- Home

- »

- Medical Devices

- »

-

Intravenous Hydration Therapy Market, Industry Report 2033GVR Report cover

![Intravenous Hydration Therapy Market Size, Share & Trends Report]()

Intravenous Hydration Therapy Market (2026 - 2033) Size, Share & Trends Analysis Report By Service (Immune Boosters, Energy Boosters), By Component (Medicated, Non-medicated), By Provider (Mobile, Physical), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-076-0

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

IV Hydration Therapy Market Summary

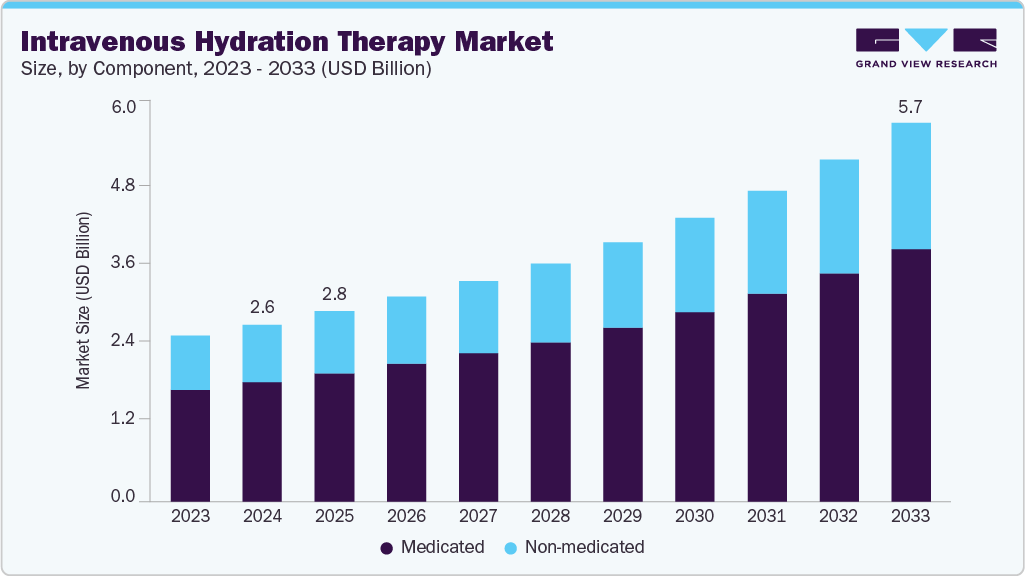

The global intravenous hydration therapy market size was valued at USD 2.83 billion in 2025 and is projected to reach USD 5.66 billion by 2033, growing at a CAGR of 9.2% from 2026 to 2033. This growth is attributed to the rising prevalence of chronic diseases such as diabetes, cardiovascular disorders, autoimmune conditions, and cancer, the growing popularity of wellness and beauty treatments, and the increasing availability of intravenous (IV) hydration therapy clinics, as well as the ease of use associated with this therapy.

