- Home

- »

- Homecare & Decor

- »

-

Books Market Size, Share & Growth, Industry Report, 2033GVR Report cover

![Books Market Size, Share & Trends Report]()

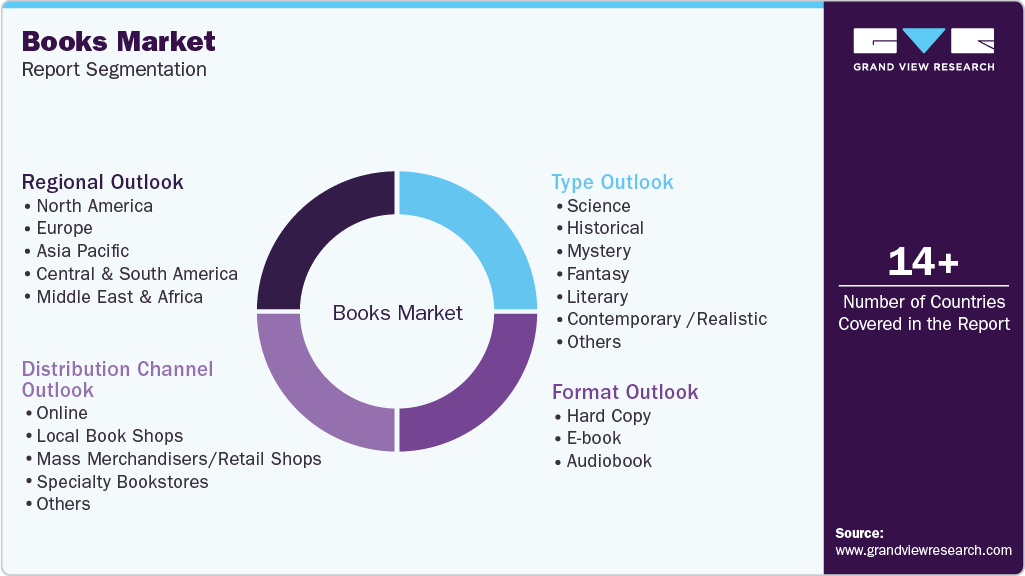

Books Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Science, Historical, Mystery, Fantasy, Literary, Contemporary /Realistic, Romance, Educational, Comic), By Format (Hard Copy, E-book, Audiobook), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-071-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Books Market Summary

The global books market size was estimated at USD 150.99 billion in 2024 and is projected to reach USD 215.89 billion by 2033, growing at a CAGR of 4.1% from 2025 to 2033. Different types of genres, such as Japanese fiction, have surged in popularity, capturing a significant share of the translated fiction market in the UK, according to an article published by The Guardian in November 2024.

Key Market Trends & Insights

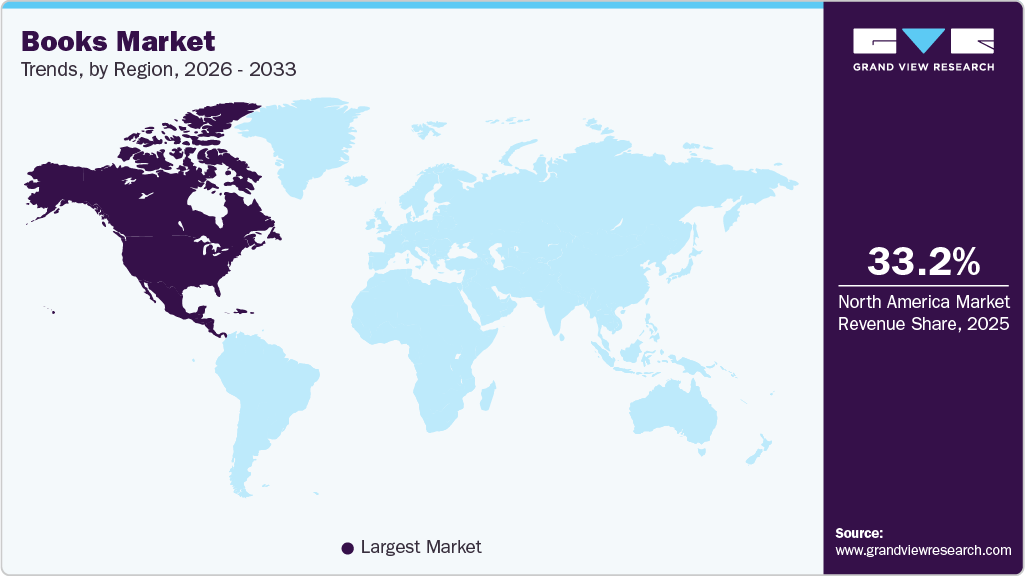

- North America's book market held the largest global revenue share of 33.19% in 2024.

