- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Masterbatch Market Size And Share, Industry Report, 2030GVR Report cover

![Masterbatch Market Size, Share & Trends Report]()

Masterbatch Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Black, Filler), By Carrier Polymer (Polypropylene, Polyethylene), By End Use (Packaging, Automotive & Transportation), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-205-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Masterbatch Market Summary

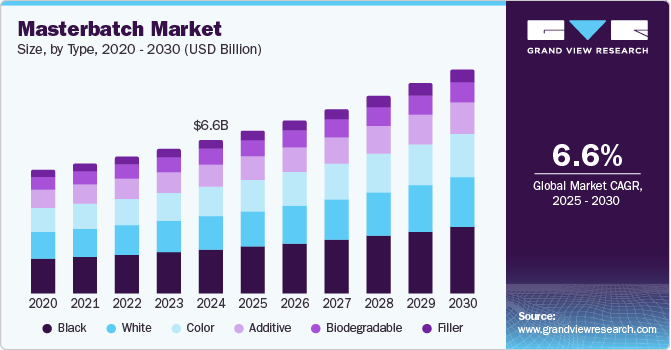

The global masterbatch market size was valued at USD 6.60 billion in 2024 and is projected to reach USD 9.65 billion by 2030, growing at a CAGR of 6.6% from 2025 to 2030. The replacement of metal with plastics in the end-use industries, including automotive and transportation, building and construction, consumer goods, and packaging, is driving market growth.

Key Market Trends & Insights

- Asia Pacific masterbatch market accounted for the largest revenue share of 30.6% in 2024.

- The masterbatch market in China led the Asia Pacific market and accounted for the largest revenue share in 2024.

- By type, the black type dominated the market with a revenue share of 28.6% in 2024.

- By carrier polymer, the polypropylene (PP) carrier polymer segment dominated the global masterbatch industry with the highest revenue share of 26.7% in 2024.

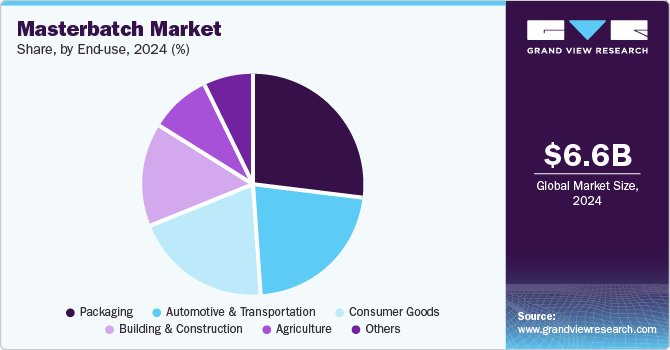

- By end use, the packaging masterbatch segment dominated the market with a revenue share of 27.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.60 Billion

- 2030 Projected Market Size: USD 9.65 Billion

- CAGR (2025-2030): 6.6%

- Asia Pacific: Largest market in 2024

Furthermore, masterbatches enhance the properties of polymers, such as providing antistatic, antifog, UV stabilization, and flame retardant qualities, thereby driving market expansion. Masterbatch is a concentrated mixture of pigments and additives encapsulated within a carrier resin, which is then used to impart color or specific properties to plastics. The plastic packaging industry is experiencing substantial growth, driven by evolving retail formats and increasing sales rates. Organized retail expansion is boosting the demand for attractive packaging. The food and beverage sector significantly contributes to this surge as plastic packaging enhances food quality and extends shelf life. Packaged foods are becoming increasingly popular. In addition to food and beverage, the pharmaceutical industry relies heavily on packaging for preserving and marketing products, complying with regulations, and ensuring patient safety.

In addition, increasing expertise in packaging for various industries, including food and beverage, pharmaceuticals, and home and personal care, is facilitating the rapid expansion of plastic packaging. Furthermore, masterbatch is used with base polymers to give the plastic specific qualities and functionalities. It is the most effective method for coloring plastic, providing both functional and coloring characteristics and accelerating the degradation of plastics.

Moreover, the automotive industry also boosts the growth of the plastic packaging market. The quantity of plastics used in vehicle parts is increasing, and the need for lightweight materials encourages the substitution of metals with plastics. Color is one of the most important aspects of vehicles, adding visual appeal, market value, and versatility. Masterbatch enhances reliability, pliability, and corrosion resistance and provides flame retardancy. It is commonly used for vehicle interiors and exteriors, improving the overall quality and appeal of vehicles.

Type Insights

The black type dominated the market with a revenue share of 28.6% in 2024. This growth can be attributed to the increasing demand for black masterbatch and the high demand for tires, PVC containers, and other products for application in the automotive and transportation, building and construction, agriculture, and packaging industries. In addition, the growing need for agricultural products such as drip irrigation tubing and tape, greenhouse films, shade cloth, and geomembranes is also projected to boost market growth over the forecast period.

Due to its broad applicability and versatility, white masterbatch is expected to grow at a CAGR of 7.0% over the forecast period. It is a foundational base for creating diverse color shades and is widely used in the packaging and textile industries. In addition, the opacity it provides enhances the visual appeal of products. Furthermore, white masterbatch offers UV protection, which is essential for applications in agriculture and construction, thus expanding its demand.

Carrier Polymer Insights

The polypropylene (PP) carrier polymer segment dominated the global masterbatch industry with the highest revenue share of 26.7% in 2024, primarily driven by the excellent mechanical strength and flexibility offered by polypropylene. In addition, polypropylene also enhances the quality of surfaces. It is lightweight and is used to replace metal components in the automotive industry. Furthermore, the extensive use of polypropylene in consumer goods contributes to the growth of product demand. It has antimicrobial and antibacterial properties, making it helpful in manufacturing various products related to building and construction.

The polyethylene (PE) segment is expected to grow at the fastest CAGR of 7.1% from 2025 to 2030, primarily driven by the increasing demand for durable, lightweight materials. In addition, polyethylene's affordability, ease of production, and ability to improve mechanical, thermal, and chemical properties make it suitable for performance polymers used in masterbatches. Furthermore, polyethylene enhances chemical, thermal, and environmental resistance when blended with certain additives, making it a preferred polymer resin for masterbatch production.

End Use Insights

The packaging masterbatch segment dominated the market with a revenue share of 27.0% in 2024. Its high share can be attributable to the packaging industry, which includes retail, industrial, and consumer packaging and includes flexible and rigid options. A rise in the number of city inhabitants who require packaged goods is resulting in an increased demand for packaging. Consumers need convenient, sustainable, flexible packaging, offers protection, and is easily traceable. As plastic packing fulfills all these needs, its demand is expected to grow, which is, in turn, projected to result in the growing demand for the product.

The automotive and transportation segment is expected to grow at a CAGR of 6.9% over the forecast period. Plastics are replacing metals to create lighter vehicles, enhancing fuel efficiency. Masterbatches improve the pliability, corrosion resistance, and flame retardancy of vehicle components, adding visual appeal and versatility. In addition, the rising demand for electric vehicles is also boosting the use of plastics for better insulation. Furthermore, the need for customized interiors and exteriors further stimulates the demand for masterbatches in the automotive sector.

Regional Insights

Asia Pacific masterbatch market dominated the global market and accounted for the largest revenue share of 30.6% in 2024. This growth can be attributed to the presence of several end-use industries, including automotive and transportation, packaging, building and construction, and consumer goods. The growth of these industries is expected to fuel the demand for the product over the next eight years. Furthermore, increasing urbanization, improved living standards, and the rising need for cost-effective and sustainable materials have contributed to market growth. Moreover, the expanding plastics industry, alongside growing consumer demand for custom colors and additives, further supports the development of the masterbatch market in this region.

China Masterbatch Market Trends

The masterbatch market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, due to the country’s robust manufacturing sector, particularly in electronics, automotive, and packaging. In addition, the increasing focus on improving the quality and efficiency of plastic products is pushing the demand for advanced masterbatches. Furthermore, China’s shift towards eco-friendly materials and sustainable production processes has increased demand for biodegradable masterbatches. Moreover, the large-scale production of consumer goods and electronics, combined with the country's strong export market, has significantly boosted the growth of the masterbatch industry.

Europe Masterbatch Market Trends

Europe masterbatch market is expected to grow at a CAGR of 6.7% over the forecast period, owing to stringent plastic use and sustainability regulations. In addition, the increased focus on recycling and reducing environmental impact has accelerated the adoption of eco-friendly masterbatches, such as biodegradable and recycled content masterbatches. Furthermore, the rising demand for high-quality plastic products in industries such as packaging, automotive, and construction is supporting the market. Moreover, well-established manufacturing industries in countries such as Germany, France, and Italy have further enhanced the market demand for specialized and customized masterbatch solutions.

North America Masterbatch Market Trends

The masterbatch market in North America is expected to grow significantly over the forecast period, primarily driven by the increasing demand for high-quality plastic products in automotive, packaging, and healthcare sectors. In addition, the focus on product differentiation, driven by consumer preferences for customized colors, additives, and functional properties, is enhancing the demand for masterbatches. Furthermore, the region’s focus on sustainability and environmental concerns has led to introducing eco-friendlier and recycled content masterbatches.

U.S. Masterbatch Market Trends

The U.S. masterbatch market led the North American market and accounted for the largest revenue share in 2024, driven by rising demand from diverse industries such as automotive, packaging, and healthcare. In addition, the country’s extensive consumer goods sector and emphasis on innovative, high-quality plastic products have increased the need for masterbatches. Furthermore, the growing adoption of recycled plastics and government regulations promoting sustainability are fueling the market, alongside the ongoing growth in manufacturing and production capabilities.

Key Masterbatch Company Insights

Key players in the global masterbatch industry include Clariant AG, Hubron International Ltd., Penn Color, Inc., and others. These companies comply with regulatory policies and are engaged in research and development activities to develop innovative products. They also focus on strategies such as product innovation, expanding production capacity, and enhancing sustainability efforts. Furthermore, they invest in research and development to offer customized solutions, strengthen supply chains, and improve cost-efficiency while meeting regulatory standards.

-

Cabot Corporation specializes in manufacturing performance materials, including a broad range of masterbatches. The company offers solutions in color, additives, and specialty plastic formulations, catering to industries such as packaging, automotive, and consumer goods. Operating in the specialty chemicals segment, the company focuses on providing high-quality, innovative products that enhance the properties of plastics, such as durability, UV protection, and color consistency.

-

Clariant AG manufactures various masterbatch solutions, including colors, additives, and custom formulations tailored for sectors such as automotive, packaging, and textiles. Operating within the specialty chemicals segment, the company focuses on providing sustainable and high-performance solutions that improve the functionality and aesthetics of plastic products. Their offerings include eco-friendly and innovative products designed to meet the evolving demands of the global market.

Key Masterbatch Companies:

The following are the leading companies in the masterbatch market. These companies collectively hold the largest market share and dictate industry trends.

- Schulman, Inc.

- Ampacet Corporation

- Cabot Corporation

- Clariant AG

- Global Colors Group

- Hubron International Ltd.

- Penn Color, Inc.

- Plastiblends India Ltd.

- PolyOne Corporation

- Tosaf Group

Recent Developments

-

In May 2024, Cabot Corporation launched new universal circular black masterbatches under the REPLASBLAK product family, certified by ISCC PLUS and powered by EVOLVE Sustainable Solutions. These masterbatches utilize mechanically recycled polymers, catering to the automotive industry's demand for sustainable materials. The new REPLASBLAK reUN5285 and reUN5290 masterbatches offer high gloss, jetness, and superior color performance, comparable to standard universal black masterbatches. These solutions allow for efficient material management with a single masterbatch suitable for various polymers and automotive applications, enhancing sustainability in the product manufacturing process.

-

In January 2024, Hubron International Ltd. and Black Swan Graphene Inc. entered a commercial agreement to expedite the use of Black Swan's graphene products. Hubron, a specialist in plastic masterbatch and conductive compounds, incorporates graphene to improve functionality in masterbatch solutions. This collaboration aims to integrate graphene into various sectors such as automotive, construction, and packaging, leveraging Hubron's market reach and expertise in masterbatch production.

-

In February 2023, Penn Color launched a new range of high-performance pigment dispersions at the European Coatings Show 2023. The expanded product line includes water-based, solvent-based, and energy-curable options designed for enhanced pigment loading and color accuracy. These dispersions cater to automotive, architectural, and industrial coatings. Penn Color also supplies colors and functional additives in masterbatches and compounds for thermoplastics.

Masterbatch Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.01 billion

Revenue forecast in 2030

USD 9.65 billion

Growth Rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, carrier polymer, end use, region.

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa.

Country scope

U.S., Germany, UK, France, China, India, Japan, Malaysia, Indonesia, Vietnam, Singapore, Philippines, Thailand, and Brazil.

Key companies profiled

Schulman, Inc.; Ampacet Corporation; Cabot Corporation; Clariant AG; Global Colors Group; Hubron International Ltd.; Penn Color, Inc.; Plastiblends India Ltd.; PolyOne Corporation; Tosaf Group.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

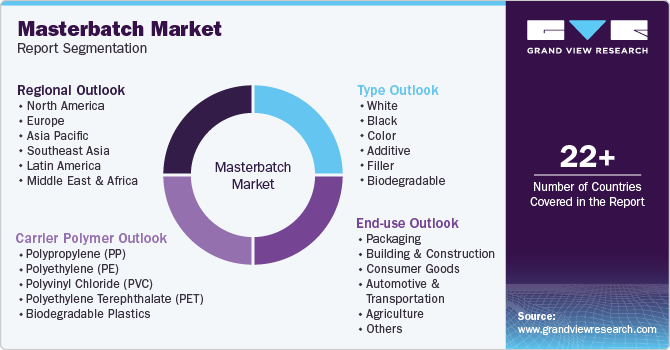

Global Masterbatch Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global masterbatch market report based on type, carrier polymer, end use, and region.

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

White

-

Black

-

Color

-

Additive

-

Filler

-

Biodegradable

-

-

Carrier Polymer Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polypropylene (PP)

-

Polyethylene (PE)

-

Polyvinyl Chloride (PVC)

-

Polyethylene Terephthalate (PET)

-

Biodegradable Plastics

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Building & Construction

-

Consumer Goods

-

Automotive & Transportation

-

Agriculture

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Southeast Asia

-

Malaysia

-

Indonesia

-

Vietnam

-

Singapore

-

Philippines

-

Thailand

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.