- Home

- »

- Healthcare IT

- »

-

Patient Engagement Solutions Market Size Report, 2030GVR Report cover

![Patient Engagement Solutions Market Size, Share & Trends Report]()

Patient Engagement Solutions Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (AI-Driven Engagement, Telehealth Solutions), By Delivery (Web/Cloud-based, On-premise), By Functionality, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-024-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Patient Engagement Solutions Market Summar

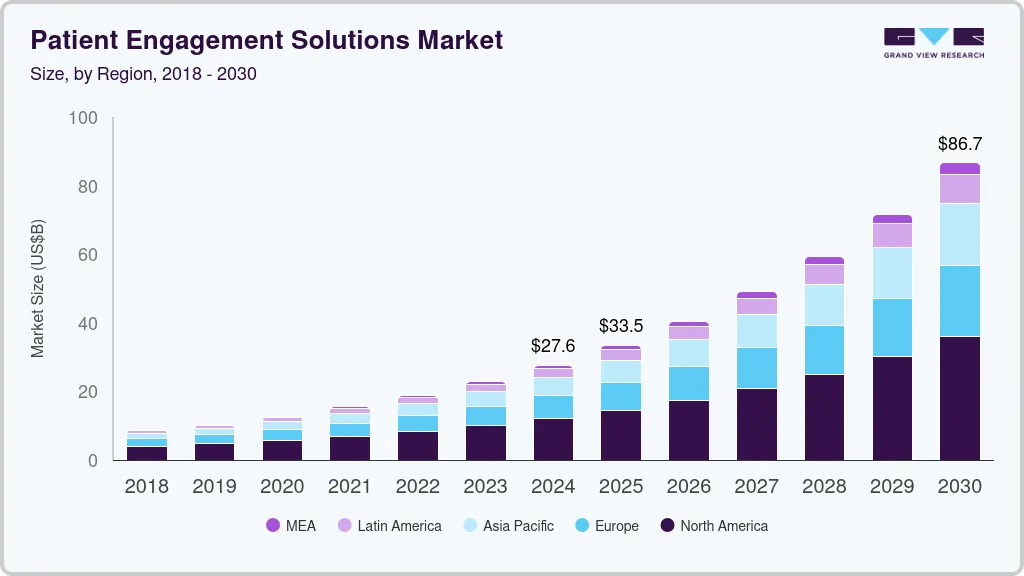

The global patient engagement solutions market size was estimated at USD 27.63 billion in 2024 and is projected to reach USD 86.67 billion by 2030, growing at a CAGR of 20.97% from 2025 to 2030. Growing technological developments, adoption of EHR and mhealth solutions, the prevalence of chronic diseases, supportive initiatives by key market stakeholders, and consumerism in healthcare are some of the key drivers of this market.

Key Market Trends & Insights

- North America patient engagement solutions industry dominated the global market with a revenue share of 43.59% in 2024.

- The patient engagement solutions industry in the U.S. is expanding rapidly.

- Based on type, the AI-driven engagement segment held the largest revenue share of 27.05% in 2024.

- In terms of delivery, web/cloud-based held the largest revenue share of 72.27% in 2024.

- Based on functionality, the enhanced communication segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 27.63 billion

- 2030 Projected Market Size: USD 86.67 billion

- CAGR (2025-2030): 20.97%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

On the other hand, pooling resources and expertise drive advancements in patient engagement tools, leading to better health outcomes and increased patient satisfaction. For instance, in November 2023, Signature Healthcare selected NRC Health to improve its network by adopting patient-focused healthcare strategies and data-informed insights to better understand its patients, staff, and local communities.

The rising demand for personalized healthcare is a significant driver of market growth. Patients are looking for solutions that address their needs and preferences, moving away from one-size-fits-all care models. Patient engagement solutions utilizing AI and data analytics are reshaping the healthcare experience by delivering personalized treatment plans. These technologies allow care to be tailored to each individual's health profile, improving patient satisfaction and clinical outcomes.

