- Home

- »

- Electronic Devices

- »

-

LED Lighting Market Size & Share, Industry Report, 2030GVR Report cover

![LED Lighting Market Size, Share & Trends Report]()

LED Lighting Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Lamps, Luminaires), By Installation Type (New, Retrofit), By Application (Indoor, Outdoor), By Sales Channel, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-123-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

LED Lighting Market Summary

The global LED lighting market size was estimated at USD 88.17 billion in 2024 and is projected to reach USD 134.71 billion by 2030, growing at a CAGR of 7.8% from 2025 to 2030. The market growth is primarily driven by the surge in construction activities across both developing and developed nations, coupled with government regulations aimed at phasing out inefficient lighting systems.

Key Market Trends & Insights

- Asia Pacific dominated the LED lighting market with the largest revenue share of 39.72% in 2024.

- The LED lighting market in the U.S. is anticipated to witness at a significant CAGR from 2025 to 2030.

- Based on product, the luminaires segment led the market with the largest revenue share of 58.91% in 2024.

- Based on application, the indoor segment led the market with the largest revenue share of 67.75% in 2024.

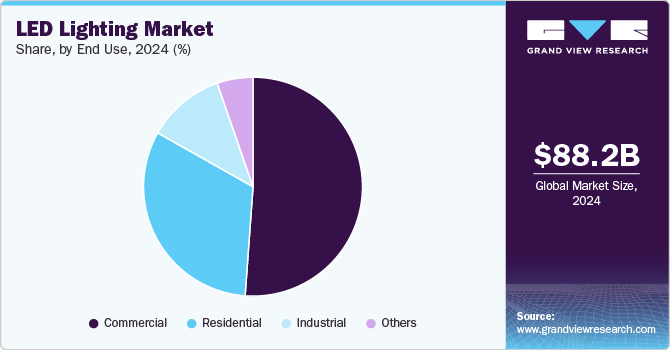

- Based on end use, the commercial segment led the market with the largest revenue share of 51.11% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 88.17 Billion

- 2030 Projected Market Size: USD 134.71 Billion

- CAGR (2025-2030): 7.8%

- Asia Pacific: Largest market in 2024

In addition, supportive government initiatives to reduce the cost of LED lighting are further propelling market expansion.

Manufacturers are increasingly integrating advanced features like Wi-Fi connectivity, occupancy sensors, and daylight harvesting technologies to boost sales. Moreover, market players are offering a wide range of LED products, including LED strips, bulbs, and tube lights, to cater to a broad customer base, thereby contributing to the overall growth of the LED lighting industry.

LED lights are often considered a superior lighting option compared to traditional alternatives such as incandescent, CFL, and halogen bulbs. They provide high-quality illumination while requiring minimal energy input. Their efficiency and versatility make them suitable for a wide range of applications, both indoors and outdoors. LED technology offers design flexibility and can withstand frequent on-off switching, which adds to its appeal for various lighting needs. With increasing consumer awareness of these benefits, the market for LED lighting is expected to grow steadily.

Regulatory bodies such as the American National Standards Institute (ANSI), China Compulsory Certification (CCC), and the International Electrotechnical Commission (IEC) play a key role in certifying LED types. Manufacturers must obtain the necessary licenses and approvals before entering the market, offering services, or engaging in international trade. Both developed and developing nations are actively promoting energy conservation, driving the demand for LED lamps and bulbs.

Offline is enforcing stringent quality standards to ensure consumer safety, manage energy consumption, and address environmental concerns. LED lighting, known for its energy efficiency, can last up to 50,000 hours while consuming significantly less electricity. These regulatory efforts are expected to accelerate the adoption of LED technology by phasing out inefficient lighting systems.

In the medical field, traditional halogen lights used in surgical and examination settings were known to produce excessive heat and consume high levels of electricity, with some bulbs ranging from 50 to 100 watts. This created discomfort for medical staff during procedures. To improve patient care and working conditions, manufacturers are increasingly integrating LEDs into surgical lights, examination lamps, phototherapy units, and endoscopic equipment. These innovations, combined with advancements in medical device technology, are expected to further drive the market growth by replacing outdated and inefficient systems.

Product Insights

The luminaires segment led the market with the largest revenue share of 58.91% in 2024. All luminaires used in track lighting, high bays, troffers, and street lighting are identified as LED lights. The primary driver of the segment's growth is the installation of new track lights and light poles as a result of the expanding commercial building space and developing smart city initiatives.

The lamps segment is anticipated to grow at the fastest CAGR of 8.9% during the forecast period, due to the expanding use of LED lighting systems in the residential sector. LED lamps provide advantages, including increased energy efficiency and greater stability over substitutes like incandescent bulbs and CFLs. They come in a wide range of forms as well. Another factor that is projected to support the growth of LED lamps is the government's policy for raising public awareness of LEDs and their potential to help reduce and manage energy usage.

