- Home

- »

- Medical Devices

- »

-

Home Infusion Therapy Market Size, Industry Report, 2030GVR Report cover

![Home Infusion Therapy Market Size, Share & Trends Report]()

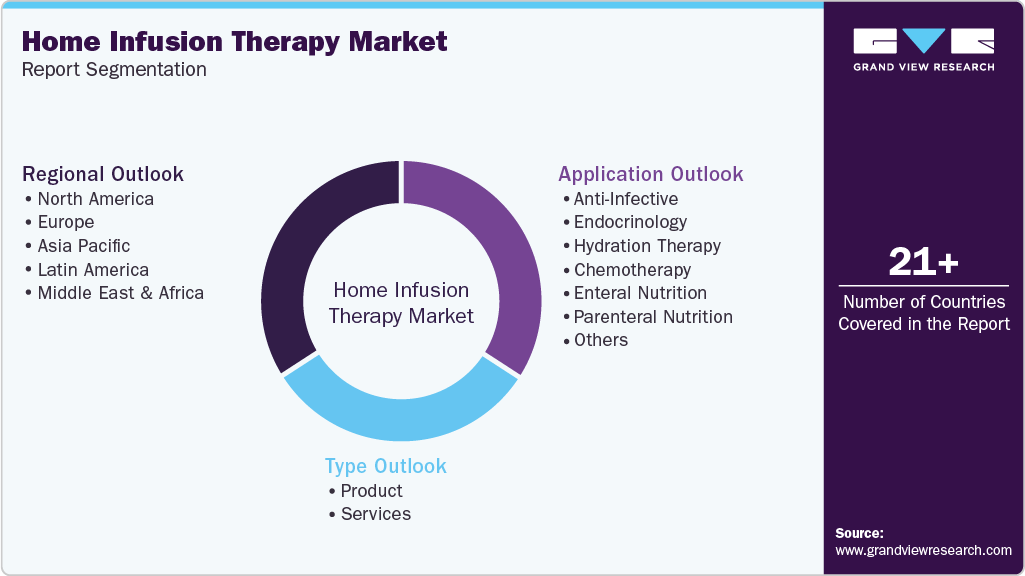

Home Infusion Therapy Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Product, Services), By Application (Anti-Infective, Endocrinology, Hydration Therapy, Chemotherapy), By Region, And Segment Forecasts

- Report ID: 978-1-68038-389-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Home Infusion Therapy Market Summary

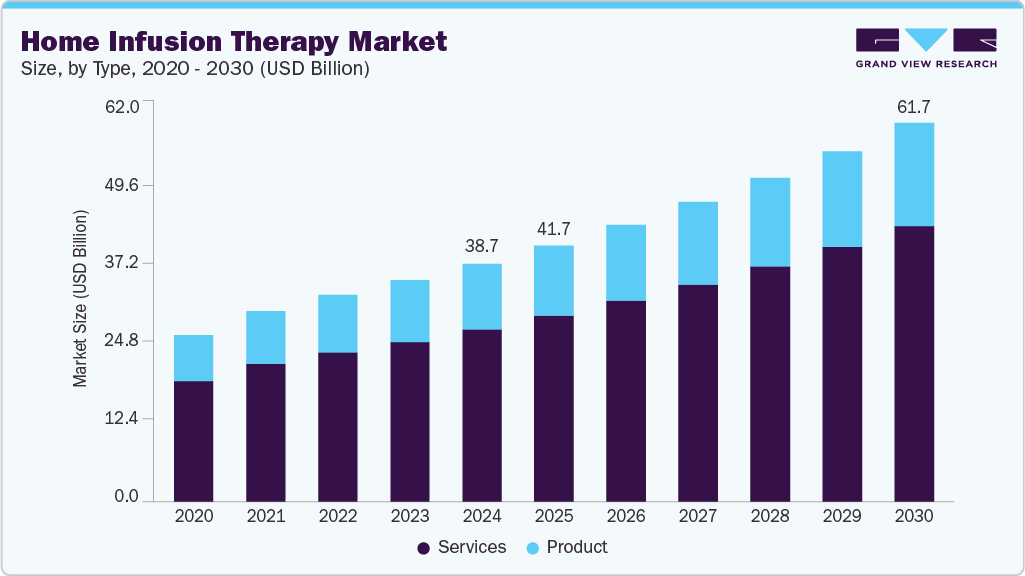

The global home infusion therapy market was valued at USD 38.66 billion in 2024 and is expected to reach USD 61.72 billion by 2030, growing at a CAGR of 8.2% from 2025 to 2030. Home infusion therapy involves delivering treatments, medications, or fluids directly into a patient's bloodstream through intravenous (IV) infusion, usually in the comfort and convenience of their home.

