- Home

- »

- Next Generation Technologies

- »

-

Factoring Services Market Size, Share, Industry Report, 2033GVR Report cover

![Factoring Services Market Size, Share & Trends Report]()

Factoring Services Market (2026 - 2033) Size, Share & Trends Analysis Report By Category (Domestic, International), By Type (Recourse, Non-recourse), By Financial Institution (Bank, Non Banking Financial Institutions), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-178-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Factoring Services Market Summary

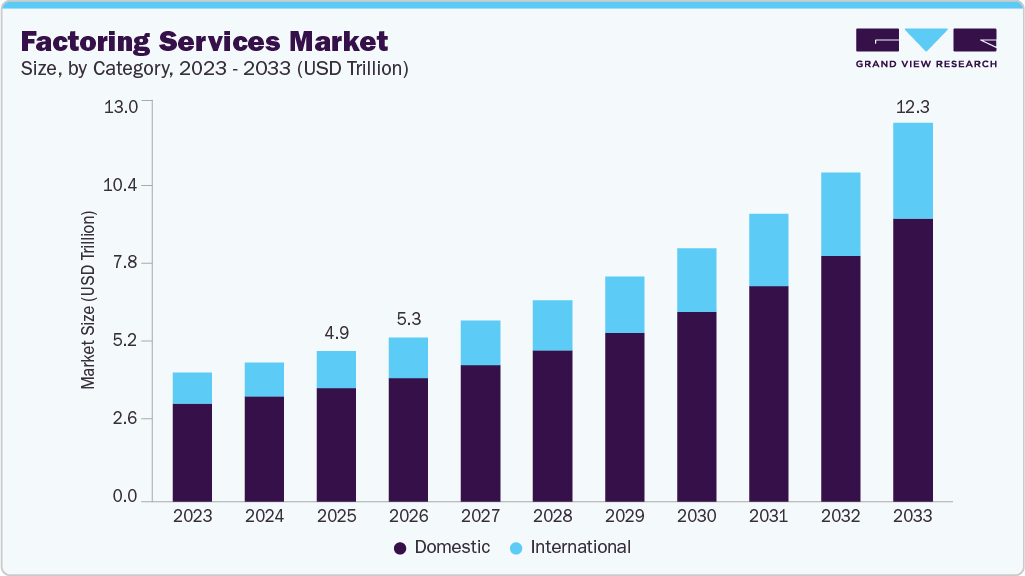

The global factoring services market size was estimated at USD 4,872.37 billion in 2025 and is projected to reach USD 12,254.74 billion by 2033, growing at a CAGR of 12.7% from 2026 to 2033. The market has been experiencing steady growth in recent years, owing to the increasing demand for alternative financing options among small and medium enterprises.

Key Market Trends & Insights

- Europe factoring services industry dominated the global market with a revenue share of 63.0% in 2025.

- The domestic segment dominated the market in 2025 and accounted for the largest share of 75.5%.

- The recourse segment held the largest market share in 2025.

- The banks segment held the largest market share in 2025.

