- Home

- »

- Advanced Interior Materials

- »

-

Facade Market Size, Share, Growth, Trends Report, 2030GVR Report cover

![Facade Market Size, Share & Trends Report]()

Facade Market (2024 - 2030) Size, Share & Trends Analysis Report By End-use (Commercial, Residential, Industrial), By Product (Ventilated, Non-Ventilated), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-221-1

- Number of Report Pages: 135

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Facade Market Summary

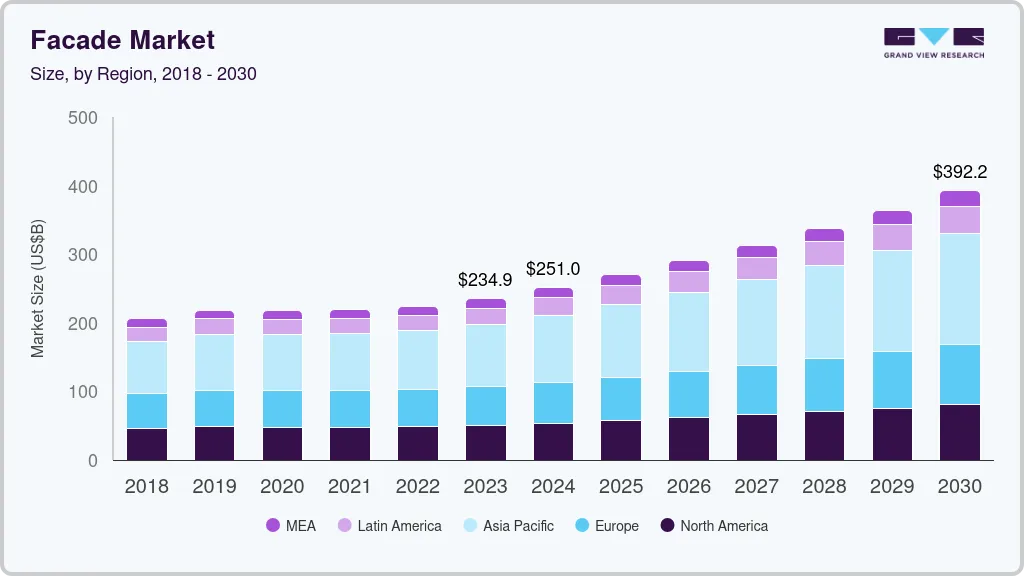

The global facade market size was estimated at USD 234,935.9 million in 2023 and is projected to reach USD 392,196.2 million by 2030, growing at a CAGR of 7.6% from 2024 to 2030. The rise in construction-related activities has been an important factor in driving the market.

Key Market Trends & Insights

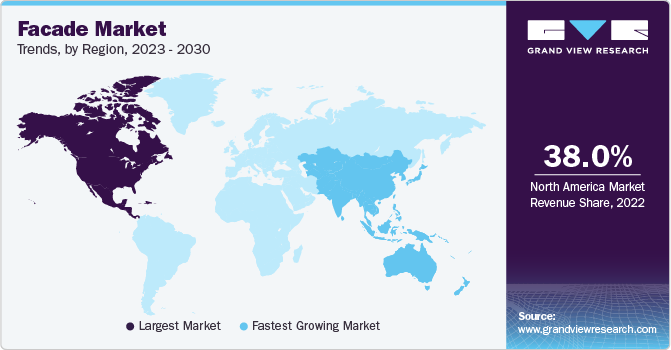

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, Oman is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, ventilated facades accounted for a revenue of USD 106,368.7 million in 2023.

- Ventilated Facades is the most lucrative product segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 234,935.9 Million

- 2030 Projected Market Size: USD 392,196.2 Million

- CAGR (2024-2030): 7.6%

- Asia Pacific: Largest market in 2023

Furthermore, technological innovations are leading to the development of energy-saving facade materials. These advanced products absorb solar energy and find widespread adoption in several commercial and residential buildings as a secondary source of electricity generation.

