- Home

- »

- Advanced Interior Materials

- »

-

Personal Protective Equipment Market, Industry Report, 2033GVR Report cover

![Personal Protective Equipment Market Size, Share & Trends Report]()

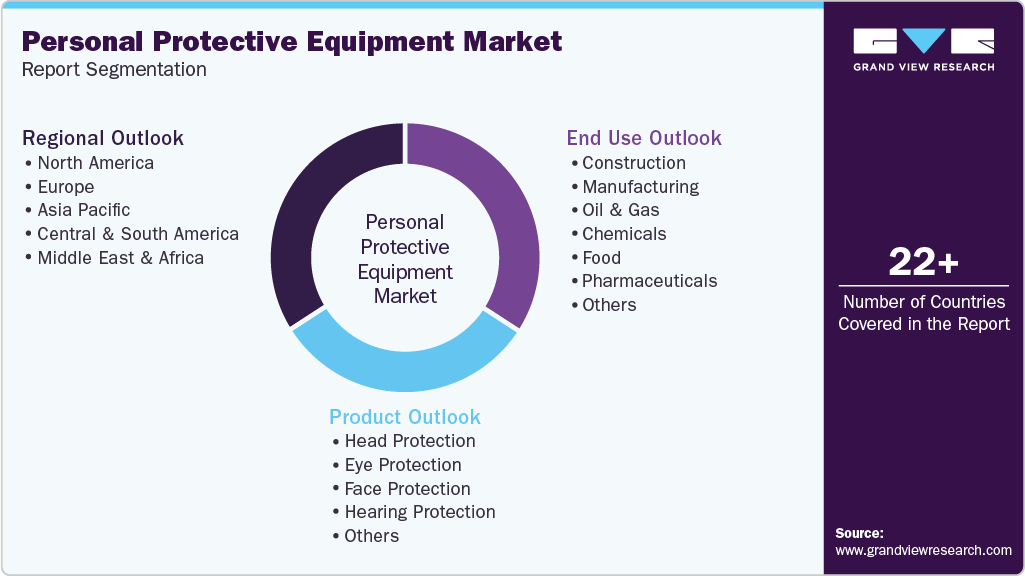

Personal Protective Equipment Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Head Protection, Eye Protection, Face Protection), By End Use (Construction, Manufacturing, Chemicals), By Region, And Segment Forecasts

- Report ID: 978-1-68038-426-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Personal Protective Equipment Market Summary