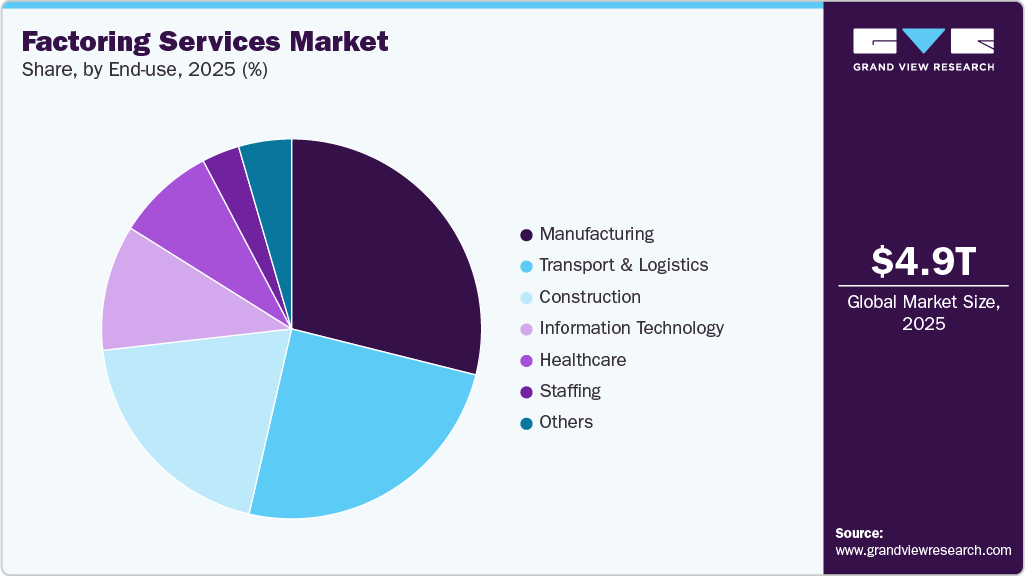

- The manufacturing segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 4,872.37 Billion

- 2033 Projected Market Size: USD 12,254.74 Billion

- CAGR (2026-2033): 12.7%

- Europe: Largest market in 2025

- Asia Pacific: Fastest growing market

The rising use of innovative technologies, such as Artificial Intelligence (AI) and machine learning, is anticipated to enhance fraud risk identification, streamline underwriting processes, deliver operational savings, and simplify payment applications. Fintech companies and banks have embraced these technologies to develop innovative products and maintain competitiveness in the market. The high precision of these tools and the resultant reduction in human underwriting are likely to enable significant outsourcing of decision-making capabilities within the market. Furthermore, the implementation of automation solutions has allowed financial institutions to significantly enhance their operational processes, particularly in accounts receivable. These solutions can integrate with various technologies such as automation, AI, and machine learning throughout the credit cycle, enabling institutions to manage financial operations more effectively.The increasing demand for quick and hassle-free financing sources among Micro, Small, and Medium Enterprises (MSMEs) is driving market growth. SMEs often struggle to access traditional bank loans due to limited collateral and short credit histories. Factoring allows them to unlock cash tied up in receivables without taking on new debt. As supply chains become more fragmented and payment cycles lengthen, especially in manufacturing, logistics, and trade, more SMEs are turning to factoring to maintain liquidity, fund operations, and support growth.

Many governments and financial regulators are promoting alternative financing to improve SME access to credit. Policies supporting invoice financing, digital lending frameworks, and trade finance reforms are making factoring more acceptable and transparent. In several regions, legal recognition of receivables as financial assets and improved enforcement of payment obligations are encouraging both factors and businesses to adopt factoring. This regulatory and institutional support is creating a more secure environment for factoring growth and attracting new players into the market.

Factoring services offer distinct advantages to businesses, such as risk mitigation, immediate cash flow, and flexibility. However, alternative financing options like bank loans and lines of credit pose a moderate threat to the factoring industry. Technological advancements and new financial products are making these alternatives more attractive and accessible. To stay competitive, factoring companies must continually innovate and emphasize their unique benefits. As businesses seek the best financial solutions tailored to their needs, factoring companies need to adapt to the evolving financial landscape to maintain their edge.

Category Insights

The domestic segment dominated the market in 2025 and accounted for the largest share of 75.5%. Domestic factoring services play a critical role in the financial ecosystem by providing local businesses with a mechanism to convert their accounts receivables into immediate cash. The rising trend of credit purchases, coupled with the increasing significance of electronic invoices, has contributed to the consolidation of the domestic factoring market. One significant driver of the domestic factoring service is the increasing need for liquidity among small- and medium-sized enterprises (SMEs) facing cash flow challenges due to delayed payments from their clients.

