- Home

- »

- Distribution & Utilities

- »

-

Middle East Switchgears Market Share & Growth Report, 2030GVR Report cover

![Middle East Switchgears Market Size, Share & Trends Report]()

Middle East Switchgears Market (2023 - 2030) Size, Share & Trends Analysis Report By Voltage, By Insulation, By Current, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-410-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

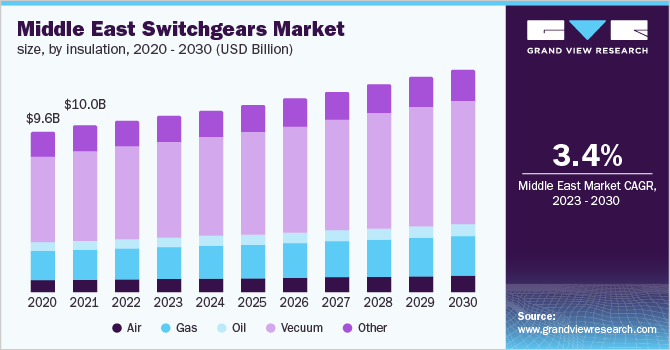

The Middle East switchgears market size was estimated at USD 10.29 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 3.4% from 2023 to 2030. The Middle East switchgears market is anticipated to be driven by the rising power demand brought on by a growing population. The main purposes of these devices are to reduce electric failures and lessen the consequences of faulty currents that pass through the circuit. The Middle East switchgears market is expanding as a result of ongoing smart grid developments and a rise in renewable energy sources. Regional expansion is also caused by the replacement of aging and outdated infrastructure. The region is expected to experience a rise in demand for electricity as a result of numerous international events, including the FIFA World Cup 2022 in Qatar and the World Expo 2020 in Dubai. The grey market, which offers inexpensive goods, can serve as a restraint on the Middle East switchgears market.

Additionally, during the forecast period, new high-voltage long-distance transmission systems are anticipated to boost market expansion. The longevity and performance of the switchgear are greatly influenced by the raw materials used in manufacturing. The raw resources are accessible from a variety of sources in enough quantity to satisfy the demands of various businesses.

The pandemic severely affected the Middle East switchgears market. Subsequent lockdowns and disruption in production induced supply chain bottlenecks, halting construction projects hence, affecting the demand for switch gears in the Middle Eastern region. However, the market saw an uptick owing to prompt vaccination efforts the price of the equipment has increased due to its advanced functionality and IoT-based control system. As a result, the Middle East switchgears market may experience slow growth in the years to come due to expensive capital expenditure and challenging environmental factors.

The efficiency of switchgear equipment often installed outside can be significantly impacted by harsh weather conditions, including temperature, pressure, and humidity as well as water leaking from the ground. As a result, regulatory bodies created strict norms and requirements to address the atmospheric conditions to increase reliability and feasibility.

The price of this equipment has increased due to its advanced functionality and IoT-based control system. As a result, the Middle East switchgears market may experience slow growth in the years to come due to expensive capital expenditure and challenging environmental factors.

Voltage Insights

Based on the voltage type segment is differentiated based on low voltage, medium voltage, and high voltage. The low voltage type dominated the market with a share of 44.3 % in 2022 and is expected to account for the highest growth rate of 3.9 % by 2030. Low voltage switchgear has a capacity of up to 1.1 kV AC. They are designed for the protection and switching of electrical equipment.

Low-voltage switchgear products serve a spectrum of industries such as process industries, residential and commercial building contractors, manufacturing companies, renewable energy suppliers, utilities, and rail equipment manufacturers, particularly in the wind and solar sectors. Additionally, the ongoing operations of refurbishing infrastructure are expected to boost market growth across the industries.

Insulation Insights

Based on the insulation type segment is differentiated based on air, gas, oil, vacuum, and others. Vacuum insulation dominated the market with a share of 53.3% in 2022. Vacuum insulation switch gears are generally used in medium voltage systems such as power distribution systems, generators, transformers, conductors, cables, or utilization equipment.

The growing population moving towards urban establishments in the Middle East is prompting countries such as UAE, Qatar, and Kuwait to construct substations that are regulated by medium voltage systems. The advantages such as better arc quenching, superior dielectric strength, low maintenance, simple breaking mechanisms, and safer mechanisms make them a preferred choice among end users.

The gas-based insulation is anticipated to illustrate the fastest growth of 3.5 % by 2030. The gas-insulated switch gears are generally installed in places that have limited space or place which are exposed to a high concentration of pollution. Its compact design and reinforced structure protect them from environmental damage and provide a longer life. The low risk of explosion and oil leakage along with lower operating costs makes them a preferred choice among end users.

Current Insights

Based on the current insights the segment is bifurcated based on AC and DC current segments. The AC current segment has a major market share of 64.1 % in 2022 and is anticipated to expand at a CAGR of 3.8 % by 2030. The AC current segment is preferred owing to the multi-directional current flow, which makes them suitable for application in businesses and homes.

Moreover, as countries such as UAE, Qatar, Kuwait, Saudi Arabia, and Oman move towards using renewable energy for public institutions and commercial usage, the demand for AC current-based switch gear is expected to elevate during the forecast period. Besides, network expansion of the electricity grids in rural areas and refurbishment of the existing transmission grids in the region is other major factor driving the segment.

