- Home

- »

- Medical Devices

- »

-

Humidifier Market Size, Share, Growth, Industry Report 2033GVR Report cover

![Humidifier Market Size, Share, & Trends Report]()

Humidifier Market (2025 - 2033) Size, Share, & Trends Analysis Report By Product (Heated Humidifiers, Passover Humidifiers, Bubble Humidifier), By Distribution Channel, By End Use (Hospitals, Outpatient Facilities, Homecare), By Region And Segment Forecasts

- Report ID: GVR-4-68040-150-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Humidifier Market Summary

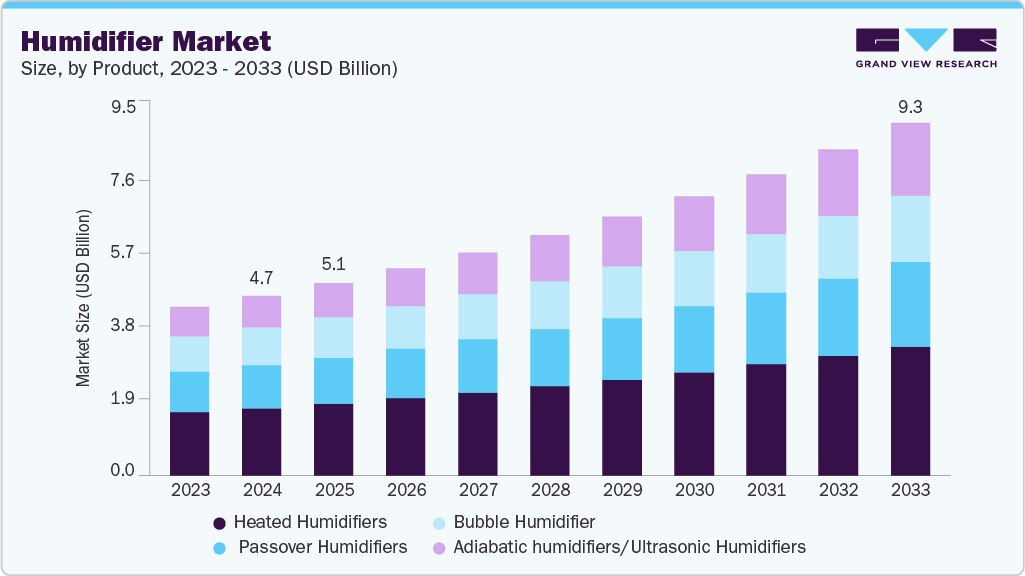

The global humidifier market size was estimated at USD 4.73 billion in 2024 and is projected to reach USD 9.30 billion by 2033, growing at a CAGR of 7.87% from 2025 to 2033. Increasing awareness about the health benefits of maintaining optimal humidity levels, such as reducing the incidence of respiratory issues, viruses, infections, dry skin, and sinus problems, is driving demand for humidifiers.

