- Home

- »

- Healthcare IT

- »

-

Fitness Tracker Market Size, Share & Trends Report, 2030GVR Report cover

![Fitness Tracker Market Size, Share & Trends Report]()

Fitness Tracker Market Size, Share & Trends Analysis Report By Type (Smart Watches, Smart Bands), By Application (Glucose Monitoring, Sports), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-291-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

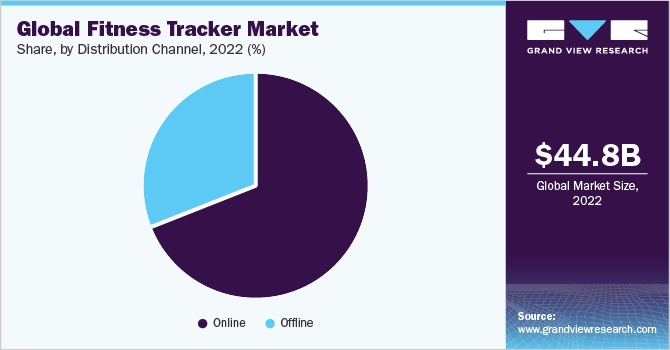

The global fitness tracker market size was valued at USD 44.8 billion in 2022 and is expected to grow a compound annual growth rate (CAGR) of 17.6% over the forecast period. The increasing prevalence of chronic diseases such as obesity, diabetes and heart diseases is one of the major drivers of the fitness tracker market. According to World Health Organization (WHO), approximately more than 1 billion people in the world are obese, and they estimate that by 2050, the number of less healthy people would increase up to 167 million.

Fitness trackers help individuals in tracking their daily physical activity which helps in maintaining a healthy lifestyle and reducing the risk of chronic diseases. The growing trend of integrating fitness trackers with smartphones and smartwatches is one of the major trends in the global fitness tracker market. The increasing popularity of fitness apps and the integration of fitness trackers with these apps is driving the market.

In September 2022, Fitbit Inc. launched Sense 2 and Versa 4, both are compatible with android and iOS. The advanced features include FitBit ECG app and PPG algorithm which can detect atrial fibrillation, heart rate variability, blood glucose tracking, breathing rate and 40 exercise modes.

Fitness Tracker Market Trends

The industry is being driven by the increase in manufacturers that are providing different fitness trackers at prices acceptable for all income levels. Additionally, the development of various wearable products, like smart jewellery, insoles, and clothing, is drawing in more customers. Additionally, the market is being further stimulated by the expanding e-commerce sector, a robust distributor network, and retail partnerships of the industry players. The growing trend of using fitness trackers as a part of corporate wellness programs is expected to create opportunities for the global fitness tracker market.

In 2021, Google has announced its acquisition of Fitbit, Inc. for USD 2.1 billion. The acquisition has helped google in expanding its presence in the wearable devices market. In November 2022, GluCare.Health, a digital therapeutics healthcare provider, announced its partnership with Fitbit for enabling the integration of the advanced health-related data from Fitbit wearable products into the clinical framework of the company. Through this partnership, Fitbit's wearables, which are now a part of Google, can be used with the GluCare.Health (disease management platforms provided by the company).

In November 2022, Pretaa, a behaviour analytics company with headquarters in Boston, announced a partnership with Fitbit to provide drug addicts with a data-driven support tool on their wrist. In January 2023, a partnership between Garmin and Leiden University are aiming to predict depression in order to prevent it in the future. In order to allow early, personalised prevention, researchers at Leiden University are employing Garmin fitness trackers and are monitoring the multimodal data of the participants to identify and assist the early warning indicators of depressive episodes.

In December 2022, Taiwanese insurance provider Nan Shan Life collaborated with fitness technology company Garmin Health to make the BAM app1 available to policyholders. The BAM app is a health management tool that combines AI technology with insurance products to motivate users to lead healthier lifestyles and prevent disease.

Type Insights

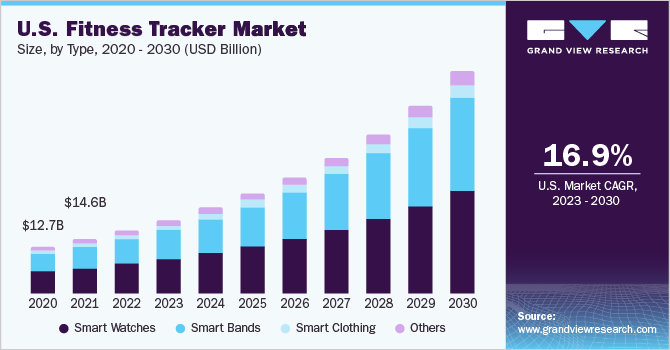

The smartwatch segment dominated the market and comprised of the largest revenue share of 48.7% in 2022. Continuous developments in products in the form of enhancement of features and functions is driving the segment growth and is anticipated to boost the adoption over the forecast period. The fitness band segment is projected to register the fastest CAGR from 2023 to 2030.

For instance, Fitbit Premium customers get access to tools for analyzing blood glucose patterns and drops in blood glucose levels over the course of 30 days. Blood glucose levels are used by Fitbit Health Coach features to create personalised exercise routines. Similar to this, Apple Watch owners can sync their data with applications like Apple Health that monitor blood glucose levels.

