- Home

- »

- Healthcare IT

- »

-

eClinical Solutions Market Size, Share, Industry Report 2033GVR Report cover

![eClinical Solutions Market Size, Share & Trends Report]()

eClinical Solutions Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (eCOA, CTMS, EDC & CDMS), By Delivery Mode (Cloud and Web-Based, On- Premise), By Development Phase, By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-874-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

eClinical Solutions Market Summary

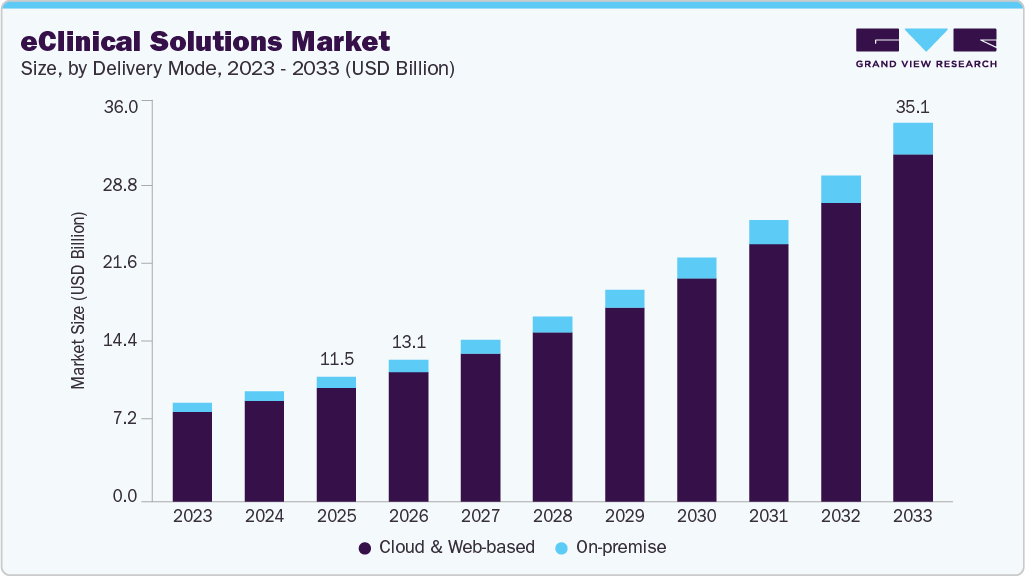

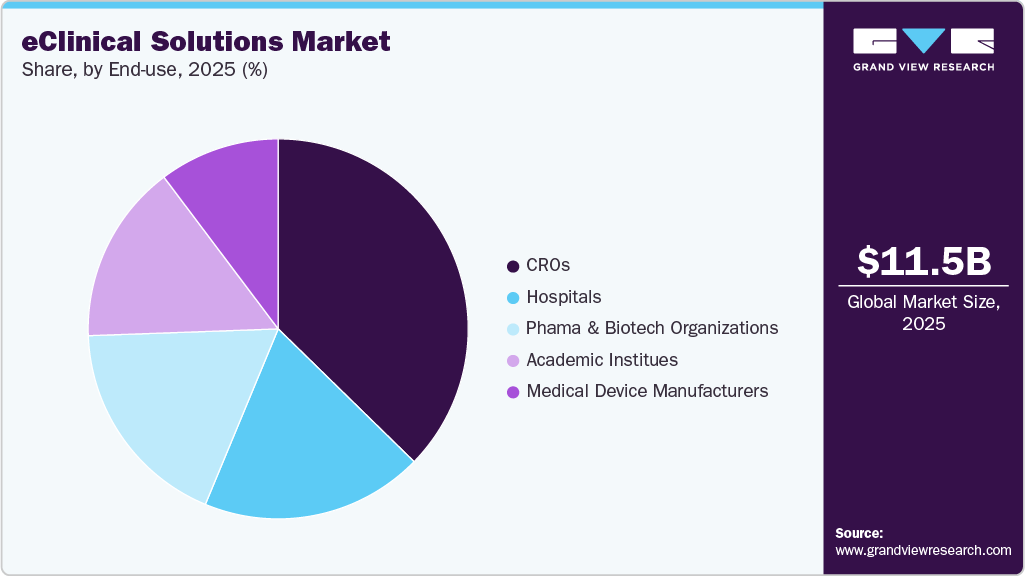

The global eClinical solutions market size was estimated at USD 11.53 billion in 2025 and is projected to reach USD 35.08 billion by 2033, growing at a CAGR of 15.07% from 2026 to 2033. Increasing research and development activities by biopharma and pharma companies is one of the key trends boosting market growth.

