- Home

- »

- Next Generation Technologies

- »

-

Europe Factoring Services Market, Industry Report, 2030GVR Report cover

![Europe Factoring Services Market Size, Share & Trends Report]()

Europe Factoring Services Market Size, Share & Trends Analysis Report By Category (Domestic, International), By Type (Recourse, Non-Recourse), By Financial Institution (Banks, Non-Banking Financial Institutions), By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-212-0

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Europe Factoring Services Market Trends

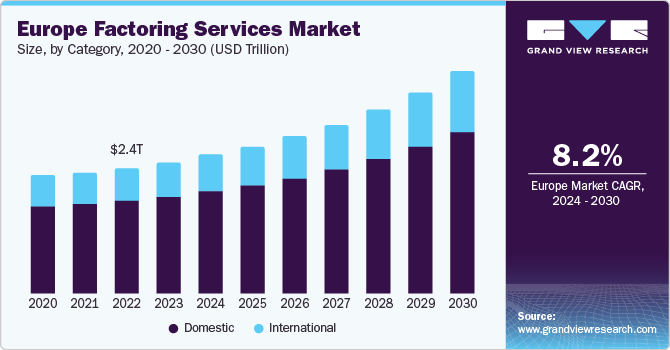

The Europe factoring services market size was estimated at USD 2,137.35 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.2% from 2024 to 2030. The Europe accounted for 56.6% of the global factoring services market. Increase in the number of small and medium sized enterprises, and when these enterprises need alternative finance options, factoring services can be of great assistance. Many European fintech companies are providing financial assistance to companies running out of funds due to delayed payments by their clients. These fintech companies buy the invoices in advance and provide an option of a cashflow when the companies require capital.

Furthermore, enterprises are increasingly looking for alternative methods of financing, such as non-banking financial institutions, due to high interest rates. In fact, Factors Chain International (FCI) has established a unique network in the European region that allows cross-border factoring collaboration. The increasing assistance of factor services is enabling the operating efficiency of Small & Medium Enterprises (SMEs) and Startups, which is driving the growth of Europe’s factoring services market in the upcoming years.

Moreover, fintech is advancing in all businesses, and the rise of cryptocurrency and blockchain technology is expected to drive the European factoring services market. Blockchain technology allows a digital ledger infrastructure and monitors all transactions, which helps to reduce the time consumption activities and builds Letter of Credit (LOC) facilities, which is ultimately helping fintech and financial service providers for funding assistance and smart contract capabilities.

Furthermore, integrating smart contract capabilities is revolutionizing how fintech and financial service providers obtain funding assistance. With the help of advanced technologies, such as AI and blockchain, the financial industry is experiencing a significant transformation in terms of efficiency, security, and transparency. By streamlining the funding process and minimizing the need for intermediaries, fintech companies such as Europe factoring services can provide faster, cheaper, and more accessible financial services to individuals and businesses alike. This is ultimately leading to a more inclusive and equitable financial landscape for newly established companies and ventures.

The pandemic has resulted in significant economic and supply chain disturbances across the world, including Europe. Due to the pandemic, the European market experienced slow economic growth, and all financial institutions faced severe setbacks. Owing to the unstable market conditions, governments and banks could not assist many SMEs and startups. Therefore, many European countries have turned to new funding sources to help protect these new firms. For instance, during the pandemic, the City of Helsinki, Finland, suspended rents of commercial and other business premises for up to three months to assist SMEs.

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The growth of factoring services in Europe has resulted in the establishment of a chain of finance-providing channels. This has allowed small companies to effectively use financial services to grow their businesses from time to time. Due to technological advancements in the finance world, many small-scale European companies are now opting for non-banking financial institutions to maintain cash flow in their day-to-day business operations. Thus, non-banking financial sources are driving the market growth for Europe factoring services.

The Europe factoring services are adopted across various SMEs and startups from all domains, such as energy and utilities, healthcare, retail, manufacturing, and telecom and IT. However, there is a vast scope of innovations in fintech solutions, especially upcoming technologies like blockchain and cryptocurrency. Europe factoring service providers usually offer low-interest financial assistance to maintain a competitive edge in the market, but due to high competition among non-banking institutions, the market observes mergers and acquisitions in Europe factoring services market.

With the increasing complexity of financial regulation in the European Union (EU) region, the European factoring services market faces challenges while providing capital funding to SMEs. Factoring services revolve around monetary transactions in which companies sell their accounts receivables, such as invoices at a discount, to a third party, known as a factor to fulfill immediate cash needs. Therefore, while doing all these transactions, the factoring service companies need to adhere to country-specific and EU regulations while executing their business operations.

In the European factoring services market, many service providers such as third-party companies, NBFCs, and several emerging banking companies in the sector have also started offering non-recourse factoring services, increasing the demand for these services. As a result, the Europe factoring services market is expected to experience significant growth over the forecast period. This means end-users have many alternative service providers in the factoring services market. However, the increasing use of technology, real-time transaction systems, and easy payment monitoring systems are aiding the growth of the European factoring service market during the forecasted period.

