- Home

- »

- Renewable Chemicals

- »

-

Fatty Acid Ester Market Size, Share, Industry Report, 2020-2027GVR Report cover

![Fatty Acid Ester Market Size, Share & Trends Report]()

Fatty Acid Ester Market (2020 - 2027) Size, Share & Trends Analysis Report By Product (Glyceryl Monostearate, MCTs), By Application (Personal Care & Cosmetics, Food Processing), And Segment Forecasts

- Report ID: 978-1-68038-685-1

- Number of Report Pages: 148

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fatty Acid Ester Market Summary

The global fatty acid ester market size was valued at USD 2.2 million in 2019 and is projected to reach USD 3.2 million by 2027, growing at a CAGR of 4.5% from 2020 to 2027. The growth in the market can be attributed to increased demand for fatty acid esters (FAEs) from various end-use industries, such as personal care, food processing, and pharmaceuticals.

Key Market Trends & Insights

- North America led the market and accounted for over 35.0% share of global revenue in 2019.

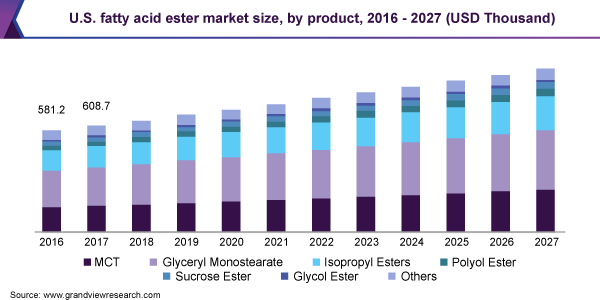

- By product, glyceryl monostearate segment led the market and accounted for more than 36% of the overall share in 2019.

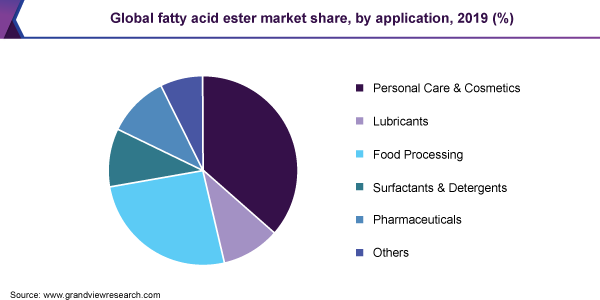

- By application, personal care & cosmetics segment led the market and accounted for a share of more than 36% in 2019.

Market Size & Forecast

- 2019 Market Size: USD 2.2 Million

- 2027 Projected Market Size: USD 3.2 Million

- CAGR (2020-2027): 4.5%

- North America: Largest market in 2019

- Asia Pacific: Fastest growing market

Rising geriatric population is expected to boost demand for natural ingredients, such as FAEs, in the pharmaceutical sector to treat gastrointestinal and other diseases. In addition, increasing demand for natural ingredients with low calorific content to promote weight loss and to adhere to the changing perceptions of beauty and appearance is expected to boost product consumption over the forecast period.

Rising cases of obesity, particularly in the developed nations on account of sedentary lifestyles and growing dependence on technology, are likely to promote the product demand in the food processing industry. However, with the unprecedented outbreak of COVID-19, which has led to the closure of manufacturing sites and factories, there has also been a significant decline in demand for personal care & cosmetic products.

Several plants have been shut down, which have impacted cosmetics production, especially in developed economies, thus hampering the product demand in the short run. On the other hand, growing demand for pharmaceutical products, surfactants & detergents, and essential food products, is estimated to boost the market growth in the near future.

Product Insights

Glyceryl monostearate led the market and accounted for more than 36% of the overall share in 2019. It is primarily used in baked goods. It has high demand in ice creams and whipped cream processing as it provides a smooth texture to the final products. It is also widely used in pharmaceuticals sector to provide control release and in several other industrial applications in the form of emulsifier, thickening agent, preservative, and lubricant. This is expected to promote the segment growth over the forecast period.

Medium Chain Triglycerides (MCT) emerged as the second-largest product segment, as MCTs improve stability and provide smooth texture to various personal care & cosmetic products. MCTs are also used in combination with prescription drugs to treat disorders, such as digestion problems, celiac and liver disease, steatorrhea (fat indigestion), and diarrhea. The product also plays an essential role in weight reduction by promoting calorie-burning.

Isopropyl esters are mainly derived from palm oils, and products, such as palmitate and myristate, are widely used in personal care products due to moisturizing properties. Other esters, such as emollient, polyols, and sucrose are witnessing high growth in the global industry. Functional properties of the product are likely to boost its demand in several end-use industries, such as paper, pharmaceuticals, and food over the forecast period.

Application Insights

Personal care & cosmetics led the market and accounted for a share of more than 36% in 2019. Rising influence of social media is expected to be a major factor driving the growth of the personal care & cosmetics segment, thereby driving the product demand. In addition, favorable government support and schemes implemented to control obesity and related lifestyle diseases have led to increased use of medium chain triglycerides in processed food products.

