- Home

- »

- Pharmaceuticals

- »

-

Excipients Market Size, Share & Trends Analysis Report 2030GVR Report cover

![Excipients Market Size, Share & Trends Report]()

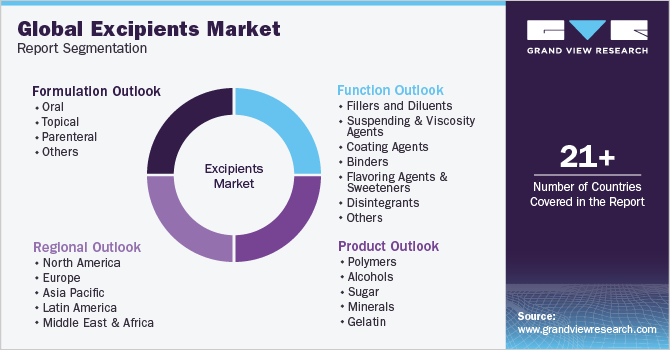

Excipients Market (2024 - 2030) Size, Share & Trends Analysis By Product (Polymers, Alcohols, Sugars, Minerals, Gelatin), By Formulation (Oral, Topical), By Function (Binders, Coating Agents), By Region, And Segment Forecasts

- Report ID: 978-1-68038-117-7

- Number of Report Pages: 104

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Excipients Market Summary

The global excipients market size was estimated at USD 9.8 billion in 2023 and is projected to reach USD 13.05 billion by 2030, growing at a CAGR of 4.1% from 2024 to 2030. Increasing usage of generic medicines and rising demand for multifunctional excipients are expected to be key factors driving revenue growth.

Key Market Trends & Insights

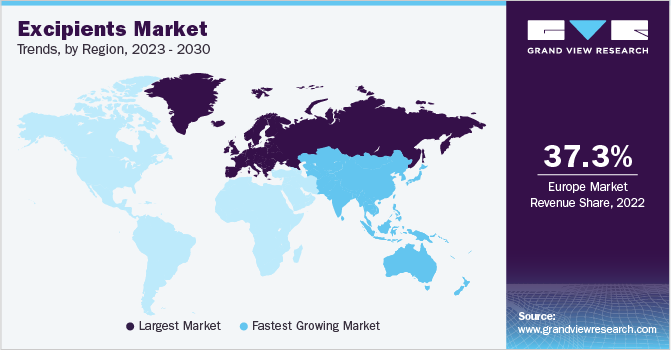

- Europe held the largest share of 37.26% of the market in 2022.

- By product, polymers segment accounted for over 45.69% of the total revenue in 2022.

- By function, binders segment held the largest share of 12.98% of the market in 2022.

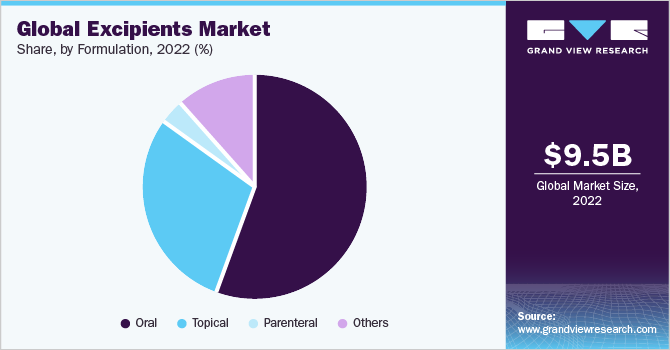

- By formulation, oral formulation segment held the largest share of 55.49% of the market in 2022.

Market Size & Forecast

- 2023 Market Size: USD 9.8 Billion

- 2030 Projected Market Size: USD 13.05 Billion

- CAGR (2024-2030): 4.1%

- Europe: Largest market in 2022

Excipients have been recognized to provide better functionality and competitive advantage in drug formulations and this has contributed to their increased usage by pharmaceutical firms in recent years. Ongoing research on and discovery of ideal or near ideal substances that can be used in drug formulations and delivery has given the market a definite boost. Another factor contributing to global growth is that most pharmaceutical firms have been developing more sophisticated excipients with an enhanced role in drug delivery.

