- Home

- »

- Digital Media

- »

-

Manga Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Manga Market Size, Share & Trends Report]()

Manga Market Size, Share & Trends Analysis Report By Content Type (Printed, Digital), By Gender (Male, Female), By Distribution Channel, By Genre, By Audience, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-013-4

- Number of Pages: 300

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Technology

Manga Market Size & Trends

The global manga market size was estimated at USD 13.69 billion in 2023 and is expected to grow at a CAGR of 18.0% from 2024 to 2030. The growth can be ascribed to the increasing popularity of graphic reading content comprising exciting stories and attractive visuals. Manga is among the most popular forms of Japanese entertainment media among children and adults. It has a powerful influence on the youth and serves as significant cultural entertainment.

The market expansion is being further driven by the launch of various new titles in line with the explosive demand from the audience. Manga content comes in a variety of forms, such as creative, funny, inspirational, artistic, philosophical, trashy, and even edifying. Manga also depicts various virtues, emotions, and vices, such as success by hard work, strong-spiritedness, self-denial, persistence, dedication, pluck, or unrequited love.

The increasing adoption of digital format of manga is creating lucrative growth prospects for the market. Several major publishing companies are introducing their works on the reading apps and trying to enhance the applications with advanced features. In November 2023, Manga Production signed an agreement with Japanese production company Production I.G., to license their anime series Great Pretender Razbliuto. The partnership will grant Manga Production the full rights for distribution, licensing, and marketing of the new season in the Middle East and North Africa region.

The online fan communities and growing consumer interest in anime are significantly driving the market growth. Streaming platforms, such as Netflix, Crunchyroll, and Funimation are impelling viewer’s interest in anime, leading to increased demand for manga as the audience seeks the original content. For instance, in January 2024, Netflix announced to launch of some big anime titles in the subsequent months, such as The Seven Deadly Sins: Four Knights of the Apocalypse, Delicious in Dungeon, and Maboroshi.

Market Concentration & Characteristics

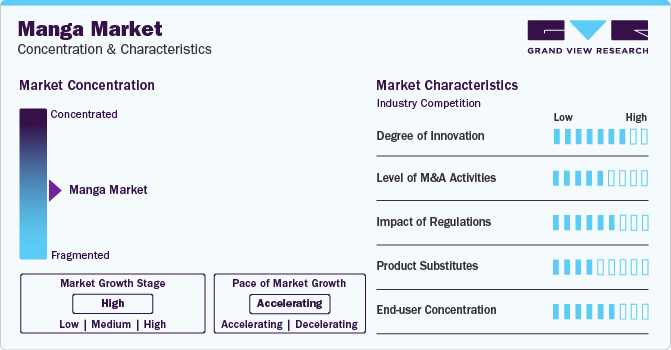

The market is witnessing a high degree of innovation, especially with the introduction of digital manga. Several market players are now offering manga and graphic novels in digital format through eBooks, e-commerce platforms, websites, and mobile apps. Moreover, the availability of digital drawing tools for manga artists such as STUDIO PAINT, CLIP, etc., is also positively influencing the market outlook.

The market is being significantly influenced by the government regulations and policies, considering the establishment of stringent copyright laws that give exclusive rights to the authors and the assignee for publishing, reproducing, and distributing copies of the work.

The market is also being influenced by the rising number of mergers & acquisition activities that help companies increase market share, expand the customer base, and strengthen product portfolios.

End-user concentration is high in the market due to the rising demand for manga and availability of wide range of titles based on different themes that attract diverse customers. Moreover, the growing interest in anime driven by OTT platforms and websites is increasing the demand for manga as users tend to take interest in the origin of the content.

Audience Insights

Based on audience, the adult segment held the market with the largest revenue share of 56.85% in 2023, due to account of the availability of a wide range of genres, such as comedy, romance, thrillers, fantasy, etc. These segments mainly interest the adult populace. Besides, the publishing companies are launching high quality content and attractive graphics that interest adults, favoring segmental growth further. Some of the mature themed series include Berserk, Monster, Tokyo Ghoul, Vagabond, Vinland Saga, Akira, and Blade of the Immortal among others.

