- Home

- »

- Semiconductors

- »

-

LED Driver Market Size, Share, Growth Analysis Report 2030GVR Report cover

![LED Driver Market Size, Share & Trends Report]()

LED Driver Market (2024 - 2030) Size, Share & Trends Analysis Report By Luminaire Type (Reflectors, Type A Lamp), By Application (Automotive, Lighting), By Component (Driver IC, Discrete Component), By Supply Type, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-793-3

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Led Driver Market Summary

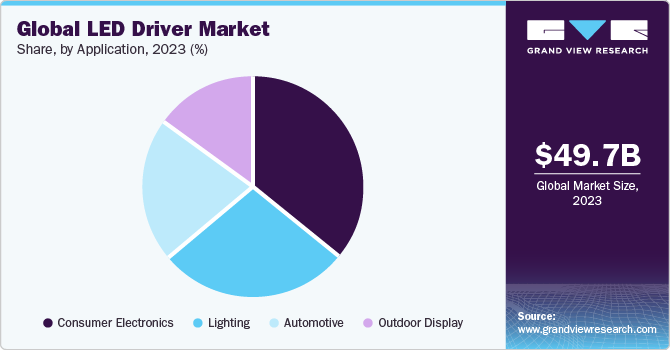

The global led driver market size was estimated at USD 49,629.2 million in 2023 and is projected to reach USD 91,185.7 million by 2030, growing at a CAGR of 9.1% from 2024 to 2030. Technological advancements in lighting components, including LED drivers, have enabled energy efficiency and performance, thus amplifying the market demand over the forecast period.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, Mexico is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, driver ic accounted for a revenue of USD 20,751.4 million in 2023.

- Driver IC is the most lucrative component segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 49,629.2 Million

- 2030 Projected Market Size: USD 91,185.7 Million

- CAGR (2024-2030): 9.1%

- Asia Pacific: Largest market in 2023

The rising penetration of light-emitting diodes in lighting in industrial and commercial segments has increased demand. Such components are utilized in the high brightness of lighting applications. In addition, firms, such as Microchip Technology, Inc. and Signify Holdings, are investing in research and development to improve the efficiency of traditional lighting solutions.

For instance, in February 2023, Signify Holdings introduced a range of new solutions for the retail industry, including the Philips StoreFlow retail lighting system, Interact Retail hybrid lighting controls, and a collection of luminaires crafted from recycled materials. The light-emitting diode driver has become a crucial part of commercial and industrial lights and has helped in the reduction of electricity costs considerably. Furthermore, the growing demand for LED lights in several applications, such as automotive, outdoor industrial, and horticultural lighting, is propelling the market growth. Several governments have initiated smart city programs to provide technologically sophisticated and environmentally friendly living environments. Sustainable lighting forms an essential part of such projects. As a result, the demand for IoT-based smart lighting systems is increasing in these nations.

Several municipalities have also installed smart lamps that use daylight sensors to switch on and off. Next-generation light-emitting diodes make it easier for designers to create efficient luminaries. For example, a high-voltage driver can supply up to 17 LEDs in series, with constant currents ranging between 350mA to 1,200mA. Such advancements are expected to boost market demand in the future. However, the absence of certain industry-defined standards to test the characteristics and behavior of such drivers has steered manufacturers to face several challenges in the industry. Solid-State Lighting (SSL) lighting and driver manufacturers worldwide follow their standards in manufacturing such a key component of lighting systems resulting in a lack of interoperability across its end-use applications hindering the market proliferation.

Market Concentration & Characteristics

The LED Driver Market growth stage is medium. The LED driver market has experienced a significant degree of innovation in recent years, with advancements aimed at enhancing energy efficiency and performance. Manufacturers are introducing smart LED drivers that incorporate intelligent controls, allowing for better customization and automation. Integration with IoT technologies has also become a notable trend, enabling remote monitoring and management of LED lighting systems. Efforts are being made to reduce the size and form factor of LED drivers, making them more compact and versatile for diverse applications. Additionally, there is a growing emphasis on developing LED drivers with improved compatibility with emerging lighting technologies, fostering a dynamic and innovative landscape in the LED driver market.