In the midst of the COVID-19 pandemic, the excipients organizations confronted huge difficulties, like a low inventory of clinical items. The excipients organizations are likewise among the ventures that the COVID-19 pandemic has straightforwardly affected. Faults in the worldwide supply chain, for example, an effect on the obtaining, procurement, and distribution of drug products, remained significant. Besides, there were numerous initiatives taken by key market players during the pandemic. For example, in November 2020, Croda International Plc went into an arrangement with Pfizer Inc to supply added substances for assembling its COVID-19 vaccine, sending the portions of the United Kingdom-based specialty chemical organization to a record high. The agreement with Pfizer runs for a considerable length of time and grants Croda an underlying stock agreement for four-part excipients utilized in the creation of the vaccine for the initial three years of the agreement. Such associations would give positive development in the impending future.

There is a rising demand for novel substances that support nanoparticle drug delivery for oncological medications to provide better stability and adoption of medicines. This is also likely to propel the market growth. Patent expiry of blockbuster drugs is also expected to boost the market at a significant pace. Currently, companies are working on optimization of excipients in drug formulations and delivery. They are also engaged in the development of such formulations. These factors are expected to have a major impact on the development and marketing of these products in future.

Product Insights

Polymers, comprising microcrystalline cellulose and pregelatinized starch, emerged as the leading product category in terms of both revenue and volume. It accounted for over 45.69% of the total revenue in 2022 and almost 40% of the overall volume used in pharmaceutical formulations. Rising usage in various dosage forms such as suspensions, capsules, and tablets is anticipated to be a key driving factor for this segment in the forecast years.

Polymers can have multiple functions in drug development, which has attributed to its high usage in pharmaceutical R&D. They offer strength and improved shelf life compared to other types of excipients used in pharmaceutical preparations. Polymers offer ideal formulation features for controlled/sustained release and help deliver drugs to specific target sites.

Alcohols have emerged as the fastest product segment in 2022 as they are used widely in pharmaceuticals as an active ingredient for the preparation of oral, parenteral, and topical along with inhalation drugs. Alcohols are also used as a replacement for stabilizers and preservatives futher driving the segment growth over the forecast period.

Function Insights

Binders held the largest share of 12.98% of the market in 2022 attributed to their use in formulation to impart flexibility or strengthen the bonding between particles. Binders help improve the gripping of substances in tablets and granules, which is crucial. They make sure the formulations are produced with the necessary physical strength and quantity. Depending on the chemicals in the formulation and the method used to prepare the dosage form, binders are either utilized in a solution or a dry state.

Coating agents are projected to grow at a lucrative rate attributable to their increasing usage for enhancing targeted drug delivery and bioavailability. improve their appearance, stability, taste, and ease of swallowing. They are an important component of the drug formulation process, as they can protect the active ingredient from degradation, and provide a barrier to prevent the drug from sticking to the machinery during processing. Coating agents are majorly used for oral formulations such as EUDRAGIT FL 30 D-55 by Evonik.

Formulation Insights

Oral formulation segment held the largest share of 55.49% of the market in 2022. The high volume usage of oral formulation increases the demand for excipients such as stabilizers, emulsifiers, polymers and solubilizing agents. Key players such as Evonik have specialized portfolios dedicated towards oral formulations, which further supports the development of excipients based on specific API formulation requirements.

Topical segment is projected to grow at a considerable rate attributable to excipients' requirement to facilitate drug delivery on/through the skin. Availability of products such as Carbopol from BASF and presence of players such as Univar Solutions Inc. and The Lubrizol Corporation allows the segment to meet the changing consumer requirements.

Regional Insights

Europe held the largest share of 37.26% of the market in 2022. The region has a presence of players that are focusing on innovation. Growing innovations in animal-free substitutes in vegetarian pharmaceuticals have attracted the attention of vegetarian and vegan consumers. For instance, in March 2022, Paraveganio was the first medicinal product in the world to be registered with the Vegan Society’s Vegan Trademark. It is the world's first medicine to be certified to contain no animal-derived products. Paraveganio is a paracetamol product manufactured by Axunio and uses a plant-based source of the excipient magnesium stearate.

Europe is closely followed by North America and Asia Pacific owing to the presence of larger companies, such as Avantor Performance Materials Inc. and FMC Corporation, that are direct manufacturers of the products. The regions are expected to witness significant growth owing to ongoing case studies on drug-excipient interactions to enhance delivery efficiency and efficacy.

Asia Pacific, Middle East, and Africa are expected to grow faster owing to an expanding generic market and high volume of unmet medical need in the regions. These regions also enable low-cost manufacturing processes and are a good source for raw material for the manufacturing of excipients.

