected to reach USD 29.71 billion in 2024.

b. The global electrical steel market is expected to witness a compound annual growth rate of 4.7% from 2024 to 2030 to reach USD 39.56 billion by 2030.

b. The transformer was the key application segment of the market with a revenue share of above 52.0% of the electrical steel market in 2023.

b. Some of the key players operating in the electrical steel market are ArcelorMittal, Tata Steel, JFE Steel Corporation, ThyssenKrupp AG, and POSCO

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."