- Home

- »

- Communications Infrastructure

- »

-

Global Positioning Systems Market Size, Share Report, 2033GVR Report cover

![Global Positioning Systems Market Size, Share & Trends Report]()

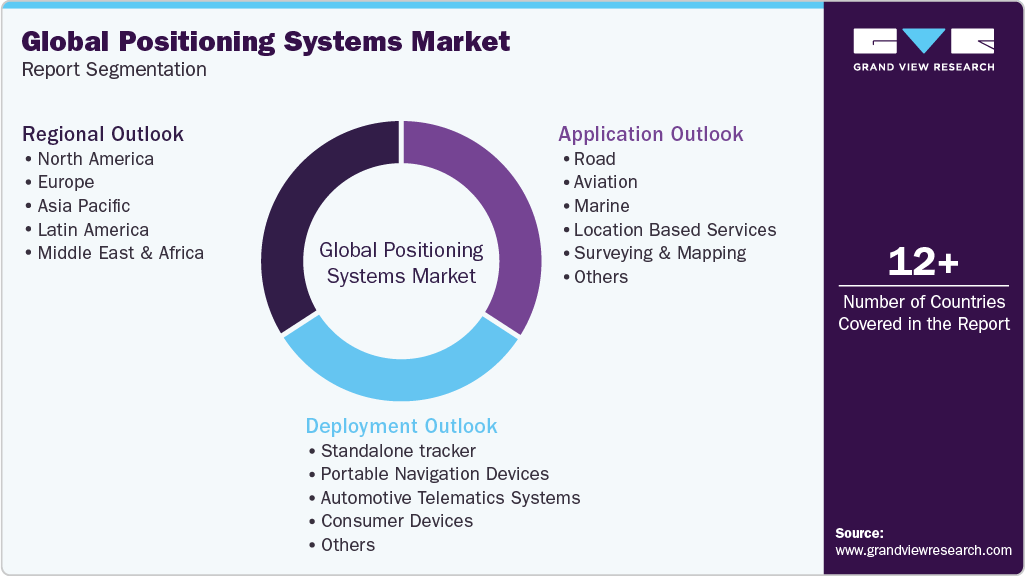

Global Positioning Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Deployment (Standalone Tracker, Portable Navigation Devices, Automotive Telematics Systems), By Application (Road, Aviation), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-473-4

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Global Positioning Systems Market Summary

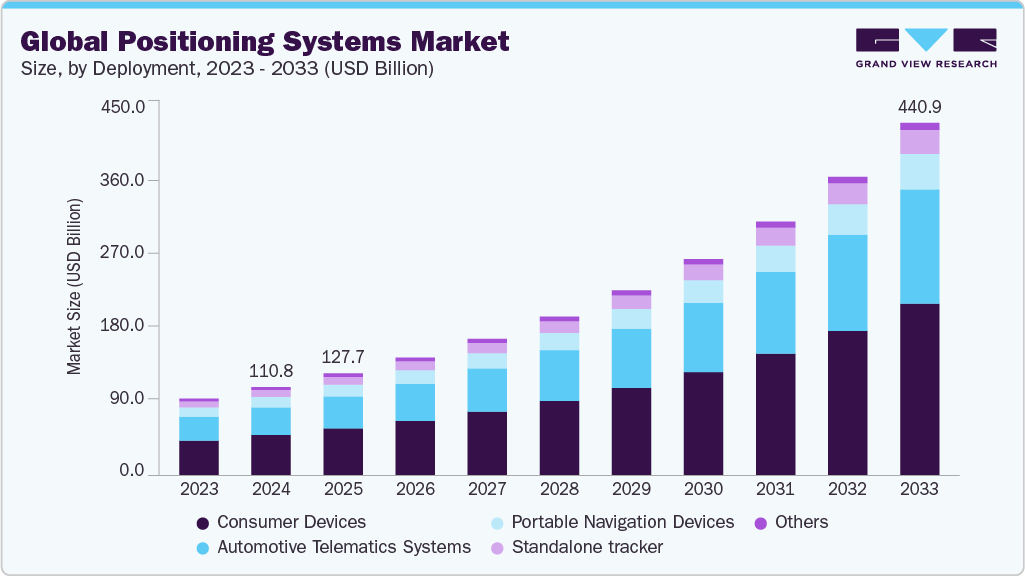

The global positioning systems market size was estimated at USD 110.76 billion in 2024 and is projected to reach USD 440.91 billion by 2033, growing at a CAGR of 16.8% from 2025 to 2033. This growth is due to the increasing adoption of GPS technology in smartphones and consumer electronics.