- The book industry in Asia Pacific is expected to grow steadily from 2025 to 2033.

- By type, educational books segment held the highest market share of 20.65% in 2024.

- By format, hard copy books segment held the highest market share in 2024.

- By distribution channel, the online segment is expected to exhibit strong growth from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 150.99 Billion

- 2033 Projected Market Size: USD 215.89 Billion

- CAGR (2025-2033): 4.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In 2022, it accounted for 25% of all translated fiction sales, and by 2024, 43% of the top 40 translated titles were Japanese, led by Asako Yuzuki’s Butter. Publishers like Doubleday have embraced this trend, with Jane Lawson pioneering the introduction of Japanese "comfort books" to English audiences. Titles like The Travelling Cat Chronicles have sold over a million copies, showcasing enduring appeal. Niche genres like romantasy, a blend of romance and fantasy, have witnessed remarkable growth, driven by platforms like TikTok’s BookTok community. Sales of science fiction and fantasy books surged by 41.3% between 2023 and 2024, with Rebecca Yarros' Fourth Wing leading the charge as a bestseller. Romance and erotic fiction also thrived, with sales increasing by 9.8% and 18.1% respectively. This shift reflects changing attitudes and greater prominence given to these genres in bookstores, appealing to a wider audience. Beyond romantasy, general and literary fiction, along with crime and thrillers, have achieved their best sales performances in over a decade, showing renewed interest in these categories. However, war fiction has seen a significant decline, with an 18.3% decrease in sales value. The success of niche genres demonstrates evolving reader preferences, with audiences gravitating towards creative and emotionally resonant storytelling, amplified by online communities and changing perceptions of genre fiction.Audiobook subscriptions have also experienced steady growth, reflecting changing consumer preferences. In 2024, 63% of audiobook listeners subscribed to at least one service, a slight increase from 62% in 2023. The American Publishers Association’s (APA) 2024 survey revealed that 52% of U.S. adults, or nearly 149 million people, have listened to an audiobook, with 38% having done so in the past year. This growth indicates that subscription models are fostering consistent engagement with books through audio platforms.

An increase in engagement among families accompanies the rise in audiobook consumption. The APA survey found that 53% of audiobook listeners with children reported that their kids also listen to audiobooks, with 77% highlighting the benefit of reducing screen time. The average number of audiobooks consumed by avid listeners rose from 6.3 titles in 2022 to 6.8 in 2023. This trend demonstrates how audiobook subscriptions cater to diverse audiences, including families, further solidifying their importance in the industry.

Social media platforms, particularly trends like #BookTok, have emerged as significant drivers of demand for books, especially among younger readers. According to the Börsenverein des Deutschen Buchhandels, the German book industry experienced a 2.8% turnover growth in 2023 and a 1.2% increase in the first half of 2024, driven by increased interest in fiction, children's, and young adult titles. Karin Schmidt-Friderichs, the association's chair, notes that social media recommendations have made books “very popular among young people, transforming them into a creative pastime and a means of navigating a complex world.

Publishers and booksellers are adapting their strategies to meet this new demand by curating programs and presentations that resonate with young, social media-savvy consumers. As Schmidt-Friderichs observes, many bookstores and publishers actively engage on these platforms to reach audiences directly. Echoing this sentiment, Peter Kraus vom Cleff highlights the potential of youthful consumer dynamics while acknowledging the challenges posed by broader economic pressures. This shift highlights how platforms like #BookTok are transforming the book market, driving sales, and revitalizing industry engagement.

