- Home

- »

- Medical Devices

- »

-

Medical Device Testing Services Market Size Report, 2030GVR Report cover

![Medical Device Testing Services Market Size, Share & Trends Report]()

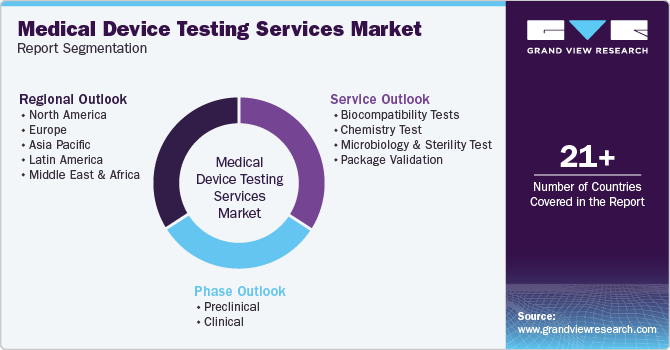

Medical Device Testing Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Biocompatibility Tests, Chemistry Test, Microbiology & Sterility Testing, Package Validation), By Phase (Preclinical, Clinical), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-115-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Device Testing Services Market Summary

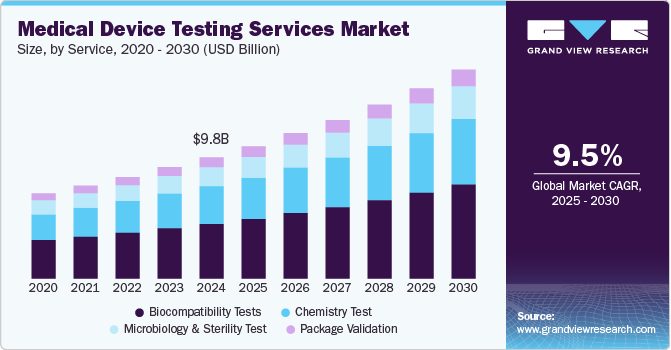

The global medical device testing services market size was estimated at USD 9,763.8 million in 2024 and is projected to reach USD 16,778.4 million by 2030, growing at a CAGR of 9.49% from 2025 to 2030. Complexity in product design, intensifying competition, increasing number of small-sized medical device manufacturers, and strict approval norms are key factors driving the market growth.

Key Market Trends & Insights

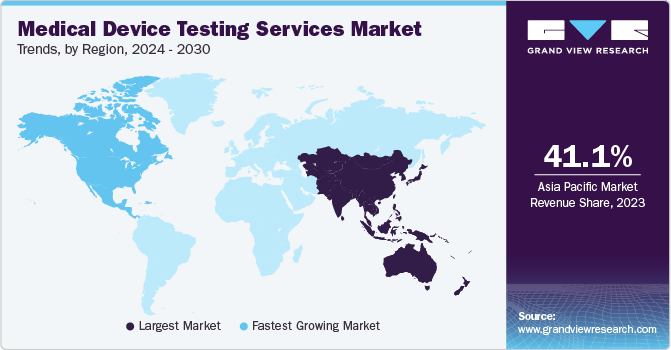

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, Thailand is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, biocompatibility tests accounted for a revenue of USD 4,835.6 million in 2024.

- Chemistry Test is the most lucrative service segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 9,763.8 Million

- 2030 Projected Market Size: USD 16,778.4 Million

- CAGR (2025-2030): 9.49%

- Asia Pacific: Largest market in 2024

Currently, the medical device industry is witnessing fierce competition where companies use offensive and defensive marketing strategies to sustain short- & long-term competition. Key strategies include new product launches, extensive R&D, competitive pricing, collaborative development, regional expansion, and mergers & acquisitions.

Moreover, intense competition requires rapid product development and market entry. Medical device testing services are crucial in expediting the regulatory approval process. Stringent product approval processes for medical devices induce medical device companies to outsource testing services to specialized firms, thereby accelerating market demand. Thus, service providers offering efficient and timely testing contribute to reducing time-to-market for medical devices and offering companies a competitive advantage.