The level of new product launches/service launches in the LED Driver Market is high. The frequent introduction of new products and services in the LED Driver Market is driven by ongoing advancements in LED technology, the rising demand for energy-efficient lighting solutions, and the competitive landscape. Companies strive to stay ahead in the dynamic industry by continually innovating to meet diverse industry needs. The emphasis on sustainability and smart lighting further accelerates research and development, contributing to the rapid release of improved LED drivers to align with evolving market demands.

The impact of regulation on the LED Driver Market is significant, with stringent energy efficiency standards and environmental regulations driving the demand for compliant and sustainable solutions. High regulatory standards, such as energy performance requirements and certification processes, create a barrier for entry, favoring established players with compliant products. However, these regulations also stimulate innovation, pushing companies to develop cutting-edge, energy-efficient LED drivers. Overall, the regulatory environment in the LED Driver Market is high, shaping the industry towards greater energy efficiency and environmental responsibility.

The availability of substitutes for LED drivers in the market is relatively low, given the specialized nature of these components in powering LED lighting systems. LED drivers have unique functionalities that are crucial for ensuring the proper functioning and longevity of LED lights, making direct substitutes less common. The impact on the LED Driver Market is minimal in terms of substitution pressure, as alternatives with comparable performance are limited. Consequently, the low availability of substitutes contributes to the stability and demand for LED drivers within the market.

The end-user concentration for LED drivers in the market is generally high, as LED drivers cater to diverse industries with specific requirements. For instance, in the automotive sector, LED drivers play a crucial role in powering automotive lighting systems. The demand is concentrated within this sector due to the specialized needs for automotive LED drivers, contributing to a high end-user concentration. Similarly, in consumer electronics, such as LED TVs and displays, LED drivers are essential components. The concentration of demand from the consumer electronics industry further reinforces the high end-user concentration for LED drivers. Despite the broad range of applications, the reliance on LED drivers within key sectors intensifies their importance. It contributes to a higher degree of end-user concentration in the LED Driver Market.

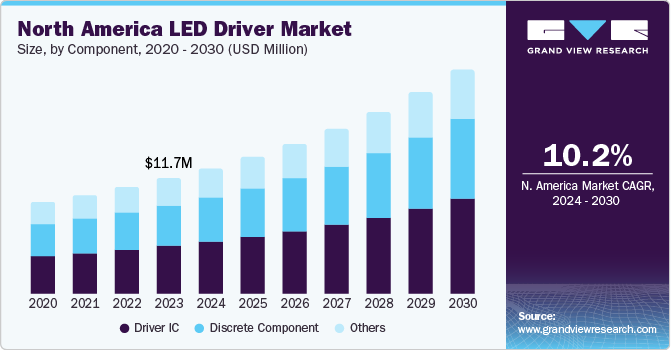

Component Insights

The driver IC segment dominated the market with a revenue share of 41.8% in 2023. It is anticipated to remain prevalent over the forecast period due to its associated benefits. LEDs need to be driven with a constant current to maintain their brightness and longevity. Driver ICs enable precise current control, ensuring that LEDs receive a consistent and accurate current, regardless of input voltage or temperature variations. Moreover, driver ICs often incorporate dimming and control capabilities, allowing users to adjust LED lighting systems’ brightness or color temperature. These ICs provide compatibility with different dimming methods, such as analog, digital, or wireless control, enabling versatile lighting control options. Such benefits associated with driver IC are anticipated to propel the growth of the segment over the forecast period.

Discrete components play an important role in the design and execution of LED driver circuits in the LED driver industry. Unlike integrated circuits (ICs), discrete components are distinct electronic components not combined into a single chip or packaging. These components are employed within the LED driver circuitry to accomplish particular purposes. Some discrete components include resistors, capacitors, inductors, and diodes, among others. These discrete components combine with integrated circuits, such as driver ICs, provide LED driver circuits with the appropriate functionality, efficiency, and protective features. Designers pick and configure these components with care to satisfy the unique needs of the LED lighting system. The segment is anticipated to grow at a CAGR of 9.5% over the forecast period.