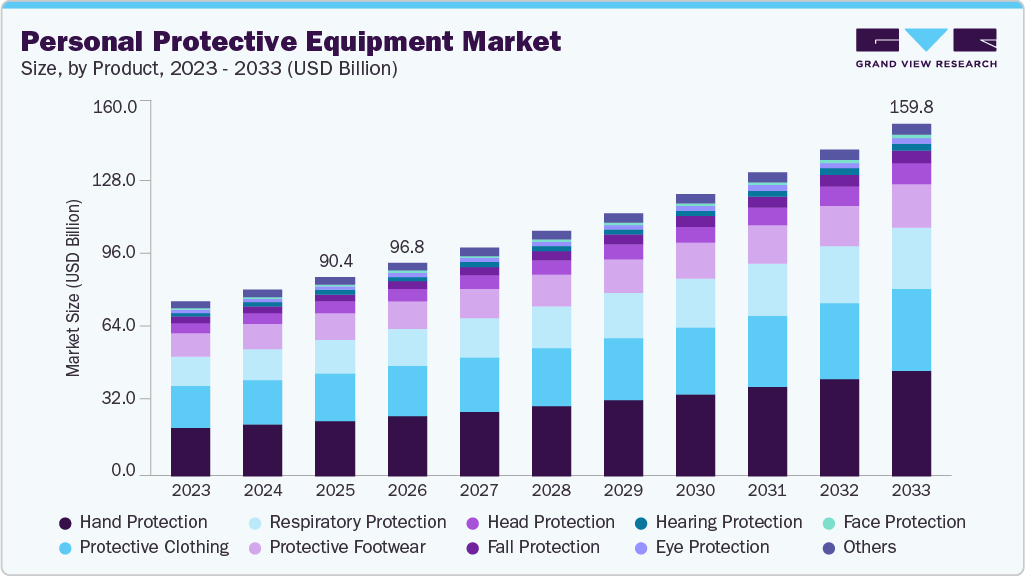

The global personal protective equipment market size was estimated at USD 90.42 billion in 2025 and is projected to reach USD 159.76 billion by 2033, at a CAGR of 7.4% from 2026 to 2033. Rising employee health and safety awareness, combined with high industrial deaths in emerging economies due to a shortage of protective equipment, is likely to fuel market expansion over the forecast period.

Key Market Trends & Insights

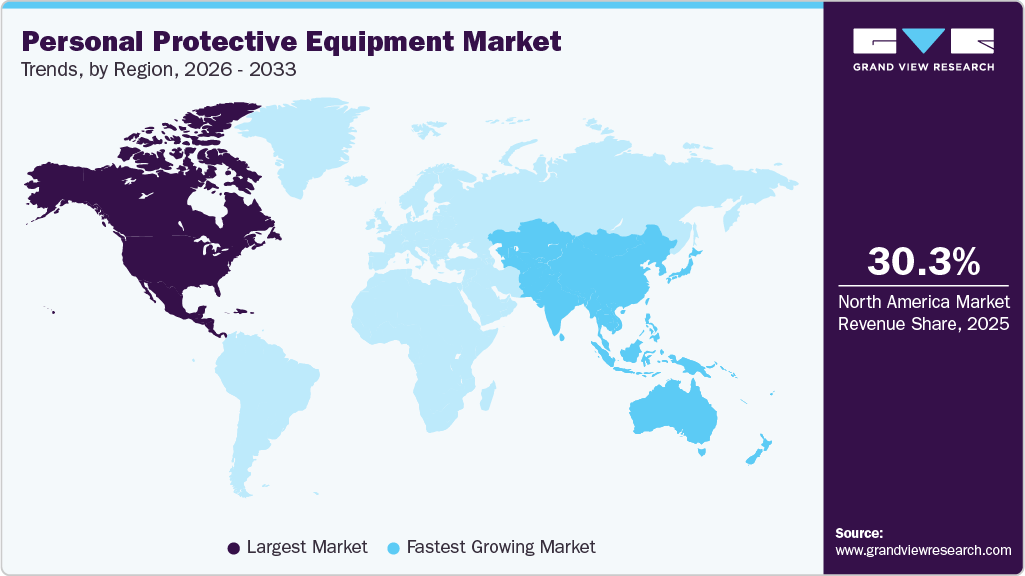

- North America dominated the personal protective equipment industry with the largest revenue share of 30.3% in 2025.

- The personal protective equipment industry in India is expected to grow at a rapid CAGR of 10.4% from 2026 to 2033.

- By product, the hand protection segment is expected to grow at a considerable CAGR of 8.3% from 2026 to 2033 in terms of revenue.

- By end use, the healthcare segment is projected to expand at a significant CAGR of 10.4% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 90.42 Billion

- 2033 Projected Market Size: USD 159.76 Billion

- CAGR (2026-2033): 7.4%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Moreover, technological innovations in smart PPE and surging customer demand for protective gear is a mix of attractive design and safety, which are also leading the growth of the market for personal protective equipment.Within the manufacturing sector, personal protective equipment functions as a necessary safeguard against a wide array of occupational hazards. Ranging from operating heavy machinery to handling chemicals, personal protective equipment, including items such as helmets, safety glasses, gloves, and protective clothing, acts as a crucial line of defense, shielding workers from physical injuries, chemical exposure, and respiratory dangers.

