- Home

- »

- Automotive & Transportation

- »

-

India Construction Equipment Market Size Report, 2030GVR Report cover

![India Construction Equipment Market Size, Share & Trends Report]()

India Construction Equipment Market Size, Share & Trends Analysis Report By Engine Capacity (Up To 250 HP, 250-500 HP, More Than 500 HP), By Propulsion Type (ICE, Electric), By Product, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-067-7

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Market Size & Trends

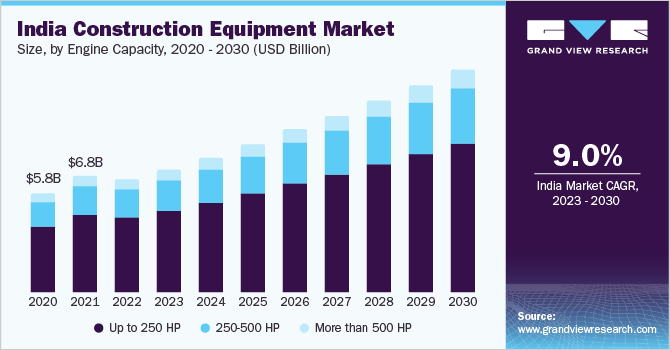

The India construction equipment market size was valued at USD 6.66 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 9.0% from 2023 to 2030. Heavy construction equipment plays an essential role in the construction industry as it makes the completion of work faster while improving the quality of the work done. Construction equipment with high engine power produces high power, enabling tasks with improved efficiency. Construction equipment is also operated in any tough situation, such as rain, cold, heavy loads, and vibration. However, the rise of construction activity, infrastructure development, government initiatives, and technological advances in the country is anticipated to drive the demand for the market.

India is an overpopulated country and is expected to rise in forth coming years. According to United Nations Population Funds (UNFPA), India’s population is expected to reach 1.4286 billion by the mid of 2023. The growing population in India requires improved transport infrastructure, including aviation, railways, and road funding. The rising infrastructural development in the country increases the demand for the India construction equipment market. However, the Indian government allocated significant funds for infrastructure development, such as roads, airports, and bridges. The Indian government is taking several initiatives and programs to boost the construction industry while increasing the construction equipment market. For instance, In June 2022, the Minister of Road Transport and Highways announced to open of 15 new national highway projects worth USD 1.7 billion in Patna Hajipur and Bihar.

Moreover, government programs and projects such as Ujwal Discoms Assurance Yojana (UDAY), Smart City Mission, Pradhan Mantri Awas Yojana, Gati Shakti Master Plan, and Bharstmala project drive the market’s growth. These programs and projects increase the demand and usage for construction equipment in the region. For instance, registration in the Micro, Small, and Medium Enterprises (MSME) Development Act of 2006, construction companies get subsidies on taxes, power, and entry to state-run industrial estates. These companies may also get an exemption from direct taxes in the initial years of their business after successful Udyam Registration. Hence, the government’s growing focus on the construction industry increases the usage and demand for the market in the region.

Several factors restrain the growth of the market. The increasing demand for rental construction equipment decreases the demand for the new construction equipment market. Small and medium-sized enterprises (SMEs) cannot afford to invest in expensive equipment, limiting their ability to compete with large manufacturers. As this heavy equipment comes with high purchase costs, contractors prefer to rent such equipment. Hence, such a factor fluctuates in demand for original equipment in the region.

However, growing technological advancements in the construction industry may increase the demand for India construction equipment market. Collaborative cloud-based technological advances such as Artificial Intelligence (AI) and Machine Learning (ML) in equipment are anticipated to increase over the forecast period. Additionally, rising infrastructure development leads to urbanization in the region. Urbanization may include the construction of sanitation, water supply, healthcare, schools, and transportation, among others. Hence, such factors are expected to provide lucrative opportunities for the market growth.

COVID-19 significantly impact the growth of the market. Decreased construction activity due to COVID-19 containment measures may result in a significant drop in demand for materials, significantly impacting the pricing of material. Materials trending lower in the past year are likely to continue on that path, with another 5% to 10% drop. In comparison, materials that have been growing may see a minor increase in the range of 1% to 3%.

Engine Capacity Insights

Up to 250 HP held the highest market share of more than 60.0% in 2022. Up to 250 HP is used broadly for material handling, grading, digging, and excavating. This equipment also comes with improved emission control systems that help reduce pollution and improve air quality. Moreover, more than 500 HP is anticipated to grow at a significant CAGR over the forecast period. More than 500 HP can perform a wide range of tasks than lower horsepower machines, making them more versatile and useful for various construction projects. This sub-segment can often operate more safely and with greater stability, reducing the risks of accidents and injuries on the job site.

Additionally, 250-500 HP is anticipated to expand at the highest CAGR of over 9.0% over the forecast period 2023-2030. This equipment can perform heavy-duty tasks faster and more efficiently while reducing project timelines and increasing productivity. This range of equipment can be used in excavation, earth moving, demolition, and grading. Hence, this segment can grow with improved fuel efficiency and increased operating capacity over the forecast period.

Propulsion Type Insights

The ICE segment led the largest market share, with over 90.0% in 2022. ICE produces power with a combustion engine, which is then transmitted to the wheels via a transmission system. With the rapid urbanization in India, there is a growing demand for commercial and residential buildings, which require the use of construction equipment. Hence, urbanization drives the growth of the ICE segment in 2022.

Moreover, electric tractors are anticipated to register the highest CAGR of nearly 13.0% over the forecast period 2023-2030. When compared to diesel or gasoline-powered tractors, electric tractors have lower operating expenses. They require less maintenance, and electricity is usually less expensive than diesel or gasoline. Hence, such a factor is expected to drive the market in forthcoming years.