Luminaire Type Insights

The type A lamp segment dominated the market with a revenue share of 31.6% in 2023. The type A lamp is a specific type of LED driver designed to operate and power type A lamps. LED drivers are electronic devices that regulate and control the power supply to LEDs, ensuring proper voltage and current levels for optimal operation. Type A lamps are retrofitting bulbs intended to replace standard incandescent bulbs without requiring changes to the existing fixtures or sockets. These lamps are often designed like classic A-shaped incandescent bulbs and have a medium screw base (E26 or E27). Moreover, these lamps are compatible with standard socket types and can be easily integrated into existing lighting systems. Decorative lamps is another crucial segment in the market. The segment is anticipated to grow at a CAGR of 10.0% over the forecast period.

Decorative lamps are intended to improve the aesthetic appeal of indoor and outdoor settings by offering eye-catching lighting options. LED drivers are essential for powering and controlling these ornamental lights. In addition, decorative lamps come in various designs, shapes, and sizes to suit various decorative lighting applications. They can include filament-style bulbs that mimic the vintage look of incandescent bulbs, strips or ropes for accent lighting, decorative pendant lights, chandeliers, wall sconces with intricate designs, and more. Furthermore, many decorative lights offer dimming capabilities that allow you to create an atmosphere and modify illumination settings based on your needs. Drivers with dimming capabilities are used to manage the light output and enable seamless dimming of the decorative lighting. This allows users to adjust the brightness or create dynamic lighting effects.

Supply Type Insights

The constant current type segment dominated the market with a revenue share of 65.8% in 2023. It is anticipated to remain prevalent over the forecast period due to its heavy industry utilization. For several applications, it is desirable to utilize constant current drivers as they offer more control and provide the ability to design a clear display and uniform brightness. As such devices use a constant current driver, they are extremely energy efficient. Constant current drivers are popular because they provide a constant forward current independent of variations in the input voltage. With a constant current source, the driver keeps the current constant even when the voltage fluctuates with temperature, eliminating thermal runaway and over-driving the LED. While utilizing light-emitting diodes for lighting applications, such a method allows for higher brightness consistency and a longer lifetime.

The constant voltage driver is utilized when many LED lights must be linked in series. Furthermore, the constant voltage driver evenly flows the voltage, resulting in uniform illumination throughout the lights. LED drivers with a constant voltage provide more versatility than a variable voltage. This is because more LEDs could be connected until the constant-voltage LED driver's maximum current capability is reached, at which point adding further LEDs will decrease the available power to each light-emitting diode, lowering the brightness. However, the constant voltage driver is less efficient than the constant current driver as it cannot stabilize the current influx, thus consuming more energy than the latter one. Therefore, the constant voltage driver is anticipated to grow at a CAGR of 8.8% from 2024 to 2030.

Application Insights

The growing demand for energy-efficient lighting across all industry verticals has compelled users to adopt LED lights. Solid-state lighting (SSL) has a compelling value proposition and ROI due to its low maintenance costs and ability to offer consistent brightness efficiently. Thus, it replaced conventional light sources, such as compact fluorescent lamps (CFLs) and incandescent light bulbs with LED lighting. As these lights require an advanced driver, the market demand is expected to grow exponentially over the forecast period. The consumer electronics segment held a revenue share of 35.7% in 2023 owing to the increasing adoption of smartphones and TVs in developing countries worldwide.

LED replaces conventional LCD screens in both these segments since they offer better picture clarity, high color accuracy, and low power consumption. These components are also used in display panels of various consumer electronics, such as refrigerators, air conditioners & others. The automotive segment has emerged as a lucrative application segment for LED drivers accounting for a market share of 28.5% in 2023 as the industry is shifting toward high-brightness light emitting diodes and LASER lights from conventional high-intensity discharge lamps (HID) & halogen lights.

