- Home

- »

- Pharmaceuticals

- »

-

Women’s Health Market Size & Share, Industry Report, 2030GVR Report cover

![Women’s Health Market Size, Share & Trends Report]()

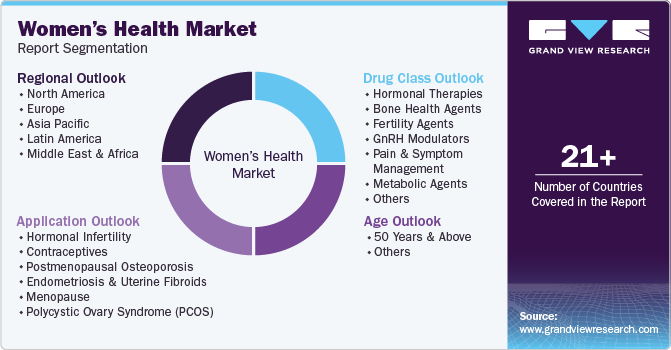

Women’s Health Market Size, Share & Trends Analysis Report By Application (Contraceptives, Menopause), By Drug Class (Hormonal Therapies, Pain And Symptom Management), By Age (50 Years And Above), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-634-9

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Women’s Health Market Size & Trends

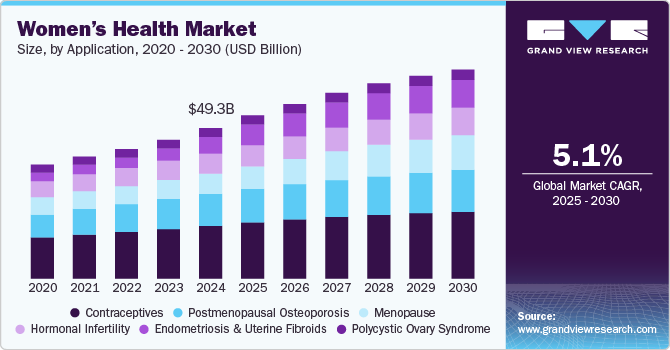

The global women’s health market size was estimated at USD 49.33 billion in 2024 and is expected to grow at a CAGR of 5.1% from 2025 to 2030. Market growth can be attributed to the increase in the geriatric population of women and the introduction of new advanced therapeutic products for women’s health, such as Relugoliz and Orilissa. Furthermore, favorable policies initiated by governments to improve women’s health and raise awareness are likely to drive market growth during the forecast period. The market exhibited slower growth during the pandemic.

Contraceptives play an important role in preventing unwanted pregnancies. Currently, there are no Over-the-counter (OTC) pills available in the U.S. for controlling pregnancy. Thus, introducing OTC contraceptive pills in the U.S. is expected to contribute to industry growth positively. For instance, In July 2023, the U.S. FDA granted approval for Opill (norgestrel) tablets developed by Laboratoire HRA Pharma to be sold over the counter as a daily oral contraceptive to prevent pregnancy. This marks the first time a progestin-only oral contraceptive is available in the U.S. without a prescription. Consumers can now purchase this birth control pill at drugstores, grocery stores, convenience stores, and online, providing greater accessibility to contraception. The successful approval of Opill and available OTC without prescription in the U.S., driving the industry growth.

Various initiatives undertaken by countries in Asia Pacific, such as Japan, India, China, Singapore, and Australia, are likely to boost the market over the forecast period. For instance, in January 2023, Australia’s Ministry of Health announced funding USD 24 million for medical and health research activities focusing on women’s health to develop novel treatments & improve patient outcomes. In addition, in May 2024, the Australian government announced an investment of USD 160 million in activities to improve women’s health as part of its 2024-2025 budget.

These factors are anticipated to fuel industry growth. According to the Society of Family Planning's #WeCount Report, in the U.S., from July 2022 to June 2023, the average monthly number of abortions was 82,298. Owing to the high unmet need for publicly funded contraceptive services and products, federal & state governments are actively working toward improving family planning services and improving access to modern contraceptives. Market players are adopting various market strategies, such as collaboration and awareness and marketing campaigns, to increase their market penetration in the country. For instance, in October 2022, Abbott conducted a survey in partnership with Ipsos to raise awareness and support women during the menopause phase. Moreover, Abbott is planning to launch, The Next Chapter campaign, to raise awareness among women with menopause

According to the United Nations Population Fund's (UNFPA) article published in September 2023, philanthropies and governments invest in family planning supplies. The Bill & Melinda Gates Foundation invested up to USD 100 million in the UNFPA Supplies Partnership. The Government of Germany invested USD 50.5 million to support the UNFPA Supplies Partnership. Furthermore, agencies such as USAID conduct family planning & reproductive health programs in more than 30 countries, including South Africa & other African countries, where there is a high unmet need for contraception. However, there are various complications and negative effects of the continuous use of contraceptives, which lead to an increase in the adoption of traditional contraceptive methods.

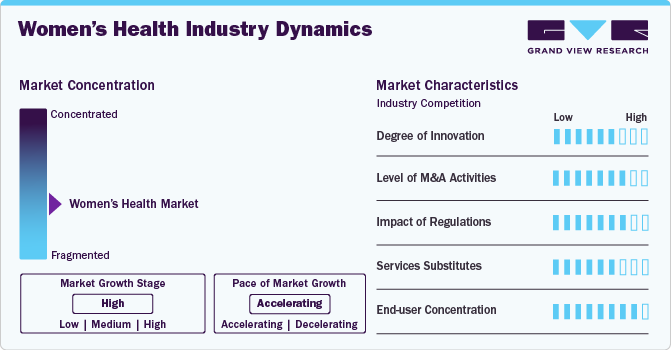

Market Concentration And Characteristics

The market growth stage is high, and the pace is accelerating. The women’s healthcare industry is characterized by a high degree of innovation due to rapid technological advancements driven by next-generation contraceptives, artificial intelligence (AI) powered ultrasounds, and future-ready diagnostics tools. Furthermore, in September 2023, according to the National Institutes of Health’s study, AI and machine learning (ML) can effectively detect PCOS.

The industry is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new AI technologies and talent, need to consolidate in a rapidly growing market, and increasing strategic importance of AI, and more.