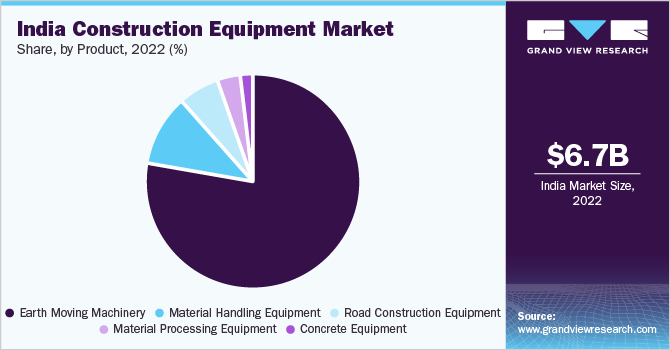

Product Insights

The earthmoving machinery accounted for the largest revenue share of over 70.0% in 2022 and is also expected to have the highest CAGR over the forecast period 2023-2030. The increase in demand is due to the increase in infrastructure projects worldwide and the use of traditional heavy-duty excavators by construction companies to build dams and highways. Commercial and residential construction projects are one of the significant fostering for the market. With the growing demand for efficient and productive machines, there is a growing trend of adoption of advanced technology in earth-moving equipment. This technology includes automation, GPS, and telematics, among others. This will help to reduce time and improve the performance of the equipment.

The material handling equipment segment is expected to register a significant CAGR of over 8.5% over the forecast period. It is ascribed to an increase in demand for crawler cranes to construct non-residential sectors, notably in industrial, manufacturing, and commercial building sectors.The segment’s thriving e-commerce industry is leading to an increase in the number of warehouses and the need to manage the supply chain in warehouses efficiently. Moreover, warehouse owners focus on lowering operational costs, increasing transparency, and enhancing productivity within the warehouse as well as operational plants. These aspects are expected to increase demand for forklifts, such as stand-up riders and narrow-aisle forklifts that offer high operation accuracy and better navigation in narrow tiers, aisles, and mezzanines.

Key Companies & Market Share Insights

Key Companies are engaging in several inorganic growth strategies, including partnerships, mergers & acquisitions, and geographical expansion, to stay afloat in the competitive market scenario. For instance, in January 2021, Honda Motor Co., Ltd. and Komatsu Ltd. signed a joint development agreement. The deal was centered on building a battery-sharing system using Honda's Mobile Power Pack (MPP) batteries for usage by various construction equipment and other civil engineering and construction equipment industries, as well as electrifying Komatsu's PCO1 mini excavators.Some of the prominent players in the India construction equipment market include:

-

AB Volvo

-

Action Construction Equipment Ltd.

-

Caterpillar

-

Hyundai Construction Equipment Co., Ltd.

-

J C Bamford Excavators Ltd.

-

KOBELCO CONSTRUCTION EQUIPMENT INDIA PVT. LTD.

-

Komatsu India Pvt. Ltd.

-

LARSEN & TOUBRO LIMITED

-

LIEBHERR

-

LiuGong India Pvt. Ltd.

-

SANY GROUP

-

Tata Hitachi Construction Machinery

-

XCMG Group

-

Zoomlion India Pvt. Ltd.

India Construction Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.23 billion

Revenue forecast in 2030

USD 13.21 billion

Growth Rate

CAGR of 9.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, engine capacity, propulsion type

Key companies profiled

AB Volvo; Action Construction Equipment Ltd.; Caterpillar; Hyundai Construction Equipment Co., Ltd.; J C Bamford Excavators Ltd.; KOBELCO CONSTRUCTION EQUIPMENT INDIA PVT. LTD.; Komatsu India Pvt. Ltd.; LARSEN & TOUBRO LIMITED; LIEBHERR; LiuGong India Pvt. Ltd.; SANY GROUP; Tata Hitachi Construction Machinery; XCMG Group; Zoomlion India Pvt. Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Construction Equipment Market Report Segmentation

The report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India construction equipment market report on the basis of engine capacity, propulsion type, and product:

-

Engine Capacity Outlook (Revenue, USD Billion, 2018 - 2030)

-

Up to 250 HP

-

250-500 HP

-

More than 500 HP

-

-

Propulsion Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

ICE

-

Electric

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Earth Moving Machinery

-

Material Handling Equipment

-

Road Construction Equipment

-

Material Processing Equipment

- Concrete Equipment

-

Frequently Asked Questions About This Report

b. The India construction equipment market size was estimated at USD 6.66 billion in 2022 and is expected to reach USD 7.23 billion in 2023

b. The India construction equipment market is expected to grow at a compound annual growth rate of 9.0% from 2023 to 2030 to reach USD 13.21 billion by 2030

b. Earthmoving machinery dominated the India construction equipment market with a market share of more than 78% in 2022. With the growing demand for efficient and productive machines, there is a growing trend of adoption of advanced technology in earth-moving equipment.

b. Some key players operating in the India construction equipment market include AB Volvo; Action Construction Equipment Ltd.; Caterpillar; Hyundai Construction Equipment Co., Ltd.; J C Bamford Excavators Ltd.; KOBELCO CONSTRUCTION EQUIPMENT INDIA PVT. LTD.; Komatsu India Pvt. Ltd.; LARSEN & TOUBRO LIMITED; LIEBHERR; LiuGong India Pvt. Ltd.; SANY GROUP; Tata Hitachi Construction Machinery; XCMG Group; Zoomlion India Pvt. Ltd.

b. The rising infrastructural development in the country increases the demand for the India construction equipment market. However, the Indian government allocated significant funds for infrastructure development, such as roads, airports, and bridges. The Indian government is taking several initiatives and programs to boost the construction industry while increasing the construction equipment market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."