- Home

- »

- Healthcare IT

- »

-

Hospital Information System Market Size & Share Report, 2030GVR Report cover

![Hospital Information System Market Size, Share & Trends Report]()

Hospital Information System Market Size, Share & Trends Analysis Report By Type (EHRs, Patient Engagement Solutions), By Component (Software, Services), By Deployment (On-premise, Cloud-based), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-364-5

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

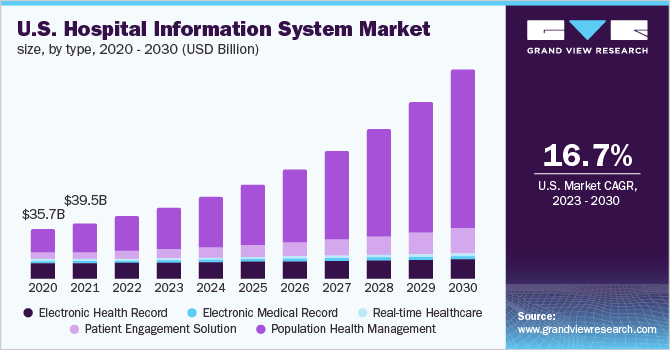

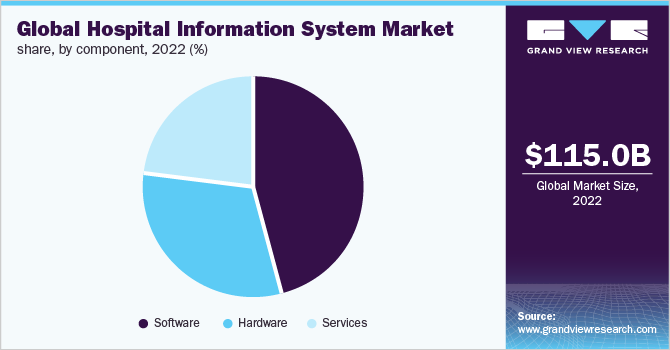

The global hospital information system market size was valued at USD 115.0 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 17.4% from 2023 to 2030. Hospital Information Systems (HIS) help healthcare facilities to improve their operational outcomes and reduce the workload on the staff, which is expected to boost industry growth. Various initiatives undertaken by governments across the globe and rising demand for the deployment of advanced IT solutions in hospitals for enhanced operational efficiency are some of the key factors that are expected to boost the adoption of HIS. The need to curb healthcare expenditures due to hospital workflow inefficiencies is also anticipated to boost the adoption of these systems globally. Thus, the growing demand for effective clinical outcomes and reduced healthcare costs are some of the key factors that are boosting the adoption of HIS in developed and emerging economies.

The developed and developing economies are struggling to provide high care delivery standards that are quality oriented with minimum medical errors and are cost-effective. The implementation of these systems helps providers offer improved patient outcomes and streamline their workflows, which is expected to further drive the demand for the systems.

Moreover, these systems offer cost-effective services and help reduce resource wastage. The rising penetration of technologically advanced solutions is also expected to drive industry growth. The rising implementation of healthcare IT services and solutions by hospitals to provide enhanced care to patients at reduced costs combined with the increasing need to upgrade the existing systems is likely to be a key driver for the industry growth. Moreover, constant upgrades in the healthcare and IT infrastructure along with increased adoption of cloud-based services in healthcare facilities are expected to drive the market further.

There are stringent regulatory norms, which ensure safe and secure storage of patient data, confidentiality, user-level authorization, traceability of information, and mitigation of cyber security threats. Thus, healthcare facilities are switching from on-premise software to cloud-based information systems to avoid security breaches and maintain data security. The pandemic had a positive impact on the industry. Factors, such as increased adoption of the HIS to reduce the workload on the already strained healthcare professionals contributed to the industry growth. Moreover, the high adoption of IT solutions in healthcare facilities further boosted the demand for these systems.