The international segment is expected to grow at the fastest CAGR over the forecast period. International factoring is a financing method that empowers business owners to extend open credit terms to foreign buyers, including those they might typically be reluctant to engage with without a traditional deposit. This service is particularly valuable as it mitigates the complexities and risks associated with international trade. International factoring services ease the burden of negotiating and managing international transactions. By funding invoices upfront and presuming the associated risks, businesses can confidently expand their foreign sales and enhance their balance sheets. This type of factoring significantly broadens the scope of potential suppliers globally, opening numerous opportunities and making businesses more attractive to international partners.

Type Insights

The recourse segment held the largest market share in 2025. Recourse factoring services are financial solutions that allow businesses to sell their accounts receivable to a factoring company under the condition that the business will repurchase any receivables that remain unpaid after a specified period. This type of factoring ensures that the factoring company bears less risk, as the business retains the ultimate responsibility for bad debts. As a result, recourse factoring generally offers lower fees and higher advances compared to non-recourse factoring, making it an attractive option for businesses looking to improve their cash flow while still maintaining some level of credit risk management. It is particularly beneficial for companies with reliable customers and a decent credit history.

The non-recourse segment is expected to grow at the fastest CAGR of 13.0% during the forecast period. In this type of factoring service, the financing company assumes the risks associated with unpaid invoices, protecting bad debts. This approach is gaining traction in both developed and developing countries. Non-recourse factoring is especially advantageous for businesses with a large customer base, as it allows them to offload their accounts receivable and clean up their balance sheets. By advancing funds against accounts receivable, non-recourse factoring offers immediate access to working capital. This cash infusion enables businesses to meet financial obligations such as wages, operating expenses, and expansion initiatives without waiting for client payments.

Financial Institution Insights

The banks segment held the largest market share in 2025. Banks such as Southern Bank Company, Mizuho Financial Group, Inc., and Deutsche Factoring Bank offer factoring services to help customers meet immediate cash flow requirements, such as payment of inventories, managing operational expenses, and investments in growth and expansion. Factoring services involve banks purchasing accounts receivable from businesses at a discount, allowing these businesses to access immediate funds instead of waiting for customer payments. This improves cash flow and enhances working capital management.

The non-banking financial institutions segment is expected to grow at the fastest CAGR from 2026 to 2033. Non-banking financial institutions (NBFIs) offer financial services without holding a full banking license. NBFIs provide customization and flexibility in factoring arrangements, unlike traditional banks. They can tailor factoring solutions to meet the specific needs and preferences of staffing agencies. This flexibility includes adjusting terms, pricing structures, advance rates, and service levels, allowing customers to select the arrangements that best match their business requirements.

End Use Insights

The manufacturing segment held the largest market share in 2025. Manufacturing companies leverage factoring services to convert their receivables into immediate cash to cover operating expenses. Instead of opting for loans with higher interest rates, these companies prefer invoice factoring due to its instant cash payments and the minimal documentation required. This makes invoice factoring an attractive option for companies looking for quick cash that may not qualify for traditional or series funding. Manufacturing companies can secure the necessary operating capital, maintain cash flow stability, and optimize their manufacturing processes by employing factoring services.

The healthcare segment is projected to grow at the fastest CAGR during the forecast period. Factoring services have become increasingly essential for the healthcare industry, primarily due to outdated payment and billing systems. These systems often lead to extended delays in receiving payments, which can significantly disrupt cash flow. The complex processes of insurance and bureaucracy further exacerbate the problem, resulting in outstanding medical bills remaining unpaid for weeks or months. By utilizing healthcare factoring services, hospitals and healthcare centers can access immediate cash to optimize their inventory of critical medical supplies such as surgical instruments, operating theater supplies, and pharmaceuticals.

