- Home

- »

- Advanced Interior Materials

- »

-

India Wood And Laminate Flooring Market Size Report, 2030GVR Report cover

![India Wood And Laminate Flooring Market Size, Share & Trends Report]()

India Wood And Laminate Flooring Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Wood, Laminate), By Application (Commercial, Residential), And Segment Forecasts

- Report ID: 978-1-68038-493-2

- Number of Report Pages: 81

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

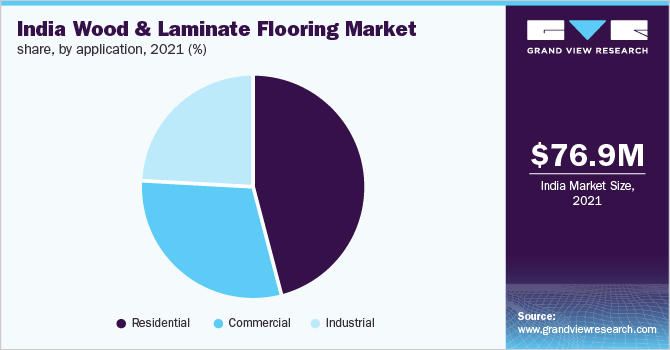

The India wood and laminate flooring market size was estimated at USD 76.9 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.4% from 2022 to 2030. The rising disposable income of consumers and growing preference to enhance the look and appeal of interiors have augmented the demand for premium or luxury construction materials in India. The expanding construction industry is a key contributor to the rapidly growing Indian industry for wood and laminate flooring.

During COVID-19, the market slowed down as a result the construction industry is badly affected. Several players employed new and innovative ideas to steer consumer demand amid the economic slowdown. The companies are developing the antiviral version of their flooring products which they are promoting to be effective against the coronavirus. In addition, these companies have also started offering advanced design solutions for commercial spaces after COVID as the workforce is returning to the office setup.

The laminate floor segment accounted for 63.27% of the market share in 2021 owing to more durability, and stain resistance, and is less expensive, offers better resistance to scratches and wear & tear, and is easier to clean compared to wood. Laminate flooring is gaining prominence in India, as most brands are educating their consumer groups, delivering in terms of good service and installation, and building up the infrastructure necessary for their business.

Traditional flooring products such as ceramic, stones, and tiles cover a major market share of the industry. The wood and laminate flooring industry is unorganized and accounts for a small portion of the overall industry. However, with the rising penetration of wood and laminate flooring products and the entry of global companies, the market is likely to witness fierce competition over the coming years.

The laminate floor industry has benefited from several technological advancements, which have improved design and performance capabilities. Wood manufacturing companies are developing alternative core materials and advanced technologies that provide water resistance with a combination of aesthetics. In laminate flooring, superior scratch protection, new embossing techniques, and other advances have further aided the growth of the industry.

Volatile organic compound (VOC) emissions that take place during the commercial and industrial application of adhesives pose risks to both, the environment, and human health. Laminate floorings are made of melamine resin which has formaldehyde as its precursor whereas wood also emits a significant amount of formaldehyde. Formaldehyde emissions may cause some environmental as well as health concerns.

Applications of the wood and laminate flooring include residential, industrial, and commercial segments. Recently commercial sectors such as retail have progressively adopted more wood & laminate flooring solutions. The increase in the demand for wood building products and western-style building products usually are account for significant change in the construction and remodeling sectors.

Product Insights

Wood flooring accounted for 36.8% of the revenue share and is expected to expand at a CAGR of 4.1% over the forecast period. Growing awareness regarding the benefits of engineered wood is projected to play a key role in the expansion of the market over the coming years. The benefits include durability, aesthetic appeal, and ease to clean.

Wood is easy to maintain as it is wear-resistant. It is made from solid wood which expands and contracts with changes in relative humidity and thus, is preferred for places with moderate climates including Bengaluru, Hyderabad, and some North-eastern states in India.

Engineered wood is moisture resistant which is lighter, easier to install, and more durable compared to wood and is suited for places like Mumbai and Kolkata. A bamboo is an environment-friendly option that is easy to install and is ideal for all climates except extremely warm places.

Laminate Flooring held the highest share at USD 48.3 million in 2021. Laminate flooring consists of layers that are mostly composed of fiberboard materials and melamine resins. Laminate flooring preference is growing in India on account of its economic cost and appearance. It is anticipated that the Northeastern market is driven on account of the rising demand for premium construction materials for décor purposes, especially in the residential sector.