Key Market Trends & Insights

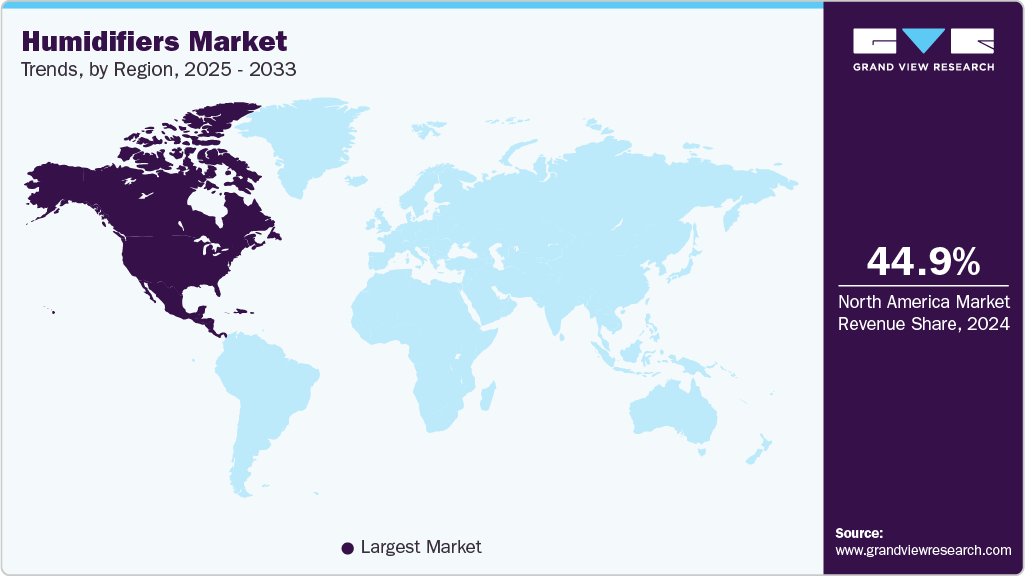

- North America dominated the market for humidifiers with a share of 44.99% in 2024.

- Asia Pacific is estimated to be the fastest-growing region over the forecast period.

- Based on product, the heated humidifiers segment held the largest market share of 37.42% in 2024.

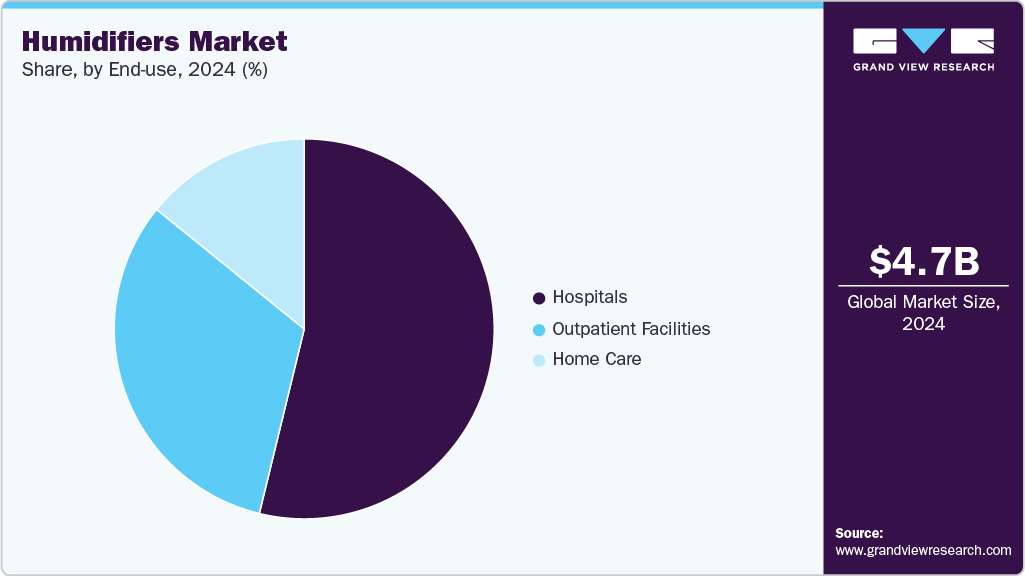

- Based on end use, hospitals held the dominant market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.73 Billion

- 2033 Projected Market Size: USD 9.30 Billion

- CAGR (2025-2033): 7.87%

- North America: Largest market in 2024

This is particularly evident in regions with dry and arid climates or significant seasonal variations, where dry indoor air is a common issue. The increasing incidence of respiratory diseases such as asthma and allergies has led to a greater emphasis on maintaining optimal humidity levels, thereby driving the market for humidifiers. According to the American Lung Association, Asthma affects around 24.8 million people in America, including over 5.5 million children, causing millions of emergency department visits and tens of billions in healthcare costs annually.

The humidity level in the air can affect the survival and transmission of pathogens, including viruses and bacteria. When the air is too dry, some pathogens can remain viable for longer periods, making it easier for them to spread. Maintaining humidity within the recommended range, typically between 40% and 60%, reduces the viability and transmission of infectious agents. This is because, in air with relative humidity (RH) above 40%, airborne viruses within droplets become less stable and are more likely to deactivate quickly, making them less infectious. Thus, the ability of humidifiers to play a vital role in infection control in hospitals by helping to maintain the appropriate levels of humidity in healthcare environments drives the overall market growth.

