- Home

- »

- Consumer F&B

- »

-

Europe Seasoning Market Size, Share, Growth Report 2030GVR Report cover

![Europe Seasoning Market Size, Share & Trends Report]()

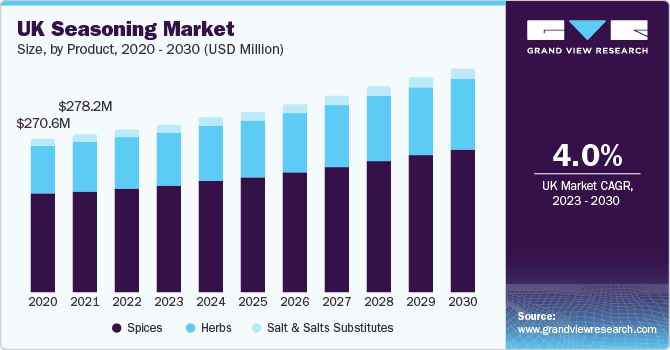

Europe Seasoning Market Size, Share & Trends Analysis Report By Product (Spices, Herbs, Salt & Salts Substitutes), By End-use (Retail, Foodservice), By Brand (National Brand, Private Label Brand), By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-136-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Europe Seasoning Market Size & Trends

The Europe seasoning market size was estimated at USD 1.62 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.0% from 2023 to 2030. Consumers are seeking diverse and convenient flavor options, including healthier and natural choices. Busy lifestyles have boosted the demand for time-saving, premade seasonings. Factors such as the increasing influence of international cuisines, the rising food service industry, and a preference for premium and sustainable foods are also driving the demand for seasonings in Europe. There has been an increase in the demand for spices such as dried peppers, turmeric, cinnamon, ginger, dried garlic, and Echinacea, benefiting the seasonings market.

Increasing buyers are willing to pay for premium fresh flavors and the growing preference for various ethnic cuisines has been driving the demand for various seasonings and spices across Europe. Eastern Mediterranean, North African, Eastern and Southeast Asian, and Indian cuisines are among the top influencers for trending ingredients in the European seasoning market. The growing preference for spiciness and authenticity leads to the demand for more regional-specific seasoning that adds layers of flavor to traditional dishes from other parts of the world. The desire to navigate new taste territories is inspiring innovative seasoning blends that mix and match lesser-known ingredients.

There has been a robust demand for sustainable herbs and spices. The market for sustainably produced herbs and spices in Europe was very low, however, it is now growing rapidly. Retailers like Lidl have been offering sustainable options for food waste-conscious consumers. For instance, in October 2022, Lidl launched a new smashed avocado range available in two flavors: ‘Smashed Avocado with Lime’ and ‘Smashed Avocado with Chilli’. The range is made from avocados that were unable to be sold whole, thus making these products a perfect option for food waste-conscious consumers. Produced in the UK, the ‘Meadow Fresh Smashed Avocado’ dips can be a toast topper, dolloped in fajitas, or served as a salad side.

In the coming years, the market is expected to witness impressive growth in organic herbs and spices, with the fast‑growing organic food trend. In Germany, for instance, the organic food market grew by more than 20% in 2021. Another prominent factor is the growing attention to the medicinal properties of spices, especially those with organic certification. Western and northern European countries, led by Germany and Switzerland, are expected to witness robust growth.

The rising demand for ready-to-use spice mixes for specific recipes has been rapidly growing, creating convenient options for consumers trying hands-on cooking. This is expected to open new avenues for the market. In addition, significant demand for seasoning and spices has been witnessed from the household sector, not only due to their taste and flavor but also their associated health benefits.

Local cuisines have been achieving international recognition owing to which light seasoning and natural flavors of their cuisines have been gaining popularity. Owing to the COVID-19 pandemic, consumers do not dine away from home frequently anymore. They hence crave big, bold flavors and spices reminiscent of restaurant-quality food. Thus, an increasing number of consumers have been experimenting with cooking ethnic cuisines such as American, Mexican, Thai, Greek, Indian, Japanese, Spanish, French, Chinese, and Italian at home.

These cuisines require numerous ingredients specific to the local taste of their origin. Adventurous consumers, especially millennials, are constantly seeking out foods and flavors from around the world. Consumers have been gravitating toward exotic dishes from countries that border the Mediterranean, such as Morocco, Israel, and Lebanon. Ethnic spice blends from this region and other parts of Europe have been gaining popularity, and spice mixes inspired by these regions are being created and launched by retail brands.

Product Insights

The spices segment dominated the market with a revenue share of 64.3% in 2022.Owing to diverse flavor profiles, which are essential for enhancing and distinguishing a wide range of European cuisines. The continent's rich culinary heritage, globalization, and the desire for unique and exotic tastes have led to a continued demand for spices. In addition, spices often carry cultural and traditional significance, and some are associated with health benefits.

