- Home

- »

- Clothing, Footwear & Accessories

- »

-

Luxury Goods Market Size, Share & Growth Report, 2030GVR Report cover

![Luxury Goods Market Size, Share & Trends Report]()

Luxury Goods Market Size, Share & Trends Analysis Report By Product (Apparel, Watches, Jewelry, Handbags, Perfumes & Cosmetics, Footwear), By End-user (Men, Women), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-261-4

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Consumer Goods

Luxury Goods Market Size & Trends

The global luxury goods market size was estimated at USD 366.23 billion in 2023 and is expected to grow at a CAGR of 6.8% from 2024 to 2030. Rising disposable incomes and wealth in various regions of the world, particularly in emerging markets such as China and India, have propelled the growth of the market. Furthermore, younger consumers, such as millennials and Generation Z, are increasingly entering the luxury market, driving the demand for more contemporary and experiential luxury offerings. The rise of social media and influencer marketing has greatly impacted the visibility and desirability of luxury products.

The increasing influencer marketing & social media influence is anticipated to propel the market growth. This can be attributed to influencer marketing becoming a powerful tool for luxury brands to reach a wider audience and connect with consumers through social media platforms. Collaborations with influencers and celebrities help create buzz around new collections and increase brand visibility among younger demographics. For instance, in July 2023, Givenchy collaborated with the renowned Chinese influencer Tao Liang, also known as Mr. Bags, to produce an exclusive limited-edition version of the popular Voyou bag. The special bag was released solely in China through Mr. Bags’ WeChat mini-program store.

The noticeable shift towards experiential luxury is driving the luxury products market. This shift is driven by changing consumer preferences, particularly among millennials and Gen Z consumers, who are increasingly valuing experiences over material possessions. As a result, luxury brands are adapting their strategies to cater to this trend by focusing on creating immersive experiences such as exclusive events, personalized services, and VIP access to engage customers on a deeper level. For instance, in April 2023, Saks Fifth Avenue expanded Saks Limitless, its exclusive invite-only program for top clients. The program offers members special services and benefits to access luxury fashion, one-of-a-kind merchandise, and exclusive experiences.

Furthermore, the growth of international travel has significantly contributed to the market. Tourists often purchase luxury goods as souvenirs or gifts while traveling abroad, leading to a boost in sales for luxury brands with a strong presence in key tourist destinations. Moreover, travel retail, including duty-free shops at airports, has become a significant channel for luxury sales, catering to affluent travelers seeking premium products. In January 2024, Aer Rianta International opened a new luxury vintage fashion & accessories store named Preloved - Fashion in Full Circle at the Lisbon Airport.

The digital revolution has transformed the way consumers interact with luxury brands. E-commerce platforms, social media, and digital marketing have become essential tools for reaching a global audience and engaging with customers. Luxury brands are investing heavily in their online presence to enhance customer experience and drive sales. For instance, in August 2023, JD.com and Gucci announced a digital partnership along with the launch of the official Gucci digital flagship store on JD.com.

Market Concentration & Characteristics

The industry shows a medium to high degree of innovation. The luxury products market is increasingly embracing innovation to cater to the evolving tastes and preferences of consumers, particularly the younger generation. This includes adopting cutting-edge technology such as virtual reality to provide virtual fitting rooms, creating unique and personalized experiences, and adopting sustainable practices.

The market is characterized by a low to moderate level of merger and acquisition. Companies undergoing mergers and acquisitions are seeking strategic partnerships to enhance their product portfolios, expand their market presence, and leverage each other’s strengths. Moreover, the competitive nature of the market has led to further encouraging the players to explore synergies, leading to occasional mergers and acquisitions to gain a competitive edge. For instance, in January 2021, LVMH announced the successful completion of the acquisition of Tiffany & Co. The acquisition aimed to strengthen its position in the watches and jewelry segment.

The market is subjected to significant regulatory scrutiny due to various factors such as counterfeiting, intellectual property protection, sustainability concerns, and consumer protection. Regulatory bodies worldwide closely monitor the luxury goods industry to ensure compliance with laws and regulations that govern the production, distribution, and marketing of luxury products. In different jurisdictions such as the European Union, the U.S., China, and Japan, there are distinct government agencies such as the European Union Intellectual Property Office (EUIPO), Federal Trade Commission (FTC), the Consumer Product Safety Commission (CPSC), and U.S. Customs and Border Protection responsible for maintaining a well-regulated marketplace with fair competition and consumer protection measures tailored to each country’s regulatory framework.