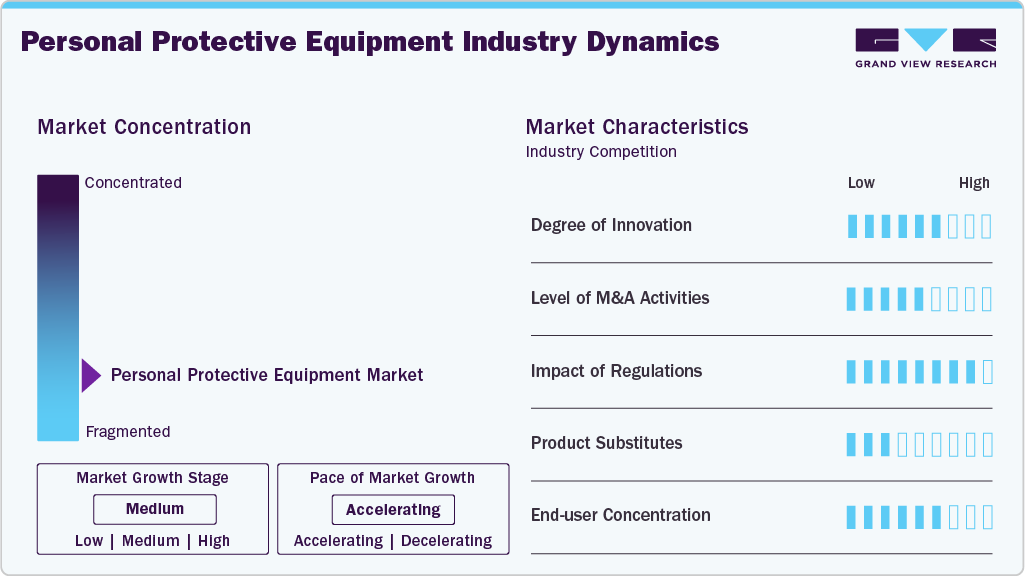

Market Concentration & Characteristics

The global Personal Protective Equipment (PPE) industry is fragmented, with large global brands competing alongside many regional suppliers. Major companies offer diverse product portfolios across respiratory, protective clothing, gloves, eyewear, and footwear to serve key industries such as healthcare, construction, manufacturing, oil & gas, and mining. Leading players focus on broad distribution networks and product quality to maintain their market presence.

Market innovation is primarily driven by increasing awareness regarding workplace safety, evolving occupational health regulations, and heightened demand from the healthcare sector, especially in the wake of infectious disease outbreaks. As a result, manufacturers are continually investing in advanced materials, ergonomic designs, and enhanced protection capabilities to improve comfort and usability while ensuring compliance with stringent global safety standards.

Regulatory bodies such as OSHA (Occupational Safety and Health Administration), NIOSH (National Institute for Occupational Safety and Health), and the European Agency for Safety and Health at Work play a significant role in shaping the PPE market. Strict regulations and certification requirements regarding product quality, performance, and usage in different environments are pivotal in maintaining industry standards. Compliance with these standards is critical for manufacturers aiming to access and expand in major markets worldwide.

The market faces competition from substitute solutions such as automation or engineering controls, which eliminate or reduce the need for PPE by redesigning processes. However, with the persistent demand for protection against emerging risks ranging from industrial accidents to biological hazards, the necessity for reliable PPE solutions remains strong. Introducing smart PPE with integrated technologies such as sensors for real-time health and safety monitoring presents further opportunities for market growth and differentiation.

Drivers, Opportunities & Restraints

Rising construction fatalities, driven particularly by falls from heights, which account for over one-third of all construction-related deaths, are a persistent safety challenge in both the U.S. and the UK. Despite ongoing industry precautions, these incidents have shown an upward trend in recent years, keeping the fatality rate much higher than the average across all industries. The prevalence of such hazards, especially in an expanding construction sector, is fueling robust demand for advanced personal protective equipment and fall protection solutions. Growing regulatory scrutiny and the heightened awareness around worker safety are expected to further drive PPE adoption in the construction industry over the coming years.