Surfactants & detergents is another significant application segment for the product. Rising demand for sustainable processes owing to increasing environmental concerns is expected to boost the product usage in this application to promote effective washing at lower temperature cycles, thereby promoting environmental benefits.

The product plays an essential role in surfactants and detergents by breaking down the interface between oils/dirt and water, allowing effective cleansing with fewer resources. Moreover, stringent regulations regarding environmental preservation, rising construction expenditures, and oil and gas production, coupled with a rebound in consumer spending on personal care products, are major driving factors for product demand in several end-use applications.

Regional Insights

North America led the market and accounted for over 35.0% share of global revenue in 2019 and is expected to continue its dominance over the forecast period. High standards of living and increasing focus on beauty and appearance owing to social media influence, changing consumer perceptions, and transitioning promotional methods by major personal care companies are expected to drive product demand in this application segment.

Rising sustainability & health concerns are also boosting the demand for natural ingredients and cosmetic products manufactured using fatty acid esters. APAC is estimated to be the fastest-growing regional market due to the high consumption of glyceryl monostearate in personal care & cosmetics products. Increasing industrial output and rising population, especially in China, India, and Southeast Asia, have driven the manufacturing and food processing industries sector in the region. This led to a high demand for natural & sustainable materials with application-specific properties.

Key Companies & Market Share Insights

Major manufacturers are actively indulging in product & technology innovations, R&D initiatives, and industrial collaborations to expand their product portfolios and increase their geographical reach. Rapid depletion of non-renewable resources and the implementation of stringent government regulations are expected to boost demand for sustainable and biodegradable products, such as FAEs, in several end-use applications, thereby supporting market growth.

The independent manufacturers in the market provide fatty acids to product manufacturers through a wide distribution network. Rising demand for oleochemicals due to low toxicity, higher sustainability, and increasing environmental concerns is expected to boost strategic alliances and partnerships among fatty acid and ester industry participants, thereby increasing their customer base and global presence. Some of the prominent players in the fatty acid ester market include:

-

Cargill, Inc.

-

Arkema

-

DuPont

-

Evonik Industries

-

Estelle Chemicals Pvt. Ltd.

-

Faci Asia Pacific Pte. Ltd.

-

P&G Chemicals

-

The Seydel Companies, Inc.

-

Fine Organics

-

Oleon N.V.

-

KLK Oleo

-

World Chem Industries

-

Stepan Company

-

Stéarinerie Dubois

-

Metroshen International Corp.

-

Zhengzhou Yi Bang Industry Co. Ltd.

-

A.B. Enterprises

Fatty Acid Ester Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 2.4 Million

Volume size in 2020

1,485.6 Ton

Revenue forecast in 2027

USD 3.2 Million

Volume forecast in 2027

2,060.7 Ton

Growth Rate

CAGR of 4.5% from 2020 to 2027 (Revenue-based)

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative Units

Volume in Ton, Revenue in USD Thousand, and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Italy, China, India, Japan, Brazil, Argentina, Saudi Arabia, South Africa

Key companies profiled

Cargill, Inc; Arkema; DuPont; Evonik Industries; Estelle Chemicals Pvt. Ltd.; Faci Asia Pacific Pte. Ltd.; P&G Chemicals; The Seydel Companies Inc.; Fine Organics; Oleon N.V.; KLK Oleo; World Chem Industries; Stepan Company; Stéarinerie Dubois; Metroshen International Corporation; Zhengzhou Yi Bang Industry Co. Ltd.; A.B. Enterprises

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. Grand View Research has segmented the global fatty acid ester market report on the basis of product, application, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Thousand, 2016 - 2027)

-

Medium Chain Triglycerides (MCT)

-

Glyceryl Monostearate

-

Isopropyl Esters

-

Polyol Esters

-

Sucrose Esters

-

Glycol Esters

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Thousand, 2016 - 2027)

-

Personal Care & Cosmetics

-

Lubricants

-

Food Processing

-

Surfactants & Detergents

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Thousand, 2016 - 2027)

-

North America

-

U.S

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fatty acid ester market size was estimated at USD 2.2 billion in 2019 and is expected to reach USD 2.40 billion in 2020.

b. The global fatty acid ester market is expected to grow at a compound annual growth rate of 4.5% from 2019 to 2027 to reach USD 3.2 billion by 2027.

b. North America dominated the fatty acid ester market with a share of 36.30% in 2019. This is attributable to increasing focus on beauty and appearance owing changing consumer perceptions, and transitioning promotional methods by personal care companies.

b. Some key players operating in the fatty acid ester market include P&G Chemicals, Evonik Industries, Oleon N.V., KLK Oleo, The Seydel Companies, Inc., World Chem Industries, Parchem, VVF, Cayman Chemicals, Matrix Universal, Sigma Aldrich, Eastman Chemical Company, and Pacific Oleo.

b. Key factors that are driving the market growth include increasing vegetable fats and oils consumption along with growing consumer inclination toward healthier lifestyle.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.