Government initiatives promoting patient-centric care are playing a significant role. For instance, in March 2022, DeliverHealth's partner program was introduced, strengthening sales globally. This aids strategic partners in enhancing patient outcomes, reducing costs, and streamlining healthcare complexities. Such initiatives help create a more connected healthcare environment, ultimately improving patient outcomes. Moreover, developing countries such as India benefit from supportive government initiatives.

The COVID-19 pandemic accelerated innovations in patient monitoring and cloud computing. For instance, in April 2020, GE Healthcare introduced a cloud-based remote-monitoring tool to help clinicians manage ventilated COVID-19 patients. The global increase in smartphone usage has also driven the adoption of mobile health (mHealth) solutions, benefiting both healthcare providers and consumers. The rise of healthcare apps, easily downloadable on smartphones and compatible with wearable devices, has supported users in managing their health. Hence, the pandemic is expected to contribute significantly to the ongoing digital transformation in healthcare.

Case Study: Integrating Innovative Technologies: A Case Study of Improving Patient Engagement Through Generative AI

Introduction: The case study explores deploying a Generative AI (GenAI)-driven chatbot within a healthcare institution to enhance patient engagement. The initiative focused on providing a platform that facilitated patient understanding of healthcare plans, communication with healthcare providers, appointment scheduling, and access to services. By leveraging advanced natural language processing, the chatbot aimed to optimize patient interactions and improve the efficiency of the overall patient experience.

Challenges: The healthcare institution faced several challenges before integrating GenAI. Traditional patient engagement methods were inefficient, leading to high manual support requests and frustrated patients. The existing systems struggled to provide timely and relevant information, resulting in increased inquiries directed to human agents. This burdened staff inhibited the ability to deliver personalized care effectively. The organization recognized the need for a solution that could streamline communication and improve patient satisfaction.

Solutions: To address these challenges, the healthcare institution adopted a GenAI-based chatbot that enhanced natural language understanding capabilities. This innovative tool was integrated into their existing systems, allowing seamless patient interactions. The chatbot provided personalized responses, enabling patients to easily navigate their healthcare options and access necessary services without needing extensive support from human agents. The implementation of this technology marked a significant shift from traditional rule-based systems to a more dynamic and responsive conversational experience.

Result: The introduction of the GenAI chatbot improved patient engagement and operational efficiency. There was a notable 20% decrease in inquiries directed to human agents, indicating the chatbot's effectiveness in managing routine queries and tasks. Patients reported higher satisfaction levels due to improved access to information and services. In addition, the project underscored the importance of continuous improvement through real-time analytics, emphasizing that innovative technologies such as GenAI are essential in transforming patient engagement and enhancing healthcare delivery overall.

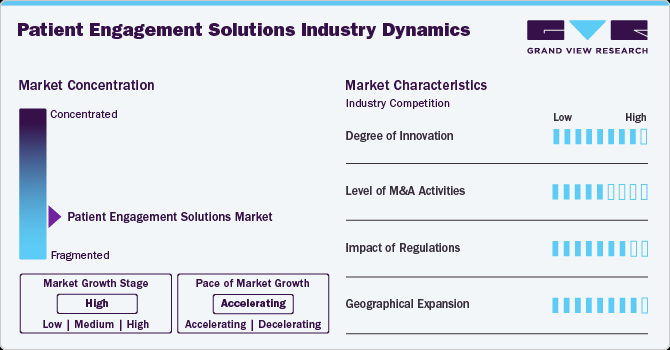

Market Concentration & Characteristics

The degree of innovation is high, driven by advancements in technologies, including AI, mobile health applications, and telehealth services. Integrating AI into patient engagement tools enables personalized interactions and real-time data analysis, enhancing patient experiences. For instance, in August 2024, Press Ganey, a healthcare provider of experience measurement and data analytics, announced an expansion of its PX Connect Suite, allowing healthcare organizations to capture and respond to patient feedback directly within Epic. The incorporation of AI-driven insights into existing workflows signifies innovation aimed at improving patient experience.