Expanding healthcare initiatives, rising government expenditures, and rapid demographic shifts in emerging economies are driving robust demand for personal protective equipment (PPE). Accelerated urbanization, an aging population, and the growing prevalence of chronic and infectious diseases are increasing healthcare service needs and, consequently, PPE requirements. Improved access to medical care and a greater focus on healthcare worker and patient safety further fuel this demand. These trends collectively present significant growth opportunities for PPE suppliers and manufacturers in the global healthcare market.

The increasing adoption of automation, robotics, and artificial intelligence in industries such as construction, manufacturing, and oil & gas is expected to restrain the growth of the personal protective equipment industry. As industrial processes become more automated and robots assume hazardous tasks, the need for human-operated protective gear diminishes. Advanced automation systems now include integrated safety features, reducing reliance on traditional PPE. Consequently, the ongoing shift toward digital manufacturing and Industry 4.0 is anticipated to curtail demand for PPE in industrial settings over the coming years.

Product Insights

The head protection segment is expected to grow at a considerable CAGR of 7.9% from 2026 to 2033 in terms of revenue. Based on product, hand protection was the dominant segment, accounting for over 28.0% of the revenue share in 2025. The market is expected to grow owing to the increasing product demand in various end use industries, such as food, pharmaceuticals, manufacturing, construction, and chemicals, to prevent hand injuries on the shop floor. Rising instances of hand injuries, including severe abrasions, punctures, chemical & thermal burns, and cuts at the workplace, are expected to fuel product demand in the near future.

The head protection segment is driven by the growing construction activities in regions like Africa and Southeast Asia, where rising hazards such as falling objects increase the need for protective headgear. Hard hats are critical for reducing head injuries in industries including construction, mining, oil & gas, and manufacturing. North America represents a mature market with strong demand for innovative, task-specific head protection products, where manufacturers focus on customization and face intense competition. These factors collectively support the steady growth of the head protection market over the forecast period.

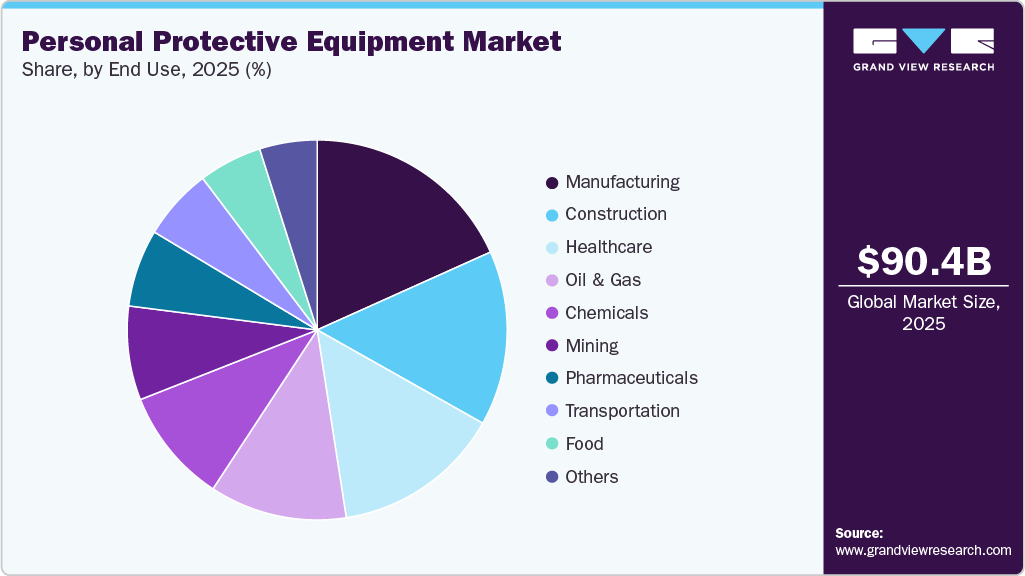

End Use Insights

The healthcare segment is expected to grow at a considerable CAGR of 10.4% from 2026 to 2033 in terms of revenue. Based on end use, manufacturing was the dominant segment, accounting for a revenue share of 18.3% in 2025. The growth of this segment can be attributed to the rising demand for head protection, fall protection, eye protection, and hearing protection equipment in the manufacturing industry to ensure the safety of employees. The manufacturing industry typically invests in a range of personal protective equipment based on specific hazards encountered by workers in production facilities and the requirement for ensuring their safety.