Key Market Trends & Insights

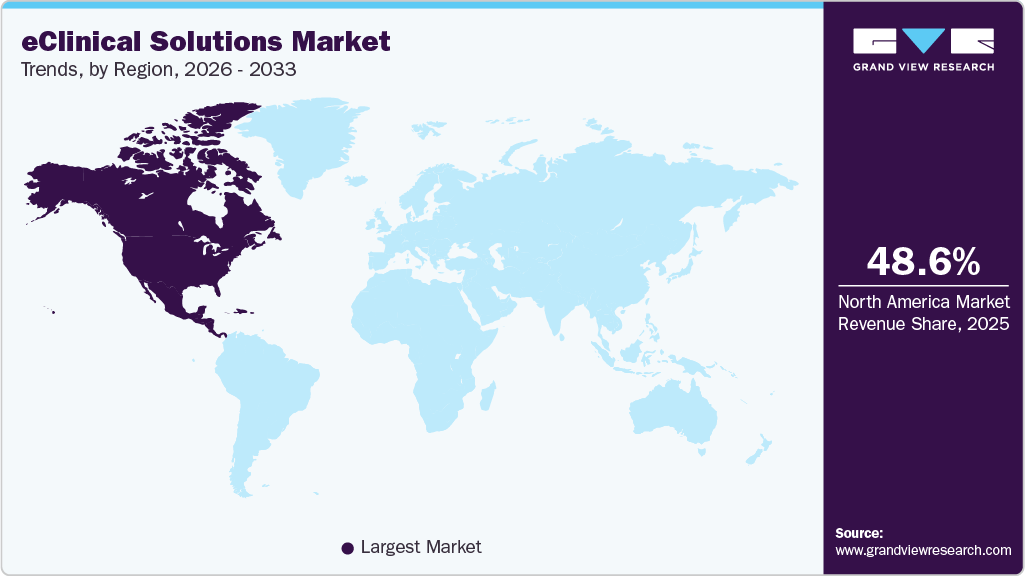

- The North America eClinical solutions industry dominated the global market and accounted for the largest revenue share of 48.56% in 2025.

- The eClinical solutions market in the U.S. held the largest share in 2025.

- Based on product, the CTMS segment dominated the market and accounted for the largest revenue share of 20.36% in 2025.

- Based on delivery mode, the web and cloud-based segment dominated the market in 2025.

- Based on end use, the CROs segment dominated the market and held the largest revenue share in 2025.

- Based on development phase, the Phase III segment dominated the market and accounted for the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 11.53 Billion

- 2033 Projected Market Size: USD 35.08 Billion

- CAGR (2026-2033): 15.07%

- North America: Largest market in 2025

Moreover, the growing incorporation of software solutions in clinical trials is projected to lead the market growth. The increasing outsourcing and externalization of clinical trials by the majority of the prominent pharmaceutical and biotechnological companies is presumed to be responsible for driving the market at an unprecedented rate throughout the forecast period.The increasing outsourcing and externalization of clinical trials by the majority of the prominent pharmaceutical and biotechnological companies is presumed to be responsible for driving the market at an unprecedented rate throughout the forecast period. Drug development is of utmost importance as it enhances the capabilities in clinical data management, electronic data capture, data conversion, and standardization, as well as statistical programming and data reporting. The rising inclination of major pharmaceutical companies toward these services is also presumed to be a direct consequence of reduced demand for internal staff, enhanced cost-efficiency, efficient management of resources, and production of lucrative & unbiased results in clinical trials, which further widens the scope of growth.