Type Insights

On the basis of types, the global industry has been further categorized into Electronic Health Records (EHRs), electronic medical records, real-time healthcare, patient engagement solution, and population health management. The population health management type segment dominated the global industry in 2022 and accounted for the maximum share of more than 49.65% of the overall revenue. Factors, such as the rising adoption of IT solutions in the healthcare and rising demand for value-based care delivery by healthcare professionals, contributed to the growth of this segment.

Moreover, increasing demand for effective disease management at lower costs is expected to boost software adoption, fueling segment growth during the forecast period. The software also helps reduce the re-admission of patients and optimum interventions for patients. This is also expected to boost segment growth. The segment is projected to expand further at the fastest CAGR maintaining its leading position throughout the forecast period. The population health management systems help in cost control by providing cost-effective alternatives to physicians. Moreover, the solutions also enable risk stratification, data aggregation, and patient communication. and care coordination, which helps improve patient outcomes.

Deployment Insights

On the basis of deployment, the global industry has been further categorized into on-premise, web-based, and cloud-based. The web-based deployment segment dominated the global market in 2022 and accounted for the maximum share of more than 41.95% of the overall revenue. An increasing number of hospitals adopting web-based deployments as compared to on-premises deployments is expected to boost the growth of this segment. The web-based platforms include electronic medical records and other information systems, which are expected to have a high demand from small- and medium-sized healthcare providers to improve their operational workflows.

Moreover, other benefits of web-based deployments, such as easy installment and maintenance, are expected to further drive the segment's growth. The cloud-based segment is expected to witness the fastest CAGR during the forecast period. This is due to the increasing demand for cloud-based technology by small-, medium- and large-scale hospitals to streamline their operations, such as legal, financial, and administrational operations. Cloud-based information systems witnessed considerable growth in recent years due to the rising security breaches on the on-platform and web-based deployments. Cloud-based platforms offer higher security as compared to the other deployments, which is also expected to contribute to segment growth.

Component Insights

On the basis of components, the global industry has been further categorized into software, services, and hardware. The software component segment dominated the global industry in 2022 and accounted for the maximum share of more than 45.50% of the overall revenue. Rising demand for comprehensive integrated software solutions in healthcare facilities significantly contributed to the growth of this segment. The software solutions perform critical functions, such as data capture, storage, interpretation, and analysis. The software solutions need periodic upgrades to sync with the latest analytics methods, which helps the facilities in managing their workflows.

On the other hand, the services component segment is expected to register the fastest growth rate during the forecast period. This rapid growth can be attributed to the factors, such as the increasing adoption of technologically advanced solutions. In addition, cost-effective solutions offered by the key companies, which are also easy to install, are positively contributing to the growth of this segment. Several vendors in the global industry offer various services, such as optimization, hosting, consulting, and installation, which help hospitals in managing their information systems.

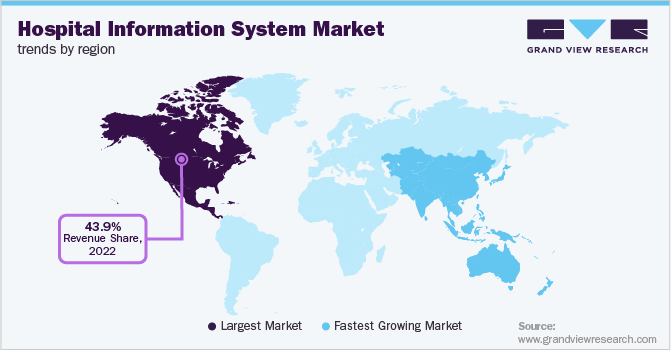

Regional Insights

North America was the dominant region in 2022 and accounted for the maximum share of more than 43.90% of the overall revenue. Factors, such as the high demand for technologically advanced products in hospitals in the U.S. combined with the presence of a large number of IT vendors, such as GE Healthcare, Oracle Cerner, Carestream Health, McKesson, and NextGen Healthcare, contributed to the growth of the regional market in the regional market. Moreover, the presence of large-scale hospital settings, such as St. Jude Children’s Research Hospital, University of Maryland Medical Center, John Hopkins Medicine, Mayo Clinic, and Cleveland Clinic, boost product demand in the region.