Laminate flooring has a shock-absorbing ability owing to its underlayment; thus, people feel less exhausted while standing or walking on the floor. The laminate floor also repels bacteria and mold, thus making them more sanitary than other options. It is suitable for warm places like Rajasthan, Madhya Pradesh, Uttar Pradesh, and Haryana.

Application Insights

In residential applications, the preference for wood and laminate flooring has been increasing due to their aesthetic look. The wood and laminate flooring market penetration is low compared to traditional ceramic flooring, however, rising income levels and changing lifestyle is likely to boost the growth in this segment. Rising investments in the development of residential buildings in India are anticipated to lead to the high demand for the wood and laminate flooring market in India.

An increasing rate of urbanization is likely to expand the residential construction industry, which, in turn, is expected to drive the demand of the market. For instance, Tamil Nadu, Maharashtra, Karnataka, Gujarat, and Punjab are expected to have more than 50% urbanization by 2030.

In commercial applications, rising construction activity in India is likely to be a prominent driver of demand for wood and laminate floors over the forecast period. Versatility and easy installation for wood and laminate flooring make them suitable for commercial applications. Some of the commercial applications include retail stores, malls, hospitals, departmental stores, offices, studios, fitness centers, cafes & restaurants, and, hotels.

The Industrial application typically includes manufacturing or production settings, wherein wood and laminate flooring is suitable for a long time and can sustain high foot traffic. Industrial settings include distribution centers, manufacturing plants, and industrial warehouses. The flooring in such settings needs to withstand heavy loads, maintain the color and appearance in extreme conditions, and resist abrasion.

The residential and commercial construction industries in cities such as Mumbai, Bangalore, Delhi, Chennai, Pune, and Hyderabad are likely to observe a growing demand on account for luxury and semi-luxury houses which will pose a positive impact on the demand for wood and laminate floor.

Key Companies & Market Share Insights

The industry accounts for a small portion of the overall industry. However, with the rising penetration of these flooring products and the entry of global companies, the market is likely to witness fierce competition over the coming years. The key players include Armstrong World Industries Inc., Greenlam Industries Ltd., Notion flooring, and, Quick-Step Flooring.

Existing players in the traditional flooring (tiles, ceramics, stones) market have wide sales channels and an understanding of consumers and their preferences. These companies along with leading global players have the capabilities to enter the Indian market which will create difficulty for new entrants. Some prominent players in the India wood and laminated flooring market include:

-

Armstrong World Industries Inc.

-

Greenlam Industries Ltd.

-

Notion Flooring

-

Quick-Step Flooring

-

Surfaces India Flooring Pvt. Ltd.

-

Westwood Flooring

-

Avant Flooring

-

Parkay Floors

-

EGO Flooring Private Limited

-

Accord Floors

India Wood And Laminate Flooring Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 80.1 million

Revenue forecast in 2030

USD 113.1 million

Growth Rate

CAGR of 4.4% from 2022 to 2030

Base year for estimation

2021

Actual estimates/Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in million square meters, revenue in USD million, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

India

Key companies profiled

Armstrong World Industries Inc.; Greenlam Industries Ltd.; Notion Flooring; Quick-Step Flooring; Surfaces India Flooring Pvt. Ltd.; Westwood Flooring; Avant Flooring; Parkay Floors; EGO Flooring Private Limited; Accord Flooring

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Wood And Laminate Flooring Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the India wood and laminate flooring market report based on product and application:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2017 - 2030)

-

Wood Flooring

-

Laminate Flooring

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2017 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Frequently Asked Questions About This Report

b. India Wood and Laminate Flooring size was estimated at USD 76.9 million in 2021 and is expected to reach USD 80.1 million by 2022.

b. India Wood and Laminated Flooring market is expected to grow at a CAGR of 4.4% from 2022 to 2030 to reach USD 113.1 million by 2030.

b. Laminate Flooring has the highest market share of 63.2% in India in 2021. The preference for laminate flooring is growing in India on account of its economic cost and appearance similar to wood.

b. Some of the key players operating in India include Armstrong World Industries Inc., Greenlam Industries Ltd., Notion Flooring, Quick-Step Flooring, Surfaces India Flooring Pvt. Ltd., Westwood Flooring, Avant Flooring, Parkay Floors, EGO Flooring Private Limited, and Accord Flooring.

b. The rising disposable income of consumers and growing preference to enhance the look and appeal of interiors have augmented the demand for premium or luxury construction materials in India. The expanding construction industry is a key contributor to the rapidly growing Indian wood and laminate flooring market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.