The industry is also subject to increasing regulatory scrutiny. For instance, the unfavorable regulations regarding abortion in the U.S. have a significant impact on the market. Rising emphasis on personalized medicine for women is one of the major trends for market growth.Advancements in medical technology, such as telehealth & genetic testing, offer avenues for enhanced accessibility and tailored treatments. The expanding focus on mental health within women's healthcare further opens doors for novel interventions.Emerging markets and a growing trend toward preventive care create a favorable landscape for industry players.

The market has a presence of several players catering to different areas in the women’s health market. Furthermore, the players actively develop and launch products to treat various women’s health issues and other business initiatives to strengthen their position in the market. Hence, it has promoted strong competition in the market globally.

End user concentration is a significant factor in the industry. Since there are several end user industries that are driving demand for women’s healthcare facilities. The concentration of demand of end-user industries creates opportunities for companies that focus on developing women’s health solutions for these industries. However, it also creates challenges for companies that are trying to compete in the industry.

Application Insights

The contraceptives segment held the highest revenue share of more than 35.07% of the global revenue in 2024, spurred by rising awareness of family planning and ongoing technological advancements in contraceptive methods. This growth is further supported by favorable government policies, such as in the U.S., where federal regulations ensure that all female-controlled contraceptive methods, including counseling and related services, are covered without out-of-pocket expenses for patients. In September 2024, the European Union (EU) and the Bill & Melinda Gates Foundation announced a partnership to enhance access to contraceptive and maternal health products in low- and middle-income countries.

The menopause segment is expected to grow at the highest CAGR from 2025 to 2030. The growth can be attributed to the increasing population of women reaching menopause and issues and the launch of new products for these conditions. For instance, in December 2023, Astellas Pharma Inc. announced the approval of VEOZA (fezolinetant) 45 mg to treat vasomotor symptoms caused by menopause.

Drug Class Insights

Hormonal therapies segment led the market in 2024 and is expected to grow at fastest growth rate over the forecast period. Key drivers for this growth include an increasing global demand for family planning solutions, rising awareness about reproductive health, and the aging population in many regions, particularly in North America and Europe. Combined hormonal contraceptives (CHCs) continue to dominate the market due to their broad usage and high effectiveness in preventing pregnancy while also offering additional benefits like menstrual regulation

Pain and Symptom Management segment is expected to grow at the lucrative CAGR from 2025 to 2030, driven by increasing global prevalence of chronic pain conditions, aging populations, and growing awareness of pain management options. The segment is expected to continue expanding during the forecast period, with significant contributions from both pharmaceutical innovations and the increasing adoption of multi-modal treatment approaches to address various types of pain and related symptoms.

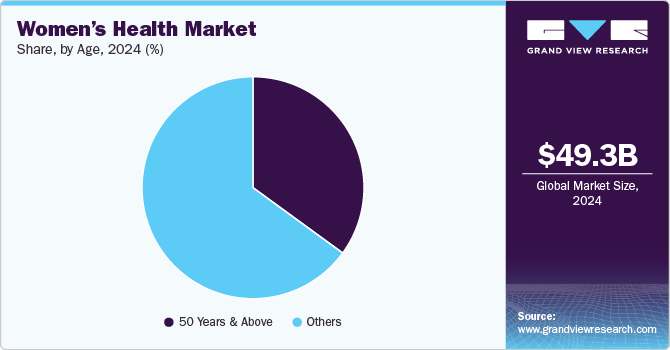

Age Segment Insights

The others (below 50 years) segment dominated the market in 2024 and is expected to sustain the position for the forecast period. Women aged below 50 years are more likely to face issues associated with fertility, such as endometriosis, hormonal infertility, and polycystic ovary syndrome. According to the UNICEF, in 2023, there are around 1.16 billion females below 18 years old globally. Hence, the significant population is prone to several women’s health issues, thereby promoting the market.

The 50 years & above age segment is expected to register the fastest growth rate FROM 2025 to 2030 as an increase in life expectancy is boosting the overall menopausal population across the globe. In addition, with a rise in the geriatric population, diseases, such as postmenopausal osteoporosis are also increasing. According to an article published in NCBI, the prevalence of postmenopausal osteoporosis in women aged 60 to 69 is around 10.95% and about 26.45% in women aged 70 & above. Other women’s health issues, such as endometriosis, are more likely to occur in reproductive age groups; however, it also affects a small percentage of postmenopausal women. All these factors are expected to drive the growth of this segment in the years to come.

Regional Insights

The North America women’s health market dominated the global market with a share of 43.04% in 2024. This growth was attributed to the favorable reimbursement policies, approval & commercialization of products, supportive government laws, and high awareness about the importance of maintaining good health. For instance, in July 2023, Canada announced funding to promote women's health and rights at the 2023 Women Deliver Conference. The country allocated USD 10 million for the "Advancing Sexual and Reproductive Health and Rights project" under Canada's SheSOARS initiative. Moreover, in May 2023, U.S. Department of Health and Human Services announced over USD 65 million to 35 HRSA-funded health centers to address the maternal mortality crisis.

U.S. Women’s Health Market Trends

The women’s health market in the U.S. is expected to grow over the forecast period attributed to launch of projects and initiatives focused on improving the health of women is further anticipated to drive market. For instance, in April 2024, Cleveland Clinic announced the launch of new women’s health comprehensive health and resource center, with an aim to improve and address the unique health needs of women during their midlife period.

Europe Women’s Health Market Trends

Europe women’s health market was identified as a lucrative region in this industry. The increasing number of market players involved in manufacturing women's health products in European countries and the growing prevalence of various women’s health issues, such as postmenopausal symptoms, PCOS, & infertility, are anticipated to boost the market.

The women’s health market in UK is growing primarily due local presence of key players, such as Pfizer Inc., AbbVie Inc., and Merck & Co. Inc., providing women’s healthcare products. Rising women’s health issues related to fertility in the UK are expected to drive the market.

Germany women’s health market is expected to grow over the forecast period attributed to high prevalence of menopause-related conditions, such as hot flashes, and key market players focusing on strategic initiatives to gain higher market share. For instance, in September 2024, Theramex announced the first commercial launch of Yselty (linzagolix) a drug used for the treatment of uterine fibroids in Germany.

