- Home

- »

- Electronic Devices

- »

-

Smartphone Market Size & Share, Industry Report, 2030GVR Report cover

![Smartphone Market Size, Share & Trends Report]()

Smartphone Market (2025 - 2030) Size, Share & Trends Analysis Report By Operating System (Android, iOS), By Distribution Channel (Online, Offline), By Price Range (Entry Level, Mid-Range, Premium), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-726-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smartphone Market Summary

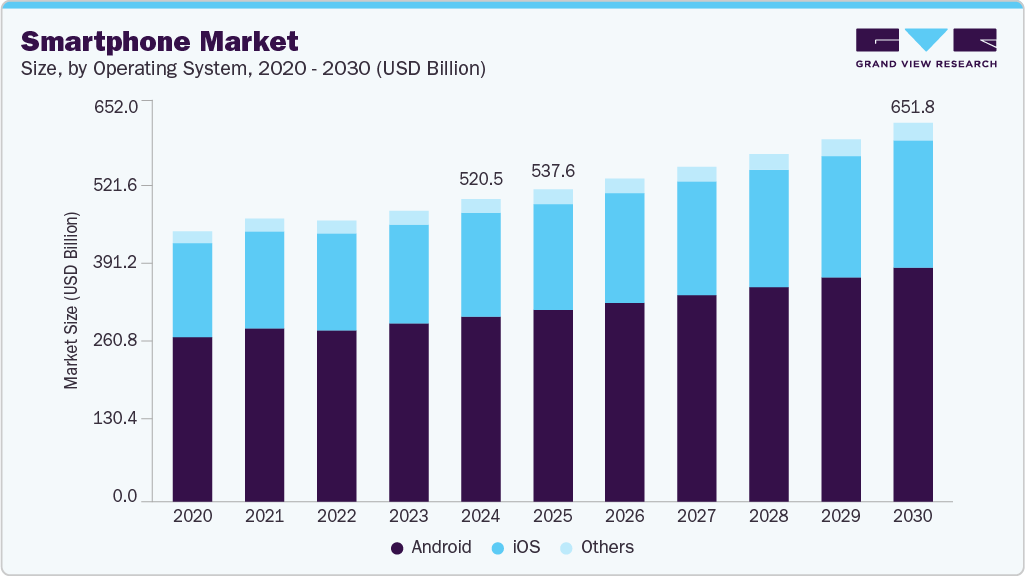

The global smartphone market size was estimated at USD 520.45 billion in 2024 and is projected to reach USD 651.82 billion by 2030, growing at a CAGR of 3.9% from 2025 to 2030. The growth is driven by the rising consumer demand for feature-rich yet affordable devices, rapid advancements in 5G connectivity, and increasing digital dependency across emerging and developed economies.