Spices are versatile ingredients that can be used in a wide range of dishes, from savory to sweet. This versatility makes them a preferred choice for home cooks and professional chefs alike. Some spices are believed to have health benefits due to their antioxidant and anti-inflammatory properties. Consumers are increasingly interested in incorporating these spices into their diets. For instance, turmeric and cinnamon have gained popularity for their potential health advantages.

The salt & salt substitutes are projected to register a CAGR of 6.8% over the forecast period due to escalating health awareness and the desire to reduce sodium intake. Consumers are increasingly seeking low-sodium and salt substitute options as they become more health-conscious, driven by concerns related to hypertension and heart diseases. Government initiatives, innovative product development, and improved labeling regulations have also contributed to this trend. Salt substitutes, which offer flavor without the health drawbacks of excessive salt consumption, are gaining popularity among those with dietary restrictions and individuals looking to make healthier food choices.

End-use Insights

Based on end-use, retail dominated the market with a revenue share of 77.4% in 2022, due to widespread presence, convenience, and accessibility to consumers. Retail channels, such as supermarkets, hypermarkets, and online platforms, offer a wide range of seasonings and cater to the diverse needs of home cooks. Consumers often prefer the convenience of purchasing seasonings for home use during their regular shopping trips, contributing to the dominance of the retail segment in the market. Retail distribution channels, offering a wide array of seasoning options, have made it easier for consumers to access and select products that align with their culinary preferences and dietary restrictions. Moreover, the cultural shift towards home cooking as a lifestyle choice has solidified the dominance of retail seasonings as consumers seek to elevate their home-cooked meals with high-quality flavor enhancers.

The food service segment is projected to register a CAGR of 7.7% over the forecast period. Several food service outlets have been increasingly using herbs and spices owing to the constantly evolving food and beverage trends in Europe and changing taste preferences that are deeply influenced by the COVID-19 pandemic. As per a study published by EIT Food on ‘European Food Behaviors’, herbs & spice use increased during the COVID-19 pandemic but not as much as chocolate & sweets (28% more vs 13% less) and crisps & snacks (28% more vs 16% less).

Inspired by Asian and Mediterranean cuisines, food service outlets across Europe are now seeking brands that offer exotic seasonings. Food service outlets are also experimenting with different flavors and culinary techniques that inspire customized ingredient creations. As a result, the demand for and use of spices and seasonings is significant in the non-home-use segment.

Brand Insights

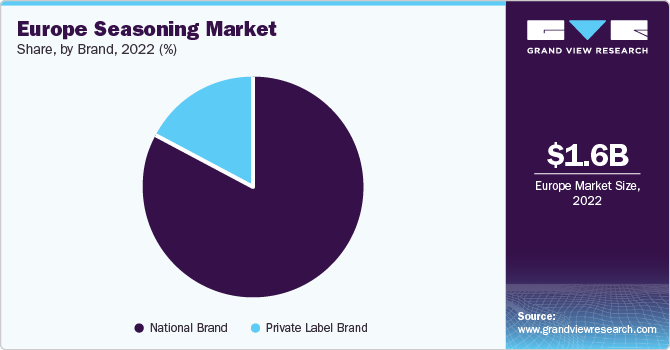

The national brands segment dominated with a revenue share of 82.5% in 2022. These brands often have a long-standing presence and heritage in the market, which builds trust and loyalty among consumers. National brands also tend to invest significantly in marketing and advertising, which helps in brand recognition and consumer awareness. Moreover, national brands often have access to a wider distribution network, ensuring that their products are readily available across various retail outlets.

Consumers may perceive national brands as offering higher quality and consistency, which can be a key driver in their preference. Increasing consumer inclination towards local spices and seasonings has driven the growth of national brands across the region as instead of buying from international companies or paying extra import duty, consumers prefer buying from domestic players. Players including European Spice Services; AKO GmbH; Key Ingredients Europe; Bart; Food. be; and European Spice Services nv are key leaders who offer spices and herbs from quality suppliers across Europe.

Along with local spices, several players including Bart, based in the UK, also sell authentic and traditional Indian spices and aromatic Thai seasonings and blends owing to changing taste preferences and the growing consumption of Indian foods across the UK. The private label brands are expected to exhibit the fastest CAGR of 8.0% from 2023 to 2030. Consumers are now opting for private label and international brands as they offer spices and seasonings in different and exotic taste profiles.

Private label manufacturers across the globe are expanding their range with sustainable, new, or better-quality herbs and spices across Europe. For instance, Euroma, a spice manufacturer in the Netherlands, works together with food producers throughout Europe on innovative food concepts including complex seasoning, or ready-to-use consumer products. Market players are also offering high-quality green herbs in freeze-dried forms.

Such initiatives and processes ensure that the flavor, aroma, color, and structure of spices are preserved perfectly, thus augmenting their shelf life. Moreover, if these spices or seasonings are added to boiling liquids, oil, and vinegar, the freeze-dried herbs return to their original condition. Such innovative offerings in seasonings by private label brands have increased the convenience of cooking at home, which is increasing the segment growth.