Many governments have implemented regulations to stop the use of hazardous HID bulbs. For instance, in August 2020, the California government prohibited the installation of aftermarket vehicle HID light systems that emit blue light rather than the approved white-to-yellow spectrum. The outdoor display segment includes signage, video walls, kiosks, and similar application displays. Due to increased digital marketing and advertisement activities, the demand for video walls has risen predominantly in developed countries, such as the U.S., China, Japan, and the UK. Despite the fact that LCDs are typically utilized for outdoor displays, LED use is increasing as prices fall.

Regional Insights

The LED Driver Market in North Market held a significant revenue share of 23.4% in 2023. North America has been witnessing substantial growth as per the regulations for the use of energy-efficient lights, being outlined by various governments in the region, rising awareness about the benefits of energy-efficient lights, plummeting prices of LED products, and subsequently, growing adoption of LED solutions across commercial, residential, and industrial applications. The growing adoption of smart lighting solutions to improve lighting performance while enhancing energy savings in commercial applications is a prominent factor driving regional market growth.

U.S. LED Driver Market Trends

The LED driver market in the U.S. dominated the LED Driver market with a revenue share of 60.3% in 2023. The growth of U.S. LED Driver Market is attributable to increased demand for energy-efficient lighting solutions across residential, commercial, and industrial sectors. Additionally, advancements in semiconductor technology and government incentives promoting sustainable lighting contribute to the rapid expansion of the U.S. LED driver market.

Europe LED Driver Market Trends

The LED Driver market in Europe is experiencing significant growth, propelled by the region's commitment to sustainability through the promotion of energy-efficient LED lighting solutions driven by EU directives, alongside national initiatives like Spain's "Aid Program for Energy Efficiency Actions," and further boosted by the implementation of smart city initiatives that require advanced LED drivers for intelligent lighting systems.

The UK LED driver market is experiencing significant growth, propelled by the government's proactive implementation of stringent energy efficiency standards and regulations, such as the Energy-related Products (ErP) Directive, alongside initiatives like the Carbon Reduction Commitment (CRC) Energy Efficiency Scheme and the Energy Savings Opportunity Scheme (ESOS), which emphasize the adoption of LED lighting systems powered by efficient LED drivers to meet energy reduction targets.

The LED driver market in Germany is experiencing significant growth, propelled by the country's strict energy efficiency standards and labels, particularly those governed by the Energy Efficiency Directive and the European Union's Ecodesign Directive, alongside the influential role of the automotive sector in adopting LED lighting solutions and the government's financial incentives and support programs, such as the National Energy Efficiency Action Plan (NAPE) and the Energy Efficiency Fund, fostering the adoption of energy-efficient LED lighting systems and drivers.

France LED driver market is growing due to the construction industry's increasing focus on energy efficiency and sustainability, as well as the adoption of green building practices, with LED lighting systems powered by efficient LED drivers playing a key role in meeting regulatory requirements, achieving certifications such as High Environmental Quality (HQE) and Leadership in Energy and Environmental Design (LEED), and meeting consumer demand for visually appealing and energy-efficient LED technology in consumer electronics.

Asia Pacific LED Driver Market Trends

Asia Pacific accounted for the highest revenue share of 28.6% in 2023. The regional market is anticipated to grow at a CAGR of over 9.5% from 2024 to 2030. The increasing adoption of LED lighting across residential, commercial, and industrial sectors in the region has been a key driver of market growth. Government initiatives promoting energy efficiency and sustainability, along with the rising awareness about the benefits of LED light, have further fueled the demand for LED drivers in the region. The rapid urbanization and infrastructure development in countries, such as China, India, and Japan, have also contributed to the growth of the market. Furthermore, in November 2021, the Chinese government outlawed incandescent bulbs unveiling the country's incandescent bulb phase-out strategy with National Development and Reform Commission. Infrastructure growth, lower pricing, local energy conservation targets, and rising urbanization levels are other significant factors driving the market growth in China. Such programs are boosting the LED driver market growth in the region. China is a global consumer and industrial electronics manufacturing base and a prominent supplier of LED drivers worldwide. The increasing demand for LEDs across consumer electronics, such as smartphones, tablets, laptops, and TVs, is expected to drive the demand for these components over the forecast period.

