- Home

- »

- Healthcare IT

- »

-

Population Health Management Market Size Report, 2030GVR Report cover

![Population Health Management Market Size, Share & Trends Report]()

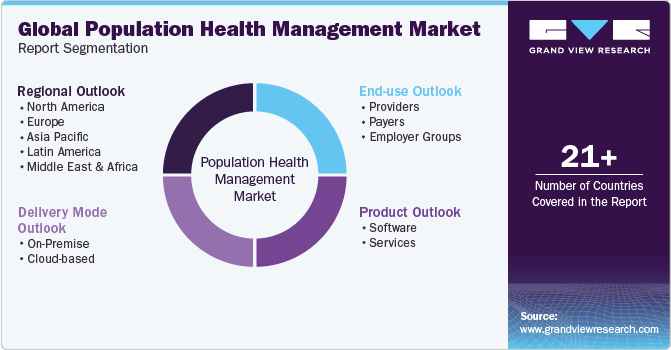

Population Health Management Market Size, Share & Trends Analysis Report By Product (Software, Services), By Delivery Mode (On-Premise, Cloud-based), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-187-0

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

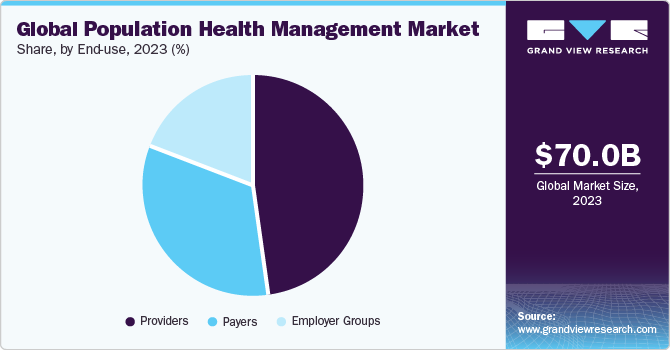

The global population health management market size was estimated at USD 70.0 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 22.0% from 2024 to 2030. The medical industry is rapidly transforming to digitization from a paper-based system, increasing demand for healthcare IT services. In addition, increasing demand for solutions supporting healthcare providers has resulted in a shift from Fee-For-Service (FFS) to Value-Based Payment (VBP) models. Rising demand for effective disease management strategies is expected to boost market growth.

During the COVID-19 pandemic, medical institutions were under tremendous strain, and healthcare industry globally was swamped by a high number of patients regularly. The pandemic has increased necessity for reliable diagnostic and treatment solutions. PHM solutions have proven to be extremely beneficial for healthcare providers as they integrate solutions such as care management, electronic health records, and patient management & healthcare payer solutions such as payment and claim management.

Population health management system assists as a patient-friendly platform that aids in cost-controlling of treatment. In addition, the platform assists service providers and payers with risk management related to reimbursement policies. In recent years, healthcare system has evolved significantly and has become more patient-centered.

In addition, PHM solutions enable healthcare industry to provide patient-centric care and help reduce high medical care costs by reducing readmission and providing appropriate and optimum intervention to patients. Furthermore, rapid global spread of COVID-19 has resulted in demand for electronic data transfer and claim management. This is projected to lead to an increase in use of population health management in forecast period.

Market Dynamics

Government bodies are aiding healthcare providers to integrate PHM software to improve patient outcomes and reduce overall healthcare expenditure. For instance, UK government and NHS are launching several programs and policies that are expected to create opportunities for PHM providers. For instance, in July 2022, UK parliament passed Health and Care Bill, granting legal responsibilities and statutory footings to ICSs, which is expected to have a direct impact on UK market.

PHM solutions aim at data-driven healthcare at population level and enable segmentation of patients based on common medical conditions and attributes. PHM enables data aggregation, risk stratification, care coordination, and patient communication. Patient care systems have improved, and use of population healthcare management systems has increased exponentially. As complexity in care delivery, payment models, and clinical needs are increasing, need for PHM programs that combine multiple functionalities is rising, which can process clinical, financial, and operational data to improve efficiency and patient care.

Penetration of healthcare IT solutions is a result of growing preference for value-based reimbursement structures and accountable care. In near future, raising awareness about adoption of better personalized medicine is expected to provide significant potential prospects for market players. Furthermore, there are a variety of solutions available, each with its own set of functions in varied care settings. These tools aid in data collection and enable payers and patients, particularly insurers, to get the most out of their healthcare expenditures.

Apart from ensuring access to healthcare, population healthcare management programs also ensure that healthcare is affordable to general public. Various approaches implemented by hospital administrators and physicians have recently been effective in testing new disease risk management models, improving medication adherence, along with lowering overall hospital costs.

Product Insights

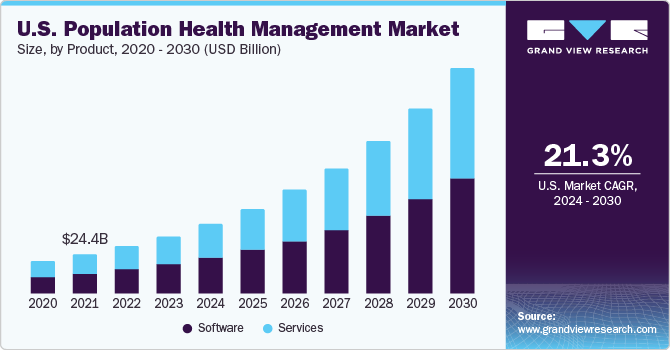

Based on product, market is segmented into software and services. In 2023, services segment gained a major market share of 51.6%. Demand for PHM services is increasing among hospitals and other healthcare organizations to involve third parties to assess patient data. Need for integrated healthcare systems is also responsible for increasing demand for PHM services.