Country Insights

Germany seasonings market held the largest revenue share in Europe, accounting for around 18.7% in 2022. Germany is one of the leading spice-importing countries in Europe, with nearly 80% of these imports coming in from developing countries. Germany has a rich culinary tradition with a diverse range of dishes that incorporate various seasonings. The demand for spices and seasonings is deeply rooted in German cuisine. Spices and herbs have several health benefits, such as controlling diabetes, high blood pressure, and cholesterol. This is expected to drive the uptake of seasonings in the country. A growing aging population in Germany, along with increasing health consciousness among consumers, is also fueling the demand for seasonings.

The Italy seasonings market is anticipated to become the fastest-growing region with a CAGR of 10.2% in the coming years. Italy's renowned culinary heritage and its diverse use of herbs and spices are highly influential. Italian cuisine, famous worldwide, relies on a wide range of seasonings, from basil to garlic, which drives demand for Italian seasonings. In addition, the export of Italian cuisine, the growing health-consciousness trend, the association of Italian seasonings with premium quality, cultural influence across Europe, and ongoing innovation in the industry contribute to the increasing demand.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Brand market share analysis indicates that key market players are focusing on strategies such as new product launches, partnerships, mergers & acquisitions, global expansions, and others. Some of the initiatives include:

-

In June 2022, McCormick & Company, Incorporated a global leader in flavor, signed an agreement to purchase 100% of the shares of Kamis, a privately held company based in Poland with distribution into Russia and other parts of Central and Eastern Europe.

-

In February 2021, Short-Horn Super Seasonings launched its first-ever insect and cricket-based seasoning range. The product is said to contain no taste, sight, or smell of crickets, is high in protein, vitamin B12, iron, potassium, omega-3, and fiber, and contains all nine essential amino acids.

Some prominent players operating in the Europe seasoning market include:

-

Döhler GmbH

-

Olam International

-

Unilever

-

Sensient Technologies Corporation

-

Kerry Group plc.

-

Prymat Group

-

Nedspice Group

-

Solina

-

Euroma

-

Schwartz

-

British Pepper & Spice

Europe Seasoning Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.71 billion

Revenue forecast in 2030

USD 2.61 billion

Growth rate

CAGR of 6.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, volume in metric tons, and CAGR from 2023 to 2030

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, brand, country

Regional scope

Europe

Country scope

UK; Germany; France; Italy; Spain; Poland; Belgium; Netherlands

Key companies profiled

Döhler GmbH; Olam International; Unilever; Sensient Technologies Corporation; Kerry Group plc.; Prymat Group; Nedspice Group; Solina; Euroma; Schwartz; British Pepper & Spice

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Seasoning Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Europe seasoning market report based on product, end-use, brands, and country:

-

Product Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

Spices

-

Pepper

-

Ginger

-

Cinnamon

-

Cumin

-

Turmeric

-

Coriander

-

Cardamom

-

Cloves

-

Others

-

-

Herbs

-

Garlic

-

Oregano

-

Mint

-

Parsley

-

Rosemary

-

Fennel

-

Others

-

-

Salt & Salts Substitutes

-

-

End-use Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

Retail

-

Foodservice

-

-

Brand Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

National Brand

-

Private Label Brand

-

-

Country Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Poland

-

Belgium

-

Netherland

-

Frequently Asked Questions About This Report

b. Consumers are seeking diverse and convenient flavor options, including healthier and natural choices. Busy lifestyles have boosted demand for time-saving, pre-made seasonings. Factors such as increasing influence of international cuisines, the rising foodservice industry, and a preference for premium and sustainable are also driving the demand for seasonings in Europe. There has been an increase in the demand for spices such as dried peppers, turmeric, cinnamon, ginger, dried garlic, and Echinacea, benefiting the seasonings market.

b. The Europe seasoning market is expected to grow at a compound annual growth rate of 6.0% from 2023 to 2030 to reach USD 2.61 billion by 2030.

b. Germany seasonings market held the largest revenue share in Europe accounting for around 18.7% in 2022, due to its rich culinary tradition, large population, emphasis on food quality, and strategic location for exports. The country's diverse food culture, strong economy, and innovation further contribute to its dominance in the European seasonings market.

b. Italy seasonings market is anticipated to become the fastest growing region with a CAGR of 10.2% in the Europe market owing to the export of Italian cuisine, the growing health-consciousness trend, the association of Italian seasonings with premium quality, cultural influence across Europe, and ongoing innovation in the industry contribute to the increasing demand.

b. Some of the key market players in the Europe seasonings market are Döhler GmbH; Olam International; Unilever; Sensient Technologies Corporation; Kerry Group plc.; Prymat Group; Nedspice Group; Solina; Euroma; Schwartz; British Pepper & Spice, among others.

b. The Europe seasoning market size was estimated at USD 1.62 billion in 2022 and is expected to reach USD 1.71 billion in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."