The children & kids segment is expected to grow at a notable CAGR of nearly 20.0% from 2024 to 2030, owing to increasing focus of manga publishers to develop new content targeted towards kids. This is driven by recent popularization of children and kids-themed manga-based anime series. Some of the examples in this category include Crayon Shin-chan, Doraemon, Tsurupika Hagemaru, Chibi Maruko-chan, Sazae-san, Case Closed, and Anpanman among others. The segmental growth is being further expedited by the growing support from parents as they see these books as means of developing reading comprehension and critical thinking skills in their kids.

Content Type Insights

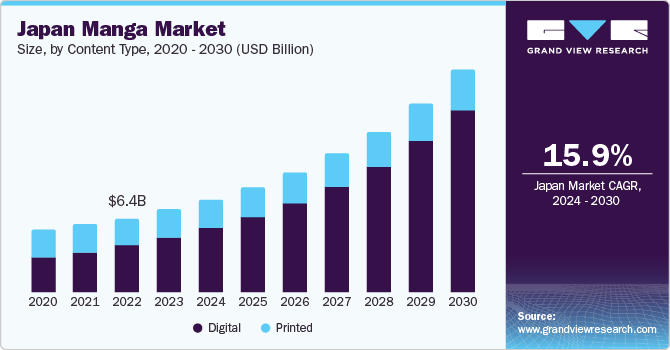

Based on content type, the printed segment held the market with the largest revenue share of 30.47% in 2023, as several enthusiasts still prefer to collect the printed versions due to the easy availability of the format, tactile experience, and affordability. Besides, the aesthetic elements in the printed books attract enthusiasts as they seek to enjoy and collect high-quality and glossy books, driving the segmental growth further.

The digital segment is anticipated to grow at the notable CAGR from 2024 to 2030, as consumers are showing an increased interest in eBooks as they offer greater convenience, address space constraints, and are relatively cheaper than the printed versions. Digital platforms in the field of graphics such as comics have been growing nowadays. This is inseparable from the development of new media technologies that have transformed several manual and analog channels into automated and digital ones.

Distribution Channel Insights

Based on distribution channel, the online segment held the market with the largest revenue share of 72.41% in 2023, owing to increasing consumer preference of ecommerce portals for purchasing books and magazines due to greater convenience and discounts. Online distribution channel has continued to grow significantly since COVID-19 pandemic. This growth is attributed to the increased consumption of content due to the work from home setup and rising focus on leisure activities, which has prevailed globally after the onset of pandemic.

Genre Insights

Based on genre, the action & adventure segment led the market with the largest revenue share of 33.52% in 2023. While the action titles mainly include a main character that fights humans, aliens, robots, animals, etc., the adventure titles comprise characters that explore vast possibilities in the world and beyond. Although it is aimed at young males, it has a significant number of female audiences. The wide availability in various other languages is increasing its global reach, thereby supporting the segmental growth. This is largely due to historical dominance and preference for action and adventure-based series such as Dragonball, One Piece, One Punch Man, Naruto, Bleach, Demon Slayer, and Jujutsu Kaisen among others.

The romance & drama segment is estimated to grow at a substantial CAGR from 2024 to 2030, owing to the increase in demand for romance and drama-based titles, especially among female readers. The romantic titles are mainly aimed at young females who enjoy reading content related to ideal romances. The titles based on drama mostly have serious themes related to the nitty-gritty of life and are popular among both male and female segments. This can be attributed to the shift in preference of younger audiences, particularly teenagers, to consume romance and drama themed content. Some of the popular titles in this category include Wotakoi: Love is Hard for Otaku, Noragami, Ao Haru Ride, and the Quintessential Quintuplets among others.

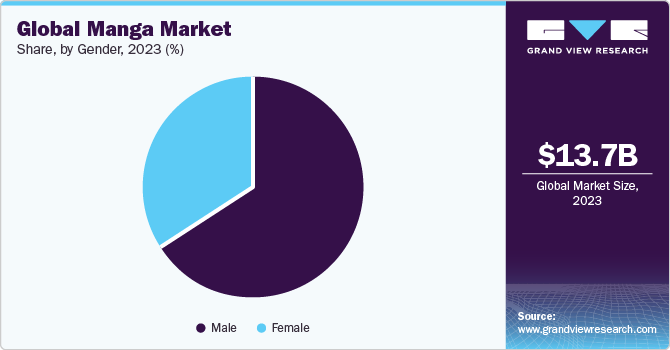

Gender Insights

Based on gender, the male segment held the market with the largest revenue share of 65.92% in 2023, while the female segment was anticipated to witness at the fastest CAGR over the forecast period. The rise in demand for content suited for female audiences attributed to the increasing number of female readers globally and it is likely to propel the growth of the segment during the forecast period.