The market's mergers and acquisitions (M&A) activity is at a moderate level. Companies acquire specialized tech firms to enhance their product offerings. For instance, in January 2022, Francisco Partners acquired IBM's healthcare data and analytics assets from Watson Health, including products such as Health Insights, MarketScan, Micromedex, and imaging software. This acquisition allows Francisco Partners to leverage IBM's extensive data sets and analytics capabilities to enhance patient engagement tools and solutions.

Regulations such as the U.S. HIPAA law require healthcare providers and tech firms to ensure their platforms protect patient information. As digital health solutions gain traction, companies comply with regional regulations, which influence product development and market strategies. This regulatory landscape shapes innovation and ensures that new solutions meet the stringent patient data protection requirements.

Geographic expansion is crucial in patient engagement, with companies targeting global markets. As healthcare digitalization rises worldwide, expanding into emerging markets offers significant growth potential driven by increasing healthcare access and smartphone usage. For instance, in February 2024, Smartpatient expanded its partnership with Merck KGaA to launch a digital companion for cardiovascular disease patients. This program, built on smartpatient's MyTherapy platform, enhances patient engagement across five continents.

Type Insights

The AI-driven engagement segment held the largest revenue share of 27.05% in 2024. AI tools, including chatbots, predictive analytics, and virtual assistants, transform patient-provider interactions by personalizing care, automating scheduling, and offering customized health guidance. Key drivers include the growing need for efficient care, rising healthcare costs, and advancements in AI technology. For instance, in March 2023, Babylon introduced integrated digital-first programs for chronic condition management, offering personalized, evidence-based care through a unified platform. By utilizing artificial intelligence, Babylon improves patient engagement and simplifies the management of chronic conditions.

The Remote patient monitoring (RPM) segment is anticipated to register the fastest CAGR of 21.46% during the forecast period due to increasing demand for personalized, continuous care outside traditional healthcare settings. RPM leverages wearable devices and mobile health apps to track vital signs and chronic conditions in real-time, enhancing patient outcomes and reducing hospital visits. Factors including the rise in chronic disease prevalence, advancements in IoT technology, and healthcare cost reduction efforts drive the market growth. For instance, in January 2025, Smart Meter, an RPM technology supplier, experienced a 300% sales increase since 2022, expanded its commercial customer base fourfold, and now serves over 350,000 patients. The company opened a new 25,000 sq. ft. facility in Tampa.

Delivery Insights

Web/cloud-based held the largest revenue share of 72.27% in 2024 and is anticipated to expand at the fastest CAGR during the forecast period, driven by the increasing demand for scalable, accessible, and cost-effective solutions. Cloud-based platforms enable real-time data access, seamless patient-provider communication, and secure storage of health information. The growth toward remote care, the need for interoperable systems, and the growing adoption of EHRs. For instance, Microsoft Cloud for Healthcare provides comprehensive solutions that enhance patient engagement through integrated services, improving healthcare delivery and outcomes.

The on-premise segment experienced a significant growth in the market. Data security, regulatory compliance, and control over IT infrastructure are key factors driving the preference for on-premise solutions. Some end users opt for on-premise systems to safeguard sensitive patient data and ensure adherence to regulations, including HIPAA. These solutions offer secure data management and convenient on-site access. In addition, on-premise services give direct control over their systems, enhancing security measures and minimizing risks associated with external data breaches or unauthorized access, contributing to their growing demand.

Functionality Insights

The enhanced communication segment held the largest revenue share in 2024. This segment prioritizes improving communication between healthcare providers and patients, incorporating features like secure messaging, appointment reminders, and telemedicine for real-time interactions. The growing demand for personalized care, improved healthcare accessibility, and the need for ongoing patient-provider engagement. For instance, telehealth services such as Teladoc offer virtual consultations, increasing convenience and patient involvement. These services contribute to better patient outcomes and enhance the overall healthcare experience.

