- Home

- »

- Display Technologies

- »

-

Head-up Display Market Size, Share & Trends Report, 2030GVR Report cover

![Head-up Display Market Size, Share & Trends Report]()

Head-up Display Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Automotive, Aviation, Wearables, Others), By Region (North America, Europe, Asia Pacific, Latin America, Middle East And Africa), And Segment Forecasts

- Report ID: GVR-1-68038-486-4

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Head-Up Display Market Summary

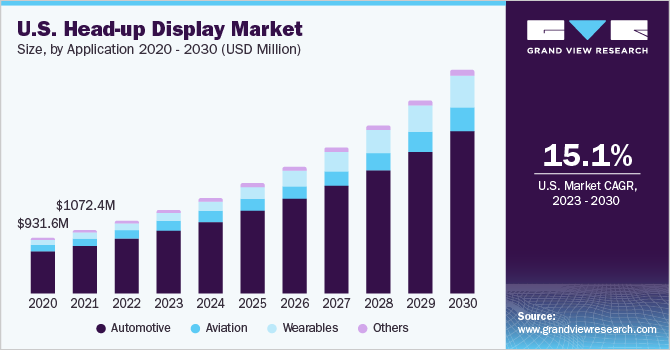

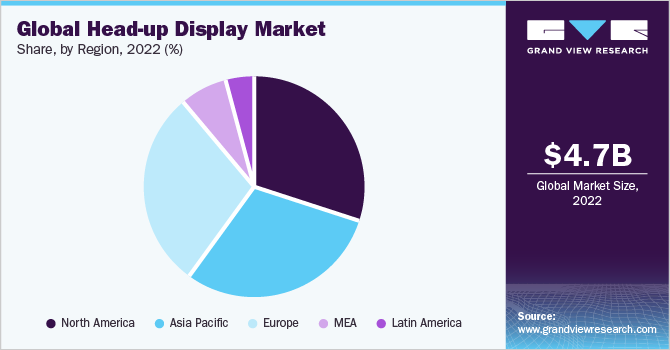

The global head-up display market size was valued at USD 4.75 billion in 2022 and is projected to reach USD 15.26 billion by 2030, growing at a CAGR of 15.7% from 2023 to 2030. The growth of the market is primarily driven due to the low cost of products and easy integration with smartphones, which enhances the safety of drivers by reducing distractions.

Key Market Trends & Insights

- North America dominated the market and accounted for the largest revenue share of 30.3% in 2022.

- Asia Pacific is expected to register the highest CAGR of 17.4% over the forecast period

- Based on application, the automotive segment accounted for the largest revenue share of around 77.2% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 4.75 Billion

- 2030 Projected Market Size: USD 15.26 Billion

- CAGR (2023-2030): 15.7%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Innovative solutions such as global positioning systems and augmented reality that can be integrated with the head-up display system further drive the industry's demand. HUD is a transparent display that presents information in the driver's line of sight without looking away from the road. HUDs were initially developed for aviation and military applications but are increasingly used in automobiles, commercial aircraft, and other wearables.

The increase in the purchasing power of individuals due to growth in disposable income is expected to fuel the industry's growth. The modern-age population is becoming more tech-savvy and accepting technologically advanced products that promote safer driving practices. Furthermore, increasing awareness regarding safety is a major factor driving further growth.

A typical head-up display consists of a projector unit, a display system, a programmed computer, and connecting chords. It is available in diverse types, such as fixed-mounted HUD, helmet-mounted HUD, and so on, and offers an advanced way of viewing navigation directions. The system can also be coupled with adaptive cruise control, a recent innovation in car transport systems, to offer the best safety systems.

The improved standard of living of the global population has resulted in increased affordability for premium cars, which has boosted the usage of head-up displays for navigation purposes. Though several automobile manufacturers offer head-up display systems as an additional feature, it may eventually become necessary for every car manufacturer to implement them for improved safety and enhanced user experience.

Application Insights

Based on application, the market is segmented into automotive, aviation, wearables, and others. The automotive segment has been sub-segmented into premium/luxury, sports, and basic & mid-segment cars. The automotive segment accounted for the largest revenue share of around 77.2% in 2022. The integration of head-up displays with driver assistance systems, which several automobile manufacturers increasingly adopt, is expected to drive the market growth of these displays. Furthermore, the rapid advancement of technology and the integration of artificial intelligence (AI) in automotive systems drive market growth.

The wearables segment is estimated to register the fastest CAGR of 20.2% over the forecast period, as vendors are investing heavily in R&D to offer an enhanced driving experience. Increasing demand for advanced technological products, that offer enhanced accuracy, is the major driving factor for the growth of the head-up display market in the wearable application.

The aviation segment is expected to grow significantly over the forecast period, owing to most commercial aircraft implementing head-up display systems for optimum landing and takeoff. The increasing number of flight simulators also significantly drives the growth of this market. Moreover, designing transparent displays proves to be a major challenge for vendors as the displays are required to provide enhanced visibility in sunlight in the same way they would at night.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 30.3% in 2022. The presence of large technology companies and huge investments made in the R&D of head-up displays are the major factors driving the market growth in North America. Recent innovations in technologies concerning the automotive industry, such as adaptive cruise control and augmented reality, are the major trends that would lead to a significant rise in the demand for the overall U.S. market. Additionally, the region, being one of the largest auto markets in the world, is also expected to boost the market revenue significantly.