The women’s health market in France is expected to grow at a lucrative rate over the forecast period owing to the availability of major players in the country. This includes players such as Abbott; Dr. Reddy's Laboratories Ltd.; Pfizer, Inc.; GSK plc; Sun Pharmaceutical Industries Ltd.; AbbVie, Inc.; Bayer AG; and Johnson & Johnson Services, Inc. Moreover, increasing market penetration of local players is anticipated to support market expansion in the coming years.

Asia Pacific Women’s Health Market Trends

The Asia-Pacific women’s health market is expected to witness the fastest CAGR of over the projected period owing to the presence of a large population and an increase in the demand for contraceptives. In Asia Pacific, India and China are highly populated countries. The rise in government initiatives undertaken to control their population growth is expected to positively impact the women’s health industry.

The women’s health market in Japan is expected to grow over the forecast owing to increase in the prevalence of endometriosis and postmenopausal osteoporosis. Moreover, favorable initiatives undertaken by government bodies are supporting market growth. For instance, in March 2024, Astellas Pharma Inc. announced the dosing of the first patient in the STARLIGHT 2 Phase 3 pivotal study for fezolinetant, an investigational oral, non-hormonal compound being studied for the treatment of vasomotor symptoms (VMS) associated with menopause in Japanese women.

Latin America Women’s Health Market Trends

Latin America women’s health market was identified as a lucrative region in this industry. Increasing R&D activities and rapid technological advancements in the region are anticipated to fuel market growth. Increasing government spending, growing investments by major pharmaceutical & biopharmaceutical companies, and the presence of major academic research institutes are among the factors likely to promote regional growth.

The women’s health market in Brazil is expected to grow over the forecast period owing to technological advancement in field of women’s health services. For instance, in April 2024, FertGroup Medicina Reproductiva, a leading network of fertility clinics in Brazil announced a partnership with Future Fertility to integrate VIOLET and MAGENTA, two innovative oocyte assessment software solutions, into our expanding clinic network.

MEA Women’s Health Market Trends

MEA women’s health market was identified as a lucrative region in this industry. The market in this region is driven by growing prevalence of infertility and other gynecological disorders. The adoption of modern contraceptives is comparatively lower than traditional ones in the MEA. However, several governments in this region are actively undertaking initiatives to promote the use of modern contraceptives.

The women’s health market in Saudi Arabia is expected to grow over the forecast period attributed to government and nongovernment bodies are collaborating to increase awareness related to women’s health among the target population. For instance, in February 2023, King Faisal Specialized Hospital and Research Centre organized a Women’s Health Awareness Day to spread awareness about osteoporosis, menopause issues, and other women’s health issues.

Key Women’s Health Company Insights

Some key players operating in the women’s health industry are Amgen, Inc., AbbVie, Inc., Bayer AG, Organon & Co., and Pfizer, Inc., among others. New players are entering the market with innovative products, whereas major players are collaborating with small companies for product development. These players have wide range of product portfolio by key players, covering a wide range of women’s health solutions to serve diverse consumer pool further increasing the competition among leading players. However, this increase in competition among the players results in decreasing profitability.

Key Women’s Health Companies:

The following are the leading companies in the women’s health market. These companies collectively hold the largest market share and dictate industry trends.

- AbbVie, Inc.

- Bayer AG

- Organon & Co.

- Pfizer, Inc.

- Theramex

- Agile Therapeutics

- Amgen, Inc.

- Apothecus Pharmaceutical Corp.

- Blairex Laboratories, Inc.

- Ferring

View a comprehensive list of companies in the Women’s Health Market

Recent Developments

-

In September 2024, Organon announced acquisition of Dermavant, a subsidiary of Roivant focused on developing and commercializing novel treatments in immuno-dermatology.

-

In March 2024, Insud Pharma announced the successful acquisition of Viatris' Women’s Healthcare division, which focuses on oral and injectable contraceptives. This strategic move strengthens Insud Pharma's industrial footprint in India by adding two manufacturing facilities located in Sarigam and Ahmedabad.

-

In March 2024, The U.S. FDA granted approval to ELAHERE, developed by AbbVie Inc., for the treatment of adult patients with folate receptor alpha (FRα)-positive, platinum-resistant epithelial ovarian, fallopian tube, or primary peritoneal cancer, who have previously undergone up to three lines of therapy.

-

In December 2023, Theramex completed the acquisition of the Femoston and Duphaston in Europe from Viatris. The company acquired these products for the consolidation of its menopause portfolio.

Women’s Health Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 53.48 billion

Revenue forecast in 2030

USD 68.53 billion

Growth rate

CAGR of 5.1% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, age, drug class, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Spain; Italy; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AbbVie, Inc.; Bayer AG; Merck & Co., Inc.; Pfizer, Inc; Teva Pharmaceutical Industries Ltd.; Agile Therapeutics; Amgen, Inc; Apothecus Pharmaceutical Corp.; Blairex Laboratories, Inc.; and Ferring B.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Women’s Health Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global women’s health market report based on the application, drug class, age, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Hormonal Infertility

-

Contraceptives

-

Postmenopausal Osteoporosis

-

Endometriosis & Uterine Fibroids

-

Menopause

-

Polycystic Ovary Syndrome (PCOS)

-

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Hormonal Therapies

-

Bone Health Agents

-

Fertility Agents

-

GnRH Modulators

-

Pain and Symptom Management

-

Metabolic Agents

-

Others

-

-

Age Outlook (Revenue, USD Million, 2018 - 2030)

-

50 years and above

-

Postmenopausal Osteoporosis

-

Endometriosis & Uterine Fibroids

-

Menopause

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global women's health market size was estimated at USD 49.33 billion in 2024 and is expected to reach USD 53.48 billion in 2025.

b. The global women's health market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2030 to reach USD 68.53 billion by 2030.

b. The contraceptives segment accounted for the largest share of more than 35.07% of the women’s health market in 2024, due to the growing awareness regarding the usage of contraceptives, favorable reimbursement policies, and rising government and non-profit organization initiatives.

b. Some of the key players operating in the women’s health market are AbbVie, Inc.; Bayer AG; Merck & Co., Inc.; Pfizer; Teva Pharmaceuticals; Agile Therapeutics; Amgen, Inc.; AstraZeneca; Bristol-Myers Squibb; and Ferring B.V.

b. An increase in the population of women aged over 60, a rise in unhealthy lifestyle habits, the introduction of novel medicines for women's health, and the impending approval of pipeline products are some of the factors that drive market growth.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Application