The market is expected to grow at a considerable rate over the forecast period. This growth can be attributed to rising customer spending power, primarily in China, Japan, India, Brazil, and GCC countries, along with the need to provide a secure work environment to employees. Furthermore, the use of metal composite materials offers a durable, harmonious, and modern appearance to the building. Increasing usage of such composite materials to build facades is projected to provide an upthrust to the market over the coming years.

Modernization and urbanization are playing a vital role in the growth of the market. Several factors, including waterproofing, fabrication, durability, and resistance to extreme climate, come to play during the construction of facades. Changing perceptions of consumers and increasing focus on the exterior appearance of a building are anticipated to boost the growth of the market. Rising disposable income is leading to increased investments in renovations, which in turn is estimated to augment the market. Growing investments for the advancement in the residential and commercial construction industry in developed countries such as the U.S. can stoke the growth of the market.

Market Concentration & Characteristics

The facade market is characterized by a high degree of innovation, driven by advancements in materials, technologies, and sustainable design practices. Innovations include the development of smart facade systems with integrated sensors and automation for enhanced energy efficiency and user comfort. Additionally, there is a growing emphasis on eco-friendly and modular facade solutions, along with façade cladding and rainscreen cladding, reflecting a broader industry trend towards sustainability and adaptability in architectural design.

The target market is also characterized by a high level of mergers & acquisitions by the leading players. Companies are strategically joining forces to strengthen their market positions, expand product portfolios, and leverage synergies in technology and expertise. This high level of M&A activity reflects a competitive landscape where firms seek to enhance their capabilities and offer more comprehensive solutions to meet the evolving demands of the architectural and construction sectors.

The facade market is facing increased regulatory scrutiny globally, with a focus on ensuring compliance with safety, environmental, and energy efficiency standards. Regulatory authorities are placing a heightened emphasis on the fire safety of facade systems, particularly in the aftermath of high-profile incidents. Additionally, environmental regulations are pushing for more sustainable and energy-efficient solutions, impacting the choice of materials and construction practices in facade design. Companies in the facade market are navigating a complex regulatory landscape, adapting their products and processes to meet evolving standards and ensure the safety and sustainability of building exteriors.

Product substitutes in the facade market, such as alternative building materials or design approaches, can impact the industry in several ways. For instance, the use of sustainable and eco-friendly materials as substitutes may influence consumer preferences and purchasing decisions, driving a shift towards more environmentally conscious facade solutions. Technological innovations, like modular construction methods, could also act as substitutes, potentially offering faster and more cost-effective alternatives to traditional facade systems. The impact of substitutes depends on factors such as market trends, regulatory requirements, and the ability of industry players to adapt and differentiate their offerings in response to changing demands.

End-user concentration in the facade market refers to the degree of reliance on a limited number of customers or clients within the construction industry. In cases where a few major construction companies or developers dominate the market, the facade industry may face risks and opportunities associated with their preferences, requirements, and economic stability. High end-user concentration can lead to vulnerability if key clients reduce construction activities or change their preferences, impacting the demand for facade solutions. On the other hand, a diverse customer base can provide stability and resilience for facade manufacturers, spreading the risk across various projects and sectors within the construction industry.

Product Insights

In 2022, the ventilated facades segment held a market share of more than 44% in the global market and expected to exhibit a CAGR of 8.0% from 2023 to 2030. Ventilated facades are likely to be the most prominent product type during the forecast period. Among the ventilated type, curtain walls are poised to be the fastest-growing sub-segment, owing to their increasing penetration in commercial buildings. They mainly comprise glass materials that can transmit heat to provide a warm atmosphere in regions with low temperatures. As a result, they are also projected to gain high demand in residential applications soon, primarily in the U.S., the U.K., and other colder parts of Europe.

The market, at present, is dominated by classic designs, which are anticipated to be replaced by modern, eco-friendly designs over the coming years. Ease of raw material availability and strong demand in the end-use sector, including the commercial and industrial sectors, owing to recovery of the global economy, is estimated to unfold opportunities for industry players over the forecast period. Major innovations in composite material development are leading to overcoming several limitations of excess heat and soundproofing. Several basic materials used in the development of the product include aluminum, plastic & fiber, glass, ceramic, and steel. Aluminum and glass-based composite materials are widely used to build facades, owing to their low weight and high transparency, respectively.

