- Home

- »

- Advanced Interior Materials

- »

-

Flooring Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Flooring Market Size, Share & Trends Report]()

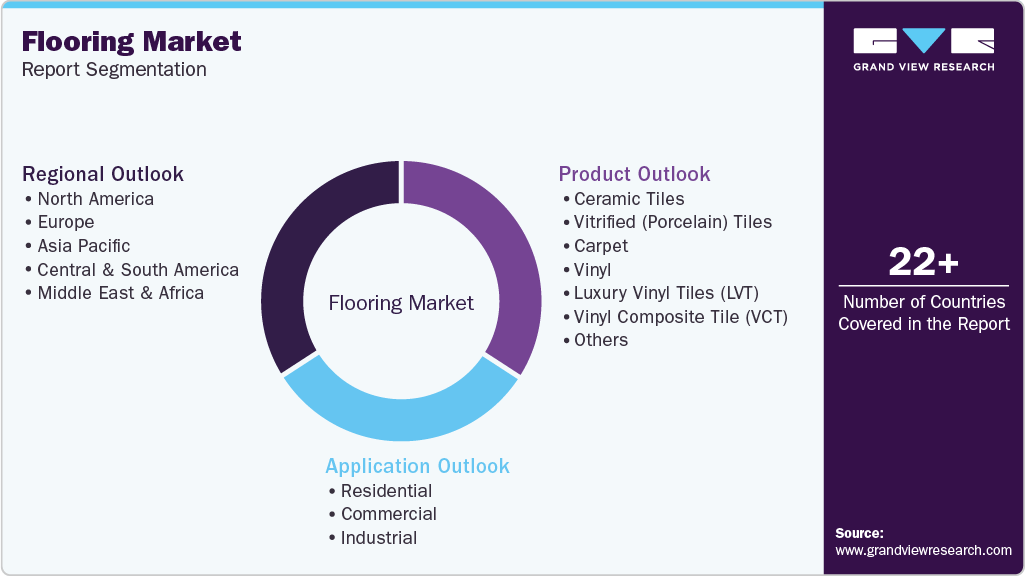

Flooring Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Ceramic Tiles, Porcelain Tiles, Carpet, Vinyl, Wood & Laminate), By Application (Residential, Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: 978-1-68038-238-9

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flooring Market Summary

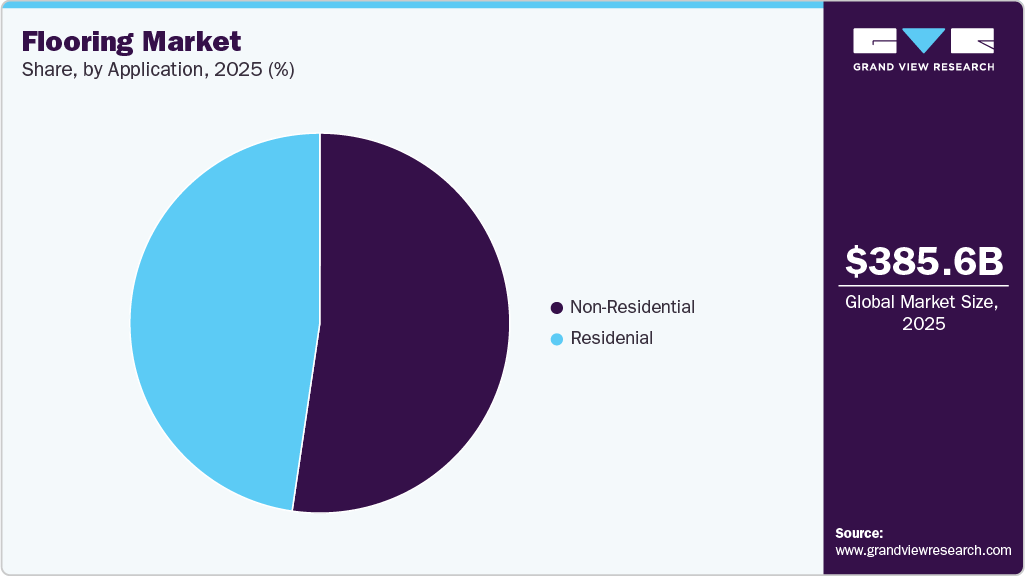

The global flooring market size was estimated at USD 385.6 billion in 2025 and is projected to reach USD 634.8 billion by 2033, growing at a CAGR of 6.4% from 2026 to 2033. Increasing demand for aesthetic, superior, and durable floor covering solutions and changing consumer trends in floor design are aiding the growth of the flooring industry over the past few years.