Key Market Trends & Insights

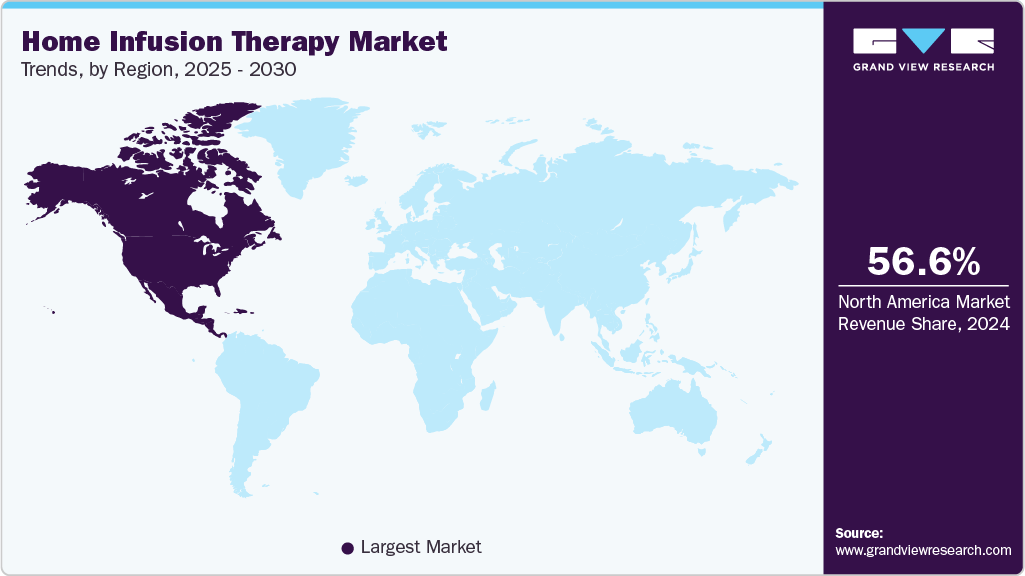

- North America dominated the market with a revenue share of 56.6% in 2024.

- The U.S. home infusion therapy market is expected to grow over the forecast period.

- By type, the services segment dominated the home infusion therapy market, accounting for 72.4% of the global revenue in 2024.