The LED Driver market in China is experiencing significant growth, driven by the crucial role of the manufacturing sector's diverse industries, including electronics and automotive, where there is a constant demand for energy-efficient lighting systems in facilities and fueled further by ambitious construction projects like the Belt and Road Initiative, leading to substantial demand for LED drivers to power and control lighting infrastructure in these developments.

Japan LED driver market is growing due to the consumer electronics industry in Japan, with a focus on energy-efficient and versatile LED lighting integrated into cutting-edge electronic devices, supported by the country's advanced manufacturing sector emphasizing precision engineering and high-quality production processes.

The LED driver market in India is experiencing significant growth, driven by the country's expanding manufacturing sector, rapid urbanization, and government initiatives promoting energy efficiency and sustainability. India, characterized by a growing economy and an increasing population, offers immense opportunities to adopt LED lighting solutions, which in turn fuels the demand for LED drivers.

Middle East & Africa LED Driver Market Trends

The LED Driver market in the Middle East & Africa has been growing significantly due to aggressive infrastructure investments, particularly in smart city projects such as NEOM in countries like the UAE and Saudi Arabia, promoting the adoption of energy-efficient LED lighting solutions, coupled with increasing awareness about the benefits of LED technology and favorable government initiatives that enforce standards and regulations for energy-efficient lighting solutions, consequently driving the demand for LED drivers.

Saudi Arabia LED Driver market has been growing significantly due to the aggressive adoption of energy-efficient LED lighting solutions in various infrastructure development projects, particularly in smart city initiatives, along with increasing awareness about the benefits of LED technology and supportive government initiatives promoting energy efficiency.

Key LED Driver Company Insights

Some of the key companies operating in the LED Driver market include ACE LEDS., SAMSUNG, Lutron Electronics Co., Inc., Macroblock, Inc., Analog Devices, Inc., NXP Semiconductors and Cree LED, among others.

-

ACE LEDS operates as a manufacturer and provider of LED lighting technology, specializing in Emergency LED Drivers (EMDs). The company provides models with cost-effective designs, compact form factors, and enhanced durability. Apart from its comprehensive range of LED Modules and LED Drivers, ACE LEDS can tailor its products to suit specific individual requirements.

-

Cree LED, a subsidiary of Smart Global Holdings, specializes in manufacturing LEDs optimized for various applications. The company utilizes innovative material systems, including Group III silicon carbide and nitrides, along with compound semiconductors, for the development of LED lighting and systems such as LCD backlighting and general lighting. The company caters to a wide range of markets, including general lighting applications such as indoor and outdoor lighting and specialty lighting for applications such as architectural/entertainment, broadcast, horticulture, portable lighting, retail lighting, and automotive & emergency vehicle lighting.

Signify Holding and Eaglerise Electric & Electronic (China) Co., Ltd. are some of the emerging companies in the global LED Driver Market.

-

Signify Holding is a Dutch global lighting corporation established as an account of the derivative of the lighting business unit of Philips. It was formerly known as Philips Lighting N.V. The company went public after its separation from Royal Phillips in 2016. The company produces light fixtures and electric lights for professionals, consumers, and the IoT. It houses brands such as Phillips, Interact, Phillips Dynalite, Phillips Hue, Color Kinetics, WiZ, Strand, Vari-Lite, UHP, Modular Lighting Instruments, and Zero 88. The company has operations in over 70 countries. The company specializes in the production and development of energy-efficient lighting, particularly LED and connected lighting systems. Signify Holding primarily focuses on LED-based solutions, with 83% of its sales as of 2022 coming from LED products. The company is listed on the Euronext Amsterdam stock exchange under the ticker symbol LIGHT.

-

Eaglerise Electric & Electronic (China) Co., Ltd. develops and manufactures energy and lighting products. The company offers its products under two segments, namely, products for energy and products for lighting. LED drivers and lighting fixtures fall under the product for the lighting segment.

