- Home

- »

- Medical Devices

- »

-

Knee Implants Market Size, Share & Growth Report, 2030GVR Report cover

![Knee Implants Market Size, Share & Trends Report]()

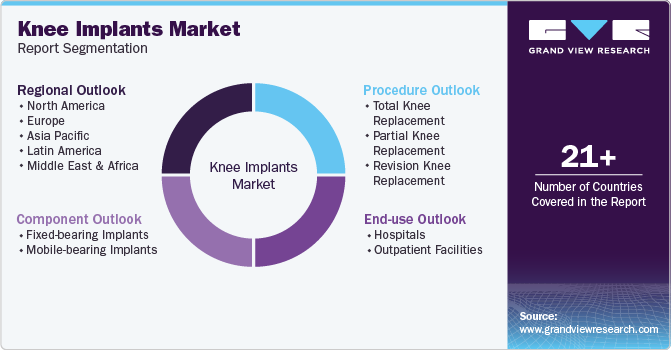

Knee Implants Market (2025 - 2030) Size, Share & Trends Analysis Report By Procedure (Total Knee Replacement, Partial Knee Replacement), By Component (Fixed-bearing, Mobile-bearing), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-164-1

- Number of Report Pages: 149

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Knee Implants Market Summary

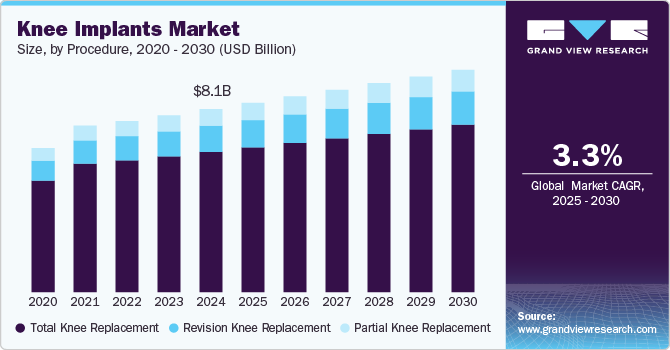

The global knee implants market size was estimated at USD 8,068.2 million in 2024 and is projected to reach USD 9,801.6 million by 2030, growing at a CAGR of 3.3% from 2025 to 2030. Factors such as the rising prevalence of arthritis and the growing adoption of minimally invasive surgeries are increasing the adoption of replacement devices, which is anticipated to drive market growth during the forecast period.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, total knee replacement accounted for a revenue of USD 6,181.9 million in 2024.

- Partial knee replacement is the most lucrative procedure segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 8,068.2 million

- 2030 Projected Market Size: USD 9,801.6 million

- CAGR (2025-2030): 3.3%

- North America: Largest market in 2024

For instance, according to Arthritis Statistics 2024, published by SingleCare Administrators in January 2024, over 22% of adults across the globe older than 40 have knee osteoarthritis.

Furthermore, injuries caused by participation in sports & related events drive the market growth. According to Stanford Medicine Children’s Health, annually, in the U.S., emergency rooms treat more than 775,000 children aged 14 and under for injuries related to sports activities. Rising career opportunities & growing inclination towards fitness have increased the number of people choosing sports as a career or a hobby. This, in turn, is anticipated to increase their chances of incurring injuries. For instance, according to Stanford Medicine Children’s Health, in the U.S., about 3.5 million children & teens incur injuries out of 30 million participating in sports.

The demand for minimally invasive procedures is growing as these procedures result in fewer traumas & quicker recovery than invasive ones. As the recovery time is shorter, hospitalization timelines are reduced, resulting in lower costs associated with surgery & hospital stay. For instance, in the case of knee replacement surgeries, traditional open surgeries involve making a vertical incision of about 8 to 10 inches to expose the joint. Owing to the following factors, minimally invasive surgeries are replacing open/invasive surgeries:

-

Lesser cases of postsurgical complications and low mortality

-

Economically viable due to the short duration of hospital stays

-

Lesser incision wounds lead to higher patient satisfaction

Moreover, the rise in the number of road accidents fuels the market growth. For instance, according to the Australian Institute of Health and Welfare, there were 3,400 hospitalizations due to transport accidents in 2021-22, with males twice as likely as females to be hospitalized. In addition, the increasing adoption of pain treatments in case of age-related joint disorders and other complications caused by co-occurring diseases, such as obesity and diabetes, is estimated to boost growth. The presence of untapped growth opportunities in the swiftly growing Asian & Latin American economies and growing awareness about knee implants are expected to propel the market growth. Therefore, manufacturers focus on harnessing opportunities in developing economies to capture maximum share.