Key Market Trends & Insights

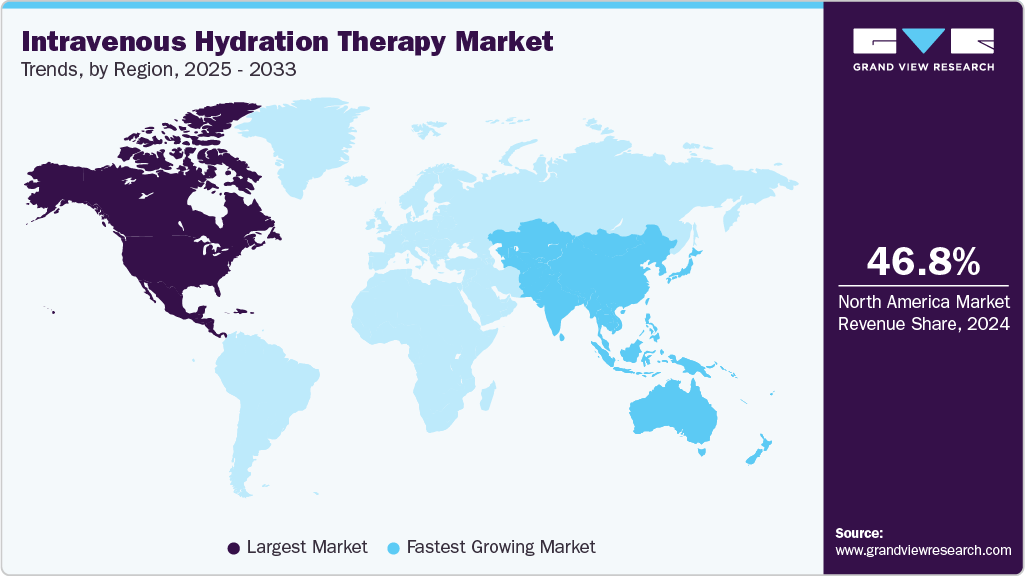

- North America dominated the market for IV hydration therapy with a share of 47.5% in 2025.

- The IV hydration therapy market in the U.S. is expected to grow at a significant CAGR over the forecast period.

- Based on service, the energy boosters segment held the largest market share of 26.36% in 2025.

- Based on provider, the physical providers segment held the dominant market share of 57.2% in 2025.

- Based on component, the medicated segment held the largest revenue share in 2025.

- Based on end use, the hospitals & clinics segment held the dominant market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.83 Billion

- 2033 Projected Market Size: USD 5.66 Billion

- CAGR (2026-2033): 9.2%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The increasing demand for IV hydration therapy is driven by the shift toward convenient, personalized wellness options that go beyond traditional clinical care. For instance, in August 2025, AquaPulse IV introduced mobile IV therapy services in Fredericksburg, Virginia. The service provides customized hydration and vitamin infusions directly to clients’ homes, workplaces, or events, administered by licensed medical professionals. Such development shows how IV therapy is becoming part of a lifestyle and preventive health approach, offering people quick recovery, energy boosts, and immune support in environments that fit their daily routines. These on-demand models highlight the rising focus on accessibility and patient-centered care in wellness services.

Growing consumer interest in preventive wellness, recovery solutions, and personalized care models is driving the expansion of the IV hydration therapy market. Beyond traditional hydration and nutrient replacement, providers are offering specialized services that support long-term health goals. For instance, in May 2025, Hydration Room introduced the NAD+ IV Membership with tiered dosing options aimed at enhancing brain health, energy, and longevity. By providing monthly access to clinically supervised NAD+ therapy in flexible doses, the program exemplifies a wider trend toward subscription-based, customized care that prioritizes consistency, convenience, and proactive health management. These innovations, along with the growth of mobile IV services and tech-enabled delivery models, are turning IV hydration therapy into a mainstream wellness option that serves both acute recovery and ongoing health optimization.

Furthermore, IV hydration therapy has gained immense popularity in the cosmetic industry, owing to the skincare benefits offered by the procedure. It has been found through extensive research that the therapy helps in providing beauty treatment by hydrating the skin, further enhancing the appearance of an individual. IV hydration therapy is believed to enhance the normal production of elastin and collagen, which are responsible for maintaining youthful and healthy-looking skin. This can help to reduce the appearance of wrinkles and fine lines over time.

Major Clinical Areas for IV Hydration Therapy Utilization

Clinical Area

Role of IV Hydration Therapy

Emergency & Critical Care

Rapid fluid resuscitation in trauma, shock, sepsis, and acute dehydration where immediate vascular access is required.

Gastrointestinal Disorders

Management of severe vomiting, diarrhea, gastroenteritis, and inflammatory bowel conditions causing fluid and electrolyte loss.

Post-Surgical Care

Maintenance of fluid balance, medication delivery, and recovery support when oral intake is restricted after surgery.

Oncology Care

Prevention and treatment of dehydration, electrolyte imbalance, and fatigue during chemotherapy and radiation therapy.

Chronic Disease Management

Hydration and electrolyte support for patients with diabetes, renal disorders, and cardiovascular conditions with limited oral intake.