Installation Type Insights

The new installation type segment led the market with the largest revenue share of 63.23% in 2024. In the industrial and commercial sectors, new manufacturing plants, warehouses, office complexes, and retail spaces are increasingly designed with high-performance LED lighting systems. These installations benefit from the directional lighting, lower heat emission, and superior luminosity of LEDs, which improve working conditions while lowering operational costs. Moreover, large-scale infrastructure projects such as airports, metro systems, and stadiums are incorporating high-efficiency LED lighting to meet safety, performance, and environmental requirements from the ground up.

The retrofit installation type segment is anticipated to register at the fastest CAGR during the forecast period. In commercial environments, retrofitting to LED lighting is especially optimal due to its rapid return on investment. Businesses operating large spaces such as offices, warehouses, and retail stores benefit from significant reductions in energy consumption and maintenance needs. LEDs use less power and have a longer lifespan, often lasting over 50,000 hours, which minimizes disruptions caused by frequent bulb changes. The ability to easily integrate sensors, dimmers, and smart controls during the retrofit process further enhances energy savings and provides improved control over lighting conditions.

Application Insights

The indoor segment led the market with the largest revenue share of 67.75% in 2024. This is the result of an increase in the demand for high-intensity discharge and fluorescent bulb substitutes from supermarkets, shopping malls, and retail establishments. LED lighting generates less heat and costs less than conventional lighting options. The segment's growth is also predicted to be aided by rising demand in public institutions like hospitals and schools.

The outdoor segment is anticipated to register at a significant CAGR during the forecast period. This is because infrastructure-related projects, including highways, airports, and public areas, are being expanded. The market for LED lights for outdoor applications is also expected to increase due to growing government initiatives to attain net-zero emissions by reducing energy use.

Sales Channel Insights

The offline segment led the market with the largest revenue share of 67.50% in 2024. The rise in construction and renovation activities supports the offline segment. Contractors and interior designers often rely on trusted local suppliers for timely deliveries and product demonstrations. Many prefer offline sourcing for bulk orders, where logistics coordination, timely dispatch, and physical quality verification are critical. Offline suppliers also tend to offer flexible payment terms and customized deals, which are especially appealing to small business owners and builders working on tight budgets or phased projects.

The online segment is anticipated to grow at the fastest CAGR of 11.0% during the forecast period. The rising adoption of smartphones and internet connectivity, particularly in emerging economies, is further bolstering the growth of the online segment. As more consumers gain access to digital tools, e-commerce becomes an increasingly attractive option. Online marketplaces such as Amazon and Alibaba and specialized lighting websites provide vast product catalogs that often include detailed specifications, installation guides, and energy savings calculators, empowering customers with the knowledge needed to make informed purchasing decisions. In addition, targeted online marketing strategies and promotional discounts are helping e-retailers attract a wider audience.

End Use Insights

The commercial segment led the market with the largest revenue share of 51.11% in 2024. The need for sophisticated lighting among exhibition, museum, and gallery owners for improved lighting applications is one of the driving forces behind the rapid growth of the commercial building industry around the world and is anticipated to promote market expansion. The demand for high-luminance LED lights is expanding predominantly owing to the requirements for office lighting to conform to government regulations and norms, which is boosting the expansion of the market.

The residential segment is anticipated to grow at the fastest CAGR of 8.7% during the forecast period. The residential market is growing worldwide, which has increased demand for LED floor lamps, architectural LED lamps, cabinet lights, etc. The LEDs used in domestic places have an efficiency of above 90-100 lumens per watt. Additionally, industrialized countries employ a lot of LEDs with an intensity of 110 lm/W -130 lm/W. It is, therefore, projected that quick advancements in LED efficiency will aid in the growth of the target market.

Regional Insights

The LED lighting market in North America is expected to register at a significant CAGR of 7.2% from 2025 to 2030. The introduction of smart lighting solutions, which enable remote operation, automated processes, and energy usage monitoring via mobile applications or additional connected gadgets, has boosted the market growth. Furthermore, the proliferation of the Internet of Things (IoT) and LED lighting integration has created new opportunities for lighting system customization and energy efficiency.

U.S. LED Lighting Market Trends

The LED lighting market in the U.S. is anticipated to witness at a significant CAGR from 2025 to 2030. Consumer preferences in the residential market are also shifting toward smart and connected lighting, which is another driver for the LED market in the U.S. Smart home systems compatible with platforms like Amazon Alexa, Google Assistant, and Apple HomeKit often use LED lighting for automation, remote control, and energy tracking. This integration of LED products with home automation technology enhances user convenience and contributes to energy management, increasing the appeal of LED lighting among tech-savvy U.S. homeowners.

