- Home

- »

- Healthcare IT

- »

-

Menstrual Health Apps Market Size & Trends Report, 2030GVR Report cover

![Menstrual Health Apps Market Size, Share & Trends Report]()

Menstrual Health Apps Market Size, Share & Trends Analysis Report By Application (Period Cycle Tracking, Fertility & Ovulation Management), By Platform (Android, iOS), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-084-2

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Menstrual Health Apps Market Size & Trends

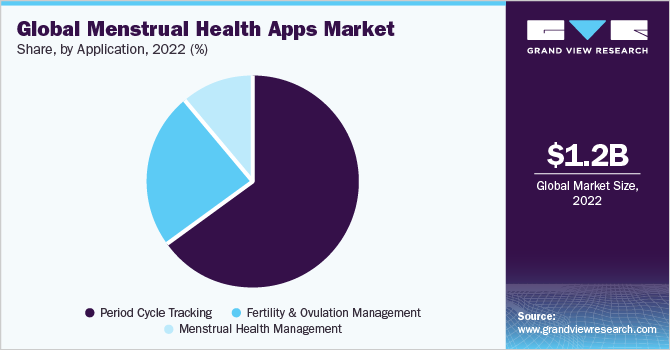

The global menstrual health apps market size was valued at USD 1.2 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 19.9% from 2023 to 2030. One of the key drivers is the rising awareness about health among women. In addition, the increasing digital literacy, widespread use of smartphones, higher disposable income, improved internet connectivity, and the emergence of new market players are contributing to the market expansion. According to the International Telecommunication Union (ITU), approximately 5.3 billion people, which accounts for 66% of the world's population, were estimated to be using the nternet in 2022. Moreover, during the COVID-19 pandemic, the number of internet users increased from 4.1 billion in 2019 to 4.9 billion in 2021.

However, approximately 2.9 billion people, with 96% residing in developing countries, still need access to the internet. The significant growth in smartphone usage, along with increased internet access, is expected to contribute to the expansion of the market. Furthermore, the introduction of new menstrual apps and strategic initiatives by major players will support the market growth. For instance, in 2020, Essar Foundation launched Sahaj app. This app, available on Android devices, aims to raise awareness about menstrual hygiene. It provides women with a comprehensive solution to menstruate with dignity.

In addition, it encourages adolescent girls to prioritize their menstrual health by offering hygienic products at subsidized prices. Various efforts by government agencies, including spreading awareness about women's health, implementing favorable policies, supporting startups, promoting advancements in mobile technologies, and improving network connectivity, will also boost the market growth. UNICEF has developed the Oky app, which is designed to provide information about periods to young girls. The app also features an individualized period cycle tracker. Initially launched in Mongolia and Indonesia, Oky is now available in Mexico and India, with plans for further expansion to additional countries in 2023.

The COVID-19 pandemic had a positive impact on the market, with menstrual health apps experiencing a surge in adoption and an increase in user numbers. Women globally started using femtech applications to support their well-being and maintain a healthy lifestyle. A study published by the NCBI in 2021 examined the COVID-19 impact on the menstrual cycle and the use of mobile apps by women during the pandemic. The results revealed that approximately 77.9% of respondents were using apps related to menstrual health during this period.

In May 2022, a group of Democrats requested Apple and Google to eliminate apps that could potentially track women expressing interest in obtaining an abortion. Following the overturning of the Roe v. Wade decision, women in the United States have become concerned about their privacy and the possibility of their personal data stored in period tracking and fertility tracking apps being utilized to criminalize those seeking an abortion. As a result, many women were uninstalling these apps to remove any digital traces, which is anticipated to hinder market growth.

Application Insights

On the basis of applications, the industry has been further segmented into fertility & ovulation management, period cycle tracking, and menstrual health management. The period cycle tracking segment dominated the market in 2022 and accounted for the maximum share of 64.5% of the overall revenue. This can be attributed to the new product launches and increasing awareness about menstrual hygiene among women. For instance, Sirona, a feminine hygiene brand, in June 2022, launched India’s first-period tracker on WhatsApp.

The fertility & ovulation management segment is anticipated to gain significant industry share in the coming years. These apps cater to women who want to track their fertility and ovulation. Users input their biological markers, which are then utilized by the apps to predict ovulation. These apps are marketed as fertility awareness-based methods, providing women with valuable information about their reproductive cycles.

