- Home

- »

- Medical Devices

- »

-

Medical Textiles Market Size, Share & Growth Report, 2030GVR Report cover

![Medical Textiles Market Size, Share & Trends Report]()

Medical Textiles Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Woven, Knitted), By Application (Implantable Goods, Non-implantable Goods), By Region, And Segment Forecasts

- Report ID: 978-1-68038-830-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Textiles Market Summary

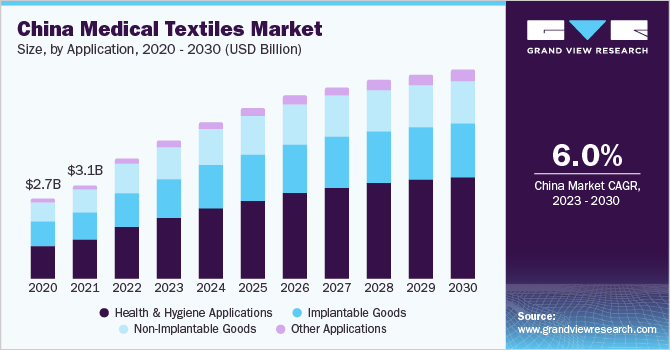

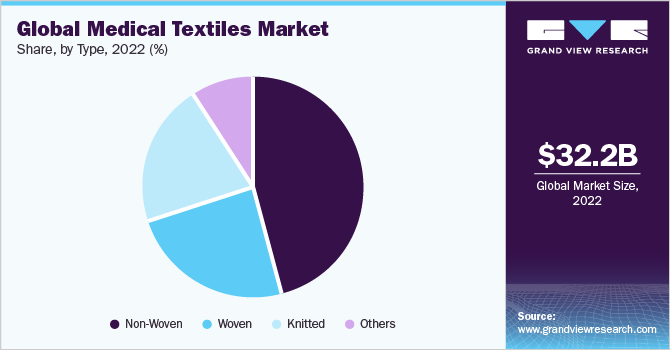

The global medical textiles market size was estimated at USD 32.20 billion in 2022 and is projected to reach USD 48.04 billion by 2030, growing at a CAGR of 4.3% from 2023 to 2030. The rising awareness of improved healthcare services and effective medical treatments drives the demand for medical-grade textile products.

Key Market Trends & Insights

- Asia Pacific dominated the medical textiles market with a revenue share of 35.46% in 2022.

- By application, the healthcare and hygiene segment led the global market, with a revenue share of 43.15% in 2022.

- By type, the non-woven segment led the market, with a global revenue share of 45.91% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 32.20 Billion

- 2030 Projected Market Size: USD 48.04 Billion

- CAGR (2023-2030): 4.3%

- Asia Pacific: Largest market in 2022

The market growth is further propelled by the increased utilization of medical textile-based implantable goods, including artificial tendons, body enhancements, and ligaments. The growing elderly population is also expected to contribute to the market expansion globally, as it leads to an increased number of knee and joint replacement surgeries, thereby driving the demand for implantable goods and fueling the market growth.

The COVID-19 pandemic had a significant impact on several countries like the U.S. Therefore, organizations have made substantial investments to expand healthcare services, including adding hospital beds and supporting domestic production of personal protective equipment (PPE). For instance, Honeywell Corporation, in 2021, expanded its manufacturing operations in Smithfield, Rhode Island, to produce N95 masks for the Strategic National Stockpile. This investment addressed the need for PPE during the COVID-19 pandemic.

Furthermore, textile manufacturers in the medical industry, such as ATEX Technologies Inc. and Bally Ribbon Mills, have implemented integration across the value chain to streamline operations and reduce costs. These companies produce essential raw materials, such as fiber and yarns, for medical textiles. Industry players are driving technological advancements and elevating the quality standards for medical-grade textiles. Developing new products in the market involves utilizing a wide range of materials, including natural fibers, biodegradable polymers, and non-biodegradable synthetic polymers.

Application Insights

In terms of applications, the healthcare and hygiene segment dominated the global industry capturing a significant share of 43.15% of the overall revenue in 2022. This segment encompasses diverse products like face masks, medical bags, gowns, shoe covers, wipes, bedsheets, maternity pads, incontinence pads, drapes, caps, and sanitary napkins. The increasing demand for healthcare and hygiene items can be attributed to government initiatives, growing hygiene awareness, and advancements in textile technology.

Furthermore, in response to the COVID-19 pandemic, countries, such as the U.S., Germany, the UK, India, China, Brazil, and UAE have expanded their healthcare infrastructure and augmented the number of beds per 100,000 population. These initiatives have also generated a surge in demand for general hygiene products and protective clothing, thereby supporting the growth of the market for medical textiles.

Type Insights

The non-woven segment dominated the market and held a substantial global revenue share of 45.91% in 2022. It is anticipated to maintain strong growth throughout the forecast period, driven by its exceptional properties, such as high air permeability, superior strength-to-weight ratio, high bacterial resistance, and excellent water vapor transmission capacity. Furthermore, the demand for non-woven medical textiles has experienced a significant surge due to the global impact of the COVID-19 pandemic. The need for personal protective equipment (PPE), including face masks and gowns, escalated in 2020 and to some extent in 2021 as measures were undertaken to control the transmission of the virus.