Smart Humidifiers: An Emerging Trend in the Humidifiers Market

Smart humidifiers are rapidly gaining traction worldwide as consumers seek advanced solutions for maintaining optimal indoor air quality and improving comfort across diverse climates. Equipped with features such as app connectivity, voice control, and customizable humidity settings, these devices allow users to monitor and adjust their environment remotely. The rising penetration of smart home technologies, coupled with growing awareness of health and wellness, is fueling global demand for intelligent, automated humidifiers that deliver enhanced convenience, energy efficiency, and health benefits.

Company

Launch Date

Product Name

Key Features

Xiaomi

August 2025

Mijia Mistless Humidifier

Mist-free design, smart sensors, antibacterial washable filters, quiet (~30 dB), app control

Blueair

June 2025

2-in-1 Purify + Humidify DH3i

Combines air purification and humidification, app-controlled, HEPASilent and InvisibleMist

InvisibleMist Humidifier

Mist-free / top-fill design, 3.5 L tank, runs up to 48 h, 500 sq ft coverage, antimicrobial wick filter, UV-powered pump, app & touchscreen control, quiet operation

Arovast Corporation.

March 2025

OasisMist 450S Smart Humidifier

Warm and cool mist settings, top-fill design, dual 360° nozzles, smart control via app

January 2025

Sprout Evaporative Humidifier (CES 2025)

Kid- and parent-friendly design, evaporative humidification, part of CES 2025 wellness lineup

March 2023

OasisMist 1000S Smart Humidifier

Smart control via app, 100-hour runtime, top-fill design, dual 360° nozzles

Market Concentration & Characteristics

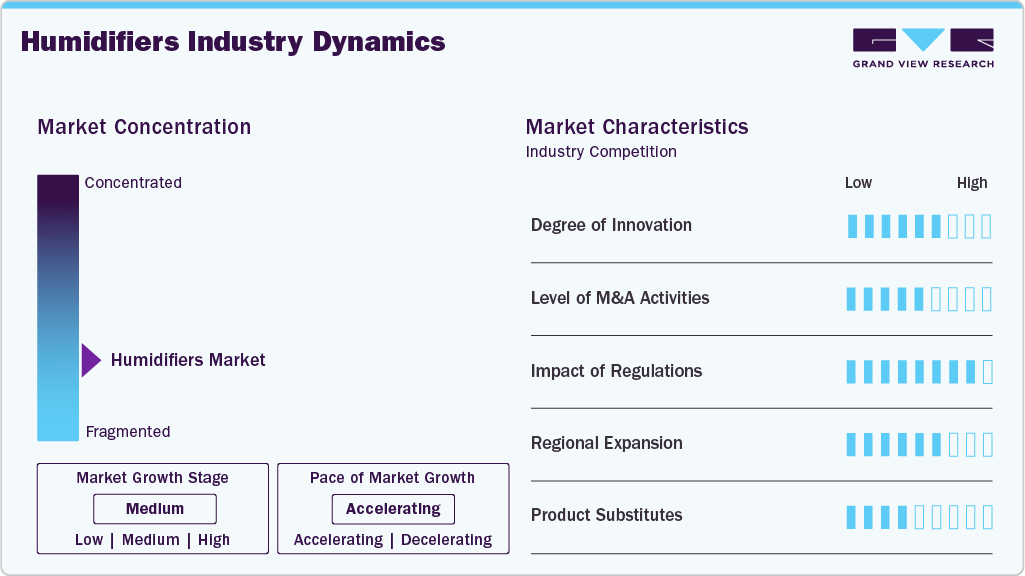

The humidifiers market is experiencing moderate growth, driven by accelerating market demand. Key factors include increasing product innovation by market players, a growing geriatric population, a rising prevalence of respiratory diseases, and technological advancements.

The humidifiers market is characterized by high innovation, with companies developing advanced products to expand their offerings and stay competitive. Innovations in humidifier technology, including the development of smart humidifiers that can be controlled via mobile apps, improved energy efficiency, and quieter operation, are attracting consumers. For instance, in June 2025, Proteomics launched the Magma, a 2-in-1 cool mist humidifier and night lamp featuring dual mist modes, adjustable lighting, and silent Type-C operation, designed to improve indoor air quality and ambiance.