Key Market Trends & Insights

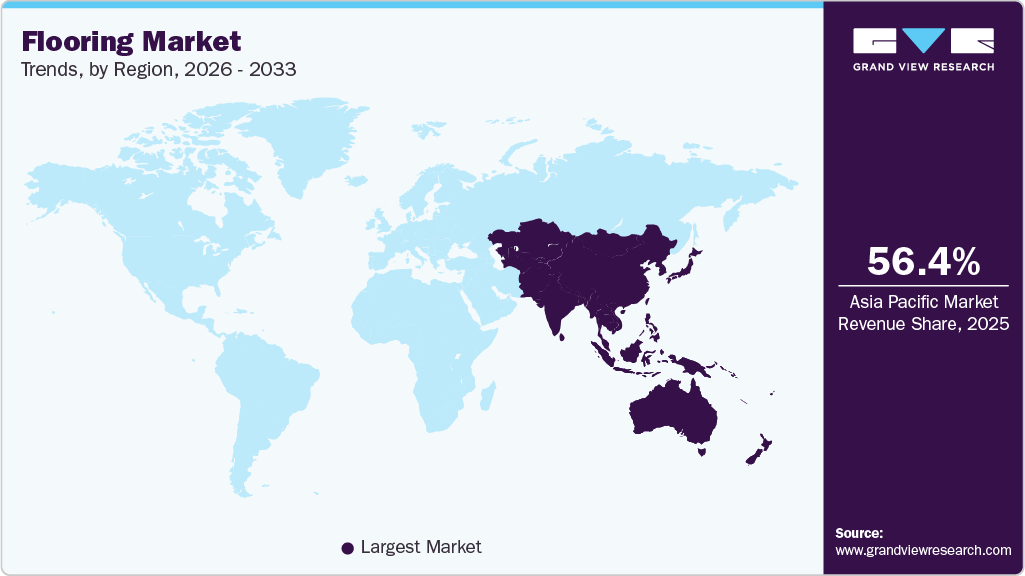

- Asia Pacific dominated the flooring market with the largest revenue share of 56.4% in 2025.

- By product, luxury vinyl tiles segment is expected to grow at fastest CAGR of 8.4% over the forecast period.

- By application, residential segment is expected to grow at fastest CAGR of 6.6% over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 385.6 Billion

- 2033 Projected Market Size: USD 634.8 Billion

- CAGR (2026-2033): 6.4%

- Asia Pacific: Largest market in 2025

The expansion of offices & workspaces, improving consumer Industrial, and rapid urbanization are factors that have also contributed to the market growth. The fast-paced infrastructural development owing to the rising population in developing countries further contributes to the growth of the flooring industry.The growing disposable income has resulted in increased investments for comfort in residential buildings. In addition, the continuous growth of high-end residential housing structures and the subsequent and growing preference for single-family housing structures are driving the demand for the market.

The advancements in easy-to-install techniques, the availability of innovative construction solutions, and the rising demand for environmentally sustainable products are expected to drive the industry’s growth. The stringent regulatory framework during the production, usage, implementation, and recycling stages is also expected to boost market growth. Furthermore, consumer preferences for aesthetically improved designs, textures, and colors, as well as low-maintenance and easy-to-install floorings, are expected to drive market growth. The growing desire for comfort and privacy as a result of noisier surroundings has increased the demand for insulation in the market, as well-insulated floors create a better acoustic environment. As a result, demand for floor insulation has increased, supporting market growth.

Market Concentration & Characteristics

The global flooring market exhibits moderate to high market concentration, with a few prominent players holding significant market shares, particularly in developed regions. The industry is characterized by continuous innovation, especially in the development of sustainable and durable flooring materials such as rigid core vinyl, recycled rubber, and bio-based polymers. Technological advancements, including digital printing and improved wear resistance in luxury vinyl tiles (LVT), have enhanced product offerings and consumer appeal. In addition, there is growing emphasis on eco-certifications and compliance with green building standards, which are influencing manufacturers to invest in environmentally friendly flooring solutions to meet regulatory and consumer demands.

Mergers, acquisitions, and strategic collaborations are increasingly common in the flooring sector, as companies aim to expand geographic reach and diversify their product portfolios. Regulatory impact remains significant, particularly with regard to volatile organic compound (VOC) emissions, worker safety, and sustainable sourcing, compelling firms to adjust production methods and raw material selection. While substitutes such as floor paints, laminates, or even modular carpets are available, they typically serve niche applications and do not pose a substantial threat to the dominant flooring categories. The end-user base is broad but concentrated in sectors such as residential construction, commercial real estate, and institutional infrastructure, which drives steady and robust demand globally.