Asia Pacific LED Lighting Market Trends

Asia Pacific dominated the LED lighting market with the largest revenue share of 39.72% in 2024. LED lighting demand is expected to grow more rapidly due to governments expanding their energy-saving measures and infrastructure projects in emerging countries. It is anticipated that the growing infrastructure in countries such as China, Japan, and India, with the numerous manufacturers concentrating on new product launches in these nations, would contribute to the growth of the regional market. In addition, the region's increasing use of smart home solutions is fostering an atmosphere that is conducive to the development of LED lighting. These factors collectively drive the market growth in Asia Pacific.

The LED lighting market in China is projected to grow at a notable CAGR from 2025 to 2030. China is home to various key players, including Guangdong R&C Lighting Technology Co., GS LIGHT, and FOSHAN ELECTRICAL AND LIGHTING Co., LTD, operating in the China market. Another major factor fueling the growth of the market in China is its manufacturing capability, which reduces the cost of the LED lighting solution.

The Japan LED lighting market is projected to grow at a significant CAGR of 7.5% from 2025 to 2030. The market growth can be attributed to the launching of LED lighting solutions by Japanese companies, which help reduce the cost of the LED lighting solution. For instance, in June 2023, ENDO Lighting Corporation, a Japanese lighting solution provider, introduced Synca. Sync Lights offers multi-functional solutions for commercial and residential spaces.

The LED lighting market in India is projected to grow at the fastest CAGR of 9.3% from 2025 to 2030. The market growth can be attributed to companies based in the country coming up with advanced lighting systems, such as smart lighting.

Europe LED Lighting Market Trends

The LED lighting market in Europe is anticipated to grow at a significant CAGR from 2025 to 2030. Europe is proactive in promoting energy conservation and reducing e-waste, among other things. Since LED lighting solutions tick both boxes, the adoption of LED lighting solutions in the region is expected to grow over the forecast period.

The UK LED lighting market is anticipated to grow at a substantial CAGR of 7.4% from 2025 to 2030. The UK government has set determined energy conservation and carbon reduction targets to address the evolving climate change and decrease greenhouse gas emissions. LED lighting is essential in meeting these targets as it consumes less energy compared to conventional lighting systems. The Carbon Trust Green Business Fund Aids Small and Medium-sized Enterprises (SMEs) in the UK to implement energy-saving initiatives such as LED lighting upgrades.

The LED lighting market in Germany is expected to grow at a significant CAGR from 2025 to 2030. The market growth can be attributed to the adoption of LED lighting in the automotive sector and the increasing strategic initiatives such as partnerships, mergers, and acquisitions.

Middle East & Africa LED Lighting Market Trends

The LED lighting market in the Middle East & Africa is anticipated to witness at a significant CAGR during the forecast period. The region has been witnessing the increasing adoption of LED lighting technology owing to initiatives from the government to install energy-efficient lighting in the country. For instance, in June 2023, Shoprite Holdings Ltd., a South African retailer, announced that the company saved USD 17.5 billion in electricity costs in the financial year 2022/2023, owing to the installation of LED lightbulbs across its stores, which are located across 11 African countries. The company announced the installation of 1,001,932 LED lightbulbs across 1,647 distribution centers and supermarkets. Such initiatives are expected to propel the market growth in the Middle East & Africa.

The Saudi Arabia LED lighting market is anticipated to witness at a significant CAGR from 2025 to 2030. The market growth can be attributed to factors such as improving infrastructure, rising purchasing power, improving supply chain networks, and increasing automotive sales.

Key LED Lighting Company Insights

Some of the key companies operating in the market are Signify Holding, Acuity Brands, Inc., and Dialight, among others are some of the leading participants in the LED lighting industry.

-

Acuity Brands Lighting, Inc. is a provider of building and lighting technology solutions and services. Its product portfolio includes lighting controls, lighting components, prismatic skylights, power supplies, fluorescent, LED lighting products, high-intensity discharge, and embedded and standalone light control solutions.

-

Signify Holding’s product portfolio includes IoT-based lighting products for residential and commercial customers. The company sells its products under various brands, such as Philips, Interact, WiZ, and Color Kinetics, among others. The product portfolio of the company includes professional lights, indoor luminaires, outdoor luminaires, and consumer lights.

Halonix Technologies Private Limited, Nanoleaf, and YEELIGHT are some of the emerging market participants in the LED lighting industry.

-

Halonix Technologies Private Limited offers various LEDs with special functionalities, such as LED inverter bulbs, LED speaker bulbs, LED radar motion bulbs, and LED all-rounder bulbs, among others.