Key Market Trends & Insights

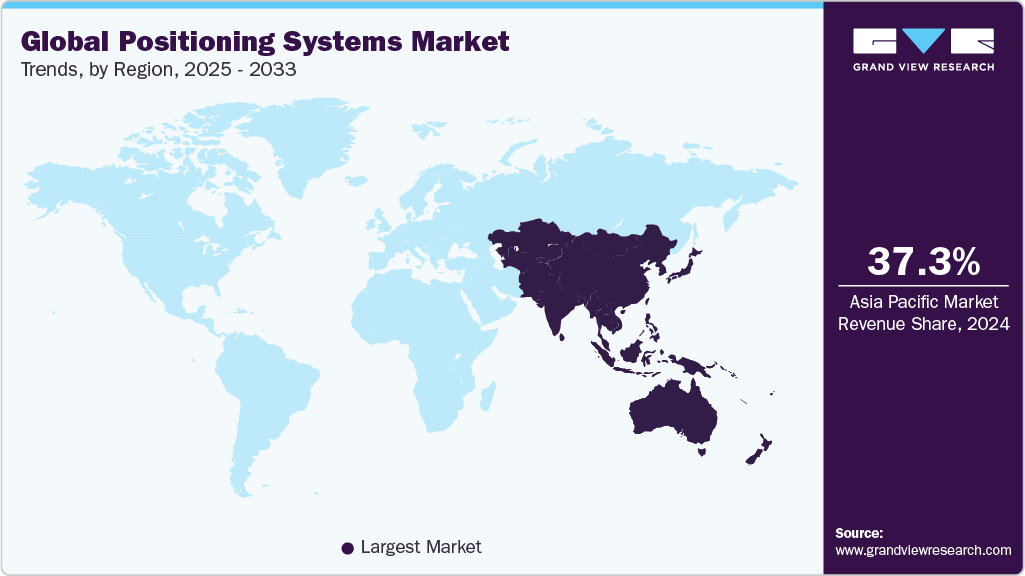

- Asia Pacific GPS market dominated the global industry with the largest revenue share of 37.3% in 2024.

- The global positioning systems industry in the U.S. is expected to grow significantly over the forecast period.

- By deployment, consumer devices led the market and held the largest revenue share of 45.8% in 2024.

- By application, location based services are expected to grow significantly over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 110.76 Billion

- 2033 Projected Market Size: USD 440.91 Billion

- CAGR (2025-2033): 16.8%

- Asia Pacific: Largest market in 2024

With the rise of location-based services (LBS), navigation apps, and augmented reality (AR) applications, demand for high-precision GPS has surged. Continuous technological advancements have improved the accuracy, reliability, and speed of global positioning systems (GPS). Innovations such as multi-constellation GNSS support, real-time kinematics (RTK), and precise point positioning (PPP) are enabling high-precision applications in sectors like agriculture, mining, surveying, and autonomous systems. Moreover, the integration of GPS with Internet of Things (IoT) devices is exposing new possibilities for asset tracking, smart logistics, and fleet management, leading to increased adoption across various industries.

The rise of autonomous technologies in vehicles and unmanned aerial vehicles (UAVs) is a significant growth driver of the global positioning systems industry. Self-driving cars and commercial drones require advanced navigation and real-time positioning data to operate safely and efficiently. As automotive and drone manufacturers increase R&D in autonomous systems, the demand for high-precision GPS solutions is expected to surge in the coming years. For instance, in July 2025, Lucid Group, Nuro Inc., and Uber Technologies announced a strategic partnership to launch a next-generation premium robotaxi program exclusively for Uber’s global ride-hailing platform. The collaboration aims to deploy over 20,000 Lucid vehicles integrated with Nuro’s autonomous driving technology, the Nuro Driver, over the next six years. The rollout is set to begin in 2026 in U.S. cities, with plans to expand across dozens of international markets.

The global push toward smart city initiatives is encouraging the deployment of GPS technologies for traffic monitoring, public safety, and infrastructure management. GPS-enabled solutions are helping urban planners optimize routes, monitor public transportation, and reduce congestion. Furthermore, as construction and infrastructure projects increase globally, especially in emerging economies, the need for geolocation-based planning and mapping is boosting the demand for GPS-enabled tools and systems.

Deployment Insights

The consumer devices segment dominated the market and accounted for the revenue share of 45.8% in 2024. The rapid proliferation of wearable devices, such as smartwatches, fitness bands, and health trackers, has significantly increased the demand for embedded GPS capabilities. These wearables increasingly include features like route tracking, activity logging, and geofencing for fitness and safety purposes. As consumers prioritize health, outdoor activity, and wellness monitoring, GPS-enabled wearables from brands like Apple, Garmin, Fitbit, and Samsung have witnessed widespread adoption, fueling growth in the consumer GPS device market.