Female segment has continued to grow significantly over the last few years as publishers are increasingly focusing content preferred by female audience such as based on romance and drama genre.

Regional Insights

North America held a significant revenue share of around 7.0% in 2023, owing to the growing fan base and popularity of anime content across the region. Moreover, the growing presence of anime studios, such as AnimEigo, Inc., Aniplex of America Inc., and Discotek Media, that are catering to the anime fan community is also contributing to the increased demand for manga in the region. The region has also witnessed an increase in the number of retail stores for anime in various cities, including California and North Carolina, which is expected to propel the market’s growth over the forecast period.

U.S. Manga Market Trends

The manga market in U.S. is expected to grow at the CAGR of 23% from 2024 to 2030, owing to the strong presence of comic bookstores contributing to heightened product sales in the country. Moreover, the increasing number of anime conventions, attracting a large fanbase across the country, is further favoring the market growth in the U.S.

Asia Pacific Manga Market Trends

Asia Pacific dominated the manga market with the largest revenue share of 86.0% in 2023. The flourishing growth of the manga industry in Japan among domestic and international consumers has boosted the regional market growth. Japan is known as the hub for animation studios as it has over 600 animation studios, with more than 500 anime studios in Tokyo alone. Manga titles are gaining a lot of traction and inspiring young and creative people to pursue careers in this industry, which is expected to drive market growth further across the region. The significant growth of e-commerce businesses has also had a positive impact on the market outlook.

The Japan manga market is estimated to expand at the fastest CAGR of 16% from 2024 to 2030. Japan is known as the home of anime and manga, and some of the market leaders are in Japan. The availability of a wide range of genres that cater to various age groups and interests is driving the market growth in Japan.

The manga market in India is estimated to record a notable CAGR of 20% from 2024 to 2030. The growing inclination towards Japanese culture, owing to the proliferation of anime music and the availability of a variety of anime titles on several OTT platforms in India, is boosting the growth of the India market.

The China manga market is accounted for the largest revenue share of more than 22% in 2023. The increased readership for the manga, driven by the availability of various renowned publishers, online content, streaming platforms, etc., is favoring the market growth in China.

Europe Manga Market Trends

The manga market in Europe is anticipated to grow at the considerable CAGR of 20.2% from 2024 to 2030, with the growing fan base and popularity of anime content across the region. Several manga publishers have obtained international licenses for translations in different languages. For instance, there are more than 10 established French versions of local manga distributors, and numerous manga titles have made their way into France from Japan. The increasing number of anime conventions and the availability of manga content on various dedicated websites and mobile apps are expected to expedite the market growth in Europe.

The France manga market accounted for a significant revenue share in 2023, owing to the rising popularity of anime and manga due to intriguing content, and the availability of French versions is contributing to the market expansion.

The manga market in UK is estimated to grow at the fastest CAGR of over 21% from 2024 to 2030, owing to the ongoing localization of manga and the availability of various official streaming services offering subtitles in English.

The Germany manga market is estimated to grow at the fastest CAGR of over around 22.0% from 2024 to 2030. The strong presence of various renowned distributors, such as Tokyopop, Carlsen Manga, and Egmont Manga, is creating lucrative opportunities for the market. Moreover, numerous anime conventions have been organized in the country, which is creating significant demand for manga in Germany.

Key Manga Company Insights

The key players operating in the market are focusing on forming strategic alliances to gain a competitive edge in the industry. For instance, in November 2023, Animoca Brands Japan collaborated with Quidd to develop and launch a customized service aimed at introducing beloved Japanese intellectual property to the western market.

Yen Press LLC expanded its product portfolio to cater to a larger customer base. For instance, in December 2023, the company expanded its webstore with the addition of more titles from some of the famous series and new releases. These titles include various genres, such as action, romance, fantasy, comedy, etc. Readers can purchase the titles directly from YenPress.com, ensuring authenticity and quality for their purchases.