-

YEELIGHT specializes in designing, developing, & distributing smart bulbs, light strips, and ambient lighting. It offers a Yeelight Fun product line for entertainment lighting, Yeelight Pro for professional lighting, and Yeelight Home for daily illumination.

Key LED Lighting Companies:

The following are the leading companies in the LED lighting market. These companies collectively hold the largest market share and dictate industry trends.

- Acuity Brands, Inc.

- Cree Lighting USA LLC

- Dialight

- Halonix Technologies Private Limited

- Hubbell

- LSI Industries Inc.

- Nanoleaf

- Panasonic Corporation

- SAVANT TECHNOLOGIES LLC

- Seoul Semiconductor Co., Ltd.

- Signify Holding

- Siteco GmbH

- Syska

- YEELIGHT

- Zumtobel Group AG

Recent Developments

-

In March 2025, Signify Holding announced a joint venture with Dixon Technologies (India) Ltd., subject to regulatory approvals. This partnership aims to manufacture high-quality lighting products and accessories for prominent brands in the competitive Indian market. The joint venture will focus on producing a wide range of innovative and cost-effective lighting solutions, including LED bulbs, downlights, spotlights, battens, rope lights, strips, and various LED lighting accessories, all made in India.

-

In October 2023, YEELIGHT launched its new LED product, The Yeelight Beam, featuring a tabletop-style design with a headphone stand. This light is easy to set up and can be controlled with multiple smart control applications such as Apple HomeKit, Amazon Alexa, and Google.

-

In October 2023, electric company Halonix Technologies launched an LED bulb, UP-DOWN GLOW, featuring three switch-enabled modes in India. This light's dome, an upper part and stem, and a lower part glow in multiple colors, enhancing the consumer's experience.

-

In September 2023, LED lighting provider US LED introduced a new series of outdoor LED luminaires, Right Choice, to improve the user's experience in sightseeing. The LED lighting design is contractor-friendly as it features a trunnion mount, direct pole mount, and adjustable slip fitter.

-

In July 2023, Zumtobel introduced two intelligent lighting technology systems and three new luminaires in its product portfolio. These cutting-edge solutions include the TRAMAO pendant luminaire for hotels and offices, which effectually absorbs sound and delivers the highest light quality, and the SPOTLIGHT infinity II light line family.

-

In May 2023, Dialight announced the launch of its industry-leading 7-year warranty for Aviation Obstruction Lighting Solutions. This initiative highlighted the company's commitment to both customer satisfaction and product quality in the LED lighting industry.

-

In May 2023, Zumtobel launched the all-new high-accuracy positioning luminaires. These new luminaires are integrated with IoT for smart analyses in logistics, retail, and industrial applications.

-

In May 2023, Dialight launched the ProSite High Mast, an extension of the company's ProSite Floodlight series. This advanced solution is a precision-engineered LED lighting fixture purposed to support mounting heights of up to 130 feet for diverse outdoor industrial applications, including airports, rail yards, container yards, transport, parking lots, product stockpiles, and perimeter lighting.

LED Lighting Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 92.37 billion

Revenue forecast in 2030

USD 134.71 billion

Growth rate

CAGR of 7.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, installation type, application, sales channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Acuity Brands, Inc.; Cree Lighting USA LLC; Dialight; Halonix Technologies Private Limited; Hubbell; LSI Industries Inc.; Nanoleaf; Panasonic Corporation; SAVANT TECHNOLOGIES LLC; Seoul Semiconductor Co., Ltd.; Signify Holding; Siteco GmbH; Syska; YEELIGHT; Zumtobel Group Ag

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global LED Lighting Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global LED lighting market report based on product, installation type, application, sales channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Lamps

-

A-Lamps

-

T-Lamps

-

Other

-

-

Luminaires

-

Streetlights

-

Downlights

-

Troffers

-

Others

-

-

-

Installation Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

New

-

Retrofit

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Indoor

-

Outdoor

-

-

Sales Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Residential

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global LED lighting market size was valued at USD 88.17 billion in 2024 and is expected to reach USD 92.37 billion in 2025

b. The global LED lighting market is expected to witness a compound annual growth rate of 7.8% from 2025 to 2030 to reach USD 134.71 billion by 2030.

b. The commercial segment dominated the LED lighting market with a share of 51.1% in 2024. This is attributable to the rising demand for LED troffers, downlights across office space, and malls among others.

b. The LED luminaires segment dominated the global LED lighting market in 2024 and accounted for 58.9% of the global revenue share.

b. The indoor segment led the global LED lighting market and accounted for over 67.7% share of the global market in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.