In addition, favorable government support is expected to drive the market. To obtain approvals & clearances, companies need to comply with an elaborate list of standards provided by regulatory bodies and maintain complete documentation of the same. These requirements must be met as per the stipulated formats and specifications to ensure the products are permitted for sale. The regulatory authorities also perform routine post-market surveillance by levying a fee on the manufacturer. Receipt of any complaints about drawbacks of the product can entail its withdrawal from the market, thereby proving the stringent nature of the regulations governing these procedures.

Moreover, a large number of medical device companies have outsourced testing operations to minimize business risks, hasten product market entry, and reduce costs. This leads to a significant rise in expenditure levels. Therefore, medical device OEMs are rapidly switching to outsourcing an effective cost-cutting approach. Implantable Medical Devices (IMDs) are increasingly used to improve patients' medical outcomes. Designers of IMDs have to balance complexity, reliability, power consumption, and costs. Consequently, companies are shifting their focus to innovation rather than noncore activities, outsourcing the latter to launch efficient devices. All these factors are expected to boost the medical device testing services industry over the forecast period.

Further, increasing capital investment among small companies to establish in-house testing facilities requires substantial capital investment in equipment, skilled personnel, and compliance with regulatory standards. Outsourcing testing services allows SMEs to avoid these high upfront costs, making it a more cost-effective option. Moreover, outsourcing testing services can expedite the product development process for small medical device companies. Companies can reduce their time-to-market and gain a competitive edge by relying on external laboratories specializing in efficient and timely testing. Furthermore, the medical device industry must comply with stringent regulatory standards. Testing service providers are often well-versed in these regulations and have established protocols to ensure compliance. Small companies benefit from partnering with these providers to navigate complex regulatory landscapes.

Opportunity Analysis

The medical device testing services sector is expected to experience various opportunities due to the increasing complexity of medical technologies, the growth of personalized medicine, and expanding regulatory scrutiny. The rising adoption of digital health solutions, such as AI-driven diagnostics and software-as-a-medical-device (SaMD) is expected to drive demand for specialized software validation and cybersecurity testing. As home-use medical devices become more common, usability and human factors testing have emerged as critical areas of focus. In addition, emerging global market trends present new market growth opportunities as regulatory frameworks strengthen and local manufacturers grow their presence. Subsequently, the trend of outsourcing is expected to continue growing, supported by enhanced integrated service offerings, real-time compliance tracking, and rapid turnaround times.

Furthermore, the integration of AI and IoT into medical devices will increase the need for comprehensive lifecycle testing to ensure reliability, interoperability, and regulatory compliance. Therefore, growing demand for medical device testing to mitigate risks associated with in-house testing, offering flexibility in resource allocation, scalability, and access to a broader range of testing capabilities based on project requirements is further providing new growth opportunities for the market.

Technological Advancements

Outsourcing companies in the medical device testing industry are adopting advanced technologies to improve efficiency, accuracy, and regulatory compliance. Evolving medical device technologies, such AI and machine learning streamline risk assessment, failure analysis, and real-time data validation, while robotic process automation (RPA) ensures precise mechanical and endurance testing. Furthermore, ethical practices, including transparency, data privacy, and patient safety support to enhance credibility and trust among clients and stakeholders. In addition, cloud-based platforms enable real-time data sharing and regulatory compliance tracking for FDA, EU MDR, and ISO 13485. Digital twin technology allows virtual simulations, reducing reliance on physical prototypes, while IoT enhances predictive maintenance and real-time monitoring. Cybersecurity testing is also expanding with AI-driven threat detection. With 3D printing advancing material testing, outsourcing firms provide faster, cost-effective solutions, ensuring product safety, regulatory adherence, and accelerated market entry.