Product Insights

The vitrified (Porcelain) tile segment led the market and accounted for over 30.7% of revenue share in 2025. This is owing to the properties of porcelain tiles such as additional strength, and more durability as compared to general ceramic tiles. These tiles can withstand extreme temperatures and are made from ultrafine and denser clays. Their durability also shines with features such as mold and bacteria resistance offered by impervious porcelain tiles substantially increasing the long-term value of floor covering. In addition, this flooring product does not fade and is easy to maintain.

Luxury vinyl tiles segment is expected to grow at fastest CAGR of 8.4% over the forecast period, driven by rising demand for durable, cost-efficient, and design-flexible flooring solutions across residential and commercial spaces. Consumers increasingly favor LVT for its ability to replicate high-end materials-such as wood and stone-while offering superior resistance to wear, moisture, and impact.

Application Insights

The non-residential application segment dominated the market and accounted for 52.3% of the revenue share in 2025 in the market, driven by strong construction activity across commercial, institutional, and industrial facilities. Businesses and developers increasingly prioritize flooring solutions that deliver long-term durability, ease of maintenance, and efficient installation to minimize operational disruptions. The growing development of offices, retail environments, healthcare centers, and educational buildings continues to sustain robust demand for resilient, high-performance flooring materials.

Residential segment is expected to grow at fastest CAGR of 6.6% over the forecast period, driven by rising demand for modern, visually appealing, and easy-to-maintain flooring solutions that enhance home interiors. Homeowners increasingly prefer materials that offer a balance of durability, comfort, and aesthetic variety, supporting the adoption of products such as LVT, laminate, and engineered wood. Growing investments in home renovation and remodeling also contribute to stronger demand, particularly as consumers prioritize upgrades that deliver long-term value.

Regional Insights

Asia Pacific Flooring Market Trends

The Asia Pacific region dominated the market and accounted for 56.4% of the total revenue share in 2025. Factors such as increasing investment in affordable housing, smart city construction, upgradation & construction of infrastructure, and investment in the tourism sector are expected to boost the demand for flooring products over the forecast period.

China Flooring Market Trends

China’s flooring market is bolstered by its vast construction sector and government-backed housing projects. As the world’s largest construction market, China exhibits high demand for vinyl, laminate, and ceramic flooring, particularly in urban areas. The country's emphasis on green building standards and energy efficiency has further encouraged manufacturers to offer eco-friendly flooring products, aligning with evolving consumer and regulatory expectations.

North America Flooring Market Trends

North America's flooring market growth is supported by renovation and remodeling activities in the residential sector, alongside technological innovations in resilient flooring materials such as luxury vinyl tiles (LVT). Energy-efficient and sustainable building practices, driven by stringent environmental regulations and green building certifications, have increased the demand for eco-friendly flooring options across both residential and commercial projects.

U.S. Flooring Market Trends

The U.S. flooring market is driven by a strong housing market, high consumer spending on home improvement, and rising demand for premium products like hardwood and engineered wood flooring. The commercial sector including retail, office spaces, and healthcare facilities is also a key growth contributor. In addition, technological innovation and a shift toward low-maintenance, durable flooring have bolstered the demand for advanced composite and hybrid materials.

Europe Flooring Market Trends

In Europe, the flooring market is influenced by the growing trend toward sustainable construction practices and regulatory frameworks promoting low-emission, recyclable, and energy-efficient building materials. The demand for innovative, noise-reducing, and thermally efficient flooring options is rising, particularly in countries focused on achieving climate goals. Renovation of older buildings in Western Europe also fuels consistent demand.

The UK flooring market is driven by increasing residential construction, post-pandemic housing reforms, and interior refurbishments in both the private and public sectors. Trends toward minimalist and modern aesthetics have encouraged the adoption of vinyl, laminate, and engineered wood flooring. Furthermore, the rising awareness of environmental impact has resulted in increased demand for sustainably sourced and recyclable flooring products.

Latin America Flooring Market Trends

In Latin America, market growth is fueled by a rebound in construction activity, particularly in Brazil, Mexico, and Colombia. Economic development, along with government-backed housing schemes and commercial real estate expansion, has led to a steady rise in demand for affordable and moisture-resistant flooring solutions. The market is also seeing increased imports of technologically advanced flooring from North America and Europe.

Middle East & Africa Flooring Market Trends

The Middle East & Africa flooring market is primarily driven by large-scale infrastructure and commercial projects, particularly in Gulf Cooperation Council (GCC) countries such as the UAE and Saudi Arabia. Ambitious initiatives such as Vision 2030 and increasing tourism-driven construction are bolstering the need for high-quality flooring materials. In Africa, urbanization and improving living standards are gradually increasing residential and institutional flooring demand.

Key Flooring Company Insights

Some of the key players operating in market include Mohawk Industries, Tarkett, S.A.

