- Home

- »

- Beauty & Personal Care

- »

-

Fragrance Market Size And Share, Industry Report, 2030GVR Report cover

![Fragrance Market Size, Share & Trends Report]()

Fragrance Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Deodorants, Perfumes), By Application (Personal Care, Household Care), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-859-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fragrance Market Summary

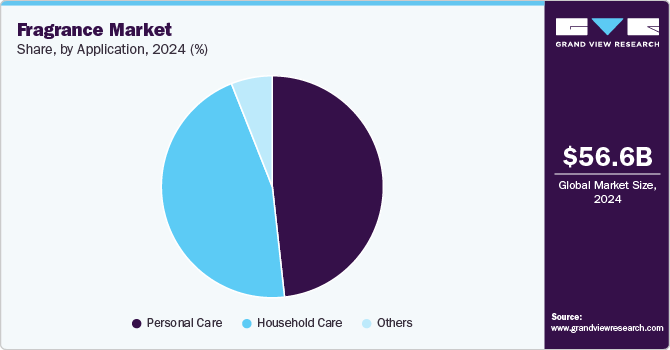

The global fragrance market size was estimated at USD 56.60 billion in 2024 and is projected to reach USD 74.76 billion by 2030, growing at a CAGR of 4.9% from 2025 to 2030. The increasing popularity of unisex fragrances, the expansion of the luxury fragrance segment, the focus on sustainability and ethical sourcing, and social media influence on consumer preferences drive the global fragrance industry.

Key Market Trends & Insights

- North America fragrance industry dominated globally with a revenue share of 33.30% in 2024.

- The U.S. fragrance industry led the North America region in terms of revenue share in 2024.

- By product, deodorants accounted for the largest revenue share of 45.97% in 2024.

- By distribution channel, offline sales dominated the market with a share of 91.84% in 2024.

- By application, personal care applications dominated the market with a share of 48.25% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 56.60 Billion

- 2030 Projected Market Size: USD 74.76 Billion

- CAGR (2025-2030): 4.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Unisex fragrances are gaining significant traction in the market, appealing to a wide audience by breaking down traditional gender-specific scent categories. These versatile scents offer broader appeal and reflect the growing consumer preference for inclusivity in fragrance offerings. Moreover, the luxury and premium fragrance segment is experiencing notable growth as consumers seek high-quality, exclusive scents. The demand for long-lasting and sophisticated fragrances is particularly strong in regions like North America and Europe, where luxury perfumes are often seen as a symbol of status and refinement. As consumers become more environmentally conscious, they are gravitating toward brands that prioritize sustainability and the ethical sourcing of ingredients. This trend is pushing companies to adopt eco-friendly practices, including the use of natural ingredients and sustainable packaging, to align with the evolving consumer expectations.

In addition, social media platforms play a crucial role in shaping consumer choices and boosting brand visibility. Fragrance brands are increasingly leveraging these platforms to engage with a wider audience, promote new products, and drive trends, thereby enhancing their market presence.

The growing adoption of technologies, such as artificial intelligence, helps manufacturers of fragrances explore additional opportunities without incurring any additional financial burden. The adoption of such technologies and commercialization provides companies with multiple benefits, such as cost containment, extended product lines, and wider geographic reach. For example, in March 2025, Osmo launched Generation, the first AI-powered fragrance house in the world. This innovative platform uses olfactory intelligence (OI) to blend AI-fragrance creation with market intelligence, allowing brands to create fragrances with more precision and creativity than ever before.

The middle class is an important demographic for the fragrance industry, with a growing appetite for high-end fragrance products. To stand out in the market, manufacturers are focusing on unique flavors and scent profiles. Consumers are seeking specialty stores and organized retail sectors to meet their fragrance needs, highlighting the importance of an immersive shopping experience in this competitive market.

Consumer Surveys & Insights

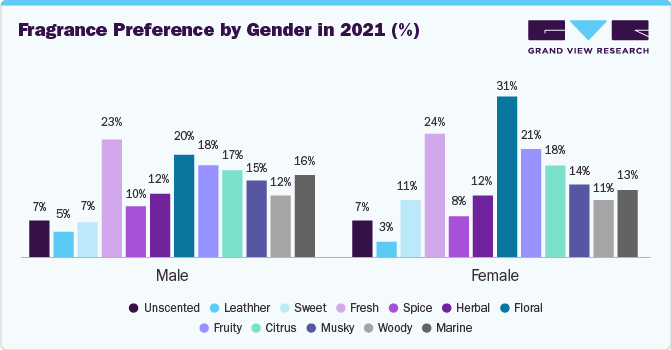

Consumers appreciate scents that elevate their mood and make them feel more at ease. They also desire invigorating smells that revive them and make them feel more alive, as evidenced by the data: Global consumers choose refreshing smells (30%), followed by refreshing scents (23%). Perfumes allow people to express themselves and their feelings. Approximately 28% of worldwide customers spend a medium amount on fragrances, with 18% purchasing high-end/premium ones.