Key Manga Companies:

The following are the leading companies in the manga market. These companies collectively hold the largest market share and dictate industry trends.

- Akita Publishing Co., Ltd.

- Bilibili Comics Pte. Ltd.

- Bungeishunjū Ltd.

- Good Smile Company, Inc.

- Hitotsubashi Group

- Houbunsha Co., Ltd.

- Kadokawa Corporation

- Kodansha Ltd.

- Nihon Bungeisha Co., Ltd.

- Seven Seas Entertainment, Inc.

- Shogakukan Inc.

- Shueisha Inc.

- VIZ, Inc.

- Yen Press LLC

Recent Developments

-

In February 2024, Viz Media and MANGA Plus by Shueisha published the first chapter of Shiro Moriya's Astro Baby manga, which was also launched on Shueisha's Shonen Jump+ website. It is a sci-fi title with a character named Billy, a soldier from North Hill who returns to the town after six years to see the woman he loves. The story shows that a cannibalistic disease called Cooper's Disease ravages the world and the people in the North Hill are forced into lockdown

-

In January 2024, Yen Press announced to release nine new titles in July 2024. The titles include Black Butler 4 by Yana Toboso, Savage Fang by Kakkaku Akashi, Excellent Property, Rejects for Residents by Suu Minazuki, The Trials of Chiyodaku by Fukurou Kogyoku, My Oh My, Atami-Kun by Asa Tanuma, Gogogogo-Go-Ghost! By Miyako Hiruzuka, Aria of The Beech Forest by Yugiri Aika, Kind of A Wolf by Machi Suehiro, and This Wolf is not Scary by Rico Sakura

-

In January 2024, KADOKAWA Corporation announced to form a joint venture with Média-Participations Paris, a prominent European publishing-based entertainment group and Éditions Dupuis S.A., the French comics publisher within the group. This venture business will publish Japanese and Korean comics, light novels, and other content for the French language markets

Manga Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.62 billion

Revenue forecast in 2030

USD 42.19 billion

Growth rate

CAGR of 18.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

April 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Content type, distribution channel, genre, gender, audience, region.

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Germany, UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Mexico; Saudi Arabia; South Africa

Key companies profiled

Akita Publishing Co., Ltd.; Bilibili Comics Pte. Ltd.; Bungeishunjū Ltd.; GOOD SMILE COMPANY, INC.; Hitotsubashi Group; Houbunsha Co., Ltd.; Kadokawa Corporation; Kodansha Ltd.; Nihon Bungeisha Co.; Ltd.; Seven Seas Entertainment, Inc.; Shogakukan Inc.; Shueisha, Inc.; VIZ Media LLC; Yen Press LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Manga Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global manga market report based on content type, distribution channel, genre, gender, audience, and region:

-

Content Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Printed

-

Digital

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Genre Outlook (Revenue, USD Million, 2018 - 2030)

-

Action and Adventure

-

Sci-Fi and Fantasy

-

Sports

-

Romance and Drama

-

Others

-

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Male

-

Female

-

-

Audience Outlook (Revenue, USD Million, 2018 - 2030)

-

Children and Kids (Aged below 10 years)

-

Teenagers (Aged between 10 to 16 years)

-

Adults (Aged above 16 years)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global manga market size was estimated at USD 13.69 billion in 2023 and is expected to reach USD 15.62 billion in 2024.

b. The global manga market is expected to grow at a compound annual growth rate of 18.0% from 2024 to 2030 to reach USD 42.19 billion by 2030.

b. Asia Pacific dominated the manga market with a share of more than 85% in 2023. This is attributable to the highest concentration of manga production studios across countries including Japan, China and South Korea in Asia Pacific region.

b. Some key players operating in the manga market include Kadokawa Corporation; Bilibili Comics Pte. Ltd.; Houbunsha Co., Ltd.; Shogakukan Inc.; Shueisha Inc.; GOOD SMILE COMPANY, INC. and Akita Publishing Co., Ltd. among others.

b. Key factors that are driving the manga market growth include the growing popularity of graphic reading content with intriguing narrative and appealing images, as well as an increase in the number of manga readers among the Millennial Generation and Generation Z

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."