- Home

- »

- Clothing, Footwear & Accessories

- »

-

Handbag Market Size, Share & Trends, Industry Report 2030GVR Report cover

![Handbag Market Size, Share & Trends Report]()

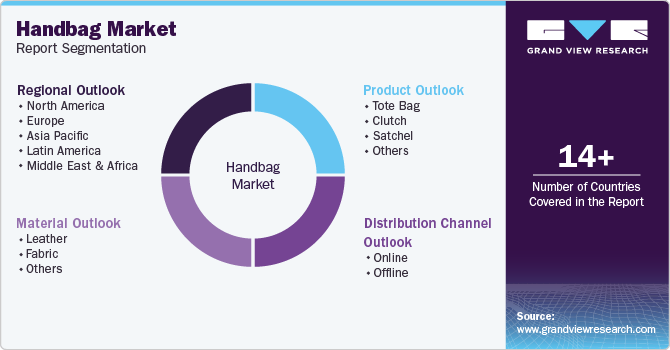

Handbag Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Tote Bag, Clutch, Satchel), By Distribution Channel (Online, Offline), By Material (Leather, Fabric), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-927-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Handbag Market Summary

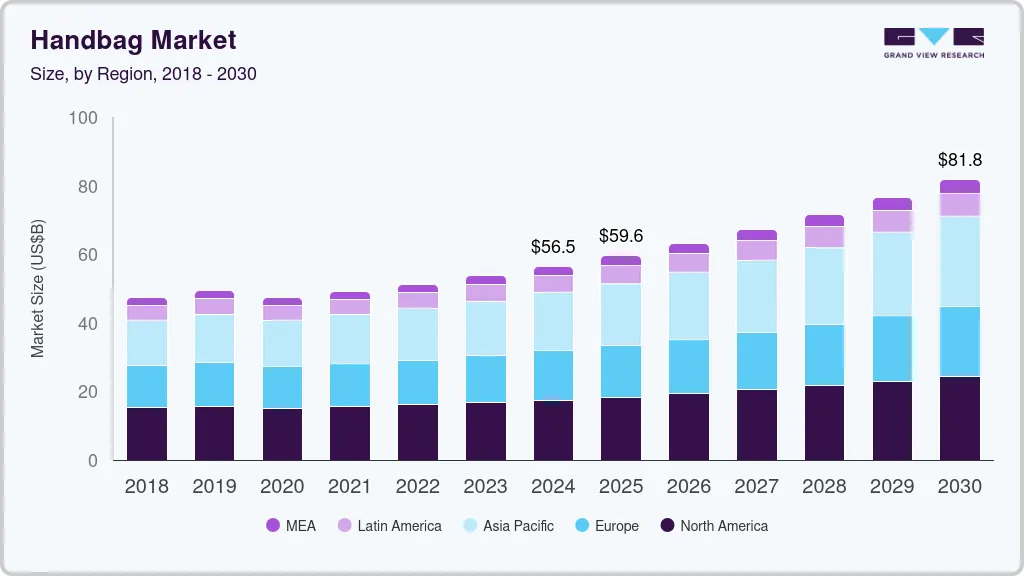

The global handbag market size was estimated at USD 56.48 billion in 2024 and is projected to reach USD 81.79 billion by 2030, growing at a CAGR of 6.5% from 2025 to 2030, propelled by the growing fashion awareness and rising disposable income. With increased exposure to global fashion trends, consumers are seeking stylish accessories to complement their outfits.

Key Market Trends & Insights

- North America handbag market held the largest revenue share of 31.0% in 2024.

- The U.S. handbag market accounted for the largest share in the regional market in 2024.

- By product, The tote bag segment dominated the market with the largest revenue share of 41.1% in 2024.

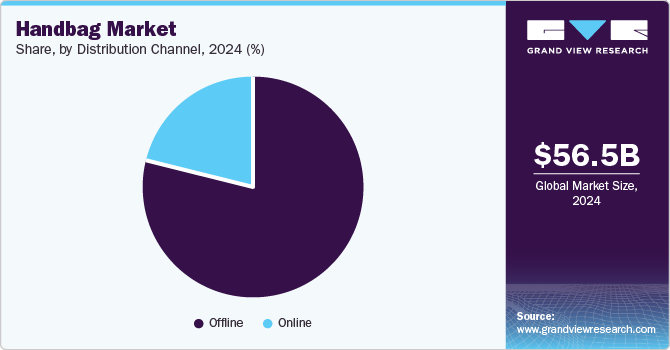

- By distribution channel, the offline segment held the largest market share in 2024.

