- Home

- »

- Healthcare IT

- »

-

Electronic Data Capture Systems Market Size Report, 2030GVR Report cover

![Electronic Data Capture Systems Market Size, Share & Trends Report]()

Electronic Data Capture Systems Market (2023 - 2030) Size, Share & Trends Analysis Report By Component, By Delivery Mode (Web & Cloud Based, On-premise), By Development Phase (Phase I, II, III, IV), By End-user, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-896-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electronic Data Capture Systems Market Summary

The global electronic data capture systems market size was estimated at USD 1.25 billion in 2022 and is projected to reach USD 3.63 billion by 2030, growing at a CAGR of 14.6% from 2023 to 2030. Increasing preference for decentralized clinical trials, the need to effectively capture and manage a large amount of clinical data, initiatives by market players, and increasing drug development and discovery activities are anticipated to drive the growth of the market.

Key Market Trends & Insights

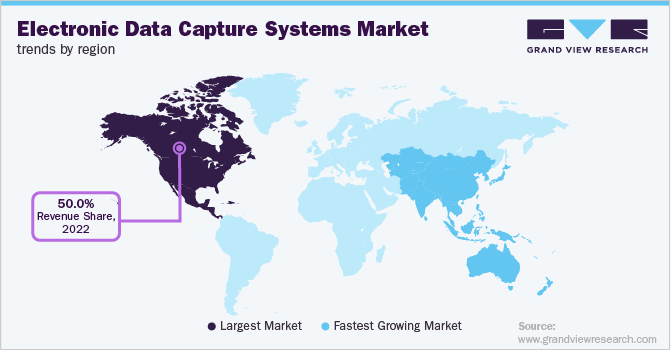

- The North America accounted for about 50% of the electronic data capture (EDC) systems market in 2022.

- The Asia Pacific is projected to grow at the fastest rate in the next few years.

- By delivery mode, web & cloud-based systems segment dominated the market in 2022.

- By development phase, phase III segment held the highest share of over 50% in 2022.

- By end-user, CROs segment held the largest market share of over 35% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 1.25 Billion

- 2030 Projected Market Size: USD 3.63 Billion

- CAGR (2023-2030): 14.6%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

In February 2022, Calyx EDC was selected by a major pharmaceutical company for a global, late-phase study to capture Real World Evidence (RWE) data. The COVID-19 pandemic notably affected the Electronic Data Capture (EDC) systems market. The impact included hurdles in clinical trial operations, canceled or delayed studies, and challenges in patient recruitment. The pandemic, however, accelerated the digitalization of clinical research. Many sponsors & CROs began adopting eClinical solutions to simplify and manage clinical studies effectively and remotely. This included the adoption of clinical trial management systems, EDC systems, eConsent, remote monitoring, virtual visits, electronic clinical outcome assessment, and analytics, among others. These solutions were either implemented independently or as a comprehensive all-in-one solution at site or enterprise levels.

Providers of EDC systems also witnessed challenges during the pandemic period, such as keeping track of alternative methods of conducting visits and facilitating workflow to accommodate alternative visits. Market players thus began offering flexible solutions to suit the changing needs. Calyx for instance offered its EDC Design Tool to help a CRO create a COVID-19 Impact page. The page was designed to capture the details of how the pandemic impacted study participation. To assist with workflow, the company configured queries based on how the scheduled visit or treatment was conducted. For instance, in case the visit was conducted over the telephone, the site was reminded to complete the Adverse Event and Concomitant Medication forms by issuing a query. These reminders helped prevent incomplete or missing data and forms. As per the company, Calyx EDC has been used in 2600+ clinical trials globally.

The increasing complexity in the management of clinical information generated before, during, and after a trial is expected to propel the demand for EDC systems over the forecast period. Electronic Data Capture (EDC) systems can help manage complex data in all phases of a clinical study. For instance, in phase-I trials, the EDC system can be used for the fast preparation of digital questionnaires, for recurring questionnaires on multiple points of measurement, and to collect and manage data securely via electronic case report form (eCRF). The associated benefits, along with the growing validity and reliability of EDC systems, are estimated to fuel the market growth. In January 2022, Medrio, a provider of eClinical solutions including EDC systems, reported the successful completion of SOC 2 Type I Evaluation of their data management technology platform for continuing commitment to customer data protection.