The market players are using various strategies such as mergers and acquisitions, partnerships, collaborations, new software developments, and geographical expansion, which has significantly contributed to the level of M&A activities in the market. For instance, in June 2021, Teleflex Incorporated completed the divestiture of its respiratory business to Medline Industries, Inc. The transaction, valued at USD 286 million in cash, took into account a reduction of USD 12 million related to working capital that would not be transferred to Medline. Teleflex's divested respiratory product lines encompass Hudson RCI offerings for oxygen & active humidification, noninvasive ventilation, aerosol therapy, and incentive spirometers.

Regulations and regulatory frameworks significantly impact the global humidifiers market. Health organizations and regulatory bodies, such as the Environmental Protection Agency (EPA) and the Consumer Product Safety Commission (CPSC), set standards for indoor air quality and safety, driving the demand for compliant humidifiers. In June 2022, U.S. EPA launched a revised guidelines for the use and care of home humidifiers on their website. According to the CFR-Code of Federal Regulation, therapeutic humidifiers for home use are classified as Class I (general controls) and are exempt from premarket notification procedures subject to the limitations in § 868.9. Maintaining indoor relative humidity within the range of 30% to 60% is suggested by the American Society of Heating, Refrigerating, and Air-Conditioning Engineers (ASHRAE) to promote health and ensure comfort.

The threat of substitution in the humidifiers market is expected to remain low over the forecast period. Humidifiers play a crucial role in healthcare settings, such as clinics and hospitals, as well as in homes, by maintaining optimal humidity levels that support the health of patients and medical professionals. While medications for conditions like COPD can offer external relief and serve as partial substitutes for therapeutic respiratory devices, the range of effective alternatives remains limited. Vaporizers, or steam humidifiers, offer another method by boiling water to release steam, and houseplants like peace lilies and ferns can naturally enhance humidity through transpiration. Despite these options, the comprehensive benefits provided by humidifiers in managing indoor air quality and supporting respiratory health are not easily matched by substitutes.

The humidifier market exhibits regional concentration, with significant demand and growth observed in North America, Europe, and Asia-Pacific. North America leads the market, driven by high awareness of indoor air quality, advanced healthcare infrastructure, and a robust consumer base. Europe follows closely, with stringent regulations on indoor air standards and a growing emphasis on respiratory health driving the adoption of humidifiers. In the Asia-Pacific region, rapid urbanization, increasing pollution levels, and rising health consciousness are fueling market expansion. In addition, the presence of key manufacturers and technological advancements in these regions further contribute to their dominant positions in the global humidifier market.

Case Study Insights

Dr. Jennifer Reiman, Ph.D., from the Mayo Clinic, conducted a study monitoring the presence of influenza virus particles in the air and on surfaces within four nursery school classrooms. Among these classrooms, two were equipped with humidifiers while the other two were not.

Product Insights

The heated humidifier segment accounted for the largest revenue share of 37.4% in 2024. The demand for heated humidifiers, specifically in children with tracheostomies who receive continuous mechanical ventilation, is driven by the need to prevent the drying of secretions. This is particularly crucial for infants who are more susceptible to respiratory complications. Heated humidifiers are sophisticated humidification systems widely employed in respiratory therapy to provide patients with warm and moist air. These humidifiers incorporate a heating element that warms the water before it is delivered as humidity. The demand for heated humidifiers stems from their ability.

The adiabatic segment is expected to grow at the fastest CAGR over the forecast period. Adiabatic humidification methods, including high-pressure atomizing, air/water atomizing, ultrasonic, and wetted media evaporative systems, offer efficient moisture addition. Among these, ultrasonic humidifiers have gained significant popularity due to their effectiveness in enhancing home wellness. Recent technological advancements have further bolstered this segment, leading to the development of ultrasonic humidifiers with enhanced features.