The decentralization of clinical trials significantly increases the number of clinical trials. A July 2022 study by the Tufts CSDD, conducted in collaboration with biopharmaceutical companies and contract research organizations (CROs), examined the impact of decentralized clinical trials (DCTs) and hybrid trial models on sponsor-CRO collaborations. The research highlighted a notable increase in global drug trials incorporating DCT components between 2020 and 2022, with expectations for further growth in the years to come. Key challenges to implementing DCTs include inconsistencies in data standards and regulations, data privacy concerns, and technical validation requirements for health apps and wearable devices.

Furthermore, regulatory compliance and data security requirements are key drivers of growth in the eClinical solutions market. Clinical trials generate large volumes of sensitive patient and trial data, making adherence to regulations such as FDA 21 CFR Part 11, GDPR, HIPAA, and ICH-GCP essential. Sponsors and CROs increasingly rely on advanced eClinical platforms to ensure secure data capture, storage, and transfer, while maintaining audit trails, electronic signatures, and role-based access controls. The growing complexity of multi-country trials, coupled with stricter oversight by regulatory authorities, has accelerated the adoption of cloud-based, validated, and compliant solutions. By providing robust compliance frameworks and data protection mechanisms, eClinical technologies reduce regulatory risk, enhance trial integrity, and build stakeholder confidence, thereby fueling market growth..

The increasing demand for advanced data analytics and AI‑enabled clinical data platforms to accelerate research productivity and reduce clinical development cycle times. For instance, in February 2025, life sciences organizations reportedly faced escalating trial complexity, larger volumes of data from diverse sources, and the need for faster insights to make informed decisions during drug development.

Notable market players are also taking initiative to expand their offering and responding to the growing demand. For instance, eClinical Solutions has responded to this demand by enhancing its flagship elluminate Clinical Data Cloud platform with embedded AI and machine learning capabilities, such as natural language query support (elluminate Assist), automated data classification, and machine‑learning‑driven audit trail reviews. These innovations help clients automate routine tasks, optimize data workflows, and interpret complex datasets more efficiently,capabilities that are increasingly critical as pharmaceutical sponsors and contract research organizations (CROs) seek to shorten trial timelines and improve operational efficiency. In 2024-2025, the company added 20 net new clients, including three CROs, and it expanded its technology suite specifically to address cycle‑time challenges in clinical trials, which underlines how data intelligence and AI integration are key drivers of its business growth.

“With rapidly advancing AI capabilities, this is a pivotal moment for industry innovation and adopting risk-based approaches that are paramount to improving the speed and quality of trials. Last year was a key stepping stone in doubling down on this modern infrastructure and fostering critical partnerships for success,” said Raj Indupuri, CEO and co-founder of eClinical Solutions. “In 2025, we’re eager to advance our technology capabilities further while continuing to invest in our people-first approach, ensuring every employee feels empowered to realize their full potential while expanding our team to meet industry needs.”

AI Integrated eClinical Solutions Market

Integrating artificial intelligence (AI) and machine learning (ML) transforms clinical trial management by streamlining patient recruitment, optimizing trial design, and enhancing site selection through data-driven insights. They enable real-time monitoring, predict patient outcomes and dropout risks, and automate data analysis for faster, more accurate results. AI also supports the creation of synthetic control arms, reduces trial costs, and improves regulatory compliance, ultimately accelerating drug development and enabling more personalized treatments. In 2024, the National Institutes of Health developed TrialGPT, an AI algorithm to speed up matching volunteers for clinical trials.

Similarly, Clinion, a U.S. based clinical trial company, offers an AI-enabled eClinical platform that combines AI, ML, and Generative AI (GenAI) to drive end-to-end efficiency in clinical trials. Its comprehensive suite includes modules such as EDC, Randomization and Trial Supply Management (RTSM), Clinical Trial Management System (CTMS), eCOA, electronic Trial Master File (eTMF), eConsent, eSource, eProtocol Automation, and Clinical Study Report (CSR) Automation, enabling seamless and intelligent trial operations.