Governments in various countries had implemented strict regulations mandating the use of face masks in public settings to ensure public safety. The knitted medical textiles product segment is anticipated to grow at a CAGR of 4.1%, driven by the increasing demand for artificial blood vessels, hernia patches, cell scaffolds, and tissue re-engineering applications. Knitted fabrics offer enhanced porosity and structural efficiency compared to woven fabrics. Knitting technology has gained prominence because of ongoing research efforts to manufacture advanced medical textiles for tissue engineering applications, particularly in the production of cell scaffolds. Furthermore, according to a whitepaper published by the China Postdoctoral Science Foundation, knitting technology is renowned for its exceptional forming capabilities and the superior performance of knitted mesh fabrics.

Regional Insights

Asia Pacific dominated the market with a revenue share of 35.46% in 2022. It is anticipated to maintain its dominance with the highest compound annual growth rate (CAGR) of 5.7% during the forecast period. The regional growth can be attributed to new non-woven fabric manufacturing facilities in China, Japan, India, Australia, South Korea, and Thailand. Medical textile companies in the region have expanded their production lines and capacities to meet the increasing demand for raw materials used in producing PPE, such as face masks and surgical gowns. Governments and key players in countries like India, Japan, and South Korea offer technological and financial support to accelerate production, positively impacting market growth.

A notable initiative is a special zone dedicated to SITRA's Meditex at Techtextil India, a renowned expo on technical textiles. SITRA, the Centre of Excellence for Medical Textiles, has been organizing the global Medical Textile Expo cum Conference, MEDITEX, since 2014. This exclusive fair provides a global platform for business opportunities in medical textiles, attracting significant industry participation. The upcoming edition of Techtextil India, organized by Messe Frankfurt India, is scheduled for September 12-14, 2023. The Europe medical textiles industry is poised for significant growth due to increased healthcare expenditure in countries, such as Germany, the UK, Spain, France, Italy, and Russia.

It has resulted in expandinghealthcare facilities, including adding hospital beds for COVID-19 patients, driving the demand for beddings, protective equipment, and cleaning pads. Furthermore, the rising number of cosmetic surgeries in European nations like Italy, Germany, the UK, Russia, and Spain presents new growth opportunities for the market. In addition, the growing elderly population in several European countries is expected to drive the demand for knee replacement surgeries, artificial ligament implants, and extracorporeal devices, further contributing to market growth.

Key Companies & Market Share Insights

Notable players in the industry are implementing various strategies to maintain a competitive edge. These strategies include launching new product lines, expanding production capacities through new units, collaborating with PPE manufacturers and healthcare institutions, and acquiring small-level players for product and geographical expansion. Niche players and visionaries in the market concentrate on local markets and expand their businesses through collaborations with larger players. These companies also prioritize the development of innovative products to establish a unique market position. Some of the key players in the global medical textiles market are:

-

Atex Technologies, Inc.

-

Life-Threads

-

Careismatic Brands

-

Bally Ribbon Mills

-

Freudenberg & Co. KG

-

Trelleborg AB

-

Indorama Corporation

-

Herculite

-

PurThread Technologies, Inc.

-

Fitesa

-

Schouw & Co.

-

Kimberly-Clark Corp.

Medical Textiles Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 35.87 billion

Revenue forecast in 2030

USD 48.04 billion

Growth rate

CAGR of 4.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Atex Technologies, Inc.; Life-Threads; Careismatic Brands; Bally Ribbon Mills; Freudenberg & Co. KG; Trelleborg AB; Indorama Corp.; Herculite; PurThread Technologies, Inc.; Fitesa; Schouw & Co.; Kimberly-Clark Corp.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Textiles Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the medical textiles market report based on application, type, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Implantable Goods

-

Non-Implantable Goods

-

Health and Hygiene Applications

-

Other Applications

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Woven

-

Knitted

-

Non-Woven

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the medical textiles market include Atex Technologies, Inc., Life-Threads, Careismatic Brands, Bally Ribbon Mills, Freudenberg & Co. KG, Trelleborg AB, Indorama Corporation, Herculite, PurThread Technologies, Inc., Fitesa, Schouw & Co., Kimberly-Clark Corporation.

b. The key factors that are driving the medical textiles market include rising awareness for better healthcare practices, coupled with ongoing technological advancements in medical science and technical textiles.

b. The global medical textiles market size was estimated at USD 32.20 billion in 2022 and is expected to reach USD 35.87 billion in 2023.

b. The global medical textiles market is expected to grow at a compound annual growth rate of 4.3% from 2023 to 2030 to reach USD 48.04 billion by 2030.

b. Healthcare & hygiene products application segment dominated the medical textiles market with a share of 43.15% in 2022. The increasing demand for healthcare and hygiene items can be attributed to government initiatives, growing hygiene awareness, and advancements in textile technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.