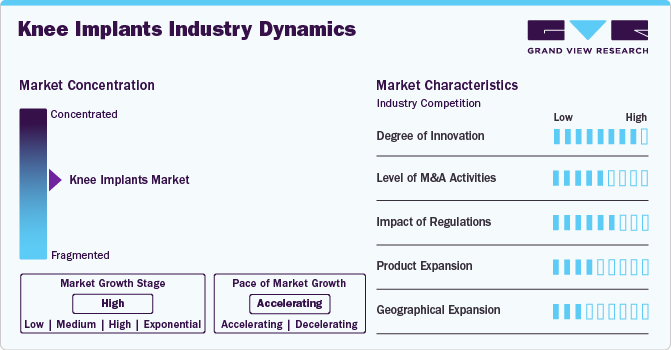

Market Concentration & Characteristics

The market is characterized by a high degree of innovation owing to the development of technologically advanced products and the rise in R&D in the orthopedic sector. Recently, biocompatible materials such as ultra-high molecular weight polyethylene (UHMWP), titanium alloys, zirconium, and smart materials have improved the performance of knee implants. Coated implants have been developed for patients sensitive to metals.

The market is characterized by a medium level of merger and acquisition (M&A) activity. These M&A activities enable access to complementary expertise, technologies, and various distribution channels, enabling companies to enhance operational efficiency, accelerate product development, and capture a larger market share. For instance, in January 2022, Smith+Nephew acquired Engage Surgical, the company that owns the sole cementless unicompartmental (partial) knee system for sale in the U.S.

Regulations play a necessary role in shaping the knee implant market, ensuring the efficacy, safety, and quality of implants available to patients. For instance, the following is the regulatory body for orthopedic implants including knee implants in Italy.

A rise in product launches creates more opportunities for the market players, which fuels market growth. For instance, in March 2023, Stryker introduced Mako Total Knee 2.0, the advanced version in Mako SmartRobotics that features an innovative digital tensioner that enables surgeons to assess the knee's stability intraoperatively during a total knee arthroplasty without additional tools.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. For instance, in June 2022, Smith+Nephew invested over USD 100 million to open a manufacturing unit in Malaysia. This strategy expanded its orthopedic business,

Procedure Insights

Based on procedure, the total knee replacement segment dominated the market in 2024 and accounted for the largest revenue share of 76.6%, owing to the growing need for implants and personalized replacement systems offered by market players. Furthermore, with the rise in the number of product launches, a significant patient base is suffering from arthritis leading to the multifold growth in procedural volume. For instance, in October 2023, at the American Association of Hip and Knee Surgeons (AAHKS) Annual Meeting, the Swiss company Medacta Group S.A. unveiled GMK SpheriKA, a femoral component optimized for kinematic alignment, designed for use in total knee replacement procedures.

The partial knee replacement segment is anticipated to witness the fastest CAGR over the forecast period. The market players continuously provide personalized and innovative partial knee replacement systems that focus on individual patient needs. For instance, in October 2023, Ortho Development Corporation, a developer of orthopedic implants, unveiled BKS Uni, an addition to its product portfolio of Balanced Knee implant systems. This partial knee replacement system is designed to streamline surgical procedures and preserve bone.

Component Insights

Based on component, the fixed-bearing implants segment dominated the market in 2024 and accounted for the largest revenue share. Factors such as the increasing prevalence of orthopedic conditions and advancements in implant materials & designs fuel the market's growth. For example, Depuy Synthes offers the ATTUNE AFFIXIUM Cementless FB Knee, an engineered 3D-printed porous structure developed for cementless implants to facilitate bone ingrowth.

The mobile-bearing implants segment is anticipated to witness the fastest CAGR of 3.8% over the forecast period. The rising penetration of bone-muscle distortion therapies in cases of accidents, hereditary diseases, and obesity among the youth is estimated to drive the growth of mobile-bearing implants. For example, Zimmer Biomet offers NexGen LPS-Flex Mobile and LPS-Mobile Bearing Knees, which allow 25 degrees of unhindered internal or external rotation post-replacement procedures. The mobile-bearing design allows a slightly greater range of rotation in the knee than the fixed-bearing design.