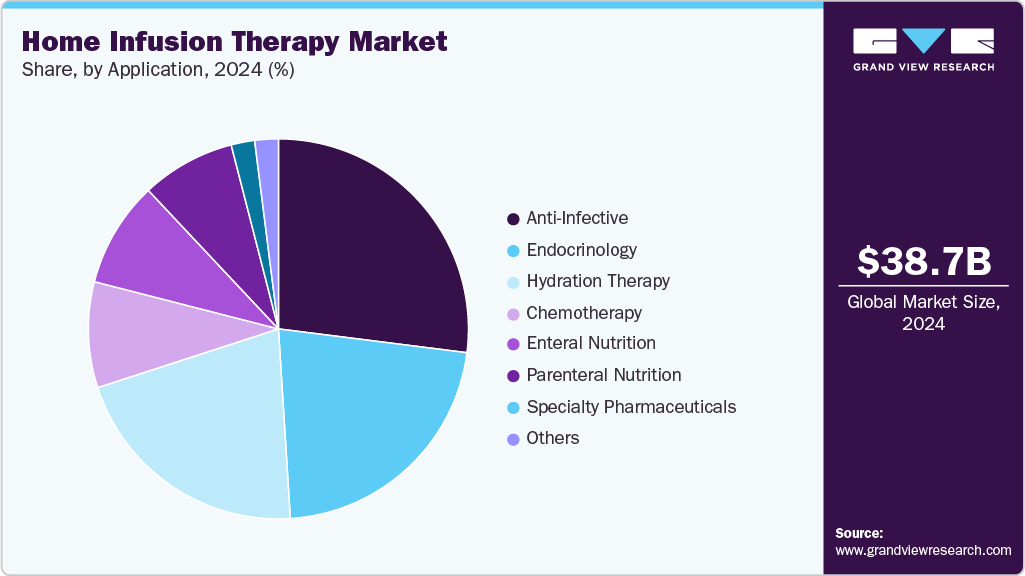

- By application, anti-infectives dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 38.66 Billion

- 2030 Projected Market Size: USD 61.72 Billion

- CAGR (2025-2030): 8.2%

- North America: Largest market in 2024

The market's growth is driven by several key factors, including the expanding geriatric population characterized by decreased mobility, a rising preference for home care, and the swift evolution of technological advancements. Infusion therapy, encompassing essential components like IV therapy and IV hydration therapy, plays a crucial role in addressing conditions such as immune deficiencies, cancer, and congestive heart failure, where oral medication is not a viable treatment option. The increasing demand for these therapies stems from the need for long-term treatment among patients, positioning home infusion therapy as a notably cost-effective alternative to hospital-based care. Incorporating IV therapy and IV hydration therapy serves as a driving force, providing patients with enhanced accessibility to effective and personalized medical solutions in the comfort of their homes.

The cost-effectiveness of home infusion therapy is a major factor driving its adoption across global healthcare systems. Enabling IV treatments outside hospital settings significantly reduces expenses associated with inpatient care, including hospital admissions, re-admissions, and extended stays. This model lowers direct treatment costs and minimizes ancillary expenditures such as facility overhead and staffing. Home infusion therapy offers substantial cost savings compared to traditional inpatient care, making it an attractive option for patients and healthcare payers. For instance,according to the National Home Infusion Association (NHIA), home infusion therapy costs approximately USD 122 to USD 225 per day. In contrast, inpatient care can range from USD 586 to USD 798 per day, depending on the therapy administered.

The increasing demographic of baby boomers struggling with diminished mobility due to conditions such as paralysis, osteoarthritis, and diabetes is expected to amplify the demand for home infusion therapy. The growing imperative to reduce the duration of inpatient stays is a pivotal factor poised to contribute significantly to the market's growth. Remarkably, continuous subcutaneous (SC) apomorphine infusion emerges as an exceptionally effective treatment for Parkinson's disease (PD), with diverse drug formulations available for the management of PD through subcutaneous delivery. In response to the mounting burden of PD, there is a notable surge in the demand for subcutaneous infusion therapy. For instance, in line with the Parkinson's Foundation's 2022 data update, approximately 90,000 individuals receive a PD diagnosis annually in the U.S. Furthermore, the anticipated number of people living with PD in the country is projected to soar to nearly 1.2 million by the year 2030.

Market Concentration & Characteristics

The home infusion therapy market is characterized by a robust demand for patient-centric healthcare solutions, emphasizing personalized treatment in the comfort of one's home. This dynamic landscape is further marked by an increasing integration of advanced technologies, fostering innovations in infusion devices, remote monitoring, and data-driven healthcare delivery.

Moreover, strategic collaborations between healthcare providers, pharmaceutical companies, and technology firms contribute to the market's vibrancy, ensuring a comprehensive and evolving approach to home-based infusion therapy.

The market is also characterized by high mergers and acquisitions (M&A) activity among leading players. This is due to several factors, including the rising focus on increasing the company’s product and service portfolio, the need to consolidate in a rapidly growing market, and the increasing strategic importance of home infusion therapy. Furthermore, in March 2021, Terumo and Glooko, a company specializing in remote patient monitoring software and mobile apps, announced a technological integration to jointly provide new diabetes data solutions globally. This collaboration enables integrating data from Terumo's diabetes care devices into Glooko's diabetes data management platform.