The healthcare segment’s growth in personal protective equipment (PPE) is driven by rising demand for protective clothing, respiratory, and hand protection to safeguard workers from infections. Increasing public healthcare expenditure in countries like India and the U.S., along with government investments in healthcare infrastructure and infection control, are boosting PPE procurement. These efforts enhance healthcare facilities' capacity to protect staff and patients, fueling sustained demand for PPE globally. Such trends highlight the ongoing importance of PPE in maintaining safety within healthcare environments.

Regional Insights

The North America personal protective equipment industry led the global market with a revenue share of 30.3% in 2025. The regional market is driven by significant growth in the oil & gas, chemical processing, and manufacturing sectors. A defining factor of the North American PPE landscape is the robust regulatory environment, spearheaded by agencies like the Occupational Safety and Health Administration (OSHA) in the U.S. and Canadian Centre for Occupational Health and Safety (CCOHS). These agencies have set comprehensive safety protocols that mandate the use of appropriate PPE in hazardous work environments, contributing significantly to sustained market growth.

U.S. Personal Protective Equipment Market Trends

The personal protective equipment industry in the U.S. is expected to grow at a CAGR of 7.9% over the forecast period, driven by increased oil and natural gas production fueled by technological advances in drilling and completion. Workers in this sector face significant risks such as chemical exposure, slips, and hand injuries, highlighting the need for durable PPE like nitrile-based reusable gloves that provide chemical resistance and grip.

Europe Personal Protective Equipment Market Trends

The European PPE industry is characterized by its strong regulatory environment, high worker safety standards, and growing emphasis on sustainable and technologically advanced protective solutions. The region is home to some of the world’s most advanced industrial and manufacturing sectors, including automotive, chemicals, construction, and pharmaceuticals, all of which contribute significantly to the demand for personal protective equipment.

Germany’s personal protective equipment industry is projected to grow at a CAGR of 6.8% over the forecast period. Germany represents one of the largest and most advanced markets for personal protective equipment (PPE) in Europe, driven by its strong industrial base and rigorous workplace safety regulations. The country’s extensive manufacturing, automotive, chemical, and construction sectors are key consumers of PPE, supported by strict enforcement from organizations like the German Social Accident Insurance (DGUV).

The personal protective equipment industry in France is expected to grow at a significant CAGR of 6.9% from 2026 to 2033. France is a key player in the European personal protective equipment (PPE) market, supported by a strong regulatory framework and a well-developed industrial sector. The country's construction, chemical, healthcare, and transportation industries are major drivers of PPE demand.

Asia Pacific Personal Protective Equipment Market Trends

The Asia Pacific personal protective equipment industry is anticipated to register the fastest CAGR over the forecast period. The rapid growth of the construction industry in Asia Pacific, driven by rising population needs and substantial investments in infrastructure across countries like China and India, is fueling demand for personal protective equipment (PPE). The region's cost-effective labor and strategic global supply chain position further support expansion across multiple sectors, including pharmaceuticals, healthcare, automotive, mining, and oil & gas. Strengthened legal and policy frameworks, such as stricter workplace safety inspections and mandatory PPE use, especially fall protection, are driving increased adoption of PPE. These factors collectively are expected to sustain strong PPE market growth in the Asia Pacific over the forecast period.

India’s personal protective equipment industry is the fastest-growing market in the region with a projected CAGR of 10.4% over the forecast period. India’s strong economic growth and infrastructure expansion are driving increased demand for PPE in the construction and manufacturing sectors. Government initiatives like “Make in India” and stricter safety regulations bolster PPE adoption across industries, including automotive and electronics. Rising workplace hazards and growing accident-related costs further emphasize the need for effective worker protection. Together, these factors are expected to sustain robust PPE market growth in India over the forecast period.