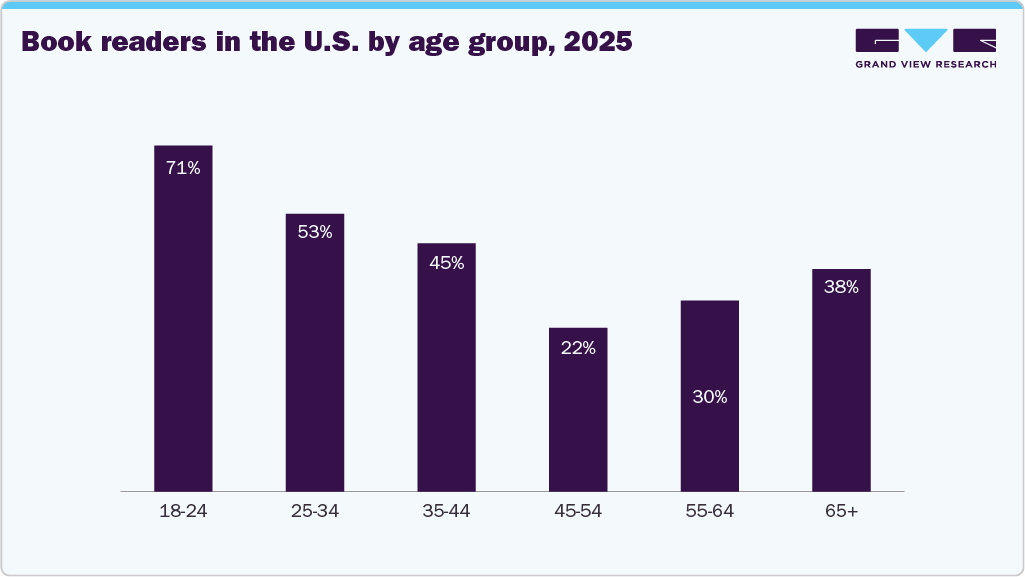

Consumer Insights

Millennials emerge as the most dedicated readers, frequently turning to libraries for their book selections. Gen Z, while showing the most improvement in reading habits, tends to rely heavily on social media for book recommendations. In contrast, Boomers and the Silent Generation often choose their reading material based on bestseller lists, while Gen X tends to gravitate towards online content, particularly news.

The COVID-19 pandemic brought about significant changes in reading behavior across the globe. Younger generations, already well-versed in digital technologies, embraced virtual lifestyles even more during lockdowns, resulting in a surge in e-books, podcasts, audiobooks, and virtual entertainment events. This shift towards digital and virtual experiences is expected to persist in the post-pandemic world.

The 18-24 age group is a key demographic in the global books market, particularly in the consumption of ebooks and digital content. Popular genres include fantasy, science fiction, and young adult fiction, which are often marketed through social media platforms like TikTok’s "BookTok" community. A 2023 Pew Research Center study found that this age group is also heavily influenced by peer recommendations and online book reviews.

The 25-34 age bracket represents a balance between digital and print formats, with many readers engaging in both mediums. They are drawn to self-improvement books, career-related literature, and contemporary fiction. Due to busy lifestyles, audiobooks are also popular among this age group. This group often uses subscription services like Amazon Kindle Unlimited and Audible, which offer convenience and variety.

Type Insights

Educational books accounted for a revenue share of 20.65% in 2024, driven by their affordability, widespread availability, and consistent demand across schools, universities, and self-learning segments worldwide. These books remain essential tools for structured learning, exam preparation, and skill development, especially in regions that prioritize literacy and educational infrastructure. Their clear content organization, subject-specific focus, and long-term relevance make them highly attractive to budget-conscious students and lifelong learners. Additionally, the growing emphasis on digital literacy, career development, and global knowledge exchange has further increased the demand for educational books in both print and digital formats.

Mystery books are projected to grow at a CAGR of 4.9% over the forecast period. The demand for mystery books has been steadily growing across the globe as mystery books have long been popular for their ability to engage readers with suspense and thrilling narratives, making them more popular than other genres. The success of mystery-themed television shows and films, such as "Sherlock Holmes", "True Detective", and "Murder on the Orient Express", has sparked an increased interest in the genre. These adaptations often lead audiences to seek out the original books, driving sales and boosting demand for mystery books.

Format Insights

Hard copy books led the books industry with a revenue share of 78.19% in 2024. They offer an opportunity to disconnect from screens and escape the constant interruptions of texts, emails, and notifications. People find balance in their daily lives by reading printed books, which promote mindfulness and a slower, more intentional pace of learning or leisure. According to the Association of American Publishers, out of all books, total trade sales of hardback and paperback books were 31.6% and 36.1%, respectively, in June 2025, reflecting readers’ sustained preference for tangible reading experiences. Despite the growing adoption of digital and audio formats, the physical book segment remains a significant contributor to the overall book market.

E-books are projected to grow at a CAGR of 4.8% over the forecast period. E-books, by contrast, offer a more sustainable option since they are created without consuming paper, ink, or adhesives, and do not require the energy-intensive processes of printing or fuel-powered transportation for distribution. Consequently, many environmentally conscious readers are opting for e-books over traditional printed copies to minimize their ecological footprint. Moreover, the convenience of digital formats has further boosted their popularity. Devices such as Kindle and tablets allow users to store and access multiple books simultaneously, eliminating the need to carry physical copies.