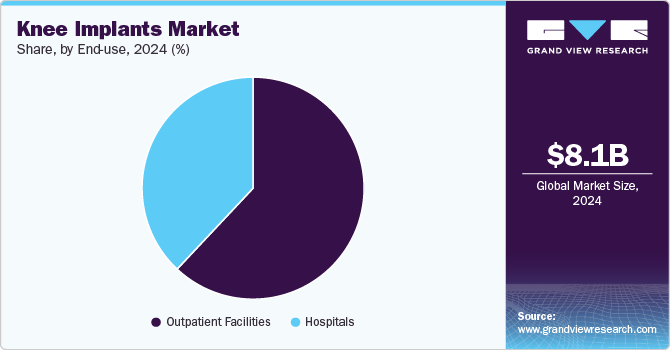

End-use Insights

Based on end use, the outpatient facilities segment dominated the market in 2024 and accounted for the largest revenue share, and is anticipated to register the fastest growth rate with a CAGR of 3.5% over the forecast period. This is attributable to the growing preference for daycare facilities & ambulatory surgery centers. Outpatient facilities provide benefits like minimized wait times, quicker discharges, cost-effective procedure expenses, and enhanced effectiveness. Moreover, they offer patients sufficient postoperative pain management, shortened hospitalizations, minimal adverse effects, and overall cost control. For instance, the average cost for an inpatient hip or knee replacement was USD 30,000, while it was USD 22,000 and USD 19,000 in the outpatient setting, respectively.

The hospitals segment is anticipated to grow significantly over the forecast period due to the prevailing preference for hospitals in the event of an injury. Additionally, the increasing hospital admissions for bone fractures and injuries resulting from road accidents are expected to drive market growth. The favorable reimbursement policies for patients visiting hospitals, in comparison to those seeking treatment at outpatient facilities, along with the widespread presence of hospitals & primary care centers in both developed & developing economies are significant factors contributing to the high demand for hospitals.

Regional Insights

North America knee implants market dominated the global industry in 2024 and accounted for the largest revenue share of 45.4%. The growing geriatric population and rising prevalence of arthritis & other joint deformities are leading to a rise in orthopedic surgeries, which is expected to propel the market growth. For instance, according to a report published by the Canadian Institute for Health Information, 117,078 knee and hip replacements were performed in Canada in 2021-2022.

U.S. Knee Implants Market Trends

The knee implants market in the U.S. held the largest share of 93.6% in 2024. The U.S. market is driven by factors such as a rise in healthcare expenditures worldwide, the growing adoption of minimally invasive surgeries, and an increase in the applications of 3D printing in the healthcare sector. For instance, according to the American Academy of Orthopaedic Surgeons, over 700,000 total knee replacement surgeries are conducted in the U.S. annually.

Europe Knee Implants Market Trends

The knee implants market in Europe is anticipated to register a significant growth rate during the forecast period. The rapidly expanding healthcare infrastructure fueled the market due to the rising medical tourism sector. Over the forecast period, the market is expected to grow significantly due to factors such as greater healthcare spending coupled with a higher incidence of osteoarthritis, osteoporosis, bone injuries, & obesity.

Germany knee implants market is anticipated to register a considerable growth rate during the forecast period. The increase in cases of road accidents in the country contributes to boosted demand for knee implants. For instance, in February 2023, according to the report published by Statistisches Bundesamt (Destatis), around 21,600 people were injured in road accidents in Germany.

The knee implants market in the UK is anticipated to register a considerable growth rate during the forecast period. The market is likely to be driven by the growing prevalence of osteoporosis and osteoarthritis and the rise in sports and road injuries. Furthermore, the market can witness new growth prospects over the forecast period owing to an increase in the reconfiguration of supply chain models by medical device manufacturers and an increase in the demand for various orthopedic implants. For instance, as per the National Institute for Health and Care Excellence, more than 100,000 knee replacements are carried out in the UK each year.

Asia Pacific Knee Implants Market Trends

The knee implants market in Asia Pacific is expected to witness the fastest growth over the forecast period. Due to the growth in sports accidents, the number of fractures and joint replacement cases is anticipated to increase, further fueling the market. The market is also expected to be driven by technological developments, such as 3D printing and smart sensors, and growing R&D efforts. Key players are investing heavily in the development of knee implants, which is expected to fuel the market growth.