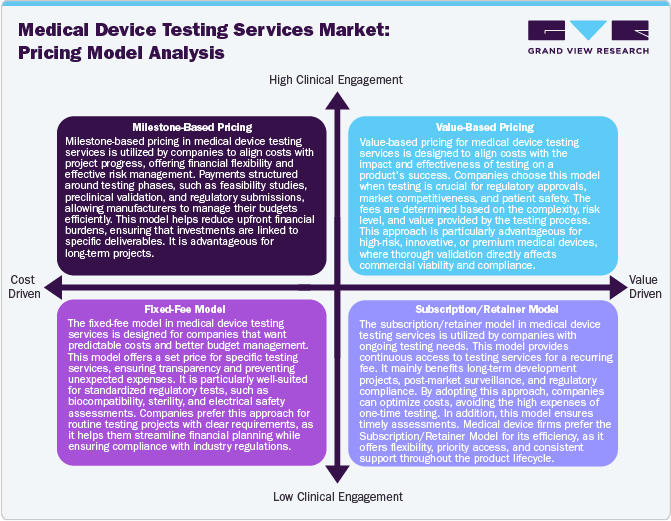

Pricing Model Analysis

The market utilizes various pricing strategies to maximize cost efficiency and profitability while complying with regulatory standards. Milestone-based pricing structures payments around project phases, ensuring financial flexibility by aligning costs with development progress. This approach is suitable for long-term testing projects where costs can be distributed over the period of time Furthermore, the fixed-free model offers a predetermined price for specific testing services. This model enhances budget predictability and is particularly useful for standard regulatory assessments. Value-based pricing is gaining increasing attention, where fees are linked to the impact of testing on product success, particularly for high-risk or innovative medical devices requiring extensive validation. In addition, the subscription/retainer model provides ongoing access to testing services for a recurring fee, benefiting companies with continuous testing needs, such as post-market surveillance and iterative product development. Moreover, hybrid approach combining these models is emerging, allowing flexibility in cost management while enhancing testing quality, regulatory compliance, and profitability for service providers.

Market Concentration & Characteristics

The market growth stage is medium, and growth is accelerating. The market is characterized by regulatory considerations, evolving technologies, materials innovation, and globalization & outsourcing of services.

ASCA's emphasis on conformity assessment encourages advancements in testing methodologies and technology adoption. Accredited labs are encouraged to continually improve and innovate, aligning with evolving regulatory expectations. Besides, innovations in testing technologies and methodologies, such as the adoption of AI, IoT, or robotics in testing processes, can significantly influence the medical device testing services industry.

Regulatory bodies, such as the U.S. FDA and EMA, continually upgrade the regulatory guidelines for safety, efficacy, & quality standards for medical devices. This growth in regulatory requirements compels medical device manufacturers to conduct more comprehensive and rigorous testing to meet these stringent standards. Thus, stringent approval norms necessitate specialized and extensive testing protocols.

The medical device testing services industry is highly competitive, characterized by numerous established and emerging players offering a wide array of testing services. Differentiation based on expertise, technology, regulatory compliance, and service quality is crucial for market positioning. Companies leveraging advanced types of medical device testing technologies and innovative methodologies gain a competitive edge. Investment in innovative equipment and the ability to offer specialized, high-value testing solutions strengthens market growth.

The medical device testing services industry is expanding due to rising regulatory requirements, technological advancements, and increasing complexity in device designs. Companies are outsourcing testing to specialized service providers to enhance compliance, accelerate market entry, and reduce costs. The market growth is driven by stringent quality standards, globalization of manufacturing, and demand for faster product approvals. Emerging markets and personalized medical devices further boost demand. Strategic partnerships and acquisitions among testing firms enhance capabilities, fostering competitive differentiation and global market penetration.

Changes in global healthcare trends, emerging markets, and shifts in research priorities are major factors impacting on the demand for medical device testing services. Besides, the growing presence of local market players along with competitive pricing, rapid technological advancements, growing demand for new & cost-effective medical devices, and high healthcare expenditure fuels the market growth.

Service Insights

On the basis of service segment, the market is classified into biocompatibility testing, chemistry testing, microbiology & sterility testing, and package validation. Biocompatibility tests held the largest share of 45.42% in 2024. The biocompatibility test plays a major role for medical devices to move medical devices successfully to market. The test is a critical step for medical device development where an assessment of biocompatibility helps medical device manufacturers ensure the device’s safety for patients & provides data that can be used to support regulatory compliance. In addition, stringent regulations, technological advancements, and a focus on personalized healthcare are expected to boost the growth of biocompatibility testing within the medical device testing services industry. Moreover, biocompatibility tests help to determine the potential toxicity of a material resulting from contact of devices or products with the body. Such tests are performed to ensure the safety of devices. In addition, the tests comply with the guidelines issued by various organizations such as FDA & ISO.