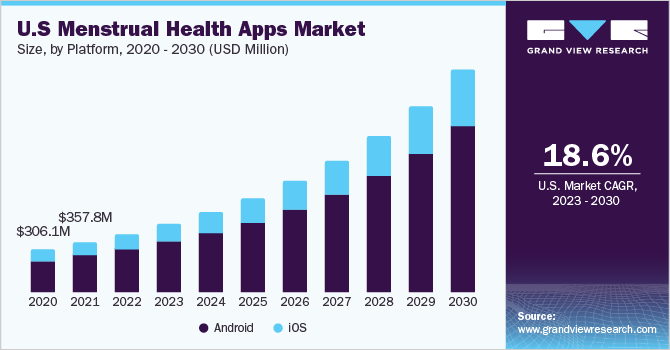

Platform Insights

On the basis of platforms, the industry has been further categorized into iOS and Android. The Android segment dominated the global industry in 2022 and accounted for the maximum share of over 73.1% of the overall revenue. The segment is anticipated to expand further at the fastest growth rate retaining its dominant position throughout the forecast period. The growth of the segment can be attributed to the easy availability and widespread usage of Android phones compared to iOS.

Key manufacturers focus on launching Android-compatible apps, due to a high number of Android smartphone users. The iOS segment is also expected to register significant growth during the forecast period. This can be attributed to the high level of security and data privacy provided by iOS. According to a survey conducted by the NCBI in 2022, out of the 90,088 health apps available on the Apple store, 7% were specifically focused on women’s health and pregnancy.

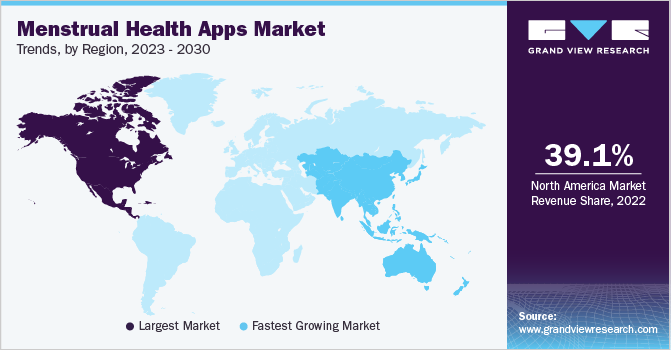

Regional Insights

North America held the largest share of over 39.1% in 2022. The demand for women's health-related smart solutions is being driven by the widespread digitalization of healthcare, as well as the increasing rates of smartphone ownership and improved internet coverage. The growth of the region can also be attributed to factors, such as the rising healthcare expenditure and the growing need for enhanced period cycle tracking apps. In addition, the increasing per capita expenditure on healthcare, which was approximately USD 12,914 per person in 2021 according to the Centers for Medicare & Medicaid Services., is expected to contribute to market growth.

The Asia Pacific region is expected to register the fastest growth rate during the forecast period. The regional market growth can be attributed to the increasing demand for effective health technology, advancements in digital infrastructure, rising expenditure on healthcare IT, and growing smartphone penetration in the region. According to the GSMA Intelligence article, at the end of 2021, the number of mobile internet users in Asia Pacific exceeded 1.2 billion. These factors contribute to the growth of the market in this region.

Key Companies & Market Share Insights

The market players are involved in product launches, expansions, collaborations, and acquisitions to sustain the competition. The increasing demand to address women’s unmet health needs is driving key participants to focus on their product development strategies and create innovative digital solutions. In March 2023, Joii, a menstrual health brand, launched an app for tracking periods and its symptoms to support endometriosis. Some of the key players in the global menstrual health apps market include:

-

Flo Health Inc.

-

Glow, Inc.

-

Biowink GmbH

-

Planned Parenthood Federation of America Inc.

-

Ovia Health

-

MagicGirl

-

Joii Ltd.

-

Procter & Gamble

-

Simple Design. Ltd.

-

Cycles

Menstrual Health Apps Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.4 billion

Revenue forecast in 2030

USD 5.1 billion

Growth rate

CAGR of 19.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, application, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Flo Health Inc.; Glow, Inc.; Biowink GmbH; Planned Parenthood Federation of America Inc.; Ovia Health; MagicGirl; Joii Ltd.; Procter & Gamble; Simple Design. Ltd.; Cycles

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Menstrual Health Apps Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global menstrual health apps market report based on platform, application, and region:

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Android

-

iOS

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Period Cycle Tracking

-

Fertility & Ovulation Management

-

Menstrual Health Management

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global menstrual health apps market is expected to grow at a compound annual growth rate of 19.9% from 2023 to 2030 to reach USD 5.1 billion by 2030.

b. North America dominated the menstrual health apps market with the highest share in 2022. This is attributable to the increasing digital literacy, widespread use of smartphones, higher disposable income, and improved internet connectivity.

b. The global menstrual health apps market size was estimated at USD 1.2 billion in 2022 and is expected to reach USD 1.4 billion in 2023.

b. Some key players operating in the menstrual health apps market include Flo Health Inc., Glow, Inc., Biowink GmbH, Planned Parenthood Federation of America Inc., Ovia Health, MagicGirl, Joii Limited, Procter & Gamble, Simple Design. Ltd, Cycles

b. Key factors that are driving the menstrual health apps market growth include the rising healthcare expenditure and the growing need for enhanced period cycle tracking apps.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."