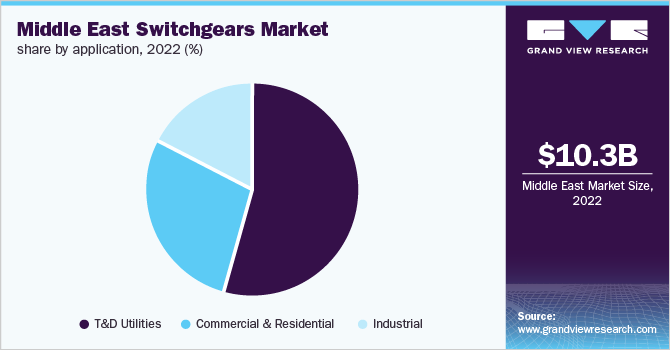

Application Insights

Based on application insights the market covers segments such as T & D utilities, commercial & residential, and industrial applications. The T & D utility segment has accumulated the highest market share of 54.3 % in 2022. T & D utility segment is further expected to illustrate growth of about 3.8 % by 2030. Transmission and Power utility lines instrumental share in transmitting energy for commercial and residential use. The utility power and transmission systems regulate and control the safe delivery of electricity to the end user.

The growing demand for energy consumption in Middle Eastern nations owing to rising temperatures, the development of transport systems, and industrialization is instigating growth in the region. Additionally, industrial applications need a stable power supply without outages and fluctuations for a wide range of functional units with high safety and reliability.

This is prompting companies to leverage technologies, which are data-driven. The data extracted during the power transmission can be used to anticipate power outages or any fluctuation while helping save power and reduce emissions.

Regional Insights

Countries such as the Kingdom of Saudi Arabia (KSA), Qatar, UAE, and Kuwait are expected to be the key contributors to market growth. Gulf Corporation Council (GCC) countries are heavily spending on their power sector to improve the generation capacity. The transmission and distribution segment is expected to gain funds, which is expected to favor the Middle East switchgears market.

Rapid economic growth in KSA across various sectors such as plastic, power, water, petrochemicals, etc. is estimated to fuel the regional market. Qatar and UAE are also estimated to show significant growth owing to the rapid commercial infrastructure developments. Increasing market reforms for improved efficiency and optimum investments in the power sector are expected to support the Egyptian switchgears market.

Key Companies & Market Share Insights

A few key market players include ABB Ltd, Alstom, Bharat Heavy Electricals Limited (BHEL), Crompton Greaves, Siemens AG, General Electric, Schneider Electric, etc. UAE announced that by 2050, the UAE wants to produce 50.0% of its electricity from carbon-free sources, mostly from solar PV. By 2026, Abu Dhabi intends to construct 5.6 GW of solar PV capacity, while by 2050, Dubai wants to generate 75.0% of its electricity from renewable sources.

These goals are anticipated to speed up the nation's adoption of renewable energy sources as the country has a number of support systems in place, including auctions, net metering, and smart Dubai programmers. Some of the prominent players in the Middle East switchgears market include:

-

ABB Ltd

-

Alstom SA

-

Areva Inc.

-

Bharat Heavy Electricals Limited (BHEL)

-

Crompton Greaves

-

Eaton Corporation

-

General Electric

-

Hitachi Limited

-

Larsen & Toubro Limited

-

Legrand

-

Mitsubishi Electric Corporation

-

NR Electric Co., Ltd

Middle East Switchgears Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 10.58 billion

Revenue forecast in 2030

USD 13.35 billion

Growth rate

CAGR of 3.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Voltage, insulation, current, application

Regional scope

Middle East

Key companies profiled

ABB Ltd; Alstom SA; Areva Inc. ; Bharat Heavy Electricals Limited (BHEL); Crompton Greaves; Eaton Corporation; General Electric; Hitachi Limited; Larsen & Toubro Limited; Legrand; Mitsubishi Electric Corporation; NR Electric Co., Ltd

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Switchgears Market Segmentation

The report forecasts revenue growth at regional and country levels in addition to providing an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Middle East Switchgears Market report based on voltage, insulation, current, application, and region:

-

Voltage Outlook (Revenue, USD Billion, 2018 - 2030)

-

Low Voltage

-

Medium Voltage

-

High Voltage

-

-

Insulation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Air

-

Gas

-

Oil

-

Vacuum

-

Other

-

-

Current Outlook (Revenue, USD Billion, 2018 - 2030)

-

AC

-

DC

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

T& D Utilities

-

Commercial & Residential

-

Industrial

-

Frequently Asked Questions About This Report

b. The middle east switchgears market size was estimated at USD 10.29 billion in 2022 and is expected to reach USD 10.58 billion in 2023.

b. The middle east switchgears market is expected to grow at a compound annual growth rate of 3.4% from 2023 to 2030 to reach USD 13.35 billion by 2030.

b. Low voltage dominated the middle east switchgears market with a share of 44.3% in 2022. This is attributable to rising demand in residential applications and power distribution systems.

b. Some key players operating in the middle east switchgears market include ABB Ltd, Bharat Heavy Electricals Limited (BHEL), Alstom, Crompton Greaves, Siemens AG, General Electric, Schneider Electric.

b. Key factors that are driving the middle east switchgears market growth include technological advancements to minimize environmental impact and device miniaturization

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.