Rising Adoption of Mobile IV Therapy, a Key Market Trend

Mobile IV therapy has become a key trend in the market, driven by rising demand for convenience, personalized treatments, and quick recovery options. By providing hydration, vitamins, and wellness infusions directly to homes, offices, and events, these services support busy schedules, athletic recovery, immunity boosting, and hangover relief, all while ensuring safety through licensed medical professionals. Some of the recent developments include:

-

In August 2025, NEXTDRIP Mobile IV Therapy launched a new location in Burbank, CA, offering a wide range of mobile IV hydration wellness services administered by licensed medical professionals, designed to provide convenient, personalized treatments for hydration, energy, recovery, and immunity directly to clients at home, work, or events.

-

In August, 2025, AquaPulse IV launched a mobile IV therapy service in Fredericksburg, Virginia, delivering personalized intravenous hydration and vitamin infusions directly to clients' homes, offices, and events, aimed at improving hydration, immunity, recovery, and overall wellness with professional administration and flexible scheduling.

-

In August 2025, local nurses launched a mobile IV hydration business serving the Atlanta Perimeter area, providing convenient in-home and on-site IV therapy treatments for hydration, energy boosting, wellness, and recovery from conditions like dehydration, migraines, and hangovers.

-

In June 2025, Vellum Health closed its Series A funding round led by FCA Venture Partners and launched a mobile IV care platform that integrates advanced technology, highly trained clinicians, and mobile service delivery to provide on-demand intravenous services at the bedside, aiming to expand nationally and improve patient outcomes.

-

In May 2025, The DRIPBaR Statesboro launched a mobile hydration service delivering high-quality IV therapy treatments, including vitamins, minerals, and fluids, directly to homes, offices, and events within a 30-mile radius, enhancing convenience for clients seeking hydration, recovery, and wellness support.

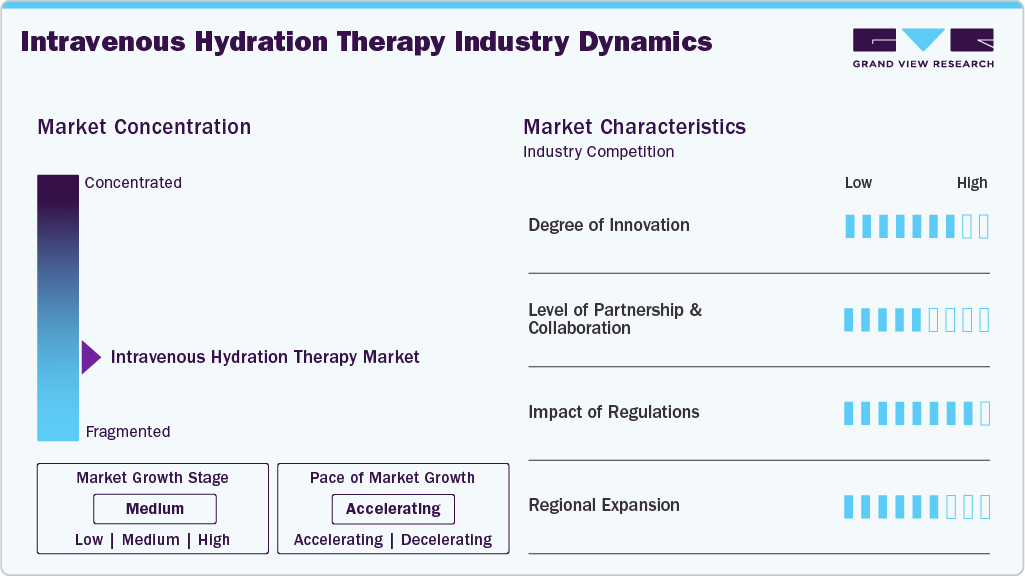

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the IV hydration therapy market is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry is high. However, the regional expansion observes moderate growth.

Innovation in the IV hydration therapy industry is rapidly advancing, driven by growing demand for personalized wellness solutions and improvements in delivery methods. For instance, in December 2024, Prime IV Hydration & Wellness launched “Power Pushes,” an innovative IV therapy that provides the same nutrient benefits as traditional drips in half the time with reduced fluid volume. This service offers tailored treatments for energy enhancement, immunity support, skin revitalization, and relief from fatigue or migraines, all administered by trained professionals across their franchise locations.