The luxury products market faces significant competition from its substitutes. Luxury goods are often associated with exclusivity, high quality, and prestige. However, in the market, there are various substitutes that consumers may consider when making purchasing decisions. These substitutes can range from counterfeit brands offering similar products at lower prices to entirely different product categories that fulfill similar needs or desires for consumers.

The level of end-user concentration in the market is notably high due to the nature of luxury goods being targeted toward a niche segment of affluent individuals with high disposable incomes. These end-users are often brand-conscious and seek products that not only signify status and wealth but also reflect their style and preferences.

Product Insights

The apparel segment accounted for a share of 25.9% of the global revenue in 2023. This large share can be attributed to factors such as product innovation & exclusivity, evolving fashion trends, and engaging marketing initiatives. For instance, in January 2024, Louis Vuitton introduced a series of pop-up stores and activations to showcase the Spring-Summer 2024 Men’s Collection in various cities like Paris, Seoul, Miami, London, Los Angeles, and New York City. Furthermore, the digitalization of the fashion industry has significantly contributed to the growth of luxury apparel. With the rise of e-commerce platforms, luxury brands are available to a wider audience globally. In addition, social media platforms have become essential marketing tools for luxury brands, allowing them to engage with their customers and build brand awareness.

The handbags segment is projected to grow at a CAGR of 7.6% from 2024 to 2030. Luxury and premium handbags have evolved beyond their utilitarian role, transforming into symbols of status and personal style. The growing purchasing power of consumers, particularly in emerging economies, combined with aspirational buying tendencies, is propelling the desire for high-end handbags. Notably, alongside well-established luxury brands, emerging designers and niche players are entering the market, introducing distinctive designs and craftsmanship. These brands cater to consumers seeking exclusivity and individuality, thus enriching the diversity of the luxury handbag market.

The perfumes & cosmetics segment is anticipated to grow at a CAGR of 6.4% from 2024 to 2030. This can be attributed to the changes in consumer preferences, the rising influence of social media, and the influence of Gen Z consumers and millennials. Gen Z is becoming a significant force in the luxury perfumes and cosmetics market. According to a study by Pinterest, 70% of its luxury audience is under the age of 35. This generation is known for its strong appreciation of experiential and personalized products, which influences luxury beauty market brands to offer customizable products or immersive shopping experiences. Moreover, the globalization of markets has enabled luxury perfume and cosmetics brands to reach a wider audience across different regions. This expansion into new markets has contributed to the overall growth of the segment. For instance, in January 2024, Chanel expanded its presence in India by opening a new fragrance and beauty boutique in Mumbai.

The jewelry segment is expected to grow at a CAGR of 7.0% from 2024 to 2030, owing to rising disposable incomes, the increasing presence of female self-purchasers, the symbolism and significance associated with luxury jewelry, the preference for branded and customized pieces, the status & symbolism attached to high-end jewelry and the rise in e-commerce. For instance, in October 2023, Bucherer Fine Jewellery formed an exclusive collaboration with luxury online retailer Mytheresa to offer a curated selection of its pieces.