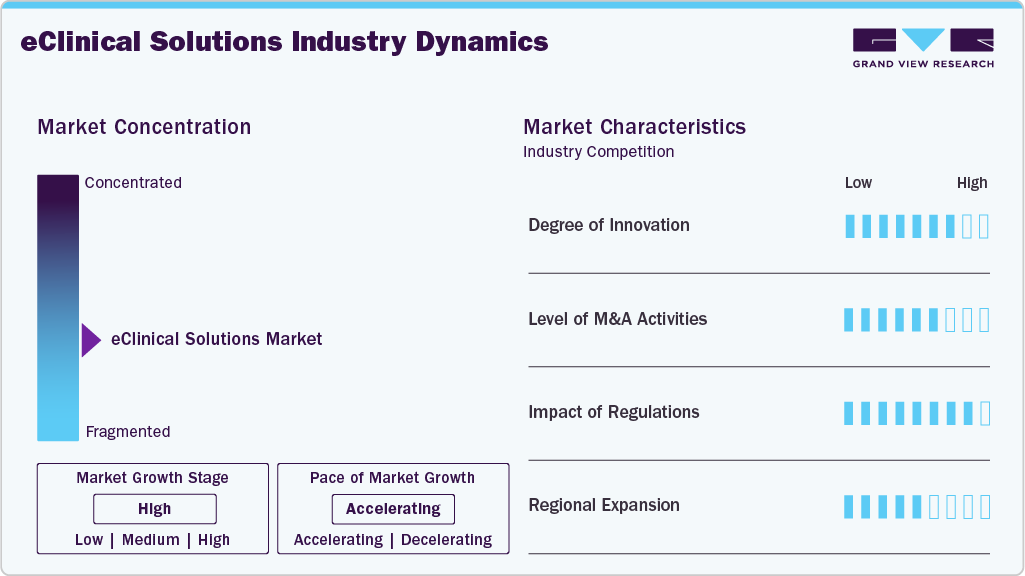

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the eClinical solutions market is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry are high. However, the regional expansion observes moderate growth.

The industry is experiencing high innovation owing to the rapid evolution of digital health technologies and the growing demand for more efficient clinical trial processes. Numerous players introduce new AI-integrated products to optimize trial design, patient recruitment, and real-time monitoring. For instance, in March 2024, PhaseV announced that it would demonstrate AI/ML-powered clinical trial design and analysis capabilities at the CMO Summit 360°.

The level of partnerships & collaboration activities by key players in the industry is high, reflecting the industry's need for integrated, interoperable, and technologically advanced solutions in clinical research. For instance, in June 2023, Syneos Health collaborated with uMotif Limited, leveraging an advanced digital platform that incorporates robust Electronic Clinical Outcome Assessment (eCOA) and Electronic Patient-reported Outcomes (ePRO) capabilities. This partnership aims to accelerate the pace of clinical trials, expediting the delivery of groundbreaking medications to patients more efficiently.

The impact of regulations on the market is high. Stringent regulatory requirements—such as those from the FDA (21 CFR Part 11), European Medical Agency (GCP), and ICH guidelines drive demand for robust, compliant digital platforms that ensure data integrity, security, and traceability throughout the clinical trial process. However, evolving regulations, particularly those encouraging decentralized trials, real-world evidence, and interoperability, such as the FDA’s Digital Health initiatives and EMA’s guidance on electronic systems, have created opportunities for innovation in the eClinical solutions industry.

The level of regional expansion in the industry is moderate, owing to the globalization of clinical trials and the increasing demand for digital health infrastructure in emerging markets. For instance, in October 2023, Lokavant received an investment of USD 8 million from Mitsui & Co. Ltd. for expanding its AI and Predictive Clinical Trial Intelligence into the Asia-Pacific region.

Case Study

TrueBlue Clinical Research, based in Tampa, Florida, transitioned from paper-based processes to RealTime's integrated eClinical platform, leading to significant operational efficiencies and growth.

“In clinical trials, the product of what we do is documentation. The data is the product. RealTime enables us to create a better product because we’re able to create high-quality data for all of our studies.”