Type Insights

The services segment dominated the home infusion therapy market, accounting for 72.4% of the global revenue in 2024. This dominance is primarily due to the increasing demand for clinical interventions such as anti-infective therapy, parenteral nutrition, chemotherapy, hydration therapy, and pain management within home settings. The segment benefits from the growing burden of chronic diseases, rising healthcare costs, and a systemic shift toward value-based care models prioritizing patient convenience and cost reduction. Additionally, the presence of skilled home healthcare providers, coupled with favorable reimbursement policies in several developed markets, has strengthened the segment’s position. The trend toward personalized treatment plans and continuity of care at home further supports the growth and dominance of service-based offerings in this space.

The product segment is further categorized into infusion pumps, intravenous sets, IV cannulas and needleless connectors. Infusion pumps dominated the product segment in 2024. Infusion pumps, designed for controlled delivery of fluids, medications, and nutrients, were initially exclusive to healthcare facilities but are now widely adopted in outpatient settings. These devices ensure precision, reducing medication errors. The surge in home healthcare has driven the demand for syringes and ambulatory pumps. Smart pumps featuring barcode technology enhance patient identity verification and prevent administration errors. These pumps also alert healthcare workers in case of inappropriate dosage selection. The introduction of advanced infusion pumps, like the CADD-Solis ambulatory infusion pump by Smiths Medical, is expected to propel market growth in the forecast period.

Needleless connectors are anticipated to register the fastest CAGR over the forecast period. Needless connectors are small devices employed in intravenous systems to reduce needlestick injuries, thereby preventing bacterial contamination and improving safety. These devices are evaluated on the basis of interstitial surface mechanisms, blood refluxes, visibility, and external surface mechanisms. Needless connectors enable smooth operative procedures, ensure safety, and aid in adhering to clinical practices.

Application Insights

Anti-infectives dominated the market with the largest revenue share in 2024. This is attributed to the considerable number of procedures performed for the administration of antifungal and antibiotic drugs. It also helps reduce exposure to patients with other hospital-acquired infections (HAIs).

Chemotherapy is estimated to be the fastest-growing segment over the forecast period. With the growing incidence of cancer, the demand for pressure pumps is expected to increase in the coming years. Pumps used for chemotherapy at home are compact, continuous pressure pumps that do not require a battery and can hence be used for a longer period of time. These pumps help administer chemotherapy drugs at the appropriate infusion speed and in the right amounts.

Regional Insights

North America dominated the market with a revenue share of 56.6% in 2024. This can be attributed to the increasing R&D in the region and the rising adoption of new technology in infusion pumps. The increasing need for long-term therapy for patients with certain conditions is driving the regional market. Development of alternate healthcare settings and home infusion services and shifting preference from acute care to home care settings due to the low cost and enhanced patient mobility would boost the growth of this market in the coming years.

U.S. Home Infusion Therapy Market Trends

The U.S. home infusion therapy market is expected to grow over the forecast period, primarily driven by the increasing prevalence of chronic diseases and the cost-effectiveness of home-based care. Medicare covers home infusion therapy services, including nursing visits, caregiver training, and patient monitoring, for certain intravenous or subcutaneous drugs administered at home.

Europe Home Infusion Therapy Market Trends

Europe is projected to be a significant region in the coming years, driven by the region’s aging demographic and the growing incidence of chronic conditions requiring prolonged intravenous treatments. Furthermore, robust public healthcare systems and favorable reimbursement policies in countries such as Germany and France support market expansion.

Asia Pacific Home Infusion Therapy Market Trends

The Asia Pacific home infusion therapy market is anticipated to grow significantly over the forecast period. This is attributed to rising patient awareness regarding the benefits of home infusion therapy over in-hospital procedures and the growing prevalence of diabetes in the region. The ever-increasing geriatric population and the rise in chronic diseases in the region are expected to fuel the market growth further.

China Home Infusion Therapy Market Trends

China dominated the home infusion therapy market in Asia Pacific, which is primarily driven by the increasing prevalence of chronic diseases, such as diabetes and cancer, that require long-term treatment solutions, making home infusion therapy a viable and convenient option for many patients. China's rapidly aging population also contributes to the rising demand for home-based healthcare services.