The level of partnerships and collaborations in the market is moderate, reflecting a growing focus on expanding accessibility and enhancing service quality. Providers are gradually forming alliances with healthcare professionals, wellness clinics, and mobile health platforms to develop new formulations, improve delivery models, and integrate technology-enabled monitoring systems. For instance, in August 2025, PICO IV partnered with Liquivida, appointing Liquivida founder Sam Tejada as spokesperson to promote the clinical potential of its sterile CBD emulsion and raise awareness of the body's endocannabinoid system, advancing IV hydration innovation with an emphasis on safety and education. This collaboration aims to enhance provider education and integrate sterile CBD into clinical and wellness protocols nationwide.

Regulations play a critical role in the market by ensuring patient safety, clinical oversight, and adherence to licensing and scope-of-practice requirements. Differences in rules across regions create operational challenges for providers, requiring tailored compliance strategies. At the same time, these regulations encourage investments in staff training, standardized protocols, quality assurance, and monitoring systems, helping ensure that IV hydration therapies are administered safely and effectively while building consumer trust in the services offered.

The IV hydration therapy industry is experiencing growth across various regions, driven by increasing consumer demand for wellness and recovery solutions, the expansion of mobile and on-demand IV services, and rising awareness of preventive healthcare. In addition, favorable regulatory frameworks, the establishment of standardized clinical protocols, and strategic partnerships between providers, wellness clinics, and technology platforms are accelerating market penetration and expanding access to IV therapy services.

Service Insights

Based on service, the energy boosters segment held the largest market share of 26.36% in 2025. The segment's dominance is due to the rising popularity of these therapies for providing quick and effective energy solutions. Energy IV therapy contains antioxidants, amino acids, and nutrients that help increase energy levels, as well as enhance mental clarity, mood, and focus. They tend to naturally and safely give a boost in energy without the use of stimulants or drugs, which is expected to drive demand.

However, the beauty and aesthetics segment is expected to grow at the fastest CAGR of 10.5% during the forecast period. This growth is driven by increasing patient spending on cosmetic procedures and beautification. Beauty IV drips consist of a special blend of minerals, electrolytes, and vitamins that help target and eliminate free radicals, which contribute to aging. In addition, they naturally detoxify the body and remove toxins, enhancing a youthful appearance of the skin. These numerous beauty benefits have led to a rising demand for skin care services.

Component Insights

Based on component, the medicated segment held the largest revenue share of 67.3% in 2025. This dominance is due to the increasing demand for medications administered through the IV route, along with key players focusing on developing customizable medicated IV hydration therapy solutions. For instance, Drip Hydration offers Stomach Flu IV treatment, consisting of an infusion of electrolytes, vitamins, fluids, and drugs to alleviate stomach flu symptoms and restore hydration within 30-60 minutes. This IV medication contains Vitamin B12, B-Complex vitamins, Vitamin C, Zofran, and Pepcid. Zofran is an anti-nausea/vomiting medication that helps reduce nausea and vomiting caused by the stomach flu.

On the other hand, the non-medicated segment is expected to grow at the fastest CAGR during the forecast period. The segment's growth can be linked to the increasing demand for therapies in beauty and energy-boosting applications. The steadily growing global population is widely adopting IV hydration therapy to hydrate their skin and maintain its natural glow.

Provider Insights

Physical providers held the largest market share in the IV hydration therapy market in 2025, driven by the widespread presence of wellness clinics, hospitals, and specialized IV therapy centers offering treatments for dehydration, fatigue, skin health, and immunity support. Their established infrastructure, professional expertise, and ability to provide personalized, medically supervised infusion therapies have positioned them as the primary choice for consumers.

Mobile providers are expected to register the highest CAGR in the IV hydration therapy industry, supported by rising demand for on-demand, at-home wellness and recovery solutions. The convenience of doorstep services, growing popularity among busy professionals, athletes, and travelers, and integration with digital booking platforms are fueling their rapid adoption.