The patient education segment is projected to grow at the fastest CAGR over the forecast period, driven by the need for informed patients and better health outcomes. As healthcare grows more complex, patients seek easily accessible and transparent information on their conditions, treatments, and wellness options. Digital tools such as educational apps, websites, and interactive videos enable patients to make well-informed decisions. For instance, in June 2023, Vital Advances improved patient education precision by introducing the industry's first AI-powered video education feature. This innovation delivers personalized, evidence-based video content customized to each patient's needs, boosting overall patient engagement and experience.

“Healthcare staffing shortages remain a critical issue for hospitals and health systems and can substantially impact both patient experience and health outcomes. With the launch of Vital’s AI-Powered Video Education feature, we are empowering clinical teams through next-generation patient engagement tools designed not only to elevate a patient’s understanding of their health but also to eliminate resource-intensive tasks that can contribute to clinician burnout and distract from the actual delivery of care.”

- Stephanie Frisch, Ph.D., MSN, RN, CEN, Director of Nursing at Vital.

End-use Insights

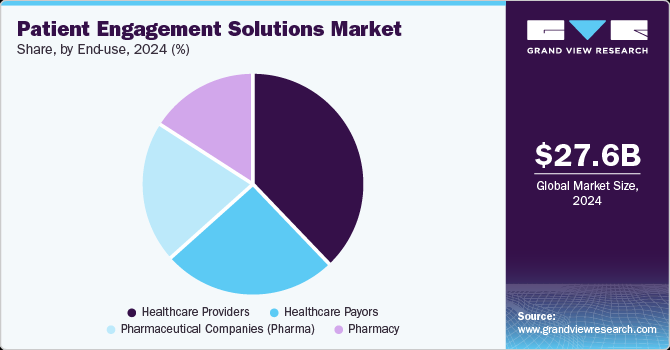

The healthcare providers segment held the largest revenue share in 2024, driven by the increasing need to improve patient outcomes and streamline healthcare delivery. Healthcare providers, including hospitals, clinics, and physician practices, utilize engagement solutions to enhance communication, manage chronic conditions, and ensure more personalized care. Factors include the shift towards value-based care, rising patient expectations, and regulatory pressures such as improved data management and patient satisfaction scores. For instance, Epic Systems enables healthcare providers to engage patients effectively through digital tools, improving care quality and operational efficiency.

The pharmaceutical companies (pharma) segment is estimated to expand at the fastest CAGR over the forecast period. These companies are increasingly adopting patient engagement solutions by providing personalized healthcare solutions, improving medication adherence, and streamlining patient communication. The integration of patient engagement solutions helps in optimizing clinical trials by identifying suitable candidates and predicting potential adverse effects, thus accelerating drug development & approval processes. These advancements not only improve patient outcomes but also drive the overall growth of the market.

Regional Insights

North America patient engagement solutions industry dominated the global market with a revenue share of 43.59% in 2024 owing to the advanced healthcare infrastructure, high technology adoption, and strong regulatory frameworks such as HIPAA, which ensure patient data security. The region's healthcare system is shifting toward value-based care, where patient engagement is crucial in improving outcomes and reducing costs. Significant investments in digital health technologies, telemedicine, and remote patient monitoring drive market growth.

U.S. Patient Engagement Solutions Market Trends

The patient engagement solutions industry in the U.S. is expanding rapidly, fueled by the country’s shift toward value-based care, which emphasizes improving patient outcomes and reducing healthcare costs. Factors include the widespread adoption of digital health technologies such as telemedicine, mobile health apps, remote monitoring tools, and increasing patient demand for personalized and convenient healthcare experiences. Strategic M&A in the market is vital for expanding capabilities, enhancing technological innovation, and broadening market reach. For instance, in January 2023, Engage Technologies Group and the APX Platform merged, creating a comprehensive medical practice management, business insights, and patient engagement solution.

Asia Pacific Patient Engagement Solutions Market Trends

The Asia Pacific patient engagement solutions industry experienced growth driven by technological innovation and an increasing focus on improving healthcare accessibility. Regulatory frameworks in the region are evolving, such as Australia's implementation of strong data privacy regulations to protect patient information. In addition, the region's aging population and rising healthcare costs have created a need for more efficient and personalized care solutions. Government initiatives, such as the National Digital Health Mission in India and innovative healthcare initiatives in China, promote integrating digital solutions into patient engagement.