Asia Pacific, on the other hand, is expected to register the fastest growth rate during the forecast period. Increasing healthcare expenditure is expected to strengthen the healthcare IT infrastructure in the region, thereby boosting the demand for HIS. Improving healthcare facilities in countries, such as Japan, Malaysia, Australia, and South Korea, is also expected to support market growth in the region. Moreover, rising product demand for efficient management of administrative, clinical, and financial aspects combined with increasing implementation of HIS by healthcare facilities in the region is expected to fuel the region’s growth.

Key Companies & Market Share Insights

Innovations in product offerings by key players and the entry of new players have led to high market competition. For instance, in December 2021, Cerner announced it had been acquired by Oracle. Through this acquisition, the companies will transform healthcare delivery by providing healthcare professionals with the information to make better treatment decisions. Some of the prominent players in the global hospital information system market include:

-

Carestream Health

-

Siemens Healthineers

-

McKesson Corp.

-

Philips Healthcare

-

Merge Healthcare Inc. (IBM)

-

GE Healthcare

-

Cerner Corp. (Oracle)

-

Allscripts

-

NextGen Healthcare

Hospital Information System Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 132.1 billion

Revenue forecast in 2030

USD 405.6 billion

Growth rate

CAGR of 17.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2016 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, component, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; Spain; Italy; France; Russia; Sweden; The Netherlands; Japan; China; India; Australia; Singapore; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Carestream Health; Siemens Healthineers; McKesson Corp.; Philips Healthcare; Merge Healthcare Inc. (IBM); GE Healthcare; Cerner Corp. (Oracle); Allscripts; NextGen Healthcare

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hospital Information System Market Segmentation

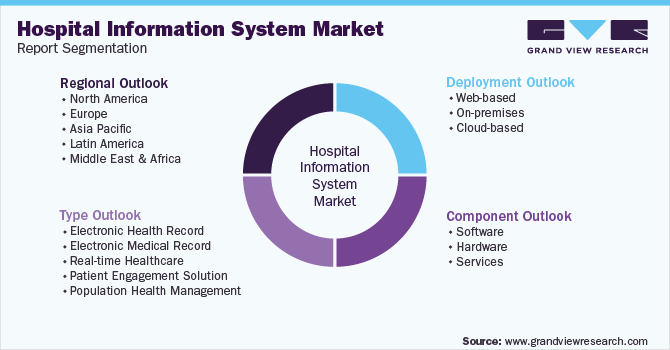

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the global hospital information system market report on the basis of type, deployment, component, and region:

-

Type Outlook (Revenue, USD Million, 2016 - 2030)

-

Electronic Health Record

-

Electronic Medical Record

-

Real-time Healthcare

-

Patient Engagement Solution

-

Population Health Management

-

-

Deployment Outlook (Revenue, USD Million, 2016 - 2030)

-

Web-based

-

On-premises

-

Cloud-based

-

-

Component Outlook (Revenue, USD Million, 2016 - 2030)

-

Software

-

Hardware

-

Services

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Russia

-

Italy

-

Spain

-

The Netherlands

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global hospital information system market size was estimated at USD 115.0 billion in 2022 and is expected to reach USD 132.1 billion in 2023.

b. The global hospital information system market is expected to grow at a compound annual growth rate of 17.4% from 2023 to 2030 to reach USD 405.6 billion by 2030.

b. Web-based technology dominated the hospital information system market with a share of 42.0% in 2022. This is attributable to the widespread use of web-based systems include cost considerations and easy installations.

b. Some key players operating in the HIS market include GE Healthcare; Cerner Corporation; Carestream Health; Siemens Healthineers; Philips Healthcare; Merge Healthcare; McKesson Corporation; NextGen Healthcare; and Allscripts.

b. Key factors that are driving the hospital information system market growth include a rapid increase in the adoption of these systems for efficient management of hospital operations and rising demand for efficient management of the large volume of data generated and its availability for medical practitioners.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."