-Jeffrey Smyth, President and Executive Director TrueBlue Clinical Research

Product Insights

The CTMS segment dominated the market for eClinical solutions and accounted for the largest revenue share of 20.36% in 2025. The rapid growth of healthcare IT, along with a preference for decentralized clinical trials, initiatives by key industry players, and a rising number of clinical studies, is expected to fuel market growth. Government initiatives and investments by biotechnology and pharmaceutical firms are driving medical research activities. Combined with technological advancements, these factors are expected to propel market growth. For example, in October 2023, the Advanced Research Projects Agency for Health (ARPA-H), a U.S. Department of Health and Human Services (HHS) agency, announced plans to enhance the country's ability to conduct clinical trials rapidly, safely, and equitably. This initiative aims to promote technological advancements and insights to establish a robust national clinical trial infrastructure, thereby fostering the adoption of CTMS and strengthening the market growth.

The ECOA segment is expected to be the fastest-growing segment during the forecast period, owing to the rising significance of high-quality clinical data. ECOA facilitates preservation of overall quality and is being increasingly incorporated in the measurement of patient-reported, clinician-reported, and observer-reported outcomes. The data capture process using eCOA platforms enhances the quality of information captured, streamlines data collection procedures, and facilitates effective data analysis.

Delivery Mode Insights

The cloud and web-based segment dominated the market for eClinical solutions in 2025, largely attributed to associated benefits, such as easy accessibility, usability, and lower investment requirements. Web and cloud-based products are easily customizable, owing to which, providers can customize the presentation of information for different user groups. Besides, these products have a greater level of interoperability. The segment is poised to maintain its position throughout the forecast period.

The on-premise delivery mode involves installing services and solutions on computers present within the organization. Though the software needs to be installed within the organization’s premises, it can be accessed from remote locations, providing the benefit of reduced costs due to power consumption and system maintenance. The on-premise eClinical solution is the most commonly preferred option due to its benefits, including security and ease of access. Preference for these services is mainly due to complete access to information and full control within the premises.

Development Phase Insights

The Phase III segment dominated the eClinical solutions market and accounted for the largest revenue share in 2025. The surging demand for the incorporation of clinical data management software to curb overall cost and improve process efficiency is contributing to the growth of the segment. The increasing number of drugs successfully reaching Phase III is providing a significant boost to the growth of the segment. Phase III involves the study of the efficacy of a drug by using a group of more than 1,000 patients. The complexity of the study increases with the number of patients, triggering the demand for computer-based systems for data management, thereby accelerating the adoption of eClinical solutions.

The Phase I segment is estimated to be the most promising segment during the forecast period, owing to the high significance of these systems in predicting future outcomes and eliminating drug candidates with the least probability of success. Advances in biological modeling systems and personalized medicine technologies are driving a surge in the development of new drugs. A large number of Phase I trials, and complex management and analysis of data acquired during various studies, are expected to propel the growth of the segment.

End Use Insights

The CROs segment dominated the market and held the largest revenue share in 2025. The segment is projected to rise at a remarkable CAGR during the forecast period, owing to the growing inclination of pharmaceutical companies to reduce overall expenditure. The rising usage of eClinical solutions in research is further widening the scope of segment growth. The benefits associated with outsourcing clinical trials to CROs are a key factor in the segment's heightened growth. These benefits include cost advantages, increased service efficiency, enhanced productivity, and a greater focus on core areas of development critical to a company’s growth.

The pharma and biotech organizations segment is expected to witness significant growth over the forecast period. This is attributed to the increasing adoption of eClinical solutions by researchers that provide improved clinical trials and streamlined research workload. Such software solutions allow biotechnology and pharmaceutical companies to identify procedural bottlenecks in clinical trials. This, in turn, is driving the demand for eClinical solutions among researchers in pharmaceutical and biotechnology companies for clinical research programs.