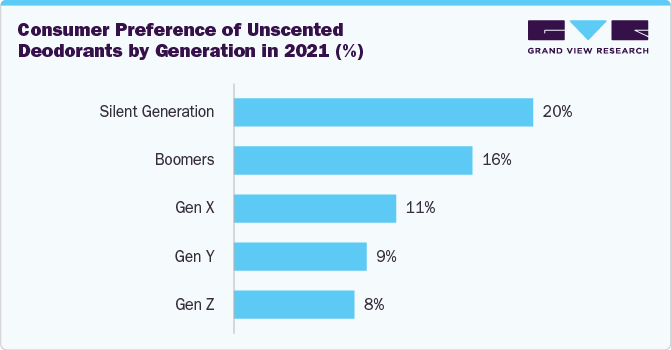

Deodorants with flowery, fresh, or citrus fragrances are most popular among customers. North Americans enjoy fresh smells, whilst Central and South Americans favor flowery and citrus scents. Brands might take these locations into account when developing new deodorants with these smells. Due to skin sensitivity, consumers may opt for unscented deodorants. Unscented deodorants are very popular among North American customers. Approximately 20% of the silent generation customers choose unscented deodorants, maybe to minimize skin irritation caused by a specific aroma.

Gen Z outperforms overall fragrance users in a variety of ways. Consumers aged 13 to 26 are most likely to use scent heavily or at least three times per week, and they are currently more involved with the category than Millennials. Gen Z is also the most likely to buy scent for themselves more than once a year. The Gen Z effect is also having an impact on scent purchases through social media. TikTok jumped to second place among customers who said social media influenced their scent purchases, thanks to Gen Z and rising Millennial interest.

Trump Tariff Impact

The Trump administration's imposition of tariffs on imported goods is expected to significantly impact the luxury, fashion, and cosmetics industries, including the fragrance industry. The tariffs have increased the cost of raw materials essential for fragrance production, such as natural oils and synthetic compounds, many of which are sourced internationally. For instance, ingredients such as oud oil from Cambodia, rose oil from Morocco, jasmine absolute from Egypt, and sandalwood oil from Australia or India have become more expensive due to these tariffs. In addition, packaging components like glass bottles and aluminum aerosol spray cans, often imported from countries like China and Italy, have also seen price hikes. Thus, Trump's tariffs may increase costs across the supply chain, particularly for imported raw materials and finished products.

The newly imposed tariffs have increased import costs for fragrances, particularly those originating from China and the European Union. For example, a 104% duty on Chinese items has been reported, significantly increasing the price of imported fragrances. To cover the higher costs, numerous perfume companies increased their retail pricing. High-end categories, such as fragrances, have experienced price rises of up to 25% to cover increased expenses. Furthermore, the United States revoked the tariff-free status for low-value imports from China and Hong Kong, putting charges on shipments worth less than $800. This regulatory change immediately impacts online sellers such as Shein and Temu, which used the exemption to provide low-cost items.

Countries affected by U.S. tariffs have sought to reduce their reliance on the American market by expanding their exports to other regions, such as the European Union, Asia-Pacific, and the Middle East. By targeting these markets, companies aim to offset losses from U.S. tariffs and tap into new consumer bases. Moreover, countries have accelerated negotiations of bilateral and multilateral trade agreements to secure tariff exemptions or reduce trade barriers. For instance, the European Union has pursued deals with Canada (CETA), Japan (EPA), and Mercosur to enhance trade cooperation, which includes the beauty and fragrance sectors.

U.S. companies are preparing for impacts like cost increases and production shifts due to the tariffs. For example, U.S. President Donald Trump's tariffs on steel and aluminum imports highlighted concerns among various American companies. Coty Inc., a leading fragrance and beauty company, has taken strategic measures to mitigate potential impacts on its operations. Coty has increased its U.S. inventories and ramped up fragrance production at its North Carolina facilities. These actions aim to reduce reliance on imported materials that may be subject to higher costs due to the tariffs.