Regional Insights

Europe Factoring Services Market Trends

Europe factoring services industry dominated the global market and accounted for a share of 63.0% in 2025. The demand for factoring services is growing in Europe owing to the presence of a large industrial base that includes automobiles, manufacturing, energy, agriculture, and food processing. The recent events, including the Russia-Ukraine war and economic slowdown, have largely affected the small traders in the market. Thus, the need for factoring services is growing significantly in the region to meet their short-term financial needs and maintain liquidity in the business.

UK factoring services industry is expected to grow at a moderate CAGR from 2026 to 2033. The growth of the UK market is primarily driven by an increased demand for alternative financing options among Micro, Small, and Medium Enterprises (MSMEs). Finance companies are offering adaptable factoring services to support freelancers and SMEs in alleviating the financial strains due to late payments. Moreover, there's a growing trend towards integrating cloud-based and Artificial Intelligence (AI) technologies to enhance the efficiency of these services.

The factoring services industry in Germany is expected to grow at a notable CAGR from 2026 to 2033. Germany possesses one of Europe's largest and most resilient economies, marked by robust industrial sectors, technological advancements, and a highly skilled workforce. This economic strength drives demand for temporary funding solutions across diverse industries, fostering business expansion and growth.

The France factoring services industry held a substantial market share in 2025. France has a thriving small- and medium-sized enterprise (SME) sector, which forms the backbone of its economy. SMEs often turn to factoring service providers to meet their liquidity needs, particularly for short-term projects or to cover seasonal fluctuations in demand and supply. This reliance on a temporary funding option fuels the demand for recourse factoring services, as agencies require financial support to manage their operations and meet the capital requirements.

Asia Pacific Factoring Services Market Trends

Asia Pacific factoring services industry is expected to grow at the fastest CAGR from 2026 to 2033. The Asia Pacific region boasts several emerging markets distinguished by dynamic business environments and thriving entrepreneurial ecosystems. Countries like China, India, and various Southeast Asian nations are experiencing rapid industrialization driven by technological advancements and elevating startup trends. In these vibrant settings, factoring services are crucial in fulfilling the flexible financing needs of growing businesses.

The China factoring services industry held a substantial market share in 2025. The increasing demand for flexible and rapid financial services in China, alongside rapid industrialization and significant advancements in the banking sector, is fueling the growth of factoring services in the region. Technological progress, especially in online platforms, digital payments, and automation, is reshaping the factoring services industry in China.

India factoring services industry is expected to grow at the fastest CAGR from 2026 to 2033. Public and government initiatives like Make in India, Startup India, and Digital India are driving entrepreneurship and supporting the growth of Small and Medium-Sized Enterprises (SMEs) in India. Make in India aims to boost domestic manufacturing, Startup India encourages the launch of new ventures, and Digital India focuses on developing digital infrastructure. These initiatives create a supportive ecosystem for business growth, increasing the demand for factoring services to meet the financing needs of emerging enterprises.

Japan factoring services industry is expected to grow at a CAGR of 15.2% from 2026 to 2033. The increasing use of digital platforms, automation, and Artificial Intelligence (AI) in factoring services has significantly improved efficiency, transparency, and accessibility. These technological advancements appeal to businesses seeking contemporary financing solutions and contribute to market expansion. The incorporation of IoT and AI technologies is crucial in assessing loan risks and enhancing the underwriting processes of financial companies, further propelling market growth.

North America Factoring Services Market Trends

The North America factoring services industry is expected to grow at a moderate CAGR during the forecast period. Factoring companies in North America, including Porter Capital, REV Capital, and RTS Financial Service, Inc., are concentrating on offering factoring services tailored to niche markets such as transportation, staffing, and advertising. This specialization enables these companies to better understand the unique needs and challenges of their clients, allowing them to provide customized financing solutions and value-added services.

U.S. Factoring Services Market Trends

The U.S. factoring services industry held a substantial market share in 2025. This is owing to the proliferation of open trade accounts and advancements in factoring services in the country. In addition, many industrial companies are shifting their focus toward alternative funding sources to meet their working capital needs, pay short-term liabilities, and support seasonal fluctuations in businesses.