Regional Insights

The North America eClinical solutions industry dominated the global market and accounted for the largest revenue share of 48.56% in 2025. An increasing target population, coupled with the rising prevalence of lifestyle-associated diseases such as diabetes and cardiac disorders, is poised to stimulate the growth of the market. In addition, the launch of new products by eClinical solution vendors and an increase in government grants are driving the market in the region. Moreover, the domicile of prominent players and the availability of sophisticated infrastructure are additional factors expected to accentuate the growth of the regional market.

U.S. eClinical Solutions Market Trends

The eClinical solutions industry in the U.S. held the largest share in 2025, owing to the region's advanced healthcare infrastructure and robust pharmaceutical industry. The presence of major players, coupled with supportive regulatory frameworks such as the FDA's 21 CFR Part 11, fosters innovation and adoption of eClinical technologies. Further, the adoption of decentralized clinical trials (DCTs) and cloud-based solutions accelerates market expansion. For instance, in August 2024, Walgreens Boots Alliance launched the Decentralized Clinical Operations in partnership with the Biomedical Advanced Research and Development Authority (BARDA) for the Healthcare and Research program. This initiative aims to strengthen U.S. decentralized clinical research capabilities and has potentially reached more than five million patients to recruit into clinical trials since its launch in 2022.

Europe eClinical Solutions Market Trends

The eClinical Solutions industry in Europe is growing significantly. This growth is attributed to the region's emphasis on personalized medicine, increasing clinical trials in oncology and rare diseases, and strong regulatory frameworks drive this growth. Countries like Germany and the UK are at the forefront, focusing on improving healthcare systems and the digital economy. Furthermore, in January 2022, the European Commission, the European Medicines Agency (EMA), and the Heads of Medicines Agencies launched the Accelerating Clinical Trials in the EU initiative. This initiative aims to transform the design and conduct of clinical trials. The initiative focuses on harmonizing clinical trial processes, fostering innovation, and integrating clinical research into the European health system, thereby supporting the adoption of eClinical solutions.

The UK eClinical Solutions industry is growing significantly as technological advancements, the presence of established healthcare, high disposable income, and rising prevalence of target diseases continue to foster market growth in the region. Furthermore, seamless integration of eClinical solutions with electronic health records has been a growing trend in the UK. This integration streamlines data exchange between clinical trial sites and healthcare providers, improving overall efficiency and data accuracy. Moreover, cloud-based eClinical solutions have gained popularity in the UK due to their flexibility, scalability, and cost-effectiveness.

The eClinical solutions industry in Germany held a significant share of the European market in 2025. The large geriatric population is one of the highest-impact rendering drivers in Germany. According to the UN population data, one in every 20 Germans is aged above 80, and the number is expected to increase till 2050. Problems faced by the geriatric population include a high risk of chronic diseases such as cardiovascular disease, diabetes, neurovascular disorders, and a decrease in immunity levels. Hence, the German government is undertaking initiatives and investing in clinical trials pertaining to the aforementioned diseases, thereby boosting the growth of the market.

Asia Pacific eClinical Solutions Market Trends

The eClinical solutions industry in the Asia Pacific is projected to register a noteworthy CAGR of 16.37% over the forecast period. High unmet medical needs and rising prevalence of target chronic diseases such as cancer, cardiovascular conditions, and infectious diseases are stoking the demand for software solutions in the region. An increasing number of trials are being outsourced to countries such as China, India, Korea, and Japan due to their large patient populations and lower costs. This outsourcing has, thereby, boosted the adoption of eClinical solutions in these regions. As an emerging economy, the growth of the APAC market is largely driven by government funding related to research and drug discovery, which is estimated to enhance its growth over the forecast period.

The Japan eClinical solutions industry is propelled by substantial R&D efforts by biopharmaceutical firms, rising integration of software solutions in clinical trials, and increasing demand for safety monitoring. Further, Japan is a significant player in the global pharmaceutical and clinical research industry. The country's pharmaceutical companies and research institutions conduct numerous clinical trials. Therefore, the adoption of eClinical solutions has become essential for efficient data collection, management, and analysis during these trials.

The eClinical solutions industry in China is driven by the increasing number of clinical trials and substantial government investments in healthcare research and technology. The country's focus on improving the quality of clinical trials and data management, along with the modernization of healthcare infrastructure, contributes to market growth. Furthermore, China's regulatory environment is evolving rapidly to accommodate the growing adoption of digital health solutions, including eClinical technologies, positively impacting market growth.