The Thailand personal protective equipment industry is estimated to expand at a CAGR of 9.8% over the forecast period. Rising awareness about worker safety, a strong focus on reducing occupational hazards, and steady manufacturing sector growth are fueling the demand for personal protective equipment (PPE) in Thailand. The chemical industry shows high PPE demand due to the widespread use of footwear, eyewear, and respirators during chemical handling and manufacturing processes

Middle East & Africa Personal Protective Equipment Market Trends

The Middle East & Africa personal protective equipment industry is anticipated to grow steadily over the forecast period. The growing oil & gas industry and large-scale infrastructure investments across the Middle East & Africa are driving strong demand for personal protective equipment (PPE) in sectors such as construction, manufacturing, healthcare, and fire services. Stringent occupational health and safety regulations, rising awareness of workplace hazards, and expanding blue-collar workforces further boost PPE adoption across the region. Significant projects including a USD 800 billion LNG expansion in Africa and nearly 700 healthcare developments in the UAE are key growth drivers. Together, these factors are expected to sustain robust PPE market growth in the Middle East & Africa over the forecast.

The personal protective equipment (PPE) industry in the UAE is expected to grow at a CAGR of 7.5% over the forecast period, driven by a surge in construction and industrial investments aimed at economic self-sufficiency, including mega infrastructure projects like Masa Residence and new airport facilities in Abu Dhabi. Although health and safety oversight lacks a centralized body and is primarily enforced by the Ministry of Labor under a two-tier legal framework, regulations related to PPE and worker safety are incorporated within labor laws.

Central & South America Personal Protective Equipment Market Trends

The personal protective equipment (PPE) industry in Central and South America faces challenges from declining commodity prices and economic uncertainties, especially in Brazil, which dampen growth in key industries like construction and delay infrastructure projects. However, ongoing development of luxury real estate and tourism-related construction may partially offset this slowdown, supporting PPE demand. Meanwhile, increased investments and expansion in the oil & gas sector, such as contracts to boost Venezuelan refining capacity, are expected to drive PPE requirements.

Brazil's personal protective equipment (PPE) industry is projected to grow at a CAGR of 8.4% over the forecast period, supported by expansion in manufacturing, electric vehicle (EV) battery production, and large-scale infrastructure investments amounting to USD 76 billion. Strong labor safety regulations requiring employers to ensure worker protection, especially for tasks at heights, further support PPE demand. Additionally, growth in the private healthcare sector and rising health spending are increasing requirements for medical protective gear. The nation's booming oil & gas industry, with record increases in crude oil and natural gas production, also contributes to heightened PPE needs across industrial segments.

Key Personal Protective Equipment Company Insights

Some of the key players operating in the market include 3M and Lakeland Inc.

-

3M is a global company with a vast distribution network spanning over 200 countries and operates through four main business segments including safety & industrial, healthcare, consumer, and transportation & electronics. Its subsidiary, PELTOR, specializes in personal protection products for industries like construction and healthcare. With headquarters and research labs in Minnesota, U.S. and a substantial number of manufacturing facilities across several U.S. states, 3M maintains strong domestic production capacity supporting its global operations.

-

Lakeland Inc. is a company engaged in the production of protective clothing and accessories, serving industries such as biotechnology, chemical manufacturing, construction, healthcare, and pharmaceuticals. Its well-known brands include ChemMax, Arc X Rainwear, Lakeland FR, and SafeGard, offering products like disposable wear, flame-resistant gear, and arc flash clothing. The company has a strong presence across North America, Europe, Asia Pacific, and the Middle East.

Key Personal Protective Equipment Companies:

The following are the leading companies in the personal protective equipment market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Lakeland industries, inc.

- DuPont

- PIP Global Safety

- Alpha Pro Tech Limited

- Ansell Ltd.

- Avon Protection plc

- Mine Safety Appliances (MSA) Company

- Mallcom (India) Limited

- Lindstrom Group

- Delta Plus Group

- Radians, Inc.