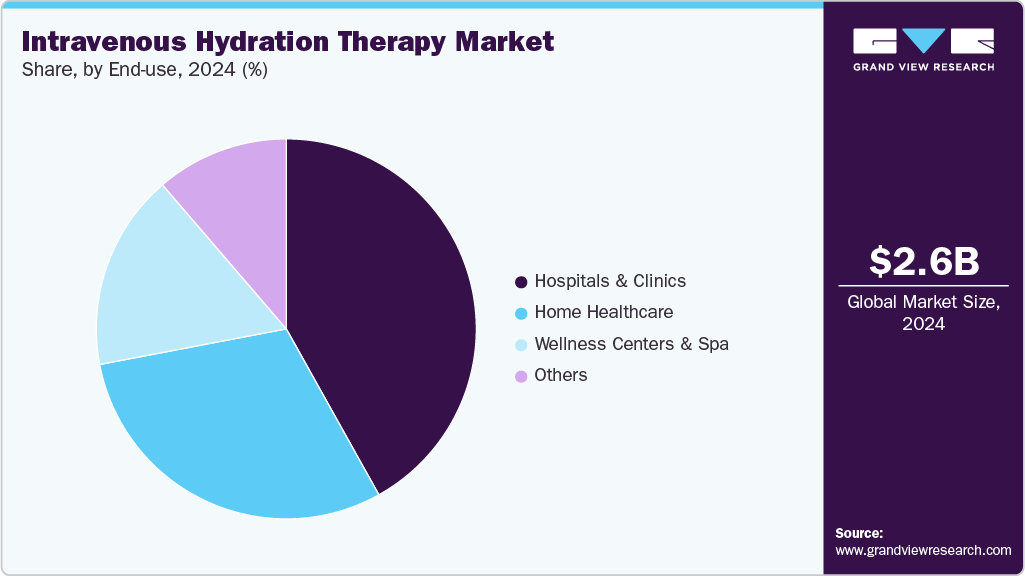

End-use Insights

Based on end use, hospitals & clinics held the dominant market share in 2025. The segment growth can be attributed to the rising need for hospitalization due to an increase in the number of people suffering from chronic disorders where IV hydration therapy is commonly used for managing dehydration, electrolyte imbalances, nutritional deficiencies, medication administration, post-surgical recovery, oncology care, gastrointestinal disorders, renal conditions, and acute infections requiring rapid fluid and nutrient replenishment.

The home healthcare segment is expected to witness the fastest CAGR over the forecast period, fueled by increasing consumer demand for convenient, personalized wellness and recovery solutions. The rising popularity of mobile IV services, at-home infusions, and subscription-based wellness programs enables patients to receive clinically supervised therapy without visiting a clinic, enhancing comfort and accessibility.

Regional Insights

North America Intravenous hydration therapy market dominated the global industry with a share of 46.7% in 2025 and is anticipated to maintain its dominance over the forecast period. The high share of the market is due to the wide adoption of IV hydration therapy in the U.S. There is an increasing demand for energy and immune boosters in the region, owing to rising incidences of chronic diseases such as diabetes, cardiovascular disorders, autoimmune conditions, and cancer. The region boasts a high disposable income and high patient spending on overall wellness, which increases the adoption of the market. Moreover, key players in the region are constantly focusing on introducing novel technologies into the market to meet the changing consumer demands, which is further anticipated to drive regional market growth. For instance, in December 2022, The DRIPBaR entered a partnership with entrepreneur and investor Kevin Harrington, who will be a major investor in the IV therapy franchise. The franchise has been gaining immense acceptance across the region.

U.S. Intravenous Hydration Therapy Market Trends

The IV hydration therapy industry in the U.S. is growing rapidly, driven by increasing awareness of the benefits of intravenous fluids for rapid rehydration, nutrient replenishment, and wellness applications. Rising demand from hospitals, outpatient clinics, and specialty wellness centers, coupled with the growing popularity of preventive and performance-enhancing hydration therapies, is fueling adoption. In addition, advancements in IV therapy solutions, such as vitamin-enriched fluids and portable infusion devices, along with a focus on patient comfort and minimally invasive care, are further propelling market growth across both clinical and lifestyle segments.