The patient engagement solutions industry in China is driven by rapid healthcare digitalization, government initiatives promoting smart healthcare, and increasing demand for AI-driven platforms. For instance, in November 2024, at the 7th China International Import Expo (CIIE) in Shanghai, Bayer China officially announced the launch of its next generation healthcare customer engagement platform OPERA 2.0. Powered by Salesforce and hosted on Alibaba Cloud, the platform enhances user experience and system stability for thousands of Bayer’s internal users across China.

The patient engagement solutions industry in India is expanding due to increasing healthcare demand, digital transformation, and government-backed initiatives such as the National Digital Health Mission (NDHM). Telemedicine, mobile health apps, and EHR innovations are reshaping the healthcare delivery model. The Indian government's push toward affordable digital healthcare solutions and the growing adoption of mobile phones made patient engagement accessible.

Europe Patient Engagement Solutions Market Trends

The patient engagement solutions industry in Europe is driven by rapid digital health adoption and a strong regulatory framework that ensures patient data security. A significant trend is the rise of personalized healthcare, where solutions are tailored to meet individual patient needs. For instance, in March 2022, the European Health Initiative, the world's most significant public-private partnership in life sciences with a USD 2.46 billion budget, aims to involve patients in all research stages. The initiative's emphasis on creating a Science & Innovation Panel open to patients reflects a broader trend toward integrating patient perspectives into healthcare decision-making processes.

Latin America Patient Engagement Solutions Market Trends

The patient engagement solutions industry in Latin America is growing due to the rising demand for accessible healthcare and expanding internet penetration. Brazil and Argentina are adopting telehealth services and mobile health applications to improve access to healthcare in rural areas. A trend is the increased focus on healthcare equity and accessibility, with governments and private sector players working together to expand digital health services. Regulatory frameworks are evolving and governments have begun recognizing the need for policies supporting digital health initiatives while ensuring quality care delivery.

Middle East & Africa Patient Engagement Solutions Market Trends

The patient engagement solutions industry in the Middle East and Africa focuses on innovation and regulatory advancements to improve healthcare delivery. Countries in this region invest in digital health initiatives to enhance patient engagement and streamline healthcare processes. For instance, the Dubai Health Authority (DHA) announced that healthcare facilities in Dubai conducted more than 300,000 telemedicine consultations in 2022, a 24% rise from the prior year. In addition, 129 hospitals in Dubai offer telemedicine services, showcasing the city's successful integration of technology in healthcare.

Key Patient Engagement Solutions Company Insights

The market is highly competitive, with both large and small companies competing for market share. To strengthen their market presence, players focus on strategies such as expanding into new regions, developing new products and solutions, and pursuing mergers, acquisitions, partnerships, and strategic alliances.

Key Patient Engagement Solutions Companies:

The following are the leading companies in the patient engagement solutions market. These companies collectively hold the largest market share and dictate industry trends.

- Cerner Corporation (Oracle)

- NextGen Healthcare, Inc.

- Epic Systems Corporation

- Allscripts Healthcare, LLC

- McKesson Corporation

- ResMed

- Koninklijke Philips N.V.

- Klara Technologies, Inc.

- CPSI, Ltd.

- Experian Information Solutions, Inc.

- athenahealth

- Solutionreach, Inc.

- IBM

- MEDHOST

- Nuance Communications, Inc.

Recent Developments

-

In September 2024, AllazoHealth introduced an advanced AI-driven content optimization solution designed to assist pharmaceutical companies in personalizing patient communications and enhancing medication initiation and adherence.

“Healthcare consumers want to be understood as individuals. Pharmaceutical companies that excel at personalization are exceeding their goals because their customers are more engaged. Our AI-Enabled Dynamic Modular Content helps pharmaceutical companies effectively predict the most relevant information for each specific patient - at the right time and in the ways they prefer to receive it - helping boost medication initiation, adherence, compliance, and patient health outcomes.”