Besides, the chemistry test segment is expected to grow at a lucrative CAGR of 9.77%. Chemistry tests support the medical device industry throughout the value chain. These tests ensure that medical devices do not cause reactions when in contact with the human body. The tests check if any solutes and/or chemicals are present on the surface of medical devices, which may leach out into the surroundings when used with the intended liquids. Besides, the test is used for regulatory submissions while remaining flexible to deliver against rapid problem-solving, manufacturing quality control & internal medical device component R&D requirements. These tests support the review of the safety parameters of medical devices. Hence, the FDA is facilitating additional data analysis of polymer & colorant examinations to provide a more holistic view of the safety of these tests. This is expected to positively impact the segment growth over the forecast period.

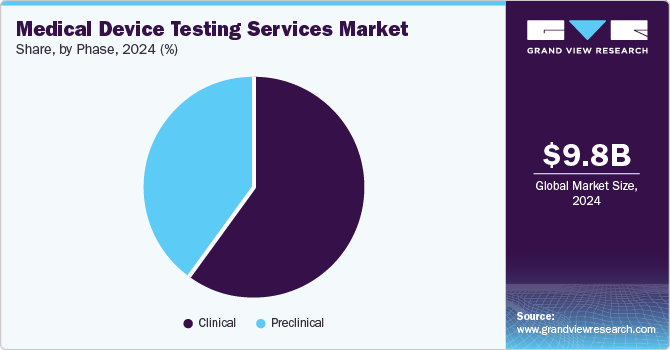

Phase Insights

On the basis of phase segment, the market is segregated into preclinical and clinical. The clinical segment accounted for the largest market share in 2024. The segment growth is due to a rise in product pipeline and continuous upgradation of regulatory standards. Growing emphasis on clinical evidence for new device approvals accelerates the demand for robust testing services during clinical trials. Moreover, the growing preference for market participants that offer advanced testing methodologies with affordable cost & reduced turnaround time for diverse clinical studies is expected to drive segment growth.

The preclinical market segment is expected to grow at the fastest CAGR over the forecast period. The preclinical is further segment into small animals, large animals, and others. Preclinical testing is crucial in the development & evaluation of medical devices before they are approved for human use. Leading CROs like Charles River Laboratories provide biocompatibility, safety testing, and pathology services during this stage. For devices and high-risk medical devices that lack appropriate clinical data, preclinical tests are conducted to demonstrate compliance with the requirements for CE marking. These tests determine the efficacy, safety, and performance of the devices, to mitigate potential risks & enhance patient outcomes. Moreover, among small animals, and large animals, the demand for small animal research is increasing due to the rise of domestic medical device manufacturers putting more effort into developing medical devices that can be used for such research. Besides, it helps address regulatory safety concerns and reduce risks associated with product validation, which further contributes to market growth.

Regional Insights

The North America Medical Device Testing Services market is projected to grow at the fastest CAGR over the forecast period. The market growth is due to continuous growth owing to the presence of established manufacturing hubs of highly reliable, complex, and high-end medical devices in the region. In addition, many Original Equipment Manufacturers (OEMs) have shifted their focus to electronics manufacturing service providers to efficiently handle the increasing volume of electronic components in current medical devices. This has led to the rise in demand for medical device testing activities for efficient healthcare in the region and is expected to be one of the major factors propelling the development of the market.

U.S. Medical Device Testing Services Market Trends

The Medical Device Testing Services market in the U.S. held the largest market in North America. This can be attributed to the presence of established companies offering medical device testing services for medical devices within the U.S. Moreover, medical device testing services enable medical device companies to focus on their core capabilities, share associated risks, and improve device delivery, which helps companies gain competitive advantages. In addition, the country has witnessed positive growth in the demand for medical devices due to innovations, product launches, and the acquisition of international medical device testing services to expand reach globally. For instance, in January 2025, NAMSA has announced its acquisition of WuXi AppTec's medical device testing operations in the U.S. This includes facilities located in Minnesota and Georgia. The acquisition will accelerate innovation in the MedTech sector and assist sponsors in delivering life-saving medical technologies across the globe.