Latin America eClinical Solutions Market Trends

The eClinical solutions industry in Latin America is growing significantly. The presence of untapped opportunities in emerging countries, such as Brazil and Mexico, is expected to propel the growth of the market. Developments in healthcare and pharmaceutical industries, expansion of clinical trials, especially in oncology, neurology, and infectious diseases, necessitate advanced clinical trial management systems, which are contributing to the market growth.

Middle East & Africa eClinical Solutions Market Trends

The eClinical solutions industry growth in the Middle East & Africa is attributed to the development of health amenities and increased funding toward medical research and technology. The GCC countries are relatively new to clinical research; however, with technological advancements and increasing digitization, the countries are overcoming the challenges faced on the technological front and witnessing significant growth.

Key eClinical Solutions Company Insights

The market is highly fragmented, with a mix of small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships are playing a key role in propelling the market growth.

Key eClinical Solutions Companies:

The following are the leading companies in the eClinical solutions market. These companies collectively hold the largest market share and dictate industry trends.

- Datatrak International, Inc.

- Oracle

- Parexel International Corporation

- Dassault Systemes

- Bioclinica

- CRF Health

- ERT Clinical

- eClinicalWorks

- IBM Watson Health

- Anju Life Sciences Software

- eClinical Solutions

- Maxisit

- IQVIA

- Castor

- Veeva Systems

- RealTime Software Solutions, LLC

- Medidata Solution, Inc

- ICON, plc

Some of the prominent players offering AI-powered eClinical solutions include:

- Deep 6 AI ( acquired by Tempus on March 12, 2025)

- Phesi

- Curebase

- Saama

- Suvoda LLC ( Merged with Greenphire in April 2025 )

- Cencora Pharmalex (acquired by AmerisourceBergen Corporation in January 2023)

- Clinion

- Jeeva Clinical Trials Inc.

- Trial Interactive by TransPerfect

Recent Developments

-

In April 2025, Veeva Systems announced the launch of Veeva SiteVault CTMS, designed for research sites. The solution is integrated with SiteVault eConsent and SiteVault eISF, enabling sites to manage end-to-end clinical trial activities within a single, unified platform. Through integration with sponsors on Veeva’s Clinical Platform, the system supports seamless bidirectional data exchange, reducing manual workflows and improving operational efficiency for research sites.

“High-quality cloud software and seamless sponsor integration will help sites be more efficient. By making the SiteVault suite free for over 90% of research sites, we are doing our part as a Public Benefit Corporation to improve clinical research for sites and sponsors.”

-Nick Frenzer, general manager, site solutions at Veeva.

-

In November 2024, RealTime eClinical Solutions expanded its Professional Services to help clinical research sites, academic medical centers, sponsors, and CROs fully leverage its comprehensive eClinical suite.

“As more research sites transition from paper or disjointed systems to our centralized, integrated Site Operations Management System (SOMS) platform, we ensure a smooth, customized experience.”

- Steve Johnson, CEO at RealTime.

-

In June 2023, ICON plc announced the latest release of its Digital Platform, supporting seamless integration of site, sponsor, and patient services with harmonized data delivery. The platform is customizable for various therapeutic areas and study designs, offering end-to-end solutions for patient services in clinical trials, including a user-friendly mobile app, direct data capture for in-home services, eCOA, telehealth visits, eConsent, and digital health technology management.

“This newest version of the Digital Platform enables the efficient capture and delivery of quality data from a range of decentralised clinical trial services. Its ease of use enables greater patient centricity, reducing the barriers to trial participation and enhancing the equity, diversity and inclusion of patient populations.”

-Steve Cutler, CEO, ICON

-

In May 2023, eClinical Solutions LLC. announced the expansion of its machine learning (ML) and artificial intelligence (AI) capabilities within the elluminate IQ offering. Data management teams can take advantage of these cutting-edge ML/AL capabilities to conduct data review more efficiently and scalable.