Japan knee implants market is anticipated to register the fastest growth rate during the forecast period. The market's expansion is propelled by the country's sophisticated healthcare infrastructure, which prioritizes innovation and technological progress. Additionally, the increasing demand for orthopedic solutions, such as knee implants, is driven by the growing number of elderly individuals requiring treatment for conditions associated with ageing, further stimulating the market's development.

Latin America Knee Implants Market Trends

The knee implants market in Latin America is anticipated to register a considerable growth rate during the forecast period owing to untapped growth opportunities, rising incorporation of implants in orthopedic procedures coupled with the rising prevalence of arthritis, and rapidly improving healthcare infrastructure. In addition, increasing healthcare awareness among individuals and technological advancements in emerging economies are anticipated to contribute to market growth.

Brazil knee implants market is anticipated to register a considerable growth rate during the forecast period. Increasing emphasis on sports and physical activity in the country drives market growth. According to a study published in NIH titled "Injuries and complaints in the Brazilian national men's volleyball team: a case study" in 2023, out of 41 athletes who played for the team during the analyzed period, 12 athletes suffered from 28 injuries, and 38 athletes reported a total of 402 complaints. Such increasing cases of injuries are expected to escalate market growth.

Middle East & Africa Knee Implants Market Trends

The knee implants market in the Middle East and Africa is growing due to several factors, including increasing awareness of implant surgeries among patients and healthcare professionals, rising prevalence of orthopedic conditions, product launches, and favorable reimbursement for orthopedic procedures.

South Africa knee implants market is anticipated to register a considerable growth rate during the forecast period. Factors such as increasing healthcare spending in the country and the growing elderly population with a high risk of osteoarthritis & bone injuries are likely to contribute to market growth over the forecast period.

Key Knee Implants Company Insights

Key participants in the knee implants market focus on developing innovative business growth strategies through mergers and acquisitions, partnerships and collaborations, product portfolio expansions, and business footprint expansions.

Key Knee Implants Companies:

The following are the leading companies in the knee implants market. These companies collectively hold the largest market share and dictate industry trends.

- DePuy Synthes

- Zimmer Biomet

- Stryker

- Smith+Nephew

- Aesculap, Inc. - a B. Braun company

- CONMED Corporation

- Conformis

- Kinamed Incorporated

- MicroPort Scientific Corporation

- Medacta International

Recent Developments

-

In June 2024, Zimmer Biomet entered into a distribution agreement with THINK Surgical, Inc. to offer TMINI Miniature Robotic System for total knee arthroplasty.

-

In June 2024, DePuy Synthes, a group of Johnson & Johnson, obtained 510(k) clearance from the U.S. FDA for the VELYS Robotic-Assisted Solution in Unicompartmental Knee Arthroplasty (UKA).

Knee Implants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.35 billion

Revenue forecast in 2030

USD 9.80 billion

Growth rate

CAGR of 3.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Procedure, component, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

DePuy Synthes; Zimmer Biomet; Stryker; Smith+Nephew; Aesculap, Inc. - a B. Braun company; CONMED Corporation; Conformis; Kinamed Incorporated; MicroPort Scientific Corporation; Medacta International

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Knee Implants Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global knee implants market report on the basis of procedure, component, end-use, and region:

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Total knee replacement

-

Partial knee replacement

-

Revision knee replacement

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed-bearing Implants

-

Mobile-bearing Implants

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global knee implants market size was estimated at USD 8.07 billion in 2024 and is expected to reach USD 8.35 billion in 2025.

b. The global knee implants market is expected to grow at a compound annual growth rate of 3.25% from 2025 to 2030 to reach USD 9.80 billion by 2030.

b. North America dominated the knee implants market with a share of 45.4% in 2024. This is attributable to growing geriatric population base and the rising prevalence of arthritis and other joint deformities.

b. Some key players operating in the knee implants market include Zimmer Biomet, Stryker, DePuy Synthes, Smith and Nephew, Aesculap Implants Systems,LLC, Exactech, Inc., Medacta, MicroPort Scientific, CONMED, Kinamed, Inc., ConforMIS, and OMNIlife science, Inc.

b. Key factors that are driving the knee implants market growth include the adoption of minimally invasive surgeries, the rising prevalence of arthritis, the increasing geriatric population, the increasing number of bone-related disorders, accident cases, and obesity.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.