Distribution Channel Insights

The offline channel segment held the largest revenue share in 2024, driven by consumer preference for physically inspecting products before purchase, specifically medical devices such as humidifiers. In addition, the immediate availability of products in offline sales channels, in-store demonstrations, and personalized assistance are further contributing to the segment's large share.

The online channel segment is expected to grow at the fastest CAGR over the forecast period. This growth is driven by an increasingly shifting toward e-commerce platforms, competitive pricing, and access to customer reviews. The surge in smartphone penetration, targeted digital marketing, and subscription-based delivery models further contributes to the segment's growth.

End Use Insights

The hospitals segment accounted for the largest revenue share of over 53.80% in 2024. Factors such as increasing awareness of the benefits of humidification in patient care and the adoption of advanced humidifier technologies are driving the segment growth. Hospitals are increasingly recognizing the importance of maintaining optimal humidity levels to improve patient comfort, prevent complications such as dry skin and respiratory issues, and support faster recovery times. In addition, the integration of sophisticated humidifier technologies into hospital settings allows for efficient and precise humidification. As a result, the hospital segment is expected to experience robust growth, contributing significantly to the overall expansion of the humidifier market.

The outpatient facilities segment is expected to grow at the fastest CAGR over the forecast period. The demand for outpatient facilities, including ambulatory surgical centers, clinics, and diagnostic centers, is increasing due to rising expenditure, healthcare accessibility, and a focus on preventive care. Moreover, the growing prevalence of respiratory conditions and the emphasis on infection control further fuel the demand for high-performance humidifiers in these settings.

Regional Insights

North America led the humidifiers market with a 44.99% revenue share in 2024, driven by several key factors. Increased awareness of indoor air quality and a rising rate of respiratory diseases have greatly contributed to market growth. In addition, the region's growing elderly population has boosted demand for humidification solutions that support respiratory health. At the same time, the American Lung Association's creation of its Research Institute, with a goal to increase annual lung disease research funding to USD 25 million, emphasizes this focus. Their initiatives to safeguard public health from air pollution include advocating for the Clean Air Act and urging the U.S. Environmental Protection Agency to ensure widespread access to safe and healthy air. These efforts reflect the region's preference for advanced technologies, seen in the rising use of smart home devices and the integration of humidifiers with HVAC systems, further driving market growth in North America.

U.S. Humidifiers Market Trends

Humidifiers market in the U.S. held the largest market share of North America humidifiers market. The growth is propelled by the country's robust healthcare infrastructure, stringent regulatory standards, and a high prevalence of respiratory conditions. According to the article published by the American Lung Association in April 2024, Over 34 million U.S. residents suffer from chronic lung diseases such as COPD and asthma.

Europe Humidifier Market Trends

Humidifiers market in Europe is driven by factors such as cold weather conditions, strict regulations, and a growing focus on health and wellness. The European Environment Agency's recent air quality health assessment, released in November 2023, indicated that meeting WHO guidelines for fine particulate matter concentrations could have prevented 253,000 deaths in Europe. Updated estimates show that exposure to air pollution can worsen conditions like asthma and lung cancer. The region's strong healthcare infrastructure, the enforcement of energy efficiency standards for appliances, and the increasing adoption of hybrid humidification systems demonstrate its commitment to sustainability and technological progress. For example, in 2023, CAREL installed adiabatic humidification systems at the new Paideia International Hospital, a private hospital in Italy.

The humidifier market in UK is expected to grow significantly over the forecast period. Factors such as variable climate, combined with concerns about indoor air quality, contribute to the demand for humidifiers. In addition, the emphasis on home wellness and comfort drives consumer interest in humidification solutions, particularly during colder seasons.

The humidifier market in Germany held the largest market share in 2024. This can be attributed to factors such as the country's strong emphasis on environmental regulations and sustainability, as well as its high standards of living. The demand for humidifiers in Germany is also driven by concerns about respiratory health, particularly among the aging population. The German Centers for Health Research reports that one person dies every four minutes due to lung or respiratory diseases in Germany. Technological advancements and the presence of innovation contribute to manufacturing industries further contributes to the market growth.