Key LED Driver Companies:

The following are the leading companies in the LED driver market. These companies collectively hold the largest market share and dictate industry trends.

- ACE LEDS

- Microchip Technology Inc.

- Cree LED

- HLI SOLUTIONS, INC.

- Signify Holding

- SAMSUNG

- Lutron Electronics Co., Inc.

- Macroblock, Inc.

- Analog Devices, Inc.

- NXP Semiconductors

- Semiconductor Components Industries, LLC

- ams-OSRAM AG

- ROHM CO., LTD.

- STMicroelectronics

- Texas Instruments

- Eaglerise Electric & Electronic (China) Co., Ltd.

Recent Developments

-

In April 2023, ACE LED announced the introduction of the Mini-Rail Constant Power Linear Emergency LED Driver. It is the industry's smallest LED driver, at 0.83" high and 1" wide. The Mini-Rail has a wide output voltage range, an isolated relay driver, and a highly efficient LiFePO4 battery. It offers innovative solutions for diverse lighting applications while maintaining constant power for over 90 minutes during emergencies.

-

In March 2023, Cree LED introduced the J Series 5050C, an E-Class LED, which offers the highest efficacy in the industry for high-power LEDs, achieving 228 lumens per watt (LPW) at 70 CRI, 4000K, and 1W. These advanced LEDs offer up to three times the light output compared to competing 5050 LEDs while maintaining the same level of efficacy. With the addition of the J Series, Cree LED provides four performance levels in its LED portfolio, catering to various directional general lighting applications.

LED Driver Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 49.63 billion

Revenue forecast in 2030

USD 91.19 billion

Growth rate

CAGR of 9.3% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, luminaire type, supply type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Spain; Italy; China; Japan; India; Taiwan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

ACE LEDS; Microchip Technology Inc.; Cree LED; HLI SOLUTIONS, INC.; Signify Holding; SAMSUNG; Lutron Electronics Co., Inc.; Macroblock, Inc.; Analog Devices, Inc.; NXP Semiconductors; Semiconductor Components Industries, LLC; ams-OSRAM AG; ROHM CO., LTD.; STMicroelectronics; Texas Instruments; Eaglerise Electric & Electronic (China) Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global LED Driver Market Report Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global LED driver market report based on component, luminaire type, supply type, application, and region:

-

Component Outlook (Revenue, USD Million; 2017 - 2030)

-

Driver IC

-

Discrete Component

-

Others

-

-

Luminaire Type Outlook (Revenue, USD Million; 2017 - 2030)

-

Decorative Lamps

-

Reflectors

-

Type A Lamp

-

Others

-

-

Supply Type Outlook (Revenue, USD Million; 2017 - 2030)

-

Constant Current

-

Constant Voltage

-

-

Application Outlook (Revenue, USD Million; 2017 - 2030)

-

Consumer Electronics

-

Lighting

-

Automotive

-

Outdoor Displays

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Taiwan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

U.A.E.

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global LED driver market size was estimated at USD 46.20 billion in 2022 and is expected to reach USD 49.36 billion in 2023.

b. The global LED driver market is expected to grow at a compound annual growth rate of 9.1% from 2023 to 2030 to reach USD 91.18 billion by 2030.

b. Asia Pacific dominated the LED driver market with a share of 28.8% in 2022. This is attributable to government subsidies, improving manufacturing facilities, and increasing penetration of LED lighting in the region.

b. Some key players operating in the LED driver market include Microchip Technology, Inc, ACE LEDs, Cree LED, Signify Holdings, Macroblock Inc.; Lutron Electronics Co., Inc.; Semiconductor Components Industries, LLC, NXP Semiconductors N.V., ams Osram, STMicroelectronics, Texas Instruments, Inc. and ROHM Semiconductors.

b. Key factors that are driving the LED driver market growth include technological advancement in lighting components, improved performance, and growing penetration of LED lightings in several applications, such as outdoor, automotive, industrial, and horticulture.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.