Category Insights

Domestic segment led the market and accounted for the highest share of over 70.0% in 2023. The rapid adoption of receivable factoring techniques in major industries has contributed to growth in the domestic market, particularly in Europe. Additionally, the increasing significance of electronic invoices has contributed to the consolidation of the domestic factoring market. Domestic factoring provides businesses with a weekly or monthly analysis of sales and payable invoices, which is a significant advantage.

However, international factoring services are anticipated to witness a significant CAGR of 8.7% from 2024 to 2030. After the pandemic, European economies began to work in cross-border space. As a result, they have observed a rising demand for open trade accounts, especially from suppliers in emerging countries. Therefore, it has become essential for firms engaging in international trade, regardless of their size and industry, to avail international factoring services. Additionally, importers in developed countries are considering factoring as a favorable alternative to conventional methods of trade finance and banking.

Type Insights

Recourse segment led the market and accounted largest share of over 50% in 2023. Recourse factoring offers all facilities except debt protection. Typically, this is the most common factoring service, where a company buys back invoices that are unable to be collected by the factoring company. Several organizations widely use this factoring to sell invoices at the lowest discounts. Furthermore, it offers several benefits, such as lower fees, flexibility on advanced rates, and flexibility in credit requirements.

Non-recourse segment is anticipated to witness significant CAGR of 8.5% from 2024 to 2030 in the market. In non-recourse factoring, the financing company takes on the risk of unpaid invoices, protecting bad debts. The growth of this service can be attributed to its widespread adoption in both developed and developing countries. This type of factoring is particularly suitable for businesses with a large customer base that wants to improve their financial position by selling their accounts receivable. Both segments are driving the demand for factoring services in the Europe market.

Financial Institution Insights

Banks segment led the market and accounted for the highest share in 2023.The banking institutions' growth can be attributed due to their convenient presence in Europe. Moreover, there is a growing adoption of blockchain technology platforms, increasing digital payment systems, and rising investments in advanced technologies such as distributed ledger technology. The adoption of these technologies in financial institutions is expected to support the growth of the segment.

On the other hand, Non-banking Financial Institutions (NBFIs) is anticipated to witness significant CAGR of 8.7% from 2024 to 2030 in the market. NBFIs are focused on developing innovative products and catering to low-income, urban customers in unorganized sectors. For instance, Novuna Finance, an invoice factoring company, offers Novuna Consumer Finance, Business Finance, Vehicle Solutions, Business Cash Flow, and Personal Finance for better integration with its platform. More private players in NBFCs make it more convenient to get financial assistance than conventional methods. As a result, NBFCs are driving more demand in European factoring services market.

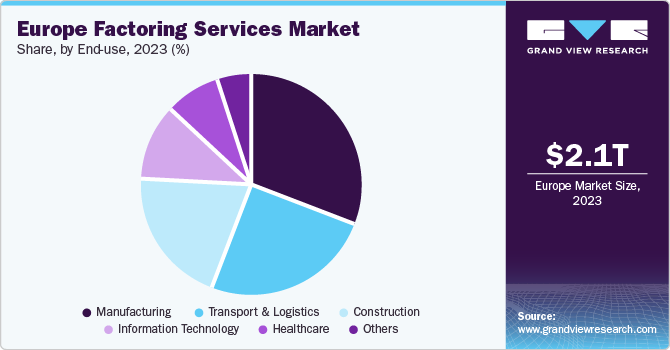

End-use Insights

Manufacturing segment accounted for the largest market share over 30.0% in 2023. In Europe, many SMEs functioning in the manufacturing sector use factoring services to convert their bills receivable to cover their operating expenses. Instead of loans with higher interest, manufacturing companies prefer invoice factoring for instant cash payments without an extensive and time-consuming documentation process to maintain cash flow in the business operations.

Healthcare is expected to register the highest CAGR during the forecast period. Healthcare service providers face difficulties due to outdated payment and billing systems. In addition, increasing complications in insurance and bureaucracy layers, along with outstanding medical bills for several weeks or months, are forcing medical companies and healthcare centers to turn to factoring services to manage their cash flow. Factoring services allow hospitals to raise instant cash to optimize their inventory of emergency medical supplies, such as OT supplies, surgical instruments, organic chemicals, and medicines. Therefore, the Europe factoring market is expected to grow in the forecast period.

Country Insights

France Factoring Services Market Trends

France accounted for largest market of 394.38 billion in 2023. The remarket in France is benefitting due to supportive government for startups and raising public and private funding. Well-established channels of factoring services are offering alternative financial aid for new entrants, such as startup entrepreneurs and SMEs, by providing buying options to clear pending invoices. Thus, funding through simplified methods of factoring services is driving the growth of the segment in the European Market.