Asia Pacific Humidifiers Market Trends

Humidifier market in the Asia Pacific region is expected to grow significantly over the coming years. Rapid urbanization and industrialization in countries like China and India have led to increased pollution levels, exacerbating respiratory problems and driving demand for air quality improvement solutions such as humidifiers. Moreover, the growing awareness of the health benefits of maintaining optimal indoor humidity levels, especially in combating respiratory ailments and enhancing comfort, further fuels this demand. Advancements in technology and the availability of innovative humidifier models tailored to the needs of the Asia Pacific market, along with the increasing prevalence of smart home trends, contribute to the robust growth prospects in this segment.

The humidifier market in China is expanding due to increased air pollution, dry seasonal conditions, and a growing awareness of health and wellness. A rising middle class with higher disposable income, combined with widespread adoption of smart home technologies, is driving demand for connected, feature-rich humidifiers. Expanding e-commerce platforms and ongoing innovation from domestic brands like Xiaomi, Smartmi, and Midea are further fueling market growth.

The humidifier market in Japan is experiencing steady growth, driven by several key factors. Increasing consumer awareness of indoor air quality and its impact on health is fueling demand for air humidifiers. Technological advancements, such as the integration of artificial intelligence and smart connectivity, are enhancing the appeal of these devices.

Latin America Humidifier Market Trends

The humidifiers market in Latin America is fueled by several factors, including seasonal dry and cold conditions in countries like Brazil and Argentina, increasing urban pollution, and rising consumer awareness of respiratory health. Growing adoption of smart home technologies and connected devices, along with the demand for energy-efficient and low-maintenance appliances, is further boosting the market.

Middle East and Africa Humidifier Market Trends

The humidifiers market in the Middle East and Africa is growing due to harsh, dry climates, rising urbanization, and increasing awareness of indoor air quality and health. Demand is further driven by smart, energy-efficient, and low-maintenance devices, with innovations like evaporative and mist-free humidifiers reflecting consumers’ preference for advanced, health-conscious solutions. For instance, in November 2024, DriSteem showcased its High-Pressure Atomization system, RTS Humidifier RX series, and Ultra-sorb Model MP steam dispersion panel at The Big 5 Saudi Arabia International Building and Construction Show, highlighting the region’s interest in advanced commercial and industrial humidification solutions.

Key Humidifiers Company Insights

The market is fragmented, with many small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships are playing a key role in propelling the market growth.

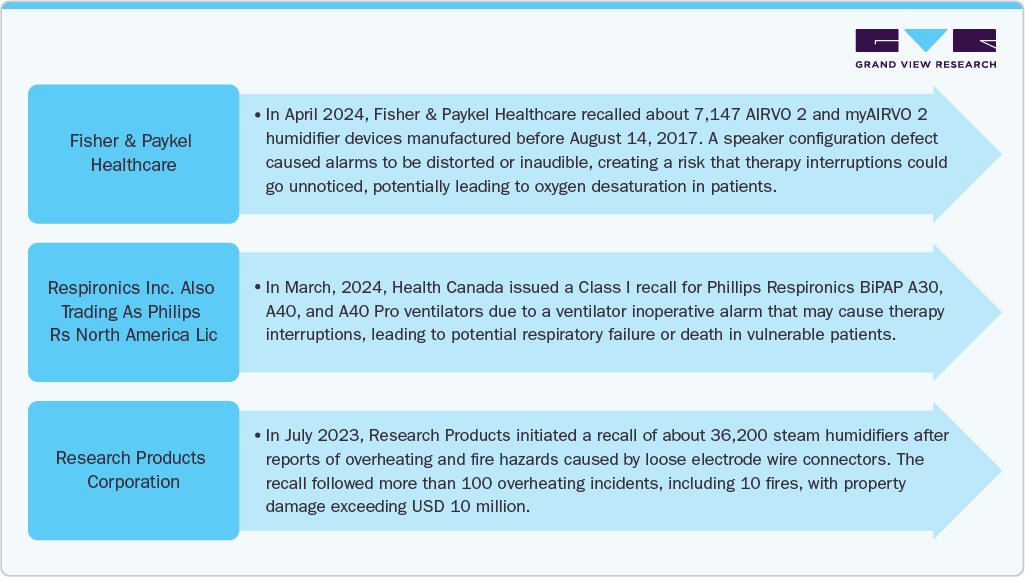

Recent Product Recalls in the Humidifier Market

Product recalls in the humidifier market due to issues such as overheating or malfunctioning alarms have raised concerns about safety and reliability. These recalls can lead to financial losses for manufacturers and reduce consumer confidence in certain products.