Key Market Trends & Insights

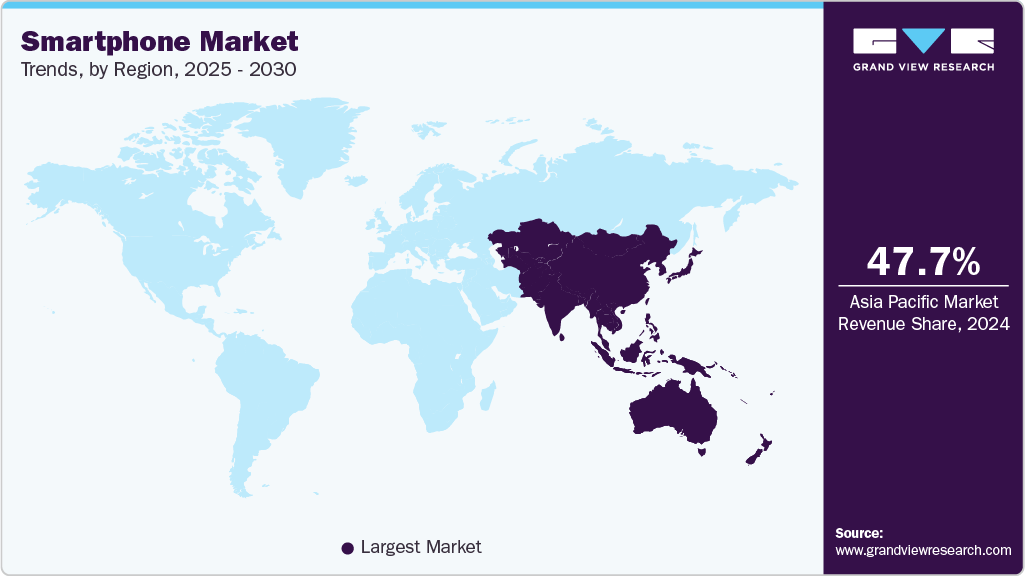

- Asia Pacific smartphone dominated the global smartphone market with the largest revenue share of 47.7% in 2024.

- The smartphone industry in India is expected to grow significantly from 2025 to 2030.

- By operating system, Android led the market with the largest revenue share of 61.4% in 2024.

- By distribution channel, the offline segment held the largest revenue share in 2024.

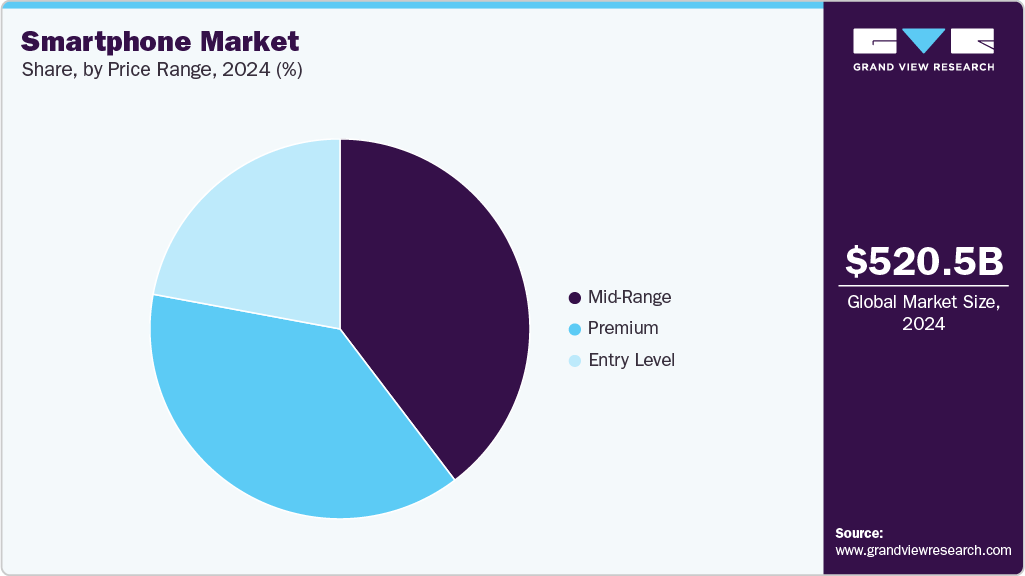

- By price range, the mid-range segment is expected to grow at the fastest CAGR from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 520.45 Billion

- 2030 Projected Market Size: USD 651.82 Billion

- CAGR (2025-2030): 3.9%

- Asia Pacific: Largest market in 2024

Key growth drivers for the smartphone industry include the proliferation of AI-powered functionalities such as on-device generative AI, enhanced mobile photography, and real-time language translation, as well as growing integration with IoT ecosystems. Smartphone adoption is further supported by expanding e-commerce penetration, competitive pricing strategies, and increasing replacement cycles due to faster technological obsolescence. Moreover, sustainability initiatives such as modular repairability, use of recycled materials, and energy-efficient chipsets are becoming central to brand differentiation. At the same time, demand from sectors like gaming, fintech, and enterprise mobility continues to reshape device capabilities and performance expectations.