Key Factoring Services Company Insights

Some of the key companies in the factoring services industry include BNP Paribas Fortis; altLINE (The Southern Bank Company); and Triumph Financial, Inc. among others.

-

BNP Paribas Fortis by leveraging its extensive network and robust financial infrastructure, the company offers comprehensive factoring solutions tailored to various industries, ensuring liquidity and improving businesses' cash flow. Renowned for its service excellence, BNP Paribas Fortis provides high advance rates and competitive discount rates, making it a preferred partner for businesses seeking to optimize working capital and manage receivables effectively.

-

altLINE (The Southern Bank Company) to improve the company’s brand visibility and reputation altLINE partners with commercial bankers, accountants, business advisors, and other intermediaries and offers its lending capabilities. By enhancing its presence through targeted marketing efforts, altLINE aims to solidify its market position and become the go-to choice for businesses seeking factoring financing services.

Key Factoring Services Companies:

The following key companies have been profiled for this study on the factoring services market.

- altLINE (The Southern Bank Company)

- BNP Paribas

- China Construction Bank Corporation

- Deutsche Factoring Bank

- Eurobank

- Factor Funding Co.

- HSBC Group

- ICBC China

- Kuke Finance

- Mizuho Financial Group, Inc.

Recent Developments

- In July 2025, RXO and Triumph strengthened their collaboration by launching RXO Extra, Factoring, a new financial solution for carriers. The service combines Factoring as a Service with LoadPay, Triumph’s digital banking platform, to provide fast and dependable payments. Carriers can receive same-day payment on approved invoices, 24/7, and the service is available even to those who do not currently work with RXO.

Factoring Services Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 5,315.76 billion

Revenue forecast in 2033

USD 12,254.74 billion

Growth rate

CAGR of 12.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Category, type, financial institution, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; Saudi Arabia; UAE; South Africa.

Key companies profiled

altLINE (The Southern Bank Company); BNP Paribas; China Construction Bank Corporation; Deutsche Factoring Bank; Eurobank; Factor Funding Co.; HSBC Group; ICBC China; Kuke Finance; Mizuho Financial Group, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Factoring Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global factoring services market report based on category, type, financial institution, end use, and region.

-

Category Outlook (Revenue, USD Billion, 2021 - 2033)

-

Domestic

-

International

-

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Recourse

-

Non-recourse

-

-

Financial Institution Outlook (Revenue, USD Billion, 2021 - 2033)

-

Banks

-

Non-banking Financial Institutions

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Manufacturing

-

Transport & Logistics

-

Information Technology

-

Healthcare

-

Construction

-

Staffing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global factoring services market size was estimated at USD 4,872.37 billion in 2025 and is expected to reach USD 5,315.76 billion in 2026.

b. Significant growth in the Banking, Financial Services, and Insurance (BFSI) industry is a key driver positively impacting market expansion. Moreover, the increasing demand for quick and hassle-free financing sources among Micro, Small, and Medium Enterprises (MSMEs) is driving market growth. Factoring services help businesses secure working capital loans and mitigate credit risks.

b. The global factoring services market is expected to witness a compound annual growth rate of 12.7% from 2026 to 2033 to reach USD 12,254.74 billion by 2033.

b. The banks segment held the largest market in 2025. Banks such as Southern Bank Company, Mizuho Financial Group, Inc., and Deutsche Factoring Bank offer factoring services to help customers meet immediate cash flow requirements, such as payment of inventories, managing operational expenses, and investments in growth and expansion.

b. Some key players operating in the market includes altLINE (The Southern Bank Company), BNP Paribas, China Construction Bank Corporation, Deutsche Factoring Bank, Eurobank, Factor Funding Co., HSBC Group, ICBC China, Kuke Finance, and Mizuho Financial Group, Inc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.