1.2.2. Age

1.2.3. Regional scope

1.2.4. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. GVR’s internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.4.5.1. Data for primary interviews in North America

1.4.5.2. Data for primary interviews in Europe

1.4.5.3. Data for primary interviews in Asia Pacific

1.4.5.4. Data for primary interviews in Latin America

1.4.5.5. Data for Primary interviews in MEA

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Application outlook

2.2.2. Drug class outlook

2.2.3. Age outlook

2.2.4. Regional outlook

2.3. Competitive Insights

Chapter 3. Women’s Health Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Rising incidence of target diseases

3.2.1.2. Increasing initiatives by government and various organizations

3.2.1.3. Rising publicly funded family planning services

3.2.2. Market restraint analysis

3.2.2.1. Patent expiry of major drugs

3.2.2.2. Lawsuits related to products

3.2.2.3. Adverse effects associated with use of contraceptive drugs and devices

3.3. Women’s Health Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Supplier power

3.3.1.2. Buyer power

3.3.1.3. Substitution threat

3.3.1.4. Threat of new entrant

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Technological landscape

3.3.2.3. Economic landscape

3.3.3. Pricing Analysis

Chapter 4. Women’s Health Market: Application Estimates & Trend Analysis

4.1. Application Market Share, 2024 & 2030

4.2. Segment Dashboard

4.3. Global Women’s Health Market by Application Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.4.1. Hormonal infertility

4.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2. Contraceptives

4.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.3. Postmenopausal osteoporosis

4.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.4. Endometriosis & uterine fibroids

4.4.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.5. Menopause

4.4.5.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.6. Polycystic ovary syndrome (PCOS)

4.4.6.1. Market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 5. Women’s Health Market: Drug Class Estimates & Trend Analysis

5.1. Drug Class Market Share, 2024 & 2030

5.2. Segment Dashboard

5.3. Global Women’s Health Market by Drug Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.4.1. Hormonal Therapies

5.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.2. Bone Health Agents

5.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.3. Fertility Agents

5.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.4. GnRH Modulators

5.4.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.5. Pain and Symptom Management

5.4.5.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.6. Metabolic Agents

5.4.6.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.7. Others

5.4.7.1. Market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 6. Women’s Health Market: Age Estimates & Trend Analysis

6.1. Age Market Share, 2024 & 2030

6.2. Segment Dashboard

6.3. Global Women’s Health Market by Age Outlook

6.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

6.4.1. 50 years and above

6.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

6.4.1.2. Postmenopausal osteoporosis

6.4.1.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

6.4.1.3. Endometriosis & uterine fibroids

6.4.1.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

6.4.1.4. Menopause

6.4.1.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

6.4.1.5. Others

6.4.1.5.1. Market estimates and forecasts 2018 to 2030 (USD Million)

6.4.2. Others

6.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 7. Women’s Health Market: Regional Estimates & Trend Analysis