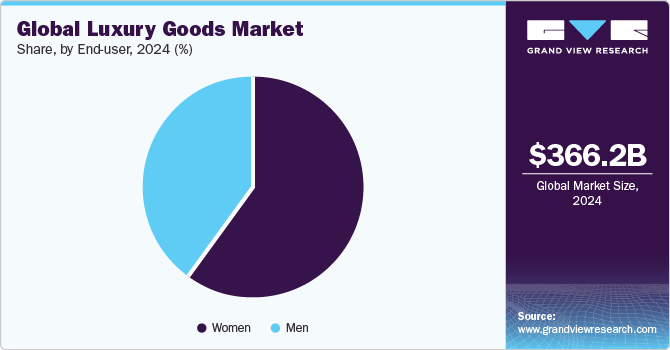

End-user Insights

The women’s segment accounted for a dominant share of 60.2% of global revenue in 2023. A significant factor driving the women's segment is the increasing wealth and financial independence of women globally. For instance, the Forbes’ 2023 ranking of the planet’s richest people featured 337 billionaire women, up from 327 in 2022. This growing wealth creates a significant market for luxury goods targeted at women. Furthermore, women are growing more conscious about their style and appearance. This trend has led to an increased demand for luxury fashion items that allow them to express their unique identity and sense of style. The rise of social media platforms has also contributed to this trend, as more women look to these platforms for inspiration and to showcase their style. In September 2023, David Yurman, a renowned luxury jewelry brand, chose Sofia Richie Grainge as the face of their new line of sculpted cable jewelry and their newest global ambassador. This collaboration showcases Richie Grainge’s influence and appeal while also promoting the brand’s innovative designs.

The men’s segment is projected to grow at a CAGR of 7.2 from 2024 to 2030. One of the primary factors driving the market is the increasing disposable income of the male population. As men’s earning power grows, they are more likely to invest in high-end, luxury items. Moreover, men’s attitudes towards fashion and luxury have evolved significantly over the years. This shift in consumer preferences has led to a surge in demand for premium and luxury products designed exclusively for men. Brands are capitalizing on this trend by offering a wide range of luxury goods that cater to the discerning tastes of male consumers. For instance, in March 2024, Dior introduced its latest men’s capsule collection, the Cannage capsule, which embraces a more relaxed and casual approach to men’s fashion while also paying a tribute to the iconic “cannage” pattern of the fashion house.

Regional Insights

The North America luxury goods market is anticipated to grow at a CAGR of 6.6% from 2024 to 2030. North America boasts a large population of fashion-conscious consumers with higher purchasing power who actively follow market trends for personal accessories such as clothing, handbags, watches, and jewelry. Social media influencers play a significant role in promoting new luxury collections from businesses to attract customers and influence their buying decisions. Consumers are attracted to luxury items due to their unique designs, durability, comfort, and aesthetics, distinguishing them from fast fashion accessories. North America has a robust network of both single-brand and multi-brand stores in airports and shopping centers, providing affluent customers with a wide range of product options from local and international luxury brands.

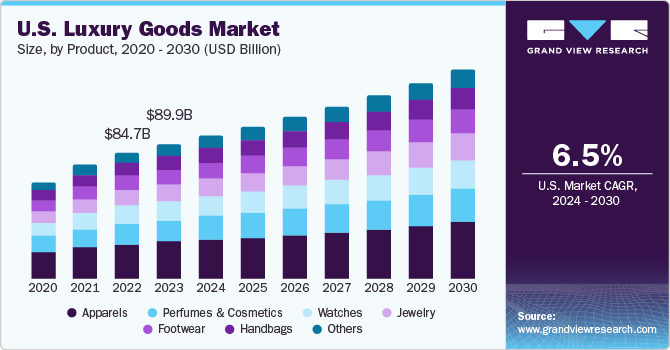

U.S. Luxury Goods Market Trends

The luxury goods market in the U.S. is projected to grow at a CAGR of 6.5% from 2024 to 2030. The growth in the number of high-net-worth individuals has led luxury brands to expand their presence in the U.S. One such example is the Italian fashion house Gucci, which has been actively opening and refurbishing stores across the U.S. In May 2022, Gucci signed a lease for a 10,000-square-foot space at the American Dream mall in New Jersey.

Europe Luxury Goods Market Trends

The luxury goods market in Europe is projected to grow at a CAGR of 6.9% from 2024 to 2030 owing to the increasing number of high-net-worth population in key markets of Scandinavia and Western Europe. Furthermore, the improvement of economic indicators in Eastern European countries such as Poland and Romania is projected to open new market avenues for the industry participants over the next few years.

Asia Pacific Luxury Goods Market Trends

The luxury goods market in Asia Pacific accounted for a share of 39.7% of the global revenue in 2023. An increase in the number of high-net-worth individuals is a key factor driving the market growth. According to the Knight Frank Wealth Report, the billionaire population in the Asia Pacific is expected to grow at a faster rate than the global average during the next five years, with a 36.7% increase compared to the world’s 33.7% average. By 2026, over one-third of the world’s billionaires are projected to be from the APAC region, as this proportion continues to rise with the wealth boom shifting east. Furthermore, luxury brands have been expanding their retail presence in Asian markets by opening new flagship stores in major cities and investing in local partnerships and collaborations with local designers and brands. By establishing a strong retail presence, these brands aim to build a loyal customer base and increase their brand recognition in the region. In August 2023, Gioia, a high-end leather goods brand, inaugurated its main store in Mumbai, India, showcasing a variety of premium handbags and accessories.