Aluminum and glass are highly preferred due to their durable and elastic properties. This allows designers to provide proper shape and size to facades. Investments in R & D have also led to the development of eco-friendly or sustainable bio-climatic “second-skin facades” to make use of the environment for building lighting, heating, and cooling.

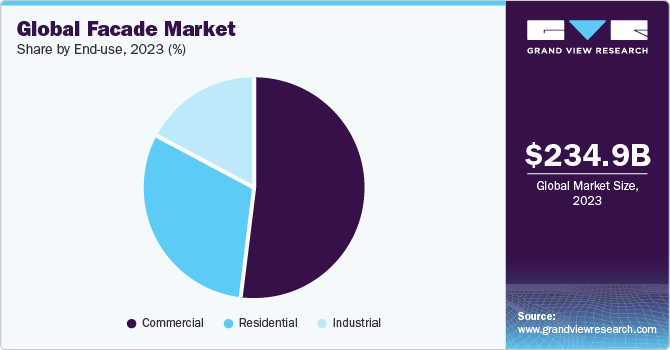

End-use Insights

In 2022, the commercial end-use segment captured a market share of exceeding 52% in the global market and expected to exhibit a CAGR of nearly 7.7% from 2023 to 2030. Facades are extensively used in commercial and residential buildings to protect the interior and provide a visually appealing outer architecture. The product is extensively used in commercial buildings due to the availability of high construction budget among corporates. Rise in the number of commercial buildings, such as retail stores, hotels, medical centers, warehouses, and garages, in India, China, Brazil, and the Middle Eastern countries are expected to spur the growth of the global facades market over the forecast period.

Implementation of the product in residential buildings is also likely to increase over the next few years. This is primarily attributed to the rising customer awareness regarding energy saving, especially in the U.S., the U.K., Germany, China, and Japan. Also, Residential buildings, nowadays, are constructed as a part of the planned development by government through Public Private Partnership (PPP). The buildings in this category are generally equipped with quality facades. Thus, it is estimated to improve the residential segment growth with respect to façade products adoption from 2023 to 2030.

Regional Insights

In 2022, Asia Pacific accounted for the largest market share of more than 38% in the global facade market. Increasing the construction of new commercial and industrial buildings in countries, including China, India, and Southeast Asia, is contributing to the growth of the region. Additionally, the evolving trends in facade design that is responsive to the geographical location, building use, social aspects, safety and sustainability concerns, is expected to fuel the APAC growth significantly by 2030. Moreover, the growing emphasis on energy efficiency coupled with the hot and humid climatic conditions in the Middle East and Africa region is anticipated to drive the regional market growth.

Furthermore, the development of innovative, eco-friendly materials is also poised to impel customers, particularly in the U.S. and the U.K., to redevelop/renovate buildings. North America and Europe, collectively, commanded more than 45% of the total market in 2022, owing to a growing affinity towards advanced facade materials. These regions are highly adaptive to new technologies. As a result, penetration of the product in the commercial and residential sectors is projected to be high, thereby positively influencing the market growth.

Key Facade Companies:

- ROCKWOOL Ltd.

- Aluplex

- THE BOUYGUES GROUP

- Enclos Corp.

- EOS Framing Limited

- Saint-Gobain Group

- AFS International

- Kingspan Group

- Lindner Group

- Fundermax

- Josef Gartner GmbH

- HansenGroup

- HOCHTIEF Aktiengesellschaft

- National Enclosure Company

Key Companies & Market Share Insights

Some of the key players operating in the market include Saint-Gobain Group and Aluplex among others.

-

Saint-Gobain Group, operating in 70 countries, specializes in designing, manufacturing, and providing materials and solutions for diverse applications, including transportation, infrastructure, buildings, aerospace & defense, and healthcare. Key brands like Certainteed, Gyproc, Isover, and Weber are integral to its product portfolio. Categorized into exterior and interior finishing, technological materials, energy efficiency solutions, and distribution & services, the company offers a wide range of products such as glass, insulation, plasterboard, and high-performance materials.