Europe Medical Device Testing Services Market Trends

Europe Medical Device Testing Services market is driven by the presence of advanced technologies as well as well-established infrastructure. Currently the medical device testing services are witnessing rising demand due extensive knowledge of complexity in product design among market players that are seeking entry into the European market. In addition, small & mid-sized medical device companies have rising requirements for medical device testing services for the performance and safety of medical devices in the region. In addition, the market is expected to grow lucratively due to stringent regulatory policies.

The UK Medical Device Testing Services market is anticipated to grow significantly over the forecast period. The country's market growth is due to the presence of various medical device companies, growing R&D investments, presence of well-established healthcare infrastructure, high healthcare spending, and rapidly evolving demand for medical device testing for the development of new devices.

The Medical Device Testing Services market in Germany held a significant share in 2024. The country's growth is due to increasing demand for medical device testing outsourcing. In addition, various benefits associated with medical outsourcing are optimization of R&D activities for higher productivity & greater regulatory compliance, which significantly enable for easy penetration into the market.

Asia Pacific Medical Device Testing Services Market Trends

Asia Pacific accounted for the largest market share of 41.18% in 2024. The evolving medical device testing services are expected to increase the market demand in the region, owing to established healthcare infrastructure with government initiatives. Furthermore, the presence of a large & diverse patient pool and demand for affordable treatment options are supporting market growth. In addition, the presence of well-established medical device companies in the region and increasing number of collaborative partnerships & strategic alliances are creating growth opportunities in the market. Moreover, government initiatives such as tax exemption and revamping regulatory policies are fueling market growth in Asia Pacific.

The Medical Device Testing Services market in China is expected to grow over the forecast period. In recent years, China has been one of the biggest attractions for the medical device testing services market owing to rapid technological advancements, growing demand for new & cost-effective medical devices, & high healthcare expenditure. Other factors contributing to market growth are rising investments, growing medical devices industry, and high standards for medical device development in the country.

Japan Medical Device Testing Services market is witnessing significant growth over the forecast period. The market's growth is due to the growing medical devices industry, rapid technological advancements, increasing demand for outsourcing services, and rising healthcare expenditure. In addition, the expanding service portfolio for preventive care is boosting the requirement for medical device testing services market.

India Medical Device Testing Services market is witnessing considerable growth as the country is the preferred sites for medical device companies to outsource their medical device testing services to due to its diversified patient pool, lower costs of labor, improved healthcare infrastructure, and availability of large number of technical experts. Moreover, growing investments from overseas firms for R&D are expected to further support market growth over the forecast period.

Key Medical Device Testing Services Company Insights

Market players are undertaking various strategic initiatives, such as the launch of new product partnerships, collaborations, and mergers & acquisitions, to strengthen their service portfolio and provide a competitive advantage. For instance, in January 2025, STEMart announced the expansion of its medical device testing capabilities by introducing Balloon Catheter Testing Services. These new testing services are designed to help ensure the development of safe medical devices, meeting the industry's compliance requirements and assisting manufacturers in minimizing compliance risks.

Key Medical Device Testing Services Companies:

The following are the leading companies in the medical device testing services market. These companies collectively hold the largest market share and dictate industry trends.

- SGS SA

- Laboratory Corporation of America Holdings

- Nelson Laboratories, LLC

- TÜV SÜD

- Charles River Laboratories

- Element Minnetonka

- Eurofins Scientific

- Pace Analytical Services LLC

- Intertek Group Plc

- North America Science Associates Inc. (NAMSA) (WuXi AppTec)

Recent Developments

-

In January 2025, IMQ Group launched Elettra Tech Labs in India as a joint venture that provide testing & inspection services for medical devices and electrical and electronic products. Such service expansions strengthened company’s offerings in the significant market.