Key Luxury Goods Company Insights

Some of the key companies operating in the luxury goods market include LVMH Group, Chanel LTD, Burberry Group PLC, Prada S.p.A, Kering SA, Rolex SA, Richemont S.A., Estée Lauder Companies Inc., L'Oréal S.A., and others.

-

LVMH Groupis a French multinational luxury goods conglomerate that owns a vast portfolio of prestigious brands across different sectors, including fashion and leather goods, perfumes and cosmetics, watches and jewelry, wines and spirits, and selective retailing. Some of the well-known brands under LVMH include Louis Vuitton, Dior, Givenchy, Fendi, Bulgari, TAG Heuer, Sephora, Moët & Chandon, Dom Pérignon, and many others.

-

Kering is one of the major players in the luxury goods industry based in France. The company focuses on fashion and leather goods, owning iconic brands such as Gucci, Saint Laurent, Bottega Veneta, Balenciaga, Alexander McQueen, and Brioni. Kering is known for its commitment to sustainability and ethical practices in the luxury industry.

Key Luxury Goods Companies:

The following are the leading companies in the luxury goods market. These companies collectively hold the largest market share and dictate industry trends.

- LVMH Group

- Chanel LTD

- Burberry Group PLC

- Prada S.p.A

- Kering SA

- Coty Inc.

- Estée Lauder Companies Inc.

- Shiseido Company, Limited

- L'Oréal S.A.

- Hermès International S.A.

- Audemars Piguet Holding SA

- PATEK PHILIPPE SA

- Rolex SA

- Omega

- RALPH LAUREN

- Richemont S.A.

- Swarovski

- Pandora Inc.

- Hugo Boss AG

Recent Developments

-

In January 2024, Miu Miu (Prada) launched its fourth limited edition collection of upcycled bags, named “Miu Miu Upcycled: Denim and Patch” bags.

-

In September 2023, Richemont SA launched a new beauty division named Laboratoire de Haute Parfumerie et Beauté.

-

In September 2023, Ralph Lauren expanded its presence in Canada by launching its first luxury brick-and-mortar store and a dedicated e-commerce platform.

-

In June 2023, Kering Beauté (Kering) announced the signing of an agreement to acquire Creed, a high-end heritage fragrance house.

Luxury Goods Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 390.17 billion

Revenue Forecast in 2030

USD 579.26 billion

Growth rate (Revenue)

CAGR of 6.8% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, end-user, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; South Africa

Key companies profiled

LVMH Group ; Chanel LTD ; Burberry Group PLC; Prada S.p.A; Kering SA; Coty Inc.; Estée Lauder Companies Inc.; Shiseido Company, Limited; L'Oréal S.A.; Hermès International S.A.; Saks Fifth Avenue; TOD’S s.p.a.; Bottega Veneta

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Luxury Goods Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global luxury goods market report based on product, end-user, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Apparels

-

Watches

-

Jewelry

-

Handbags

-

Perfumes & Cosmetics

-

Footwear

-

Others

-

-

End-user Outlook (Revenue, USD Billion, 2018 - 2030)

-

Men

-

Women

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global luxury goods market size was estimated at USD 366.23 billion in 2023 and is expected to reach USD 390.17 billion in 2024.

b. The global luxury goods market is expected to grow at a compounded growth rate of 6.8% from 2024 to 2030 to reach USD 579.26 billion by 2030.

b. Luxury apparel market accounted for a share of over 25.9% of the global revenues in 2023. This high share can be attributed to factors such as product innovation & exclusivity, evolving fashion trends, and engaging marketing initiatives.

b. Some key players operating in Luxury Goods market include LVMH Group; Chanel LTD; Burberry Group PLC; Prada S.p.A; and Kering SA, Rolex SA, Richemont S.A., Estée Lauder Companies Inc., L'Oréal S.A., and others

b. Key factors that are driving the market growth include rising disposable incomes and wealth in various regions of the world, particularly in emerging markets like China and India.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."