-

Aluplex, an Indian firm, specializes in the design, manufacturing, engineering, and installation of architectural facade systems. Their product range encompasses unitized and semi-unitized curtain wall synergy systems, doors and windows, bolted glass assemblies, and double-skinned facades, all rigorously tested for air permeability, seismic loading, and water tightness. The company services various sectors, such as IT companies, hospitals, hotels, banks, and residential projects, Aluplex has notable clients such as Acme Group, Mahindra System, Bank of India, Citibank, and Crisil.

-

Hansen Group and THE BOUYGUES GROUP are some of the emerging market participants in the target market.

-

Hansen Group specializes in the manufacturing, design, and installation of aluminum facades, curtain walling, roofing, glazing, entrances, and door systems, with a dedicated entity known as Hansen Facade focusing on facade systems. The company provides its services across various sectors, including retail, education, offices, factories, residential, and health, offering Scandinavian designs to its clientele. With a presence in Denmark, Norway, Sweden, Poland, Germany, and the UK, Hansen Group caters to a diverse range of clients and geographical locations in the construction and architectural industry.

-

THE BOUYGUES GROUP, a France-based company with operations in the construction industry, operates across three main sectors: construction, telecom, and media. Bouygues Construction, one of its subsidiaries, offers facade solutions to various industries, including public-sector buildings, private-sector buildings, transport infrastructure, and energy & communication networks. With a global presence, the company markets its products and services in 81 countries spanning the Americas, Europe, the Middle East and Africa (MEA), and the Asia-Pacific (APAC) region.

Recent Developments

-

In December 2023, Saint-Gobain has announced its intention to acquire a majority stake in IMPTEK Chova del Ecuador, a prominent player in the construction chemicals market in Ecuador specializing in innovative waterproofing solutions.

-

In January 2023, Enclos Corp. announced the successful acquisition of PFEIFER Structures America, LLC, in line with its strategic goal of offering comprehensive custom building envelope solutions. This acquisition enhances the company's product range by encompassing custom structural glass systems, tensile membrane structures, and kinetic structures, expanding its capabilities in delivering tailored solutions to engineers, owners, architects, and general contractors across North America.

Facade Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 234,935.9 million

Revenue forecast in 2030

USD 392,196.2 million

Growth Rate

CAGR of 7.6% from 2023 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; Poland; France; China; Japan; India; South Korea; Australia; Mexico; Brazil; KSA; UAE; Kuwait; Bahrain; Qatar; Oman; South Africa

Key companies profiled

ROCKWOOL Ltd.; Aluplex; THE BOUYGUES GROUP; Enclos Corp.; EOS Framing Limited; Saint-Gobain Group; AFS International; Kingspan Group; Lindner Group; Fundermax; Josef Gartner GmbH; HansenGroup; HOCHTIEF Aktiengesellschaft; National Enclosure Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Facade Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global facade market report based on product, end-use, and region.

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Ventilated

-

Curtain Walls

-

Others

-

Non-Ventilated

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Commercial

-

Residential

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Poland

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

Kuwait

-

Bahrain

-

Qatar

-

UAE

-

Oman

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global facade market size was estimated at USD 217.9 billion in 2020 and is expected to reach USD 218.6 billion in 2021.

b. The global facade market is expected to grow at a compound annual growth rate of 6.4% from 2021 to 2028 to reach USD 336.6 billion by 2028.

b. Asia Pacific dominated the facade market with a share of 37.8% in 2019. This is attributable to the increasing construction of new commercial and industrial buildings in countries including China, India, and Southeast Asia.

b. Some key players operating in the facade market include Enclos Corp.; Permasteelisa North America; Walters & Wolf; Harmon Inc.; and SEPA.

b. Key factors that are driving the facade market growth include a rise in construction-related activities, high technological innovations in the development of energy-saving facade materials, and rising customer spending power, primarily in China, Japan, India, Brazil, and GCC countries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.