Europe Intravenous Hydration Therapy Market Trends

The IV hydration therapy industry in Europe is witnessing steady growth, driven by increasing awareness of rapid rehydration and nutrient supplementation benefits in both clinical and wellness settings. Rising adoption in hospitals, outpatient clinics, and wellness centers, coupled with growing interest in preventive healthcare and performance-enhancing therapies, is fueling demand. Technological advancements in infusion devices, customized nutrient formulations, and patient-centric administration methods are further supporting market expansion across key European countries.

The IV hydration therapy industry in the UK is experiencing growth, driven by increasing awareness of the benefits of rapid rehydration, nutrient supplementation, and wellness-focused therapies in both clinical and lifestyle settings. Rising adoption in hospitals, outpatient clinics, and specialized wellness centers, along with a growing focus on preventive healthcare and patient-centric care, is fueling demand. For instance, in February 2024, Clinicbe London launched Intravenous Nutrient Therapy (IVNT), offering a range of personalized vitamin and nutrient infusions to boost health and wellness, complemented by free OligoScan testing and consultations until March 31, 2024. This initiative exemplifies the trend toward combining medical treatment with wellness and performance enhancement, further accelerating market adoption.

The IV hydration therapy industry in Germany is expanding, driven by rising consumer demand for wellness-focused treatments, preventive healthcare, and quick recovery solutions for fatigue, dehydration, and stress. Increasing adoption among urban professionals and athletes, alongside growing medical use for post-surgical recovery and nutrient deficiencies, is fueling uptake.

Asia Pacific Intravenous Hydration Therapy Market Trends

Asia PacificIV hydration therapy industry is estimated to be the fastest-growing region over the forecast period. The region's expansion can be attributable to the increased awareness of IV hydration therapy and its associated benefits. Moreover, the market is expected to witness a surge in demand owing to initiatives being taken by healthcare facilities in the region, as a result of the rising occurrence of various immunity disorders. For instance, in December 2022, Chinese clinics announced the launch of a drive-through IV Infusion system to help deal with the overwhelming number of COVID patients.

The IV hydration therapy industry in Japan is experiencing growth, driven by increasing consumer interest in wellness and preventive healthcare. Factors such as rising awareness of the benefits of rapid rehydration, nutrient supplementation, and personalized therapies are contributing to this trend. For instance, Tokyo Midtown Clinic offers a range of intravenous vitamin infusions, including high-dose vitamin C and liver detox cocktails, aimed at enhancing immunity, combating fatigue, and promoting skin health. These offerings reflect the growing demand for tailored hydration solutions that cater to individual health and beauty needs.

The China IV hydration therapy industry is witnessing rising adoption driven by increasing urban stress, growing demand for wellness and beauty-oriented treatments, and the expanding medical aesthetics sector. The popularity of IV nutrient therapies is fueled by consumer interest in energy enhancement, anti-aging, and skin rejuvenation. According to a report in August 2025, the use of intravenous nutrient therapy (IVNT) drips is gaining momentum in China and South Korea, with antioxidant-rich formulations like the “Cinderella drip” and garlic drip favored for their potential benefits in boosting energy and improving skin health. This trend highlights how wellness-conscious consumers in China are embracing IV hydration as a lifestyle and preventive healthcare solution.

Latin America Intravenous Hydration Therapy Market Trends

The Latin America IV hydration therapy industry is gaining momentum, supported by increasing adoption of wellness and preventive healthcare solutions, rising medical tourism, and growing consumer demand for quick recovery and energy-boosting treatments. Urban populations in countries such as Brazil is increasingly seeking IV nutrient infusions for hydration, immunity support, and skin health, often offered in premium wellness centers and private clinics.

Middle East & Africa Intravenous Hydration Therapy Market Trends

The Middle East IV hydration therapy industry is growing, driven by increasing medical tourism, rising consumer interest in wellness solutions, and the opening of luxury clinics in hubs such as Dubai and Riyadh that offer customized drips for energy, beauty, and recovery. However, safety concerns remain a major obstacle, exemplified in August 2025 when a woman in Dubai was hospitalized after a severe allergic reaction to her first IV drip, highlighting expert warnings that trend-driven health and beauty treatments can pose risks like vein irritation and nutrient imbalances.