-

In March 2024, Stryker expanded its prototype and testing facility in India, representing a major step in enhancing its research and development footprint in the country. This advanced facility spans 55,600 square feet integrates cutting-edge infrastructure along with improved microbiology capabilities. This expansion broadened company’s operational capabilities in the market.

-

In June 2023, TÜV SÜD opened a new laboratory in Minnesota. It is ISO 17025 accredited for the biological & chemical testing of medical devices. It is a part of the company’s commitment to providing high-quality medical device services.

Medical Device Testing Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.66 billion

Revenue forecast in 2030

USD 16.78 billion

Growth rate

CAGR of 9.49% from 2025 to 2030

Historical Year

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, phase, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Netherlands; Belgium; Switzerland; Japan; China; India; Australia; South Korea; Malaysia; Indonesia; Singapore; Philippines; Thailand; Brazil; Argentina; Colombia; Chile; South Africa; Saudi Arabia; UAE; Kuwait; Israel; Egypt

Key companies profiled

SGS SA; Nelson Laboratories, LLC; Laboratory Corporation of America Holdings; TÜV SÜD; Charles River Laboratories; Eurofins Scientific; Element Minnetonka; Pace Analytical Services LLC; Intertek Group Plc; North America Science Associates Inc. (NAMSA) (WuXi AppTec)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Device Testing Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical device testing services market report based on service, phase and region:

-

Service Outlook (Revenue, USD Million; 2018 - 2030)

-

Biocompatibility Tests

-

Cardiovascular Device's Biocompatibility Tests

-

Orthopedic Device's Biocompatibility Tests

-

Dental Implant Devices' Biocompatibility Tests

-

Dermal Filler's Biocompatibility Tests

-

General Surgery Implantation Devices Biocompatibility Tests

-

Neurosurgical Implantation Devices Biocompatibility Tests

-

Ophthalmic Implantation Device's Biocompatibility Tests

-

Others

-

-

Chemistry Test

-

Chemical characterization (E&L)

-

Analytical method development and validation

-

Toxicological Risk Assessment and consulting

-

-

Microbiology & Sterility Test

-

Bioburden Determination

-

Pyrogen & Endotoxin Testing

-

Sterility Test & Validation

-

Antimicrobial Testing

-

Others

-

-

Package Validation

-

-

Phase Outlook (Revenue, USD Million; 2018 - 2030)

-

Preclinical

-

Large animal research

-

Biocompatibility Tests

-

Chemistry Test

-

Microbiology & Sterility Test

-

-

Small animal research

-

Biocompatibility Tests

-

Chemistry Test

-

Microbiology & Sterility Test

-

-

-

Clinical

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Netherlands

-

Belgium

-

Switzerland

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Malaysia

-

Indonesia

-

Singapore

-

Philippines

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Israel

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global medical device testing services market size was estimated at USD 9.76 billion in 2024 and is expected to reach USD 10.66 billion in 2025.

b. The global medical device testing services market is expected to grow at a compound annual growth rate of 9.49% from 2025 to 2030 to reach USD 16.78 billion by 2030.

b. Asia Pacific dominated the medical device testing services market with a share of 41.18% in 2024. This is attributable to stringent regulatory requirements, growing healthcare infrastructure, and increasing medical device production. Rising demand for cost-effective outsourcing, technological advancements, and strong government support further fuel regional expansion. Additionally, the region's growing aging population and increased adoption of advanced medical technologies boost the need for thorough testing services.

b. Some key players operating in the medical device testing services market include SGS SA, Nelson Laboratories, LLC, Laboratory Corporation of America Holdings, TÜV SÜD, Charles River Laboratories, Eurofins Scientific, Element Minnetonka, Pace Analytical Services LLC, Intertek Group Plc, North America Science Associates Inc. (NAMSA).

b. Key factors that are driving the market growth include a by stringent regulatory requirements, increasing device complexity, and the need for faster product approvals. Rising outsourcing trends, technological advancements, and globalization of manufacturing further accelerating market demand. Growth in personalized and connected medical devices, along with expanding healthcare infrastructure in emerging markets, also contributes to the industry's expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.