The increasing penetration of smartphones and other smart devices across both developed and emerging economies also contributes to the market growth. Smartphones have become essential tools for communication, entertainment, and productivity, driving consistent demand. In addition, the rise of wearable technology, such as smartwatches and fitness trackers, has contributed to market expansion as health and fitness awareness grows. The integration of these devices with other smart home products, such as voice assistants and security systems, has further boosted consumer interest and spending in this sector. For instance, in January 2025, Alarm.com, a U.S.-based technology company, launched its new AI Deterrence (AID) service, an advanced automated audio response system aimed at strengthening property security. Leveraging artificial intelligence, the service issues personalized verbal warnings to potential intruders, adapting messages based on visual cues like clothing and environmental context.

Operating System Insights

The Android segment dominated the smartphone market and accounted for the revenue share of 61.4% in 2024. The Android segment is gaining momentum globally due to its strong alignment with evolving consumer expectations around content creation, performance optimization, and software longevity. Manufacturers are increasingly integrating advanced artificial intelligence features at the system level, such as intelligent imaging, contextual search, and on-device productivity tools, to elevate the user experience in the mid-premium category.

The others segment is anticipated to grow at the fastest CAGR during the forecast period. The others segment, which includes operating systems such as KaiOS, Windows, HarmonyOS (outside China), and legacy platforms, maintains a modest yet persistent presence in the global market. While Android and iOS dominate consumer choice, the residual usage of non-mainstream systems persists primarily in institutional, accessibility-focused, or first-time user environments.

Distribution Channel Insights

The offline segment dominated the smartphone industry and accounted for the largest revenue share in 2024. The segment continues to retain a dominant share in smartphone distribution by offering an immersive shopping experience that digital platforms cannot fully replicate. As premiumization accelerates, consumers increasingly seek in-store validation of product quality, camera performance, display standards, and building materials before committing to high-value purchases.

The online segment is expected to grow at a significant CAGR during the forecast period. Online sales accounted for a significant market share in the smartphone market due to their enhanced convenience, transparent pricing structures, and ease of product comparison. Consumers benefit from access to a broad range of models, exclusive limited-time promotions, and flexible payment and delivery options. Additionally, this sales channel demonstrates growth during high-demand periods such as festive seasons and end-of-quarter campaigns, where e-commerce platforms leverage their extensive reach and operational efficiency.

Price Range Insights

The mid-range segment dominated the market and accounted for the largest revenue share in 2024. This segment continues to witness robust traction as consumers across both developed and emerging markets seek smartphones that offer a balanced combination of performance, camera capabilities, design, and battery efficiency without entering flagship price brackets. The growth is largely fueled by buyers upgrading from entry-level devices and users seeking near-premium features such as AMOLED displays, fast charging, 5G connectivity, and multi-lens AI-powered cameras within accessible price bands.

The premium segment is expected to grow at a significant CAGR over the forecast period. This growth is attributed to the rising demand for devices that deliver high-performance computing, advanced AI integration, and sophisticated imaging capabilities. Consumers, especially in metropolitan and upper-tier cities, are increasingly adopting flagship models that double as productivity tools and lifestyle statements. These users prioritize ecosystem continuity, long-term software updates, and exclusive service access, such as cloud backups, premium support, and security features integrated with wearables and home devices.

Regional Insights

The North America smartphone market held a significant revenue share in 2024. The growth is driven by strong consumer preference for premium devices with advanced features such as AI-powered cameras, foldable screens, and 5G integration. A high replacement rate, driven by frequent upgrade programs offered by carriers and OEMs, sustains demand. Additionally, the rapid adoption of mobile payment systems, integration of smartphones into connected ecosystems like smart homes and vehicles, and the push for eco-friendly devices with longer lifecycles are fueling market expansion.