7.1. Regional Market Share Analysis, 2024 & 2030

7.2. Regional Market Dashboard

7.3. Global Regional Market Snapshot

7.4. Market Size & Forecasts Trend Analysis, 2018 to 2030:

7.5. North America

7.5.1. U.S.

7.5.1.1. Key country dynamics

7.5.1.2. Regulatory framework/ reimbursement structure

7.5.1.3. Competitive scenario

7.5.1.4. U.S. market estimates and forecasts 2018 to 2030 (USD Million)

7.5.2. Canada

7.5.2.1. Key country dynamics

7.5.2.2. Regulatory framework/ reimbursement structure

7.5.2.3. Competitive scenario

7.5.2.4. Canada market estimates and forecasts 2018 to 2030 (USD Million)

7.5.3. Mexico

7.5.3.1. Key country dynamics

7.5.3.2. Regulatory framework/ reimbursement structure

7.5.3.3. Competitive scenario

7.5.3.4. Mexico market estimates and forecasts 2018 to 2030 (USD Million)

7.6. Europe

7.6.1. UK

7.6.1.1. Key country dynamics

7.6.1.2. Regulatory framework/ reimbursement structure

7.6.1.3. Competitive scenario

7.6.1.4. UK market estimates and forecasts 2018 to 2030 (USD Million)

7.6.2. Germany

7.6.2.1. Key country dynamics

7.6.2.2. Regulatory framework/ reimbursement structure

7.6.2.3. Competitive scenario

7.6.2.4. Germany market estimates and forecasts 2018 to 2030 (USD Million)

7.6.3. France

7.6.3.1. Key country dynamics

7.6.3.2. Regulatory framework/ reimbursement structure

7.6.3.3. Competitive scenario

7.6.3.4. France market estimates and forecasts 2018 to 2030 (USD Million)

7.6.4. Italy

7.6.4.1. Key country dynamics

7.6.4.2. Regulatory framework/ reimbursement structure

7.6.4.3. Competitive scenario

7.6.4.4. Italy market estimates and forecasts 2018 to 2030 (USD Million)

7.6.5. Spain

7.6.5.1. Key country dynamics

7.6.5.2. Regulatory framework/ reimbursement structure

7.6.5.3. Competitive scenario

7.6.5.4. Spain market estimates and forecasts 2018 to 2030 (USD Million)

7.6.6. Norway

7.6.6.1. Key country dynamics

7.6.6.2. Regulatory framework/ reimbursement structure

7.6.6.3. Competitive scenario

7.6.6.4. Norway market estimates and forecasts 2018 to 2030 (USD Million)

7.6.7. Sweden

7.6.7.1. Key country dynamics

7.6.7.2. Regulatory framework/ reimbursement structure

7.6.7.3. Competitive scenario

7.6.7.4. Sweden market estimates and forecasts 2018 to 2030 (USD Million)

7.6.8. Denmark

7.6.8.1. Key country dynamics

7.6.8.2. Regulatory framework/ reimbursement structure

7.6.8.3. Competitive scenario

7.6.8.4. Denmark market estimates and forecasts 2018 to 2030 (USD Million)

7.7. Asia Pacific

7.7.1. Japan

7.7.1.1. Key country dynamics

7.7.1.2. Regulatory framework/ reimbursement structure

7.7.1.3. Competitive scenario

7.7.1.4. Japan market estimates and forecasts 2018 to 2030 (USD Million)

7.7.2. China

7.7.2.1. Key country dynamics

7.7.2.2. Regulatory framework/ reimbursement structure

7.7.2.3. Competitive scenario

7.7.2.4. China market estimates and forecasts 2018 to 2030 (USD Million)

7.7.3. India

7.7.3.1. Key country dynamics

7.7.3.2. Regulatory framework/ reimbursement structure

7.7.3.3. Competitive scenario

7.7.3.4. India market estimates and forecasts 2018 to 2030 (USD Million)

7.7.4. Australia

7.7.4.1. Key country dynamics

7.7.4.2. Regulatory framework/ reimbursement structure

7.7.4.3. Competitive scenario

7.7.4.4. Australia market estimates and forecasts 2018 to 2030 (USD Million)

7.7.5. South Korea

7.7.5.1. Key country dynamics

7.7.5.2. Regulatory framework/ reimbursement structure

7.7.5.3. Competitive scenario

7.7.5.4. South Korea market estimates and forecasts 2018 to 2030 (USD Million)

7.7.6. Thailand

7.7.6.1. Key country dynamics

7.7.6.2. Regulatory framework/ reimbursement structure

7.7.6.3. Competitive scenario

7.7.6.4. Thailand market estimates and forecasts 2018 to 2030 (USD Million)

7.8. Latin America

7.8.1. Brazil

7.8.1.1. Key country dynamics

7.8.1.2. Regulatory framework/ reimbursement structure

7.8.1.3. Competitive scenario

7.8.1.4. Brazil market estimates and forecasts 2018 to 2030 (USD Million)

7.8.2. Argentina

7.8.2.1. Key country dynamics

7.8.2.2. Regulatory framework/ reimbursement structure

7.8.2.3. Competitive scenario

7.8.2.4. Argentina market estimates and forecasts 2018 to 2030 (USD Million)

7.9. MEA

7.9.1. South Africa

7.9.1.1. Key country dynamics

7.9.1.2. Regulatory framework/ reimbursement structure

7.9.1.3. Competitive scenario

7.9.1.4. South Africa market estimates and forecasts 2018 to 2030 (USD Million)

7.9.2. Saudi Arabia

7.9.2.1. Key country dynamics

7.9.2.2. Regulatory framework/ reimbursement structure

7.9.2.3. Competitive scenario

7.9.2.4. Saudi Arabia market estimates and forecasts 2018 to 2030 (USD Million)

7.9.3. UAE

7.9.3.1. Key country dynamics

7.9.3.2. Regulatory framework/ reimbursement structure

7.9.3.3. Competitive scenario

7.9.3.4. UAE market estimates and forecasts 2018 to 2030 (USD Million)

7.9.4. Kuwait

7.9.4.1. Key country dynamics

7.9.4.2. Regulatory framework/ reimbursement structure

7.9.4.3. Competitive scenario

7.9.4.4. Kuwait market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company/Competition Categorization

8.3. Vendor Landscape

8.3.1. List of key distributors and channel partners

8.3.2. Key customers

8.3.3. Key company market share analysis, 2024

8.3.4. AbbVie, Inc.

8.3.4.1. Company overview

8.3.4.2. Financial performance

8.3.4.3. Product benchmarking

8.3.4.4. Strategic initiatives

8.3.5. Bayer AG

8.3.5.1. Company overview

8.3.5.2. Financial performance

8.3.5.3. Product benchmarking

8.3.5.4. Strategic initiatives

8.3.6. Merck & Co., Inc.

8.3.6.1. Company overview

8.3.6.2. Financial performance

8.3.6.3. Product benchmarking

8.3.6.4. Strategic initiatives

8.3.7. Pfizer, Inc.

8.3.7.1. Company overview

8.3.7.2. Financial performance

8.3.7.3. Product benchmarking

8.3.7.4. Strategic initiatives

8.3.8. Teva Pharmaceutical Industries Ltd.

8.3.8.1. Company overview

8.3.8.2. Financial performance

8.3.8.3. Product benchmarking

8.3.8.4. Strategic initiatives

8.3.9. Agile Therapeutics

8.3.9.1. Company overview

8.3.9.2. Financial performance

8.3.9.3. Product benchmarking

8.3.9.4. Strategic initiatives

8.3.10. Amgen, Inc.

8.3.10.1. Company overview

8.3.10.2. Financial performance

8.3.10.3. Product benchmarking

8.3.10.4. Strategic initiatives

8.3.11. Apothecus Pharmaceutical Corp.

8.3.11.1. Company overview

8.3.11.2. Financial performance

8.3.11.3. Product benchmarking

8.3.11.4. Strategic initiatives

8.3.12. Blairex Laboratories, Inc.

8.3.12.1. Company overview

8.3.12.2. Financial performance

8.3.12.3. Product benchmarking

8.3.12.4. Strategic initiatives

8.3.13. Ferring B.V.

8.3.13.1. Company overview

8.3.13.2. Financial performance

8.3.13.3. Product benchmarking

8.3.13.4. Strategic initiatives

List of Tables

Table 1 List of abbreviation

Table 2 North America women’s health market, by region, 2018 - 2030 (USD Million)

Table 3 North America women’s health market, by application, 2018 - 2030 (USD Million)

Table 4 North America women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 5 North America women’s health market, by age, 2018 - 2030 (USD Million)

Table 6 U.S. women’s health market, by application, 2018 - 2030 (USD Million)

Table 7 U.S. women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 8 U.S. women’s health market, by age, 2018 - 2030 (USD Million)

Table 9 Canada women’s health market, by application, 2018 - 2030 (USD Million)

Table 10 Canada women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 11 Canada women’s health market, by age, 2018 - 2030 (USD Million)

Table 12 Mexico women’s health market, by application, 2018 - 2030 (USD Million)

Table 13 Mexico women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 14 Mexico women’s health market, by age, 2018 - 2030 (USD Million)

Table 15 Europe women’s health market, by region, 2018 - 2030 (USD Million)

Table 16 Europe women’s health market, by application, 2018 - 2030 (USD Million)

Table 17 Europe women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 18 Europe women’s health market, by age, 2018 - 2030 (USD Million)

Table 19 Germany women’s health market, by application, 2018 - 2030 (USD Million)

Table 20 Germany women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 21 Germany women’s health market, by age, 2018 - 2030 (USD Million)