Key Humidifiers Companies Companies:

The following are the leading companies in the humidifier market. These companies collectively hold the largest market share and dictate industry trends.

- Fisher & Paykel Healthcare Limited

- Resmed

- Drägerwerk AG & Co. KGaA

- Koninklijke Philips N.V.

- Medline Industries, LP

- Hamilton Medical

- Armstrong Medical Ltd

- Intersurgical Ltd

- Teleflex Incorporated

- Medical Depot, Inc. dba Drive DeVilbiss Healthcare

- Precision Medical, Inc.

- acehealthcare

- CAREL INDUSTRIES S.p.A.

- Vapotherm

- Humidifirst, Inc.

- MEDICOP Medical Devices

Recent Developments

In November 2024, Homedics launched the Natura humidifier, a 1.3-gallon top-fill ultrasonic model that delivers warm or cool mist for spaces up to 402 sq. ft., runs up to 60 hours, features Clean Tank Technology, auto-shutoff, programmable humidity, and doubles as a planter with a removable compartment for plants.

“Natura has truly become one of my favorite products. It's not just a humidifier-it's a blend of wellness and design that we've carefully crafted to elevate any home. What makes it special is how it seamlessly merges top-tier performance with a modern, elegant aesthetic, plus the added touch of greenery that brings life into your space.”

-Daniel Kaufman, Head of Corporate Strategy at FKA Brands.

- In April 2024, Condair announced that Konvekta, an energy recovery specialist, is utilizing the Condair ME evaporative humidifier as a standard adiabatic cooling solution in its exhaust air cooling systems. The company aims to achieve up to 92% annual energy recovery for its clients' buildings.

“A single Condair ME humidifier contributed more than 60,000kWh/a of cooling during this period from just 3,800kwh/a of consumed electricity.”

-Amir Ibrahimagic, Group Business Development Manager, Konvekta

-

In February 2024, Canopy, a beauty and wellness brand, launched its Canopy Portable Humidifier, a dermatologist-approved hybrid cool mist humidifier. The humidifier's 500-milliliter tank can run for up to 24 hours without needing a refill. It has three adjustable settings, and Canopy's proprietary dry-out mode technology prevents mold growth by keeping air flowing until there's no water left, ensuring hydration.

-

In September 2023, Smartmi introduced its High-Capacity Evaporative Humidifier 3, designed to improve air quality and convenience. This product offers mist-free natural humidification, a 350ml/h humidity output, and a large 5L tank. It features smart controls and ultra-quiet operation, making it ideal for individuals with respiratory issues, the elderly, infants, vocal performers, and those in homes with dry climates and forced air heating.

-

In October 2022, Medtronic separated its Patient Monitoring and Respiratory Interventions businesses into a new entity, NewCo. This strategic move aimed to enhance value for Medtronic and its shareholders by allowing the company to concentrate on long-term strategies for innovation-driven growth. The separation was expected to optimize focus and capital allocation, positioning NewCo to unlock its value.

-

In March 2022, Hamilton Medical announced the production of a HAMILTON-H900 humidifier at its facility in Reno, Nevada, catering to the U.S. market. The facility would expand its manufacturing capabilities to include heated breathing circuit sets and chambers. This strategic initiative was expected to enhance efficiency in delivering products to customers in the U.S.