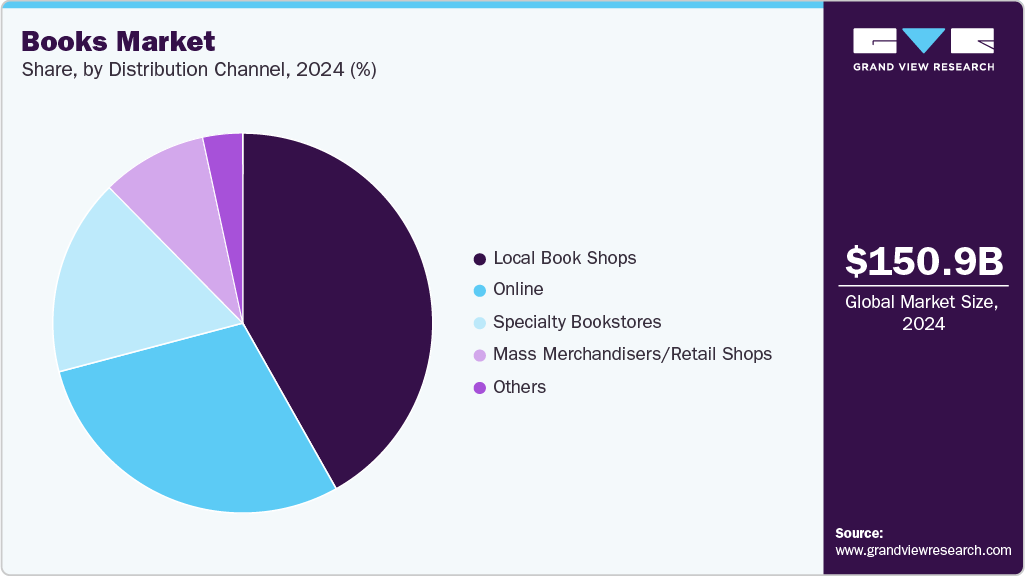

Distribution Channel Insights

Local book shop sales accounted for a revenue share of 41.83% of the global books market in 2024. Independent bookstores continue to attract loyal readers through curated selections, personalized recommendations, and community engagement events that create a distinct browsing experience. These stores often highlight regional authors, niche genres, and exclusive editions that are not always available through mass retailers. Additionally, growing consumer interest in supporting local businesses and sustainable retail practices further enhances their appeal. Targeted displays, author signings, and reading clubs contribute significantly to sustained in-store traffic and repeat purchases.

Online sales for books are projected to grow at a CAGR of 5.3% over the forecast period of 2025-2033, driven by increasing digital literacy, expanding e-commerce penetration, and the rising availability of region-specific content. As more countries invest in broadband access and digital payment infrastructure, readers are increasingly turning to online platforms for convenient access to a diverse range of genres, competitive pricing, and instant delivery or downloads. The industry has responded with user-friendly interfaces, personalized recommendations, and subscription-based reading services that encourage habitual engagement. Additionally, social media book communities and virtual author events have further contributed to the growing popularity of online book purchases, boosting revenue growth in this segment.

Regional Insights

The North America books market held a 33.19% of the global revenue share in 2024, due to the strong presence of independent publishers and an expanding audience of engaged readers. Major retailers, such as Amazon and Barnes & Noble, dominate the region, while the rising popularity of e-books and audiobook formats reflects evolving consumer preferences. Although many brick-and-mortar bookstores face challenges from digital alternatives, the shift toward online purchasing and subscription-based reading platforms has stimulated market expansion. According to the Association of American Publishers, the U.S. book publishing industry generated USD 29.9 billion in revenue in 2023, underscoring its substantial economic impact.

U.S. Books Market Trends

The book industry in the U.S. accounted for a revenue share of 80.70% in 2024. An expanding base of avid readers and strong demand for diverse literary genres have reinforced the nation’s leadership in global book consumption. The growing popularity of e-books and audiobooks, alongside established print sales, has boosted overall market value. Furthermore, extensive retail networks, advanced publishing capabilities, and increasing digital access have made books accessible to a wide audience, driving the industry’s dominant revenue share within the region.