-

Mohawk Industries, Inc. is one of the world's largest flooring companies headquartered in the U.S. The company offers a diverse portfolio of flooring solutions including carpet, ceramic tile, laminate, wood, stone, and vinyl. Mohawk caters to both residential and commercial sectors with a focus on innovation, sustainability, and design flexibility.

-

Tarkett, S.A., based in France, is a global leader in innovative flooring and sports surface solutions. The company provides vinyl, laminate, wood, linoleum, carpet, and rubber flooring products tailored for commercial, residential, and healthcare environments. Tarkett is also recognized for its commitment to circular economy practices.

AFI Licensing, Burke Flooring Products, Inc. are some of the emerging market participants in flooring market.

-

AFI Licensing is known for its Armstrong-branded flooring solutions, primarily offering hardwood and resilient flooring. The company provides high-quality designs for residential and commercial use, emphasizing durability, easy maintenance, and aesthetic appeal through innovative surface technologies.

-

Burke Flooring Products, Inc., a subsidiary of Mannington Mills, specializes in resilient rubber flooring and accessories. The company's offerings include stair treads, wall base, tiles, and floor finishing products, widely used in healthcare, education, and institutional applications for safety and performance.

Key Flooring Companies:

The following are the leading companies in the flooring market. These companies collectively hold the largest market share and dictate industry trends.

- Mohawk Industries, Inc.

- Tarkett, S.A.

- AFI Licensing

- Burke Flooring Products, Inc.

- Firbo Flooring

- Shaw Industries, Inc.

- Interface, Inc.

- Gerflor

- Mannington Mills, Inc.

- Polyflor

- RAK Ceramics

- Crossville Inc.

- Atlas Concorde S.P.A.

- Porcelanosa Group

- Kajaria Ceramics Limited

Recent Developments

-

In March 2023, Shaw Industries Group, Inc. announced its partnership with Encina for recycling waste generated from carpet manufacturing. Shaw Industries will provide more than USD 2.5 million of waste every year to Encina. The partnership will help the former decrease its greenhouse gas emissions as well as carbon footprint, which in turn will help the company achieve its sustainability target.

Flooring Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 411.9 billion

Revenue forecast in 2033

USD 634.8 billion

Growth rate

CAGR of 6.4% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million, volume in million square meter, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; Romania; Czech Republic; Portugal; Ukraine; Slovakia; Hungary; China; India; Japan; Indonesia; South Korea; Australia; Philippines; Vietnam; Saudi Arabia; UAE; Israel; Qatar; South Africa; Morocco; Brazil; Argentina; Peru; Colombia; Chile

Key companies profiled

Mohawk Industries, Inc.; Tarkett, S.A.; AFI Licensing; Burke Flooring Products, Inc.; Firbo Flooring; Shaw Industries, Inc.; Interface, Inc.; Gerflor; Mannington Mills, Inc.; Polyflor; RAK Ceramics; Crossville Inc.; Atlas Concorde S.P.A.; Porcelanosa Group; Kajaria Ceramics Limited

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flooring Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global flooring market report based on product, application, and region.

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2021 - 2033)

-

Ceramic Tiles

-

Vitrified (Porcelain) Tiles

-

Carpet

-

Vinyl

-

Luxury Vinyl Tiles (LVT)

-

Vinyl Composite Tile (VCT)

-

Linoleum/Rubber

-

Wood & Laminate

-

Other Flooring Materials

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Romania

-

Czech Republic

-

Portugal

-

Ukraine

-

Slovakia

-

Hungary

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Philippines

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

Peru

-

Colombia

-

Chile

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Israel

-

Egypt

-

Qatar

-

South Africa

-

Morocco

-

-

Frequently Asked Questions About This Report

b. The global flooring market size was estimated at USD 385.6 billion in 2025 and is expected to reach USD 411.9 billion in 2026.

b. The global flooring market is expected to grow at a compound annual growth rate of 6.4% from 2026 to 2033 to reach USD 634.8 billion by 2033.

b. The non residential application segment dominated the market and accounted for 52.3% of the revenue share in 2025 in the market, driven by strong construction activity across commercial, institutional, and industrial facilities

b. Some of the key players operating in the flooring market include Mohawk Industries, Inc., Tarkett, S.A., AFI Licensing, Burke Flooring Products, Inc., Firbo Flooring, Shaw Industries, Inc., Interface, Inc., Gerflor, Mannington Mills, Inc., Polyflor, RAK Creamics, Crossville Inc., Atlas Concorde S.P.A., Porcelanosa Group, Kajaria Ceramics Limited

b. The key factors driving the flooring market include rapid urbanization, increased construction activities across residential and commercial sectors, rising demand for aesthetically appealing and durable flooring materials, and growing investments in renovation and remodeling projects.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.