U.S. Smartphone Market Trends

The smartphone industry in the U.S. is expected to grow significantly at a CAGR of 10.3% from 2025 to 2030. In the U.S., smartphone growth is supported by intense competition among carriers providing attractive financing and trade-in programs that lower the entry barrier for high-end devices. The proliferation of e-commerce platforms and direct-to-consumer sales models enhances accessibility.

Europe Smartphone Market Trends

The smartphone industry in Europe is anticipated to register considerable growth from 2025 to 2030. The European market for smartphones benefits from stringent sustainability and e-waste regulations, pushing manufacturers toward offering modular designs, recyclability, and extended software support. Consumers are increasingly attracted to eco-conscious brands and mid-range models offering high value at competitive prices. The growth of fintech and digital ID integration within smartphones also supports higher adoption across public and private sectors.

The UK smartphone market is expected to grow rapidly in the coming years as. In the UK, growth is driven by the rapid adoption of 5G networks and demand for budget-friendly 5G-enabled devices among younger consumers. A rising gaming culture, coupled with smartphones optimized for high-performance gaming, supports segment growth. Furthermore, frequent promotional tie-ins with streaming and entertainment services are creating additional incentives for upgrades.

The smartphone market in Germany held a substantial market share in 2024. Germany’s market is propelled by a strong demand for data privacy and security-centric devices, encouraging manufacturers to provide enhanced encryption and GDPR-compliant features. The country’s large industrial workforce and SME sector fuel the adoption of rugged and enterprise-grade smartphones. Additionally, the growing popularity of dual-SIM and multi-functional devices caters to Germany’s business-travel-heavy consumer base.

Asia Pacific Smartphone Market Trends

Asia Pacific dominated the global smartphone industry with the largest revenue share of 47.7% in 2024. The market is growing rapidly due to the massive young demographic and rising internet penetration in emerging economies. Local OEMs are aggressively innovating with competitive pricing, advanced features, and localized apps, boosting adoption. Rapid expansion of mobile-first financial services, super apps, and digital entertainment platforms is creating sustained demand, particularly in India and Southeast Asia.

The Japan smartphone market is expected to grow rapidly in the coming years. Japan’s smartphone growth is driven by demand for highly sophisticated, compact, and durable devices that cater to tech-savvy consumers. Integration of smartphones with advanced robotics, IoT-enabled homes, and automotive ecosystems adds unique market traction. Moreover, Japan’s aging population fuels demand for senior-friendly smartphones with larger interfaces, emergency functions, and health monitoring features.

The smartphone market in China held a substantial revenue share in 2024. China’s market is led by aggressive innovation cycles, with local giants rapidly pushing foldables, high-resolution displays, and AI-driven ecosystems at competitive prices. Domestic manufacturing dominance allows faster adoption of cutting-edge hardware. Government-driven digital initiatives such as e-CNY wallets and smart city applications also encourage deeper smartphone penetration across urban and rural areas.

Key Smartphone Company Insights

Key players operating in the smartphone industry are Apple Inc.; Samsung Electronics Co. Ltd.; Xiaomi Corporation; Google LLC; and OnePlus. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives:

-

In July 2025, Apple Inc. launched AppleCare+ One, a unified subscription plan that consolidates coverage for iPhone, Mac, iPad, and Apple Watch into a single package. It simplifies device protection, includes theft and loss coverage, and offers priority support.

-

In January 2025, Google LLC acquired part of HTC’s extended reality (XR) unit for approximately USD 250 million, transferring select VIVE engineering talent and non-exclusive IP rights. This supports Google’s Android XR platform development and deeper partnerships in the XR ecosystem.

-

In July 2024, Xiaomi Corporation partnered with Dixon, DBG, and other EMS companies to assemble smartphones and other devices in India, aiming to reach 55% local component sourcing and double device shipments to 700 M in India over the next decade.

Key Smartphone Companies:

The following are the leading companies in the smartphone market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- Asus

- Google LLC

- Huawei

- HMD Global

- Lenovo Group Limited

- Motorola

- OnePlus

- Oppo

- Realme

- Samsung Electronics Co. Ltd.