Asia Pacific is expected to register the highest CAGR of 17.4% over the forecast period, owing to the increasing awareness among users regarding the benefits offered by the technology. Growth in the standard of living and increasing disposable income are the driving factors for the market growth in this region.

Key Companies & Market Share Insights

The market is highly competitive, and the players are undertaking strategies such as forecast launches, acquisitions, and collaborations to increase their global reach. For instance, in June 2023, Honeywell International Inc. acquired Saab's heads-up display assets to enhance its avionics offerings. Under the agreement, Saab will collaborate with Honeywell to enhance and expand its HUD product line. Heads-up-display improves pilots' situational awareness, particularly during challenging weather or nighttime conditions. This partnership will result in safer and more fuel-efficient flights, allowing passengers to reach their destinations more reliably.

Key Head-up Display Companies:

- BAE Systems

- Continental AG

- DENSO CORPORATION

- Elbit Systems Ltd.

- Visteon Corporation

- YAZAKI Corporation

- Robert Bosch LLC

- Collins Aerospace

- Thales

Recent Developments

-

In February 2023, AeroBrigham acquired the SkyDisplay HUD division from MyGoFlight and rebranded it as AeroDisplay. The company intends to further enhance the HUD by developing configurations for more Part 23 aircraft and Part 27 helicopters. AeroDisplay plans to incorporate engine and external load information into the HUD's display for helicopters. Additionally, AeroDisplay integrates with thermal imaging systems, such as the Astronics Max-Viz enhanced flight vision system.

-

In January 2023, HARMAN International launched HARMAN Ready Vision, a range of Augmented Reality (AR) head-up display hardware and AR software products. The AR software of Ready Vision integrates with vehicle sensors to provide immersive audio and visual alerts, delivering crucial information to the driver accurately and promptly without being disruptive. Additionally, the system utilizes computer vision and machine learning for precise 3D object detection, enabling the driver to receive non-intrusive warnings for potential collisions, blind spots, lane departures, lane changes, and low-speed zones.

-

In May 2022, BAE Systems announced the launch of LiteWave, an innovative compact Head-Up Display (HUD) designed exclusively for aviation cockpits with restricted space. The HUD utilizes BAE Systems' unique waveguide technology and is flexible to accommodate different flying postures. This function allows pilots to maintain situational awareness even in adverse weather or low visibility scenarios.

-

In February 2022, Continental AG launched a head-up display (HUD) for trams, developed by their in-house team at Continental Engineering Services (CES). This innovative display aims to enhance safety in urban traffic by allowing tram drivers to concentrate fully on the road, reducing the need for emergency braking. Additionally, the increasing prevalence of cellphone distractions among road users has contributed to a growing number of accidents involving trams, prompting the need for improved safety measures.

-

In January 2022, Panasonic Corporation of North America announced the launch of Augmented Reality HUD (AR HUD) 2.0, incorporating an innovative eye tracking system (ETS) to enhance the AR experience. This exclusive technology is made possible by integrating an IR camera into the AR HUD projector and optics, eliminating the necessity for a separate camera focused on the driver. The ETS accurately detects the driver's gaze direction and optimizes the AR visuals to ensure clear and precise imagery, resulting in a more intuitive and enjoyable user experience.

-

In January 2022, CY Vision announced the launch of a 3D Augmented Reality Head-Up Display (3D AR-HUD), a groundbreaking windshield technology that offers uninterrupted depth and authentic 3D functionality. This cutting-edge display surpasses all other augmented reality displays available in terms of its expansive field of view, catering to various distances and weather conditions.

Head-up Display Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.49 billion

Revenue forecast in 2030

USD 15.26 billion

Growth rate

CAGR of 15.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; United Arab Emirates; Saudi Arabia; South Africa

Key companies profiled

BAE Systems; Continental AG; DENSO CORPORATION; Elbit Systems Ltd.; Visteon Corporation; YAZAKI Corporation; Robert Bosch LLC, Collins Aerospace; Thales

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Head-up Display Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global head-up display market based on application and region:

-

Application Outlook (Revenue in USD Million, 2017 - 2030)

-

Automotive

-

Premium/Luxury Cars

-

Sports Cars

-

Basic & Mid-segment Cars

-

-

Aviation

-

Wearables

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global head-up display market size was estimated at USD 4.75 billion in 2022 and is expected to reach USD 5.49 billion in 2023.

b. The global head-up display market is expected to grow at a compound annual growth rate of 15.7% from 2023 to 2030 to reach USD 15.26 billion by 2030.

b. North America dominated the head-up display market with a share of over 30% in 2022. This is attributable to the growing number of startups in the technology & software industry and increasing adoption of the ADAS by economy car manufacturers in the region.

b. Some key players operating in the head-up display market include BAE Systems PLC; Continental AG; Elbit Systems Ltd.; Visteon Corporation; Robert Bosch LLC; Rockwell Collins, Inc.; Thales Group; Saab AB; and Denso Corporation.

b. Key factors that are driving the market growth include an increase in the disposable income of the tech-savvy population, growing demand for electric & luxury vehicles, and increasing use of HUDs along with augmented reality & gamification.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.