Table 22 UK women’s health market, by application, 2018 - 2030 (USD Million)

Table 23 UK women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 24 UK women’s health market, by age, 2018 - 2030 (USD Million)

Table 25 France women’s health market, by application, 2018 - 2030 (USD Million)

Table 26 France women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 27 France women’s health market, by age, 2018 - 2030 (USD Million)

Table 28 Italy women’s health market, by application, 2018 - 2030 (USD Million)

Table 29 Italy women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 30 Italy women’s health market, by age, 2018 - 2030 (USD Million)

Table 31 Spain women’s health market, by application, 2018 - 2030 (USD Million)

Table 32 Spain women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 33 Spain women’s health market, by age, 2018 - 2030 (USD Million)

Table 34 Denmark women’s health market, by application, 2018 - 2030 (USD Million)

Table 35 Denmark women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 36 Denmark women’s health market, by age, 2018 - 2030 (USD Million)

Table 37 Sweden women’s health market, by application, 2018 - 2030 (USD Million)

Table 38 Sweden women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 39 Sweden women’s health market, by age, 2018 - 2030 (USD Million)

Table 40 Norway women’s health market, by application, 2018 - 2030 (USD Million)

Table 41 Norway women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 42 Norway women’s health market, by age, 2018 - 2030 (USD Million)

Table 43 Asia Pacific women’s health market, by region, 2018 - 2030 (USD Million)

Table 44 Asia Pacific women’s health market, by application, 2018 - 2030 (USD Million)

Table 45 Asia Pacific women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 46 Asia Pacific women’s health market, by age, 2018 - 2030 (USD Million)

Table 47 China women’s health market, by application, 2018 - 2030 (USD Million)

Table 48 China women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 49 China women’s health market, by age, 2018 - 2030 (USD Million)

Table 50 Japan women’s health market, by application, 2018 - 2030 (USD Million)

Table 51 Japan women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 52 Japan women’s health market, by age, 2018 - 2030 (USD Million)

Table 53 India women’s health market, by application, 2018 - 2030 (USD Million)

Table 54 India women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 55 India women’s health market, by age, 2018 - 2030 (USD Million)

Table 56 South Korea women’s health market, by application, 2018 - 2030 (USD Million)

Table 57 South Korea women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 58 South Korea women’s health market, by age, 2018 - 2030 (USD Million)

Table 59 Australia women’s health market, by application, 2018 - 2030 (USD Million)

Table 60 Australia women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 61 Australia women’s health market, by age, 2018 - 2030 (USD Million)

Table 62 Thailand women’s health market, by application, 2018 - 2030 (USD Million)

Table 63 Thailand women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 64 Thailand women’s health market, by age, 2018 - 2030 (USD Million)

Table 65 Latin America women’s health market, by region, 2018 - 2030 (USD Million)

Table 66 Latin America women’s health market, by age, 2018 - 2030 (USD Million)

Table 67 Latin America women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 68 Latin America women’s health market, by application, 2018 - 2030 (USD Million)

Table 69 Brazil women’s health market, by application, 2018 - 2030 (USD Million)

Table 70 Brazil women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 71 Brazil women’s health market, by age, 2018 - 2030 (USD Million)

Table 72 Argentina women’s health market, by application, 2018 - 2030 (USD Million)

Table 73 Argentina women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 74 Argentina women’s health market, by age, 2018 - 2030 (USD Million)

Table 75 MEA women’s health market, by region, 2018 - 2030 (USD Million)

Table 76 MEA women’s health market, by application, 2018 - 2030 (USD Million)

Table 77 MEA women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 78 MEA women’s health market, by age, 2018 - 2030 (USD Million)

Table 79 South Africa women’s health market, by application, 2018 - 2030 (USD Million)

Table 80 South Africa women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 81 South Africa women’s health market, by age, 2018 - 2030 (USD Million)

Table 82 Saudi Arabia women’s health market, by application, 2018 - 2030 (USD Million)

Table 83 Saudi Arabia women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 84 Saudi Arabia women’s health market, by age, 2018 - 2030 (USD Million)

Table 85 UAE women’s health market, by application, 2018 - 2030 (USD Million)

Table 86 UAE women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 87 UAE women’s health market, by age, 2018 - 2030 (USD Million)

Table 88 Kuwait women’s health market, by application, 2018 - 2030 (USD Million)

Table 89 Kuwait women’s health market, by drug class, 2018 - 2030 (USD Million)

Table 90 Kuwait women’s health market, by age, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Primary interviews in North America

Fig. 5 Primary interviews in Europe

Fig. 6 Primary interviews in APAC

Fig. 7 Primary interviews in Latin America

Fig. 8 Primary interviews in MEA

Fig. 9 Market research approaches

Fig. 10 Value-chain-based sizing & forecasting

Fig. 11 QFD modeling for market share assessment

Fig. 12 Market formulation & validation

Fig. 13 Women’s health market: market outlook

Fig. 14 Women’s health competitive insights

Fig. 15 Parent market outlook

Fig. 16 Related/ancillary market outlook

Fig. 17 Penetration and growth prospect mapping

Fig. 18 Industry value chain analysis

Fig. 19 Women’s health market driver impact

Fig. 20 Women’s health market restraint impact

Fig. 21 Women’s health market strategic initiatives analysis

Fig. 22 Women’s health market: Application movement analysis

Fig. 23 Women’s health market: Application outlook and key takeaways

Fig. 24 Hormonal infertility market estimates and forecast, 2018 - 2030

Fig. 25 Contraceptives estimates and forecast, 2018 - 2030

Fig. 26 Postmenopausal osteoporosis market estimates and forecast, 2018 - 2030

Fig. 27 Endometriosis & uterine fibroids estimates and forecast, 2018 - 2030

Fig. 28 Menopause market estimates and forecast, 2018 - 2030

Fig. 29 Polycystic ovary syndrome (PCOS) estimates and forecast, 2018 - 2030

Fig. 30 Women’s health market: Drug movement analysis

Fig. 31 Women’s health market: Drug outlook and key takeaways

Fig. 32 Hormonal Therapies market estimates and forecast, 2018 - 2030

Fig. 33 Bone Health Agents market estimates and forecast, 2018 - 2030

Fig. 34 Fertility Agents market estimates and forecast, 2018 - 2030

Fig. 35 GnRH Modulators estimates and forecast, 2018 - 2030

Fig. 36 Pain and Symptom Management market estimates and forecast, 2018 - 2030

Fig. 37 Metabolic Agents estimates and forecast, 2018 - 2030

Fig. 38 Others estimates and forecast, 2018 - 2030

Fig. 39 Women’s health Market: Age movement Analysis

Fig. 40 Women’s health market: Age outlook and key takeaways

Fig. 41 50 years and above market estimates and forecasts, 2018 - 2030

Fig. 42 Postmenopausal osteoporosis market estimates and forecasts,2018 - 2030

Fig. 43 Endometriosis & uterine fibroids market estimates and forecasts,2018 - 2030