“The continued proliferation of data volume coupled with heightened demand for efficiency and cycle time gains necessitates the adoption of advanced AI techniques”.

- Raj Indupuri, CEO and co-founder of eClinical Solutions

eClinical Solutions Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 13.13 billion

Revenue forecast in 2033

USD 35.08 billion

Growth rate

CAGR of 15.07% from 2026 to 2033

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, delivery mode, development phase, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Netherlands; Sweden; Denmark; Japan; China; India; South Korea; Australia; New Zealand; Taiwan; Hong Kong; Singapore; Thailand; Vietnam; Brazil; Argentina; Chile; South Africa; Saudi Arabia; UAE; Qatar, Egypt

Key companies profiled

Datatrak International, Inc.; Oracle; Parexel International Corporation; Dassault Systèmes; Bioclinica; CRF Health; ERT Clinical; eClinicalWorks; IBM Watson Health; Anju Life Sciences Software; eClinical Solutions; Maxisit; IQVIA; Castor; Veeva Systems; RealTime Software Solutions, LLC; Medidata Solutions, Inc.; ICON, plc.

Companies offering AI integrated eclinical Solutions

Deep 6 AI (acquired by Tempus on March 12, 2025); Phesi; Curebase; Saama; Suvoda LLC (merged with Greenphire in April 2025); Cencora Pharmalex (acquired by AmerisourceBergen Corporation in January 2023); Clinion; Jeeva Clinical Trials Inc.; Trial Interactive by TransPerfect.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global eClinical Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global eClinical solutions market report on the basis of product, delivery mode, development phase, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Electronic Data Capture (EDC) and Clinical Data Management Systems (CDMS)

-

Traditional

-

AI-Enhanced

-

-

Clinical Trial Management Systems (CTMS)

-

Traditional

-

AI-Enhanced

-

-

Clinical Analytics Platforms

-

Traditional

-

AI-Enhanced

-

-

Randomization and Trial Supply Management (RTSM)

-

Traditional

-

AI-Enhanced

-

-

Clinical Data Integration Platforms

-

Traditional

-

AI-Enhanced

-

-

Electronic Clinical Outcome Assessment (eCOA)

-

Traditional

-

AI-Enhanced

-

-

Safety Solutions

-

Traditional

-

AI-Enhanced

-

-

Electronic Trial Master File (eTMF)

-

Traditional

-

AI-Enhanced

-

-

Econsent

-

Traditional

-

AI-Enhanced

-

-

-

Delivery Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud and Web-Based

-

On-Premise

-

-

Development Phase Outlook (Revenue, USD Million, 2021 - 2033)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals/Healthcare providers

-

CROs

-

Academic Institutes

-

Pharma & Biotech Organizations

-

Medical Device Manufacturers

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

New Zealand

-

Taiwan

-

Hong Kong

-

Singapore

-

Thailand

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

Chile

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the eClinical solutions market growth include increasing R&D activities by biopharma and pharma companies, application of software solutions in clinical trials, and expanding customer base.

b. The global eClinical solutions market size was estimated at USD 11.53 billion in 2025 and is expected to reach USD 13.13 billion in 2026.

b. The global eClinical solutions market is expected to grow at a compound annual growth rate of 15.07% from 2026 to 2033 to reach USD 35.08 billion by 2033.

b. Clinical Trial Management Systems (CTMS) dominated the eClinical solutions market with a share 20.35% in 2025. This is attributable to its benefits such as centralized end-to-end management of clinical trial activities, elimination of reliance on manual processes, real-time status tracking, and maintenance of multiple databases, which cumulatively improve the overall efficiency of clinical trials.

b. Some key players operating in the eClinical solutions market include Datatrak International, Inc., Oracle, Parexel International Corporation, Dassault Systèmes, Bioclinica, CRF Health, ERT Clinical, eClinicalWorks, IBM Watson Health, Anju Life Sciences Software, eClinical Solutions, Maxisit, IQVIA, Castor, Veeva Systems, RealTime Software Solutions, LLC, Medidata Solutions, Inc., and ICON, plc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.