Key Companies & Market Share Insights

The global market is highly competitive and fragmented, with many international companies competing for a large share of the global revenue. Development of multifunctional and novel excipients is expected to be a key parameter for competition in this market, with mergers and acquisitions as an additional attempt to expand product offerings and gain revenue share. In March 2022, Evonik had increased plant-derived cholesterol supply, one of the critical components for the production of gene therapies & mRNA vaccines. The large-scale production of PhytoChol will meet the cholesterol market demand in Germany.

Expansion of facilities is another strategy players adopt to meet the growing demands of the market. For instance, in March 2023, Evonik announced the construction of new facility for production of RNA vaccine excipients. This allows the company to secure the supply chain for RNA medicines excipients. The plant is projected to become functional in 2025. Some of the prominent players in the global excipientsmarket include:

-

Eastman Chemical Corporation

-

P&G Chemicals

-

Avantor Performance Materials, LLC

-

Huntsman Corporation

-

BASF SE

-

Ashland Inc.

-

FMC Corporation

-

Roquette

-

Colorcon Inc.

-

Lubrizol Corporation

-

Valeant

-

JRS Pharma

-

Shin-Etsu Chemical Co., Ltd.

-

DFE Pharma

-

Finar Limited

Excipients Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.27 billion

Revenue forecast in 2030

USD 13.05 billion

Growth Rate

CAGR of 4.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

May 2023

Market representation

Volume in tons, revenue in USD million/billion, and CAGR from 2024-2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, formulation, function, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key Companies

Eastman Chemical Corporation; P&G Chemicals; Avantor Performance Materials, LLC; Huntsman Corporation; BASF SE; Ashland Inc.; FMC Corporation; Roquette; Colorcon Inc.; Lubrizol Corporation; Valeant; JRS Pharma; Shin-Etsu Chemical Co., Ltd.; DFE Pharma; Finar Limited

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Excipients Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global excipients market report based on product, formulation, function, and region:

-

Product Outlook (Volume in Tons; Revenue in USD Million, 2018 - 2030)

-

Polymers

-

MCC

-

HPMC

-

Ethyl Cellulose

-

Methyl Cellulose

-

CMC

-

Croscarmellose Sodium

-

Povidone

-

Pregelatinized starch

-

Sodium starch glycolate

-

Polyethylene Glycol

-

Acrylic Polymers

-

-

Alcohols

-

Glycerin

-

Propylene Glycol

-

Sorbitol

-

Mannitol

-

Others

-

-

Sugar

-

Lactose

-

Sucrose

-

Others

-

-

Minerals

-

Calcium Phosphate

-

Calcium Carbonate

-

Clay

-

Silicon Dioxide

-

Titanium Dioxide

-

Others

-

-

Gelatin

-

-

Formulation Outlook (Revenue in USD Million, 2018 - 2030)

-

Oral

-

Topical

-

Parenteral

-

Others

-

-

Function Outlook (Revenue in USD Million, 2018 - 2030)

-

Fillers and Diluents

-

Suspending & Viscosity Agents

-

Coating Agents

-

Binders

-

Flavoring Agents & Sweeteners

-

Disintegrants

-

Colorants

-

Lubricants and Glidants

-

Preservatives

-

Emulsifying Agents

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global excipients market size was estimated at USD 9.51 billion in 2022 and is expected to reach USD 9.88 billion in 2023.

b. The global excipients market is expected to grow at a compound annual growth rate of 4.03% from 2023 to 2030 to reach USD 13.05 billion by 2030.

b. Europe dominated the excipients market with the highest share in 2022. This is attributed to the presence of European Medicines Agency’s scientific guidelines on excipients, which facilitates pharmaceutical entities to prepare marketing authorization applications for medicines.

b. Some key players operating in the excipients market include Eastman Chemical Corporation; P&G Chemicals; Avantor Performance Materials, LLC; Huntsman Corporation; BASF SE; Ashland Inc.; FMC Corporation; Roquette; Colorcon Inc.; Lubrizol Corporation; Valeant; JRS Pharma; Shin-Etsu Chemical Co., Ltd.; DFE Pharma; and Finar Limited.

b. Key factors driving the excipients market growth include ongoing research on and discovery of ideal or near-ideal substances that can be used in drug formulations coupled with the rising demand for novel substances that support nanoparticle drug delivery for oncological medications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.