Fig. 44 Menopause market estimates and forecasts,2018 - 2030

Fig. 45 Others market estimates and forecasts,2018 - 2030

Fig. 46 Others market estimates and forecasts,2018 - 2030

Fig. 47 Global women’s health market: Regional movement analysis

Fig. 48 Global women’s health market: Regional outlook and key takeaways

Fig. 49 Global women’s health market share and leading players

Fig. 50 North America market share and leading players

Fig. 51 Europe market share and leading players

Fig. 52 Asia Pacific market share and leading players

Fig. 53 Latin America market share and leading players

Fig. 54 Middle East & Africa market share and leading players

Fig. 55 North America: SWOT

Fig. 56 Europe SWOT

Fig. 57 Asia Pacific SWOT

Fig. 58 Latin America SWOT

Fig. 59 MEA SWOT

Fig. 60 North America, by country

Fig. 61 North America

Fig. 62 North America market estimates and forecasts, 2018 - 2030

Fig. 63 U.S.

Fig. 64 U.S. market estimates and forecasts, 2018 - 2030

Fig. 65 Canada

Fig. 66 Canada market estimates and forecasts, 2018 - 2030

Fig. 67 Mexico

Fig. 68 Mexico market estimates and forecasts, 2018 - 2030

Fig. 69 Europe

Fig. 70 Europe market estimates and forecasts, 2018 - 2030

Fig. 71 UK

Fig. 72 UK market estimates and forecasts, 2018 - 2030

Fig. 73 Germany

Fig. 74 Germany market estimates and forecasts, 2018 - 2030

Fig. 75 France

Fig. 76 France market estimates and forecasts, 2018 - 2030

Fig. 77 Italy

Fig. 78 Italy market estimates and forecasts, 2018 - 2030

Fig. 79 Spain

Fig. 80 Spain market estimates and forecasts, 2018 - 2030

Fig. 81 Denmark

Fig. 82 Denmark market estimates and forecasts, 2018 - 2030

Fig. 83 Sweden

Fig. 84 Sweden market estimates and forecasts, 2018 - 2030

Fig. 85 Norway

Fig. 86 Norway market estimates and forecasts, 2018 - 2030

Fig. 87 Asia Pacific

Fig. 88 Asia Pacific market estimates and forecasts, 2018 - 2030

Fig. 89 China

Fig. 90 China market estimates and forecasts, 2018 - 2030

Fig. 91 Japan

Fig. 92 Japan market estimates and forecasts, 2018 - 2030

Fig. 93 India

Fig. 94 India market estimates and forecasts, 2018 - 2030

Fig. 95 Thailand

Fig. 96 Thailand market estimates and forecasts, 2018 - 2030

Fig. 97 South Korea

Fig. 98 South Korea market estimates and forecasts, 2018 - 2030

Fig. 99 Australia

Fig. 100 Australia market estimates and forecasts, 2018 - 2030

Fig. 101 Latin America

Fig. 102 Latin America market estimates and forecasts, 2018 - 2030

Fig. 103 Brazil

Fig. 104 Brazil market estimates and forecasts, 2018 - 2030

Fig. 105 Argentina

Fig. 106 Argentina market estimates and forecasts, 2018 - 2030

Fig. 107 Middle East and Africa

Fig. 108 Middle East and Africa market estimates and forecasts, 2018 - 2030

Fig. 109 South Africa

Fig. 110 South Africa market estimates and forecasts, 2018 - 2030

Fig. 111 Saudi Arabia

Fig. 112 Saudi Arabia market estimates and forecasts, 2018 - 2030

Fig. 113 UAE

Fig. 114 UAE market estimates and forecasts, 2018 - 2030

Fig. 115 Kuwait

Fig. 116 Kuwait market estimates and forecasts, 2018 - 2030

Fig. 117 Market share of key market players- Women’s health marketWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Women’s Health Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- Women’s Health Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- Women’s Health Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- Women’s Health Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- North America Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- North America Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal Osteoporosis

- Endometriosis & Uterine Fibroids

- Menopause

- Others

- Others

- 50 years and above

- U.S.

- U.S. Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- U.S. Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- U.S. Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal Osteoporosis

- Endometriosis & Uterine Fibroids

- Menopause

- Others

- Others

- 50 years and above

- U.S. Application Outlook (Revenue in USD Million, 2018 - 2030)

- Canada

- Canada Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- Canada Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- Canada Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal Osteoporosis

- Endometriosis & Uterine Fibroids

- Menopause

- Others

- Others

- 50 years and above

- Canada Application Outlook (Revenue in USD Million, 2018 - 2030)

- Mexico

- Mexico Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- Mexico Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- Mexico Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- Mexico Application Outlook (Revenue in USD Million, 2018 - 2030)

- North America Application Outlook (Revenue in USD Million, 2018 - 2030)

- Europe

- Europe Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- Europe Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- Europe Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- Germany

- Germany Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- Germany Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- Germany Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- Germany Application Outlook (Revenue in USD Million, 2018 - 2030)

- UK

- UK Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- UK Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- UK Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- UK Application Outlook (Revenue in USD Million, 2018 - 2030)

- France

- France Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- France Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- France Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- France Application Outlook (Revenue in USD Million, 2018 - 2030)

- Italy

- Italy Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- Italy Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- Italy Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- Italy Application Outlook (Revenue in USD Million, 2018 - 2030)

- Spain

- Spain Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- Spain Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- Spain Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- Spain Application Outlook (Revenue in USD Million, 2018 - 2030)

- Denmark

- Denmark Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- Denmark Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- Denmark Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- Denmark Application Outlook (Revenue in USD Million, 2018 - 2030)

- Sweden

- Sweden Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- Sweden Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- Sweden Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- Sweden Application Outlook (Revenue in USD Million, 2018 - 2030)