Delivery Mode Insights

Web & cloud-based systems dominated the market in 2022 by delivery mode. This is due to related advantages such as minimal technical issues and remote access to data. Other benefits are scalability, reduced costs, centralization of data, and uptime consistency. Depending on the current level of implementation and future growth prospects, cloud-based delivery systems for EDC services are expected to register the highest demand in the near future. This exponential growth rate is a consequence of increasingly being recognized to provide greater efficiency in numerous applications, such as the trial design stage, data collection processes, and monitoring & report generation.

On the other hand, the on-premises solutions offer higher data security, control over data, and operational efficiency. These, however, have a high cost of implementation, which may restrain segment growth. The increasing number of companies is estimated to propel market growth. Some of the key companies include Calyx; IBM; IQVIA Inc.; Medidata Solutions, Inc.; Oracle; DATATRAK International, Inc.; Clario; Veeva Systems; and others.

Component Insights

The highest share of the global Electronic Data Capture (EDC) Systems market, in terms of components, was held by the services segment in 2022. The software segment, on the other hand, is expected to grow at a lucrative rate in the near future. The increasing regulatory requirements for the recruitment of patients and the conduction of clinical trials are anticipated to contribute toward the growing demand over the forecast period.

In April 2020, ClinCapture, an Electronic Data Capture (EDC) systems provider, partnered with the biopharmaceutical firm MediciNovato to support a clinical trial targeting severe COVID-19. ArisGlobal, another company in the market, offers managed services, professional services, and training, in addition to its Lifeshpere Clinical EDC system. The increasing product portfolio by key market participants is estimated to fuel market growth.

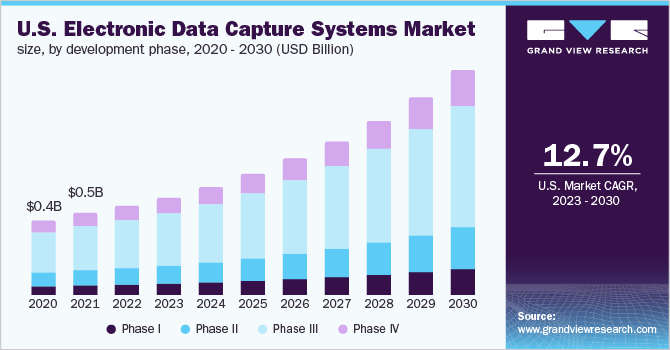

Development Phase Insights

In the development phase segment, Phase III held the highest share of over 50% in 2022 owing to the high requirement for EDC software to curb the overall cost and improve the efficiency of processes. On the other hand, Phase I is presumed to advance with a lucrative growth rate as these systems support analysis of clinical data, future outcomes, and eliminating drug candidates with a low probability of success in clinical trials.

A large number of phase I trials and complex management and analysis processes of the information acquired during various studies have been boosting the demand for EDC solutions. The currently available tools have enabled the minimization of manual errors and have increased efficiency while reducing costs. Direct data and remote information capturing are the factors aiding the market growth during the forecast period. The integration of EDC systems is expected to result in lowering the prices for data management, which is anticipated to boost the market in developing regions.

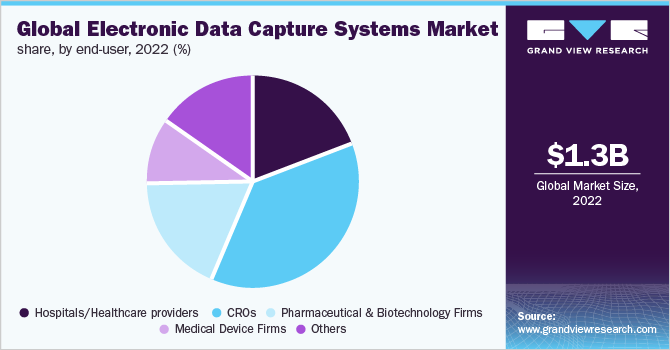

End-user Insights

By end-user, CROs held the largest market share of over 35% in 2022 and are anticipated to exhibit the fastest growth as a consequence of the rising inclination of pharmaceutical companies toward reducing overall expenditure and outsourcing of clinical R&D. This trend is anticipated to continue over the forecast period. Associated benefits such as cost-effectiveness, increased efficiency of services, enhanced compatibility, and a higher focus on the core areas of development that are critical to a company's growth are other contributing factors to segment growth.