Europe Books Market Trends

The Europe book industry accounted for a revenue share of around 25.93% in 2024, supported by the region’s rich literary heritage, strong readership culture, and extensive publishing networks. Many European countries promote reading through national education programs, public library investments, and tax incentives on printed materials, encouraging reading across all age groups. The popularity of both physical and digital formats continues to grow, driven by the increasing availability of multilingual content and the rising adoption of e-readers and audiobook platforms. Additionally, high production quality, a well-established distribution ecosystem, and participation in international book fairs have helped sustain Europe’s prominent position in the global market for both print and digital books.

Asia Pacific Books Market Trends

The Asia Pacific books industry is projected to grow at a CAGR of 4.6% from 2025 to 2033, supported by large population bases, expanding literacy rates, and increasing access to educational resources. Many countries in the region, including China, India, and Indonesia, are experiencing growing demand for both academic and leisure reading materials as urbanization and digital connectivity rise. Government initiatives promoting education and multilingual publishing, along with investments in public libraries and affordable digital platforms, are further supporting market expansion. Additionally, the increasing popularity of e-books and the growth of local publishing houses are making reading more accessible across diverse socioeconomic groups, fueling sustained industry development across the Asia Pacific.

Key Books Company Insights

The global books market comprises a mix of long-established publishing houses and innovative new entrants that continue to reinvent editorial formats, distribution strategies, and reader engagement to align with changing consumer behaviors. Leading companies emphasize content quality, diverse genre offerings, and user accessibility while leveraging digital platforms and multimedia formats to enhance the reading experience. By collaborating with global retailers, educational institutions, and online marketplaces and expanding their presence across subscription and e-commerce channels, these publishers ensure a broad reach and strong market visibility. Furthermore, strategic partnerships and flexible production models enable key industry players to deliver print, digital, and audiobook editions tailored to specific linguistic, cultural, and demographic segments worldwide.

Key Books Companies:

The following are the leading companies in the books market. These companies collectively hold the largest Market share and dictate industry trends.

- Disney.

- Penguin Random House

- Pearson

- Hachette Book Group

- HarperCollins Publishers

- Scholastic Inc.

- Simon & Schuster, Inc.

- McGraw-Hill.

- Macmillan

- IDW Publishing

Recent Developments

-

In March 2025, HarperCollins India launched Booktopus, a new imprint designed for preschoolers and early readers. This imprint aims to foster curiosity and learning through interactive and engaging books. The initial collection features a variety of formats, including board books, puzzle books, touch-and-feel books, sticker books, and lift-the-flap books. Tina Narang, Executive Publisher of HarperCollins Children's Books, emphasized the importance of providing creative and stimulating content for young learners.

-

In January 2025, Penguin Random House launched The Penguin Nehru Library, a collection of Jawaharlal Nehru’s writings, including his letters, essays, and other works. This initiative aims to provide readers with a deeper understanding of Nehru’s ideas, his vision for modern India, and his reflections on its cultural and political landscape.

Books Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 156.57 billion

Revenue forecast in 2033

USD 215.89 billion

Growth rate

CAGR of 4.1% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, format, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Belgium; Netherlands; Luxembourg; China; India; Japan; Australia; South Korea; Indonesia; Thailand; Vietnam; Singapore; Malaysia; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Disney; Penguin Random House; Pearson; Hachette Book Group; HarperCollins Publishers; Scholastic Inc.; Simon & Schuster, Inc.; McGraw-Hill; Macmillan; IDW Publishing

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Books Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global books market report based on type, format, distribution channel, and region:

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Science

-

Historical

-

Mystery

-

Fantasy

-

Literary

-

Contemporary /Realistic

-

Romance

-

Educational

-

Comic

-

Others

-

-

Format Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hard Copy

-

E-book

-

Audiobook

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Online

-

Local Book Shops

-

Mass Merchandisers/Retail Shops

-

Specialty Bookstores

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Belgium

-

Netherlands

-

Luxembourg

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Indonesia

-

Thailand

-

Vietnam

-

Singapore

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global books market size was estimated at USD 150.99 billion in 2024 and is expected to reach USD 156.57 billion in 2025.

b. The global books market is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2033 to reach USD 215.89 billion by 2033.

b. The books market in North America accounted for a share of over 33.19% of the global market revenue in 2024 on account of the presence of a large number of independent publishers and publishing companies in the region is anticipated to boost the market.

b. Some key players operating in the books market include Disney; Penguin Random House; Pearson; Hachette Book Group; HarperCollins Publishers; Scholastic Inc.; Simon & Schuster, Inc.; McGraw-Hill; Macmillan; IDW Publishing

b. Rising consumer spending on books, driven by increasing incomes and growing interest in reading, along with innovations in format that enhance the reading experience, are key factors fueling market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.