- By material, the leather segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 56.48 Billion

- 2030 Projected Market Size: USD 81.79 Billion

- CAGR (2025-2030): 6.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Handbags have transformed from mere utility items into fashionable statements, catering to varying tastes and lifestyles. Higher disposable income allows consumers to invest in premium, branded products, boosting market demand. This financial capability enables frequent purchases and experimentation with designs, fostering market expansion. Moreover, the rise in gift culture and urbanization is expected to propel the market growth. As gifting becomes an integral part of modern celebrations, handbags emerge as a popular and versatile choice for various occasions.

Urbanization has led to busy lifestyles and improved retail accessibility, encouraging consumers to explore convenient and stylish options. Urban dwellers often seek compact, functional handbags suited to their dynamic routines, further driving market demand. The synergy of gifting trends and urban lifestyle preferences creates opportunities for innovation, contributing to the thriving handbag industry.

Modern working women seek a blend of style and practicality, making handbags vital to their daily routines. They need to transition seamlessly between professional and personal settings, and handbags fulfill this role adeptly. These versatile options carry work-related items, particularly laptops, documents, and planners, along with personal essentials such as wallets, cosmetics, and electronic devices. Results of the Omnibus survey conducted by Circana, a media company, in June 2023, indicated that 39% of American women aged 18 to 34 carry a handbag to work or school. Moreover, over 60% of women aged 35 and older always have a handbag with them for activities beyond work or school.

According to a survey conducted by The International Council of Societies of Industrial Design (ICSID) in November 2021, an American woman owns an average of 11 handbags and spends approximately USD 160 on a bag. Thus, the high expenditure by women on handbags in the country contributes to the growth of the market, making it the largest market in the region.

In addition, luxury and premium handbags have evolved beyond their utilitarian role, transforming into status and personal style symbol. The growing purchasing power of consumers, particularly in emerging economies, combined with aspirational buying tendencies, is propelling the desire for high-end handbags. Notably, alongside well-established luxury brands, emerging designers and niche players are entering the market, introducing distinctive designs and craftsmanship. These brands cater to consumers seeking exclusivity and individuality, thus enriching the diversity of the luxury handbag industry.

Product Insights

The tote bag segment dominated the market with the largest revenue share of 41.1% in 2024. Tote bags are multi-purpose bags that can be used for a variety of tasks. They are larger than other types of purses, making it easier for consumers to carry their essentials to offices, universities, and other places. These bags are popular among consumers due to their size. The rising influence of Korean fashion and aesthetics among younger consumers is also driving the sale of tote bags.

Tote bags are considered environment-friendly because they can be used multiple times, reducing the need for disposable bags. This aligns with sustainability goals to reduce plastic pollution. For instance, in 2021, Anya Hindmarch, a fashion designer based in England, collaborated with Sainsbury's and Waitrose supermarket chains in the UK to reuse shopping tote bags to tackle sustainability challenges.

The satchel segment is anticipated to grow at the fastest CAGR of 7.6% over the forecast period, attributed to its blend of practicality and style. Offering ample space, versatility, and a structured design, satchels appeal to consumers seeking both functionality and fashion. With the rise of work-from-home and hybrid work models, the demand for bags transitioning seamlessly from professional to casual settings has surged. Furthermore, luxury brands are embracing satchels, driving their popularity in high-end markets. This combination of utility and aesthetic appeal is expected to fuel significant growth in the segment.

Distribution Channel Insights

The offline segment held the largest market share in 2024, owing to consumer preference for tactile experiences and immediate gratification. Physical stores allow customers to touch, feel, and try products before purchasing, which is particularly important for high-value items like handbags. Moreover, in-store shopping provides personalized customer service and the opportunity to make immediate purchases, enhancing the overall shopping experience.

The online segment is projected to be the fastest-growing segment during the forecast period. Increasing internet accessibility and convenience-driven shopping preferences encourage more consumers to explore online platforms. The digital space enables a vast array of choices, competitive pricing, and seamless global access, fostering wider appeal. Social media campaigns and influencer partnerships create powerful marketing channels, enhancing visibility and demand. Furthermore, advancements in user-friendly interfaces and secure payment systems boost consumer trust. For instance, in November 2024, Lee introduced a new handbag collection, blending its denim legacy with modern trends. Featuring durable denim and vegan leather, each tote displays the brand’s logo. The collection was launched on social and e-commerce platforms and celebrates the growing popularity of denim bags, making it a stylish and thoughtful holiday gift choice.