Key Home Infusion Therapy Company Insights

Some key companies operating in the home infusion therapy market include Option Care Health, Inc., Baxter, and Fresenius Kabi AG.

-

Baxter, commonly known as Baxter, is a global healthcare company that provides a wide range of medical products, therapies, and technologies. With a rich history dating back to the 1930s, Baxter has evolved into a leading player in the healthcare industry. The company develops innovative solutions for critical medical needs, including renal care, medication delivery, pharmaceuticals, and various therapeutic areas.

-

Becton, Dickinson, and Company (BD) is a global medical technology company. BD specializes in developing and manufacturing medical devices, laboratory equipment, and diagnostic products that advance the diagnosis and treatment of various medical conditions. Committed to improving healthcare outcomes, BD focuses on delivering solutions in areas such as medication management, infection prevention, diagnostics, and biosciences.

Key Home Infusion Therapy Companies:

The following are the leading companies in the home infusion therapy market. These companies collectively hold the largest market share and dictate industry trends.

- Baxter

- B. Braun SE

- BD

- Fresenius Kabi AG

- ICU Medical, Inc.

- Terumo Corporation

- JMS Co. Ltd.

- Option Care Health, Inc.

- CareCentrix, Inc.

- Coram LLC.

- PharMerica Corporation

- Moog Inc.

- Amedisys, Inc.

Recent Developments

-

In June 2023, Baxter International, an American healthcare company, introduced the Progressa+ Next Gen ICU bed to address the critical needs of patients at home. This technology makes it easier for nurses to take care of patients while supporting therapy at home.

-

In May 2023, Fresenius Kabi, a global healthcare company, initiated an agreement with Premier, Inc., an American healthcare company, that resulted in pricing and term benefits for the Ivenix Infusion System. This system is designed to advance the reliability and simplicity of infusion pumps.

-

In May 2023, Option Care Health, a healthcare service provider, created an independent platform for home care services in collaboration with Amedisys Inc., a leading provider of home health services. This platform comprises pharmacists, dieticians, therapists, social workers, and others to provide high-quality healthcare services at home.

-

In April 2023, BD (Becton, Dickinson, and Company) launched a new, easy-to-use advanced ultrasound technology to provide clinicians with optimal IV insertions. More than 90% of hospitalized patients receive IV therapy, thus contributing to the market growth of home infusion therapy.

-

In January 2022, ICU Medical, a California-based global operations company, finalized the acquisition of Smiths Medical from Smiths Group Plc to create a leading infusion therapy company with a combined revenue of USD 2.5 billion.

Home Infusion Therapy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 41.71 billion

Revenue forecast in 2030

USD 61.72 billion

Growth rate

CAGR of 8.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Netherlands; Belgium; Switzerland; Russia; Sweden; China; India; Japan; Australia; South Korea; Malaysia; Indonesia; Singapore; Philippines; Thailand; Brazil; Argentina; Colombia; Chile; South Africa; Saudi Arabia; UAE; Israel; Egypt;

Key companies profiled

Baxter; B. Braun SE; BD; Fresenius Kabi AG; ICU Medical, Inc.; Terumo Corporation; JMS Co. Ltd.; Option Care Health, Inc.; CareCentrix, Inc.; Coram LLC.; PharMerica Corporation; Moog Inc.; Amedisys, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Home Infusion Therapy Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels as well as provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the home infusion therapy market report on the basis of type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Product

-

Infusion Pumps

-

Elastomeric

-

Electromechanical

-

Gravity

-

Others

-

-

Intravenous Sets

-

IV Cannulas

-

Needleless Connectors

-

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Anti-Infective

-

Endocrinology

-

Diabetes

-

Others

-

-

Hydration Therapy

-

Athlete

-

Others

-

-

Chemotherapy

-

Enteral Nutrition

-

Parenteral Nutrition

-

Specialty Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

Belgium

-

Switzerland

-

Russia

-

Sweden

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Malaysia

-

Singapore

-

Thailand

-

Philippines

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

Rest of Latin America

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Israel

-

Egypt

-

Rest of Middle East & Africa (MEA)

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.