- Norway

- Norway Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- Norway Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- Norway Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- Norway Application Outlook (Revenue in USD Million, 2018 - 2030)

- Europe Application Outlook (Revenue in USD Million, 2018 - 2030)

- Asia Pacific

- Asia Pacific Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- Asia Pacific Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- Asia Pacific Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- China

- China Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- China Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- China Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- China Application Outlook (Revenue in USD Million, 2018 - 2030)

- Japan

- Japan Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- Japan Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- Japan Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- Japan Application Outlook (Revenue in USD Million, 2018 - 2030)

- India

- India Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- India Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- India Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- India Application Outlook (Revenue in USD Million, 2018 - 2030)

- Thailand

- Thailand Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- Thailand Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- Thailand Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- Thailand Application Outlook (Revenue in USD Million, 2018 - 2030)

- South Korea

- South Korea Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- South Korea Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- South Korea Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- South Korea Application Outlook (Revenue in USD Million, 2018 - 2030)

- Australia

- Australia Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- Australia Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- Australia Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- Australia Application Outlook (Revenue in USD Million, 2018 - 2030)

- Asia Pacific Application Outlook (Revenue in USD Million, 2018 - 2030)

- Latin America

- Latin America Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- Latin America Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- Latin America Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- Brazil

- Brazil Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- Brazil Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- Brazil Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- Brazil Application Outlook (Revenue in USD Million, 2018 - 2030)

- Argentina

- Argentina Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- Argentina Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- Argentina Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- Argentina Application Outlook (Revenue in USD Million, 2018 - 2030)

- Latin America Application Outlook (Revenue in USD Million, 2018 - 2030)

- Middle East and Africa

- Middle East and Africa Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- Middle East and Africa Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- Middle East and Africa Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- South Africa

- South Africa Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- South Africa Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- South Africa Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- South Africa Application Outlook (Revenue in USD Million, 2018 - 2030)

- Saudi Arabia

- Saudi Arabia Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- Saudi Arabia Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- Saudi Arabia Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- Saudi Arabia Application Outlook (Revenue in USD Million, 2018 - 2030)

- UAE

- UAE Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- UAE Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- UAE Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- UAE Application Outlook (Revenue in USD Million, 2018 - 2030)

- Kuwait

- Kuwait Application Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal infertility

- Contraceptives

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Polycystic ovary syndrome (PCOS)

- Kuwait Drug Outlook (Revenue in USD Million, 2018 - 2030)

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

- Kuwait Age Outlook (Revenue in USD Million, 2018 - 2030)

- 50 years and above

- Postmenopausal osteoporosis

- Endometriosis & uterine fibroids

- Menopause

- Others

- Others

- 50 years and above

- Kuwait Application Outlook (Revenue in USD Million, 2018 - 2030)

- Middle East and Africa Application Outlook (Revenue in USD Million, 2018 - 2030)

- North America

Report content

Qualitative Analysis

- Industry overview

- Industry trends

- Market drivers and restraints

- Market size

- Growth prospects

- Porter’s analysis

- PESTEL analysis

- Key market opportunities prioritized

- Competitive landscape

- Company overview

- Financial performance

- Product benchmarking

- Latest strategic developments

Quantitative Analysis

- Market size, estimates, and forecast from 2018 to 2030

- Market estimates and forecast for product segments up to 2030

- Regional market size and forecast for product segments up to 2030

- Market estimates and forecast for application segments up to 2030

- Regional market size and forecast for application segments up to 2030

- Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

Grand View Research employs a comprehensive and iterative research methodology focused on minimizing deviance in order to provide the most accurate estimates and forecast possible. The company utilizes a combination of bottom-up and top-down approaches for segmenting and estimating quantitative aspects of the market. In Addition, a recurring theme prevalent across all our research reports is data triangulation that looks market from three different perspectives. Critical elements of the methodology employed for all our studies include:

Preliminary data mining

Raw market data is obtained and collated on a broad front. Data is continuously filtered to ensure that only validated and authenticated sources are considered. In addition, data is also mined from a host of reports in our repository, as well as a number of reputed paid databases. For a comprehensive understanding of the market, it is essential to understand the complete value chain, and in order to facilitate this; we collect data from raw material suppliers, distributors as well as buyers.

Technical issues and trends are obtained from surveys, technical symposia, and trade journals. Technical data is also gathered from an intellectual property perspective, focusing on white space and freedom of movement. Industry dynamics with respect to drivers, restraints, pricing trends are also gathered. As a result, the material developed contains a wide range of original data that is then further cross-validated and authenticated with published sources.

Statistical model

Our market estimates and forecasts are derived through simulation models. A unique model is created customized for each study. Gathered information for market dynamics, technology landscape, application development, and pricing trends are fed into the model and analyzed simultaneously. These factors are studied on a comparative basis, and their impact over the forecast period is quantified with the help of correlation, regression, and time series analysis. Market forecasting is performed via a combination of economic tools, technological analysis, industry experience, and domain expertise.

Econometric models are generally used for short-term forecasting, while technological market models are used for long-term forecasting. These are based on an amalgamation of the technology landscape, regulatory frameworks, economic outlook, and business principles. A bottom-up approach to market estimation is preferred, with key regional markets analyzed as separate entities and integration of data to obtain global estimates. This is critical for a deep understanding of the industry as well as ensuring minimal errors. Some of the parameters considered for forecasting include:

• Market drivers and restraints, along with their current and expected impact

• Raw material scenario and supply v/s price trends

• Regulatory scenario and expected developments

• Current capacity and expected capacity additions up to 2030We assign weights to these parameters and quantify their market impact using weighted average analysis, to derive an expected market growth rate.

Primary validation

This is the final step in estimating and forecasting for our reports. Exhaustive primary interviews are conducted, face to face as well as over the phone to validate our findings and assumptions used to obtain them. Interviewees are approached from leading companies across the value chain including suppliers, technology providers, domain experts, and buyers so as to ensure a holistic and unbiased picture of the market. These interviews are conducted across the globe, with language barriers overcome with the aid of local staff and interpreters. Primary interviews not only help in data validation but also provide critical insights into the market, current business scenario, and future expectations and enhance the quality of our reports. All our estimates and forecast are verified through exhaustive primary research with Key Industry Participants (KIPs) which typically include:

• Market-leading companies

• Raw material suppliers

• Product distributors

• BuyersThe key objectives of primary research are as follows: