- Home

- »

- Medical Devices

- »

-

Mechanical Ventilator Market Size And Share Report, 2030GVR Report cover

![Mechanical Ventilator Market Size, Share & Trends Report]()

Mechanical Ventilator Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Critical Care, Neonatal, Transport & Portable), By Ventilation Mode (Invasive, Non-invasive), By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-543-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mechanical Ventilator Market Summary

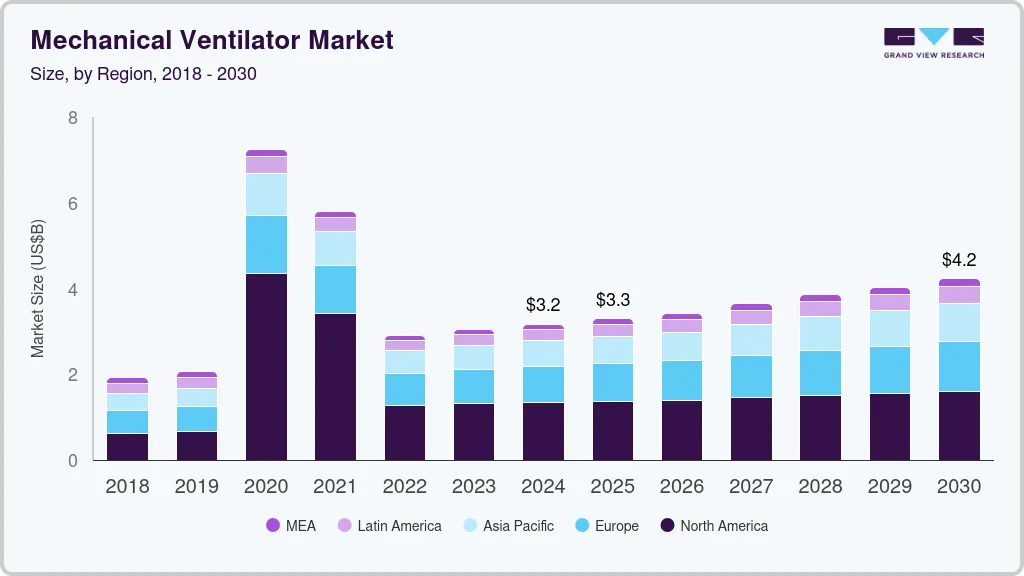

The global mechanical ventilator market size was estimated at USD 3.17 billion in 2024 and is projected to reach USD 4.22 billion by 2030, growing at a CAGR of 4.9% from 2025 to 2030. The increasing prevalence of chronic respiratory conditions such as chronic obstructive pulmonary disease (COPD), acute respiratory distress syndrome, asthma, obstructive sleep apnea, exertional dyspnea, and pulmonary embolism is fueling market growth.

Key Market Trends & Insights

- North America dominated the global mechanical ventilator market with the largest revenue share of 43.21% in 2023.

- The mechanical ventilator market in the U.S. led the North America and held the largest revenue share in 2023.

- By product, the transport and portable mechanical ventilator segment led the market, holding the largest revenue share in 2023.

- By ventilation mode, the non-invasive ventilation mode held the dominant position in the market and accounted for the leading revenue share of 57.7% in 2023.

- By end use, the home healthcare segment is expected to grow at the fastest CAGR from 2024 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 3.17 Billion

- 2030 Projected Market Size: USD 4.22 Billion

- CAGR (2025-2030): 4.9%

- North America: Largest market in 2023

As of October 2023, National Council on Aging data indicates that Obstructive Sleep Apnea (OSA), characterized by irregular breathing and reduced oxygen supply to the brain, affects about 39 million adults in the U.S. and an estimated 936 million globally.

Furthermore, intensive research and development efforts focused on respiratory interventions and the introduction of innovative devices are anticipated to offer lucrative growth opportunities for the market in the coming years. Major players in the market are directing investments towards the development of cost-effective mechanical ventilators, with a favorable regulatory environment further facilitating market expansion. For instance, in July 2022 -Nihon Kohden OrangeMed, Inc. received U.S. FDA clearance for the NKV-330 Ventilator System. This system is non-invasive and provides respiratory support in emergencies.

Market Concentration & Characteristics

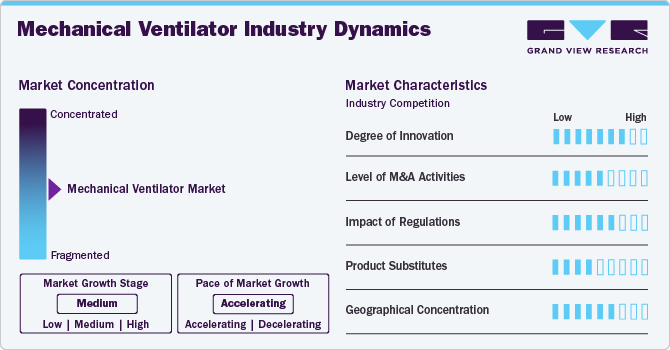

The mechanical ventilator market is currently experiencing moderate growth with an accelerating pace, propelled by factors including a growing geriatric population, a substantial patient pool with respiratory disorders, and the introduction of technologically advanced devices. For example, in August 2023, Getinge received U.S. FDA clearance for its non-invasive wall gas-independent mechanical ventilator, Servo-air Lite.

In the mechanical ventilator market, a noteworthy emphasis has been placed on innovation to enhance patient comfort, compliance, efficacy, and overall treatment outcomes. The integration of smart technology and digital sensors plays a pivotal role in augmenting therapy management, contributing significantly to the market's momentum.

The market is witnessing an upswing in mergers and acquisitions, with companies strategically utilizing multiple acquisitions to bolster product portfolios, extend their global presence, diversify offerings, integrate technologies, and strengthen their positioning within the industry.

The prevalence of respiratory disorders globally introduces opportunities and competitive dynamics across various regions. Markets such as the United Kingdom (UK), Germany, France, Italy, and Spain are experiencing growth propelled by factors such as aging populations, lifestyle influences, healthcare reforms, and regulatory standardization. In contrast, the well-established markets in the U.S. and Canada exhibit high COPD prevalence rates and sophisticated healthcare systems.

Product Insights

The transport and portable mechanical ventilator segment held the largest market share in 2023 and is anticipated to grow at the fastest CAGR of 5.4% from 2024 to 2030. The market growth can be attributed to the efficiency of mechanical ventilators in various applications across diverse care delivery settings. The evolution of cost-effective, patient-friendly, and portable devices further fuels their increasing adoption. For instance, in May 2022, Max Ventilator introduced non-invasive ventilators featuring humidifiers and oxygen therapy capabilities, demonstrating versatility in applications for both adult and neonatal care.

Portable ventilators have diverse applications, ranging from home care to ambulatory centers. The market for point-of-care treatment is expanding, driven by an increase in medical emergencies, serving as a key factor for the growth of this segment. Hospitals are proactively promoting portable ventilators that facilitate swift and convenient patient care, ensuring seamless transitions from ambulances to hospital beds. Moreover, the accessibility of portable ventilators is fostering a trend toward home care, gaining popularity among patients seeking flexible healthcare options.

Ventilation Mode Insights

The non-invasive ventilation mode segment held the largest market share of 57.7% share in 2023. The segment is anticipated to witness the fastest growth at a CAGR of 5.1 from 2024 to 2030. The growth of the segment is attributed to its wide range of applications and its ability to provide precise and higher concentrations of oxygen. The delivery of non-invasive ventilation is made possible with advanced intensive care ventilators that offer various respiratory support modes.

Extensive research and development investments, combined with rising per capita income, are driving the growth of the healthcare sector. The surge in the prevalence of respiratory diseases is a key factor fueling the overall market growth for Continuous Positive Airway Pressure (CPAP) devices. These devices are crucial in emergency settings and hospitals, serving as an efficient oxygen source for patients facing respiratory challenges. Furthermore, CPAP devices provide vital oxygen support to patients undergoing heart treatments. These factors collectively contribute to the anticipated market growth over the forecast period.

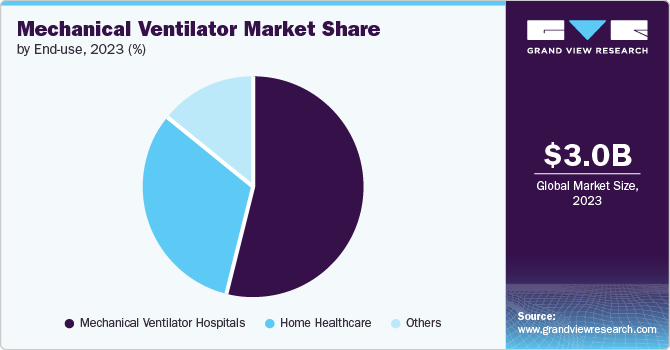

End-use Insights

In 2023, the hospitals segment held the largest market share, owing to hospitals' increasing expenditure on technologically advanced ventilators. Furthermore, the availability of skilled healthcare providers to operate these ventilators and the emphasis on better health outcomes contributed to the segment growth. In addition, patients are more likely to prefer healthcare facilities that offer constant monitoring from hospital staff, which further boosts the market growth.

Moreover, the home healthcare segment is expected to witness the fastest growth from 2024 to 2030, owing to the increasing number of government initiatives aimed at curbing healthcare expenditures by promoting home healthcare to support market growth. In addition, value-based healthcare is another major factor contributing to market growth. In the U.S., Medicare reimbursements are highly favorable in providing value-based healthcare for improved patient outcomes at a low cost.

Regional Insights

North America mechanical ventilator market dominated globally with a revenue share of over 43.21% in 2023. The increasing prevalence of respiratory conditions, such as Chronic Obstructive Pulmonary Disease (COPD), asthma, and sleep apnea, is driving the therapeutic respiratory devices market in the region. According to the American Lung Association, 11.7 million people, which is 4.6% of adults, reported a diagnosis of COPD (chronic obstructive pulmonary disease, chronic bronchitis, or emphysema in 2022. Moreover, key market players, such as GE Healthcare; CAIRE, Inc.; Koninklijke Philips N.V.; Invacare, Medtronic, and React Health, are employing strategies, such as acquisitions, collaborations, expansions, & new product launches, to extend their product offerings and geographical reach.

U.S. Mechanical Ventilator Market Trends

The mechanical ventilator market in the U.S. is driven by several key factors, including a high prevalence of chronic respiratory diseases such as COPD and asthma, an aging population, and advancements in healthcare infrastructure. According to an article published by the American Lung Association in February 2023, over 34 million U.S. individuals suffer from chronic lung diseases, including COPD, asthma, chronic bronchitis, and emphysema. The COVID-19 pandemic has also heightened the demand for ventilators, leading to rapid innovation and production scaling. Advanced technologies like AI are being integrated for monitoring and predictive analytics, and portable ventilator models are being developed for various healthcare settings.

Europe Mechanical Ventilator Market Trends

Europe mechanical ventilator market, particularly in the UK, is shaped by stringent regulatory requirements, technological advancements, and a growing elderly population. There is a notable emphasis on developing ventilators that are energy-efficient, environmentally friendly, and capable of providing personalized patient care. The Medical Device Regulations (MDR), which came into effect in May 2021, harmonizes the regulation of medical devices across the European Union (EU). It sets stringent requirements for the safety, performance, and quality of mechanical ventilators and other medical devices. Manufacturers must comply with detailed technical documentation, clinical evaluation, and post-market surveillance requirements to obtain and maintain CE marking.

Asia Pacific Mechanical Ventilator Market Trends

The mechanical ventilator market in the Asia Pacific region is anticipated to witness significant growth at a CAGR of 7.0% over the forecast period. The segment growth is attributed to the high burden of respiratory disorders and the high risk of lifestyle factors such as smoking and allergies resulting in several respiratory conditions. According to the World Health Organization, China has one of the highest smoking populations in the world, with over 300 million smokers, contributing significantly to respiratory health issues. This has driven a robust demand for mechanical ventilators capable of providing both invasive and non-invasive ventilation support. In addition, government initiatives to boost ventilator production and collaborations between manufacturers to create advanced ventilators to meet high demand are also propelling the region’s growth.

The Japan mechanical ventilator market is anticipated to grow due to the demand for advanced ventilator technologies that improve patient outcomes and operational efficiency, driven by an aging population and high healthcare standards in the region. According to the Population Reference Bureau, in 2021, over 28% of Japan's population was aged 65 or older, creating a substantial demand for healthcare solutions that cater to age-related respiratory conditions and critical care needs. This demographic shift compels healthcare providers to adopt advanced ventilators equipped with features like non-invasive ventilation modes, high-flow oxygen therapy, and integrated monitoring systems to enhance patient care and manage complex respiratory cases more effectively.

Key Companies & Market Share Insights

The competitive landscape of the mechanical ventilator industry features key players such as ResMed, Koninklijke Philips N.V., and Fisher & Paykel Healthcare. These industry leaders are actively engaged in strategic initiatives, including mergers and acquisitions, to strengthen their market positions.

A notable example is the partnership formed in August 2023 between Medline, a prominent U.S.-based medical supplies and devices manufacturer, and Flight Medical, an Israeli respiratory device manufacturer. Within this collaboration, Medline exclusively offers the Flight 60 transportable ventilator. This advanced device seamlessly transitions between invasive and non-invasive ventilation modes, addressing the ventilation needs of high-acuity patients. Notably, the ventilator's portability and durability make it suitable for a diverse range of patients, from pediatric to adult cases.

“This collaboration will make an impact in addressing ventilator availability in the industry and, most importantly, help our providers improve patient care. By joining forces with Flight Medical, we strengthen our respiratory portfolio to meet the needs of customers across the continuum of care.”- Brian Groskopf, Senior Director, Product Management, Medline

Key Mechanical Ventilator Company Insights

Key players in the market employ various strategies, including mergers and acquisitions, product launches, expansion into emerging economies, and enhancing service networks, to strengthen their market positions. For instance, the partnership formed in August 2023 between Medline, a prominent U.S.-based medical supplies and devices manufacturer, and Flight Medical, an Israeli respiratory device manufacturer. Within this collaboration, Medline exclusively offers the Flight 60 transportable ventilator. This advanced device seamlessly transitions between invasive and non-invasive ventilation modes, addressing the ventilation needs of high-acuity patients. Notably, the ventilator's portability and durability make it suitable for a diverse range of patients, from pediatric to adult cases.

Exit Strategies of Key Market Players

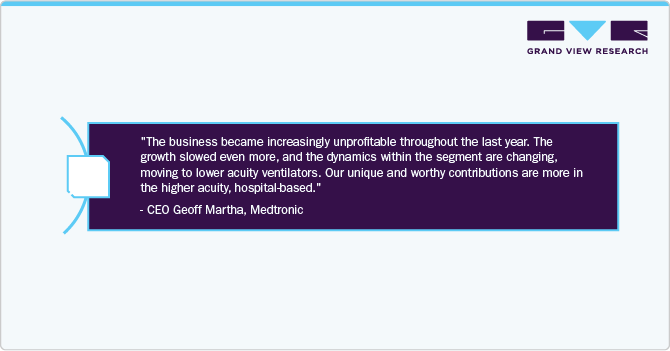

Medtronic

-

In October 2022, Medtronic decided to separate its respiratory interventions (PMRI) and patient monitoring businesses from the ventilator market. The decision was made due to the company's significant expansion during the COVID-19 pandemic, which led to ventilator shortages.

-

Later, Medtronic recognized that the spinoff plan no longer benefited the firm. Therefore, in February 2024, Medtronic announced to exit the ventilator business and merge its Patient Monitoring and Respiratory Interventions (PMRI) segments into a new unit called Acute Care and Monitoring (ACM).

Medtronic Strategy

-

Despite ceasing new sales, Medtronic will continue to honor existing contracts for ventilators. This ensures that their current customers and patients relying on these devices are not abruptly affected.

-

By discontinuing the unprofitable ventilator line, Medtronic reallocated resources, both financial and operational, to other segments within the ACM unit. This move is expected to enhance investment in areas with better growth potential and higher profitability.

Koninklijke Philips N.V.

-

In January 2024, Koninklijke Philips N.V. announced the discontinuation of select respiratory products in the U.S. and its territories, including the ventilators, SimplyGo Mini, SimplyGo, and Everflo oxygen concentrators. This decision is expected to bring notable shifts in the ventilators market. According to a survey poll conducted by HME News in February 2024, approximately 70% of respondents believe that Philips' withdrawal from a significant portion of the U.S. respiratory market will have a considerable influence on the industry.

-

While the discontinuation of respiratory products by Philips Respironics indicates a significant development in the mechanical ventilators industry, it also presents opportunities for other market players to innovate and expand their presence.

Recent Developments

-

In January 2023, Getinge launched its latest mechanical ventilator, the Servo-c, which provides lung-protective therapeutic capabilities for pediatric and adult patients. The Servo-c utilizes modular parts, facilitating intelligent fleet management. This ensures optimal uptime and reduces costs, eliminating the necessity for proprietary disposables. Moreover, the Servo-c is equipped with CO2 monitoring and Servo Compass technology.

“Lung protection challenges come in many shapes and sizes. That is why Servo-c is designed for safe, easy and efficient use that enables personalized respiratory treatments. With the essential functionalities provided, it is ideal for hospitals in the targeted markets looking for a high acuity ventilator at an affordable price point.”

- Elin Frostehav, President of Acute Care Therapies, Getinge

- In October 2021, Movair, a respiratory therapy company, launched Luisa, an advanced ventilator designed for diverse settings such as homes, hospitals, institutions, and portable applications. The U.S. commercial launch of Luisa comes in response to the growing demand for reliable and safe ventilators. Luisa is eligible for use under the FDA's Emergency Use Authorization.

Key Mechanical Ventilator Companies

The following are the leading companies in the mechanical ventilators market. These companies collectively hold the largest market share and dictate industry trends.

Prominent players

Notable Players Exist

Filed Bankruptcy Player

- Abbott

- Boston Scientific Corporation

- BIOTRONIK

- MicroPort Scientific Corporation

- Stryker

- ResMed

- Fisher & Paykel Healthcare Limited

- Drägerwerk AG & Co. KGaA

- Getinge AB

- ZOLL Medical Corporation (Asahi Kasei Corporation)

- Air Liquide

- VYAIRE MEDICAL, INC.

- GE Healthcare

- Hamilton Medical

- Smiths Group plc

- Allied Medical LLC (A Flexicare Company)

- aXcent Medical GmbH

- Metran Co., Ltd

- MAGNAMED

- Avasarala Technologies Limited

- Airon Corporation

- Bio-Med Devices

- Hill-Rom (Baxter)

- HEYER Medical AG

- Leistung Engineering Pvt. Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- NIHON KOHDEN CORPORATION

- Schiller AG

- Koninklijke Philips N.V.(January, 2024)

- Medtronic

(February, 2024) - Teleflex Incorporated (June, 2021)

Vyaire Medical, Inc.

Mechanical Ventilation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.29 billion

Revenue forecast in 2030

USD 4.22 billion

Growth rate

CAGR of 4.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors and trends, clinical trials outlook, volume analysis

Segments covered

Product, ventilation mode, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Abbott;; Boston Scientific Corporation; BIOTRONIK; MicroPort Scientific Corporation; Koninklijke Philips N.V.; Stryker; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; NIHON KOHDEN CORPORATION; Schiller AG; ResMed; Fisher & Paykel Healthcare Limited; Drägerwerk AG & Co. KGaA; Getinge AB; ZOLL Medical Corporation (Asahi Kasei Corporation); Air Liquide; VYAIRE MEDICAL, INC.; GE Healthcare; Hamilton Medical; Smiths Group plc; Allied Medical LLC (A Flexicare Company); aXcent Medical GmbH; Metran Co., Ltd; MAGNAMED; Avasarala Technologies Limited; Airon Corporation; Bio-Med Devices; Hill-Rom (Baxter); HEYER Medical AG; Leistung Engineering Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mechanical Ventilator Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global mechanical ventilator market report based on product, ventilation mode, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Critical Care

-

Ventilators

-

Accessories

-

-

Neonatal

-

Ventilators

-

Accessories

-

-

Transport & Portable

-

Ventilators

-

Accessories

-

-

Others

-

-

Ventilation Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Invasive

-

Non-invasive

-

CPAP

-

BiPAP

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Mechanical Ventilator Hospitals

-

Home healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe (EU) (RoE)

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific (RoAPAC)

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America (RoLA)

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of Middle East & Africa (RoMEA)

-

-

Frequently Asked Questions About This Report

b. The global mechanical ventilator market size was estimated at USD 3.05 billion in 2023 and is expected to reach USD 3.17 billion in 2024.

b. The global mechanical ventilator market is expected to witness a compound annual growth rate of 4.90% from 2024 to 2030 to reach USD 4.22 billion by 2030.

b. Critical care ventilators are expected to account for over 38.0% of the overall mechanical ventilator market share by 2023, owing to technological advancements, such as Spontaneous Breathing Trial (SBT) and AutoTrak.

b. Some of the key players operating in the mechanical ventilator market include Medtronic; Abbott;; Boston Scientific Corporation; BIOTRONIK; MicroPort Scientific Corporation; Koninklijke Philips N.V.; Stryker; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; NIHON KOHDEN CORPORATION; Schiller AG; ResMed; Fisher & Paykel Healthcare Limited; Drägerwerk AG & Co. KGaA; Getinge AB; ZOLL Medical Corporation (Asahi Kasei Corporation); Air Liquide; VYAIRE MEDICAL, INC.; GE Healthcare; Hamilton Medical; Smiths Group plc; Allied Medical LLC (A Flexicare Company); aXcent Medical GmbH; Metran Co., Ltd; MAGNAMED; Avasarala Technologies Limited; Airon Corporation; Bio-Med Devices; Hill-Rom (Baxter); HEYER Medical AG; Leistung Engineering Pvt. Ltd.

b. The U.S. mechanical ventilator market is expected to witness a compound annual growth rate of 2.85% from 2024 to 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.