- AllazoHealth CEO William Grambley

-

In March 2022, Tata Elxsi introduced TEngage, a cloud-based digital health platform designed to help hospitals and healthcare providers deliver a seamless patient experience across multiple channels, enabling access to healthcare services anytime and anywhere.

“TEngage enables providers to deliver omnichannel patient engagement with a seamless, continuous customer experience across any device or location a customer wishes to engage in, a personalized brand experience, and the ability to get any service at any time, in every variety and permutation.

- Muthusamy Selvaraj, VP, Innovation & Emerging Business at Tata Elxsi.

Patient Engagement Solutions Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 33.45 billion

Revenue forecast in 2030

USD 86.67 billion

Growth Rate

CAGR of 20.97% from 2025 to 2030

Actual Data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, delivery, functionality, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Sweden; Denmark; Norway; Asia Pacific; Japan; China; India; Australia; South Korea; Thailand; Latin America; Brazil; Argentina; Middle East & Africa; South Africa; Saudi Arabia; UAE

Key companies profiled

Cerner Corporation (Oracle); NextGen Healthcare, Inc.; Epic Systems Corporation; Allscripts Healthcare, LLC; McKesson Corporation; ResMed; Koninklijke Philips N.V.; Klara Technologies, Inc.; CPSI, Ltd.; Experian Information Solutions, Inc.; athenahealth; Solutionreach, Inc.; IBM; MEDHOST; Nuance Communications, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Patient Engagement Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global patient engagement solutions market report based on type, delivery, functionality, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

AI-Driven Engagement

-

Telehealth Solutions

-

Patient Portals

-

Remote Patient Monitoring

-

Population Health Management

-

Appointment and Medication Reminders

-

Others

-

-

Delivery Outlook (Revenue, USD Million, 2018 - 2030)

-

Web/Cloud-based

-

On-premise

-

-

Functionality Outlook (Revenue, USD Million, 2018 - 2030)

-

Enhanced Communication

-

Patient Education

-

Predictive Analytics

-

Streamlined Operations

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare Providers

-

Outpatient Facility

-

Inpatient Facility

-

-

Healthcare Payors

-

Private

-

Public

-

-

Pharmaceutical Companies (Pharma)

-

Pharmacy

-

Independent Pharmacies (Nuclear Pharmacies)

-

Community Pharmacies

-

Mail-Order Pharmacies

-

Retail Pharmacies

-

Digital Pharmacies

-

Specialty Pharmacies

-

Central Fill Pharmacies

-

Compounding Pharmacies

-

Others (Alternate dispensing site, Closed door)

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global patient engagement solutions market size was estimated at USD 27.63 billion in 2024 and is expected to reach USD 33.45 billion in 2025.

b. The global patient engagement solutions market is expected to grow at a compound annual growth rate of 20.97% from 2025 to 2030 to reach USD 86.67 billion by 2030.

b. North America held the largest market share of 43.59% in 2024. The can be attributed to presence of key players, increasing adoption of mhealth & EHR, and growing investment in patient engagement software by the major companies. Moreover, increasing awareness level coupled with government spending on the healthcare sector is further expected to accelerate the growth.

b. Some key players operating in the patient engagement solutions market include Cerner Corporation (Oracle), NextGen Healthcare, Inc., Epic Systems Corporation, Allscripts Healthcare, LLC, McKesson Corporation, ResMed, Koninklijke Philips N.V., Klara Technologies, Inc., CPSI, Ltd., Experian Information Solutions, Inc., athenahealth, Solutionreach, Inc., IBM, MEDHOST, Nuance Communications, Inc.

b. Key factors that are driving the patient engagement solutions market growth include increasing demand for personalized treatment plans & healthcare experiences, rising adoption of digital platforms, growing need for an omnichannel approach, and increasing role of AI in enhancing pharmacy efficiency & managing supply chain complexities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.