The automotive telematics systems segment is anticipated to grow at a CAGR of 17.2% during the forecast period. GPS-powered telematics systems are crucial for fleet management, enabling real-time location tracking, route optimization, fuel monitoring, and driver behavior analysis. Logistics and transportation companies are increasingly adopting these solutions to improve operational efficiency and reduce costs. Moreover, insurers are offering usage-based insurance (UBI) models that rely on telematics data-collected through GPS to assess driver risk and set personalized premiums.

Application Insights

The location based services segment accounted for the largest revenue share in 2024, driven by the rise of on-demand services such as ride-hailing, grocery delivery, and food ordering. These services rely heavily on real-time GPS data to track users, drivers, and delivery personnel, ensuring timely and accurate service. Platforms like Uber Eats, Swiggy, and DoorDash use location based services for routing, proximity detection, and performance analytics, making GPS a critical enabler in the expanding gig and delivery economy.

The road application segment is expected to grow at a significant CAGR over the forecast period. GPS technology is a significant enabler of electronic toll collection systems and smart highways. Countries around the world are implementing GPS-based tolling solutions to reduce congestion at toll booths and improve revenue collection. These systems are driving government and private sector investments in GPS-enabled road infrastructure. Moreover, urban congestion and increasing vehicle density are stimulating governments and traffic authorities to invest in GPS-enabled intelligent transportation systems (ITS). These systems use GPS data to monitor real-time traffic conditions, optimize traffic signals, and suggest alternative routes during congestion or road closures.

Regional Insights

North America global positioning systems industry is driven by the advanced defense applications, a robust automotive industry, and widespread adoption of fleet management solutions. The region benefits from strong government investment in military-grade navigation systems, next-generation satellite infrastructure, and emergency response services. Additionally, the prevalence of connected vehicles and autonomous driving R&D, especially in logistics and public safety sectors, has accelerated GPS demand across commercial and public domains.

U.S. Global Positioning Systems Market Trends

The U.S. global positioning systems market in the U.S. is expected to grow significantly due to the rising use of precision agriculture technologies and rural broadband expansion. Farmers are increasingly adopting GPS-enabled equipment for field mapping, soil sampling, and autonomous tractor navigation to improve yield and reduce input costs. Moreover, government-led initiatives support smart highway development and enhanced location-based public services, further supporting GPS adoption across rural and urban infrastructure.

Europe Global Positioning Systems Industry Trends

The Europe global positioning systems market in Europe is anticipated to register considerable growth from 2025 to 2033 due to the integration of GPS and Galileo systems for multi-constellation positioning in transportation, maritime, and air traffic management. The region places high regulatory emphasis on environmental sustainability and multimodal mobility, driving demand for accurate geolocation to optimize public transit, cycling paths, and carbon reduction strategies.

The UK global positioning systems market is expected to grow rapidly in the coming years, owing to the advancements in geospatial intelligence and smart city initiatives. As cities deploy smart transportation, waste management, and urban mobility projects, real-time GPS data is being used to optimize services.

The global positioning systems market in Germany held a substantial market share in 2024, owing to the country’s automotive and manufacturing sectors, which are rapidly integrating GPS with industrial IoT (IIoT) and Industry 4.0 frameworks. Moreover, the deployment of GPS in high-speed rail and public infrastructure digitization aligns with Germany’s Digital Rail for Germany and smart mobility strategies, pushing demand for precise and reliable positioning solutions.

Asia Pacific Global Positioning Systems Industry Trends

The Asia Pacific global positioning systems market in Asia Pacific dominated with the largest revenue share of 37.3% in 2024, due to the large-scale infrastructure development, booming e-commerce logistics, and rising investments in smart agriculture. Emerging economies in Southeast Asia and South Asia are adopting GPS to modernize roads, utilities, and delivery systems. Moreover, with regional governments supporting space programs and GNSS enhancements, the need for GPS interoperability and precision is growing rapidly across both commercial and defense sectors.

The Japan global positioning systems market is expected to grow rapidly in the coming years, driven by the advanced robotics industry and the use of GPS in disaster preparedness and mitigation. The country leverages high-accuracy GPS for earthquake monitoring, early warning systems, and evacuation planning. Moreover, Japan’s Quasi-Zenith Satellite System (QZSS) complements GPS to provide centimeter-level accuracy for autonomous systems, logistics, and urban navigation, essential in dense urban environments.