Application Insights

The running segment held the highest revenue share of 22.8% in 2022. High competition, growing adoption and consumer preferences have led to the availability of most of these applications in the majority of the fitness trackers available. Intake of food and water is also recorded by fitness trackers. While running or lifting weights, these trackers use bluetooth to alert users to notifications.

However, some devices, such as Nurvv Run by Nurvv and Forerunner by Garmin are specially designed for the sports-related applications as they provide features, such as lap count, Hill Splitter, and goal-setting. Sports is estimated to be the second-largest application segment by 2030. On the other hand, the glucose monitoring segment is estimated to register the fastest CAGR from 2023 to 2030.

Distribution Channel Insights

In 2022, the online distribution channel segment dominated the global market and accounted for the largest revenue share of 64.8%. The rising adoption and penetration of smartphones and the internet utilization, along with the increasing accessibility and popularity of the e-commerce platforms owing to the high convenience and quick service provided by them, will boost the segment growth over the forecast years.

By distribution channels, the market has been divided into offline and online. The offline segment is also projected to demonstrate significant growth owing to the fact that offline stores allow users to examine and analyze the product prior to buying it. Furthermore, offline stores are beneficial in providing immediate assistance from a skilled personnel with product knowledge, which is helpful in driving the product sales with the help of this distribution channel.

Regional Insights

In 2022, North America held the highest revenue share of 42.2% owing to the rise in awareness and adoption of fitness trackers. Moreover, rising cases of health issues related to sedentary lifestyles, the advent of innovative products by key market players, and the growing penetration of smartphones and the internet in North America will drive the regional industry. According to a 2022 article by ValuePenguin, 45% of Americans now wear smartwatches on a regular basis, including Fitbits (16%) and Apple Watches (20%). The devices are favoured by women (51%), Gen Zers (70%), and millennials (57%).

Asia Pacific, on the other hand, is anticipated to have the highest growth rate in the regional market from 2023 to 2030 as a result of the high adoption of fitness trackers in the working-class population, due to steady economic expansion, technological advancements, and population growth. Due to a rise in fitness awareness among the populace in China, fitness trackers are well received by the market there. The key drivers driving the growth of the fitness trackers market in Japan are changes in standard of living, an increase in the number of fitness enthusiasts, and an increase in the population of young people.

Key Companies & Market Share Insights

The rapidly changing technology and innovations by the key market players present a tough industry competition. The market players are focusing on research and development to provide more efficient products to cater to the rising demand. The increasing number of brands offering fitness trackers with cutting-edge technology, continuous development of features offering the best customer experience and at prices suiting different earning groups, and growing e-commerce sector support the market growth. Some of the prominent players in the global fitness tracker market include:

-

Apple, Inc.

-

Fitbit, Inc.

-

Garmin Ltd.

-

Ambiotex GmbH

-

Samsung Electronics Co. Ltd.

-

Fossil Group, Inc.

-

Huawei Technologies Co. Ltd.

Recent Development

-

In March 2023, Garmin Singapore announced the Forerunner 265 series and Forerunner 965 smartwatches with vibrant AMOLED displays. The watch offers innovative features to help athletes push the limits by planning, preparing and tracking their fitness routine.

-

In September 2022, Garmin International, Inc. launched a new Black Panther fitness tracker wrist watch to track the daily activities of kids. The watch design adds Avengers character watch faces that help to motivate kids to stay active.

-

In September 2022, Apple introduced Apple Watch Ultra offering a unique design that delivers a comfortable fit for every adventure. The watch is customized with a variety of features including workouts, backtrack, fitness tracker, and many more.

-

In January 2022, Fossil and Razer collaborated to launch the Razer X Fossil Gen 6 Smartwatch for USD 329. The smartwatch includes features such as health & wellness sensors, and sleep tracking to track the fitness level of users.

-

In April 2021, Huawei announced the launch of HUAWEI Band6, a fitness tracker band in Singapore. The band supports features such as heart rate monitoring, SpO2, sleep monitoring, and many more.

Fitness Tracker Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 52.19 billion

Revenue forecast in 2030

USD 162.75 billion

Growth rate

CAGR of 17.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; India; Japan; China; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Apple, Inc.; Fitbit, Inc.; Garmin Ltd.; Ambiotex GmbH; Samsung Electronics Co. Ltd.; Fossil Group, Inc.; Huawei Technologies Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fitness Tracker Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global fitness tracker market report based on type, application, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Smart Watches

-

Smart Bands

-

Smart Clothing

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Heart Rate Tracking

-

Sleep Monitoring

-

Glucose Monitoring

-

Sports

-

Running Tracking

-

Cycling Tracking

-

Others

-

-

Distribution channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global fitness tracker market is expected to grow at a compound annual growth rate of 17.6% from 2023 to 2030 to reach USD 162.7 billion by 2030.

b. The smartwatch segment dominated the fitness tracker market in 2022 accounting for the largest revenue share of over 48% owing to the high demand for smartwatches.

b. Some of the key players in the fitness tracker market are Apple Inc., Fitbit Inc., Garmin Ltd., Beienda, Ambiotex GmBh, Hexoskin, Huawei Technologies, Nurvv, Oura Health Ltd., and Withings.

b. The fitness tracker market growth was extensively attributed to the rising health & fitness awareness, the growing penetration of smartphones and the internet, and the increase in the consumer’s disposable incomes.

b. The running application segment held the maximum revenue share of more than 22% in 2022 in the fitness tracker market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."