Product Insights

Deodorants accounted for the largest revenue share of 45.97% in 2024. The emphasis on personal grooming and hygiene drives demand for deodorants, fueled by the global fitness trend and increased gym usage. As a result, consumers are seeking effective odor-control solutions. Rising disposable incomes have also boosted demand for premium deodorants, offering a lucrative opportunity for manufacturers.

Perfume is expected to register the fastest CAGR of 5.0% from 2025 to 2030. Perfumes have evolved into a staple in personal grooming, with consumers viewing them as an essential component of their daily routine. Fragrance companies utilize sophisticated marketing strategies and celebrity endorsements to create an air of exclusivity and allure around their perfumes, driving consumer desire. The trend towards niche and artisanal perfumes is also growing, offering unique scents and a sense of individuality for discerning consumers.

Distribution Channel Insights

Offline sales dominated the market with a share of 91.84% in 2024. Specialty stores focus primarily on personal care and beauty products, making them the key distribution points for both mid-range and luxury fragrances. These stores offer a curated selection, with expert sales staff to guide consumers in choosing the right scent; this enhances the overall shopping experience. Brands frequently collaborate with specialty stores to host fragrance workshops, pop-up events, or promotional campaigns. These activities help create a more engaging and immersive experience, encouraging brand loyalty and higher sales conversion rates in this channel.

Online sales are projected to grow at the fastest CAGR of 5.4% over the forecast period. The online channel has seen exponential growth, particularly in the luxury fragrance segment. E-commerce platforms provide a wider selection of both niche and designer perfumes, allowing consumers to explore different brands and price points from the comfort of their homes. Personalized shopping experiences, such as virtual fragrance consultations or customized scent recommendations, are increasingly becoming popular on e-commerce sites. These services enhance customer engagement and help brands connect with a tech-savvy, convenience-oriented consumer base.

Application Insights

Personal care applications dominated the market with a share of 48.25% in 2024. Fragrances are increasingly being integrated into a widening range of personal care products, extending beyond traditional perfumes and deodorants to body lotions, shower gels, shampoos, conditioners, makeup, and beard care products. This diversification provides consumers with multiple opportunities to incorporate fragrance into their daily routines, enhancing the sensory experience and driving market growth.

The household care application is expected to register a significant CAGR of 4.8% over the forecast period. The rising importance of creating a welcoming atmosphere in homes has driven the growth of fragrances in household products. Consumers are seeking to eliminate unpleasant odors and leave behind desirable scents, making fragrances a key factor. The market offers a diverse range of seasonal and trendy options for products such as candles, air fresheners, and fabric softeners, catering to the demand for a fresh and inviting home environment.

Regional Insights

North America fragrance industry dominated globally with a revenue share of 33.30% in 2024. The region’s market growth was fueled by a thriving economy, increasing demand for premium products, and rising living standards. Online retail is a major distribution channel in the North America market, with platforms including Sephora, Amazon, and Ulta Beauty driving significant sales growth. The convenience of e-commerce, along with the availability of reviews and exclusive offers, has shifted consumer behavior toward online purchases, especially among younger consumers.

U.S. Fragrance Market Trends

The U.S. fragrance industry led the North America region in terms of revenue share in 2024, which was driven by widespread adoption across various sectors. The US fragrance industry is highly diverse, with a strong demand for both premium and mass-market products. Perfumes and fragrances are popular across various demographics, and consumers are increasingly looking for personalized and niche scents that reflect their individuality. Luxury perfumes, particularly Eau de Parfum and Eau de Toilette, hold a significant share, with brands including Tom Ford, Calvin Klein, and Marc Jacobs leading in this segment.

Europe Fragrance Market Trends

Europe fragrance industry was identified as a lucrative region in 2024. The region’s rich heritage in perfumery has cultivated a strong affinity for fragrances. This cultural predisposition translates to higher consumer interest and spending, driving demand for premium fragrances. The growing trend towards natural fragrances and perfumes further fuels the region’s robust market. Luxury fragrances are a growing segment in the European region, with premium brands expanding their presence in major retail channels such as department stores and specialty boutiques.

The fragrance industry in France is a global hub with a long-standing tradition of producing some of the world’s most iconic luxury perfumes. The country is home to major luxury brands, including Chanel, Dior, and Guerlain, which dominate both the domestic and international markets. France's status as the birthplace of fine perfumery strongly influences the consumer market, where Eau de Parfum and Parfum are in high demand.

Asia Pacific Fragrance Market Trends

The Asia Pacific fragrance industry is projected to grow at the fastest CAGR of 6% over the forecast period, driven by rapid urbanization and exposure to Western cultures and trends. Cultural diversity across Asia Pacific influences fragrance preferences, with light and fresh scents being favored in Japan and South Korea. India and China, on the other hand, are witnessing growing interest in traditional fragrances such as attars alongside modern perfumes. E-commerce is becoming a key distribution channel across Asia Pacific, providing consumers with access to a broader variety of global and local brands. Online shopping for fragrances is especially popular in China.

India fragrance industry demonstrated a significant market share in 2024. The fragrance industry in India is diverse, with strong cultural influences shaping consumer preferences. Traditional scents, such as attars (natural, alcohol-free perfumes) and scented oils, are deeply embedded in Indian heritage; however, there is growing demand for modern perfumes and body sprays, particularly in urban areas. The rising middle class and increasing disposable incomes are driving the demand for both affordable and premium fragrances in India.

Key Fragrance Company Insights

Some key companies in the fragrance industry include Natura&Co, L’Oréal, LVMH, The Estée Lauder Companies Inc., and others. Prominent market players compete on brand reputation, innovation, marketing, and distribution reach, with global conglomerates and niche brands operating in the market, utilizing strategies including mergers and licensing agreements.

-

Coty Inc. is a global beauty company, offering a diverse portfolio of fragrance, makeup, hair care, body care, and skincare products under iconic brands such as Gucci, Rimmel, Adidas, and Calvin Klein. The company serves professional salons and retail channels, distributing its products through a wide range of channels, including upscale retailers, online platforms, and mass merchants, to reach the global fragrance industry.

-

CHANEL, a premier luxury brand, offers a diverse portfolio of high-end products including perfumes, makeup, skincare, and jewelry. The iconic brand is renowned for its iconic creations such as Chanel No. 5, the “little black dress”, and the Chanel Suit, solidifying its position as a leader in the luxury fragrance industry.

Key Fragrance Companies:

The following are the leading companies in the fragrance market. These companies collectively hold the largest market share and dictate industry trends.

- Natura & Co

- L’Oréal

- LVMH

- The Estée Lauder Companies Inc.

- KERING

- Coty Inc.

- CHANEL

- PVH Corp.

- Burberry Group plc

- Dolce & Gabbana S.R.L.

- Shiseido Company

Recent Developments

-

In July 2024, Shiseido and Max Mara collaborated on a long-term fragrance partnership, granting Shiseido exclusive global rights to develop, manufacture, launch, and distribute perfumes under the Max Mara label. The agreement was formalized through a licensing contract, with Shiseido EMEA handling the license.

-

In September 2023, The Estée Lauder Companies (ELC) successfully opened an Atelier in Paris, France. The Atelier enabled ELC to expand its luxury fragrance capabilities, facilitating innovation, accelerated product launches, and high-quality production on a larger scale, leveraging connections across its brand portfolio.

-

In December 2022, Giorgio Armani launched Armani Privé Sable Nuit, a unisex fragrance with warm and spicy notes. This addition resonated with the market’s trend toward gender-neutral fragrances, influencing other luxury brands to invest in inclusive fragrance lines and subsequently catering to diverse consumer preferences.

Fragrance Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 58.89 billion

Revenue forecast in 2030

USD 74.76 billion

Growth rate (Revenue)

CAGR of 4.9% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; South Africa.

Key companies profiled

Natura&Co; L’Oréal; LVMH; The Estée Lauder Companies Inc.; KERING; Coty Inc.; CHANEL; PVH Corp.; Burberry Group plc; Dolce & Gabbana S.R.L.; Shiseido Company.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fragrance Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fragrance market report based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Deodorants

-

Perfumes

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Personal Care

-

Household Care

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fragrance market was estimated at USD 56.60 billion in 2024 and is expected to reach USD 58.89 billion in 2025.

b. The global fragrance market is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2030 to reach USD 74.76 billion by 2030.

b. North America dominated the fragrance market in 2024 with a share of about 33.30%. The region’s market growth was fueled by a thriving economy, increasing demand for premium products, and rising living standards.

b. Key players in the fragrance market are Natura&Co, L’Oréal, LVMH, The Estée Lauder Companies Inc., KERING, Coty Inc., CHANEL, PVH Corp., Burberry Group plc, Dolce & Gabbana S.R.L., and Shiseido Company.

b. Key factors that are driving the fragrance market growth include increasing popularity of unisex fragrances, the expansion of the luxury fragrance segment, the focus on sustainability and ethical sourcing, and social media influence on consumer preferences.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.