Besides, rising R&D investment by manufacturers to launch innovative products has supported healthcare organizations to a major extent. For instance, in December 2022, Morris Heights Health Center (MHHC), a healthcare center launched a partnership with Garage, a population health management technology company, under which health center will use a platform to improve care in the Bronx community for 50,000 patients.

Company’s Garage’s Software as a Service population health management platform “Bridge” is designed to connect care teams and providers to facilitate patient information exchange, secure messaging, patient tracking & communication, referral management, clinical integration, clinical intelligence, clinical data management, and clinical analytics.

Delivery Mode Insights

Based on delivery mode, market is segmented into On-Premise and Cloud-based. Cloud-based segment held the largest market share of 71.9% in 2023 and is anticipated to register the fastest CAGR over the forecast period. In addition, a cloud-based population health management suite improves processes with cutting-edge data integration technologies and advanced analytics, further benefiting end-user to meet their population health management requirements.

In addition, cloud-based platform assists with workflow automation, improved care management, and coordination with better clinical results. Likewise, cloud-based segment has witnessed its highest demand during the COVID-19 pandemic benefiting market growth.

End-use Insights

Healthcare providers segment held a revenue share of 48.0% in 2023, owing to improved clinical outcomes by aiding in better disease management, resulting in reduced in-patient stays and minimized observation hours of physicians. Healthcare providers are increasingly investing in population health management to offer better outcomes. It can be used to track discharged patients’ vital signs, which can then be analyzed to provide insights into patient’s health.

Furthermore, the pandemic has helped healthcare providers to offer physicians an integrated electronic medical record (EMR) to collect data from patients and create registries. This factor has supported providers to focus on patient care and reduce overall costs.

Payers are ideally third-party entities that reimburse or finance health services costs. This competitive advantage has led to increasing demand for PHM software for payers and is expected to propel segment growth over forecast period.

Regional Insights

North America dominated the market and is anticipated to grow lucratively throughout forecast period with a revenue share of 46.2% in 2023. Growth is driven by reduced medical costs, cloud computing, regulatory scenarios, rising use of information technology in healthcare, and increasing disease prevalence. Furthermore, in this region, the U.S. is one of the primary hubs that offer commercialized PHM services, with more than 100 companies operating in region. High potential of market is attracting new players into region and simultaneously, existing players are making value-based additions to their current offerings to create new opportunities in market.

Asia Pacific’s market is anticipated to witness fastest growth throughout forecast period due to developing healthcare infrastructure and rising healthcare expenditure. Furthermore, chronic disease incidence is expected to double from 2001 to 2025 in the Asia Pacific region. For managing data generated from these increased incidences of chronic diseases, advanced data analytics will be required, which is expected to boost market growth.

Key Companies & Market Share Insights

Companies' strategic initiatives to strengthen their market presence include mergers and acquisitions, providing customized solutions, and business partnerships with other key players. Furthermore, as part of their commercialization strategies, companies are investing significant sums of money in developing new products and platforms with enhanced and improved features.

-

For instance, in January 2023, Gainwell Technologies was awarded a USD 600 million contract by the California Department of Health Care Services as part of the CalAIM initiative for population health management services.

-

In October 2022, MEDITECH introduced Expanse Population Insight, a population health management product. The product is supported by the Innovaccer Data Platform and offers data aggregation and curation along with care delivery and data analytics.

Key Population Health Management Companies:

- Veradigm LLC

- Oracle

- Conifer Health Solutions, LLC

- eClinicalWorks

- Enli Health Intelligence (Cedar Gate Technologies)

- McKesson Corporation

- Medecision

- Optum, Inc.

- Koninklijke Philips N.V.

- Athenahealth, Inc.

- Welltok (Virgin Pulse)

Population Health Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 85.2 billion

Revenue forecast in 2030

USD 280.8 billion

Growth rate

CAGR of 22.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, delivery mode, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Norway; Denmark; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Veradigm LLC.; Oracle; Conifer Health Solutions, LLC; eClinicalWorks; Enli Health Intelligence (Cedar Gate Technologies); McKesson Corporation; Medecision; Optum, Inc.; Koninklijke Philips N.V.; Athenahealth, Inc.; Welltok (Virgin Pulse)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Population Health Management Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global population health management market report based on product, delivery mode, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premise

-

Cloud-based

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Providers

-

Payers

-

Employer Groups

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global population health management market size was estimated at USD 70.0 billion in 2023 and is expected to reach USD 85.2 billion in 2024.

b. The global population health management market is expected to grow at a compound annual growth rate of 22% from 2024 to 2030 to reach USD 280.8 billion by 2030.

b. North America dominated the population health management market with a share of 46.2% in 2023. This is attributable to the supportive government initiatives, rising healthcare costs, and local presence of major players in the market.

b. Some key players operating in the population health management market are Veradigm LLC, Oracle, Conifer Health Solutions, LLC, eClinicalWorks, Enli Health Intelligence, McKesson Corporation, Medecision, Optum, Inc., Advisory Board, Koninklijke Philips N.V., Athenahealth, Inc., Welltok

b. Key factors that are driving the population health management market growth include the shift from Fee-For-Service (FFS) to Value-Based Payment (VBP) models, accelerating demand for healthcare IT solutions, and growing need for disease management strategies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."