Key Intravenous Hydration Therapy Company Insights

Key players in the IV hydration therapy industry are adopting innovative strategies, offering personalized infusion formulations, mobile and in-clinic services, and digital booking platforms to enhance accessibility and patient experience. Integration of smart infusion technologies and partnerships with wellness centers, fitness facilities, and luxury providers are further driving adoption and expanding market reach.

Key Intravenous Hydration Therapy Companies:

The following are the leading companies in the intravenous (IV) hydration therapy market. These companies collectively hold the largest market share and dictate industry trends.

- Baxter

- B. Braun SE

- Otsuka Pharmaceutical Co., Ltd.

- Grifols, S.A.

- Vifor Pharma Management Ltd.

- JW Life Science Corporation

- Amanta Healthcare

- NexGen Health

- Core IV Therapy, LLC

- Cryojuvenate UK Ltd.

- Drip Hydration

- REVIV

Recent Developments

-

In August 2025, ChromaDex announced the launch and nationwide availability of pharmaceutical-grade intravenous Niagen (nicotinamide riboside chloride), offering a superior, faster, and better-tolerated alternative to traditional NAD+ IV therapies for enhanced cellular health and aging benefits.

-

In March 2025, beOnd Airlines announced a partnership with The Elixir Clinic to offer passengers exclusive IV VitaDrip therapy as an add-on to their flight bookings, enhancing wellness and hydration before or after flights between Dubai, the Maldives, and Zurich. This collaboration aims to elevate the luxury travel experience by combining holistic wellness with premium air travel comfort.

Intravenous Hydration Therapy Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3.05 billion

Revenue forecast in 2033

USD 5.66 billion

Growth rate

CAGR of 9.2% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Market value in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, component, provider, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Baxter; B. Braun SE; Otsuka Pharmaceutical Co., Ltd.; Grifols, S.A.; Vifor Pharma Management Ltd.; JW Life Science Corporation; Amanta Healthcare; NexGen Health; Core IV Therapy, LLC; Cryojuvenate UK Ltd.; Drip Hydration; REVIV

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intravenous Hydration Therapy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global intravenous hydration therapymarket report based on service, component, provider, end-use, and region:

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Immune Boosters

-

Energy Boosters

-

Hydration

-

Beauty/ Aesthetics

-

Detoxification

-

Longevity/ Antiaging

-

Performance/ Athletics

-

Migraine & Pain Relief

-

Stress/Sleep/Mood Support

-

Flu/Stomach

-

Others

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Medicated

-

Non-medicated

-

-

Provider Outlook (Revenue, USD Million, 2021 - 2033)

-

Mobile Providers

-

Physical Providers

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Clinics

-

Wellness Centers and Spas

-

Home Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some of the key players in the global IV hydration therapy market include Baxter, B. Braun SE, Otsuka Pharmaceutical Co., Ltd., Grifols, S.A., Vifor Pharma Management Ltd., JW Life Science Corporation, Amanta Healthcare, NexGen Health, Core IV Therapy, LLC, Cryojuvenate UK Ltd., Drip Hydration, and REVIV.

b. North America dominated the IV hydration therapy market with a share of 46.7% in 2025and is anticipated to maintain its dominance over the forecast period. The high share of the market in the region can be due to the unprecedented adoption of IV hydration therapy in the U.S.

b. The growth of the intravenous hydration therapy market is attributed to rising prevalence of chronic diseases such as diabetes, cardiovascular disorders, autoimmune conditions, and cancer, the growing popularity of wellness and beauty treatments, and the increasing availability of IV hydration therapy clinics, as well as the ease of use associated with this therapy.

b. The global intravenous (IV) hydration therapy market is expected to grow at a compound annual growth rate of 9.2% from 2026 to 2033 to reach USD 5.66 billion by 2033.

b. The global intravenous hydration therapy market size was estimated at USD 2.83 billion in 2025 and is expected to reach USD 3.05 billion in 2026.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.