The global positioning systems market in China held a substantial share in 2024, due to the dominance of its BeiDou Navigation Satellite System (BDS), which complements and competes with GPS in national applications. Domestic GPS demand is growing in areas like ride-hailing, drone delivery, mobile payments, and smart logistics. Moreover, the Chinese government's push for digital transformation through initiatives such as Made in China 2025 and New Infrastructure includes widespread deployment of GNSS-based technologies in transportation, mining, agriculture, and consumer electronics.

Key Global Positioning Systems Companies Insights

Key players operating in the global positioning systems market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Global Positioning Systems Companies:

The following are the leading companies in the global positioning systems market. These companies collectively hold the largest market share and dictate industry trends.

- Broadcom

- Collins Aerospace

- Garmin Ltd.

- Hemisphere GNSS, Inc.

- Hexagon AB

- MiTAC Holdings Corporation

- Qualcomm Technologies, Inc.

- Quectel Wireless Solutions Co., Ltd.

- Septentrio N.V.

- Sierra Wireless

- Swift Navigation

- Texas Instruments Incorporated

- TomTom International BV

- Topcon Positioning Systems, Inc.

- Trimble Inc.

Recent Developments

-

In June 2025, Garmin Ltd. introduced the GPSMAP 15x3 chartplotter, designed to enhance navigation for boaters, cruisers, and sailors. Featuring an ultrawide 15-inch high-resolution touchscreen, the device delivers superior clarity and a modern, space-saving design. Its edge-to-edge glass display fits seamlessly into various dash setups, allowing users to benefit from a dual-screen experience without installing multiple units. This streamlined solution makes it easier to access and view essential data and applications during marine travel.

-

In June 2025, TomTom International BV and Singapore-based AI mapping provider NextBillion.ai announced an expanded partnership to deliver highly accurate route calculations and travel time estimations for the global mobility, fleet, and logistics sectors. Through this collaboration, NextBillion.ai integrates TomTom’s Orbis Maps into its API-first platform, enabling improved route optimization, scheduling efficiency, and seamless integration for enterprise applications worldwide.

-

In January 2025, Hexagon AB announced an agreement to acquire Septentrio NV, a GNSS technology provider, to enhance its Resilient Positioning solutions. The strategy combines Septentrio’s advanced GNSS platform with Hexagon’s sensor fusion, anti-jamming, and correction technologies, enabling more robust solutions across diverse industries.

Global Positioning Systems Market Report Scope

Report Attribute

Details

Market size in 2025

USD 127.69 billion

Revenue forecast in 2033

USD 440.91 billion

Growth rate

CAGR of 16.8% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Deployment, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Broadcom; Collins Aerospace; Garmin Ltd.; Hemisphere GNSS, Inc.; Hexagon AB; MiTAC Holdings Corporation; Qualcomm Technologies, Inc.; Quectel Wireless Solutions Co., Ltd.; Septentrio N.V.; Sierra Wireless; Swift Navigation; Texas Instruments Incorporated; TomTom International BV; Topcon Positioning Systems, Inc.; Trimble Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Positioning Systems Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global positioning systems market report based on deployment, application, and region:

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Standalone tracker

-

Portable Navigation Devices

-

Automotive Telematics Systems

-

Consumer Devices

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Road

-

Aviation

-

Marine

-

Location Based Services

-

Surveying & Mapping

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global global positioning systems market size was estimated at USD 110.76 billion in 2024 and is expected to reach USD 110.76 billion in 2024.

b. The global GPS market is expected to grow at a compound annual growth rate of 16.8% from 2025 to 2033 to reach USD 440.91 billion by 2033.

b. Asia Pacific dominated the global market, with a revenue share of 40.2% in 2024, due to large-scale infrastructure development, booming e-commerce logistics, and rising investments in smart agriculture.

b. Some key players operating in the global positioning systems market include Broadcom, Collins Aerospace, Garmin Ltd., Hemisphere GNSS, Inc., Hexagon AB, MiTAC Holdings Corporation, Qualcomm Technologies, Inc., Quectel Wireless Solutions Co., Ltd., Septentrio N.V., Sierra Wireless, Swift Navigation, Texas Instruments Incorporated, TomTom International BV, Topcon Positioning Systems, Inc., Trimble Inc.

b. Key factors driving market growth include the increasing adoption of GPS technology in smartphones and consumer electronics. With the rise of location-based services (LBS), navigation apps, and augmented reality (AR) applications, demand for high-precision GPS has surged.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.