Germany Factoring Services Market Trends

Germany is expected to register the highest CAGR of 9.5% during the forecast period. In recent years, Germany has seen a surge in demand for factoring services, driven by the country's thriving startup culture and the export business of its established automotive and transport companies. Factoring services have become increasingly popular for these businesses, as they allow for a more flexible approach to cash flow management and provide access to fast and reliable funding. This trend has led to exceptional growth in the factoring market in Germany and Europe as a whole. As a result, factoring has become a key financing solution for many large and small businesses across the region.

Key Europe Factoring Services Company Insights

Some of the major companies in the Europe factoring services market include Deutsche Factoring Bank, BNP Paribas, Hitachi Capital (UK) PLC, Eurobank, Barclays Bank PLC, and Kuke Finance. To increase their market shares and engage with existing and new clients, these players are focusing on strategic partnerships and mergers & acquisitions. In addition, they are aggressively investing in advanced technologies like distributed ledger and blockchain activities to gain a competitive edge.

Key Europe Factoring Services Companies:

- Aldermore

- Barclays Bank PLC

- Bibby Financial Services

- BNP Paribas

- Deutsche Factoring Bank

- Eurobank

- Novuna.co.uk (Hitachi Capital (UK) PLC & Mitsubishi Hc Capital UK Plc)

- HSBC Group

- Kuke Finance

- Mizuho Financial Group, Inc.

- Skipton Business Finance

- Société Générale S.A.

Recent Developments

-

In February 2024, Barclays Bank UK PLC is set to acquire Tesco's retail banking business and form an exclusive, long-term partnership to provide Tesco-branded credit cards, personal loans, and deposits.

-

In January 2024, Aldermore announced its new agriculture finance division aimed to assist the farming industry to get the assets it needs to grow and diversify. In addition to leveraging our existing expertise, we will offer a refreshed customer experience backed by an experienced team.

-

In December 2023, EIB Group and BNP Paribas have recently signed a new securitization transaction to support France's small and mid-cap companies. The structure of this transaction has been designed to achieve the best possible risk-weighted asset relief over the next five years. This will increase lending ability to support financing for the real economy further.

-

In February 2022, Hitachi Capital (UK) PLC has rebranded to Novuna. Novuna is a trading style of Mitsubishi HC Capital UK PLC, a financial services company with millions of customers across the UK. The Novuna brand was established by Hitachi Capital (UK) PLC to deal with the recently established business, Mitsubishi HC Capital UK PLC.

Europe Factoring Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2,255.51 billion

Factoring volume forecast in 2030

USD 3,611.54 billion

Growth Rate

CAGR of 8.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Factoring volume in USD billion and CAGR from 2024 to 2030

Report coverage

Factoring volume forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Category, type, financial institutions, end-use, country

Country scope

UK; Germany; France; Italy; Spain

Key companies profiled

Aldermore; Barclays Bank PLC; Bibby Financial Services; BNP Paribas; Deutsche Factoring Bank; Eurobank; Novuna.co.uk (Hitachi Capital (UK) PLC & Mitsubishi Hc Capital UK Plc); HSBC Group; Kuke Finance; Mizuho Financial Group, Inc.; Skipton Business Finance; Société Générale S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Factoring Services Market Report Segmentation

This report forecasts factoring volume growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe factoring services market report based on category, type, financial institutions, end-use, and country.

-

Category Outlook (Factoring volume, USD Billion, 2018 - 2030)

-

Domestic

-

International

-

-

Type Outlook (Factoring volume, USD Billion, 2018 - 2030)

-

Recourse

-

Non-Recourse

-

-

Financial Institutions Outlook (Factoring volume, USD Billion, 2018 - 2030)

-

Banks

-

Non-Banking Financial Institutions

-

-

End-use Outlook (Factoring volume, USD Billion, 2018 - 2030)

-

Manufacturing

-

Transport & Logistics

-

Information Technology

-

Healthcare

-

Construction

-

Others

-

-

Country Outlook (Factoring volume, USD Billion, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Frequently Asked Questions About This Report

b. The Europe factoring services market size was estimated at USD 2,137.35 billion in 2023 and is expected to reach USD 2255.51 billion in 2024.

b. The Manufacturing segment accounted for the largest revenue share of 30.0% in 2023. In Europe, many SMEs functioning in the manufacturing sector use factoring services to convert their bills receivable to cover their operating expenses.

b. Fintech is advancing in all businesses, and the rise of cryptocurrency and blockchain technology is expected to drive the European factoring services market. Due to technological advancements in the finance world, many small-scale European companies are now opting for non-banking financial institutions to maintain cash flow in their day-to-day business operations.

b. Some key players operating in the the Europe factoring services market include Aldermore; Barclays Bank PLC; Bibby Financial Services; BNP Paribas; Deutsche Factoring Bank; Eurobank; Novuna.co.uk (Hitachi Capital (UK) PLC & Mitsubishi Hc Capital UK Plc); HSBC Group; Kuke Finance; Mizuho Financial Group, Inc.; Skipton Business Finance; Société Générale S.A.

b. The Europe factoring services market is expected to grow at a compound annual growth rate of 8.2% from 2024 to 2030 to reach USD 3,611.54 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."