Material Insights

The leather segment accounted for the largest market share in 2024 due to its association with luxury, durability, and timeless appeal. Leather handbags are considered a symbol of sophistication, making them highly sought after by fashion-conscious consumers. The material’s durability and high quality further contribute to its popularity, as leather bags are seen as long-term investments. In addition, the rise in disposable incomes and a growing preference for premium products have fueled demand. Luxury, longevity, and status have strengthened leather's position in the handbag industry. For instance, in November 2024, Moschino launched its latest statement piece, the Sedano bag. It is a celery-inspired clutch crafted from nappa leather with stunningly realistic details. Priced at nearly half a million rupees, it features 3D shading, wire-reinforced stalks for movement, and a hidden magnetic clasp, blending playful design with luxury craftsmanship.

The fabric segment is anticipated to grow over the forecast period, driven by consumer preference for eco-friendly and sustainable products. With rising awareness of environmental issues, fabric handbags made from organic cotton, recycled polyester, and other sustainable materials are gaining popularity. These bags offer lightweight, versatile options without compromising style, attracting eco-conscious buyers. Furthermore, the ability to create diverse designs, patterns, and colors in fabric handbags appeals to fashion-forward consumers. This shift toward sustainability, combined with affordability and trendiness, is expected to favor the growth of the fabric segment in the coming years.

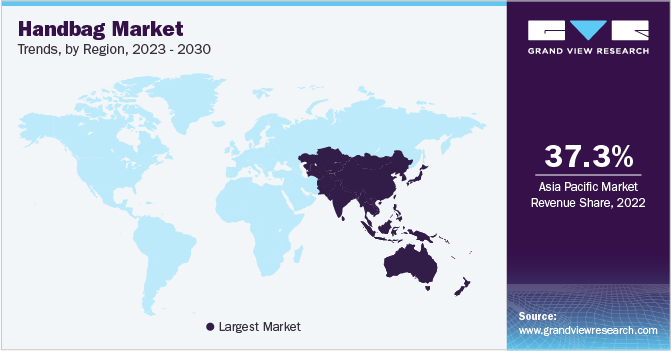

Regional Insights

North America handbag market held the largest revenue share of 31.0% in 2024, fueled by the growing influence of the fashion industry and increased discretionary spending. As handbags transition from functional accessories to fashion essentials, consumers are increasingly investing in premium, luxury, and designer options. The rise in disposable incomes, particularly among millennials and Gen Z, has led to higher spending power, fueling demand for trendy, high-quality handbags. Moreover, fashion trends, social media influencers, and celebrity endorsements further elevate the status of handbags, making them a must-have item for style-conscious buyers.

U.S. Handbag Market Trends

The U.S. handbag market accounted for the largest share in the regional market in 2024, owing to the integration of smart technology and the growing demand for personalized handbags. Consumers increasingly seek functional bags equipped with features including wireless charging, GPS tracking, and biometric locks, blending convenience with style. In addition, brands are offering customization options, such as monogramming and bespoke designs, allowing consumers to express individuality. This convergence of technology and personalization enhances user experience and fosters brand loyalty, contributing to market growth.

Europe Handbag Market Trends

Europe handbag market is set to grow significantly during the forecast period, attributed to innovation in handbag design and the influence of social media and celebrity endorsements. Brands are introducing innovative designs, incorporating sustainable materials and functional features to cater to the evolving preferences of consumers. Moreover, social media platforms, especially Instagram and TikTok, have become essential marketing tools, enabling brands to showcase their products to a broader audience. Celebrity endorsements further amplify brand visibility and desirability, significantly impacting consumer purchasing decisions. Together, these factors are propelling the handbag industry in Europe, leading to increased demand and market expansion. For instance, in April 2025, Aspinal of London unveiled The Great British Season collection, designed to complement every social occasion. Inspired by the essence of an English summer, the product line features soft pastels, airy textures, and refined embellishments. Standout pieces in the collection include the Midi Mayfair Bag in seasonal shades, East West totes adorned with floral and bee charms, elegant silk scarves by British artist Julia Bickham, and chic woven crossbodies.

Asia Pacific Handbag Market Trends

Asia Pacific handbag market is anticipated to grow at the fastest CAGR of 7.7% from 2025 to 2030, propelled by the expansion of e-commerce and social commerce in the region. Increased internet penetration and smartphone usage are driving online shopping, while platforms such as Alibaba, JD.com, and Instagram are enhancing consumer engagement. Social commerce, through influencer marketing and live streaming, further accelerates sales. In addition, the growth of the pre-owned market, fueled by sustainability trends and the desire for affordable luxury, is also expanding. These factors are expected to propel the regional growth, offering consumers more choices and accelerating overall market size.

India handbag market is projected to grow at the fastest rate in the regional market over the forecast period, driven by the growth of the luxury and premium handbag segments and increasing focus on sustainability and ethical manufacturing. Rising disposable incomes and an evolving middle class are fueling demand for high-end, designer bags, with consumers prioritizing both style and exclusivity. Furthermore, there is a growing preference for eco-conscious products, with consumers opting for brands that use sustainable materials and ethical production practices. This shift toward premium and sustainable options is set to contribute to the market growth in India.

Key Handbag Company Insights

Some of the key companies in the handbag industry include Louis Vuitton, Hermès, Michael Kors, Fossil Group, and Guccio Gucci S.p.A.

-

Fossil Group specializes in consumer fashion accessories. Its principal offerings include fashion watches, jewelry, handbags, small leather goods, belts, sunglasses, and clothing. The company operates a diverse portfolio of owned and licensed brands, such as Fossil, Skagen, Michael Kors, Armani Exchange, and Tory Burch.

-

Guccio Gucci S.p.A., known as Gucci, offers handbags, ready-to-wear clothing, footwear, accessories, watches, jewelry, fragrances, and home décor. The company also licenses its name and branding to Coty for fragrance and cosmetics under the name Gucci Beauty.

Key Handbag Companies:

The following are the leading companies in the handbag market. These companies collectively hold the largest market share and dictate industry trends.

- Louis Vuitton

- Hermès

- Michael Kors

- Fossil Group

- Guccio Gucci S.p.A.

- PRADA

- Burberry Group Plc

- Tapestry, Inc.

- Chanel

- Compagnie Financière Richemont SA

Recent Developments

-

In September 2024, Gucci introduced its latest handbag, the Gucci Blondie, with a fitting campaign celebrating London's enduring charm. The campaign titled We Will Always Have London features rock legend Debbie Harry and Kelsey Lu, adding a touch of musical and cultural nostalgia to the launch.

-

In June 2023, Michael Kors launched a Pride capsule collection featuring the Elliot backpack, Slater sling pack, and Raquel pavé watch. The brand also partnered with the Stonewall National Monument Visitor Center (SNMVC) for a cobranded tote, with a portion of proceeds donated to the center. The black canvas tote features the SNMVC logo inside and a rainbow MK logo on the outside.

-

In March 2023, Hermès International S.A. introduced six new handbags for Fall/Winter 2023, including the Sac Mini Médor, Sac So Medor, Drawstring Tote, Arcon Bag, Fringe Birkin, and Harness Birkin. The collection combined classic and modern styles with a distinctly feminine aesthetic.

Handbag Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 59.62 billion

Revenue forecast in 2030

USD 81.79 billion

Growth Rate

CAGR of 6.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, material, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Germany; U.K.; China; India; Brazil; South Africa

Key companies profiled

Louis Vuitton; Hermès; Michael Kors; Fossil Group; Guccio Gucci S.p.A.; PRADA; Burberry Group Plc; Tapestry, Inc.; Chanel; and Compagnie Financière Richemont SA.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Handbag Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global handbag market report based on product, distribution channel, material, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Tote Bag

-

Clutch

-

Satchel

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Leather

-

Fabric

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global handbag market size was valued at USD 56.48 billion in 2024.

b. The global handbag market is projected to grow at a CAGR of 6.5% from 2025 to 2030

b. The tote bag segment dominated the market with the largest revenue share of 41.1% in 2024. Tote bags are multi-purpose bags that can be used for a variety of tasks. They are larger than other types of purses, making it easier for consumers to carry their essentials to offices, universities, and other places. These bags are popular among consumers due to their size. The rising influence of Korean fashion and aesthetics among younger consumers is also driving the sale of tote bags.

b. Some key players operating in handbag market are Louis Vuitton, Hermès International S.A., Michael Kors, Fossil Group, Inc., Guccio Gucci S.p.A., Prada S.p.A., Burberry Group Plc, Tapestry, Inc., Chanel, Compagnie Financière Richemont SA

b. The global workforce has seen a significant rise in women's participation over the years, with women now integral to various industries in diverse roles, from corporate executives to entrepreneurs. This increased participation drives the demand for accessories meeting the needs of working women. Handbags have evolved from accessories to essential tools, addressing the multifaceted demands of modern professional life.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.