- FallTech

- COFRA S.r.l.

- Polison Corp.

Recent Developments

-

In May 2025, PIP Global Safety completed its acquisition of Honeywell’s PPE division, adding key brands like UVEX and North. This move boosts PIP’s global presence and safety product range. The acquisition strengthens its position as a top PPE provider worldwide.

-

In March 2024, FallTech launched the FT-Lineman Pro Body Belt. The latest utility belt breaks away from the conventional design and offers unmatched comfort, versatility, and lasting support. This new launch is likely to help the company strengthen its position in the personal protective equipment industry.

Personal Protective Equipment Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 96.81 billion

Revenue forecast in 2033

USD 159.76 billion

Growth rate

CAGR of 7.4% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region.

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Scandinavia; Russia; Spain; China; Japan; India; Australia; South Korea; Indonesia; Thailand; Malaysia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

3M; Lakeland Industries, Inc.; DuPont; PIP Global Safety; Alpha Pro Tech Limited; Ansell Ltd.; Avon Protection plc; Mine Safety Appliances (MSA) Company; Mallcom (India) Limited; Lindstrom Group; Delta Plus Group; Radians, Inc.; FallTech; COFRA S.r.l.; Polison Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Personal Protective Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global personal protective equipment market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Head Protection

-

Hard Hats

-

Bump Caps

-

-

Eye Protection

-

Safety Glasses

-

Goggles

-

-

Face Protection

-

Full Face Shields

-

Half Face Shields

-

-

Hearing Protection

-

Earmuffs

-

Earplugs

-

-

Protective Clothing

-

Heat & flame protection

-

Chemical defending

-

Clean room clothing

-

Mechanical protective clothing

-

Limited general use

-

Others

-

-

Respiratory Protection

-

Air-purifying respirator

-

Supplied air respirators

-

-

Protective Footwear

-

Leather

-

Rubber

-

PVC

-

Polyurethane

-

Others

-

-

Fall Protection

-

Soft Goods

-

Hard Goods

-

Others

-

-

Hand Protection

-

Disposable by Type

-

General purpose

-

Chemical handling

-

Sterile gloves

-

Surgical

-

Others

-

-

Disposable by Material

-

Natural Rubber

-

Nitrile

-

Vinyl

-

Neoprene

-

Polyethylene

-

Others

-

-

Durable

-

Mechanical gloves

-

Chemical handling

-

Thermal/flame retardant

-

Others

-

-

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Construction

-

Manufacturing

-

Oil & Gas

-

Chemicals

-

Food

-

Pharmaceuticals

-

Healthcare

-

Transportation

-

Mining

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

Russia

-

Scandinavia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

Malaysia

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global personal protective equipment market size was estimated at USD 90.42 billion in 2025 and is expected to be USD 96.81 billion in 2026.

b. The global personal protective equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.4% from 2026 to 2033 to reach USD 159.76 billion by 2033.

b. The North America personal protective equipment market dominated the market in 2025, accounting for 30.3% share driven by expanding oil & gas, chemical, and manufacturing sectors, alongside major investments in electric vehicle and infrastructure projects. Increasing industrial activity and the resulting need for worker safety are expected to sustain robust PPE demand across the region over the forecast period.

b. Some of the key players operating in the global personal protective equipment market include 3M; Lakeland Industries, Inc.; DuPont; PIP Global Safety; Alpha Pro Tech Limited; Ansell Ltd.; Avon Protection plc; Mine Safety Appliances (MSA) Company; Mallcom (India) Limited; Lindstrom Group; Delta Plus Group; Radians, Inc.; FallTech; COFRA S.r.l.; Polison Corp.

b. Rising workplace safety regulations, growing awareness of occupational hazards, and expanding industrial activities are the primary drivers of the global personal protective equipment (PPE) market. Additionally, increased investments in infrastructure, healthcare, and manufacturing sectors especially in emerging economies continue to fuel PPE demand worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.