Hospitals/healthcare providers, medical device firms, and others also held a notable share of the market in 2022. This is owing to the increasing adoption of EDC systems and services by these end-users. In March 2019, Siriraj Clinical Research Center, a Thailand-based research institute, selected the Oracle Health Sciences EDC solution to enhance its operational efficiency, overall regulatory compliance, and clinical trial data quality.

Regional Insights

North America accounted for about 50% of the Electronic Data Capture (EDC) Systems market in 2022. This is attributable to the advanced healthcare infrastructure, presence of key companies, rising digitalization of clinical research, and decentralization of clinical studies. Key market players implement various strategies to increase their market penetration and capabilities. In November 2021, ERT, a leading clinical endpoint technology provider, and Bioclinica merged to form Clario. Clario offers an EDC suite of solutions as part of a single platform to enhance operational efficiency, eliminate obstacles, and manage data for a single study or a global portfolio of clinical trials.

Asia Pacific is projected to grow at the fastest rate in the next few years. This is owing to the availability of a large patient population, increasing R&D investments, outsourcing of clinical trials, and the high number of clinical trials conducted across the region. The International Severe Asthma Registry (ISAR) helped kickstart data collection in Japan by conducting a training session for the ISAR EDC system running on the OpenClinica platform in January 2019. Such initiatives are estimated to promote market growth in the region.

Key Companies & Market Share Insights

The Electronic Data Capture (EDC) Systems market is competitive with several small and large companies. Key companies are involved in the deployment of strategic initiatives, such as the expansion of services, software upgrades & launches, partnerships & collaborations, customer acquisition, and mergers & acquisitions, among others. For instance, in February 2022, Clinixir Company Limited, a leading Thailand-based CRO, selected Oracle’s pharmacovigilance and clinical research solutions as its eClinical platform. This included the Oracle Clinical One EDC as part of the solutions implemented. In March 2020, Elsevier, a key information analytics provider, launched Veridata EDC to capture patient data for clinical research. The solution was made available for free to researchers working to develop COVID-19 vaccines and other therapies. Some of the prominent players in the global electronic data capture systems market include:

-

Calyx

-

Castor

-

OpenClinica, LLC

-

IBM

-

IQVIA Inc.

-

Medidata Solutions, Inc.

-

Oracle

-

DATATRAK International, Inc.

-

Clario

-

Veeva Systems

Electronic Data Capture Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.40 billion

The revenue forecast in 2030

USD 3.63 billion

Growth Rate

CAGR of 14.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Delivery mode, component, development phase, end-user, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; South Africa; Saudi Arabia

Key companies profiled

Calyx; Castor; OpenClinica, LLC; IBM; IQVIA Inc.; Medidata Solutions, Inc.; Oracle; DATATRAK International, Inc.; Clario; Veeva Systems

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electronic Data Capture Systems Market Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global electronic data capture systems market report based on delivery mode, component, development phase, end-user, and region:

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Web & Cloud-based

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Development Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals/Healthcare providers

-

CROs

-

Pharmaceutical and Biotechnology Firms

-

Medical Device Firms

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global electronic data capture systems market size was estimated at USD 1.25 billion in 2022 and is expected to reach USD 1.40 billion in 2023.

b. The global electronic data capture systems market is expected to grow at a compound annual growth rate of 14.6% from 2023 to 2030 to reach USD 3.63 billion by 2030.

b. North America accounted for about 50% of the Electronic Data Capture (EDC) Systems market in 2022. This is attributable to the advanced healthcare infrastructure, presence of key companies, rising digitalization of clinical research, and decentralization of clinical studies.

b. Some key players operating in the electronic data capture systems market include Calyx; Castor; OpenClinica, LLC; IBM; IQVIA Inc.; Medidata Solutions, Inc.; Oracle; DATATRAK International, Inc.; Clario; and Veeva Systems.

b. Key factors that are driving the electronic data capture systems market growth are increasing preference for decentralized clinical trials, the need to effectively capture and manage large amounts of clinical data, initiatives by market players, and increasing drug development and discovery activities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.