- Sony Corporation

- Vivo

- Xiaomi Corporation

- ZTE Corporation

Smartphone Market Report Scope

Report Attribute

Details

Market size in 2025

USD 537.62 billion

Revenue forecast in 2030

USD 651.82 billion

Growth rate

CAGR of 3.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

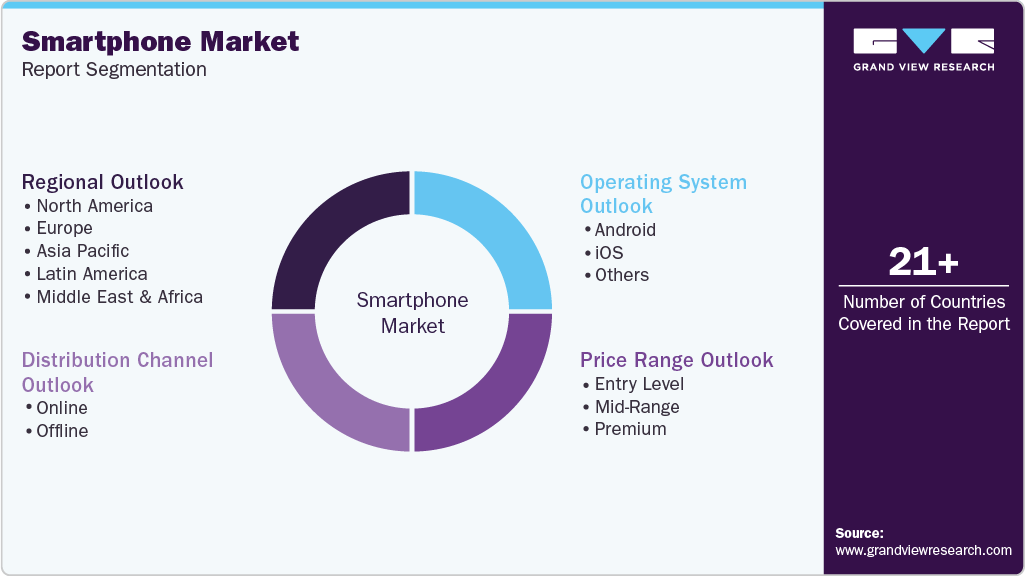

Operating system, distribution channel, price range, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Apple Inc.; Asus; Google LLC; Huawei; HMD Global; Lenovo Group Limited; Motorola; OnePlus; Oppo; Realme; Samsung Electronics Co. Ltd.; Sony Corporation; Vivo; Xiaomi Corporation; ZTE Corporation

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smartphone Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the smartphone market report based on operating system, distribution channel, price range, and region:

-

Operating System Outlook (Revenue, USD Billion, 2018 - 2030)

-

Android

-

iOS

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Price Range Outlook (Revenue, USD Billion, 2018 - 2030)

-

Entry Level

-

Mid-Range

-

Premium

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smartphone market size was estimated at USD 520.45 billion in 2024 and is expected to reach USD 537.62 billion in 2025.

b. The global smartphone market is expected to grow at a compound annual growth rate of 3.9% from 2025 to 2033 to reach USD 651.82 billion by 2033.

b. Asia Pacific dominated the global market with the largest revenue share of 47.7% in 2024. The Asia Pacific smartphone market is growing rapidly due to the massive young demographic and rising internet penetration in emerging economies.

b. Some key players operating in the smartphone market include NVIDIA Corporation, Intel Corporation, Advanced Micro Devices, Inc., Micron Technology, Inc., IBM Corporation, Samsung SDS, Qualcomm Technologies, Inc., Google Cloud, Imagination Technologies, Huawei Cloud Computing Technologies Co., Ltd.

b. Key factors that are driving the market growth include rising consumer demand for feature-rich yet affordable devices, rapid advancements in 5G connectivity, and increasing digital dependency across emerging and developed economies

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.