Humidifiers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.07 billion

Revenue forecast in 2033

USD 9.30 billion

Growth rate

CAGR of 7.87% from 2025 to 2033

Actual data

2021- 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in units (000’), and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, end use, region

Key companies profiled

Fisher & Paykel Healthcare Limited; Resmed; Drägerwerk AG & Co. KGaA; Koninklijke Philips N.V.; Medline Industries, LP; Hamilton Medical; Armstrong Medical Ltd; Intersurgical Ltd; Teleflex Incorporated; Medical Depot, Inc. dba Drive DeVilbiss Healthcare; Precision Medical, Inc.; acehealthcare; CAREL INDUSTRIES S.p.A.; Vapotherm; Humidifirst, Inc.; MEDICOP Medical Devices.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

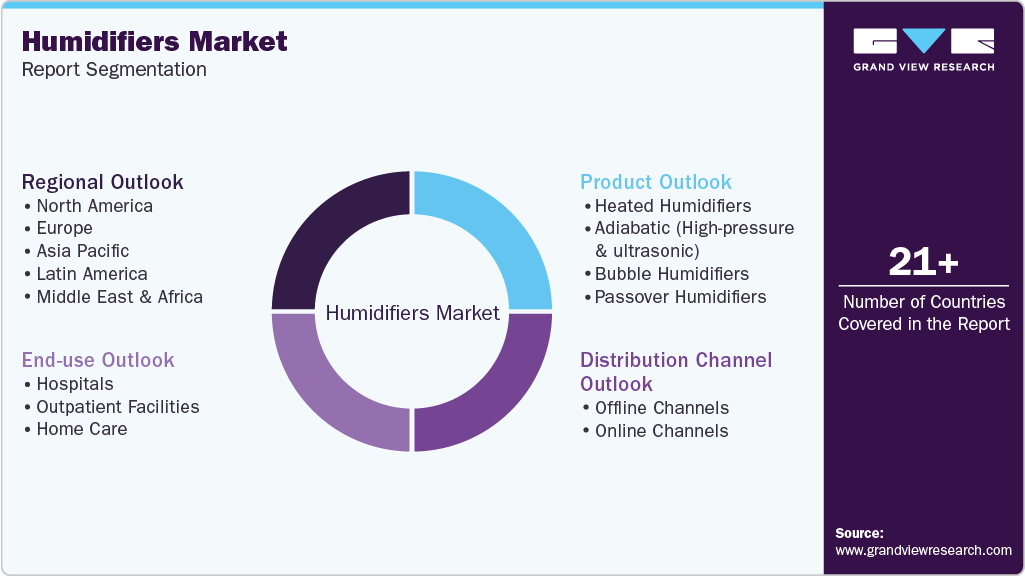

Global Humidifiers Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the humidifiers market report based on product, distribution channel, end use, and region.

-

Product Outlook (Revenue, USD Million; Unit Volume 000'; 2021 - 2033)

-

Heated Humidifiers

-

Integrated or Built-in

-

Standalone

-

-

Adiabatic (High-pressure & ultrasonic)

-

Bubble Humidifiers

-

Passover Humidifiers

-

-

Distribution Channel Outlook (Revenue, USD Million; Unit Volume 000'; 2021 - 2033)

-

Offline Channels

-

Retail Stores

-

Supermarkets & Hypermarkets

-

Pharmacy & Health Stores

-

Exclusive Brand Stores / Showrooms

-

-

Online Channels

-

E-commerce Platforms

-

Company-owned Online Stores

-

Specialized Wellness & Home Appliance E-retailers

-

-

-

End Use Outlook (Revenue, USD Million; Unit Volume 000'; 2021 - 2033)

-

Hospitals

-

Outpatient Facilities

-

Home Care

-

-

Regional Outlook (Revenue, USD Million; Unit Volume 000'; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global humidifier market size was estimated at USD 4.73 billion in 2024 and is expected to reach USD X billion in 2025.

b. The global humidifier market is expected to grow at a compound annual growth rate of 7.87% from 2025 to 2033 to reach USD 9.30 billion by 2033.

b. North America dominated the humidifier market with a share of 44.99% in 2024.

b. Some key players operating in the humidifier market include Medtronic; Fisher & Paykel Healthcare; ResMed; DeVilbiss Healthcare; Koninklijke Philips N.V; Acare Technology Co., Ltd.; Teleflex Incorporated; Vapotherm; Precision Medical, Inc; GE Healthcare.

b. Key factors that are driving the market growth include the rise in the prevalence of allergies, respiratory disease and increased concerns about harmful health effects from dry air.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.